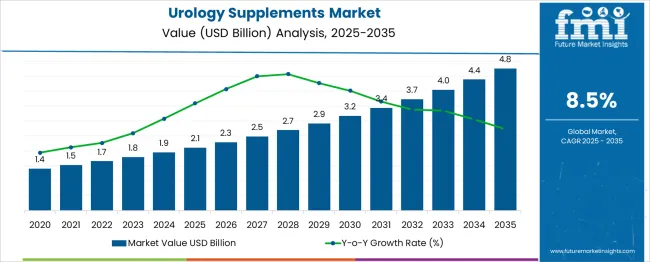

The global urology supplements market is forecasted to grow from USD 2.1 billion in 2025 to approximately USD 4.8 billion by 2035, recording an absolute increase of USD 2.7 billion over the forecast period. This translates into a total growth of 128.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 8.5% between 2025 and 2035. The market size is expected to grow by nearly 2.28X during the same period, supported by increasing prevalence of urological disorders, growing awareness about preventive healthcare, and rising adoption of natural supplement solutions for urinary and prostate health management.

Between 2025 and 2030, the urology supplements market is projected to expand from USD 2.1 billion to USD 3.2 billion, resulting in a value increase of USD 1.1 billion, which represents 40.7% of the total forecast growth for the decade. This phase of growth will be shaped by rising consumer awareness about urological health, increasing demand for natural and organic supplement formulations, and growing penetration of preventive healthcare solutions in emerging markets. Healthcare companies are expanding their urology supplement portfolios to address the growing demand for comprehensive urological health management solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.1 billion |

| Forecast Value in (2035F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

From 2030 to 2035, the market is forecast to grow from USD 3.2 billion to USD 4.8 billion, adding another USD 1.6 billion, which constitutes 59.3% of the ten-year expansion. This period is expected to be characterized by expansion of e-commerce channels, integration of advanced supplement formulation technologies, and development of personalized urological health solutions. The growing adoption of evidence-based supplements and healthcare provider-recommended products will drive demand for premium urology supplements with enhanced bioavailability and safety profiles.

Between 2020 and 2025, the urology supplements market experienced steady expansion, driven by increasing consumer focus on preventive healthcare and growing awareness of urological disorders. The market developed as healthcare providers recognized the need for effective supplemental solutions to support urinary tract health, prostate function, and kidney wellness. Social media influence and healthcare practitioner recommendations began emphasizing the importance of nutritional supplements in maintaining optimal urological health.

Market expansion is being supported by the increasing prevalence of urological disorders including urinary tract infections, prostate enlargement, and kidney stones, particularly among aging populations worldwide. Modern consumers are increasingly focused on preventive healthcare measures that can support urological function and reduce the risk of complications. The proven efficacy of specific nutrients and botanical extracts in supporting urinary tract health and prostate function makes them preferred ingredients in specialized supplement formulations.

The growing focus on natural health solutions and evidence-based supplementation is driving demand for urology supplements derived from clinically studied ingredients such as cranberry extract, saw palmetto, and D-mannose. Consumer preference for multi-functional products that combine multiple urological health benefits in single formulations is creating opportunities for innovative supplement development. The rising influence of healthcare provider recommendations and patient education programs is also contributing to increased product adoption across different age groups and demographics.

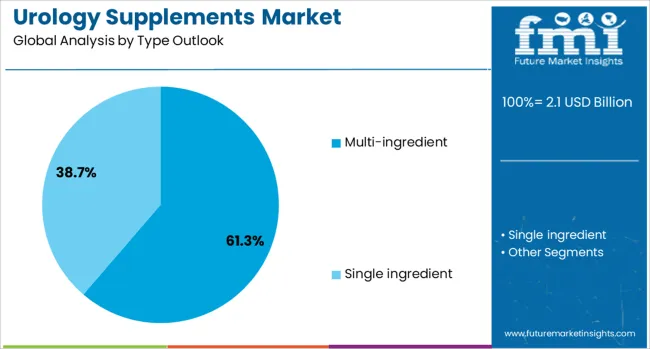

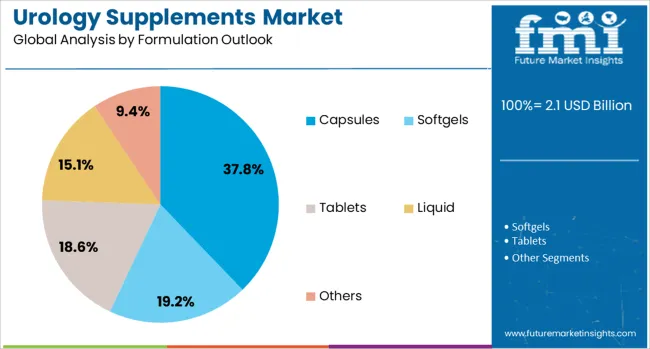

The market is segmented by type, application, formulation, distribution channel, and region. By type, the market is divided into multi-ingredient and single ingredient supplements. Based on application, the market is categorized into urinary tract infections, kidney health, prostate health, bladder health, and others. In terms of formulation, the market is segmented into capsules, softgels, tablets, liquid, and others. By distribution channel, the market is classified into brick & mortar and e-commerce. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The multi-ingredient type is projected to account for 61.3% of the urology supplements market in 2025, reaffirming its position as the category's preferred formulation approach. Consumers increasingly understand the synergistic benefits of combining multiple active ingredients that address various aspects of urological health simultaneously. Multi-ingredient formulations offer comprehensive support for urinary tract function, prostate health, and kidney wellness in single dosage forms.

This segment forms the foundation of most product positioning, as it represents the most practical and cost-effective approach to urological health supplementation. Healthcare provider endorsements and clinical studies continue to strengthen trust in comprehensive multi-ingredient formulations. With consumer lifestyles requiring convenient supplementation options, multi-ingredient products align with both preventative and therapeutic health goals. The broad appeal across demographics and specific health concerns ensures dominance, making it the central growth driver of urology supplement demand.

Urinary tract infections are projected to represent 36.9% of urology supplement demand in 2025, underscoring their role as the most common urological concern driving supplement usage. Consumers gravitate toward preventive and supportive supplementation for UTI management, recognizing the benefits of ingredients like cranberry extract, D-mannose, and probiotics in maintaining urinary tract health and reducing infection recurrence.

The segment is supported by the rising awareness of antibiotic resistance and the desire for natural prevention strategies. Additionally, healthcare providers are increasingly recommending specific supplements as adjunctive therapy for UTI prevention, particularly in women with recurrent infections. As evidence-based research continues to validate the efficacy of certain nutrients in supporting urinary tract health, UTI-focused supplements will continue to dominate demand, reinforcing their essential positioning within the urological health market.

The capsules formulation is forecasted to contribute 37.8% of the urology supplements market in 2025, reflecting consumer preference for convenient, precise dosing and optimal ingredient stability. Capsules offer superior protection for sensitive botanical extracts and nutrients commonly used in urology supplements, ensuring potency and bioavailability. This format aligns with consumer expectations for professional-grade supplementation that delivers consistent therapeutic benefits.

The capsule segment benefits from consumer perception of higher quality and pharmaceutical-grade standards compared to other formulation types. The format also allows for combination of multiple ingredients in precise ratios, supporting the multi-ingredient product trend. With increased focus on standardized dosing and ingredient protection, capsules serve as the preferred delivery method for premium urology supplements, making them a critical driver of market growth and consumer confidence in supplement efficacy.

The urology supplements market is advancing rapidly due to increasing prevalence of urological disorders and growing consumer awareness about preventive healthcare solutions. The market faces challenges including regulatory variations across regions, ingredient standardization issues, and competition from pharmaceutical alternatives. Innovation in bioavailability enhancement and evidence-based formulation continue to influence product development and market expansion patterns.

The increasing incidence of urological conditions including benign prostatic hyperplasia, urinary tract infections, and kidney stones, particularly among aging populations, is driving demand for supportive supplementation. Demographic shifts toward older populations in developed countries are creating demand for prostate health and urinary function support products. Healthcare systems are increasingly recognizing the value of preventive supplementation in reducing healthcare costs and improving patient outcomes.

The expanding adoption of online retail platforms is enabling supplement manufacturers to reach consumers directly and provide comprehensive product education and personalized recommendations. E-commerce channels offer convenience, detailed ingredient information, and customer reviews that influence purchasing decisions. Digital marketing strategies and healthcare practitioner partnerships are driving brand awareness and product adoption, particularly among health-conscious consumers who prefer researched-based supplementation.

Modern urology supplement manufacturers are incorporating clinical research findings and evidence-based ingredient selection to enhance product efficacy and consumer confidence. Standardized botanical extracts, clinically studied dosages, and third-party testing are becoming standard practices that differentiate premium products. Advanced formulation techniques enable targeted delivery and enhanced bioavailability, improving therapeutic outcomes and supporting healthcare provider recommendations.

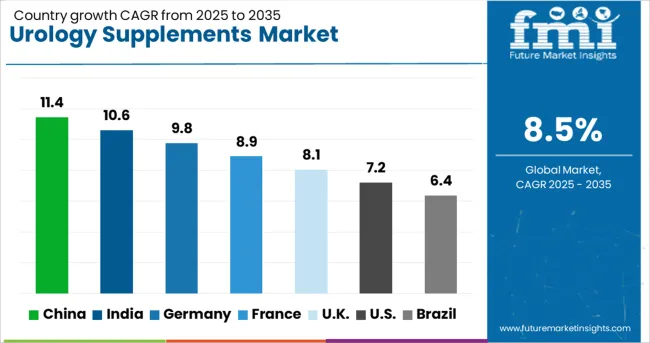

| Countries | CAGR (2025-2035) |

|---|---|

| China | 11.4% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

The urology supplements market is experiencing robust growth globally, with China leading at an 11.4% CAGR through 2035, driven by rapid population aging, increasing healthcare spending, and growing awareness of urological health maintenance. India follows closely at 10.6%, supported by large population base, rising disposable income, and increasing penetration of organized healthcare. Germany shows strong growth at 9.8%, emphasizing evidence-based supplementation and healthcare provider recommendations. France records 8.9%, focusing on premium formulations and pharmaceutical-grade supplements. The UK shows 8.1% growth, prioritizing natural ingredients and clinical validation. The USA demonstrates 7.2% growth, representing a mature market with focus on innovation and premium positioning.

Revenue from urology supplements in China is projected to exhibit strong growth with a CAGR of 11.4% through 2035, driven by rapid population aging and increasing prevalence of prostate-related disorders among older men. The country's expanding healthcare infrastructure and growing consumer awareness about preventive health measures are creating significant demand for urological health supplements. Major international and domestic supplement manufacturers are establishing comprehensive distribution networks to serve the growing population of health-conscious consumers across tier-1 and tier-2 cities.

Revenue from urology supplements in India is expanding at a CAGR of 10.6%, supported by large population base, increasing healthcare awareness, and rising integration of traditional Ayurvedic ingredients with modern supplement formulations. The country's growing middle class and increasing exposure to global health trends are driving demand for effective urological health solutions. International supplement brands and domestic manufacturers are leveraging traditional herbal knowledge to develop culturally relevant formulations.

Demand for urology supplements in Germany is projected to grow at a CAGR of 9.8%, supported by strong focus on evidence-based healthcare and consumer preference for clinically validated supplement formulations. German consumers prioritize product quality, standardized ingredients, and healthcare provider recommendations when selecting urological health supplements. The market is characterized by demand for pharmaceutical-grade formulations with documented efficacy.

Revenue from urology supplements in France is projected to grow at a CAGR of 8.9% through 2035, driven by the country's focus on premium healthcare solutions and consumer preference for pharmaceutical-grade supplement formulations. French consumers value product quality, clinical validation, and healthcare provider guidance in supplement selection for urological health management.

Revenue from urology supplements in the UK is projected to grow at a CAGR of 8.1% through 2035, supported by rising consumer interest in natural health solutions and evidence-based supplementation for urological wellness. British consumers value ingredient transparency, clinical research, and product safety when selecting supplements for prostate and urinary tract health.

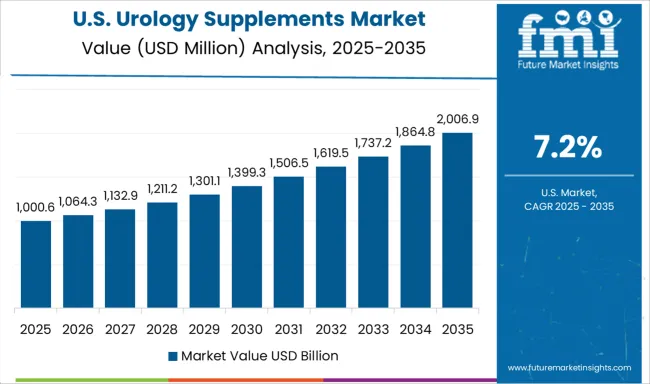

Revenue from urology supplements in the USA is projected to grow at a CAGR of 7.2% through 2035, representing a mature market with focus on product innovation, premium positioning, and specialized formulations for specific urological conditions. American consumers prioritize evidence-based ingredients, third-party testing, and healthcare provider recommendations when selecting supplements.

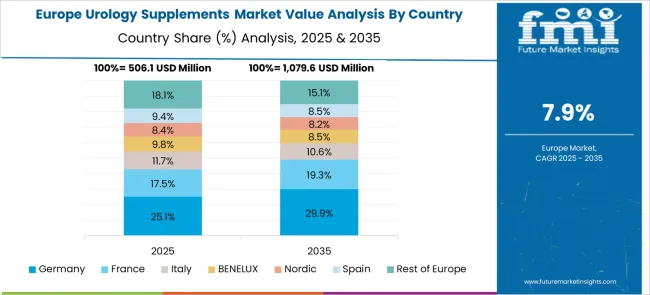

The European urology supplements market demonstrates sophisticated development across major economies with Germany leading through its precision nutraceutical excellence and advanced healthcare product capabilities, supported by companies pioneering comprehensive urology supplement solutions with focus on multi-ingredient formulations, prostate health applications, and capsule formats while emphasizing clinical efficacy and regulatory compliance. The UK shows strength in evidence-based supplement protocols and quality standards, with companies specializing in advanced urology supplement technologies that meet strict regulatory requirements and provide consistent health outcomes.

France contributes through companies delivering integrated supplement solutions and healthcare excellence for comprehensive urological health applications. Italy and Spain demonstrate growth in specialized supplement formulations for kidney health and bladder health applications. The market benefits from stringent EU supplement regulations, established healthcare infrastructure, and growing focus on preventive health approaches positioning Europe as key center for advanced urology supplement technologies.

The Japanese urology supplements market demonstrates steady growth driven by precision healthcare focus, advanced nutraceutical technologies, and consumer preference for high-quality supplement systems ensuring superior health benefits and safety compliance throughout wellness operations. International companies establish presence through cutting-edge supplement technologies aligning with Japan's sophisticated health product industry and stringent quality standards while incorporating advanced formulation capabilities and evidence-based health protocols.

The market emphasizes quality-controlled supplement systems, precision formulation excellence, and advanced health innovations reflecting Japanese wellness precision and attention to detail in nutraceutical processes. Growing investment in preventive healthcare supports intelligent supplement systems with enhanced bioavailability, reduced side effects, and optimized health performance. Japanese consumers prioritize product reliability, consistent health outcomes, and regulatory compliance, creating opportunities for premium urology supplement solutions delivering exceptional performance across prostate health, kidney health, and urinary tract applications requiring highest quality standards.

The South Korean urology supplements market shows exceptional growth potential driven by expanding healthcare awareness, increasing adoption of preventive health technologies, and growing focus on men's health requiring efficient and reliable supplement solutions. The market benefits from South Korea's technological advancement capabilities and increasing focus on health innovation competitiveness driving investment in modern nutraceutical technologies meeting international quality standards and regulatory requirements.

Korean consumers increasingly adopt advanced supplement formulations, multi-ingredient products, and integrated health technologies improving wellness outcomes and health maintenance while ensuring safety compliance. Growing influence of Korean health and wellness trends in global markets supports demand for sophisticated urology supplement solutions ensuring health excellence while maintaining cost-effectiveness. Integration of digital health principles and smart wellness technologies creates opportunities for intelligent supplement systems with personalized formulations, predictive health monitoring, and real-time wellness optimization across diverse urological health applications.

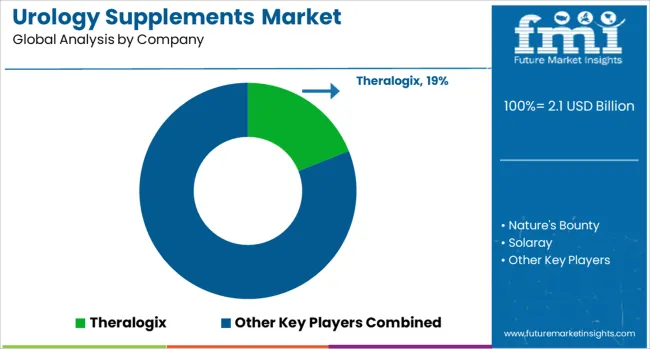

The urology supplements market is characterized by competition among established nutritional supplement companies, pharmaceutical manufacturers, and specialized urology health brands. Companies are investing in clinical research, advanced formulation technologies, healthcare provider education, and digital marketing strategies to deliver effective, safe, and accessible urological health solutions. Brand positioning, ingredient innovation, and distribution channel expansion are central to strengthening product portfolios and market presence.

Theralogix leads the market with specialized focus on evidence-based urological health formulations, emphasizing clinical research and healthcare provider recommendations. Nature's Bounty provides comprehensive supplement ranges with established brand recognition and wide distribution networks across multiple retail channels. Solaray offers premium botanical-based formulations with focus on ingredient quality and standardization.

Puritan's Pride delivers accessible, value-oriented products through direct-to-consumer channels and retail partnerships. Schiff Nutrition focuses on science-backed formulations with focus on bioavailability and therapeutic effectiveness. ZAHLER provides specialized urological health solutions with focus on kosher and natural formulations. Natrol LLC emphasizes innovative delivery systems and targeted health solutions. Biotex life offers premium natural supplements with focus on organic and green sourcing. Himalaya Wellness leverages traditional Ayurvedic knowledge with modern supplement science. Himalayan Organics provides organic, natural formulations with focus on purity and traditional ingredients.

| Items | Values |

| Quantitative Units (2025) | USD 2.1 billion |

| Type | Multi-ingredient, Single ingredient |

| Application | Urinary tract infections, Kidney health, Prostate health, Bladder health, Others |

| Formulation | Capsules, Softgels, Tablets, Liquid, Others |

| Distribution Channel | Brick & mortar, E-commerce |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Theralogix, Nature's Bounty, Solaray, Puritan's Pride, Schiff Nutrition, ZAHLER, Natrol LLC, Biotex life, Himalaya Wellness, and Himalayan Organics |

| Additional Attributes | Dollar sales by ingredient type and concentration level, regional demand trends, competitive landscape, consumer preferences for natural versus synthetic formulations, integration with healthcare provider recommendations, innovations in bioavailability enhancement, controlled release technologies, and evidence-based formulation practices |

United States

Canada

Mexico

Germany

United Kingdom

France

Italy

Spain

Nordic

BENELUX

Rest of Europe

China

Japan

South Korea

India

ASEAN

Australia & New Zealand

Rest of Asia Pacific

Brazil

Chile

Rest of Latin America

Kingdom of Saudi Arabia

Other GCC Countries

Turkey

South Africa

Other African Union

Rest of Middle East & Africa

The global urology supplements market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the urology supplements market is projected to reach USD 4.8 billion by 2035.

The urology supplements market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in urology supplements market are multi-ingredient and single ingredient.

In terms of application outlook , urinary tract infections segment to command 36.9% share in the urology supplements market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Urology Lasers Market Size and Share Forecast Outlook 2025 to 2035

Urology Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Urology Disposables Market

Neurology Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

Neurology Services Market Overview - Growth & Forecast 2025 to 2035

Neurology Digital Therapeutics Market Growth – Trends & Forecast 2024-2034

Nephrology and Urology Incontinence Devices Market Growth – Trends & Forecast 2025 to 2035

Supplements And Nutrition Packaging Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Andro Supplements Market

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Peptide Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Dietary Supplements Packaging Market Analysis – Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA