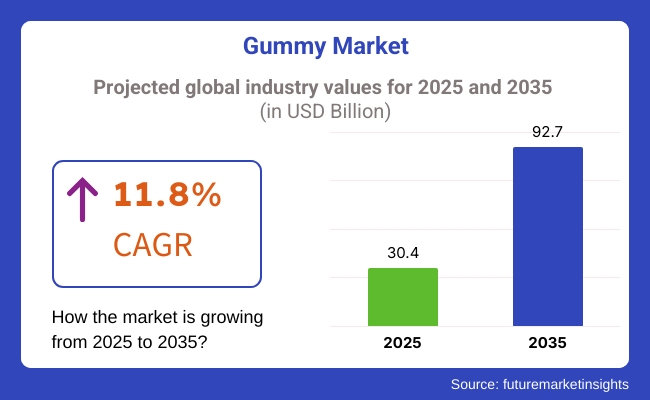

The gummy market is likely to increase substantially by 2025, with an expected worth of USD 30.4 billion. The overall market is forecasted to grow at a CAGR of 11.8% in terms of sales between 2025 and 2035. The gross value of the industry should reach USD 92.7 billion by the end of 2035.

Gummies have become a very well-liked product, being the most popular way of taking vitamins instead of swallowing pills or eating candy. The sweet taste, chewable texture, and simplicity of using them are the main factors of their popularity among children and adults. Functional variants that are mixed with vitamins, minerals, and additional health sources are the strongest drivers of growth. Gummies are being considered the best way to add health benefits to food.

The growth is being advanced due to the increased consumer knowledge and interest in wellness and health. Functional gummies, such as multivitamins, probiotics, collagen, and CBD-infused types, are even more obligatory for daily nutrition and self-care. The rise of the clean label, the plant-based, and sugarless formulations also brings innovation and draws the interest of customers.

The prevalence of gummies as a delivery option for nutrients and dietary supplements is forcing the industry to transform. Firms are funding the research and development of products that are particular for various dietary needs, such as vegan, gluten-free, and organic. Besides, the creation of pectin-based and gelatin-free gummies ensures that they are available to the broader public.

Certain difficulties are hovering that must be handled. The adequately established sugary convention products have led to a spike in health-oriented presentations, which in turn has compelled suppliers to turn to options that fit into these types. Besides, to some extent, the stabilization of gelatin in the gummy formulation is also a crucial technical issue for the product developers.

The challenges can help open up some possibilities. The shift towards more individualized dietary solutions as well as fast and convenient nutrients is happening via the newest kind of specialized gummies that help with immunity, sleep support, digestion, and beauty.

The rapid expansion of online omnichannel, including e-commerce selling platforms and B2C sales, is advancing. Due to the changes in consumer choices, the gummy segment is not likely to be well-bet, and it will, thus, remain successful everywhere.

Between 2020 and 2024, there was a remarkable growth in sales due to increasing demand for convenient-to-consume and entertaining-filled supplement forms and confectionery food with diverse flavors and textures. The demand for gummy vitamins and supplements offered an edible option to traditional pill forms, increasing consumer acceptance.

Flavor development and healthier product shapes, such as lower-sugar and fortified options, were key drivers of growth. Consumers grew more health-aware and demanded functional gummies with added benefits such as immune system support, stress management, and digestive health. However, concerns about sugar content and regulatory attention to labeling practices compelled manufacturers to strike the right balance of taste, health value, and compliance.

Between 2025 and 2035, there will be continued growth, shifting towards functional and plant-based products. Increased demand for vegan and animal-free gummies is one part of the broader consumer demand for plant-based consumption. Functional gummies for specific health needs, such as cognitive function and gut health, will be a driver of innovation. Technological innovations in manufacturing will make low-sugar and sugar-free gummies accessible without any compromise in texture or taste. Sustainability will increasingly become an issue as manufacturers resort to sustainable packaging and sourcing. Regulatory reforms will emphasize transparency, source of ingredients, and health declarations to meet changing consumer and governmental needs.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Focus on international flavors and convenient-to-consume supplement formats. | Higher demand for plant-based and health-functionality-driven gummies |

| Industry growth is driven by increasing demand for gummy vitamins and confectionery | Continuous growth with a focus on health benefits and nutritional requirements |

| Introduction of fortified and low-sugar formats | Development of functional gummies with a focus on brain health, stress management, and digestive health |

| Higher health-led consumption and demand for cleaner labels | Focus on natural ingredients, more nutritional value, and less sugar |

| More focus on sugar content and health labeling | More stringent controls on transparency and ingredient authenticity |

| The early motion toward sustainable packaging and sourcing | Focus on green activities and less environmental footprint |

The gummy category is growing exponentially across industries due to consumer preference for easy, flavorful, and functional products.

Within the confectionery industry, gummies are a well-loved sugar confectionery, with growth in reduced-sugar and plant-based gummies. The nutraceutical industry is experiencing a boost in vitamin-enriched and CBD gummies, attracting health-oriented consumers who are looking for alternative supplement forms.

The pharmaceutical sector utilizes gummies for over-the-counter drugs such as melatonin, probiotics, and multivitamins, with emphasis on regulatory compliance and functional ingredients. In pet supplements, gummy-based treats are increasingly popular for providing necessary nutrients in an attractive form for pets.

Also, beauty and personal care companies are launching gummies infused with collagen, biotin, and hyaluronic acid that continue the move toward edible beauty. With consumer demand increasing, manufacturers are pushing innovations through clean-label ingredients, organic colors, and eco-friendly packaging for better alignment with changing consumer sentiment.

Rising consumer preference for handy, tasty supplements and candied fruits have been driving the growth. Meanwhile, the regulatory challenges that the manufacturers face when it comes to protecting the public's health from harmful adulterants, such as labeling compliance and health claims, are still a risk.

Supply chain interruptions, notably shortages of critical ingredients such as gelatin, pectin, and natural sweeteners, can disrupt stability in production. Additionally, price fluctuations in raw materials paired with transportation restraints can give rise to cost instability. Enterprises are advised to set up multiple sources of supply and to do away with dependency risks by investing in the procurement of sustainable ingredients and optimizing transportation.

Manufacturing hurdles are the formulation intricacies and the shelf-life stability. Avoiding the use of artificial additives requires the implementation of advanced formulation processes. In contrast, optimal texture and taste, along with better nutrient retention, are achieved only by high-level techniques.

Oversupply and excessive competition from the traditional supplements sector, as well as functional foods, lead to pressure on prices and cause problems in the industry's differentiation. In order to remain in the game, firms ought to concentrate on innovations that stem from combining unique ingredients and showing the health benefits that come with them, while supermarkets and the internet serve as vehicles that carry the message further to the customers, thus increasing industry penetration.

Economic detours and the shift in dietary preferences can change the demand for gummies, especially in the areas of well-being and health. Businesses should give top priority to being cost-effective, staying environmentally friendly, and extending their distribution channels. At the same time, they must be open to changes in consumers' habits and innovations that the industry delivers.

In the industry, the Vitamins segment is gaining traction, whereas Minerals are also creating their share owing to the growing inclination of consumers toward tasty, instant supplements.

Over the forecast period of 2025 to 2035, the vitamin segment is expected to dominate, with a share of 58.2% in 2025 and a CAGR of 11.9% during the same period. Demand is being propelled by growing health awareness, especially related to immunity and general well-being. So while brands like Olly, SmartyPants, and Vitafusion were once trailblazers, bringing unique formulations together to be perfect for any health need (i.e., energy, skin health, digestive tract), today you fuse them into one ideal gummy vitamin. MaryRuth Organics and Garden of Life are others that have expanded to meet the demand for sugar-free and organic vitamin gummies. The segment growth is further propelled by the increasing number of consumers of vegan and plant-based gummies who avoid gelatin-based products.

The minerals segment is anticipated to hold a 41.8% share of the entire industry by 2025 and, together, is expected to expand at a CAGR of 10.5% during the period 2025 to 2035. Gummies of calcium, magnesium, and zinc are still trending, especially among bone health, relaxation, and muscle recovery-minded consumers. Proven brands like Nature’s Bounty and Nordic Naturals are creating specific formulations with chelated minerals for better absorption. Iron and magnesium gummies are also gaining acceptance among children and pregnant women due to their contribution to nutrient deficiencies.

The ingredient segment is divided into two parts: The former and the most commonly used Gelatin and Plant-Based Gelatin Substitutes, which have a prominent role in supplement, confectionery, and pharma formulations.

With a share of 63.4% in 2025, gelatin is the leading ingredient and is anticipated to grow at a CAGR of 11.6% between 2025 and 2035. Its superior gelling, texturizing, and protein-rich properties make it widely used in gummies, capsules, and functional foods.

Major manufacturers like Rousselot, Gelita, and Nitta Gelatin are shifting towards high-purity, pharmaceutical-grade gelatin to meet the demands for clean-label and fortified supplements. Furthermore, the binding and stabilizing advantages of gelatin make it a big part of sports nutrition and collagen-based items.

With the continuing rise of veganism and vegetarianism, plant-based gelatin alternatives are on the rise. Excipients like agar-agar, pectin, and carrageenan are being used increasingly due to clean-label, allergen-free, and Halal/Kosher certification requirements. CP Kelco, TIC Gums, and DuPont are among the companies investing in advanced plant-derived hydrocolloids to create heat-stable, texture-enhancing formulations. This segment is expected to register a 9.8% CAGR from 2025 to 2035, driven by increasing demand for plant-based gummies and capsules.

Gelatin is still the leader, but plant-based alternatives can quickly be added, and there are many different options for health-conscious consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.5% |

| UK | 12.6% |

| France | 10% |

| Germany | 9.8% |

| Italy | 9.5% |

| South Korea | 11% |

| Japan | 8.5% |

| China | 14.5% |

| Australia | 9% |

| New Zealand | 8.8% |

The USA is expected to develop with a CAGR of 10.5% during the period between 2025 and 2035. The growing consumer demand for convenient and enjoyable formats of supplements influences the growth. The popularity of health and wellness trends has created a trend towards vitamin-enriched gummies, providing a substitute for traditional pills. Large brands such as Vitafusion have profited from this trend by offering numerous gummy vitamins for both children and adults.

In addition, the USA has witnessed an explosion of CBD-infused gummies, a move that indicates increasing acceptance of cannabis-based products. Brands like Charlotte's Web have been releasing CBD gummies directed to health-aware consumers. The intersection of flavor, convenience, and perceived health advantage continues to drive growth in the USA

The UK is expected to grow at a CAGR of 12.6% during the forecast period. With more emphasis on wellness and health, consumers have turned towards functional confectionery items. Nutriburst has responded by introducing vitamin-fortified gummies that attract health-aware consumers. Plant-based diets have also had an impact, with vegan gummies gaining popularity.

The UK 's strict controls on sugar levels have led manufacturers to innovate with lower-sugar versions, supporting public health campaigns. The blend of health value, indulgence, and compliance has driven the strong growth of this industry in the UK

The French industry is projected to register a CAGR of 10% from 2025 to 2035. French consumers' preference for quality and taste has propelled the demand for high-end products. Brands such as Lutti have launched gourmet gummies targeting refined tastes, fusing traditional confectionery with contemporary flavors.

The focus on natural and organic content has also influenced the industry, with consumers seeking products that do not contain artificial additives. This trend is in line with the wider clean-label movement, pushing manufacturers to be more transparent and authentic in what they offer.

Germany is expected to expand at a CAGR of 9.8% over the forecast period. The nation's rich confectionery heritage, represented by companies like Haribo, has created a solid base for gummy consumption. The market has diversified to encompass functional gummies, including those with added vitamins and minerals, targeting health-conscious consumers.

Demand for plant-based goods has also been a factor, with gelatin-free gummies becoming increasingly popular among vegetarians and vegans. German consumers' emphasis on quality and sustainability has led to manufacturers embracing eco-friendly production and sourcing natural ingredients.

The Italian gummies market is estimated to expand with a CAGR of 9.5% during the forecast period of 2025 to 2035. Italy's cultural focus on indulgence and taste has influenced the popularity of gummies as tasty treats. Companies such as Fida have launched gummies that blend historical Italian flavors and contemporary confectionery methods.

The increased demand for health and well-being has also affected the market, with buyers looking for gummies that contain functional ingredients. The balance of indulgence versus health benefits has been a central factor in the growth of the market in Italy.

South Korea is anticipated to grow at a CAGR of 11% over the next decade. The country's dynamic food culture and rapid adoption of trends have led to the popularity of gummies among younger consumers. Brands like Orion have launched innovative products that resonate with the tech-savvy and trend-conscious population.

The emphasis on beauty and health has also had an impact on the industry, with collagen-enriched gummies becoming popular among consumers looking for easy beauty supplements. The integration of confectionery and functional benefits is further propelling the growth of the industry in South Korea.

Japan is projected to grow at 8.5% CAGR from 2025 to 2035. Japanese consumers' need for novel textures and flavors has provided impetus for the creation of varied gummies. Organizations such as Meiji have launched gummies with differentiated textures to suit domestic consumer preferences.

The industry has also witnessed the addition of Japanese heritage flavors like matcha and yuzu to gummy items, bringing together cultural legacy and contemporary confectionery. Portion control and packaging style have also increased the popularity of gummies in Japan.

China is estimated to grow at 14.5% CAGR during the forecast period. Urbanization and the rising middle class have raised demand for convenient and fun snacking options. Healthy consumers have fueled growth for vitamin and mineral-enhanced gummies as a tasty alternative to conventional supplements.

The inclusion of traditional Chinese medicine ingredients in gummies has also become popular, targeting consumers looking for complete health solutions. The synergy of taste, convenience, and perceived health benefits keeps driving the industry growth in China.

Australia's gummy industry is expected to register a CAGR of 9% during the period 2025 to 2035. The nation's emphasis on health and wellness has made functional gummies popular, especially those with vitamins and minerals. Nature's Way has launched gummy supplements for adults and children.

The shift towards organic and natural products has also impacted sales, with consumers looking for gummies that are not made with artificial colors and flavors. The convergence of indulgence with health has been a major driver of growth in Australia.

The New Zealand gummy market is predicted to develop at a CAGR of 8.8% over the forecast period. Natural products and sustainability have been high on the country's agenda, and it has influenced the buying behavior for clean-label ingredients in gummies. Companies such as Healtheries have launched gummies targeted toward health-focused customers looking for easily consumable supplements.

The increasing demand for functional foods has also influenced sales, with probiotics and other nutrient-enriched gummies becoming increasingly popular. The harmony between taste, convenience, and health benefits continues to propel the growth of the gummy market in New Zealand.

The gummy market is evolving by creating niches across the population with increased consumer demand for functional and nutritional gummies, as well as confectionery gummies. Consumers have always been inclined towards easy and fun modes of supplementation, apart from the increasing popularity of clean-label formats and plant-based and sugar-free formulations.

Leading companies comprising Church & Dwight (Vitafusion), Bayer AG, the Clorox Company (OLLY), Nature's Way, and Pharmavite (Nature Made) are well recognized for their innovation. Startups and niche brands have created organic, vegan, and collagen-infused gummy entries for consumers with different tastes.

These include gummy vitamins, functional gummies (CBD, probiotics, sleep aid), and conventional fruit flavors in confectionery gummies. Companies are directing their innovations at reducing sugar and natural flavors, as well as fortifying with vitamins, minerals, and adaptogens in the current health craze.

Market innovations have brought about extensive developments of pectin-alginate and gelatin-free gummies, which now have applications that extend well beyond dietary supplements to include sports nutrition, beautified-from-within gummies, and medicinal gummies. North America and Europe continue to be the largest markets in demand, while Asia Pacific promises the highest growth rates as health awareness coexists with growing household disposable income.

Strategic factors influencing competition are sustainable packaging, new ingredient innovations, and retail expansion via e-commerce and subscription models. To further advance their positioning to meet new consumer expectations, many companies are investing in customizing formulations, clean-label certification, and multinational partnerships.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bayer AG (One A Day, Flintstones) | 18-22% |

| Church & Dwight (Vitafusion) | 14-18% |

| Pharmavite (Nature Made) | 10-14% |

| The Clorox Company (OLLY) | 8-12% |

| Nestlé Health Science (Solgar, Garden of Life) | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Focus |

|---|---|

| Bayer AG | A key leader in multivitamins and children's gummies, leveraging strong brand recognition and scientific research. |

| Church & Dwight (Vitafusion) | An innovator in adult gummy vitamins, focusing on high-potency formulations and sugar-free alternatives. |

| Pharmavite (Nature Made) | Specializes in USP-verified, clinically tested gummies, ensuring scientific backing and regulatory compliance. |

| The Clorox Company (OLLY) | Leader in lifestyle and wellness-focused gummies, using trendy, functional ingredients like adaptogens and collagen. |

| Nestlé Health Science | Expanding plant-based, organic, and probiotic offerings through brands like Solgar and Garden of Life. |

Key Company Insights

Bayer AG (18-22%)

The world's leading player produces multivitamin gummies with celebrated brands, such as One A Day and Flintstones, with clinically approved formulations.

Church & Dwight (14-18%)

Known for its comprehensive assortment under the name of Vitafusion, it's targeting health-minded audiences by introducing sugar-free and plant-based innovations.

Pharmavite (10-14%)

Focusing on research-based supplementation where Nature Made gummies have found recognition through USP certification.

The Clorox Company (8-12%)

The brand name OL is the most favored in the premium wellness gummy category as it sells collagen, sleep, and stress-relieving gummies housed in attractive packaging.

Nestlé Health Science (6-10%)

Adding more functional and organic gummies to the portfolio, integrating probiotics, superfoods, and plant-based ingredients.

Other Key Players

It's classified as Vitamins, Minerals, Carbohydrates, Omega Fatty Acids, Proteins & Amino Acids, Probiotics & Prebiotics, Dietary Fibers, CBD/CBN, Psilocybin/Psychedelic Mushroom, Melatonin, and Others.

It's classified as Gelatin and Plant-based Gelatin Substitutes.

It's classified as Adults, Men, Women, Pregnant Women, Geriatric, and Kids.

It's classified as Offline (including Hypermarkets/Supermarkets, Pharmacies, Specialty Stores, practitioners, and Others) and Online.

It's divided into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and the Pacific, and the Middle East & Africa.

The industry is expected to generate USD 30.4 billion in 2025, driven by rising demand for convenient, tasty supplement formats across health-conscious consumer segments.

The market is projected to grow to USD 92.7 billion by 2035, fueled by innovations in functional ingredients, plant-based formulations, and a growing consumer focus on wellness and preventive health. The market is expected to expand at a CAGR of 11.8%.

Key players include Bayer AG, Church & Dwight, Pharmavite, The Clorox Company, Nestlé Health Science, SmartyPants Vitamins, NutraBlast, Herbaland Naturals, Nature’s Bounty, and Nordic Naturals.

North America and Western Europe lead due to high supplement consumption and wellness trends. At the same time, East Asia, South Asia, and the Pacific show rapid growth, driven by rising health awareness and expanding middle-class populations.

Vitamin and mineral-based gummies dominate, with growing demand for probiotics, melatonin, and plant-based variants. Gelatin remains common, though plant-based substitutes are gaining traction. Both offline and online distribution channels are key, with online sales growing rapidly.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Ingredient, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Ingredient, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 9: Global Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Ingredient, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Ingredient, 2018 to 2033

Table 17: North America Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 19: North America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 25: Latin America Market Value (US$ million) Forecast by Ingredient, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Ingredient, 2018 to 2033

Table 27: Latin America Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 29: Latin America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 35: Western Europe Market Value (US$ million) Forecast by Ingredient, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Ingredient, 2018 to 2033

Table 37: Western Europe Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 39: Western Europe Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ million) Forecast by Ingredient, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Ingredient, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ million) Forecast by Ingredient, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Ingredient, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 65: East Asia Market Value (US$ million) Forecast by Ingredient, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Ingredient, 2018 to 2033

Table 67: East Asia Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 69: East Asia Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ million) Forecast by Product, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ million) Forecast by Ingredient, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Ingredient, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Ingredient, 2023 to 2033

Figure 3: Global Market Value (US$ million) by End-Use, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 14: Global Market Value (US$ million) Analysis by Ingredient, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Ingredient, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 18: Global Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 22: Global Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product, 2023 to 2033

Figure 27: Global Market Attractiveness by Ingredient, 2023 to 2033

Figure 28: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ million) by Product, 2023 to 2033

Figure 32: North America Market Value (US$ million) by Ingredient, 2023 to 2033

Figure 33: North America Market Value (US$ million) by End-Use, 2023 to 2033

Figure 34: North America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 44: North America Market Value (US$ million) Analysis by Ingredient, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Ingredient, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 48: North America Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 52: North America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product, 2023 to 2033

Figure 57: North America Market Attractiveness by Ingredient, 2023 to 2033

Figure 58: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) by Product, 2023 to 2033

Figure 62: Latin America Market Value (US$ million) by Ingredient, 2023 to 2033

Figure 63: Latin America Market Value (US$ million) by End-Use, 2023 to 2033

Figure 64: Latin America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 74: Latin America Market Value (US$ million) Analysis by Ingredient, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Ingredient, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 78: Latin America Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 82: Latin America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Ingredient, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ million) by Product, 2023 to 2033

Figure 92: Western Europe Market Value (US$ million) by Ingredient, 2023 to 2033

Figure 93: Western Europe Market Value (US$ million) by End-Use, 2023 to 2033

Figure 94: Western Europe Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 104: Western Europe Market Value (US$ million) Analysis by Ingredient, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Ingredient, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 108: Western Europe Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 112: Western Europe Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Ingredient, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ million) by Product, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ million) by Ingredient, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ million) by End-Use, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ million) Analysis by Ingredient, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Ingredient, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Ingredient, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ million) by Product, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ million) by Ingredient, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ million) by End-Use, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ million) Analysis by Ingredient, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Ingredient, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Ingredient, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ million) by Product, 2023 to 2033

Figure 182: East Asia Market Value (US$ million) by Ingredient, 2023 to 2033

Figure 183: East Asia Market Value (US$ million) by End-Use, 2023 to 2033

Figure 184: East Asia Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 194: East Asia Market Value (US$ million) Analysis by Ingredient, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Ingredient, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 198: East Asia Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 202: East Asia Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Ingredient, 2023 to 2033

Figure 208: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ million) by Product, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ million) by Ingredient, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ million) by End-Use, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ million) Analysis by Product, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ million) Analysis by Ingredient, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Ingredient, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Ingredient, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Ingredient, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Ingredient, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by End-Use, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Sleep Gummy Market Analysis by Primary Ingredient, Customer Orientation, Pack Size and Product Claim Through 2035

Coffee Gummy Market Analysis by sales channel, application and region Through 2025 to 2035

Organic Gummy Worms Market Analysis by Flavors, Distribution Channel and Region from 2025 to 2035

Collagen Gummy Market Analysis by Flavor Type, Source, Functionality, Sales Channel and Region through 2035

Mushroom Gummy Market – Consumer Trends & Functional Benefits

Sugar-Free Gummy Market Insights - Consumer Trends & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA