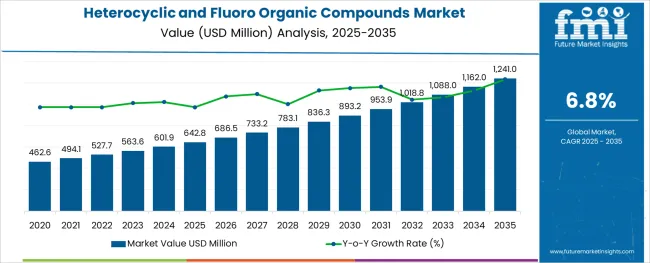

The Heterocyclic and Fluoro Organic Compounds Market is estimated to be valued at USD 642.8 million in 2025 and is projected to reach USD 1241.0 million by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

The heterocyclic and fluoro organic compounds market is gaining traction as industries increasingly demand specialized molecules for advanced applications. Rising investment in agrochemicals and pharmaceutical R&D is fueling the need for custom heterocyclic scaffolds and fluorinated compounds that enhance stability, bioavailability, and performance.

Regulatory pressure to reduce environmental impact combined with an emphasis on green chemistry is encouraging the adoption of cleaner synthesis routes and safer fluorination techniques. Manufacturing efficiencies, including flow chemistry and catalytic processes, are enabling cost reductions and scalability.

Furthermore, growing collaborations between academic institutions, contract research organizations, and chemical suppliers are accelerating compound innovation. The market outlook remains strongly positive, with opportunities emerging from evolving agrochemical formulations, crop protection demands, and tailored fluoro motifs that support next-generation specialty chemicals and sustainable product development.

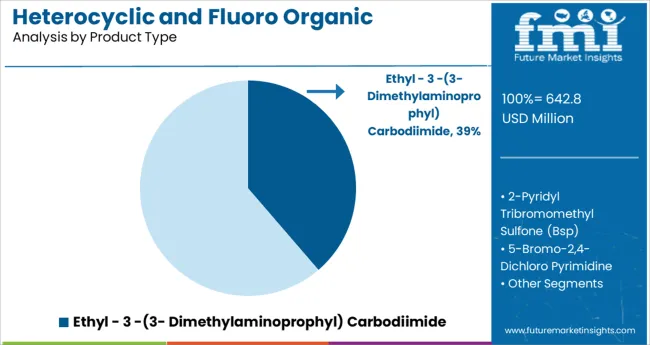

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Ethyl - 3 -(3- Dimethylaminoprophyl) Carbodiimide, 2-Pyridyl Tribromomethyl Sulfone (Bsp), 5-Bromo-2,4-Dichloro Pyrimidine, Cyclam (1,4,8,11 Tetraazacyclotetradecane), 2,2,6,6-Tetramethylpiperidine N-Oxyl (Tempo), Trimethylsilyl Trifluoromethanesulfonate, Trifluoromethanesulfonicanhydride, Bromoacetonitrile, 4-Bromobenzene Sulfonyl Chloride, 5-Bromovaleric Acid, and Alpha Tetralol. In terms of Application, the market is classified into Agrochemicals, Pharmaceuticals, Biotech, Paints and Coatings, Polymers, Electronics, and X-Ray Films. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

It is noted that the Ethyl33DimethylaminoprophylCarbodiimide product type accounts for 38.7% of total market share in 2025. This share is explained by its widespread utility as a coupling reagent, particularly in peptide synthesis and research scale applications.

Its efficiency in forming stable amide bonds and its compatibility with varied solvents and reaction conditions have underpinned demand. Additionally its moderate cost and favorable safety profile compared to alternative carbodiimides have encouraged adoption by both academic labs and industry.

Consistent supply and established manufacturing processes have further reinforced its position. Consequently this compound has emerged as the leading product type within this market segment.

It is observed that the agrochemicals application holds 42.3% of the market share for 2025. This dominance is driven by the widespread use of heterocyclic and fluoro organic compounds in the development of herbicides fungicides and insecticides.

These compounds deliver enhanced chemical stability improved target specificity and longer environmental persistence relative to nonfluorinated analogs. Regulatory requirements for safer crop protection agents have also shifted focus toward fluoro heterocyclic scaffolds that offer higher selectivity and reduced non target toxicity.

Furthermore vertical integration by agrochemical manufacturers and growing demand from emerging agricultural markets have fuelled usage. As a result the agrochemicals application remains the primary end use, securing its position as the top application segment.

The global heterocyclic and fluoro organic compounds market witnessed a CAGR of 3.6% during the historical period of 2020 and 2024. Significant expansion of various end-use industries such as pharmaceuticals, agrochemicals, and chemicals, as well as the rising medicinal and biological significance of these compounds, led to an increased demand for heterocyclic and fluoro organic compounds over the historical period.

However, as per the current survey conducted by FMI, the global heterocyclic and fluoro organic compounds market is anticipated to exhibit growth at a CAGR of around 6.8% in the period of 2025 to 2035. Heterocyclic compounds, also known as heterocycles, refer to a class of organic compounds having at least one hetero atom (i.e. atom other than carbon) in the cyclic ring system.

The most common heteroatoms in a cyclic ring are oxygen (O), nitrogen (N), and sulfur (S). Nitrogen-based heterocyclic compounds are expected to dominate among the other types of heterocyclic compounds owing to their pharmacological and physiological properties. For instance, more than 75% of drugs approved by the US Food and Drug Administration (FDA) that are currently available in the market contain nitrogen-containing heterocyclic moieties.

Increasing Use as Herbicides and Urinary Antiseptics by Healthcare Companies to Drive Sales

The majority of the molecules that mankind recognizes as drugs, vitamins, and various other natural products are heterocycles. As a result, a significant percentage of chemical research is focused on heterocyclic chemistry. Due to their therapeutic properties, they might be employed to treat infectious diseases. Numerous heterocyclic substances created in laboratories have been used successfully as medicinal drugs across the globe.

Besides, several pharmacologically active heterocyclic substances are employed to treat a wide range of common illnesses as antimicrobials, herbicides, urinary antiseptics, and anti-inflammatory medications. Also, numerous heterocycles have antitumor, anti-HIV, antibiotic, anti-inflammatory, antimalarial, antimicrobial, antibacterial, antifungal, antiviral, antidepressant, and anti-diabetic properties.

Medicinal chemistry is witnessing an increasing number of novel heterocyclic moieties with significant physiological and promising applications. It is anticipated that the aforementioned factors are projected to push the global heterocyclic and fluoro organic compounds market in the next ten years.

Shift of Production Facilities to China by American Companies will Spur Sales of Heterocyclic Compounds

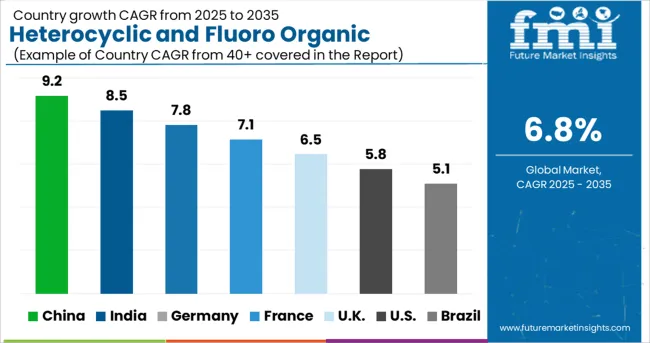

The East Asia region is expected to be one of the key consumers and producers in the heterocyclic and fluoro organic compounds market. The region is expected to account for nearly 30%-35% of the global market share and is expected to create an absolute dollar opportunity of USD 149.7 million during the forecast period.

In East Asia, China is expected to be one of the prominent countries in terms of consumption of heterocyclic and fluoro-organic compounds owing to the significant development of end-use industries such as pharmaceuticals, agrochemicals, and paints & coatings. Various European and American key chemical and pharmaceutical players have shifted their production facilities to the country backed by stringent environmental regulations in American and European countries, which have also positively impacted growth in the heterocyclic and fluoro organic compounds market in China.

Rising Pharmaceutical Exports from India to Propel the Demand for Novel Heterocyclic Compounds.

India is expected to remain one of the prominent consumers of heterocyclic and fluoro organic compounds globally owing to the increasing demand from the pharmaceutical industry. The country is expected to account for nearly 15% of the share in the global heterocyclic and fluoro organic compounds market during the forecast period. India holds the leading position in global generic drug exports, while the Indian pharmaceutical export reached more than USD 601.9 Billion in 2024.

The government of India offers a policy to support the pharmaceutical industry and has a novel vision to push the country as a pharma leader in the manufacturing of drugs & medicines. Heterocyclic and fluoro organic compounds, as well as other easily available compounds, are majorly consumed in the pharmaceutical industry for the production of drugs and medicines.

The growth of the pharmaceutical industry and an increasing number of active pharmaceutical ingredient (API) units in India are expected to propel the demand for heterocyclic and fluoro organic compounds. Thus, the India heterocyclic and fluoro organic compounds market is expected to witness significant growth at a CAGR of 8.0% during the forecast period, finds FMI.

Use of Aromatic Heterocycles to Surge among Pharmaceuticals and Agrochemical Companies

Based on application, the global heterocyclic and fluoro organic compounds market is categorized into agrochemicals, pharmaceuticals, biotech, paints, polymers, electronics, and x-ray films. Amongst these, the pharmaceuticals segment is expected to remain at the forefront in the global heterocyclic and fluoro organic compounds market. As per FMI, the segment is expected to witness a significant growth rate at a CAGR of 8.1% over the forecast period.

Agrochemical, on the other hand, is anticipated to be one of the fastest-growing applications of heterocyclic and fluoro-organic compounds during the forecast period, followed by pharmaceuticals. High demand for agrochemicals and increasing consumption of these compounds in the development of pesticides are expected to drive the need for heterocyclic and fluoro-organic compounds in the agrochemicals sector.

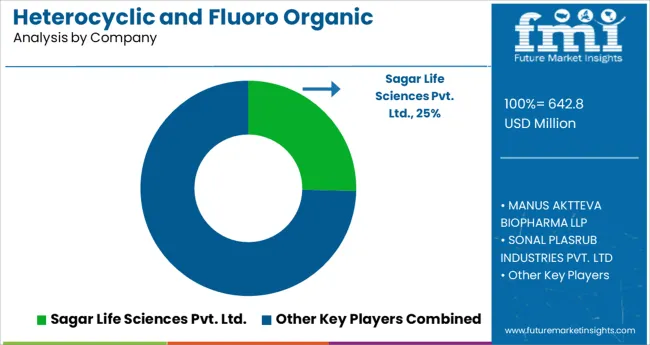

Key players in the global heterocyclic and fluoro organic compounds market are investing in research & development (R&D) activities for the creation of innovative products with enhanced features. A few other companies are aiming to introduce sustainable products to minimize their carbon footprint.

Meanwhile, some of the other companies are also focusing on capacity expansions and geographical expansions in emerging economies to bolster their stronghold in the heterocyclic and fluoro organic compounds market. Leading players are focusing on the acquisition of other local players to increase their consumer base.

For instance:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 642.8 million |

| Projected Market Valuation (2035) | USD 1241.0 million |

| Value-based CAGR (2025 to 2035) | 6.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value (million) and Volume (Tons) |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, BENELUX, Russia, China, Japan, South Korea, India, ASEAN, ANZ, GCC Countries, Turkey, Northern Africa, South Africa |

| Key Segments Covered | Product Type, Application, and Region |

| Key Companies Profiled |

Tokyo Chemical Industry Co. Ltd; Biosynth Carbosynth; Central Glass Co., Ltd.; Toronto Research Chemicals Inc.; Galen Ltd.; Glentham Life Sciences Limited; SynQuest Laboratories, Inc.; SAGAR Life Sciences Private Limited; Manus Aktteva Biopharma LLP; SimSon Pharma Limited; Life Chem Pharma Pvt. Ltd.; Sonal Plasrub Industries Pvt. Ltd.; Survival Technologies Ltd.; Others |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global heterocyclic and fluoro organic compounds market is estimated to be valued at USD 642.8 million in 2025.

It is projected to reach USD 1,241.0 million by 2035.

The market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types are ethyl - 3 -(3- dimethylaminoprophyl) carbodiimide, 2-pyridyl tribromomethyl sulfone (bsp), 5-bromo-2,4-dichloro pyrimidine, cyclam (1,4,8,11 tetraazacyclotetradecane), 2,2,6,6-tetramethylpiperidine n-oxyl (tempo), trimethylsilyl trifluoromethanesulfonate, trifluoromethanesulfonicanhydride, bromoacetonitrile, 4-bromobenzene sulfonyl chloride, 5-bromovaleric acid and alpha tetralol.

agrochemicals segment is expected to dominate with a 42.3% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA