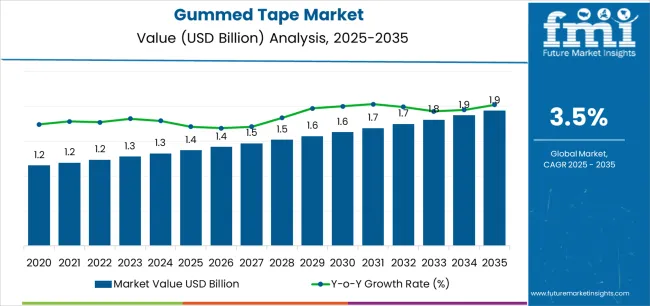

The Gummed Tape Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 1.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

The Gummed Tape market is experiencing consistent growth driven by increasing demand for sustainable and tamper-evident packaging solutions across industrial, e-commerce, and logistics sectors. The shift towards eco-friendly materials has positioned gummed tape as a preferred alternative to plastic-based tapes, aligning with global sustainability goals. The market outlook remains strong as manufacturers adopt biodegradable and recyclable paper-based materials, catering to the rising consumer and regulatory emphasis on environmental responsibility.

Technological advancements in adhesive formulations have further improved product performance, ensuring better bonding strength and moisture resistance during shipping and storage. Additionally, the expansion of online retail and cross-border trade has significantly increased the usage of gummed tapes in carton sealing applications.

Growing automation in packaging lines and preference for tapes compatible with water-activated dispensers are also driving the market forward As industries continue to transition toward sustainable and efficient packaging solutions, gummed tapes are expected to maintain steady growth momentum over the coming years.

| Metric | Value |

|---|---|

| Gummed Tape Market Estimated Value in (2025 E) | USD 1.4 billion |

| Gummed Tape Market Forecast Value in (2035 F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

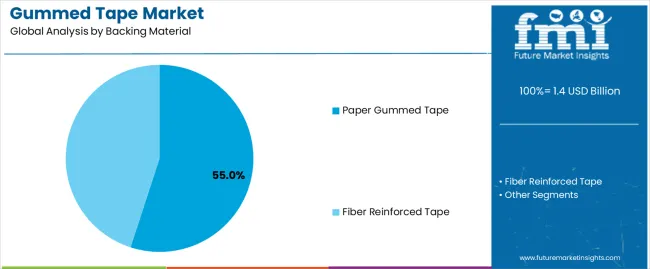

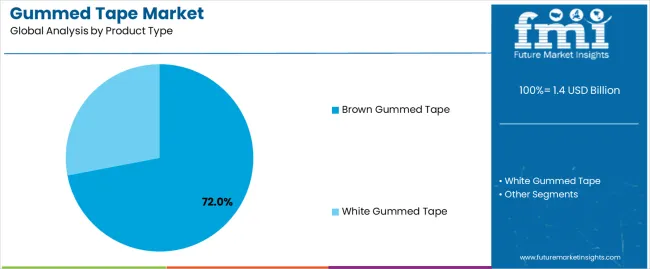

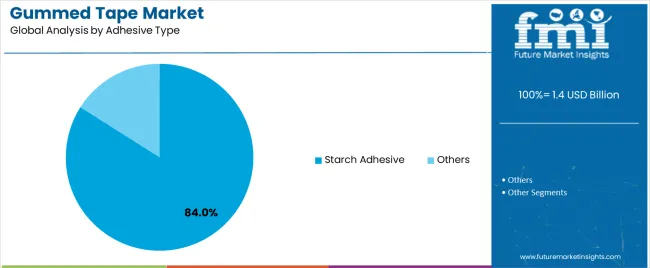

The market is segmented by Backing Material, Product Type, Adhesive Type, Application, and End Use Industry and region. By Backing Material, the market is divided into Paper Gummed Tape and Fiber Reinforced Tape. In terms of Product Type, the market is classified into Brown Gummed Tape and White Gummed Tape. Based on Adhesive Type, the market is segmented into Starch Adhesive and Others. By Application, the market is divided into Box And Carton Sealing, Splicing, and Others. By End Use Industry, the market is segmented into Shipping And Logistics, Building And Construction, Food And Beverages, Electrical And Electronics, Automotive, Healthcare And Hygiene, Metalworking, Oil And Gas, General Industries, and Consumer Good. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The paper gummed tape segment is projected to hold 55.0% of the Gummed Tape market revenue share in 2025, establishing it as the leading backing material segment. The dominance of this segment is attributed to the increasing adoption of paper-based materials as part of the global sustainability shift in packaging. Paper gummed tapes are fully recyclable and biodegradable, which supports the growing demand for eco-friendly alternatives in the packaging industry.

Their superior adhesion and strength make them suitable for heavy-duty carton sealing applications, especially in logistics and e-commerce sectors. The segment has also benefited from rising government regulations restricting plastic packaging, leading businesses to adopt paper-based options.

Additionally, the ability of paper gummed tapes to provide a tamper-evident seal enhances security during transportation, further driving preference among packaging manufacturers The expansion of automated packaging lines and compatibility with water-activated dispensers continue to reinforce the market position of this segment.

The brown gummed tape segment is expected to capture 72.0% of the Gummed Tape market revenue share in 2025, positioning it as the dominant product type. This growth is driven by its extensive use in packaging operations due to its cost-effectiveness, high tensile strength, and strong adhesion properties. Brown gummed tapes offer superior sealing quality, ensuring package integrity during transit and handling.

The segment’s growth has been reinforced by the increasing preference for natural-colored packaging materials that align with brand sustainability initiatives. Additionally, brown gummed tapes are preferred in bulk packaging and industrial shipments as they provide durable performance and maintain a professional aesthetic appeal.

Their adaptability for various substrates and moisture-activated adhesive system enhances their reliability in diverse climatic conditions The rising expansion of e-commerce and retail sectors, coupled with the push for sustainable packaging, continues to support the segment’s strong market position and long-term growth prospects.

The starch adhesive segment is anticipated to account for 84.0% of the Gummed Tape market revenue in 2025, making it the leading adhesive type. The growth of this segment is attributed to the increasing demand for natural and bio-based adhesive solutions in packaging. Starch adhesives are derived from renewable resources, making them environmentally friendly and cost-effective compared to synthetic alternatives.

Their excellent wet tack, quick bonding, and strong fiber penetration ensure durable seals on corrugated cartons, enhancing shipment security. The segment’s expansion has also been supported by regulatory encouragement toward biodegradable adhesive systems and growing adoption by manufacturers focusing on sustainability.

Additionally, starch-based adhesives are non-toxic and safe for food packaging applications, further broadening their use across industries Continuous innovation in adhesive chemistry and improvements in performance consistency have further strengthened the preference for starch adhesives, consolidating their leadership position within the gummed tape market.

The below table presents the expected CAGR for the global gummed tape market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 3.3%, followed by a slightly higher growth rate of 3.9% in the second half (H2) of the same year.

| Particulars | Value CAGR |

|---|---|

| H1 | 3.3% (2025 to 2035) |

| H2 | 3.9% (2025 to 2035) |

| H1 | 4.2% (2025 to 2035) |

| H2 | 3.5% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.2% in the first half and remain relatively moderate at 3.5% in the second half. In the first half (H1) the market witnessed a decrease of 90 BPS while in the second half (H2), the market witnessed an increase of 60 BPS.

Increased Applications in Shipping and Logistics Sector

Due to rising e-commerce all over the globe, there has been a rise in the shipment and logistics of several products or goods via several e-commerce sites or apps. Products such as electronics, foods, beverages, automotive spare parts, consumer goods and pharmaceutical products are shipped over long distances.

These products pass through several stages from production to delivery, to make sure that the product is not damaged there is a need for superior packaging and sealing solutions during logistics.

According to the India Brand Equity Foundation (IBEF), the logistics sector is one of the crucial sectors driving the country’s economy and is anticipated to exhibit a CAGR of around 32% from 2025 TO 2035. These gummed tape possess high strength, tamper-evident features and tolerance for fluctuating temperature.

These tape once applied and then removed leave a trace of the earlier tape application, thus offering increased thefts and forceful manipulations. With the daily increasing shipping and logistics sector not only in India but across the globe, the gummed tape market is expected to grow over the forecast period.

Rising Use in Food and Beverage Industry due to Distinct Properties

With rise in consumption of packaged foods all over the world, efficient packaging has been a point of concern to prevent food spoilage and contamination as consuming such foods leads to various types of severe food-borne diseases. As per the reports of the Centers for Disease Control and Prevention (CDC) in August 2025, 1.4 million people were sick, 128,000 people had to be hospitalized and 3,000 people died due to food-borne illness.

These gummed tape are responsible for keeping the product intact and ensuring the product’s integrity. These tape offer the required strength, durability, and resistance to moisture, heat, and cold making them the most preferable tape for all types of food packaging applications. Paper gummed tape are used prominently for packaging pastry boxes, meat trays and packaged frozen foodstuffs.

Its superior adhesive properties guarantee a tight bond that holds out against fluctuating temperatures, preventing moisture from contaminating the foodstuffs. With day by day fast-growing food industry, tape manufacturers are focusing on research and development to bring innovative gummed tape that have benefits to the food industry.

Availability of Alternative Sealing Solutions

Among many of its applications, sealing is the major application performed by gummed tape due to its distinct characteristics. But in the market there are several types of tape which are used for similar purpose which include pressure-sensitives tape, gummed tape, adhesive tape, shrink labels and many more.

Some of these tape offer certain additional benefits as compared to gummed such cost effectiveness, extra strength, convince and durability. Thus, easy availability of substitute sealing options may hamper the gummed tape market over the forecast period.

The global market recorded a CAGR 2.5% during the historical period between 2020 and 2025. Market growth of gummed tape was positive as it reached a value of USD 1,259.3 million in 2025 from USD 1,079.5 million in 2020.

The industry is experiencing growth due to the increased usage of gummed tape in several end-use industries. Gummed tape have proven to be the preferred choice of tape in the construction industry because of their ease of use, and versatility in terms of adhesive types such as starch-based and composition consisting of layers of fibreglass.

Among many end use industries the electrical and electronics industry is shown to have huge applications in gummed tape market. Gummed tape are used for a variety of applications which include insulation, wire harnessing, EMI shielding, heat dissipation and many others.

The use of brown gummed tape is projected to rise amid its superior strength, ability to be customized, recyclability and environment friendliness. One of its peculiarities is that it provides a neat and professional look to the packages, thus offering an improved presentation of packaged goods.

These brown gummed tape are made from kraft paper derived from wood pulp, thus making them environmentally friendly. They show compatibility for different dispensers such as automatic or water-activated tape dispensers and also find application in various end-use industries.

These beneficial characteristics are encouraging companies to manufacture brown gummed tape. The rise in demand for sustainable and eco-friendly gummed tape from several end users is expected to create opportunities in the gummed tape market.

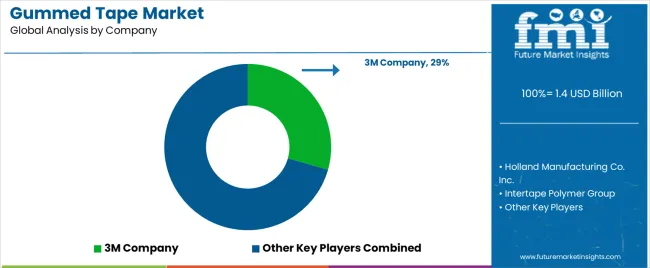

Tier 1 companies comprise market leaders with a market revenue of above USD 20.4 million capturing significant market share of 10% to 15% in global market. These market leaders are characterized by high production capacity and a wide product portfolio.

These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include 3M Company, Intertape Polymer Group. Inc. and Shurtape Technologies, LLC.

Tier 2 companies include mid-size players with revenue of USD 10.2 to 20.4 million having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge.

These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Holland Manufacturing Co. Inc., Loytape Industries SDN.BHD., Windmill Tape & Labels Ltd., and Neubronner GmbH & Co.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets having revenue below USD 10.2 million. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the future forecast for gummed tape market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia, Europe, Oceania and MEA is provided. India is anticipated to remain at the forefront in South Asia, with a CAGR of 5.3% through 2035. In East Asia, China is projected to witness a CAGR of 4.2% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| The United States | 2.3% |

| The United Kingdom | 1.9% |

| Germany | 1.5% |

| Brazil | 3.1% |

| China | 4.2% |

| India | 5.3% |

| GCC Countries | 3.8% |

The gummed tape industry in India is projected to hold more than 34.4% share of the South Asia region by 2035. As per the survey of the Packaging Industry Association of India (PIAI),among all sectors contributing to India’s economy, the packaging industry has been ranked 5th in terms of the largest economies. The packaging industry is expected to exhibit a CAGR of 26.7% between 2024 and 2025.

India has been a hub for setting up industries due to its high population, GDP and availability of several resources. Packaging is a key factor for almost all end-use industries to store and deliver products in the most appropriate condition to the consumer. These gummed tape have been helpful in providing safe and sturdy packaging solutions by offering excellent sealing properties over boxes and cartons.

New Zealand’s food and beverage manufacturing sector offers a lot of opportunities for the market. The country is anticipated to hold a value share of 32.1% in 2035 and record a CAGR of 2.7% during the valuation period.

According to The New Zealand Food & Grocery Council (FGC), the food and beverage manufacturing industry is the largest sector in New Zealand accounting for 45% of total manufacturing income. It generates sales more than USD 40 billion in the domestic retail food, grocery, beverage, and products market in New Zealand.

With rising food and beverage sector, there is also an augmented demand for its packaging solutions. Due to changing lifestyles and rising disposable income, people have shifted over packaged food items over others. These food items need a protective packaging that offers sturdiness, non-tampering of the containers and most importantly away from the impact of moisture, air, and microbial contamination. Gummed tape known for its superior sealing ability are thus used for packaging such packaged food items.

The USA is projected to showcase a CAGR OF 2.3% in the forecast period. The growing oil and gas industry in the country is projected to play a significant role in pushing demand for gummed tape for protection, sealing and labelling applications. As per the reports of the American Petroleum Institute, oil and gas contribute highly to the country’s GDP, showcasing 8% of the total GDP.

Gummed tape have several applications in the oil and gas industry which include sealing parts or equipment, moisture protection to air and humidity-sensitive components, and labelling and identification by printing to provide information regarding that product or any kind of specifications.

Apart from this, gummed tape are sometimes used for protection from harsh environmental conditions such as extreme temperature fluctuation or exposure to any kind of chemicals and any other external elements. As the oil and gas industry is growing, and gummed tape have various applications, the market is expected to grow in upcoming years.

The section contains information about the leading segments in the industry. In terms of adhesive type, starch adhesive is estimated to account for a share of 84% by 2035. By product type, the brown gummed tape segment is projected to dominate by holding a share of 72% by the end 2035.

| Adhesive Type | Starch Adhesive |

|---|---|

| Value CAGR (2035) | 84% |

Starch adhesive among other adhesive types is expected to lead the gummed tape market during the forecast period. Starch adhesive is anticipated to rise at a CAGR of 2.7%, by 2035. Starch adhesives gummed tape are made from renewable and natural resources such as potato starch, and corn starch. These gummed tape require water for activating its adhesive properties. After dipping it into water, they are applied over the desired product for sealing purpose.

Majorly these type of gummed tape are used for box and carton sealing because strength and tamper-evident properties. As these tape are made using renewable materials, they fulfill the environmental and sustainability standards, ultimately seeking attention of those end users preferring naturally made gummed tape and having least impact to the environment.

| Product Type | Brown Gummed Tape |

|---|---|

| Value CAGR (2035) | 72% |

The brown gummed tape segment is estimated to lead the gummed tape industry. It is anticipated to hold around 2.7% CAGR value share in 2035. Apart from other product types, brown gummed tape are used more often due to their additional beneficial properties. Brown gummed tape are used for brand marketing and differentiation by customizing them with the brand’s logo, images and slogans.

The type of labelling and packaging is one of the most important deciding factors when choosing between purchasing any product. Thus using brown gummed tape for branding purposes will lead to increased marketing and several consumers buying that product. Brown gummed tape don’t make any noise at the time of dispensing as compared to other types of tape, thus becoming an ideal tape for busy working environments.

Key players of gummed tape industry are developing and launching new products in the market. They are integrating with different firms and extending their geographical presence. Few of them are also collaborating and partnering with local brands and start-up companies for new product development.

Key Developments in Gummed Tape Market

In terms of backing material, the industry is divided into paper gummed tape and fiber reinforced tape.

Few of the important product type include white gummed tape and brown gummed tape.

Some of the important adhesive type include starch adhesive and others.

Important applications of gummed tape include box and carton sealing, splicing and others.

Some of end use industries related to gummed tape market include shipping and logistics, building and construction, food and beverages, electrical and electronics, automotive, healthcare and hygiene, metalworking, oil and gas, general industries and consumer good.

Key countries of North America, Latin America, East Asia, South Asia, Europe, Oceania, Middle East and Africa are covered.

The global gummed tape market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the gummed tape market is projected to reach USD 1.9 billion by 2035.

The gummed tape market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in gummed tape market are paper gummed tape and fiber reinforced tape.

In terms of product type, brown gummed tape segment to command 72.0% share in the gummed tape market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Companies & Market Share in the Gummed Tape Sector

Paper Gummed Tape Market Growth - Demand & Forecast 2025 to 2035

Tape Unwinder Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Tape Backing Materials Market Analysis by Material Type, Application, and Region through 2025 to 2035

Tape Stretching Line Market Analysis – Growth & Trends 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Competitive Overview of Tape Dispenser Companies

Competitive Overview of Tape Backing Materials Companies

Tape & Label Adhesives Market

Tape Applicator Machines Market

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

Pre-Gummed Labels Market Growth - Demand & Forecast 2025 to 2035

Leading Providers & Market Share in PVC Tapes Industry

ESD Tapes and Labels Market from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA