The global ammonium sulphate supply market is expected to register steady growth during the forecast period owing to the growing demand for fertilizers, increasing uptake of industrial chemicals and increasing strain on agriculture worldwide to increase the crop yields without overstressing the limited resources available.

Ammonium sulphate, a nitrogenous fertilizer that also contains sulphur is essential to maintaining nutrients balance in soil, particularly in sulphur deficient areas as well as for enhancing quality and productivity of crops.

Favorable government measures for food security and increasing investment in the caprolactam and water treatment industries are fueling Global supply) patterns. Ammonium sulphate is playing a dual role, as both fertilizer and industrial raw material that contributes to supply chain resilience.

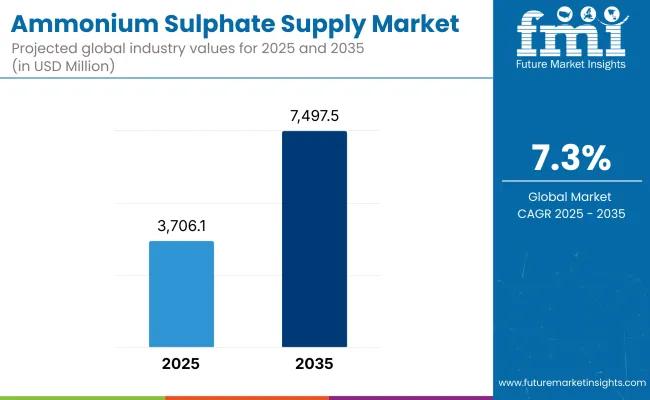

In the global ammonium sulphate supply industry, the market was valued at USD 3,706.1 Million in 2025 and is projected to reach a value of USD 7,497.5 Million by 2035, by expanding at a CAGR of 7.3% from 2025 to 2035.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 3,706.1 Million |

| Projected Market Size in 2035 | USD 7,497.5 Million |

| CAGR (2025 to 2035) | 7.3% |

The demand for ammonium sulphate supply is still on the rise as the global agricultural, chemical, and polymer sector require more and more dependable nitrogen-bearing compounds for fertilizer mixing as well as for intermediate purposes. Ammonium sulphate (AS) is a type of crystalline salt, mainly used as nitrogen fertilizer, and it is now produced and obtained through chemical byproduct recovery processes.

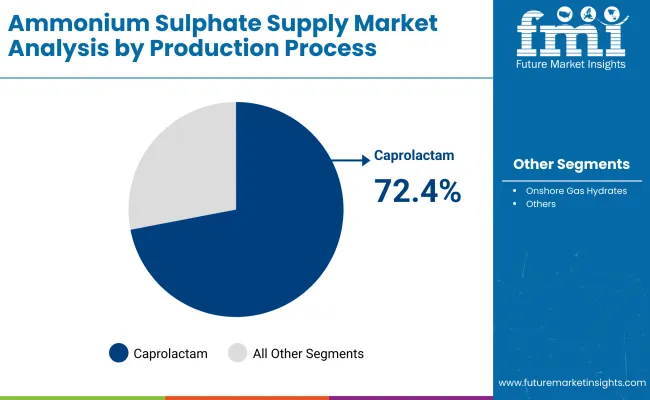

Ammonium sulphate, based on caprolactam, accounts for highest global market share among production processes owing to the incorporation of this process in nylon-6 production method, the cost-benefit of the process as well as a continuing supply in developed as well as developing regions. This segment plays a significant role in nitrogen supply chains, and helps you achieve industrial circularity, converting caprolactam waste into a valuable agronomic input.

Ammonium sulphate is produced as a by-product of caprolactam plants, used to make nylon intermediates, and increases output could be felt in East Asia and Europe, where demand from their downstream textile and plastic sectors remains healthy. This production route augments supply security at the regional level and mitigates environmental burdens from disposal.

| Production Process | Market Share (2025) |

|---|---|

| Ammonium Sulphate for Caprolactam | 72.4% |

As a result, caprolactam-based production dominates the ammonium sulphate supply market, because ammonium sulphate is produced continuously and can be tailor made to match the solid feed composition going directly into nylon-6 polymer production. Generating about 2.5 to 3 tons of ammonium sulphate per metric ton of caprolactam produced, this route has become a key pillar in nitrogen fertilizer markets.

Chinese, German and South Korean manufacturers extensively utilize this method with integrated production balancing the industrial chemical and fertilizer markets. The dual-product adds more profitability while being sustainable and taking care of chemical effluents from the process.

Its crystalline structure allows it to dissolve easily and be stored, blended, transported in bulk, leading to its popularity in neutralize and acidic dryland soils.

Coke oven gas and gypsum-based methods cater to regional markets or are limited by raw material availability; meanwhile, caprolactam-based AS has a stronghold due to industrial-scale capacity, steady supply, and synergy with synthetic polymer ecosystems.

Supply dependence on byproduct routes and trade volatility limits consistency.

We find that we can only solve a few primary problems with the ammonium sulphate supply chain, primarily involving its reliance on the production of byproduct from the processing of caprolactam and coke oven gas instead of dedicated production. This exposes supply volumes to volatility in upstream sectors like nylon and steel. As a consequence, changes in caprolactam production on a global scale affect the availability of the fertilizer in agricultural plant regions.

Geopolitical tensions and export bans in critical supplier countries have also set off volatility in global prices and availability. They face challenges such as the lack of proliferation of standalone production units and discrepancies in set standard quality levels across suppliers hindering seamless integration in global markets. Supply shortages are particularly damaging in developing countries at critical planting seasons.

Standalone production, green ammonia integration, and precision farming create growth momentum.

To improve reliability, many countries are now targeting dedicated ammonium sulphate production from synthetic ammonia and sulfuric acid, and decoupling supply from caprolactam cycles. Now, this shift opens investment opportunities in emerging economies that are heavily import-dependent.

In addition, the emergence of green ammonia made from renewable hydrogen is likely to profoondly affect nitrogen fertilizer markets over the next ten years. Low-carbon ammonium sulphate, for example, may be a component of sustainability fertilizer systems. The rising adoption of precision agriculture and integrated nutrient management plans also boosts the consumption of sulfur-based fertilizers for localized soil treatment, which in turn supports steadily growing demand.

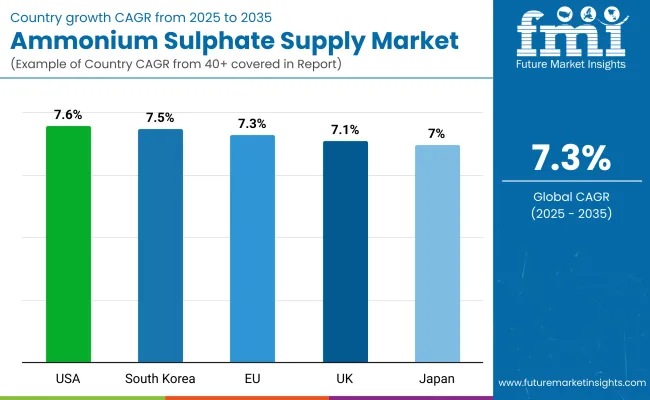

In the USA, ammonium sulphate supply market continues to expand due to its usage in crop fertilization, particularly where soil sulfur range is lower, especially in the Midwest and Southeast regions. The fertilizer is also a major contributor to yield maximization of corn, wheat, and soybeans.

Ammonium sulphate is being promoted as a dual nutrient nitrogen and sulfur sources due to the increasing emphasis on sustainable agriculture. The USA Environmental Protection Agency advocates the proper amount of fertilizer application to reduce nitrate runoff while ameliorating groundwater In addition, support for domestic production comes from byproduct recovery from the caprolactam and coke industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.6% |

In the UK, ammonium sulphate is used extensively in the fertilization of cereals, rapeseed, and grassland. The prestigious increase in interest for sulfur-based fertilizers is due to the declining sulfur deposit in the atmosphere and the growing role of sulfur lacking in effective agricultural farming system.

To help guide crop protein content and limit environmental impact, the agricultural sector is now moving towards a more balanced fertilization strategy. Nutrient management plans as supported by UK regulations that are aligned with the Environment Act 2021 promote the use of ammonium sulphate. Granular and blended formulations are also being promoted for precision application in fertilizer distribution.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.1% |

The demanding nutrient efficiency regulations in the Common Agricultural Policy (CAP) and the Farm to Fork Strategy are driving the expansion of the EU ammonium sulphate market. Countries such as Germany, France, and Poland are applying ammonium sulphate to combat sulfur shortages in cereal and oilseed crops.

EU funds production of circular fertilizer from industrial byproducts This shift of emphasis toward sustainable intensification of agriculture has a positive impact on the interest of the industry for the incorporation of ammonium sulphate within multi-nutrient fertilizer programs. And manufacturers are improving granulation and coating of products for uniform application and less volatilization.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.3% |

Demand from rice farming, horticulture and greenhouse cultivation fuels Japan’s ammonium sulphate market. The fertilizer is favored for its chloride-free profile, making it available for salt-sensitive crops. Policies encouraging self-sufficiency in food supply have led to the development of balanced nutrient management practices.

Formulations have been smoothed out (for use in precision agriculture and fertigation systems) by domestic suppliers. Research institutes are also working to introduce their ammonium sulphate into carbon-neutral farming techniques and designing processes to incorporate the ammonium sulphate into organics and slow-release fertilizers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

Strong demand from rice cultivation and protected agriculture sectors in South Korea is driving the ammonium sulphate supply market in the country. It is used in large quantities in nitrogen-sulfur synergy urea blends and compound fertilizers. In line with the Korean New Deal, the government encourages balanced fertilization under sustainable agriculture programs.

Domestic chemical manufacturers are ramping production from industrial byproducts and improving granulation to suit drip irrigation. Agricultural cooperative educational programs are clear examples of helping smallholder farmers understand sulfur management concepts.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.5% |

Strong growth in the ammonium sulphate supply market is driven primarily due to its common use in nitrogenous fertilizers, as well as in industrial chemicals, water treatment, and pharmaceutical applications. With agriculture still taking the lead in global demand, growing population and expanding food security programs are driving fertilizer & agrochemicals use across Asia, Latin America and Africa.

Non-durable industrial uses in flame retardants, leather processing and feed additives also are supportive of supply diversification. Producers are also investing in coupled production from caprolactam byproducts, flue gas desulfurization, and coke oven gas streams to meet circular economy and emission-reduction mandates.

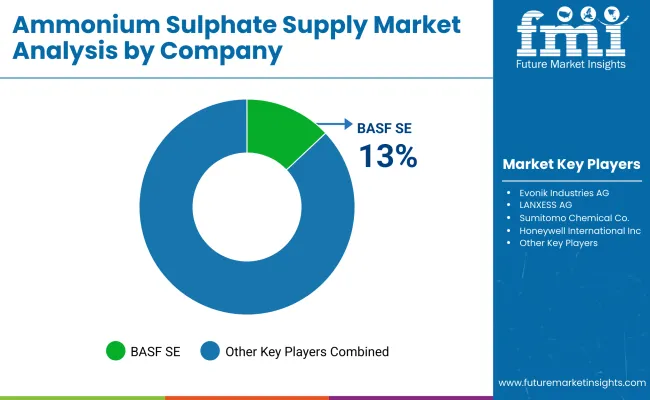

BASF SE (13-16%)

BASF remains a global leader in ammonium sulphate supply through its integration with caprolactam production lines. In 2024, it ramped up output in its European plants, delivering high-purity ammonium sulphate for agriculture and industrial formulations. In 2025, BASF launched granular fertilizer versions suitable for mechanized spreading, targeting large-scale farming operations in Europe and South America. Its alignment with EU soil nutrient efficiency regulations supports sustainable fertilizer use.

Evonik Industries AG (11-14%)

Evonik is advancing circular nitrogen solutions through its emissions-to-fertilizer innovations. In 2024, it optimized ammonium sulphate generation from sulfur recovery and byproduct treatment, reducing waste and emissions. By 2025, it expanded its export logistics in Southeast Asia via specialized shipping terminals. Evonik’s fertilizer-grade ammonium sulphate supports food production in rice-growing economies and aligns with regional soil enrichment goals.

LANXESS AG (9-12%)

LANXESS serves both industrial and agricultural sectors with technical and fertilizer-grade ammonium sulphate. In 2024, it focused on the leather and textile industries, supplying ammonium sulphate for pH control and protein coagulation. In 2025, LANXESS developed dust-suppressed formulations suited for use in arid regions such as the Middle East and North Africa. These solutions support industrial sustainability and regional climate adaptation strategies.

Sumitomo Chemical Co. (7-10%)

Sumitomo Chemical operates vertically integrated production units in Asia, focusing on high-grade fertilizers. In 2024, it modernized its ammonium sulphate production lines in Japan to include tailored nutrient blends for precision farming. In 2025, it introduced anti-caking variants ideal for tropical and monsoon climates. Sumitomo’s products cater to rice, fruit, and vegetable cultivators in high-humidity regions, reinforcing Asia’s agricultural resilience.

Honeywell International Inc. (6-9%)

Honeywell is leveraging its expertise in emission recovery to supply ammonium sulphate from flue gas streams. In 2024, it expanded its USA-based recovery systems linked to power and chemical facilities. In 2025, it began supplying municipal and regional water treatment agencies with ammonium sulphate for chlorination and coagulation processes. Honeywell’s model contributes to closed-loop chemical usage and resource recovery in water management.

Other Key Players (38-45% Combined)

Several regional and state-owned producers are meeting local and export demand with cost-effective ammonium sulphate solutions. These include:

The overall market size for the ammonium sulphate supply market was USD 3,706.1 Million in 2025.

The ammonium sulphate supply market is expected to reach USD 7,497.5 Million in 2035.

The demand for ammonium sulphate is rising due to its widespread use as a nitrogen fertilizer, particularly in alkaline soils, and increasing agricultural productivity requirements. Caprolactam-based production remains a key source, supporting both fertilizer demand and the expansion of synthetic fiber manufacturing.

The top 5 countries driving the development of the ammonium sulphate supply market are China, the USA, India, Russia, and Brazil.

Caprolactam-based production is expected to command a significant share over the assessment period.

Table 1: Global Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 2: Global Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 3: Global Market Value (Million) Analysis, 2022 to 2032

Table 4: Global Market Value (Million) Analysis, 2022 to 2032

Table 5: Global Market Value (Million) Forecast, by Region, 2022 to 2032

Table 6: Global Market Value (Million) Forecast, by Region, 2022 to 2032

Table 7: North America Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 8: North America Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 9: North America Market Value (Million) Analysis, 2022 to 2032

Table 10: North America Market Value (Million) Analysis, 2022 to 2032

Table 11: North America Market Value (Million) Forecast, by Country, 2022 to 2032

Table 12: North America Market Value (Million) Forecast, by Country, 2022 to 2032

Table 13: The USA Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 14: The USA Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 15: The USA Market Value (Million) Analysis, 2022 to 2032

Table 16: The USA Market Value (Million) Analysis, 2022 to 2032

Table 17: Canada Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 18: Canada Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 19: Canada Market Value (Million) Analysis, 2022 to 2032

Table 20: Canada Market Value (Million) Analysis, 2022 to 2032

Table 21: Europe Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 22: Europe Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 23: Europe Market Value (Million) Analysis, 2022 to 2032

Table 24: Europe Market Value (Million) Analysis, 2022 to 2032

Table 25: Europe Market Value (Million) Forecast, by Country and Sub-region, 2022 to 2032

Table 26: Europe Market Value (Million) Forecast, by Country and Sub-region, 2022 to 2032

Table 27: Germany Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 28: Germany Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 29: Germany Market Value (Million) Analysis, 2022 to 2032

Table 30: Germany Market Value (Million) Analysis, 2022 to 2032

Table 31: The UK Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 32: The UK Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 33: The UK Market Value (Million) Analysis, 2022 to 2032

Table 34: The UK Market Value (Million) Analysis, 2022 to 2032

Table 35: France Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 36: France Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 37: France Market Value (Million) Analysis, 2022 to 2032

Table 38: France Market Value (Million) Analysis, 2022 to 2032

Table 39: Italy Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 40: Italy Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 41: Italy Market Value (Million) Analysis, 2022 to 2032

Table 42: Italy Market Value (Million) Analysis, 2022 to 2032

Table 43: Spain Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 44: Spain Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 45: Spain Market Value (Million) Analysis, 2022 to 2032

Table 46: Spain Market Value (Million) Analysis, 2022 to 2032

Table 47: Russia & CIS Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 48: Russia & CIS Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 49: Russia & CIS Market Value (Million) Analysis, 2022 to 2032

Table 50: Russia & CIS Market Value (Million) Analysis, 2022 to 2032

Table 51: Rest of Europe Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 52: Rest of Europe Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 53: Rest of Europe Market Value (Million) Analysis, 2022 to 2032

Table 54: Rest of Europe Market Value (Million) Analysis, 2022 to 2032

Table 55: Asia Pacific Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 56: Asia Pacific Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 57: Asia Pacific Market Value (Million) Analysis, 2022 to 2032

Table 58: Asia Pacific Market Value (Million) Analysis, 2022 to 2032

Table 59: Asia Pacific Market Value (Million) Forecast, by Country and Sub-region, 2022 to 2032

Table 60: Asia Pacific Market Value (Million) Forecast, by Country and Sub-region, 2022 to 2032

Table 61: China Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 62: China Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 63: China Market Value (Million) Analysis, 2022 to 2032

Table 64: China Market Value (Million) Analysis, 2022 to 2032

Table 65: Japan Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 66: Japan Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 67: Japan Market Value (Million) Analysis, 2022 to 2032

Table 68: Japan Market Value (Million) Analysis, 2022 to 2032

Table 69: India Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 70: India Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 71: India Market Value (Million) Analysis, 2022 to 2032

Table 72: India Market Value (Million) Analysis, 2022 to 2032

Table 73: ASEAN Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 74: ASEAN Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 75: ASEAN Market Value (Million) Analysis, 2022 to 2032

Table 76: ASEAN Market Value (Million) Analysis, 2022 to 2032

Table 77: Rest of Asia Pacific Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 78: Rest of Asia Pacific Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 79: Rest of Asia Pacific Market Value (Million) Analysis, 2022 to 2032

Table 80: Rest of Asia Pacific Market Value (Million) Analysis, 2022 to 2032

Table 81: Latin America Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 82: Latin America Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 83: Latin America Market Value (Million) Analysis, 2022 to 2032

Table 84: Latin America Market Value (Million) Analysis, 2022 to 2032

Table 85: Latin America Market Value (Million) Forecast, by Country and Sub-region, 2022 to 2032

Table 86: Latin America Market Value (Million) Forecast, by Country and Sub-region, 2022 to 2032

Table 87: Brazil Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 88: Brazil Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 89: Brazil Market Value (Million) Analysis, 2022 to 2032

Table 90: Brazil Market Value (Million) Analysis, 2022 to 2032

Table 91: Mexico Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 92: Mexico Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 93: Mexico Market Value (Million) Analysis, 2022 to 2032

Table 94: Mexico Market Value (Million) Analysis, 2022 to 2032

Table 95: Rest of Latin America Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 96: Rest of Latin America Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 97: Rest of Latin America Market Value (Million) Analysis, 2022 to 2032

Table 98: Rest of Latin America Market Value (Million) Analysis, 2022 to 2032

Table 99: Middle East & Africa Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 100: Middle East & Africa Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 101: Middle East & Africa Market Value (Million) Analysis, 2022 to 2032

Table 102: Middle East & Africa Market Value (Million) Analysis, 2022 to 2032

Table 103: Middle East & Africa Market Value (Million) Forecast, by Country and Sub-region, 2022 to 2032

Table 104: Middle East & Africa Market Value (Million) Forecast, by Country and Sub-region, 2022 to 2032

Table 105: GCC Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 106: GCC Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 107: GCC Market Value (Million) Analysis, 2022 to 2032

Table 108: GCC Market Value (Million) Analysis, 2022 to 2032

Table 109: South Africa Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 110: South Africa Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 111: South Africa Market Value (Million) Analysis, 2022 to 2032

Table 112: South Africa Market Value (Million) Analysis, 2022 to 2032

Table 113: Rest of Middle East & Africa Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 114: Rest of Middle East & Africa Market Value (Million) Forecast, by Production Process, 2022 to 2032

Table 115: Rest of Middle East & Africa Market Value (Million) Analysis, 2022 to 2032

Table 116: Rest of Middle East & Africa Market Value (Million) Analysis, 2022 to 2032

Figure 1: Global Market Price Trend, by Region, 2022 to 2032 (US$/Ton)

Figure 2: Global Market Value Share, by Production Process, 2020, 2026, and 2031

Figure 3: Global Market Attractiveness, by Production Process

Figure 4: Global Market Value Share, Analysis, 2020, 2026, and 2031

Figure 5: Global Market Attractiveness, Analysis

Figure 6: Global Market Value Share, by Region, 2020, 2026, and 2031

Figure 7: Global Market Attractiveness, by Region

Figure 8: North America Market Value Share, by Production Process, 2020, 2026, and 2031

Figure 9: North America Market Attractiveness, by Production Process

Figure 10: North America Market Value Share, Analysis, 2020, 2026, and 2031

Figure 11: North America Market Attractiveness, Analysis

Figure 12: North America Market Value Share, by Country, 2020, 2026, and 2031

Figure 13: North America Market Attractiveness, by Country

Figure 14: Europe Market Value Share, by Production Process, 2020, 2026, and 2031

Figure 15: Europe Market Attractiveness, by Production Process

Figure 16: Europe Market Value Share, Analysis, 2020, 2026, and 2031

Figure 17: Europe Market Attractiveness, Analysis

Figure 18: Europe Market Value Share, by Country and Sub-region, 2020, 2026, and 2031

Figure 19: Europe Market Attractiveness, by Country and Sub-region

Figure 20: Asia Pacific Market Value Share, by Production Process, 2020, 2026, and 2031

Figure 21: Asia Pacific Market Attractiveness, by Production Process

Figure 22: Asia Pacific Market Value Share, Analysis, 2020, 2026, and 2031

Figure 23: Asia Pacific Market Attractiveness, Analysis

Figure 24: Asia Pacific Market Value Share, by Country and Sub-region, 2020, 2026, and 2031

Figure 25: Asia Pacific Market Attractiveness, by Country and Sub-region

Figure 26: Latin America Market Value Share, by Production Process, 2020, 2026, and 2031

Figure 27: Latin America Market Attractiveness, by Production Process

Figure 28: Latin America Market Value Share, Analysis, 2020, 2026, and 2031

Figure 29: Latin America Market Attractiveness, Analysis

Figure 30: Latin America Market Value Share, by Country and Sub-region, 2020, 2026, and 2031

Figure 31: Latin America Market Attractiveness, by Country and Sub-region

Figure 32: Middle East & Africa Market Value Share, by Production Process, 2020, 2026, and 2031

Figure 33: Middle East & Africa Market Attractiveness, by Production Process

Figure 34: Middle East & Africa Market Value Share, Analysis, 2020, 2026, and 2031

Figure 35: Middle East & Africa Market Attractiveness, Analysis

Figure 36: Middle East & Africa Market Value Share, by Country and Sub-region, 2020, 2026, and 2031

Figure 37: Middle East & Africa Market Attractiveness, by Country and Sub-region

Figure 38: Global Market Share Analysis, by Company, 2020

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ammonium Humate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Dichromate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Nitrate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Metavanadate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Thiosulfate Market – Size, Share, and Forecast 2025 to 2035

Ammonium Chloride Food Grade Market Growth - Demand & Trends 2025 to 2035

Ammonium Sulfate Food Grade Market Report - Industry Insights 2025 to 2035

Ammonium Carbonate Market Growth 2024-2034

Ammonium Phosphate Market Trends & Analysis 2019-2029

Ammonium Phosphatides Market

Diammonium Hydrogen Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Diammonium Phosphate Market

Triammonium Citrate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Ammonium Nitrate Market Growth - Trends & Forecast 2025 to 2035

Aluminium Ammonium Sulphate Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Food Grade Ammonium Carbonate Market Growth - Product Type & Application Analysis

Food Grade Ammonium Bicarbonate Market

Quaternary Ammonium Compounds Market

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

Cetyl Trimethyl Ammonium Chloride Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA