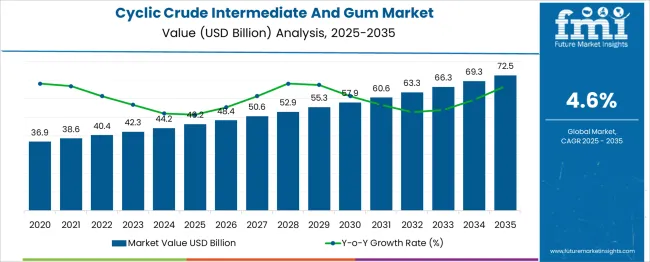

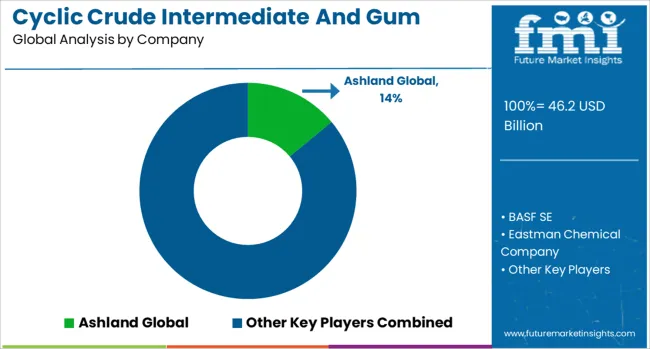

The Cyclic Crude Intermediate And Gum Market is estimated to be valued at USD 46.2 billion in 2025 and is projected to reach USD 72.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period. A year-on-year (YoY) growth analysis shows a stable and incremental increase throughout the forecast period, indicating strong and sustained demand. From 2025 to 2026, the market is expected to grow from USD 46.2 billion to 48.4 billion, representing a YoY growth of approximately 4.8%.

This growth trend continues consistently, with annual increases ranging between 4.5% and 5.0%, reflecting steady industrial demand across applications such as adhesives, coatings, sealants, resins, and synthetic rubber production. By 2030, the market is forecasted to reach USD 55.3 billion, with a YoY increase of roughly 4.6% from the previous year. From 2030 to 2035, the annual growth continues to hover around 4.5% to 4.7%, reaching USD 72.5 billion by the end of the period. This consistent YoY expansion is driven by growing industrialization, increased investment in specialty chemicals, and expanding end-use industries such as automotive, construction, and packaging. Additionally, rising demand for bio-based and synthetic resins is also contributing to the market's healthy and predictable year-on-year performance.

| Metric | Value |

|---|---|

| Cyclic Crude Intermediate And Gum Market Estimated Value in (2025 E) | USD 46.2 billion |

| Cyclic Crude Intermediate And Gum Market Forecast Value in (2035 F) | USD 72.5 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The cyclic crude intermediate and gum market is a specialized segment within the broader petrochemical and specialty chemicals industry, which is valued at over USD 800 billion globally. This parent market includes key categories such as olefins, aromatics, and chemical intermediates used in the production of plastics, resins, elastomers, adhesives, and coatings. Cyclic crude intermediates are critical for manufacturing cycloalkanes, cycloolefins, and high-performance resin precursors, while industrial gums serve functional roles as stabilizers, binders, and rheology modifiers in various formulations. Cyclic crude intermediates account for approximately 5–7% of the global petrochemical intermediate market, reflecting their importance in synthetic rubber, resin, and polymer production. Industrial gums, both natural and synthetic, represent an additional 2–3%, primarily in the specialty chemicals space. Together, they form a niche but expanding segment of the value chain, driven by demand for performance materials in automotive, construction, packaging, and electronics sectors. The market benefits from ongoing trends in sustainable materials, increased use of advanced composites, and growing industrialization in emerging markets. Key players in the parent market include Dow, ExxonMobil, BASF, Chevron Phillips, and Eastman Chemical, all of which provide integrated solutions across intermediates and specialty chemical segments.

The Cyclic Crude Intermediate And Gum market is undergoing significant transformation, driven by rising demand across pharmaceutical, chemical, and industrial sectors. The increasing focus on specialty chemicals, coupled with advancements in purification and extraction technologies, has been instrumental in enhancing product performance and consistency. Manufacturers are prioritizing the development of high-purity cyclic compounds and gum derivatives to meet strict regulatory standards and formulation requirements, especially in therapeutic and excipient applications.

Additionally, growing investments in pharmaceutical R&D and expansion of API production are contributing to sustained demand for cyclic crude intermediates. The market is also experiencing a surge in innovation aimed at improving yield efficiency and sustainability through green chemistry processes.

As global healthcare infrastructure expands and industrial formulations become more specialized, the market is expected to maintain strong growth momentum. Strategic partnerships between raw material suppliers and end-use industries are also helping to streamline supply chains and reinforce the long-term viability of this niche yet crucial market segment..

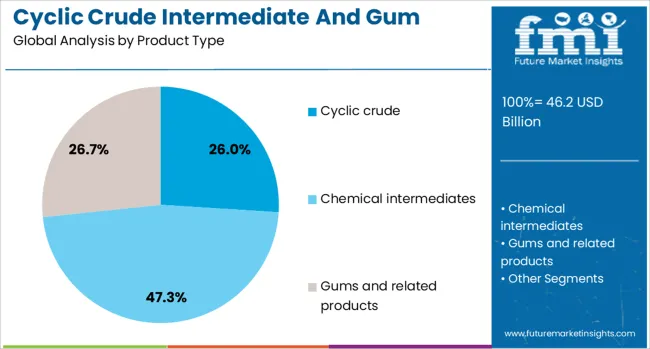

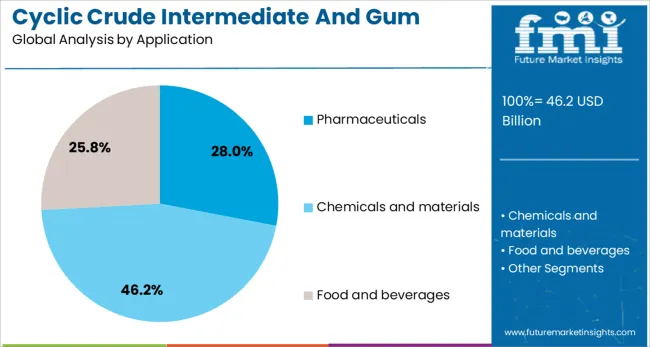

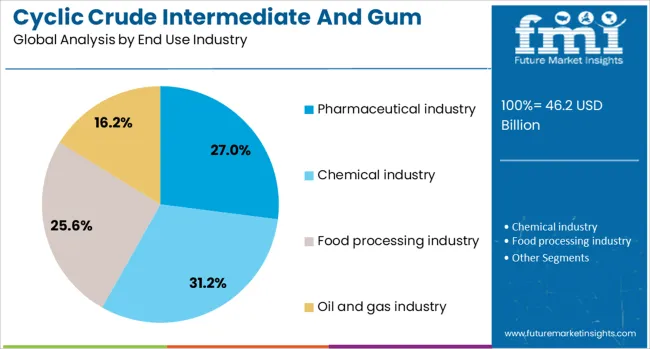

The cyclic crude intermediate and gum market is segmented by product type, application, and end use industry and geographic regions. The cyclic crude intermediate and gum market is divided by product type into Cyclic crude, Chemical intermediates, Gums and related products, Wood chemicals, Tall oil, Charcoal, Naval stores, and Other wood chemicals. In terms of application of the cyclic crude intermediate and gum market is classified into Pharmaceuticals, Chemicals and materials, Food and beverages, Oil and gas, Textiles, Cosmetics and personal care, Agriculture, and Others. Based on end use industry of the cyclic crude intermediate and gum market is segmented into Pharmaceutical industry, Chemical industry, Food processing industry, Oil and gas industry, Textile industry, Cosmetics and personal care industry, Agricultural industry, and Others. Regionally, the cyclic crude intermediate and gum industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cyclic crude segment is projected to hold 26% of the Cyclic Crude Intermediate And Gum market revenue share in 2025, establishing it as the leading product type. Its dominance has been attributed to its versatility and critical function as a foundational component in high-value chemical synthesis. Extensive use of cyclic crude in the development of pharmaceutical intermediates, agrochemicals, and performance enhancers has driven its sustained uptake.

The segment’s strength has been supported by its stable molecular structure, which allows precise manipulation during complex synthesis pathways. Increasing emphasis on refining purity levels and consistency in raw material sourcing has further solidified the position of cyclic crude in various industrial applications.

Its compatibility with modern extraction and processing techniques has enabled improved scalability and reduced production costs. As regulatory frameworks continue to demand higher quality and traceability of chemical constituents, the cyclic crude segment is expected to benefit from its integral role in enabling formulation accuracy and compliance..

The pharmaceuticals segment is expected to capture 28% of the Cyclic Crude Intermediate And Gum market revenue share in 2025, making it the leading application segment. This growth has been driven by rising global demand for active pharmaceutical ingredients and excipients derived from cyclic intermediates and specialty gums. The role of these materials in enhancing bioavailability, stability, and controlled release has positioned them as essential components in drug formulation.

Increased R&D spending by pharmaceutical companies and growing investments in generic and specialty drugs have contributed to the expanding application of these intermediates. Additionally, the ongoing shift toward clean-label and biocompatible ingredients in formulations has reinforced the appeal of natural and semi-synthetic gum derivatives.

Regulatory encouragement for excipient innovation and safer drug delivery systems has provided a further boost to the segment. As personalized medicine and advanced therapeutics continue to shape the pharmaceutical landscape, the demand for high-quality cyclic intermediates in this application is projected to remain strong..

The pharmaceutical industry is projected to account for 27% of the Cyclic Crude Intermediate And Gum market revenue share in 2025, maintaining its position as the primary end-use industry. This dominance has been driven by the sector’s growing reliance on precision chemical intermediates and functional gums to ensure the efficacy and stability of a wide range of therapeutic products. With increasing global attention on expanding drug manufacturing capabilities, especially in emerging economies, the consumption of cyclic crude and gum derivatives has intensified.

These components play a vital role in various stages of drug development, from synthesis of core molecules to formulation enhancements. The segment has also been influenced by stringent regulatory expectations for purity, traceability, and formulation consistency, prompting pharmaceutical manufacturers to prioritize high-quality intermediates.

Furthermore, the acceleration of innovation in biologics and complex generics has created new avenues for the use of specialty cyclic compounds. The continued expansion of the pharmaceutical supply chain globally is expected to further reinforce the segment’s leading position in the market..

The cyclic crude, intermediate and gum market blends petroleum-derived cyclic hydrocarbons with wood- and gum‑based chemistries, such as tall oil and gum turpentine. Global production is relatively flat, with moderate growth in the USA and Asia as firms innovate in sustainability and processing efficiency. Demand is driven by industrial end-use in coatings, adhesives and specialty intermediates. Challenges include raw material supply volatility, regulatory environmental compliance and capital‑intensive infrastructure. Innovation in circular feedstocks, automation and new automation-based manufacturing methods differentiates leading firms in a moderately concentrated sector.

This market depends on diverse feedstocks including petroleum, natural gas, wood distillates and gum resin. Volatility in wood chemical supply arises from fluctuating forestry output, weather impacts, and regional labor or governance disruptions—especially for gum-based inputs sourced from limited producing regions. Petroleum-derived cyclic intermediate supply is influenced by crude oil pricing and refining capacity. Geographic concentration plus logistical bottlenecks affect consistency of supply and pricing. Producers with vertically integrated sourcing or geographic diversification can mitigate risk. In addition, demand from downstream sectors such as coatings and adhesives creates pressure for quality consistency across feedstock types. Ensuring steady input flow remains essential to meeting industrial client specifications and sustaining reliable operations.

Environmental and safety regulations shape both wood-chemicals and petroleum-based intermediate production. Emissions control, waste management and sustainable sourcing mandates drive manufacturers toward cleaner processes. Pressure from regulators and customers encourages adoption of renewable feedstocks, bio-based cyclic hydrocarbons and traceable wood chemicals. Compliance investment is significant, particularly for firms handling coal tar derivation, gum distillation or tall oil extraction. Companies focusing on circular economy principles and low-impact production practices stand to gain client trust and regulatory advantage. Automation and robotics offer pathways to safer, lower-emission operations while enabling precision control to optimize yield. Firms that align production with environmental norms and clean sourcing gain stronger market access and differentiation.

Leading firms in this sector invest in advanced processing techniques and automation to improve yield and consistency. Automation through robotics enhances safety and throughput while reducing manual exposure—industry experts estimate robotics can boost speed by around thirty percent and reduce workplace injuries. Enhanced distillation and purification technologies help refine cyclic crudes and gum-derived intermediates to match precise industrial specifications. Companies also explore circular feedstock models, converting byproducts into high-value intermediates. Digitalization of process controls and integration of Industry 4.0 systems improve operational monitoring, quality assurance, and resource efficiency. These advancements support adoption by industrial end-users in coatings, adhesives, and specialty chemicals where performance and traceability are key selection criteria.

The market features moderate concentration, led by global chemical giants offering petroleum-based cyclic hydrocarbons and multinational firms in gum chemistries. Major players include BASF, ExxonMobil, Dow, DuPont, as well as DuPont- or CP Kelco-type firms specializing in gum products like pectin and xanthan. Large integrated producers benefit from scale and innovation capabilities, while niche suppliers focus on specialty gum chemicals or bio‑based intermediates. Demand remains stable from industrial clients who prioritize quality, consistency and compliance. Small-scale entrants face high capital and technical barriers. Competitive advantage derives from strong supplier networks, innovation in sustainable chemistry, and digital process control. End‑use demand elasticity is low, with minor seasonality and steady industrial cycle influence.

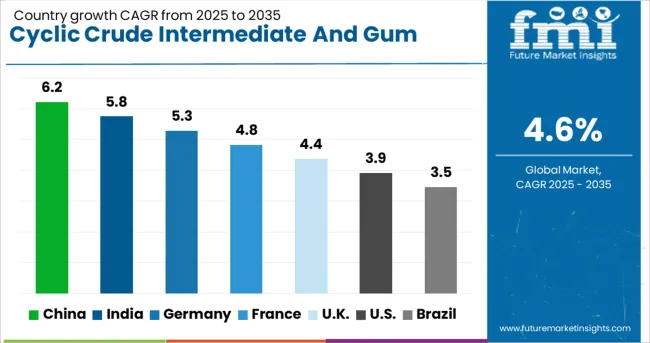

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

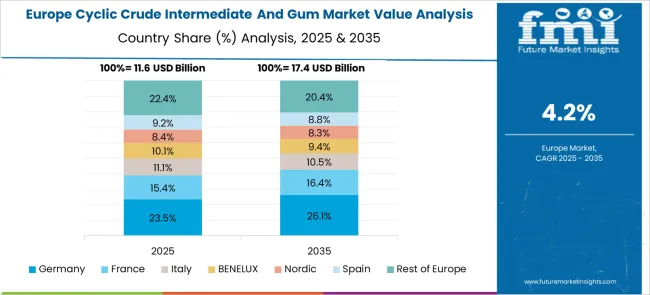

The global cyclic crude intermediate and gum market is projected to grow at a CAGR of 4.6% through 2035, shaped by industrial usage and evolving chemical processing standards. China leads with a 6.2% growth rate, driven by large-scale chemical manufacturing and expanding downstream applications. India follows at 5.8%, supported by increased demand in adhesives, sealants, and intermediate production. Germany reports 5.3% growth, emphasizing precision chemical engineering and eco-compliant formulations. The United Kingdom maintains steady progress at 4.4%, influenced by innovation in specialty materials and regulatory alignment. The United States, a mature market growing at 3.9%, focuses on supply chain efficiency and product consistency. These countries illustrate how regulatory frameworks and industrial capabilities are shaping global trends. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China has recorded a CAGR of 6.2% in the cyclic crude intermediate and gum market, driven by robust growth in chemical processing and manufacturing sectors. The country's large-scale production of adhesives, resins, and industrial sealants relies heavily on cyclic crude intermediates and gums, leading to consistent demand. Domestic manufacturers have ramped up output capacity and process optimization to reduce production costs and increase yield. Regional chemical parks and industrial hubs are investing in vertically integrated operations to streamline sourcing and distribution. Regulatory support for industrial expansion and process modernization further enhances growth. Export-oriented companies are also tailoring products to meet global quality standards.

India’s cyclic crude intermediate and gum market is expanding at a CAGR of 5.8%, supported by the growth of construction, packaging, and textile industries. These sectors require consistent supply of intermediates and gums for applications such as adhesives, waterproofing agents, and sizing materials. Indian manufacturers are scaling production facilities and upgrading technology to enhance process efficiency. Demand from both domestic and export markets is driving investment in quality improvement and waste reduction. Government-backed industrial cluster development programs are also promoting easier access to raw materials and transportation infrastructure.

Germany has observed a CAGR of 5.3% in the cyclic crude intermediate and gum market, primarily driven by specialty chemical applications. The country’s advanced manufacturing ecosystem supports precision blending and formulation of resins, coatings, and specialty adhesives. German firms emphasize consistent product quality, low impurity levels, and batch traceability. Increased use in electronics, medical packaging, and engineered plastics continues to drive innovation in formulation and processing. The domestic market also benefits from the country’s strong export profile in high-performance chemicals.

The United Kingdom has posted a CAGR of 4.4% in the cyclic crude intermediate and gum market, supported by steady demand in the coatings, packaging, and pharmaceutical industries. Despite limited raw material sourcing, local manufacturers focus on refining imported intermediates into high-grade end-products. Flexible batch production and tailored formulations support niche applications and export contracts. The market also benefits from R&D collaborations between chemical firms and academic labs aimed at enhancing purity and performance. Increased regulatory emphasis on formulation safety is shaping product development.

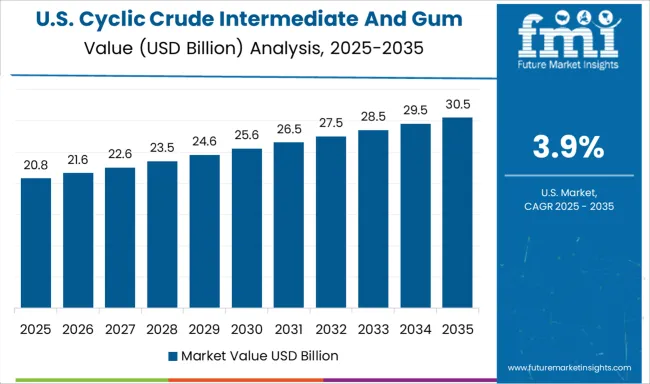

The United States cyclic crude intermediate and gum market is growing at a CAGR of 3.9%, supported by the country’s broad industrial base. Usage in the automotive, construction, and flexible packaging sectors fuels ongoing demand. USA manufacturers are adopting advanced filtration and blending techniques to ensure product uniformity and reduce impurities. The market is also supported by consistent demand from formulators of performance adhesives and engineered polymers. Supply chain improvements and regional distribution networks enable quicker turnaround and lower lead times for industrial customers.

The cyclic crude intermediate and gum market underpins a wide range of downstream chemical industries, serving as foundational raw materials for the production of resins, solvents, adhesives, and specialty polymers. These intermediates, derived from petrochemical feedstocks or biomass sources, are essential in paints and coatings, rubber compounding, surfactants, and functional materials.

As demand rises for performance chemicals with consistent purity, the market continues to evolve with greater focus on sustainable synthesis, regulatory compliance, and process integration. Ashland Global leads with specialty intermediate chemicals used across adhesives, personal care, and coatings, offering tailored cyclic derivatives with high solubility and reactivity profiles. BASF SE and Eastman Chemical Company supply high-volume cyclic compounds and gum derivatives that act as building blocks for performance polymers and custom chemical syntheses. Their broad industrial reach and vertically integrated manufacturing capabilities make them key enablers of innovation in both commodity and specialty applications. Huntsman Corporation, Dow Chemical Company, and Solvay SA bring expertise in formulation chemistry, offering cyclic intermediates engineered for precision in high-stress environments such as aerospace and electronics. AkzoNobel N.V., while best known for coatings, also supplies specialty intermediates critical to resin and binder systems. As manufacturers move toward low-VOC formulations, renewable feedstocks, and high-performance additives, market leaders with adaptable chemistries, global scale, and sustainability-driven R&D pipelines are well positioned to capitalize on the growing demand for refined cyclic crude and gum products.

BASF SE, a major player in the cyclic crude, intermediate & gum industry, emphasizes innovation through its Verbund integrated systems, advanced catalytic processes, and digital automation (AI/IoT) to boost production efficiency, minimize waste, and support sustainable operations

| Item | Value |

|---|---|

| Quantitative Units | USD 46.2 Billion |

| Product Type | Cyclic crude, Chemical intermediates, Gums and related products, Wood chemicals, Tall oil, Charcoal, Naval stores, and Other wood chemicals |

| Application | Pharmaceuticals, Chemicals and materials, Food and beverages, Oil and gas, Textiles, Cosmetics and personal care, Agriculture, and Others |

| End Use Industry | Pharmaceutical industry, Chemical industry, Food processing industry, Oil and gas industry, Textile industry, Cosmetics and personal care industry, Agricultural industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ashland Global, BASF SE, Eastman Chemical Company, Huntsman Corporation, Dow Chemical Company, Solvay SA, and AkzoNobel N.V. |

| Additional Attributes | Dollar sales by type include cyclic crude, cyclic intermediates such as cyclohexane and cyclopentane, and natural or synthetic gums like guar and xanthan. Applications span pharmaceuticals, specialty chemicals, food, cosmetics, and oil and gas. Demand drivers include sustainability trends and industrial expansion. Innovation focuses on digitalization and green chemistry. Costs are influenced by raw materials, energy use, and regulatory compliance. |

The global cyclic crude intermediate and gum market is estimated to be valued at USD 46.2 billion in 2025.

The market size for the cyclic crude intermediate and gum market is projected to reach USD 72.5 billion by 2035.

The cyclic crude intermediate and gum market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in cyclic crude intermediate and gum market are cyclic crude, _aromatic hydrocarbons, _alicyclic hydrocarbons, _heterocyclic compounds, chemical intermediates, _cyclic intermediates, _cyclohexanone, _cyclohexane, _cyclopentane, _other cyclic intermediates, _pharmaceutical intermediates, _agrochemical intermediates, _other intermediates, gums and related products, _natural gums, _gum arabic, _guar gum, _xanthan gum, _ghatti gum, _other natural gums, _synthetic gums, _chewing gum base, _carboxymethyl cellulose (cmc), _other synthetic gums, wood chemicals, tall oil, charcoal, naval stores and other wood chemicals.

In terms of application, pharmaceuticals segment to command 28.0% share in the cyclic crude intermediate and gum market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA