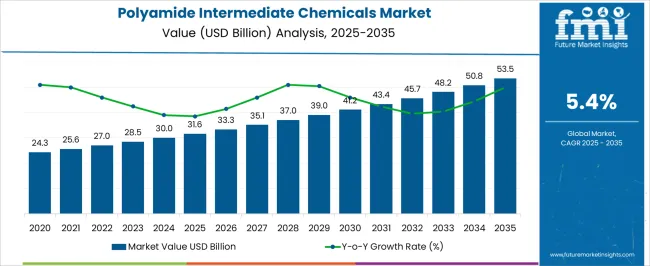

The Polyamide Intermediate Chemicals Market is estimated to be valued at USD 31.6 billion in 2025 and is projected to reach USD 53.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Polyamide Intermediate Chemicals Market Estimated Value in (2025 E) | USD 31.6 billion |

| Polyamide Intermediate Chemicals Market Forecast Value in (2035 F) | USD 53.5 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The polyamide intermediate chemicals market is witnessing notable growth, driven by the increasing use of polyamide-based materials in diverse industries such as automotive, textiles, and packaging. Rising demand for lightweight, durable, and high-performance polymers is stimulating consumption of intermediate chemicals used in the production of various polyamide grades.

The market is further supported by the growing trend toward energy-efficient and sustainable solutions, as polyamides play a vital role in enabling lightweight designs that improve fuel efficiency and reduce emissions. Expansion in tire manufacturing, engineered plastics, and industrial machinery is creating new opportunities for polyamide intermediates, particularly as advanced formulations are being developed to enhance chemical resistance and thermal stability.

Additionally, the rising penetration of electric vehicles and demand for high-strength materials in critical applications are further reinforcing market expansion Global investments in manufacturing facilities and innovations in chemical processing technologies are enabling higher output and improved quality, positioning the market for sustained long-term growth in line with evolving industrial requirements.

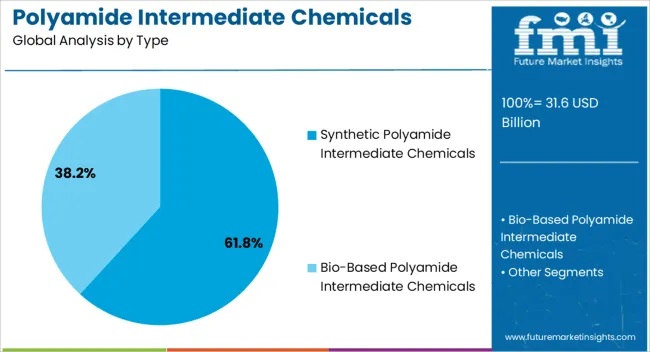

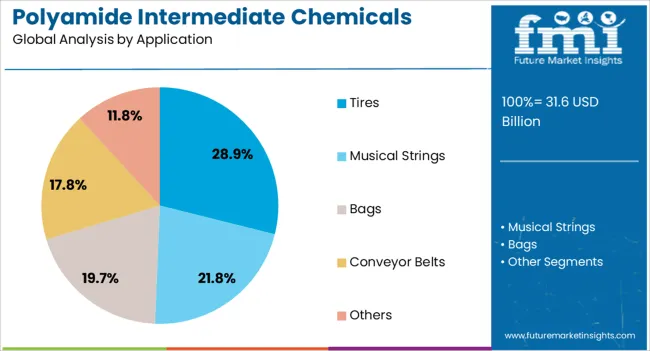

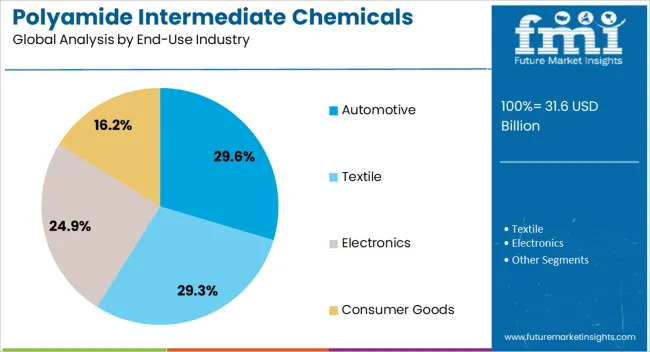

The polyamide intermediate chemicals market is segmented by type, application, end-use industry, and geographic regions. By type, polyamide intermediate chemicals market is divided into Synthetic Polyamide Intermediate Chemicals and Bio-Based Polyamide Intermediate Chemicals. In terms of application, polyamide intermediate chemicals market is classified into Tires, Musical Strings, Bags, Conveyor Belts, and Others. Based on end-use industry, polyamide intermediate chemicals market is segmented into Automotive, Textile, Electronics, and Consumer Goods. Regionally, the polyamide intermediate chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The synthetic polyamide intermediate chemicals segment is projected to hold 61.8% of the polyamide intermediate chemicals market revenue share in 2025, making it the leading type category. This dominance is being supported by the widespread industrial use of synthetic intermediates, which offer superior consistency, scalability, and performance reliability compared to natural counterparts. High demand from large-scale industrial applications, including automotive parts, textiles, and electrical components, is driving growth in this segment.

Advances in chemical synthesis processes are enabling manufacturers to develop intermediates with improved molecular uniformity, enhancing the performance characteristics of final polyamide products. Additionally, the flexibility of synthetic intermediates to be tailored for specific end-use requirements is expanding their adoption across multiple industries.

The ability of synthetic intermediates to support mass production while meeting stringent quality and regulatory standards is further strengthening their market leadership As industries continue to prioritize high-strength, lightweight, and durable materials, synthetic intermediates are expected to remain the preferred choice for ensuring efficiency, cost-effectiveness, and global supply reliability.

The tires application segment is anticipated to account for 28.9% of the polyamide intermediate chemicals market revenue share in 2025, establishing itself as the leading application area. This position is being reinforced by the growing requirement for high-performance tires with enhanced durability, fuel efficiency, and safety features. Polyamide intermediates are essential in the production of tire cord fabrics, which provide strength, flexibility, and heat resistance, making them critical to overall tire performance.

Increasing global automobile production, rising replacement demand, and expansion in commercial transportation are driving sustained adoption. The trend toward lightweight and fuel-efficient vehicles is also encouraging tire manufacturers to incorporate polyamide-based reinforcements. Continuous innovations in tire design and manufacturing, such as low rolling resistance technologies, are further amplifying demand for polyamide intermediates.

The ability of these materials to extend tire life, reduce maintenance costs, and improve overall vehicle efficiency is ensuring their continued use in the sector As mobility patterns evolve and global automotive industries expand, the segment is expected to maintain its leadership in the market.

The automotive segment is expected to represent 29.6% of the polyamide intermediate chemicals market revenue share in 2025, making it the leading end-use industry. Its leadership is being driven by the extensive use of polyamide-based materials in vehicle manufacturing for applications such as engine components, under-the-hood parts, electrical connectors, and structural elements. The demand is further strengthened by the growing emphasis on lightweight vehicles that enhance fuel efficiency and reduce emissions, with polyamide intermediates serving as essential inputs for producing advanced polymers.

Rising production of electric vehicles is creating additional demand, as polyamides are increasingly used in high-voltage components and battery systems due to their insulation properties and thermal stability. The ability of polyamide intermediates to provide strength, durability, and chemical resistance makes them highly suitable for demanding automotive applications.

As regulatory pressures for sustainability intensify, automotive manufacturers are prioritizing materials that combine performance with environmental compliance, reinforcing reliance on polyamide intermediates With global automotive output expanding and technological transitions accelerating, this segment is positioned to remain the leading end-use contributor to market growth.

Polyamide intermediates are thermoplastic silky material, which is also known as nylon. It is available in fibrous state as well as in plastics. The polyamide intermediates are used for an array of applications, which includes fabrics, tires, and carpets among others.

The consumption of polyamide intermediate chemicals in the automotive sector is expected to be the highest over the forecast period. Polyamide intermediate chemicals possess special characteristics, which includes high abrasion resistance, high elongation, and chemical resistance among others. Many manufacturers are engaged in developing bio-based methods for developing the polyamide intermediates.

With introduction of bio-based polyamide intermediates, the global polyamide intermediates market is expected to foster a healthy growth rate, as it is recyclable and being adopted by the various end use industries from automotive to consumer goods. The consumption of polyamide intermediate chemicals in the automotive sector is expected to be the highest over the forecast period.

The global polyamide intermediate chemicals market is primarily driven by the demand for environmental friendly consumer products and stringent regulations for ecofriendly products.

With a wide range of application of polyamide intermediates chemicals in various end use industries such as automotive, electronics, textiles and consumer goods among others is attributed with the growth of global polyamide intermediate chemicals globally.

The use of polyamide intermediate chemicals in the automotive sector to replace some of the alloy parts such as nuts and bolts to reduce the weight of vehicles are increasing the adoption of polyamide intermediates chemicals in the automotive industry.

Thus, this demand is fostering the growth of polyamide intermediate chemicals market. However, the moisture absorption properties of the polyamide intermediates chemicals decreases the tensile strength of the material which might pose as a restraint to its adaptability also the molded polyamide intermediates are subjected to shrinkage which might restrain the growth of polyamide intermediate chemicals market.

Based on the geographic regions, global polyamide intermediate chemicals market is segmented into seven key market segments namely North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Japan, and Middle East & Africa.

Among the aforementioned regions, Asia-Pacific market for polyamide intermediate chemicals holds the largest market. In the Asia-Pacific market, China holds the largest share followed by India, the growth of polyamide intermediate chemicals in these countries are attributed with the growth of automotive, chemicals and textile industries in these regions.

The demand for bio-based polyamide intermediates chemicals in the North America and the European market to cope up with stringent environmental regulations in the region is fostering the growth of polyamide intermediate chemicals but in a moderate speed. Overall, the market is expected to show a significant growth rate by the end of forecast period.

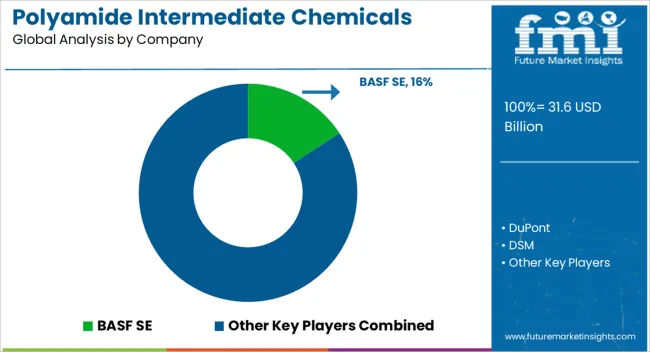

Some of the major players identified in the global polyamide intermediate chemicals market includes, BASF SE, DuPont, DSM, Segetis, Inc., Solvay, Arizona Chemical Company, LLC., and Genomatica, Inc. among others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, types, technology and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

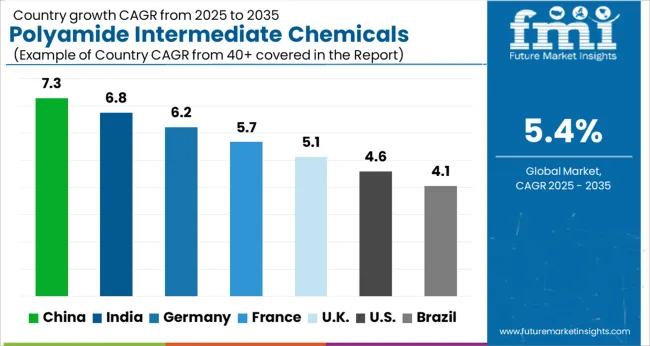

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The Polyamide Intermediate Chemicals Market is expected to register a CAGR of 5.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.3%, followed by India at 6.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Polyamide Intermediate Chemicals Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.2%. The USA Polyamide Intermediate Chemicals Market is estimated to be valued at USD 11.6 billion in 2025 and is anticipated to reach a valuation of USD 18.1 billion by 2035. Sales are projected to rise at a CAGR of 4.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.7 billion and USD 865.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 31.6 Billion |

| Type | Synthetic Polyamide Intermediate Chemicals and Bio-Based Polyamide Intermediate Chemicals |

| Application | Tires, Musical Strings, Bags, Conveyor Belts, and Others |

| End-Use Industry | Automotive, Textile, Electronics, and Consumer Goods |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, DuPont, DSM, Solvay, Kraton Corporation, Genomatica, Inc., Akzo Nobel N.V., Bayer AG, Eastman Chemical Company, and Arkema |

The global polyamide intermediate chemicals market is estimated to be valued at USD 31.6 billion in 2025.

The market size for the polyamide intermediate chemicals market is projected to reach USD 53.5 billion by 2035.

The polyamide intermediate chemicals market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in polyamide intermediate chemicals market are synthetic polyamide intermediate chemicals and bio-based polyamide intermediate chemicals.

In terms of application, tires segment to command 28.9% share in the polyamide intermediate chemicals market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Intermediate Bulk Container (IBC) Market Forecast and Outlook 2025 to 2035

Polyamide Resins Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in the Polyamide Industry

Breaking Down Market Share in Intermediate Bulk Containers

Japan Intermediate Bulk Container Market Insights – Growth & Forecast 2023-2033

Korea Intermediate Bulk Container Market Growth – Trends & Forecast 2023-2033

Western Europe Intermediate Bulk Container Market Growth – Trends & Forecast 2023-2033

Biochemicals Control Market Size and Share Forecast Outlook 2025 to 2035

LNG Intermediate Fluid Vaporizer (IFV) Market Size and Share Forecast Outlook 2025 to 2035

Oxo Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Soy Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Bio-Polyamide, Specialty Polyamide & Precursors Market Growth – Trends & Forecast 2025 to 2035

Fine Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fluorochemicals Market Size and Share Forecast Outlook 2025 to 2035

Paper Chemicals Market Growth – Trends & Forecast 2023-2033

Leather Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Roofing Chemicals Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA