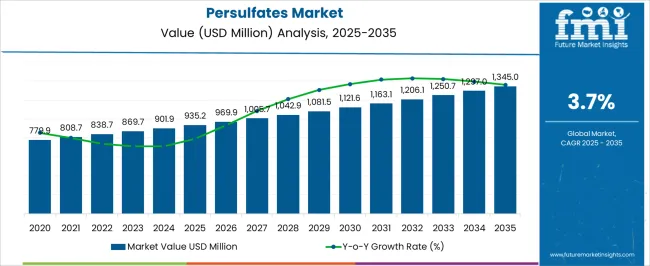

The Persulfates Market is estimated to be valued at USD 935.2 million in 2025 and is projected to reach USD 1345.0 million by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Persulfates Market Estimated Value in (2025 E) | USD 935.2 million |

| Persulfates Market Forecast Value in (2035 F) | USD 1345.0 million |

| Forecast CAGR (2025 to 2035) | 3.7% |

The persulfates market is experiencing steady growth driven by increased demand for high performance oxidizing agents across a variety of industrial processes. The market is benefiting from the expanding use of persulfates in polymer manufacturing, metal treatment, and water purification applications.

These compounds are valued for their strong oxidative potential, long shelf life, and versatility in initiating polymerization reactions and surface cleaning. Stringent environmental regulations are prompting industries to adopt cleaner and more effective chemical alternatives, further supporting persulfate adoption.

Technological advancements in production efficiency and the availability of high purity grades are widening their industrial applications. The market outlook remains favorable as sustainability goals, rising industrialization, and regulatory compliance continue to shape purchasing behaviors in key end use sectors.

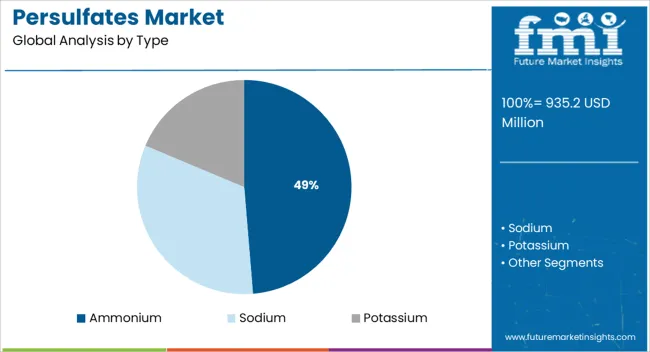

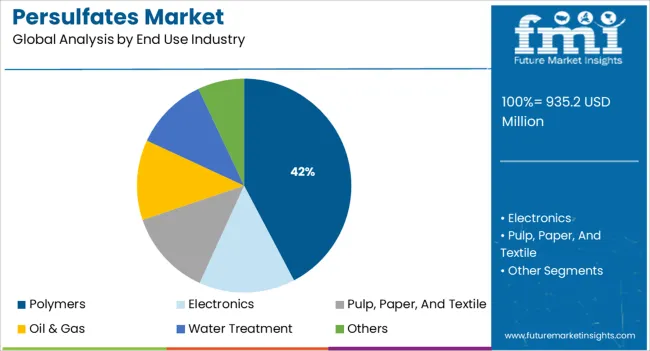

The market is segmented by Type and End Use Industry and region. By Type, the market is divided into Ammonium, Sodium, and Potassium. In terms of End Use Industry, the market is classified into Polymers, Electronics, Pulp, Paper, And Textile, Oil & Gas, Water Treatment, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ammonium segment is expected to contribute 48.70% of total market revenue by 2025 within the type category, positioning it as the leading segment. This dominance is attributed to its strong oxidative properties, cost effectiveness, and adaptability across multiple applications such as polymerization initiators, etching processes, and environmental remediation.

Ammonium persulfate is widely used due to its high solubility and stability, which make it ideal for use in aqueous systems. Its compatibility with emulsion and solution polymerization techniques has enhanced its presence in the production of synthetic resins and rubber.

Additionally, the increasing shift toward eco friendly chemical processes in manufacturing and surface treatment is favoring its adoption. These functional advantages have enabled ammonium persulfate to maintain its leadership within the type segment.

The polymers segment is projected to hold 42.30% of total market revenue by 2025 under the end use industry category, making it the most dominant segment. This growth is supported by the rising global production of plastics, rubbers, and resins which rely on persulfates as initiators during polymerization.

The need for consistent product quality, faster reaction rates, and clean processing has elevated the importance of persulfates in polymer manufacturing. Industries are increasingly adopting water based and low VOC polymer systems, where persulfates are favored due to their effectiveness and environmental compatibility.

The continued expansion of packaging, construction, and automotive sectors is further driving demand for polymer raw materials, reinforcing the relevance of persulfates in this segment. The polymers industry thus remains a core application area, underpinning the overall market trajectory.

Over the historical period, the COVID-19 pandemic influenced metal production because mining was halted due to quarantine regulations and worker protections. The coronavirus pandemic has had a substantial impact on the electronics sector, disrupting the distribution network of electronic components. Furthermore, COVID-19 had an adverse influence on the oil and gas industry, where persulfates are used as gel breakers, as popularity reduced.

In the coming decades, market growth will be enabled by continuous research and development for the innovation of Persulfates. Over the forecast timeframe, market growth will be driven by the increasing use of Persulfates as a peroxymonosulfate in water treatment developments. (2025 to 2035).

During the forthcoming years, the market is anticipated to be propelled by increasing demands for persulfates in the electronics industry to be utilized in the cleaning and etching of printed wiring substrates. As, persulfates are utilized for surface cleaning of metals such as brass, copper, nickel, aluminum, zinc, and titanium which is estimated to raise demand and spur the market for persulfates.

Burgeoning Wastewater Treatment Projects are propelling the market growth

Persulfates are employed by the water treatment sector to treat contaminants such as halogenated olefins, perfluorinated substances, phenols, pharmaceutical drugs, inorganics, and others. The global rise in wastewater management initiatives is promoting the expansion of the water treatment market.

The Philippines Aglipay Sewage Treatment Plant in Mandaluyong, for example, started construction in 2024. In order to reduce adverse effects on Manila Bay and the Pasig River, including its environmental footprint, it will consistently meet federal guidelines that exceed EU requirements.

The venture is currently under construction, with an anticipated completion date of early 2025. Besides that, work on the New Upper Thompson Sanitation District Wastewater Treatment Facility,a future production wastewater treatment project will begin in the United States by 2025. Such projects are growing rapidly for persulfates and, as a result, cruising sales growth.

Increasing polymers Production is Soaring the market growth

Potassium Persulfate is used as a polymerization initiator in the creation of a variety of polymers, including vinyl, neoprene, and others. Factors such as rising consumption from the packaging industry boost growth from transportation to ensure excellent durability and flexibility, among others. These aspects are hastening the expansion of the polymers industry.

As reported by the Chemicals and Petrochemicals Manufacturers' Association (CPMA), polymer production in India was 901.9 million tons in 2024 and 901.9 million tonnes in 2024, a 9.63% increase. As a result, rising polymer production is driving up supply for persulfates, ramping up market growth.

Persulfate-related health concerns pose a market challenge

Because of the health risks associated with the use of persulfates, there are various restrictions imposed on their usage. For example, the New Jersey Department of Health and Senior Services has classified sodium persulfates as a hazardous substance since they can induce eye, nose, and skin irritation as well as respiratory issues.

Furthermore, raw materials utilized in the production of persulfates, such as persulfuric acid, have negative health impacts. As a consequence, the aforementioned medical problems associated with the use of persulfates may limit the persulfates industry's growth during the predicted forecast period.

The presence of several leading manufacturers in the plastics industry drives the market

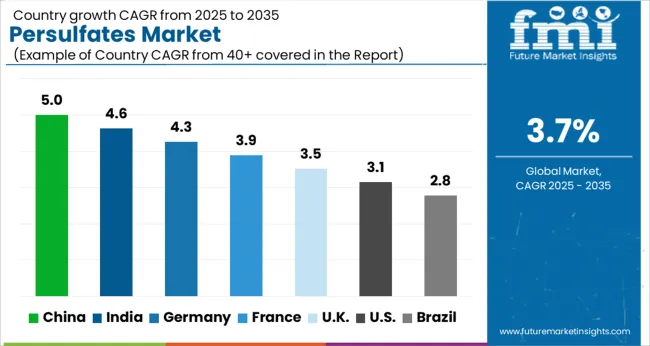

Over the forthcoming years, North America is expected to grow at a revenue-based CAGR of 3.8%. This is due to the existence of several key manufacturers in the plastic industry in the USA, including ExxonMobil Chemical Division and DoW Chemical. The plastics industry is the nation's third-largest manufacturing sector. High-density polyethylene, low-density polyethylene, and linear low-density polyethylene are a few of the most widely produced polymers in the USA.

In terms of size, the USA electronics market is the biggest in the world. It is anticipated to remain the market leader during the projected timeframe, owing to the use of sophisticated technology, a rise in the number of Research and Development centers, and rising consumer demand. Therefore, this factor will generate major revenue for the market in North America.

Changing fashion and lifestyle trends are spurring industry growth

Asia Pacific has emerged as the dominant region, accounting for more than 45.5% of revenue in 2024. The existence of a substantial number of plastic manufacturing sectors in countries such as China, Indonesia, and Malaysia is credited with the development. Thailand's plastic production industry has expanded quickly in recent years, with approximately 5,000-5500 organizations.

Furthermore, evolving fashion and lifestyle trends may encourage the growth of hair dyes, and thus persulfates, due to their use in hair bleaches and color correctors to decolorize hair by oxidizing colors present in the hair shaft. During the forecast years, the Asia-Pacific hair color market is expected to grow at a CAGR of more than 6.1%, which may augment the persulfates market.

Furthermore, China is home to some of the world's largest electronic manufacturing firms, including Lenovo, BOE Technology, and Huawei. As a consequence, an increment in the Chinese electronics market will strengthen the Asia Pacific persulfate market over the next decade.

As initiators, the use of multiple persulfates is influencing segment growth

In 2025, the polymers segment led the market, accounting for more than 51% of total revenue. This is due to the utilization of all three persulfates as innovators in emulsion polymerization reactions for the manufacturing of polystyrenes, polyvinyl chlorides, neoprene, and acrylics. The product is also employed as an inducer in concrete formulations and for the polymeric sealant of graphite microfibrils.

The ammonium segment is extensively used in treating Wastewater

In 2024, the ammonium segment dominated the industry with overall revenue of 50.5%. The broad range of uses for ammonium persulfate, including the diagnosis of metal surfaces, the producers of semiconductors, and the etching of copper on printed circuit boards, is credited with the expansion. It is also widely used throughout wastewater treatment and as a precursor for the polymerization of acrylic monomers in emulsions.

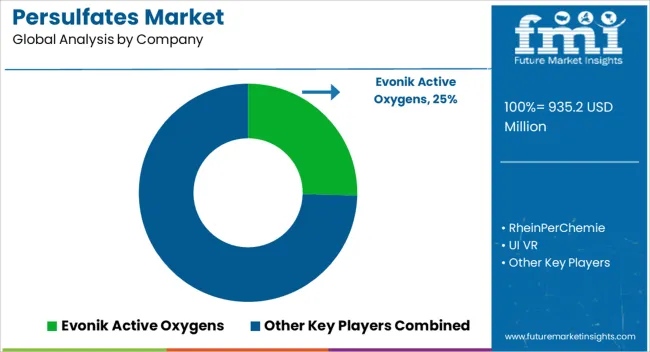

Key players in the Persulfates market are Evonik Active Oxygens; RheinPerChemie; UI VR Persulfates; MITSUBISHI GAS CHEMICAL COMPANY, INC.; Fujian ZhanHua Chemical Co., Ltd.; Ak-Kim; Yatai Electrochemistry Co. Ltd.; Hebei Jiheng Group; Fujian Jianou Yongsheng Industry; San Yuan Chemical Co., Ltd.

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 935.2 million |

| Market Value in 2035 | USD 1345.0 million |

| Growth Rate | CAGR of 3.7% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type, End Use, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa(MEA) |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, Singapore, Thailand, Indonesia, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Evonik Active Oxygens; RheinPerChemie; UI VR Persulfates; Mitsubishi Gas Chemical Company Inc.; Fujian ZhanHua Chemical Co., Ltd.; Ak-Kim; Yatai Electrochemistry Co. Ltd.; Hebei Jiheng Group; Fujian Jianou Yongsheng Industry; San Yuan Chemical Co., Ltd. |

| Customization | Available Upon Request |

The global persulfates market is estimated to be valued at USD 935.2 million in 2025.

The market size for the persulfates market is projected to reach USD 1,345.0 million by 2035.

The persulfates market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in persulfates market are ammonium, sodium and potassium.

In terms of end use industry, polymers segment to command 42.3% share in the persulfates market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA