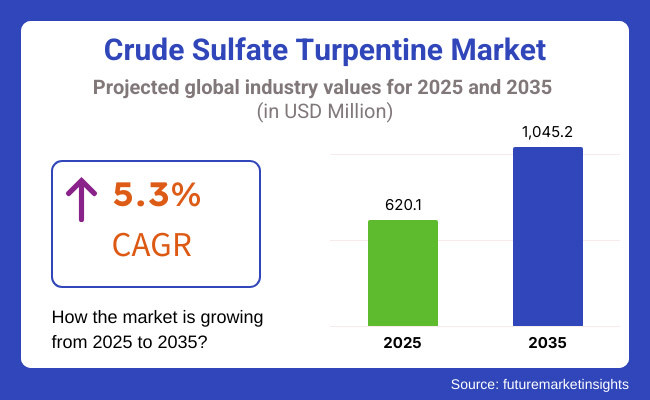

The global crude sulfate turpentine market is set to witness USD 620.1 million in 2025. The industry is expected to witness 5.3% CAGR from 2025 to 2035, reaching USD 1,045.2 million by 2035.

Crude sulfate turpentine (CST) is a byproduct of the kraft pulping process, which is mainly derived from the wood of pine. CST contains beneficial chemicals such as alpha-pinene, beta-pinene, and other terpenes that are commonly used in the aroma, adhesive, and chemical sectors. CST is a key feedstock in the production of flavors, solvents, disinfectants, and bio-based fuels. The increasing use of the product and its environmentally friendly applications as well as the rising demand for bio-based replacements for petrochemicals drives the world to move toward renewable and sustainable feedstock.

The increasing demand for natural and bio-based ingredients in end-user products such as fragrances, adhesives, and paints is one of the key factors driving the industry growth. With an increase in consumer interest and demand for sustainable and environmentally friendly products, the product has become a preferred raw material as its natural in origin.

The industry is making large investments to upgrade and expand plants and gain a competitive edge. Companies such as Kraton Corporation, DRT (Dérivés Résiniques et Terpéniques), and Pine Chemical Group have announced expansions in their turpentine distillation plants in order to increase production and cater increasingly to the surging international demand. Moreover, a novel processing technology has enabled the manufacturers to optimize the quality and field of use of the product, making it even more suitable for the high-end industries: perfumes and drugs. Manufacturers are also pursuing mergers and acquisitions advanced, alongside strategic partnerships in the industrial space to determine in advance. For instance, a few major producers have entered into long-term agreements with pulp mills to secure a guaranteed flow of crude sulfate turpentine at a steady production level. This is true for many companies, which are focusing more on creative marketing to position their products as greener alternatives in the specialty chemicals space.

The table below presents a comparative assessment of the variation in CAGR over six-month intervals for the base year (2024) and the current year (2025) in the global crude sulfate turpentine industry. This analysis provides critical insights into revenue realization trends and helps stakeholders track the industry's evolving growth trajectory.

| Particular | H1 |

|---|---|

| Year | 2024 to 2034 |

| CAGR | 4.6% |

| Particular | H2 |

|---|---|

| Year | 2024 to 2034 |

| CAGR | 5.1% |

| Particular | H1 |

|---|---|

| Year | 2025 to 2035 |

| CAGR | 4.8% |

| Particular | H2 |

|---|---|

| Year | 2025 to 2035 |

| CAGR | 5.2% |

The first half of the year (H1) spans from January to June, while the second half (H2) covers July to December. Over the decade from 2025 to 2035, the industry is projected to expand at a CAGR of 5.1% in H1, followed by a similar growth trend in H2. The projected CAGR from H1 2025 to H2 2035 remains stable, showcasing a sustained industry expansion. In the first half (H1), the industry experienced a growth of 20 BPS, while in the second half (H2), a slight decrease of 10 BPS was observed, indicating dynamic shifts in demand and supply.

Expanding Applications in Aromatherapy and Therapeutic Formulations

The growing interest in natural wellness solutions has significantly increased the demand for the product in aromatherapy and therapeutic applications. Essential oil manufacturers are utilizing its derivatives, such as alpha-pinene and beta-pinene, in formulations for stress relief, respiratory benefits, and cognitive enhancement. This shift is driven by rising consumer inclination toward holistic health solutions, particularly in regions with strong herbal medicine traditions. Manufacturers are responding by refining extraction processes to enhance the purity of terpenes used in these applications. Additionally, companies are investing in research collaborations with wellness brands to develop innovative formulations incorporating crude sulfate turpentine derivatives. The focus remains on regulatory compliance and safety, ensuring that crude sulfate turpentine-based formulations meet global health standards while tapping into the expanding consumer base seeking natural therapeutic solutions.

Increased Integration in High-Performance Adhesives and Coatings

Crude sulfate turpentine derivatives are witnessing heightened adoption in high-performance adhesives and industrial coatings due to their superior bonding capabilities and eco-friendly profile. With stricter regulations on synthetic chemical usage in industrial applications, manufacturers are turning to natural alternatives that enhance product sustainability without compromising performance. This trend is particularly pronounced in sectors such as construction, automotive, and electronics, where durability and environmental compliance are key concerns. Producers are scaling up investments in refining technologies to optimize crude sulfate turpentine derivatives for advanced adhesive formulations. Additionally, strategic partnerships with industrial manufacturers are driving demand for customized solutions that integrate well with modern manufacturing processes. As companies focus on reducing carbon footprints, crude sulfate turpentine-based solutions are positioned as a viable replacement for traditional petroleum-derived components in industrial applications.

Strengthening Regional Supply Chains to Counter Volatility

Fluctuations in raw material availability and geopolitical uncertainties have pushed manufacturers to strengthen regional supply chains for the product. The dependency on specific regions for raw material extraction has exposed the industry to supply disruptions caused by trade restrictions, environmental regulations, and economic instability. To mitigate risks, manufacturers are increasing investments in local sourcing and establishing processing facilities closer to demand centers. This shift ensures a more stable supply of the product while reducing logistics costs and enhancing profitability. Companies are also focusing on sustainable forest management initiatives to secure long-term raw material availability. Additionally, firms are exploring alternative pine resin sources to diversify supply streams and minimize dependency on traditional production hubs, ensuring uninterrupted operations in an increasingly volatile global trade environment.

Advancements in Distillation Technologies for Higher Purity Grades

Technological advancements in distillation processes are reshaping the industry by enabling the production of higher-purity derivatives. The demand for refined turpentine fractions with minimal impurities is rising, particularly in pharmaceutical, fragrance, and high-end industrial applications. Traditional distillation methods often lead to inconsistencies in product quality, affecting industry adoption. To address this, manufacturers are integrating advanced fractional distillation and molecular separation techniques to achieve superior product consistency. These innovations not only enhance the purity of turpentine derivatives but also improve yield efficiency, reducing production costs. Companies are also implementing automated monitoring systems to optimize process control and ensure adherence to stringent industry standards. As regulatory frameworks tighten across key consumer markets, the ability to offer high-purity crude sulfate turpentine derivatives is becoming a major competitive differentiator for manufacturers.

The increasing adoption of natural and bio-based chemicals has significantly driven industry expansion, particularly in industries such as fragrances, adhesives, and coatings. Recently, the product has established itself as a viable eco-friendly substitute for petrochemical technology-based solvents that have recently raised a lot of concern.

The advances made toward bio-sourced raw materials have encouraged companies to increase their production capacities and put in place more robust supply chains. Further continuous research is being undertaken to refine extraction methods to improve product purity and open further industrial applications. Manufacturers are also focusing on creating high-performance formulations to fulfil the niche industry of pharmaceuticals and premium perfumes.

The tactics of successful positioning have certainly played a considerable role in this growth of industry share for the product. Companies now partner with industries to gain consumer trust and differentiate their products from competitors. With improvements in processing technologies and innovative marketing endeavors, in future, there might be consistent growth of the demand for the product.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| More demand for the product (CST) in fragrance, adhesives, and industrial solvents. | Further getting into bio-based chemicals, green solvents, and pharmaceutical intermediates due to sustainability trends. |

| Volatility in CST prices due to fluctuations in pine chemical supply and global trade dynamics. | AI-driven supply chain optimization stabilizes pricing and improves procurement efficiency. |

| Rising regulatory scrutiny on VOC emissions and environmental impact of CST-based products. | Advanced purification and eco-friendly processing methods enhance regulatory compliance and industry acceptance. |

| Increased use of CST-derived terpene resins in rubber, inks, and coatings industries. | Advances in sustainable coatings and bio-based polymers fuel increased demand for CST derivatives. |

| North America and Europe were leading producers of CST, while Asia-Pacific experienced rising demand. | Making source areas diverse makes the supply chain robust. |

| Sustainability issues brought forestry techniques in CST procurement. | Traceability based on blockchain and certified sustainable forestry programs improve ethical standards of sourcing. |

Alpha-Pinene is an important component of fragrance formulations, pharmaceutical applications, and industrial solvents, with increasing demand for bio-based and natural ingredients used in perfumes, personal care products, and household cleaners. Moreover, glycyrrhizin's anti-microbial and anti-inflammatory properties are used for various pharmaceutical applications such as expectorants, anti-inflammatory medications, and topical agents. The alpha-pinene industry is expected to continue its dominance during the forecast period, with the growth of pharmaceutical and fragrance industries and sustainability-oriented innovations.

Oil is the predominantly used source of the product, owing to its high versatility and widespread applications in industries. The product is produced as a by-product in the kraft pulping process as volatile oil, hence oil-based crude sulfate turpentine dominates the industry. It has major constituents like alpha-pinene, beta-pinene, camphene, and limonene, which are required raw materials in the manufacturing of fragrances, flavorings, resins, and solvents. Due to the high purity and simple extraction from the oil form, it is the first choice as the source for commercial purposes.

Sulfate distilled is the principal process of refining crude sulfate turpentine, mostly because of its extensive application in the kraft pulping process, which is the prevalent technology used for paper and wood product manufacture worldwide. This process consists of the isolation of volatile organic compounds from wood chips during the kraft pulping process with the result being crude sulfate turpentine as a by-product. The high rate of efficiency and extensive usage of kraft pulping render sulfate distillation the most prevalent technique for obtaining the product.

The personal care and cosmetics industry is one of the principal end users of the product owing to its significant function in manufacturing aroma chemicals and fragrance ingredients. The product contains high amounts of alpha-pinene, beta-pinene, and limonene, which are used extensively in the manufacturing of perfumes, deodorants, and body care items. These chemicals have pleasant odor profiles and are naturally derived, and thus they are very much in demand in fragrance-containing products. With the rise in consumer interest in natural and plant-derived ingredients, crude sulfate turpentine-derived aroma chemicals are being increasingly used to substitute synthetic chemicals in cosmetics.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.6% |

| China | 7.5% |

| India | 8.9% |

| Germany | 3.3% |

| Australia | 6.6% |

The USA shares a major industry share in the global industry and is anticipated to witness a CAGR of 4.6% during the forecast period of 2025 to 2035, as per FMI. The increasing demand for bio-based alternatives for paint, coatings, adhesives, and personal care products boosts the demand for the product. A well-established pulp and paper industry provides a consistent supply of crude sulfate turpentine by-products, backed by improved extraction and purification technology for better quality and efficiency. Strict environmental regulations also hasten the shift from synthetic chemicals to natural alternatives, further fueling industry growth. Collaboration between research institutions and producers is driving product development and broadening applications.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Emerging Demand for Bio-Based Chemicals | Industries are moving towards sustainable and renewable raw materials. |

| Robust Pulp & Paper Industry | Guarantees a consistent supply of the product. |

| Regulatory Push Towards Green Products | Stricter environmental laws favor bio-based products. |

As per FMI, the Chinese industry is expected to register CAGR of 7.5% during 2025 to 2035, driven by the growing expansion of the construction, automotive, and consumer goods industries. The emphasis of the Chinese government on sustainable development has resulted in greater use of bio-based products, and consequently, the product has emerged as a sought-after substitute for petrochemical products. Producers at home are investing in capacity building and upgrading processing technology to cater to local and international demand. Strategic joint ventures with foreign partners also enhance China's worldwide industry share.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Growing Industrial Applications | Turpentine derivatives have versatile applications in coatings, fragrances, and resins. |

| Government Interest in Sustainability | Regulatory initiatives promote bio-based product adoption. |

| Investments in Processing Tech | Enhanced manufacturing plants enhance productivity and purity. |

India is a rapidly growing industry with an estimated 8.9% CAGR over 2025 to 2035, as per FMI. Increasing personal care, pharmaceutical, and industrial demand propels growth. The availability of raw materials at cheap rates offers a competitive advantage to Indian producers, who aim to increase supply chain productivity and eco-friendly operations. Regulatory policies supporting sustainable and renewable resources are also propelling the industry forward, and increased consumer awareness regarding organic and natural products is opening up new growth opportunities.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Increase in Demand for Natural Ingredients | Increased use in cosmetics, pharmaceuticals, and coatings. |

| Cost-Affordable Production & Supply Chain Effectiveness | Competitive pricing and robust logistics infrastructure. |

| Government Initiatives Towards Bio-Based Products | The policy is in favor of renewable and green materials. |

Germany's industry is expected to grow at a CAGR of 3.3% between 2025 and 2035 because of its solid foundation in chemical production and industrial use. Manufacturers ' preference for sustainable formulation drives increased usage of bio-based chemicals in the fragrance, adhesives, and coatings markets. Also, stringent environmental regulations in Germany are driving the use of renewable and biodegradable raw materials.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Demand for Bio-Based Solvents & Fragrances | Growing demand for natural ingredients. |

| Stringent Environmental Policies | Promoting the use of renewable and biodegradable raw materials. |

| Strong Industrial Manufacturing Base | Extensively used in resins, adhesives, and coatings. |

As per FMI, Australia's crude sulfate turpentine market is poised to grow at a 6.6% CAGR during 2025 to 2035, driven by rising industrial usage and the growing emphasis on bio-based products.The country's well-established wood industry drives turpentine production, supported by a guaranteed supply of raw materials. On top of this, increased usage of green chemicals such as paints, coatings, and adhesives is driving the industry.

Growth Drivers in Australia

| Key Drivers | Details |

|---|---|

| Resilient Forest Industry | Provides a consistent supply of the product. |

| Increasing Green Chemistry Programs | Increased application of bio-based alternatives in major markets. |

| R&D Spending on High-Value Applications | Pharmaceuticals, food additives, and cosmetics innovations. |

The global industry is moderately concentrated, with a mix of regional players and private label brands competing for industry share. Regional manufacturers play a crucial role in catering to localized demand, ensuring stable supply chains, and maintaining cost competitiveness. These players are primarily focused on securing long-term contracts with pulp mills to strengthen their raw material sourcing capabilities. Additionally, they are investing in advanced processing technologies to enhance product purity and increase application potential across industries such as adhesives, coatings, and flavors.

Private label brands are gradually gaining traction, particularly in niche segments where customized formulations are required. These brands often collaborate with contract manufacturers to develop high-quality turpentine derivatives for end-use industries. Their industry presence is growing due to flexible pricing strategies, targeted marketing campaigns, and direct distribution channels that cater to specialized customer demands.

Regional variations in the product production influence industry dynamics, with certain areas experiencing supply bottlenecks due to raw material constraints. To mitigate these challenges, manufacturers are expanding production facilities in strategic locations and exploring alternative sources of raw materials. Emerging markets are witnessing an increase in local manufacturers who are focusing on sustainable sourcing and product differentiation to gain a competitive edge.

With the rise in demand for bio-based chemicals, industry players are continuously innovating to meet stringent regulatory standards while maintaining cost efficiency. The competitive landscape remains dynamic, with companies exploring strategic partnerships and capacity expansions to strengthen their foothold in the industry.

The global crude sulfate turpentine (CST) industry is quite competitive because of the increasing demand for natural and bio-based chemicals from different industries, such as those related to fragrances, adhesives, and solvents. Advances in extraction and refining processes, as well as sustainability advancements and changing regulatory standards, encourage development in this industry to find eco-friendly alternatives for petrochemical-based chemicals.

Major companies in the industry include Kraton Corporation, DRT (Les DérivésRésiniques et Terpéniques), Symrise AG, WestRock, and Pine Chemical Group. This industry has seen the advent of competition through vertical integration, a strong ability to produce, and a very diverse range of products within their portfolios. They primarily focus on high-value CST derivatives, such as aroma chemicals, resins, and specialty solvents, to enhance their competitive edge.

Sustainability is a key fundamental aspect under which all major companies get involved in greener extraction techniques, circular economy models, and responsible raw material sourcing so as to conserve natural resources and reduce their overall environmental footprint. Compliance with global safety and environmental standards, however, is what sets one industry apart from the rest. The competition will, therefore, witness further intensification with investments geared toward R&D and supply-chain optimization, as well as strategic alliances that will shape the future of the industry.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| DRT (Dérivés Résiniques et Terpéniques) | 14-18% |

| Symrise AG | 12-16% |

| WestRock Company | 10-14% |

| International Flavors & Fragrances Inc. | 9-13% |

| Kraton Corporation | 7-11% |

| Other Companies (combined) | 30-40% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| DRT (Dérivés Résiniques et Terpéniques) | Specializes in terpene-based resins and aroma chemicals, emphasizing sustainable sourcing. |

| Symrise AG | Focuses on CST-derived fragrance ingredients and high-purity aroma chemicals. |

| WestRock Company | Supplies CST for adhesives, coatings, and industrial applications, prioritizing sustainable forestry practices. |

| International Flavors & Fragrances (IFF) | Utilizes CST for perfumery and specialty chemicals, investing in bio-based solutions. |

| Kraton Corporation | Produces CST-based performance materials for adhesives, coatings, and polymers. |

DRT (14-18%)

Leading supplier of CST derivatives, leveraging sustainable forestry and bio-based innovations.

Symrise AG (12-16%)

Strengthening its fragrance and aroma chemicals segment through CST refining advancements.

WestRock Company (10-14%)

Enhancing CST production capabilities for adhesives, coatings, and industrial uses.

International Flavors & Fragrances Inc. (9-13%)

Focusing on high-value CST applications in the fragrance and personal care industry.

Kraton Corporation (7-11%)

Investing in advanced polymer applications and sustainable CST extraction.

Other Key Players (30-40% Combined)

The industry is slated to reach USD 620.1 million in 2025.

The industry is predicted to reach USD 1,045.2 million by 2035.

Key players include DRT (Dérivés Résiniques et Terpéniques), Symrise AG, WestRock Company, International Flavors & Fragrances Inc., Kraton Corporation, Pine Chemical Group, Stora Enso Oyj, UPM-Kymmene Corporation, Georgia-Pacific LLC, and Privi Speciality Chemicals Limited.

India, slated to grow at 8.9% CAGR during the forecast period, is poised for the fastest growth.

Alpha-pinene is being widely used.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Liters) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 6: Global Market Volume (Liters) Forecast by Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Processing Method, 2018 to 2033

Table 8: Global Market Volume (Liters) Forecast by Processing Method, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (Liters) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 16: North America Market Volume (Liters) Forecast by Source, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Processing Method, 2018 to 2033

Table 18: North America Market Volume (Liters) Forecast by Processing Method, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (Liters) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 26: Latin America Market Volume (Liters) Forecast by Source, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Processing Method, 2018 to 2033

Table 28: Latin America Market Volume (Liters) Forecast by Processing Method, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (Liters) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 36: Europe Market Volume (Liters) Forecast by Source, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Processing Method, 2018 to 2033

Table 38: Europe Market Volume (Liters) Forecast by Processing Method, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Europe Market Volume (Liters) Forecast by Application, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: Asia Pacific Market Volume (Liters) Forecast by Source, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Processing Method, 2018 to 2033

Table 48: Asia Pacific Market Volume (Liters) Forecast by Processing Method, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: Asia Pacific Market Volume (Liters) Forecast by Application, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: MEA Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 56: MEA Market Volume (Liters) Forecast by Source, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Processing Method, 2018 to 2033

Table 58: MEA Market Volume (Liters) Forecast by Processing Method, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: MEA Market Volume (Liters) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Processing Method, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Liters) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 15: Global Market Volume (Liters) Analysis by Source, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Processing Method, 2018 to 2033

Figure 19: Global Market Volume (Liters) Analysis by Processing Method, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Processing Method, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Processing Method, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (Liters) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Source, 2023 to 2033

Figure 28: Global Market Attractiveness by Processing Method, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Processing Method, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 45: North America Market Volume (Liters) Analysis by Source, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Processing Method, 2018 to 2033

Figure 49: North America Market Volume (Liters) Analysis by Processing Method, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Processing Method, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Processing Method, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (Liters) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Source, 2023 to 2033

Figure 58: North America Market Attractiveness by Processing Method, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Processing Method, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 75: Latin America Market Volume (Liters) Analysis by Source, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Processing Method, 2018 to 2033

Figure 79: Latin America Market Volume (Liters) Analysis by Processing Method, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Processing Method, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Processing Method, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (Liters) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Processing Method, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Processing Method, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Europe Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 105: Europe Market Volume (Liters) Analysis by Source, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Processing Method, 2018 to 2033

Figure 109: Europe Market Volume (Liters) Analysis by Processing Method, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Processing Method, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Processing Method, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Europe Market Volume (Liters) Analysis by Application, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Source, 2023 to 2033

Figure 118: Europe Market Attractiveness by Processing Method, 2023 to 2033

Figure 119: Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Processing Method, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Liters) Analysis by Source, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Processing Method, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Liters) Analysis by Processing Method, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Processing Method, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Processing Method, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Liters) Analysis by Application, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Processing Method, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Processing Method, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: MEA Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 165: MEA Market Volume (Liters) Analysis by Source, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Processing Method, 2018 to 2033

Figure 169: MEA Market Volume (Liters) Analysis by Processing Method, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Processing Method, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Processing Method, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 173: MEA Market Volume (Liters) Analysis by Application, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 176: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Source, 2023 to 2033

Figure 178: MEA Market Attractiveness by Processing Method, 2023 to 2033

Figure 179: MEA Market Attractiveness by Application, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Turpentine Market Size and Share Forecast Outlook 2025 to 2035

Crude Oil Flow Improvers Market Size and Share Forecast Outlook 2025 to 2035

Sulfate-Free Shampoos Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Crude Heater Market Size and Share Forecast Outlook 2025 to 2035

CDU Heat Exchanger Anti-foulant Market 2025-2035

Crude Oil Assay Testing Services Market

Persulfates Market Size and Share Forecast Outlook 2025 to 2035

Gum Turpentine Oil Market Growth - Trends & Forecast 2025 to 2035

Nickel Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Cyclic Crude Intermediate And Gum Market Size and Share Forecast Outlook 2025 to 2035

Ferric Sulfate Market Growth - Trends & Forecast 2025 to 2035

Barium Sulfate Market Analysis - Size, Share & Forecast 2025 to 2035

Ferric Sulfate & Polyferric Sulfate Market 2024-2034

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Diethyl Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Ferrous Sulfate Market - Size, Share & Forecast 2025 to 2035

Ammonium Sulfate Food Grade Market Report - Industry Insights 2025 to 2035

Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

UK Ferric Sulfate Market Trends – Size, Share & Industry Growth 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA