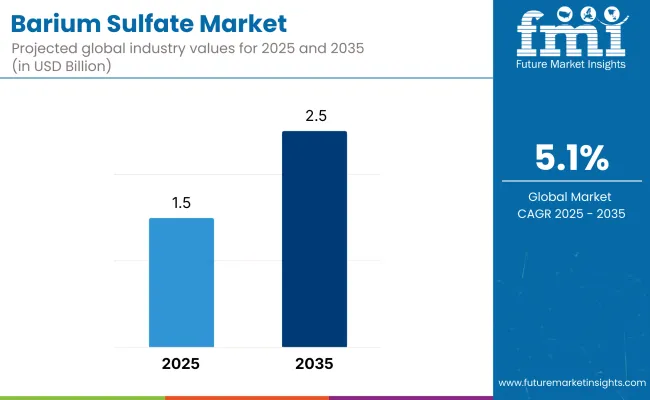

The global barium sulfate market is poised for steady growth over the next few years, with its market value estimated at USD 1.5 billion in 2025 and expected to reach USD 2.5 billion by 2035. This growth translates to a CAGR of 5.1% from 2025 to 2035.

The market expansion is primarily driven by the increasing demand for barium sulfate across a diverse range of industries such as paints and coatings, plastics, rubber, oil and gas, and pharmaceuticals. These industries rely heavily on barium sulfate due to its unique properties that enhance product performance, especially in high-end and specialized applications.

One of the key reasons for the market’s growth is the widespread use of modified and nanometer precipitated barium sulfate, which dominates the product segment. These variants offer advanced functionalities, including higher purity levels, better dispersion capabilities, and improved control over particle size distribution.

Such characteristics are critical in industries like coatings, pharmaceuticals, plastics, and rubber, where product quality and performance are heavily dependent on the additive’s properties. Modified barium sulfate, in particular, is preferred for applications that require enhanced mechanical reinforcement and stability, making it indispensable in many industrial processes.

Several driving factors contribute to the increasing adoption of barium sulfate. Its role as a high-performance additive ensures improved opacity and durability in coatings and paints, while in plastics and rubber, it enhances strength and stability. In the pharmaceutical industry, its inert nature and purity make it suitable for medical applications, further broadening the scope of demand.

Leading market players such as Nippon Chemical Industrial Co., Ltd., Anand Talc, Guizhou Redstar Development Co., Ltd., and Sachtleben Chemie GmbH are actively innovating and expanding their product portfolios to meet the rising needs of the market. Their focus on developing cost-efficient, specialized barium sulfate products supports the market’s growth trajectory, catering to the evolving requirements of end-use industries. Overall, the market is expected to maintain healthy growth fueled by technological advancements and expanding applications worldwide.

The barium sulfate market is segmented by type into ordinary precipitated barium sulfate, modified barium sulfate, nanometre precipitated barium sulfate, and other types (surface-treated, coated, and ultra-high-purity variants).

By end user, the market is categorized into the coating industry, pharmaceuticals industry, rubber industry, plastic industry, and other end-use industries (oil and gas, paper manufacturing, ceramics, electronics, and adhesives & sealants). Geographically, the market is analyzed across regions including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

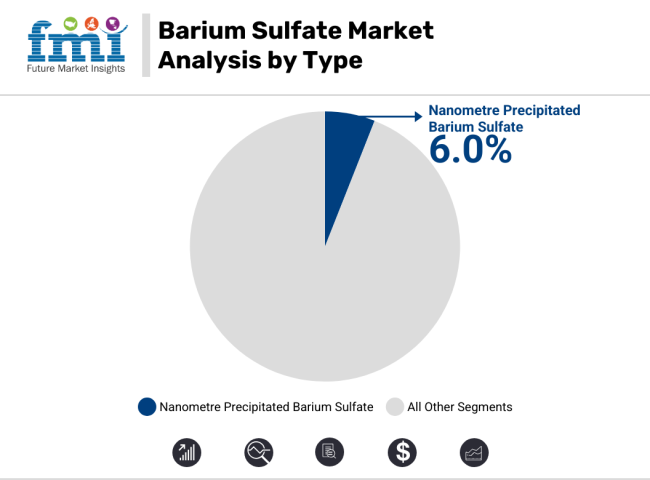

Nanometre precipitated barium sulfate is the fastest-growing segment. It is poised to grow at a CAGR of 6.0% during the forecast period. Its ultrafine particle size offers excellent dispersion and high surface area, which significantly enhances product performance. This type is highly valued in advanced applications such as pharmaceuticals, high-quality coatings, and specialty plastics, where precise control over particle size and purity is critical. Its ability to reinforce mechanical properties also makes it popular in cutting-edge rubber and plastic formulations.

Modified barium sulfate is widely used in applications requiring improved functional performance. Through surface modification or chemical treatment, this type offers enhanced compatibility with various matrices, resulting in better dispersion and stability. It is particularly important in the coatings industry, where it improves opacity and durability, and in the rubber sector, where it enhances tensile strength and abrasion resistance.

Ordinary precipitated barium sulfate remains a staple in the market due to its cost-effectiveness and reliability. It is commonly used in standard industrial applications such as fillers in plastics, paints, and rubber products. While it lacks the advanced features of modified or nanometre precipitated types, its affordability and consistent quality make it attractive for large-scale, less specialized uses.

Other types of barium sulfate are designed to meet niche requirements. These may involve specific particle shapes, surface treatments, or purity levels tailored for unique applications in sectors like electronics, catalysts, or medical imaging.

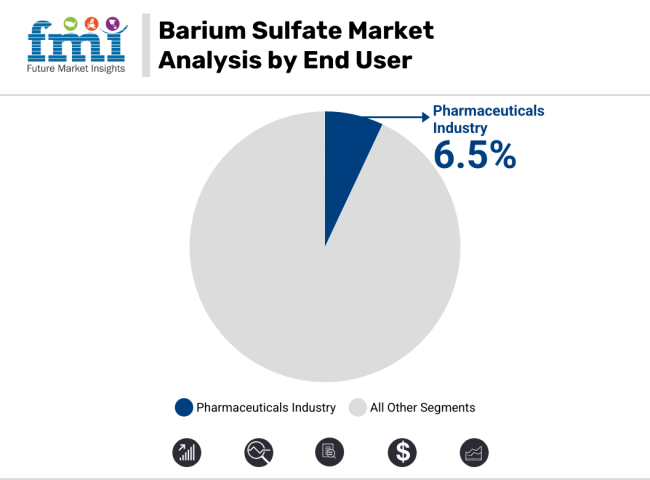

The pharmaceuticals industry is the fastest-growing end-user segment in the barium sulfate market, with a robust projected CAGR of 6.5% from 2025 to 2035. This rapid growth is largely driven by the increasing demand for high-purity and biocompatible materials in medical applications.

Barium sulfate’s inert nature and excellent radiopacity make it a preferred agent in diagnostic imaging techniques such as X-rays and computed tomography (CT) scans, helping doctors to visualize the gastrointestinal tract and other body parts clearly. Beyond imaging, the product is increasingly used in drug formulation as an inactive ingredient and in medical devices where safety and stability are critical.

The coating industry is one of the largest consumers of barium sulfate. It uses the material to enhance opacity, brightness, and durability in paints, varnishes, and other coatings. Barium sulfate improves scratch resistance and gloss, making it essential in automotive, construction, and industrial coatings where performance and aesthetics are critical.

The plastic industry uses barium sulfate primarily as a filler to improve the physical properties of plastic products. It enhances stiffness, impact resistance, and heat stability in items ranging from packaging materials to consumer goods. Its role in plastics helps reduce production costs while maintaining or improving product quality.

The rubber industry incorporates barium sulfate as a reinforcing agent to boost tensile strength, abrasion resistance, and overall durability in tires, hoses, seals, and other rubber components. This improves the lifespan and performance of rubber products, which is particularly important in automotive and industrial applications.

Other end-use industries include sectors such as oil and gas, paper manufacturing, ceramics, and electronics. In oil and gas, barium sulfate is used as a weighting agent in drilling fluids. In paper and ceramics, it serves as a filler to improve brightness and texture. Specialty applications in electronics leverage its insulating properties.

Challenges

However, the fluctuation of prices of raw materials, which impacts the overall production cost may hinder the growth of the barium sulfate market. In addition, environmental issues related to barium sulfate mining and disposal regulations are expected to impede market growth. Tight government rules on waste and industrial gas emissions might force manufacturers to look for new materials or green processing methods.

Opportunities

The limitations pose challenges, but technological advances with the manufacture and processing of barium sulfate-based coatings and plastics present lucrative growth opportunities. Furthermore, the increasing need for lightweight and eco-friendly materials in automotive and aerospace applications will contribute to the growth opportunities of the market.

Moreover, growth of the pharmaceutical industry and the increasing incidence of gastrointestinal disorders will bolster the sustained demand for barium sulfate in medical imaging applications.

The need for barium sulfate derived from oil is driving growth in the United States and the USA barium sulfate industry continues to be a growth market for manufacturers, with growing demand from the oil drilling, paints and coatings, plastics, and medical industries.

The oil and gas industry is still one of the biggest consumers of barium sulfate, which is used as a weighting agent to manage pressure in oil wells in drilling fluid formulations. Given the revitalized domestic shale drilling and offshore drilling exploration activities, the demand for high-purity barite (barium sulfate) powder is projected to persist strong.

Barium sulfate is a widely used filler in paints and coatings, where it is used to improve opacity, gloss and durability. Rapidly expanding construction and automotive industries are raising the demand for high-performance coatings, thereby driving the market growth. Barium sulfate | Plaster of Paris grade is utilized as a strengthening filler in the plastic and rubber industries, improving the mechanical characteristics and density of polymer mixtures.

Barium sulfate has a significant application as a contrast agent in X-ray imaging and CT scans, which makes the healthcare industry one of the prominent factors in the market growth. The barium-releasing radiology products will have continued demand amid the rising prevalence of gastrointestinal disorders and an aging population.

| Country | CAGR (2025 to 2035) |

|---|---|

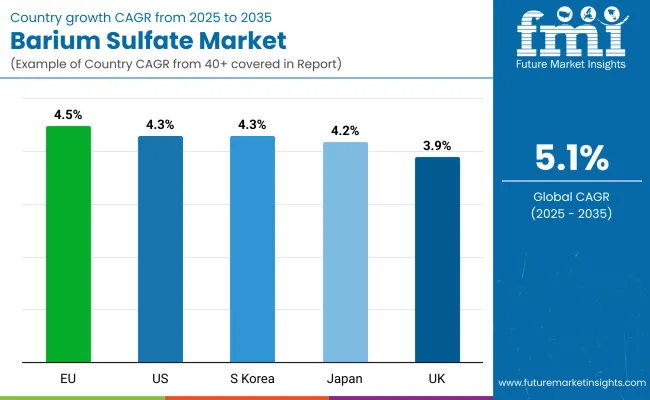

| USA | 4.3% |

Barium sulfate is widely used in coatings and cross-linking in high-performance plastics, pharmaceutical applications, printing inks, etc. in several industries. The stringent environmental regulations that the UK imposes on heavy metals and mining operations are helping to support synthetic and eco-friendly barium sulfonate products.

One of the significant growth factors in the UK is the growth of the automotive coatings industry. With the increasing number of luxury car manufacturers including Rolls-Royce, Bentley, and Aston Martin are increasing the demand for barium sulfate high-gloss coatings that provide better durability and weather resistance.

Moreover, barium sulfate is also used across the globe for test imaging during anaesthesia which is a positive factor for market growth. The demand for contrast agents in radiology applications is surging, thanks to the UK’s aging population and rising healthcare investments.

The push in UK towards green and sustainable materials has also led to research on Nano-barium sulfate, primarily for high-performance coatings and lightweight composites. Another major end-user is the construction industry as barium sulfate is recorded to be used in soundproofing and non-combustible materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

Key Companies in the European Barium Sulfate Market are Increasing the Market Growth Factors In addition, the growing automotive manufacturing business, the pharmaceutical sector, as well as the industrial coatings are expected to fill up the growth factors in the European barium sulfate market. As the EU has very strict environmental regulations for mining and the application of heavy metals, its synthetic and high-purity barium sulfate products are being more accepted.

Germany, France, and Italy are the prominent contributors to the market, which can be attributed to high automotive, pharmaceutical, and chemical industries. Demand for barium sulfate is rising in automotive paint and coatings because of the trend of EVs and the use of high-durability coatings.

The healthcare industry in Europe is another key driver, as barium sulfate is extensively used in medical imaging processes. This, coupled with the recent progress in the field of nanotechnology in the region, is further propelling the demand for ultra-fine barium sulfate powders used in high-performance applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

The Japanese barium sulfate market is expected to grow at a compound annual growth rate (CAGR) of around 5.5% over the forecast period. Japan is a pioneer in precision manufacturing and new materials, meaning high-purity barium sulfate for ultra-thin coatings, semiconductors, and specialty plastics would find wide application in this market.

Increasing use of Nano-scale precipitated barium sulphate for leveraging opacity and durability, particularly in Japan’s automotive coatings and LCD display sectors, is expected to fuel demand in the near future. Furthermore, contrast agents based on barium sulfate for gastrointestinal imaging, have a need in Japan’s sophisticated medical sector. Rising EV (electric vehicle) sector is telling on market dynamics as well, as barium sulfate is applied as a filler for lightweight battery casings and high-performance plastics.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

With its increasing application in automotive coatings, pharmaceuticals, and high-performance plastics, the barium sulfate market in South Korea is on the rise. This new barium sulfate production will provide South Korea with a BC Dinner, an important component of many, and a key ingredient for industrial coatings, polymer reinforcement, and radiopaque agents in medical imaging.

The field of ultra-fine barium sulfate in optical coatings and microelectronics is floating as the semiconductor and display panel industry rapidly grows in South Korea. More recently, the growing acceptance of electric vehicles (EVs) is propelling demand for barium sulfate-filled polymer composites for light weight and improved mechanical strength.

An increase in diagnostic imaging procedures, which is also being fueled by the government's focus on healthcare modernization, is boosting demand for barium sulfate contrast agents. In addition, the increasing infrastructure sector in South Korea is further driving the demand for barium sulfate-based coatings & construction materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

The barium sulfate market is a crucial segment of the global metals industry, driven by demand from industries such as automotive, aerospace, construction, and packaging. Major global manufacturers and regional suppliers play a key role in ensuring a steady supply of aluminium while focusing on sustainability, lightweight materials, and energy-efficient production. The market is shaped by advancements in recycling technology, increasing industrial applications, and government initiatives promoting eco-friendly alternatives.

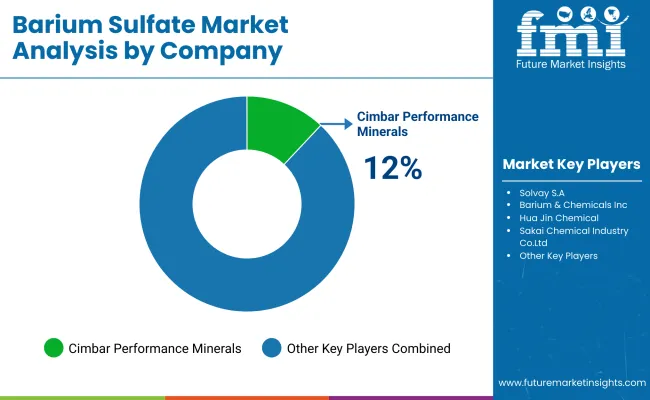

Cimbar Performance Minerals (12-17%)

High-density and ultra-fine barium sulfate is produced and sold by Cimbar Performance Minerals, which supplies the industrial coatings, pharmaceutical and niche markets. The company remains ahead in key markets because of its focus on innovation and its R&D-based custom formulations.

Solvay S.A. (10-14%)

Solvay is still a prominent producer of high-purity barium sulfate for medical and industrial applications. The company's dedication to sustainable and efficient production practices reinforces its international market position.

Barium & Chemicals, Inc. (7-12%)

Barium & Chemicals, Inc. is a manufacturer of industrial barium sulfate, an ingredient in drilling fluids, paints, and plastics. The company's specialty in additives and performance-enhancing solutions makes it a major contributor to the market.

Hua Jin Chemical (Guangdong) Co., Ltd. (5-9%)

Hua Jin Chemical specializes in cheap barium sulfate products for developing regions, especially high-growth markets in Asia. This specialization provides it a powerful regional foothold.

Sakai Chemical Industry Co., Ltd. (3-7%)

Sakai Chemical manufactures a plethora of high grade barium sulfate, which is utilized in surface coatings, battery manufacturing and niche development fillers. Its robust growth inherent in its research and innovations helped it grow steadily in the market.

Several global and regional companies collectively hold a significant market share, contributing through innovation, cost efficiency, and specialized products. Key players include:

The overall market size for barium sulfate market was USD 1.5 Billion in 2025.

The barium sulfate market is expected to reach USD 2.5 Billion in 2035.

Industries demand high-purity, stable, and radiopaque materials; thus, the demand for barium sulfate is projected to remain high. Growing demand in paints & coatings, pharmaceuticals, and plastic, among others, is contributing to the growth of the market. Moreover, innovations in manufacturing processes and growing investment in sustainable solutions are accelerating its uptake.

The top 5 countries which drives the development of barium sulfate market are USA, UK, Europe Union, Japan and South Korea.

Modified and Nanometer Precipitated Barium Sulfate to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use Industry, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End Use Industry, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End Use Industry, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End Use Industry, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End Use Industry, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End Use Industry, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Barium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Barium Fluoride Market Size and Share Forecast Outlook 2025 to 2035

Barium Nitrate Market Size and Share Forecast Outlook 2025 to 2035

Barium Titanate Market Size and Share Forecast Outlook 2025 to 2035

Barium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Precipitated Barium Sulphate Market Growth – Trends & Forecast 2025 to 2035

Sulfate-Free Shampoos Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Persulfates Market Size and Share Forecast Outlook 2025 to 2035

Crude Sulfate Turpentine Market Analysis by Product Type, Source, Processing Method, Application, and Region through 2035

Nickel Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Ferric Sulfate Market Growth - Trends & Forecast 2025 to 2035

Ferric Sulfate & Polyferric Sulfate Market 2024-2034

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Diethyl Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Ferrous Sulfate Market - Size, Share & Forecast 2025 to 2035

Ammonium Sulfate Food Grade Market Report - Industry Insights 2025 to 2035

Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

UK Ferric Sulfate Market Trends – Size, Share & Industry Growth 2025-2035

USA Ferric Sulfate Market Analysis – Demand, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA