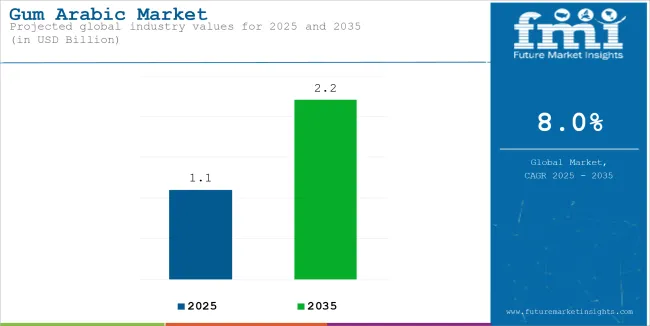

The Gum arabic market is projected to grow from USD 1.1 billion in 2025 to USD 2.2 billion by 2035, registering a CAGR of 8% during the forecast period. The market is being driven by the rising demand for gum arabic in industries such as food and beverages, pharmaceuticals, cosmetics, and textiles.

Acacia Senegal is expected to dominate the market in 2025, accounting for 40% of the share. South Asia is identified as a key growth region, where the demand for gum arabic is rising due to its expanding food and beverage sector.

| Attributes | Description |

|---|---|

| Global Industry Size (2025E) | USD 1.1 Billion |

| Global Industry Value (2035F) | USD 2.2 Billion |

| CAGR (2025 to 2035) | 8% |

Acacia Senegal is expected to dominate the gum arabic market in 2025, accounting for approximately 40% of the market share. This particular variety of gum arabic is highly sought after due to its superior quality and suitability for a wide range of applications, including in the food and beverage industry.

The increasing demand for natural gums as a replacement for synthetic emulsifiers and stabilizers will continue to drive the growth of the Acacia Senegal segment. Furthermore, the growing popularity of natural food additives and clean-label ingredients is expected to boost the demand for gum arabic in both developed and emerging markets

In October 2024, Ahmed Al-Tayeb Al-Anan, President of the Gum Arabic Exporters Division at the Federation of Chambers of Commerce, discussed the state of Sudan's gum arabic market in an interview with Al-Ahdath. Al-Anan reported a sharp increase in gum arabic prices, with the price of a quintal rising from 80 pounds to 400,000 Sudanese pounds in production areas.

Additionally, international prices for Hashab gum rose from USD 2,200 per quintal to between USD 3,900 and USD 4,000, and Talha gum prices increased from USD 1,200 to USD 1,650-USD 1,700 per quintal. However, exports of gum arabic have significantly declined, dropping from 150,000 tons before the war to 60,000 tons recently, due to the ongoing conflict impacting Sudan’s gum production belt.

| Segment | Value Share (2025) |

|---|---|

| Beverages (Application) | 32% |

Due to rising consumer demand for natural ingredients the beverages segment dominated the market in 2025 holding a 32% revenue share. The market saw a rise in health consciousness among consumers who preferred beverages devoid of artificial additives and preservatives.

According to a recent survey 45% of participants thought that healthy products were those devoid of preservatives and additives. Gum Arabic is a natural stabilizer and emulsifier that improves the texture and stability of a variety of beverages such as fruit juices flavored waters and soft drinks.

| Segment | Value Share (2025) |

|---|---|

| Acacia Senegal (Type) | 40% |

Acacia Senegal is the most popular gum type according to gum arabic market research driving 40% of the market. Gum from Acacia Senegal is widely acknowledged for its exceptional quality which makes it the go-to option across a range of industries.

Its special qualities have made it a leader in the field including high solubility stability and viscosity control. The widespread use of Acacia Senegal in food and drink is the reason for its dominance the market for medications and other sectors that appreciate its remarkable qualities and adaptability.

High Usage of Gum Arabic in the Food and Beverage Sector to Propel Market Expansion

One of the main factors driving the markets expansion is the variety of uses for gum arabic. The food and beverage pharmaceutical and personal care sectors all use gum arabic. Additionally, gum arabic is used to thicken chewing gum bind watercolour paints add to ceramic glazes and make rolling papers for cigarettes.

Gum arabic is expected to grow significantly during the forecast period as a result of the global demand for natural products in the food and beverage sector. Due to the health advantages of natural foods consumers are now consuming more of these products.

Gum Arabic’s Exceptional Adherence in Printing is Fuelling the Market’s Expansion

It is also used in conventional printing and lithography. Typically, newspapers use it for their printing. Gum Arabic gives the ink a high level of adhesion which helps the print stay permanent. Consequently, one of the main factors driving the markets expansion on a global scale is the variety of applications for gum arabic.

The Market’s Growth May be Hampered by the Growing Use of Substitutes

With abiotic factors like climate change in the countries where gum arabic is produced the global gum arabic market growth is expected to decline. Instability in politics is another important factor contributing to market retardation. Many difficulties are faced by the nations that produce gum Arabic particularly Somalia and Sudan.

Due to limited production these issues will negatively impact the market in the future. Additionally, chemical manufacturers have created a number of synthetic alternatives that can be used for emulsification in place of gum arabic. Due to their low cost these alternatives pose a threat to the gum arabic market even though they cannot match it. It’s possible that consumers will prioritize opportunity cost over quality.

Tier 1 companies includes industry leaders acquiring a significant share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality. Prominent companies within tier 1 include TIC Gums, Gum Arabic Company, Nexira, Kerry Group, Farbest Brands, Agrigum International Ltd.

Tier 2 companies include mid-size players having a presence in specific regions and highly influencing the local commerce. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance. Prominent companies in tier 2 include Hawkins Alland & Robert SE, Watts Limited, Daniels-Midland Company (ADM), Archer.

Tier 3 companies includes mostly of small-scale businesses serving niche economies and operating at the local presence. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, France and India come under the exhibit of high consumption, recording CAGRs of 7%, 7.5% and 8%, respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 7% |

| France | 7.5% |

| India | 8% |

In terms of consumption North America currently leads the market with the food and beverage sector being its main application. Natural and plant-based ingredients are becoming more and more popular in a variety of industries including food and drink medicine and cosmetics. gum arabic is a popular option for product formulation because of its emulsifying and stabilizing qualities.

Its use has also been boosted by possible health advantages such as its use as a prebiotic and dietary fibre. Gum arabic’s qualities make it a popular option for beverages, confections and medications. The gum Arabic market in the USA is expanding as a result of the trend toward natural and healthful products.

The growing food and beverage industry are the main driver of the gum arabic markets expansion in India. Despite this the Indian gum arabic market has grown.

However, it still faces difficulties obtaining raw gum arabic from certain acacia tree species which can be impacted by geopolitical and environmental factors in the production regions. Gum Arabic quality variances and price fluctuations also cause uncertainty for producers and consumers.

France was the world’s second-largest exporter of gum arabic with USD 190 million in exports. In the same year France’s fifth-most-exported product was gum arabic. Frances top export destinations for gum arabic are the USA, Germany Ireland China and Italy. France became the world’s top importer of Gum Arabic bringing in USD 110 million in the process.

The global gum arabic market is characterized by a consolidated competitive landscape, with dominant players, key players, and emerging firms. Dominant players such as Nexira, Kerry Group, and Ingredion Incorporated hold leading positions, supported by their extensive product portfolios, global distribution networks, and well-known brands. Key players including AEP Colloids Inc., Hawkins Watts Limited, and Alland & Robert focus on diverse gum arabic offerings, from emulsifiers to stabilizers, with strong regional presences in North America and Europe.

Emerging players like Agrigum International Limited, Polygum AG, and C.E. Roeper GmbH are gaining traction by catering to the growing demand for specialty gum arabic products and sustainable sourcing practices, offering innovative solutions in the evolving gum arabic market.

Recent Gum Arabic Industry News

By function industry has been categorized into Thickener, Gelling Agent, Fat replacer, Stabilizer

By function industry has been categorized into Organic, Conventional

By function industry has been categorized into Pharmaceutical Industry, Food and Beverages Industry, Printing & Painting

By function industry has been categorized into Viscosity, Solubility, Emulsifier, Film forming, Fat substitute, Fiber, Stabilizer

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa and Asia

The market is expected to grow at a CAGR of 8% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 2.2 Billion.

Growing consumer preference for healthier options which in turn is driving up demand for natural ingredients.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Gum Arabic Company, Nexira, TIC Gums, Agrigum International Limited, Kerry Group, Farbest Brands and more.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gummed Tape Market Size and Share Forecast Outlook 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Gummy Market Analysis by Product, Ingredient, End-Use, Distribution Channel, and Region - Forecast through 2025 to 2035

Gum Turpentine Oil Market Growth - Trends & Forecast 2025 to 2035

Gum Hydrocolloid Market Analysis by Product Type, Source, and Region through 2035

Key Companies & Market Share in the Gummed Tape Sector

Evaluating Gum Fiber Market Share & Provider Insights

Gum Rosin Market Size & Demand Analysis 2024-2034

Gum Content Tester Market

CBD Gummies Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Pre-Gummed Labels Market Growth - Demand & Forecast 2025 to 2035

Guar Gum for Construction Market Size and Share Forecast Outlook 2025 to 2035

Tara Gum Market Size and Share Forecast Outlook 2025 to 2035

Guar Gum Market Growth & Demand Forecast 2024-2034

Sleep Gummy Market Analysis by Primary Ingredient, Customer Orientation, Pack Size and Product Claim Through 2035

Paper Gummed Tape Market Growth - Demand & Forecast 2025 to 2035

CoQ10 Gummies Market Analysis by Source, Distribution Channels, and Key Regions Through 2035

Ester Gums Market Growth – Trends & Forecast 2025 to 2035

Dammar Gum Market Size and Share Forecast Outlook 2025 to 2035

Biotin Gummies Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA