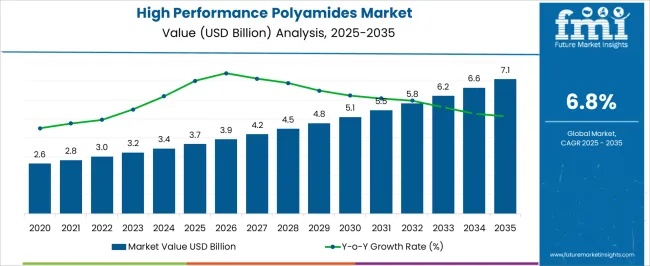

The high performance polyamides market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 7.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period. The high performance polyamides market is projected to create an absolute dollar opportunity of USD 3.4 billion over the forecast period. This growth, supported by a strong CAGR of 6.8%, is driven by the increasing demand for polyamides across industries such as automotive, electronics, and textiles due to their superior properties, including heat resistance, mechanical strength, and lightweight characteristics.

During the first five-year phase (2025–2030), the market is expected to grow from USD 3.7 billion to USD 5.2 billion, adding USD 1.5 billion, which accounts for 44.1% of the total incremental growth. This phase is driven by the expanding use of polyamides in the automotive and electronics industries, where lightweight and durable materials are essential for improving efficiency and reducing emissions. In the second phase (2030–2035), the market will contribute an additional USD 1.9 billion, representing 55.9% of the total growth, reflecting stronger momentum due to broader adoption in advanced applications like 3D printing, aerospace, and renewable energy.

Annual increments will rise from USD 0.3 billion in the early years to USD 0.7 billion by 2035, signaling accelerated growth. This later phase will be propelled by further innovation in polyamide technologies and increased demand for high-performance materials in emerging industries. Manufacturers who focus on optimizing production methods, enhancing material properties, and addressing sustainability will be positioned to capture the largest share of this USD 3.4 billion opportunity.

| Metric | Value |

|---|---|

| High Performance Polyamides Market Estimated Value in (2025 E) | USD 3.7 billion |

| High Performance Polyamides Market Forecast Value in (2035 F) | USD 7.1 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The high performance polyamides market is experiencing robust growth driven by the rising demand for lightweight, durable, and heat resistant materials across key industrial applications. The expanding adoption of high performance polymers in structural components, under-the-hood applications, and electrical housings is reinforcing their role in advanced manufacturing.

Innovation in material chemistry has enabled improved thermal stability, chemical resistance, and mechanical strength, making these polyamides essential in engineering applications. Regulatory pressure to reduce vehicle emissions and enhance fuel efficiency is promoting the substitution of metal parts with high-strength polymer solutions.

Additionally, the electronics and packaging sectors are leveraging the advantages of high-performance polyamides for miniaturization and functional integration. As industries transition toward more sustainable and efficient production, these materials are positioned as core enablers of next-generation product design and performance.

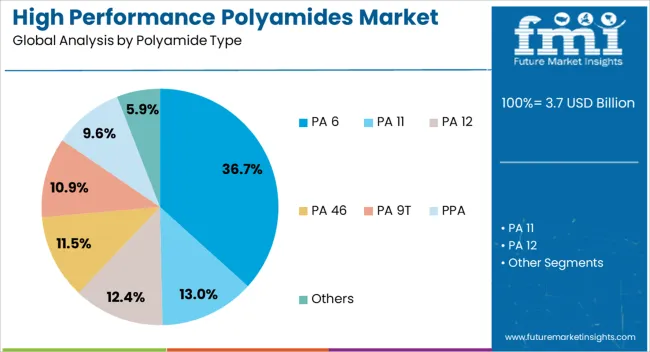

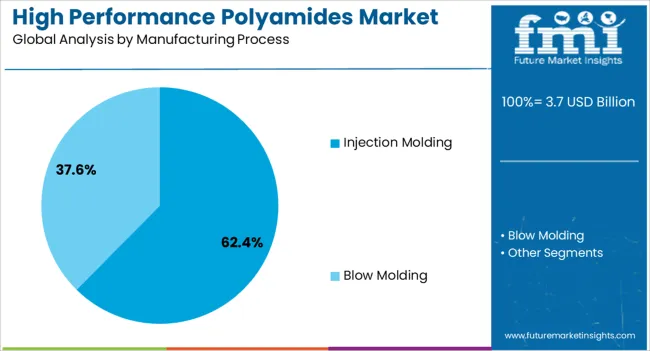

The high performance polyamides market is segmented by polyamide type, manufacturing process, end-use industry, and geographic regions. By polyamide type, the high performance polyamides market is divided into PA 6, PA 11, PA 12, PA 46, PA 9T, PPA, and Others. In terms of manufacturing process, the high performance polyamides market is classified into Injection Molding and Blow Molding.

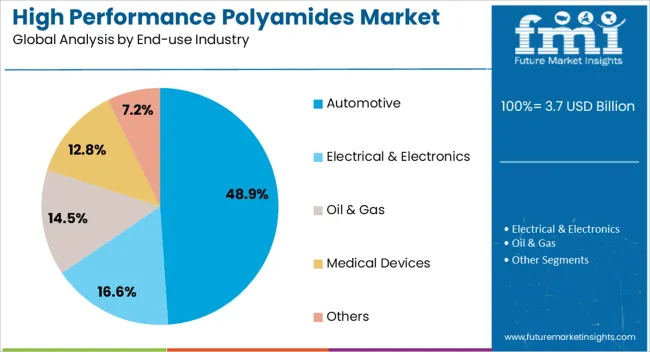

Based on end-use industry, the high performance polyamides market is segmented into Automotive, Electrical & Electronics, Oil & Gas, Medical Devices, and Others. Regionally, the high performance polyamides industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The PA 6 segment is anticipated to account for 36.70% of market revenue by 2025 under the polyamide type category, making it the most significant contributor. This dominance stems from its cost-effectiveness, balanced mechanical properties, and widespread availability.

PA 6 is widely used in applications requiring high tensile strength and impact resistance, particularly in automotive and consumer goods manufacturing. Its compatibility with various additives and reinforcements has broadened its usability in multiple structural and non-structural parts.

Furthermore, its recyclability and improved processing efficiency make it a favorable material choice in industries aiming for sustainable and streamlined operations. These advantages have secured PA 6’s position as the leading polyamide variant in the current market landscape.

Injection molding is projected to contribute 62.40% of total market revenue by 2025 within the manufacturing process category, establishing it as the dominant method. This prominence is attributed to its ability to produce complex, precision components at scale with minimal material waste.

Injection molding supports high repeatability, design flexibility, and efficient cycle times, which are essential for automotive and electronic applications. The process also enables integration of reinforced polyamides, enhancing part strength without compromising weight targets.

With growing demand for lightweight engineered components across sectors, the use of injection molding has been solidified as the preferred manufacturing route for high performance polyamides due to its scalability and cost efficiency.

The automotive segment is expected to generate 48.90% of market revenue by 2025 within the end use industry category, making it the leading application area. This is driven by the industry’s ongoing shift toward lightweight design, fuel efficiency, and component durability.

High performance polyamides are being increasingly used to replace metal in structural applications, engine components, and fluid systems due to their excellent heat resistance and mechanical performance. The electrification of vehicles has further expanded the need for advanced polymers that can insulate, protect, and support sensitive electronic modules.

Moreover, regulatory mandates on emissions and recyclability are encouraging manufacturers to adopt materials that deliver both performance and environmental benefits. These trends are anchoring the automotive industry as the primary growth engine of the high performance polyamides market.

Opportunities in these expanding industries, along with emerging trends in bio-based polyamide solutions, are reshaping the market. However, challenges like high production costs and material sourcing limitations remain significant barriers. By 2025, addressing these obstacles through innovative manufacturing techniques and diversified raw material sourcing will be crucial to supporting sustained market growth and adoption across various industries.

The high-performance polyamides market is growing due to the increasing demand for durable and high-strength materials in diverse sectors like automotive, electronics, and textiles. These materials offer superior thermal resistance, chemical stability, and mechanical strength, making them essential in applications requiring high performance under harsh conditions. As industries aim to enhance product durability and functionality, the demand for high-performance polyamides continues to rise. By 2025, this trend will remain strong, especially in sectors where high-performance materials are critical, such as automotive lightweighting and electronics miniaturization.

Opportunities in the high-performance polyamides market are expanding with the ongoing growth of the automotive and electronics industries. In automotive manufacturing, the demand for lightweight yet durable materials that improve fuel efficiency and reduce vehicle weight is driving the use of polyamides. Additionally, polyamides are essential in the electronics industry for producing high-performance components like connectors, casings, and insulation that need to withstand extreme conditions. By 2025, the increasing demand for high-performance materials in these sectors will continue to offer substantial opportunities for the growth of the polyamide market.

Emerging trends in the high-performance polyamides market include a rising interest in bio-based and eco-friendly polyamide materials. As industries and consumers alike become more environmentally conscious, manufacturers are responding by developing polyamides derived from renewable resources. These bio-based polyamides are increasingly being used in automotive, textiles, and consumer electronics applications. By 2025, eco-conscious polyamide solutions will likely become more prevalent, driven by tighter environmental regulations and growing consumer preference for products that contribute to reducing environmental footprints in the manufacturing process.

Despite the market’s growth, challenges such as high production costs and material sourcing constraints remain significant obstacles. Producing high-performance polyamides involves specialized processing techniques and requires expensive raw materials, which can result in higher product costs. Furthermore, fluctuations in the availability of raw materials, such as aromatic diamines and adipic acid, can disrupt production timelines and lead to supply chain challenges. By 2025, addressing these challenges through more efficient manufacturing methods and diverse sourcing strategies will be essential for enabling broader market adoption and growth.

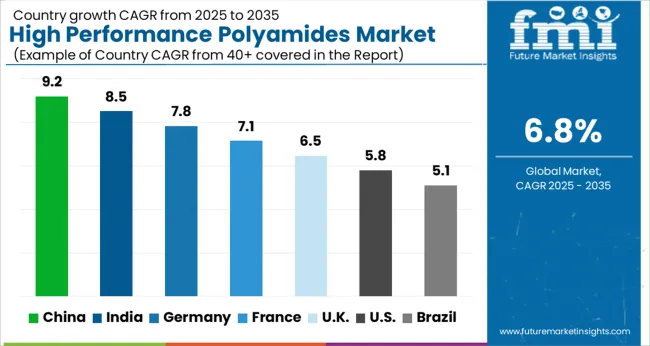

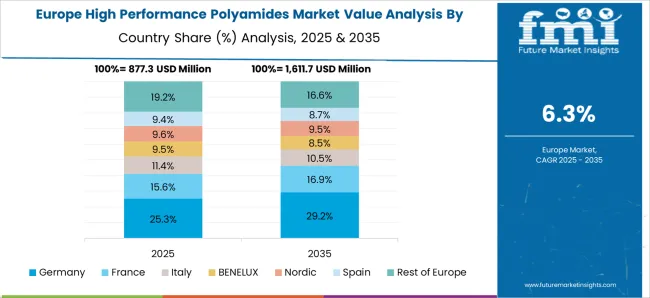

The global high-performance polyamides market is projected to grow at a 6.8% CAGR from 2025 to 2035. China leads with a growth rate of 9.2%, followed by India at 8.5%, and Germany at 7.8%. The United Kingdom records a growth rate of 6.5%, while the United States shows the slowest growth at 5.8%. Factors driving growth include increasing demand for high-performance materials in automotive, aerospace, and electronics industries, particularly due to the need for heat-resistant, durable, and lightweight materials. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, urbanization, and rising demand for advanced materials. Meanwhile, mature markets like the USA and UK see steady growth driven by technological advancements, stringent environmental regulations, and sustainability trends. Market dynamics in these regions are also influenced by infrastructure development, innovation in manufacturing processes, and the rise of eco-friendly materials in response to global environmental concerns. This report includes insights on 40+ countries; the top markets are shown here for reference.

The high-performance polyamides market in China is growing rapidly, with a projected CAGR of 9.2%. China’s industrial expansion, particularly in the automotive, electronics, and aerospace sectors, is driving significant demand for advanced polyamide solutions. The country’s rapid urbanization, coupled with the expanding manufacturing base, is fueling the demand for lightweight, durable, and heat-resistant materials, which are vital for automotive parts, electronic devices, and other industrial applications. Additionally, China’s growing focus on sustainability and environmental regulations is pushing industries to adopt eco-friendly materials. The government’s support for technological advancements, infrastructure development, and green energy further enhances the adoption of high-performance polyamides in the manufacturing and construction industries. These factors position China as a leader in the global polyamides market.

The high-performance polyamides market in India is projected to grow at a CAGR of 8.5%. India’s rapid industrial growth, particularly in the automotive, electronics, and manufacturing sectors, is a key driver for high-performance polyamides. The increasing focus on sustainability and energy efficiency, combined with the growing demand for durable, heat-resistant materials, is pushing industries to adopt these advanced materials. The automotive sector’s shift toward electric vehicles (EVs) and lighter components is particularly important in driving the demand for polyamides. India’s expanding infrastructure, along with the rising adoption of advanced manufacturing techniques, further contributes to market growth. The country’s large consumer base and increasing disposable income also support the demand for higher-quality, durable products, further boosting the polyamides market.

The high-performance polyamides market in Germany is projected to grow at a CAGR of 7.8%. Germany, known for its strong automotive, industrial, and aerospace sectors, remains a key market for high-performance polyamides. The growing demand for lightweight, durable, and heat-resistant materials, essential in automotive manufacturing and electronics production, is driving steady growth. Germany’s focus on sustainability and energy efficiency, combined with stringent environmental regulations, is prompting industries to adopt polyamide solutions that meet both performance and sustainability criteria. Additionally, the country’s commitment to innovation and technological advancement in manufacturing processes supports the widespread adoption of high-performance polyamides. Germany’s position as a leader in environmental policies, along with its growing emphasis on renewable energy, further contributes to the market’s steady growth.

The high-performance polyamides market in the United Kingdom is projected to grow at a CAGR of 6.5%. The UK market is driven by increasing demand for lightweight and durable materials in industries such as automotive, aerospace, and electronics. The country’s regulatory environment, emphasizing sustainability and reducing carbon emissions, accelerates the adoption of eco-friendly and energy-efficient polyamide solutions. The growing shift towards electric vehicles (EVs) and advancements in automotive safety and efficiency further contribute to the market’s expansion. Additionally, the rise in the adoption of smart technologies and automation in manufacturing processes drives the need for high-performance polyamides. The UK government’s support for renewable energy and clean technologies also enhances the demand for high-performance materials in various sectors.

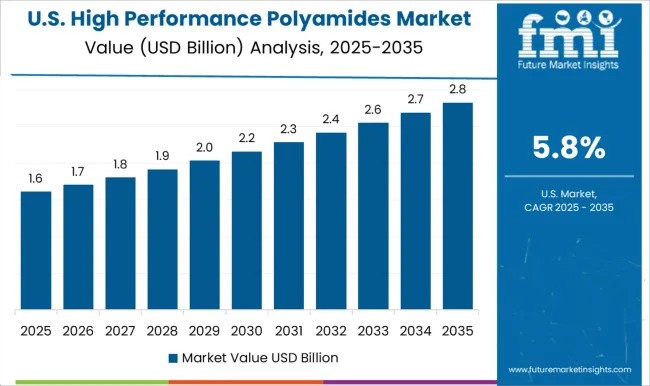

The high-performance polyamides market in the United States is expected to grow at a CAGR of 5.8%. The USA remains a significant market for polyamides, driven by the growing demand for durable, heat-resistant materials in automotive, electronics, and industrial sectors. The increasing focus on sustainability, energy efficiency, and government incentives for green technologies are accelerating the demand for high-performance polyamides. Additionally, the growing automotive sector, especially with the rise of electric and autonomous vehicles, is a key driver for the adoption of lightweight, high-performance materials. The USA also benefits from advancements in manufacturing technologies and the increasing trend of automation, further supporting the market’s growth. Furthermore, the need for advanced materials in various industrial applications continues to fuel demand in the USA

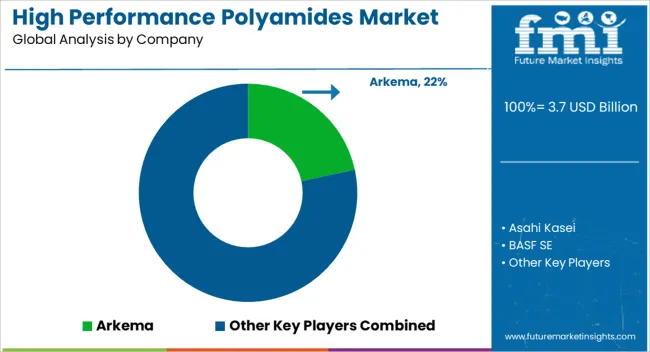

The high-performance polyamides market is dominated by Arkema, a leader in the development of advanced polyamide solutions used in automotive, aerospace, industrial, and electronics sectors. Arkema’s dominance is supported by its continuous innovation, strong R&D capabilities, and global reach, offering products that provide superior thermal stability, chemical resistance, and mechanical strength. The company is a trusted supplier of high-performance polyamides that meet the stringent requirements of high-demand industries. Key players such as BASF SE, Evonik, and SABIC maintain significant market shares by offering a wide range of polyamide products designed for high-performance applications. These companies focus on product development and customization to meet growing demand for lightweight, durable, and efficient materials in various industrial applications, from automotive lightweighting to electronics and industrial machinery.

Emerging players like Asahi Kasei, KURARAY, and Lanxess are expanding their presence by providing specialized polyamides for niche applications, including 3D printing, coatings, and other high-performance applications that require enhanced mechanical properties and high resistance to extreme conditions. Their strategies involve improving the sustainability of polyamides, creating recyclable solutions, and focusing on customization to meet the diverse needs of industries. Market growth is driven by increasing demand for polyamides in automotive lightweighting, electronics, and renewable energy sectors, along with advancements in high-performance materials for industrial uses. Innovations in polyamide formulations, including multi-functional properties and sustainable production practices, are expected to continue shaping competitive dynamics and fuel further growth in the high-performance polyamides market.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 Billion |

| Polyamide Type | PA 6, PA 11, PA 12, PA 46, PA 9T, PPA, and Others |

| Manufacturing Process | Injection Molding and Blow Molding |

| End-use Industry | Automotive, Electrical & Electronics, Oil & Gas, Medical Devices, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arkema, Asahi Kasei, BASF SE, Evonik, KURARAY, Lanxess, Royal DSM, SABIC, Solvay S.A., and Toray |

| Additional Attributes | Dollar sales by polyamide type and application, demand dynamics across automotive, electronics, and textiles sectors, regional trends in high-performance polyamide adoption, innovation in heat resistance and lightweight materials, impact of regulatory standards on safety and environmental concerns, and emerging use cases in 3D printing and renewable energy applications. |

The global high performance polyamides market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the high performance polyamides market is projected to reach USD 7.1 billion by 2035.

The high performance polyamides market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in high performance polyamides market are pa 6, pa 11, pa 12, pa 46, pa 9t, ppa and others.

In terms of manufacturing process, injection molding segment to command 62.4% share in the high performance polyamides market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

High Throughput Screening Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

High Purity Carbonyl Iron Powder (CIP) Market Size and Share Forecast Outlook 2025 to 2035

High Voltage PTC Heater Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Grease Market Size and Share Forecast Outlook 2025 to 2035

High Frequency Chest-Wall Oscillation Devices Market Size and Share Forecast Outlook 2025 to 2035

High-purity Fluoropolymer Valves Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Pharmaceutical Packaging Films for Blister Market Size and Share Forecast Outlook 2025 to 2035

High Current Ion Implanter Market Size and Share Forecast Outlook 2025 to 2035

High Rate Discharge Test Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA