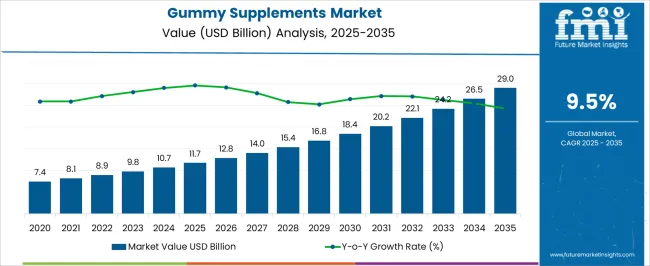

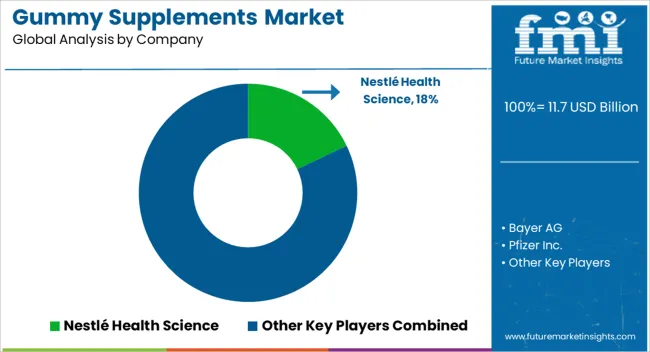

The gummy supplements market is projected to grow from USD 11.7 billion in 2025 to USD 29.0 billion by 2035, reflecting a CAGR of 9.5%. The anticipated market expansion is strongly linked to macroeconomic trends, such as increasing disposable incomes, heightened health awareness, and a broader shift toward preventive healthcare. A significant driving force behind this growth is the rising demand for convenient, easy-to-consume dietary supplements, which is expected to benefit from the growing consumer expenditure on wellness products.

As economic conditions improve, particularly in developed regions like North America and Europe, higher disposable incomes will lead to greater consumer willingness to invest in premium health products, including gummy supplements. The aging demographic in these regions, along with growing interest in natural and plant-based ingredients, will further drive demand, supporting long-term market growth. However, while the market is projected to remain strong, economic slowdowns could present challenges, as consumers tend to reduce spending on non-essential items during periods of financial uncertainty.

Despite this, the ongoing global health and wellness trend, supported by rising healthcare costs and an increasing focus on health optimization, is expected to provide resilience to the gummy supplements market. This trend, paired with a growing emphasis on preventive health measures, ensures that the market will continue to expand even in the face of potential economic turbulence.

| Metric | Value |

|---|---|

| Gummy Supplements Market Estimated Value in (2025 E) | USD 11.7 billion |

| Gummy Supplements Market Forecast Value in (2035 F) | USD 29.0 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The gummy supplements market is influenced by five interconnected parent markets that shape its growth trajectory globally. The largest contributor is the health and wellness market, holding about 40% share, driven by increasing consumer demand for natural, preventative health solutions and supplements. The pharmaceutical market accounts for 25%, as gummy supplements are increasingly recognized for their ease of consumption, particularly in delivering vitamins and minerals to different age groups.

The e-commerce market contributes 15%, reflecting the growth of online sales channels where consumers can easily purchase supplements with direct-to-door delivery. The organic and natural products market holds 10%, fueled by the rising trend of plant-based and organic ingredients, which many gummy supplement manufacturers are incorporating into their products to meet consumer demand for clean and healthy labels. The lifestyle and fitness market contributes around 10%, as health-conscious individuals seek supplements that enhance overall well-being and performance.

The health and wellness and pharmaceutical markets form the backbone of the gummy supplements market, while e-commerce, organic products, and fitness segments offer further opportunities for growth. These interconnected markets help drive the expansion and diversification of gummy supplements, ensuring strong potential for long-term market success.

The gummy supplements market is experiencing robust expansion driven by rising consumer preference for convenient and enjoyable supplement formats that combine health benefits with palatable taste. Growing awareness regarding preventive healthcare and the importance of micronutrients has increased adoption across diverse age groups.

Technological advancements in formulation have allowed for higher nutrient stability and better flavor profiles, making gummies a viable alternative to traditional capsules or tablets. The clean label movement, coupled with the demand for plant based and sugar free options, is further influencing purchasing behavior.

Marketing strategies focusing on lifestyle integration and functional health benefits have amplified consumer engagement. With a surge in e-commerce accessibility and product personalization trends, the market outlook remains strong, presenting opportunities for innovation in formulation, packaging, and targeted health applications.

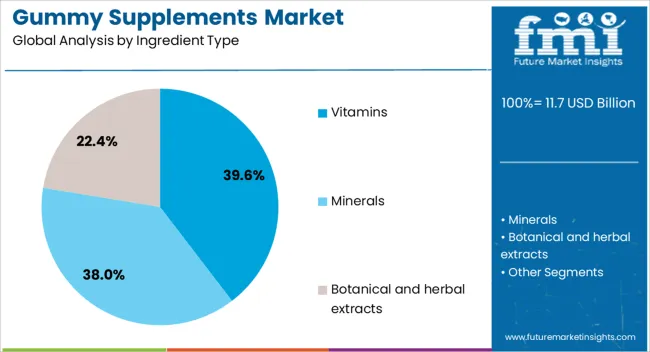

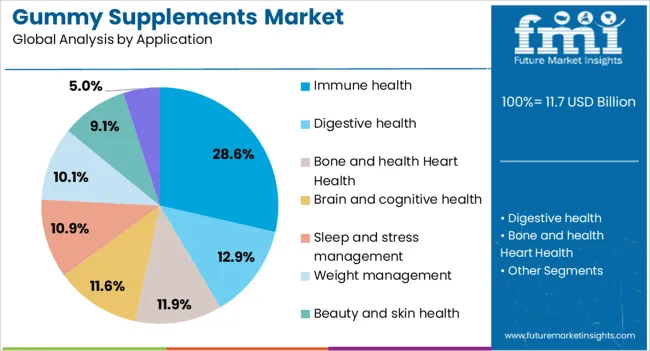

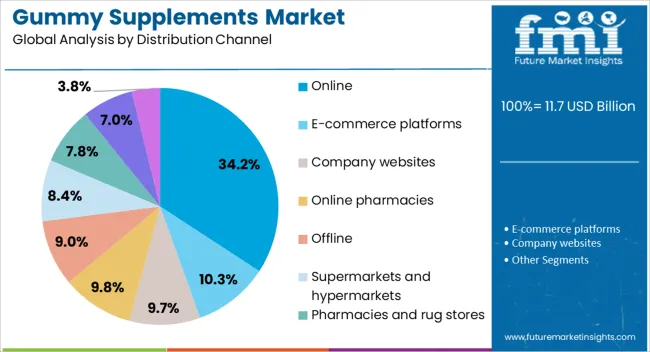

The gummy supplements market is segmented by ingredient type, application, distribution channel, and geographic regions. By ingredient type, gummy supplements market is divided into Vitamins, Minerals, Botanical and herbal extracts, Specialty nutrients, Probiotics and prebiotics, and Other. In terms of application, gummy supplements market is classified into Immune health, Digestive health, Bone and health Heart Health, Brain and cognitive health, Sleep and stress management, Weight management, Beauty and skin health, and Others. Based on distribution channel, gummy supplements market is segmented into Online, E-commerce platforms, Company websites, Online pharmacies, Offline, Supermarkets and hypermarkets, Pharmacies and rug stores, Specialty stores, and Others. Regionally, the gummy supplements industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vitamins segment is projected to hold 39.60% of total market revenue by 2025 within the ingredient type category, making it the leading segment. This dominance is driven by the essential role vitamins play in daily nutrition and the high consumer awareness of their health benefits.

Gummy formats have increased compliance rates by providing a more appealing alternative to traditional supplements, especially for children and adults seeking convenience. The ability to combine multiple vitamins in a single serving and the growth of fortified products have further enhanced adoption.

As consumers prioritize immunity, energy, and overall wellness, vitamins in gummy form continue to attract a broad demographic, reinforcing their market leadership.

The immune health segment is expected to account for 28.60% of the total market revenue by 2025 within the application category, positioning it as the most prominent application area. Heightened global focus on immunity, particularly following recent public health events, has accelerated demand for supplements that support the body’s defense systems.

Gummy supplements targeting immune health often feature vitamins C and D, zinc, and herbal extracts, delivering both preventive and supportive benefits. Easy consumption, pleasant taste, and portability have contributed to strong consumer uptake.

This segment’s growth is reinforced by the increasing integration of immune boosting formulations into daily routines, ensuring consistent and long term demand.

The online distribution channel is projected to represent 34.20% of total market revenue by 2025, making it the leading sales channel. This growth is attributed to the convenience of direct-to-consumer purchasing, wider product variety, and competitive pricing offered by e-commerce platforms.

The ability to access detailed product information, customer reviews, and subscription services has strengthened consumer trust in online channels. Digital marketing campaigns and influencer endorsements have further expanded reach and brand visibility.

As consumers continue to value time efficiency and doorstep delivery, online sales of gummy supplements are expected to maintain strong growth momentum, solidifying their dominant position in the distribution landscape.

Health awareness, e-commerce expansion, organic demand, and tailored formulations are key dynamics shaping the gummy supplements market. These factors collectively push the growth of the market, positioning it for sustained expansion.

Consumer health consciousness is a primary driver for the growth of the gummy supplements market. More people are prioritizing health and well-being, particularly in the form of preventative measures. As the focus shifts toward self-care, consumers are opting for easier-to-consume supplements like gummies. This shift towards convenience, paired with growing awareness about maintaining long-term health, has spurred the demand for gummy supplements. The appeal of gummies over traditional pill forms is also boosted by their tastiness, which enhances consumer adoption among children and adults alike. As health consciousness intensifies, gummy supplements are positioned to thrive in the global wellness market.

E-commerce is transforming the gummy supplements market by increasing accessibility and convenience for consumers worldwide. Online platforms enable easy access to a wide variety of gummy products, offering greater choice and the ability to shop from the comfort of one’s home. This convenience has led to higher sales volumes, especially as consumers embrace direct-to-consumer models. Subscription services, product reviews, and detailed ingredient information on online platforms also contribute to building trust and driving repeat purchases. The rapid expansion of e-commerce and mobile commerce offers a significant channel for the distribution of gummy supplements, driving market growth further.

The increasing preference for natural and organic ingredients is reshaping the gummy supplements market. Consumers are more inclined toward products that use plant-based, non-GMO, and organic ingredients, motivated by concerns over artificial additives and chemicals in food and health products. This shift is leading many gummy supplement manufacturers to offer cleaner, healthier alternatives, catering to the demand for natural options. As the organic trend continues to rise in various consumer goods markets, it is expected that organic gummy supplements will see a notable increase in sales. This trend also aligns with the growing interest in clean-label products.

A significant market dynamic for gummy supplements is the increasing customization of products tailored to specific health needs. Consumers are seeking supplements that address particular concerns, such as immunity, digestion, skin health, and energy. Gummy supplements offer an appealing way to deliver these specific benefits, especially with formulations designed for children, elderly adults, and fitness enthusiasts. This demand for personalized health solutions is driving the innovation of gummy supplements with targeted benefits and formulations. With greater awareness of personalized wellness, this segment is anticipated to grow rapidly, making it an essential driver for the market.

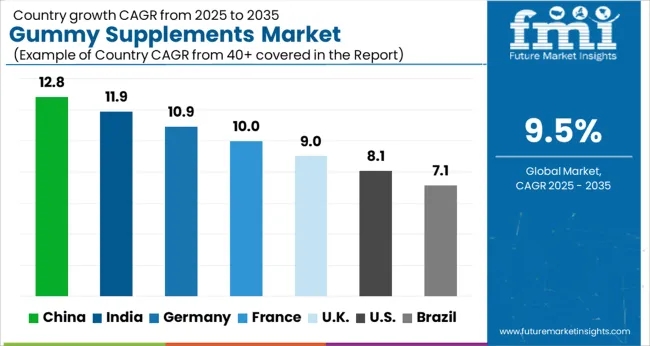

| Country | CAGR |

|---|---|

| China | 12.8% |

| India | 11.9% |

| Germany | 10.9% |

| France | 10.0% |

| UK | 9.0% |

| USA | 8.1% |

| Brazil | 7.1% |

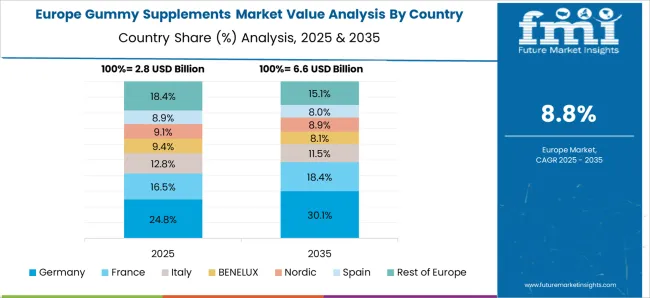

The global gummy supplements market is projected to grow at a CAGR of 9.5% from 2025 to 2035. China leads the expansion at 12.8%, followed by India at 11.9%, Germany at 10.9%, the United Kingdom at 9.0%, and the United States at 8.1%. Growth is driven by the increasing health consciousness in China and India, where wellness and convenience-based products are gaining popularity. China is witnessing significant growth due to rising disposable incomes and the expanding middle class, leading to higher consumer demand for dietary supplements. India is following closely with a surge in health awareness and a growing e-commerce landscape, enhancing the market's reach. European markets like Germany and the UK emphasize clean-label and natural supplements, leading to steady demand, while the USA focuses on premium wellness products, expanding the consumer base for gummy vitamins and supplements. The analysis spans across 40+ countries, with the leading markets shown below.

The gummy supplements market in China is expected to grow at a CAGR of 12.8% from 2025 to 2035. Driven by rising disposable incomes, greater health awareness, and an expanding e-commerce landscape, the market is rapidly evolving. Consumers are increasingly inclined towards convenient and easy-to-consume dietary supplements, which complement their busy lifestyles. The popularity of functional and natural ingredients further boosts the market, with rising interest in gummies that offer vitamins, minerals, and other health benefits. China’s growing middle class, particularly in tier-1 cities, is adopting these products in large numbers, with a noticeable shift towards clean-label, plant-based, and organic offerings. Leading players in the market are leveraging digital platforms and influencers to tap into the growing demand for wellness products, particularly among millennials and Generation Z.

The gummy supplements market in India is projected to rise at a CAGR of 11.9% from 2025 to 2035. As health awareness increases among Indian consumers, particularly in urban areas, there is growing demand for convenient and easy-to-consume dietary supplements. Factors like rising disposable income, changing lifestyles, and the increasing inclination toward preventive healthcare are accelerating growth. With a large portion of the population moving towards healthier food choices, the market for gummy supplements, particularly for immunity, weight management, and beauty-from-within segments, is witnessing a significant boost. The growing middle class in Tier-2 and Tier-3 cities is also contributing to this demand. Furthermore, India’s growing e-commerce sector, with its wide reach, plays a key role in expanding the market by offering easy access to these products.

Germany’s gummy supplements market is expected to grow at a CAGR of 10.9% from 2025 to 2035. Driven by increasing health-conscious consumers and a strong preference for natural ingredients, Germany continues to lead the European market in terms of demand for functional food products. As more consumers shift to preventive health measures, gummies that offer benefits such as immunity boosting, energy, and digestive health are gaining traction. Germany’s robust pharmaceutical and retail infrastructure ensures that these products are easily accessible. Additionally, high disposable incomes and the growing trend of wellness and self-care are propelling market growth. With an increasing number of consumers prioritizing convenient and effective solutions, the demand for gummy supplements is expected to expand across all age groups, with a significant focus on clean-label and organic products.

The gummy supplements market in the UK is anticipated to grow at a CAGR of 9.0% from 2025 to 2035. The demand for easy-to-consume health supplements is rising, driven by busy lifestyles and the growing trend toward health optimization. A shift towards plant-based ingredients and the increasing popularity of vegan-friendly options further enhances the market. The UK market is seeing an increased focus on gummies that provide functional benefits such as cognitive health, beauty, and general wellness. Increased awareness of the benefits of supplements among young adults and an aging population contribute significantly to the market's growth. The rise in online retail and specialized health stores offering a wide variety of gummy options further supports this trend.

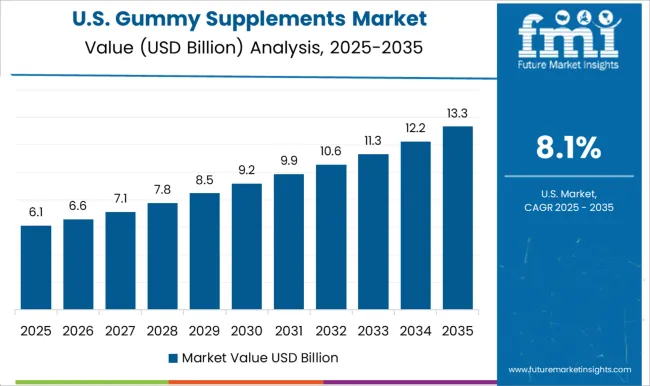

The gummy supplements market in the USA is projected to grow at a CAGR of 8.1% from 2025 to 2035. The USA leads the global market in terms of innovation and product diversity. Consumers are increasingly shifting toward convenient and enjoyable ways of taking dietary supplements, driving demand for gummy forms. The aging population, combined with the rising demand for immunity boosters, vitamins, and wellness products, continues to fuel market growth. Millennials and Generation Z, with their health-conscious lifestyles, are increasingly choosing gummies for vitamins, weight management, and other health needs. Additionally, e-commerce platforms and direct-to-consumer models are helping expand the market reach and driving product availability.

The gummy supplements market is highly competitive, shaped by large nutraceutical brands, private label manufacturers, and emerging clean-label supplement producers. Key players such as Church & Dwight, The Clorox Company, Bayer, Unilever, Pharmavite, and Nature’s Way compete by offering extensive product lines across vitamins, minerals, probiotics, and functional wellness categories. Their competitive strength comes from established brand equity, broad distribution through retail chains and e-commerce platforms, and continuous product innovation targeting different age groups and health needs.

Smaller companies and private label brands intensify competition by focusing on niche formulations, plant-based ingredients, and sugar-free or allergen-free claims to attract health-conscious consumers. Pricing strategies, flavor variety, texture quality, and packaging design are crucial differentiators in consumer purchasing decisions. Strategic partnerships with contract manufacturers, celebrity endorsements, and digital marketing campaigns are widely adopted to boost visibility and market reach. Regulatory compliance, especially regarding ingredient transparency and labeling standards, also influences competitive positioning. Overall, companies that balance science-backed formulations with appealing taste and convenience are gaining a distinct edge in the crowded gummy supplements market.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.7 Billion |

| Ingredient Type | Vitamins, Minerals, Botanical and herbal extracts, Specialty nutrients, Probiotics and prebiotics, and Other |

| Application | Immune health, Digestive health, Bone and health Heart Health, Brain and cognitive health, Sleep and stress management, Weight management, Beauty and skin health, and Others |

| Distribution Channel | Online, E-commerce platforms, Company websites, Online pharmacies, Offline, Supermarkets and hypermarkets, Pharmacies and rug stores, Specialty stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestlé Health Science, Bayer AG, Pfizer Inc., Church & Dwight Co., Inc., The Clorox Company (Rainbow Light), Pharmavite LLC (Nature Made), Haleon plc (formerly GSK), Herbalife Nutrition Ltd., Olly PBC, SmartyPants Vitamins, Glanbia plc, Procaps Group S.A., Amway Corp., Unilever (OLLY), and The Honest Company |

| Additional Attributes | Dollar sales by region, market share by segment (e.g., immunity, beauty, digestion), consumer demographics, growth drivers, distribution channels (online, retail), competitive landscape, and pricing trends. |

The global gummy supplements market is estimated to be valued at USD 11.7 billion in 2025.

The market size for the gummy supplements market is projected to reach USD 29.0 billion by 2035.

The gummy supplements market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in gummy supplements market are vitamins, _single vitamins, _multivitamins, minerals, _calcium, _zinc, _magnesium, _iron, _others, botanical and herbal extracts, _elderberry, _turmeric, _ashwagandha, _others, specialty nutrients, _omega 3 fatty acids, _collagen, _coenzyme q10, _others, probiotics and prebiotics and other.

In terms of application, immune health segment to command 28.6% share in the gummy supplements market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gummy Market Analysis by Product, Ingredient, End-Use, Distribution Channel, and Region - Forecast through 2025 to 2035

Sleep Gummy Market Analysis by Primary Ingredient, Customer Orientation, Pack Size and Product Claim Through 2035

Coffee Gummy Market Analysis by sales channel, application and region Through 2025 to 2035

Organic Gummy Worms Market Analysis by Flavors, Distribution Channel and Region from 2025 to 2035

Collagen Gummy Market Analysis by Flavor Type, Source, Functionality, Sales Channel and Region through 2035

Mushroom Gummy Market – Consumer Trends & Functional Benefits

Sugar-Free Gummy Market Insights - Consumer Trends & Growth 2025 to 2035

Supplements And Nutrition Packaging Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Andro Supplements Market

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Urology Supplements Market Size and Share Forecast Outlook 2025 to 2035

Peptide Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Dietary Supplements Packaging Market Analysis – Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA