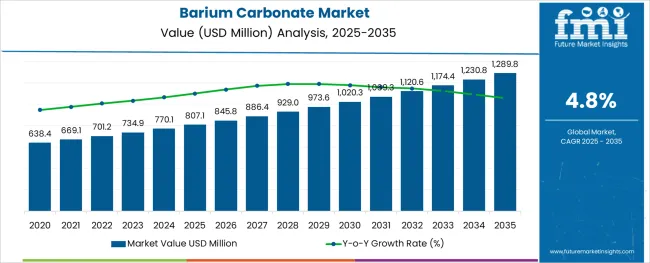

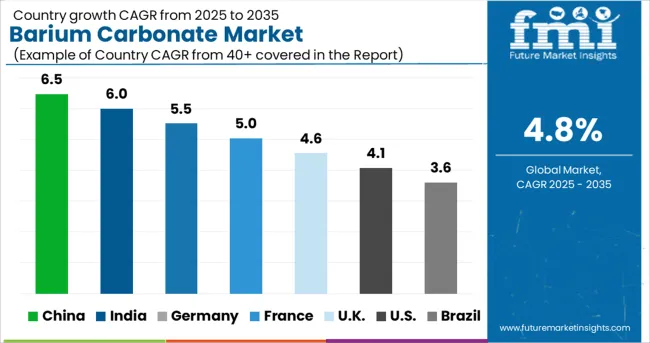

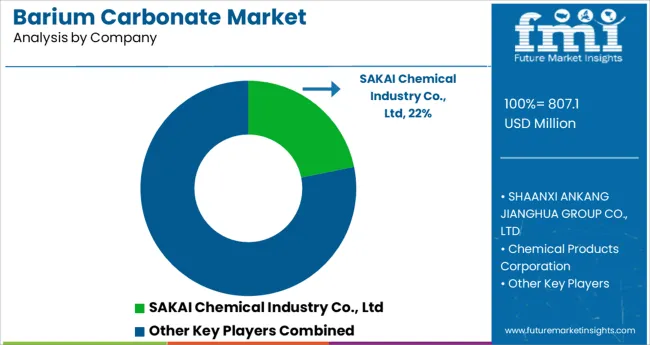

The Barium Carbonate Market is estimated to be valued at USD 807.1 million in 2025 and is projected to reach USD 1289.8 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The barium carbonate market is experiencing steady growth, underpinned by its extensive use in manufacturing ceramics, specialty glass, and bricks, particularly in rapidly urbanizing economies. Increased demand for durable and cost-effective building materials has contributed to sustained market expansion, with barium carbonate being a key component for enhancing product strength, thermal resistance, and chemical stability.

A stable supply of raw materials and advancements in refining processes have improved production efficiency, leading to cost competitiveness across regional markets. The future outlook remains positive, driven by construction sector recovery, infrastructure modernization programs, and increased investments in residential and commercial property developments globally.

Additionally, regulatory emphasis on environmentally sound manufacturing practices has prompted producers to optimize formulations and reduce impurities in barium carbonate-based applications. The rising adoption of energy-efficient kilns and advanced processing methods is anticipated to further enhance product consistency and operational performance, positioning the market for continuous, incremental growth in both established and emerging economies.

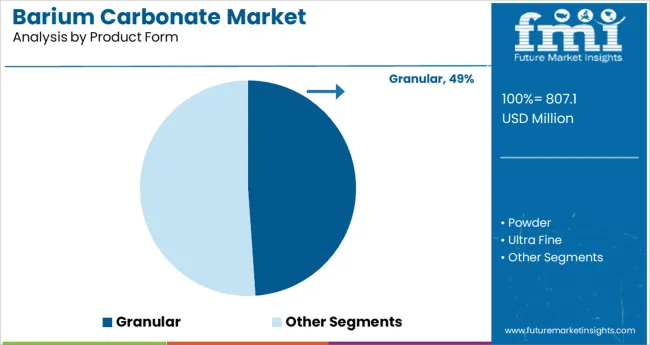

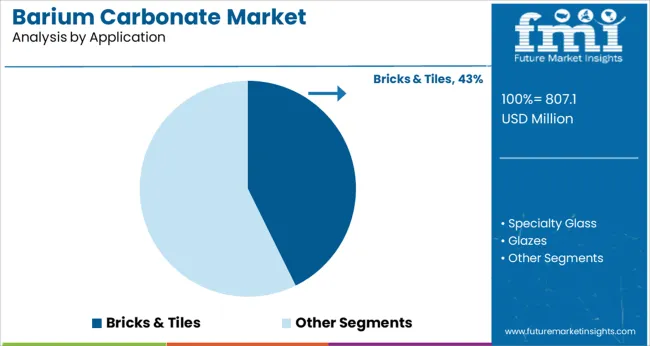

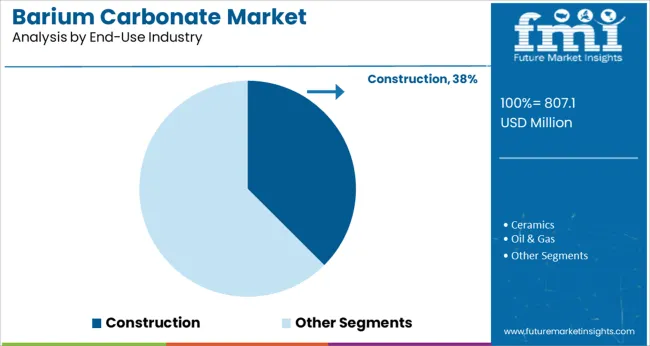

The market is segmented by Product Form, Application, and End-Use Industry and region. By Product Form, the market is divided into Granular, Powder, and Ultra Fine. In terms of Application, the market is classified into Bricks & Tiles, Specialty Glass, Glazes, Enamel, Electro Ceramic, and Others. Based on End-Use Industry, the market is segmented into Construction, Ceramics, Oil & Gas, Electronics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The granular product form segment held a dominant 48.9% share in the barium carbonate market, supported by its superior handling, reduced dust emissions, and enhanced blending properties. Industries have preferred granular barium carbonate for its ease of application in high-temperature processes, particularly within ceramic, glass, and brick manufacturing.

Its consistent particle size distribution and lower volatility compared to powder forms contribute to safer and more stable operations in large-scale production environments. The segment's growth has been reinforced by its suitability for automated feed systems and better storage characteristics, which reduce material losses and improve operational efficiencies.

Manufacturers have increasingly adopted granular forms to meet the quality expectations of end users while complying with occupational health standards, particularly in regions with stringent workplace exposure regulations. Going forward, continuous improvements in granulation technologies and the introduction of high-purity grades are expected to consolidate the segment's leadership, particularly as demand for high-performance and low-emission ceramic products intensifies across global construction and consumer goods industries.

Within the application category, the bricks and tiles segment led the market with a substantial 42.7% share, attributed to the integral role of barium carbonate in preventing efflorescence and enhancing structural integrity in ceramic-based building materials.

The material’s ability to react with soluble sulfates and eliminate unsightly salt deposits has made it indispensable in the production of high-quality bricks and tiles for both residential and commercial construction projects. Sustained growth in urban infrastructure projects, affordable housing developments, and demand for aesthetically superior building finishes have collectively driven consistent consumption of barium carbonate in this segment.

Additionally, the rising emphasis on sustainable construction materials with extended service life and reduced maintenance needs has further solidified the segment’s prominence. Manufacturers have responded by optimizing production techniques to ensure uniform distribution of barium carbonate in clay mixtures, enhancing product performance while addressing environmental and safety standards. The segment is expected to maintain steady expansion, supported by ongoing investment in modern kilns and innovative brickwork designs that emphasize durability and visual appeal.

The construction end-use industry dominated the barium carbonate market with a commanding 37.5% share, benefiting from the material's extensive applications in building materials and structural ceramics.

Its utility in improving the physical properties of construction products, particularly bricks, tiles, and certain specialized cements, has positioned it as a crucial additive in the global building materials sector. The steady growth of urbanization, government-led infrastructure upgrades, and rising demand for long-lasting, weather-resistant materials have driven increased usage within this sector.

Additionally, the need for efficient moisture control and enhanced durability in construction components has amplified the reliance on barium carbonate as a preventative agent against material degradation. As urban centers expand and emerging economies accelerate public housing and commercial property development initiatives, the construction industry's demand for barium carbonate is anticipated to grow proportionally. Continuous product innovations focusing on high-performance, eco-friendly, and cost-efficient building materials will likely reinforce the segment’s market share, ensuring sustained procurement from construction material manufacturers worldwide.

The barium carbonate demand grew at 2.8% CAGR between 2020 and 2024. The industry is expected to grow considerably during the forecast period (2025 to 2035). This is attributable to the widespread use of barium carbonate in diverse applications. Prior to the COVID-19 outbreak, the barium carbonate market grew rapidly due to high demand from various end users. However, during the pandemic outbreak, the market experienced sluggish growth.

The industry is expected to log a CAGR of 4.8% over the estimated period. Barium carbonate is an odorless, heavy, and white to cream or pale-yellow colored compound with the formula, BaCO3. Naturally, it is found in Witherite minerals, whereas commonly, it is manufactured synthetically. Usually, barium carbonate is available in granular, powder, and ultra-fine forms.

In recent years, there has been a surging interest in modern and cutting-edge designs for building unique and unusual structures. People are calling for groundbreaking home advancement plans because they want their structures to last long.

As a result, the construction and infrastructure development sectors are incorporating blocks of barium carbonate and tiles into their intended structures. These blocks provide the structures with the expected strength to withstand nature's most powerful forces, such as earthquakes, floods, and cyclones. The global barium carbonate market is growing, because of these benefits and the inclination toward fundamentally-planned structures.

Due to the sheer increase in infrastructure projects, the construction sector is projected to be the dominant segment. To prevent scumming, barium carbonate is used in tiles, bricks, and blocks. Since bricks and tiles are widely used in the construction sector, the consumption of barium carbonate can rise in tandem with construction activities. The construction segment is projected to reach about USD 1289.8 Million by the end of 2035.

The toxic nature of barium and barium compounds such as barium carbonate may hinder the market in the forecast period. Barium and its compounds find multiple applications in different end-use sectors.

Naturally, barium occurs in groundwater & food and can be found in the form of barite (barium sulfate) & Witherite (barium carbonate). The toxicity of barium & barium compounds depends on their solubility in water. However, barium carbonate is insoluble in water and has some adverse effects on the human body.

BaCO3 is toxic to humans because it is soluble in their gastrointestinal tracts. Barium & its insoluble compounds are non-toxic. But, when exposed to gastrointestinal tracts, they are toxic, especially when there is perforation of the tracts or colon cancers and when barium penetrates the bloodstream.

Although barium carbonate is insoluble in water, it reacts with Hydrochloric acid in the stomach and produces barium chloride. Barium Chloride is water-soluble and releases barium ions, which are very toxic. Hypokalemia, muscle weakness, paralysis, abdominal pain, and vomiting are some of the ill effects that result from the ingestion of barium & its compounds. Barium poisoning is rare but can be life-threatening.

Booming Construction Sector Creating Opportunities for Barium Carbonate Sales in India

Barium carbonate is one of the essential raw materials, which is used in the construction sector. In India, the construction sector holds the 2nd most important place in terms of industrial growth and contribution to the GDP. The sector includes mainly industrial, residential, & real estate. The expanding construction sector in India will favor the barium carbonate market, as it is extensively utilized in construction.

A rising number of infrastructural projects in India and investments in building & construction are reported to bolster the demand for barium carbonate. As the Govt. is taking initiatives & announcing new projects at different time intervals, the barium carbonate market can grow at a faster pace.

As the industry grows, ample opportunities will see the light of day. The Indian Barium Carbonate market is anticipated to expand at a CAGR of 5.3% during the forecast period.

Demand in Construction Sector to Push Barium Carbonate Sales in China

East Asia is expected to emerge as the largest and fastest-growing barium carbonate market. Barium carbonate consumption in construction and renovation activities will drive the region. China could dominate the region over the forecast period. Rapid growth in the construction and electronics sectors is driving the sales of China, and thereby, East Asia.

The consumption of barium carbonate in electronic components is predicted to propel market demand. Barium titanate, which is produced by barium carbonate and used in laptops, desktops, medical devices, and data center devices, is expected to boost the market demand. The Chinese Barium Carbonate market is slated to attain about USD 1289.8 Million by the end of 2035.

Rapid Urbanization Will Propel the Adoption Of Barium Carbonate in Bricks & Tiles Applications

The increasing use of barium carbonate in the production of blocks, bricks, and tiles is predicted to drive the market. The blocks and tiles segment accounts for a sizeable chunk of the barium carbonate market. Alteration of clay tiles for metal components, marble floors, and other home improvement items is required to aid the market in the coming years.

Expanding the use of barium carbonate in blocks, bricks, and tiles to prevent scrimmaging is expected to boost barium carbonate demand. Aside from that, the market is propelled by rapid urbanization and rising consumer spending power, especially in developing countries.

This has increased the demand for high-quality decorative items, such as glass paintings, vases, and ceramic miniatures. The bricks & tiles segment is expected to expand at a CAGR of 5.3% during the forecast period.

Growth of Electronic Ceramics Can Boost the Market Sales

Ceramics are among the end-use sectors that make extensive use of barium carbonate. Barium carbonate generates classic barium crystal mattes. It is a significant and primary source of barium oxide, which is used in glazes. It acts as a flux in glazes and contributes to the production of a matte finish.

Barium carbonate is used to manufacture other chemicals. These chemicals go into different end-use industries, such as ceramics, electronics, and others. For that purpose, a certain diameter of barium carbonate particle is required. These electronic ceramics are used in electronic components, for instance, transmitters, electrical condensers, and others.

The demand for electronic ceramics is growing along with the rapid development of the electronics sector. As barium carbonate is an essential raw material in electronic ceramics, its demand is constantly increasing. Both segments are collectively expected to hold 46% of the total market shares in 2025.

Key market participants are fortifying their positions by expanding their production capacities. Some key players, on the other hand, have acquired other players to broaden their reach. This will aid in the expansion of their product portfolio and global footprint.

For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value and Tons for Volume |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, BENELUX, Russia, China, Japan, South Korea, India, ASEAN, Australia and New Zealand, GCC Countries, Turkey, Northern Africa, South Africa |

| Key Segments Covered | Product Form, Application, End-Use Industry & Region |

| Key Companies Profiled | Sakai Chemical Industry Co., Ltd.; Shaanxi Ankang Jianghua Group Co., Ltd; Chemical Products Corporation; Honeywell International Inc.; Nippon Chemical Industrial Co., Ltd; Ag Chemi Group; Kandelium; Hubei Jingshan Chutian Barium Salt Corporation Ltd.; Hebei Xinji Chemical Group Co. Ltd.; Zaozhuang Yongli Chemicals Co., Ltd; Guizhou Red Star Development Import And Export Co. Ltd. |

| Report Coverage |

Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global barium carbonate market is estimated to be valued at USD 807.1 million in 2025.

It is projected to reach USD 1,289.8 million by 2035.

The market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types are granular, powder and ultra fine.

bricks & tiles segment is expected to dominate with a 42.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Barium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Barium Fluoride Market Size and Share Forecast Outlook 2025 to 2035

Barium Nitrate Market Size and Share Forecast Outlook 2025 to 2035

Barium Titanate Market Size and Share Forecast Outlook 2025 to 2035

Barium Sulfate Market Analysis - Size, Share & Forecast 2025 to 2035

Rare-earth Barium Copper Oxide (REBCO) Wire Market Size and Share Forecast Outlook 2025 to 2035

Precipitated Barium Sulphate Market Growth – Trends & Forecast 2025 to 2035

Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Carbonate Mineral Market Growth – Trends & Forecast 2024-2034

Polycarbonate Junction Box Market Forecast and Outlook 2025 to 2035

Polycarbonate Composites Market Size and Share Forecast Outlook 2025 to 2035

Polycarbonate Films Market Size and Share Forecast Outlook 2025 to 2035

Polycarbonate Resins Market - Trends & Forecast 2025 to 2035

Polycarbonate Sheet Market Growth – Trends & Forecast 2024-2034

Zinc Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Nickel Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Uranyl Carbonate Market

Cobalt Carbonate Market

Calcium Carbonate Biocement Market Size and Share Forecast Outlook 2025 to 2035

Calcium Carbonate Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA