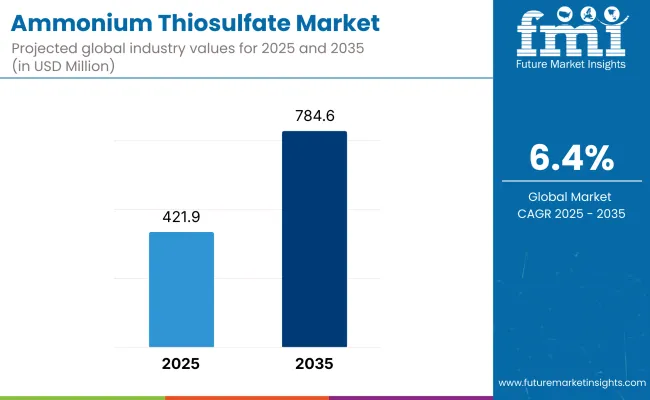

The global ammonium thiosulfate market is expected to grow significantly from USD 421.9 million in 2025 to reach USD 784.6 million by 2035, expanding at a steady CAGR of 6.4%.

This growth is primarily driven by rising demand in the agriculture sector, where ammonium thiosulfate is widely used as an efficient fertilizer and nutrient management solution. The increasing adoption of liquid ammonium thiosulfate formulations, favored for their ease of application and nutrient availability, further propels market expansion.

The growing global population pressures and heightened focus on improving crop yields and soil health, farmers and agricultural stakeholders are increasingly adopting advanced fertilizers to meet food production demands. Beyond agriculture, expanding industrial applications and enhanced agricultural mechanization also contribute to the market's upward trajectory.

Technological advancements play a crucial role in market growth by improving the effectiveness and sustainability of ammonium thiosulfate products. Innovations in formulation techniques and the integration of ammonium thiosulfate with precision farming technologies enhance nutrient use efficiency while minimizing environmental impact.

Additionally, rising environmental awareness and stringent regulations promote the adoption of sustainable agricultural practices, such as reducing chemical runoff and soil degradation. Governments and agricultural bodies in emerging economies actively encourage agricultural reform programs and soil fertility management initiatives, boosting accessibility and wider adoption of ammonium thiosulfate fertilizers.

Regulatory frameworks globally emphasize product safety, environmental protection, and efficacy standards. Regulatory agencies such as the U.S. Environmental Protection Agency (EPA), the European Union Fertilizer Regulation, and other regional authorities impose strict guidelines on fertilizer composition and application methods to mitigate ecological risks.

The growing focus on eco-friendly fertilizers and minimizing chemical residues is pushing manufacturers to develop greener ammonium thiosulfate variants and sustainable production processes. To stay competitive and align with global sustainability goals, industry players are heavily investing in research and development to provide high-quality, efficient, and environmentally compliant ammonium thiosulfate products.

The global ammonium thiosulfate market is segmented by form type into powder and liquid; by grade into industrial grade and photo grade; by end use into fertilizer, photochemical, mining, others (, water treatment, textile processing, leather tanning, educational & research institutes), and educational & research institutes; and by region into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

The liquid form segment is poised to be the most lucrative forecasted to increase at a CAGR of 8.1%. This segment is projected to grow from an estimated USD 479 million in 2025 to approximately USD 1,048 million by 2035, significantly outpacing the overall market growth rate. Liquid ammonium reflecting widespread adoption across agricultural applications due to its ease of application, better nutrient absorption, and compatibility with precision farming techniques.

The liquid form's scalability and suitability for large-scale farming systems in regions like Asia Pacific and North America support this momentum. The powder segment, while stable serves more niche industrial and specialty chemical use cases, with comparatively limited volume and slower adoption rates in agriculture.

Though necessary in certain technical applications, the logistical complexity and lower solubility of powder formulations constrain their commercial scalability. As the industry continues to shift towards high-efficiency fertilizer systems and integrated nutrient delivery, liquid ammonium thiosulfate will remain the growth engine of the market.

| Form Type Segment | CAGR (2025 to 2035) |

|---|---|

| Liquid Form | 8.1% |

The industrial grade segment is expected to emerge as the most lucrative and to grow at a CAGR of 7.9% through 2035In 2025, industrial-grade ammonium thiosulfate, driven by its widespread use in large-scale agricultural applications and select industrial processes.

This grade is valued for its high purity, stability, and compatibility with advanced nutrient management systems, which makes it the preferred choice in mechanized and precision-based farming. The high-volume usage in fertilizer blends, particularly in North America and Asia Pacific, positions it as the commercial backbone of the market.

Additionally, rising adoption in industrial sectors such as mining and wastewater treatment further reinforces its growth trajectory. The photo grade segment serves highly specific applications in the photographic and imaging sectors, which are witnessing declining demand due to digitalization. Its niche appeal and limited scalability prevent it from matching the industrial grade's revenue contribution or growth outlook.

| Grade Segment | CAGR (2025 to 2035) |

|---|---|

| Industrial Grade | 7.9% |

Among this segment, the fertilizer segment is poised to be the most lucrative expanding a CAGR of 7.7%. Fertilizer applications are expected to grow from an estimated USD 580 million in 2025 to approximately USD 1,210 million by 2035, surpassing the overall market growth rate.

This segment driven by its critical role in enhancing crop yields and improving soil nutrient management. The segment’s growth is underpinned by rising global food demand, increasing adoption of liquid ammonium thiosulfate fertilizers in precision agriculture, and supportive government policies promoting sustainable farming practices.

Other segments such as photochemical and mining maintain steady demand due to specialized industrial uses but contribute less to overall market value and volume. The “others” category, including water treatment, textile processing, leather tanning, and educational & research institutes, holds a smaller market share, reflecting niche applications with limited scalability. While these sectors provide steady revenue streams, their slower growth and lower market penetration position them behind fertilizer in terms of commercial potential.

| End Use Segment | CAGR (2025 to 2035) |

|---|---|

| Fertilizer | 7.7% |

Challenge

Regulatory Pressures and Environmental Considerations

Ammonium thiosulfate is an eco-friendly and natural product without adverse impacts on the environment, which positively contributes to the Ammonium Thiosulfate Market, whereas the exacting guidelines such as product safety and chemical storage maintenance restrains the growth of the ammonium thiosulfate market. Ammonium thiosulfate is subjected to stringent regulations governing its manufacture, distribution, and usage, especially in the agricultural and industrial domains.

Moreover, increasing threats on groundwater pollution and environmental sustainability also push producers to use safer manufacturing processes and dispose of waste properly. Such growth certainly brings advantages for various organizations but it also brings with it threats that need to be abated by companies who have to address these challenges through regulations compliance,

sustainable sourcing, and innovations. Toggle further developing research and development bounded guidance towards building greener variants and adding up manufacturing processes are going to be the major steps to tackle these challenges with success.

Opportunity

Applications in Agriculture and Industrial Market Expansion

Market players can find immense growth potential based on the rising application in agriculture as an ammonium thiosulfate nitrogen-sulfur fertilizer. Ammonium thiosulfate is used by farmers to assist in increasing the soil health and crop productivity, especially in the case of the region being sulfur deficient. It is also increasingly used in applications including water treatment, chemical processing, and photography.

Market growth is attributed to recent developments in liquid fertilisers, precision agriculture, and better nutrient management practices. The companies that diversified their product portfolio, sustainable product formulations, and improved their distribution network will beat the competition in the growing Ammonium Thiosulfate Market. Moreover, collaborating with agricultural cooperatives and industrial manufacturers would help expand market reach and improve customer engagement.

United States Ammonium Thiosulfate Market is projected to reach at a significant rate during the forecast period. Increasing demand from agriculture sector is one of the major factors stimulating growth in the USA ammonium thiosulfate market as it is widely used as a sulfur-containing fertilizer to improve the salts in the soil. There is are also growing focus on sustainable farming out there and improved crop yields is also contributing to the market boost.

Demand from the chemical and industrial sectors also finds its way to ammonium thiosulfate, particularly for its use in photographic solutions and metal treatment processes. Continuous research on precision agriculture and liquid fertilizer efficiency is anticipated to promote market growth.

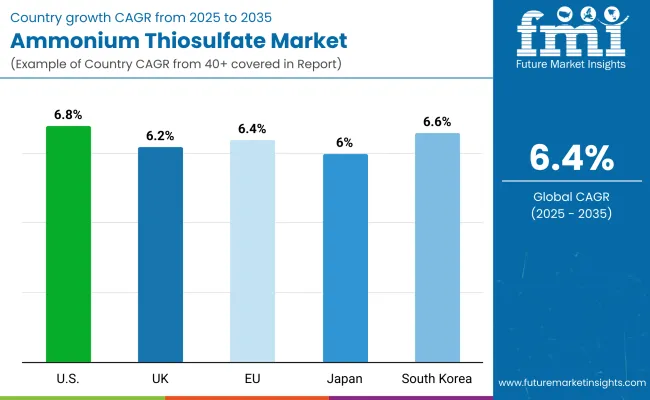

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

The UK ammonium thiosulfate market is projected to witness growth on account of growing awareness about soil nutrient management coupled with the adoption of liquid fertilizers by large-scale farming. Ammonium thiosulfate is also gaining popularity among farmers as a sulfur fertilizer to enhance nitrogen uptake efficiency in crops like barley and wheat.

The further market growth is driven by governmental initiatives endorsing sustainable agricultural practices and eco-friendly fertilizers. Chemical Industry: Demand for industrial applications is further boosting the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.2% |

Germany, France and Italy are some of the major agricultural economies in Europe, developing the ammonium thiosulfate market steadily in the region. One of the major factors in the growth of the market is the rising use of sulfur-based fertilizers for improving soil deficiencies as well as for enhancing soil productivity.

Stringent environmental regulations are promoting the use of low-emission liquid fertilizers, driving demand for ammonium thiosulfate. Furthermore, its usage in industrial wastewater treatment and chemical synthesis is boosting the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.4% |

Ammonium thiosulfate market in Japan is witnessing steady growth, with usage in agriculture and industrial applications. Precision farming practices and soil health management in the country is leading to increased demand for liquid fertilizers, including ammonium thiosulfate.

Moreover, ammonium thiosulfate is being used in photographic processing and metal treatment processes in the chemical industry. The market is also seeing research into its alternative uses, such as environmental remediation solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

The South Korean ammonium thiosulfate market is witnessing growth due to the rising focus on increasing agricultural efficiency and crop yield. Liquid fertilizers are being used by farmers to enhance nutritional absorption and for better growth of soils; especially for high-value crops.

And outside agriculture, industrial applications like water treatment and chemical processing are adding demand. Owing to the growing emphasis on sustainable farming methods and innovative fertilizer formulations, the market is projected to remain poised for growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.6% |

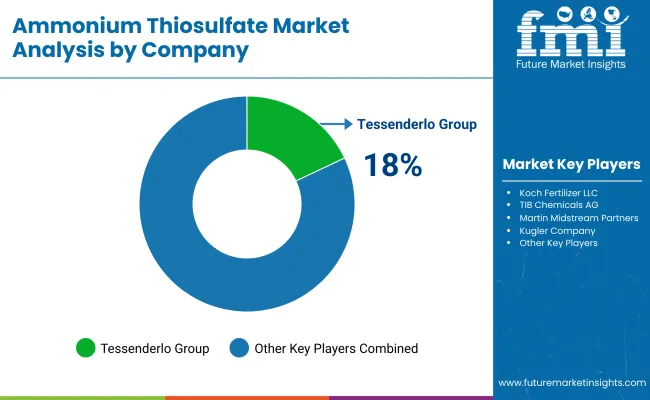

Tessenderlo Group (18-22%)

The ammonium thiosulfate market is led by the high-purity formulations manufactured by Tessenderlo Group specifically for agricultural efficiency and industrial processing. Its focus on nutrient delivery solutions and commitment to sustainability as a company also positions it well in the market.

Koch Fertilizer LLC (15-19%)

Ammonium thiosulfate providers like Koch Fertilizer LLC also serve as leading manufacturers of these fertilizers with advanced formulations designed to accelerate sulphur uptake in crops, specifically ammonium thiosulfate fillers that increase nitrogen growth in crops, which boosts productivity in every field.

TIB Chemicals AG (12-16%)

TIB Chemicals AG specializes in ammonium thiosulfate for industrial applications, including gold leaching, wastewater treatment, and specialty chemical production. Its high-quality formulations cater to a wide range of industries.

Martin Midstream Partners (9-13%)

Martin Midstream Partners commercializes ammonium thiosulfate and specializes in integration logistics and bulk supply to agricultural and industrial end-users.

Kugler Company (7-11%)

With Precision Application Solutions for Ammonium Thiosulfate-based Liquid Fertilizers, Kugler Company is helping their customers apply nutrients for maximum uptake and increased production.

Other Key Players (30-40% Combined)

The ammonium thiosulfate market also comprises of other specialized manufacturers and suppliers that offer formulations, advanced materials, and organic solutions for various agricultural and industrial applications. Notable players include:

The overall market size for Ammonium Thiosulfate Market was USD 421.9 Million in 2025.

The Ammonium Thiosulfate Market expected to reach USD 784.6 Million in 2035.

The demand for the ammonium thiosulfate market will grow due to increasing use as a nitrogen and sulphur fertilizer in agriculture, rising demand in industrial applications such as water treatment and photography, and expanding adoption in metal leaching and chemical processing industries.

The top 5 countries which drives the development of Ammonium Thiosulfate Market are USA, UK, Europe Union, Japan and South Korea.

Liquid Ammonium Thiosulfate and Industrial Grade lead market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Form Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Form Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Form Type, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Form Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Form Type, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Form Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Form Type, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Form Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Form Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Form Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Form Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Form Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Form Type, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Form Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Form Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Form Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Form Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Grade, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Form Type, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Form Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Form Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Form Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Form Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Grade, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Form Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Form Type, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Form Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Form Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Form Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Form Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Grade, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Form Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Form Type, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Form Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Form Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Form Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Form Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Grade, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Form Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Form Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Form Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Form Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Form Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Form Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Grade, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Form Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Form Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Form Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Form Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Form Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Form Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Grade, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Form Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Grade, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Form Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Form Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Form Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Form Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Form Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Grade, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Form Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Grade, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Form Type, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Form Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Form Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Form Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Form Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Grade, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Form Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Grade, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Form Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Form Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Form Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Form Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Grade, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ammonium Humate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Dichromate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Nitrate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Metavanadate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Sulphate Supply Market-Trends & Forecast 2025 to 2035

Ammonium Chloride Food Grade Market Growth - Demand & Trends 2025 to 2035

Ammonium Sulfate Food Grade Market Report - Industry Insights 2025 to 2035

Ammonium Carbonate Market Growth 2024-2034

Ammonium Phosphate Market Trends & Analysis 2019-2029

Ammonium Phosphatides Market

Diammonium Hydrogen Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Diammonium Phosphate Market

Triammonium Citrate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Ammonium Nitrate Market Growth - Trends & Forecast 2025 to 2035

Aluminium Ammonium Sulphate Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Food Grade Ammonium Carbonate Market Growth - Product Type & Application Analysis

Food Grade Ammonium Bicarbonate Market

Quaternary Ammonium Compounds Market

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

Cetyl Trimethyl Ammonium Chloride Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA