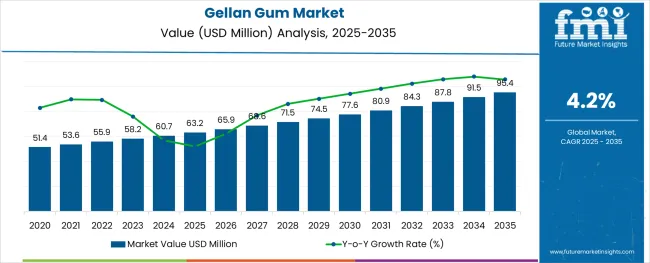

The global gellan gum market is anticipated to experience steady growth, expanding from an estimated USD 63.2 million in 2025 to USD 95.4 million by 2035, at a CAGR of 4.2%. Gellan gum, a high-performance polysaccharide derived primarily from Sphingomonas elodea through microbial fermentation, has established itself as a versatile hydrocolloid across multiple industries.

| Attributes | Description |

|---|---|

| Estimated Global Gellan Gum Market Size (2025E) | USD 63.2 million |

| Projected Global Gellan Gum Market Value (2035F) | USD 95.4 million |

| Value-based CAGR (2025 to 2035) | 4.2% |

Its natural origin and superior gelling, thickening, and stabilizing capabilities make it a preferred alternative to synthetic additives. The steady rise in demand is closely linked to the growing global appetite for plant-based, clean-label, and allergen-free ingredients in processed foods, beverages, personal care items, and pharmaceuticals.

Its adaptability to diverse pH conditions and temperature ranges further enhances its utility across applications, allowing formulators to optimize product consistency and shelf life.

Gellan gum accounts for a relatively niche share within its parent markets due to its specialized use and premium positioning. In the global hydrocolloids market, which is valued in the multi-billion-dollar range, gellan gum accounts for less than 1% due to competition from widely used agents like xanthan and guar gum. Within the food additives market, its share is also below 1%, reflecting its selective application in high-performance formulations.

In the functional food ingredients and texturizing agents markets, it captures a modest 1-2% share, driven by its superior gelling and stabilizing properties. Its role is more pronounced in the clean-label ingredients market, where it holds around 3% share, benefiting from rising demand for plant-based, non-GMO, and allergen-free components.

The supply chain begins with microbial fermentation using carbohydrate feedstocks such as glucose or lactose, which are then inoculated with Sphingomonas elodea cultures. Post-fermentation, the broth is clarified, filtered, and precipitated, usually using alcohol, before drying and milling into a fine powder. Raw material availability and fermentation efficiency are critical to maintaining production yields and cost-effectiveness.

Suppliers must adhere to stringent food-grade and pharmaceutical-grade quality standards, necessitating consistent process controls and certification compliance. Distributors then supply products in various grades, low acyl and high acyl, to manufacturers in food, beverage, pharma, personal care, and industrial sectors

End users incorporate the ingredient in formulations based on required textural and functional attributes, often blending it with other hydrocolloids. As traceability gains prominence, supply chain transparency, clean processing techniques, and responsible sourcing are becoming central to stakeholder expectations across the ecosystem.

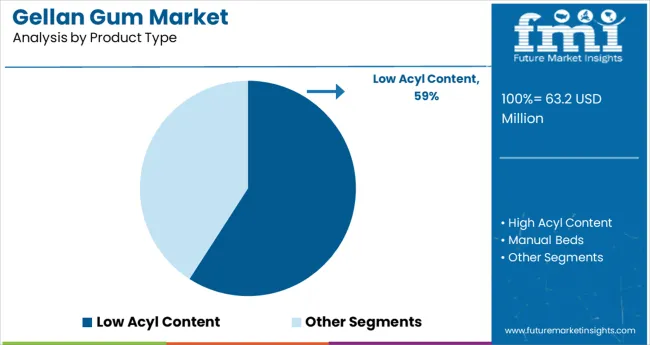

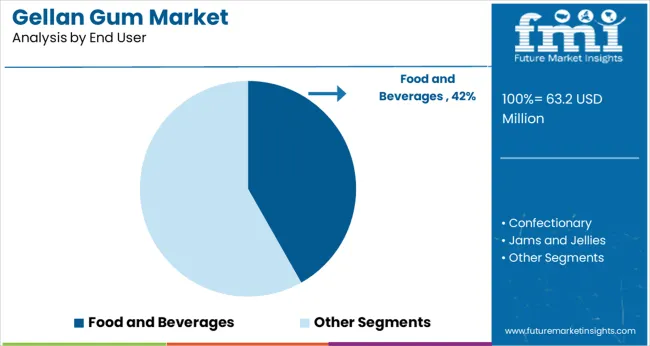

Low acyl gellan gum leads the market with a 59% share in 2025, favored for its firm gel formation, stability in acidic and calcium-rich products, and cost-efficiency. The food and beverages segment dominates end-use applications with a 42% share, driven by growing demand for clean-label, plant-based, and functional ingredients across dairy alternatives, jams, and low-sugar products.

In the market, low acyl content is the leading product type segment, accounting for 59% of the total market share in 2025. This dominance is largely attributed to its ability to form firm, brittle gels that are highly suitable for a broad range of food and beverage applications.

The food and beverages segment stands as the largest end-user of gellan gum, commanding a leading 42% share of the market in 2025. This dominance is primarily due to gellan gum’s exceptional functionality as a gelling, stabilizing, and thickening agent in a wide variety of food applications.

Gellan gum is increasingly adopted for clean-label reformulations, replacing synthetic agents in over 200 SKUs and benefiting from E418 labeling clarity in APAC. Its use in nutritional beverages is rising, with 35% of new plant-protein drinks in Europe using it to improve stability and reduce sedimentation.

Amid rising consumer demand for simplified ingredient lists, food and beverage manufacturers are increasingly choosing products to replace synthetic gelling agents and emulsifiers. Gellan gum’s compatibility with clean-label standards has made it a preferred choice in plant-based, gluten-free, and allergen-free products.

Large-scale processors in the USA and Europe reformulated over 200 SKUs in 2024 using low acyl content, replacing carrageenan and modified starches. This shift is reinforced by retailer pressure to align with “natural origin” standards, leading to higher product shelf presence. Regulatory clarity on E418 labeling in APAC has also accelerated uptake across multi-national F&B portfolios.

Gellan gum is gaining traction in nutritional beverage applications, particularly protein drinks, fortified waters, and low-pH juices that demand suspension stability and visual appeal. Its superior dispersion and anti-settling properties help preserve consistency in high-protein formulations without affecting taste or mouthfeel.

In 2025, over 35% of newly launched plant-protein drinks in Europe listed product as a key stabilizer. RTD beverage startups in South Korea and Canada reported a 21% decline in product returns due to sedimentation after switching to gellan gum. These formulation gains are crucial for beverage brands targeting athletes, seniors, and meal-replacement users seeking functional, convenient, and label-friendly options.

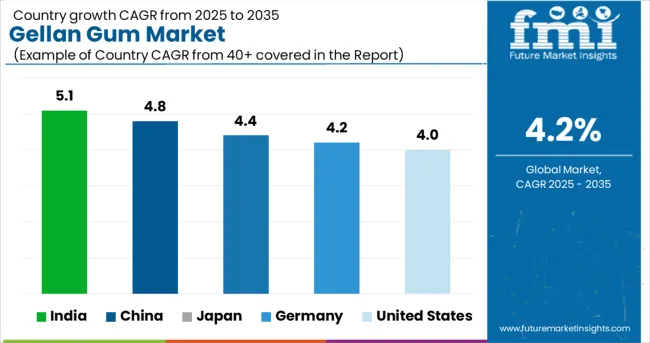

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.0% |

| Germany | 4.2% |

| Japan | 4.4% |

| China | 4.8% |

| India | 5.1% |

The global gellan gum market is projected to grow at a 4.2% CAGR from 2025 to 2035, with BRICS nations leading the acceleration. India records the highest CAGR among key countries at 5.1%, outperforming the global average by nearly one percentage point.

Growth is fueled by increasing demand from plant-based dairy, confectionery, and personal care formulations, along with localized production of food-grade hydrocolloids. China follows at 4.8%, driven by expanded use in beverages, jellies, and pharmaceutical suspensions, supported by vertically integrated fermentation units.

In OECD countries, Japan posts 4.4%, slightly above the global average, as its aging population boosts demand for soft-textured functional foods and supplements. Germany grows in line at 4.2%, while the United States trails slightly at 4.0%, constrained by formulation conservatism in traditional food brands.

ASEAN countries like Thailand and Indonesia are emerging contributors, with growing applications in vegan beverages and texturizing agents for localized processed foods.

The CAGR for the USA gellan gum market was 2.7% during 2020 to 2024, but is expected to rise to 4.0% for the 2025 to 2035 period, signaling a marked acceleration in adoption. The previous phase of modest growth was attributed to the limited uptake of clean-label additives in conventional processed food sectors and slower regulatory momentum around ingredient transparency.

However, from 2025 onward, regulatory clarity and rising consumer preferences for plant-based, allergen-free, and gluten-free ingredients have shifted the trajectory upward. Food processors increasingly reformulated SKUs using products to eliminate synthetic emulsifiers like carrageenan, especially in dairy alternatives and low-sugar desserts.

Meanwhile, beverage brands targeting seniors and wellness-focused millennials adopted low acyl gellan gum to address visual separation and enhance mouthfeel.

Germany’s gellan gum market has evolved from a CAGR of around 3.1% during 2020 to 2024 to a stronger 4.2% from 2025 to 2035, driven by the country’s maturing clean-label food segment and the strong influence of EU-wide ingredient reform regulations. The earlier years saw moderate growth due to tight cost controls among local food manufacturers and preference for traditional gelling agents.

However, the introduction of EU clean-label compliance frameworks in 2024 catalyzed a wave of formulation overhauls, especially among private-label organic brands. German retailers began prioritizing products using naturally derived hydrocolloids, with gellan gum being favored for its superior stability in acidic and high-calcium beverages.

The rising consumption of vegetarian and flexitarian diets has further reinforced its utility across jams, yogurt drinks, and confectionery.

The Chinese gellan gum market has seen a significant increase in momentum, with CAGR improving from 3.6% in 2020 to 2024 to 4.8% in 2025 to 2035, surpassing the global average. This boost is primarily driven by China’s intensified regulatory push toward phasing out synthetic food additives in processed products and the rapid growth of its health-conscious middle class.

Government incentives for localized ingredient manufacturing helped increase domestic gellan gum output, which reduced import dependency and stabilized pricing for food manufacturers. Major beverage and jelly-based snack brands capitalized on this by formulating new product lines using low acyl gellan gum, particularly in fortified drinks and children’s nutrition products. Clean-label initiatives tied to e-commerce platforms like JD.com and Tmall boosted visibility and uptake among urban consumers.

Japan’s gellan gum market has shifted from a CAGR of 2.9% in 2020 to 2024 to 4.4% during 2025 to 2035, thanks to evolving consumer preferences and the strong influence of domestic food clusters. In earlier years, market growth was constrained by the dominance of traditional gelling agents like agar and konjac.

However, Japan’s premium functional food sector, particularly meal replacements, senior nutrition drinks, and beauty-enhancing beverages, has embraced gellan gum for its stability, clarity, and biocompatible properties. Its wide adoption in probiotic drinks and health-oriented desserts has made it a central feature in next-gen convenience products. Leading beverage formulators in Tokyo and Osaka also favor gellan gum for its mouthfeel control in high-acid and low-pH drinks.

India has witnessed a significant jump in its gellan gum market performance, moving from a CAGR of 3.8% during 2020 to 2024 to a projected 5.1% between 2025 to 2035, marking one of the highest growth rates among developing nations. Initially, limited adoption was tied to cost-sensitivity and the dominance of traditional thickeners in domestic food industries.

However, rising demand for fortified beverages, nutritional puddings, and clean-label confections has shifted the market outlook. Tier-1 food manufacturers are incorporating low acyl content into beverages like protein shakes and children's drinks, while the growing influence of modern retail chains is increasing consumer access to value-added packaged foods. Regulatory upgrades under FSSAI and rising exports of Indian plant-based products are also contributing to stronger local demand.

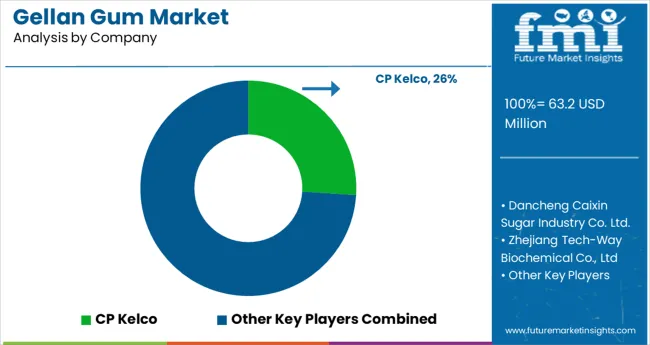

In the gellan gum market, key manufacturers are capitalizing on demand for clean-label, plant-based stabilizers across food, personal care, and pharmaceutical sectors. Industry leader CP Kelco dominates with its broad portfolio and global reach, supplying high-quality low and high-acyl variants. Other major players such as Dancheng Caixin Sugar Industry Co., Ltd., Zhejiang Tech-Way Biochemical Co., Ltd, and Zhejiang DSM Zhongken Biotechnology Co., Ltd play pivotal roles in scaling production and driving hydrocolloid formulations.

Chinese companies like Hangzhou Gellan Solutions Biotec, Hebei Xinhe Biochemical, and Inner Mongolia Rainbow Biotech are expanding their presence in APAC markets, while Meron Group, Fufeng Group, and others support growing global demand through competitive pricing, technical customization, and diversified product offerings. These firms are essential in improving the accessibility and affordability of products across varied end-use industries.

Leading Company - CP Kelco

Industry Share - 26%

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 63.2 million |

| Projected Industry Size (2035) | USD 95.4 million |

| CAGR (2025 to 2035) | 4.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and volume in tons |

| Product Type Analyzed (Segment 1) | High Acyl Content, Low Acyl Content, and Manual Beds. |

| End User Analyzed (Segment 2) | Food And Beverages, Confectionery, Jams and Jellies, Fabricated Foods, Water-Based Gels, Pie Fillings and Puddings, Dairy Products, Processed Meat, Personal Care and Cosmetics, Industrial and Household Cleaners, Pharmaceuticals. |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | CP Kelco, Dancheng Caixin Sugar Industry Co., Ltd., Zhejiang Tech-Way Biochemical Co., Ltd., Zhejiang DSM Zhongken Biotechnology Co., Ltd., Hangzhou Gellan Solutions Biotec Co., Ltd., Hebei Xinhe Biochemical Co., Ltd., Meron Group, Inner Mongolia Rainbow Biotech Co., Ltd., Fufeng Group, Others. |

| Additional Attributes | Dollar sales, share, regional demand trends, clean-label adoption, end-use sector growth (food, pharma, cosmetics), pricing dynamics, competitor positioning, and regulatory developments. |

The industry includes high acyl content, low acyl content, and manual beds.

The industry is segmented into food and beverages, confectionery, jams and jellies, fabricated foods, water-based gels, pie fillings and puddings, dairy products, processed meat, personal care and cosmetics, industrial and household cleaners, and pharmaceuticals.

The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific.

The industry is valued at USD 63.2 million in 2025.

It is forecasted to reach USD 95.4 million by 2035.

The industry is anticipated to grow at a CAGR of 4.2% during this period.

Low acyl content is projected to lead the market with a 59% share in 2035.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 5.1%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gum Rosin Market Size and Share Forecast Outlook 2025 to 2035

Gummed Tape Market Size and Share Forecast Outlook 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Gum Arabic Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Gummy Market Analysis by Product, Ingredient, End-Use, Distribution Channel, and Region - Forecast through 2025 to 2035

Gum Turpentine Oil Market Growth - Trends & Forecast 2025 to 2035

Gum Hydrocolloid Market Analysis by Product Type, Source, and Region through 2035

Key Companies & Market Share in the Gummed Tape Sector

Evaluating Gum Fiber Market Share & Provider Insights

Gum Content Tester Market

CBD Gummies Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Pre-Gummed Labels Market Growth - Demand & Forecast 2025 to 2035

Guar Gum Market Size and Share Forecast Outlook 2025 to 2035

Guar Gum for Construction Market Size and Share Forecast Outlook 2025 to 2035

Tara Gum Market Size and Share Forecast Outlook 2025 to 2035

Sleep Gummy Market Analysis by Primary Ingredient, Customer Orientation, Pack Size and Product Claim Through 2035

Paper Gummed Tape Market Growth - Demand & Forecast 2025 to 2035

CoQ10 Gummies Market Analysis by Source, Distribution Channels, and Key Regions Through 2035

Ester Gums Market Growth – Trends & Forecast 2025 to 2035

Dammar Gum Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA