Between 2025 and 2035, this steady market growth is forecasted to continue its upward climb. This is partly due to the growing demand in plastics and rubber as well as pharmaceuticals for coatings. With its superb properties of high-brightness, low solubility and chemical inertia, precipitated barium sulphate is used in paint, coating and pigment.

The market is projected to exceed USD 11,00.7 Million by 2035, growing at a CAGR of 3.3% over the forecast period.

Besides, innovation is opening up new frontiers of market growth, such as increasingly widespread employment in CT (Medical Imaging) and drilling derricks collecting or well shut-ins. Technological advancements, aimed at producing finer and purer grades of precipitated barium sulphate, also contribute to the expansion.

North America is a major consumer of precipitated barium sulphate, especially in the United States where demand for coatings, plastics and oil & gas sectors is strong. The growing automotive and construction industries are driving the need for paints and coatings and thus exerting a great deal of pressure on the market.

Moreover, the advanced healthcare system in the region supports increasing use of barium sulphate for diagnostic purposes. Manufacturers are urged to produce in a more environmental way due to laws designed to reduce emissions that pollute.

Europe is a mature yet still growing market where demand for precipitated barium sulphate comes from the automotive, construction and healthcare industries. Germany, France and Italy are the most important contributors thanks to their advanced industrial bases. The region's emphasis on high-performance and eco-friendly coatings and plastic applications is providing an outlet for precipitated barium sulphate.

As strict environmental rules increasingly require production to reduce its carbon footprint-also barium sulphate based formulations will become more popular this year.

Asia-Pacific is expected to see the fastest growth in the precipitated barium sulphate market. Rapid industrialization, urbanization and infrastructure construction throughout China, India and Southeast Asia is driving demand. It is the combination of the construction industry's booming growth and improving healthcare facilities that is giving rise to consumption.

Challenge

Raw Material Price Volatility

The key problems facing the market for Precipitated Barium Sulphate come with the unpredictable price of raw materials, especially barite. Fluctuations in the availability and cost of barite, caused by mining policies and supply chain breakdowns, affect the cost of manufacture and profit margins for producers.

Environmental Regulations

Increasingly stringent environmental regulations on mining and chemicals processing are imposing huge liabilities for producers in the Precipitated Barium Sulphate Market. An increased focus on "sustainable mining" practice as well as pollution control measures is cramping production to a scale even lower than it would otherwise be: this is leading to higher costs for each ton produced.

Opportunity

Growth in Paints and Coatings Industry

With the development of the paint and coatings industry, the market of Precipitated Barium Sulphate is facing a great chance. High whiteness, chemical inertness and low oil absorption make it ideal for use in automotive painting systems as well as industrial paints and architectural applications

Emergence of Eco-Friendly Production Technologies

The increasingly popular demand for sustainable products is prompting producers of precipitated barium sulphate to adopt eco-friendly production methods. Green chemistry advances and cleaner processes of manufacturing not only mean companies have new opportunities that are in line with regulation, but also appeal to the environmentally conscious consumer who wants a product that is "safe".

2020 to 2024 saw a generally stable growth of from its mainstay of supply to the paints and coatings, plastics, rubber industries. But with unstable prices for raw material and regulation difficulties, companies integrated alternative resource approaches as well as adopting cleaner technologies.

Expectedly by 2025 to 35 the market will undergo many changes with global attention shifting strongly towards sustainability and innovation. The advent of cleaner production processes and rapid expansion in end use fields such as car manufacturing medical equipment demand, or buildings for this urban society shape future trends.

Invest in low-emission, high-purity grades for R&D with precipitated barium sulphate and get a leg up. Maintenance Depot offerings are moving rapidly from old materials to new kinds of coating Costly R & D can pay off big quality investments look better than ever as the economic returns improve.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with mining and chemical emission regulations |

| Market Demand | Consistent demand from paints, plastics, and rubber industries |

| Industry Adoption | Use of conventional manufacturing techniques |

| Supply Chain and Sourcing | Dependence on traditional barite mining regions |

| Market Competition | Dominated by established chemical manufacturers |

| Market Growth Drivers | Growth in construction and industrial sectors |

| Sustainability and Energy Efficiency | Initial adoption of waste management and emission reduction strategies |

| Integration of Digital Innovations | Limited use of automation and digital tools |

| Advancements in Product Development | Standard grades for general-purpose industrial applications |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter environmental standards and promotion of sustainable manufacturing practices |

| Market Demand | Expansion into high-performance applications in automotive, electronics, and healthcare |

| Industry Adoption | Shift towards eco-friendly and energy-efficient production technologies |

| Supply Chain and Sourcing | Diversification of sourcing and investment in synthetic alternatives |

| Market Competition | Growth of innovative startups focused on sustainable and specialized barium sulphate solutions |

| Market Growth Drivers | Rising demand for high-purity and eco-friendly precipitated barium sulphate in advanced applications |

| Sustainability and Energy Efficiency | Large-scale implementation of green chemistry principles and carbon-neutral production processes |

| Integration of Digital Innovations | Expansion of smart manufacturing, real-time process monitoring, and data-driven production optimization |

| Advancements in Product Development | Development of customized grades for niche applications such as medical devices and electronics |

Increased demand from the auto and construction industries has played a significant part in American Precipitated Barium Sulphate market's growth. In addition to coats, plastics and rubber goods making physical support for pigment or gaseous sides, the need for colour lithography fillers which are high purity offering superior whiteness and chemical resistance.

Technical advances in fine chemical production and nanotechnology are also having an impact on the market. United States the safe environmental production methods on which factories must focus will result in their facing stricter regulations for investing intensive in plants and equipment.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 3.1% |

The United Kingdom is seeing major activity in the Precipitated Barium Sulphate market. Increasing demand from the paint and coats industry has given rise to this demand. And durable high-performance materials such as barium sulphate are being sought after as laws on automobile improvement catch on in England.

The UK also benefits from its status as a base for many European chemical manufacturers, who have integrated environmentally responsible process technology. The EU's environmental rules and those in its member countries drive these producers towards its safer and more environmentally friendly alternatives, ongoing R&D aimed at extending the uses of the material in medical and polymer applications is having a positive impact on market dynamics.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.2% |

The European Union has a substantial part of the world Precipitated Barium Sulphate market, as automotive, construction and chemical manufacturing are well developed there. Major contributors include Germany and France; Italy too plays its part. Bars of barium sulphate are an intrinsic ingredient for filling hungry pigment systems, such as those using carbon black.

EU-wide regulations for sustainable development and environmentally friendly materials force manufacturers to innovate, developing products that require low emissions and are recyclable. The region is also busy developing its infrastructure and materials for the automobile industry, which each month provides steady orders for Precipitated Barium Sulphate. And so on this basis alone, the Chinese enterprise is now cooling its heels.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.4% |

In South Korea, the growing automotive and electronics sectors and high-tech manufacturer base support the Precipitated Barium Sulphate market. Its application as a functional additive in paints, coatings, and engineered plastics has strong market demand. Domestic producers are also working to improve barium sulphate's purity and performance so that it meets international standards. Government policy has encouraged companies to produce sustainable products, as well as to make new materials which are better. The country has a strong export market, so by extension Precipitated Barium Sulphate will be needed for many high-value commodities

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.5% |

The up to 1 μm size particle business from mine out Clauses Library, Precipitated barium sulphate accounts Sit right among top. Fine particles bring enhanced brightness, gloss and easy spreading properties to precipitated barium sulphate, so that it is very popular in high-end precision applications like coatings inks and plastics. Nano-sized particles For painting materials such as inks varnishes oils they will certainly increase the smoothness and hiding power of colours, as well as their ability to resist UV light.

As an added advantage, the result is that surfaces will be more even in finish. In industries such as automotive coatings and electronics where the quality and uniformity of the product surface are of paramount importance people are increase-singly crying out for sub-micron barium sulphate. Furthermore, the pharmaceutical industry benefits from ultrafine precipitated barium sulphate as a radiographic contrast medium for use in medical diagnostic procedures.

Building on the rising demand to produce high performance coatings and composites at increasingly longer length, the need for more efficiently made materials temporally calls for ultrafine powders with fine ceramic synthesis technology so that its final appearance can also be of high quality benefits greatly from Precipitated barium sulphate s ultra-fine particle technology in ink-jet printers or in medium grey coatings for LAN cables which must keep phone lines free of interference at 10 dB attenuation lines.

The biggest source of demand in the precipitated barium sulphate market comes from paint and coatings. These applications need the material because it can work as both an extender of other things in a product and give some heft to just about any type of substance you want put on your wall Precipitated barium sulphate is highly valued in the paints and coatings industries for both its ability to lengthen the life-span of products and their resistance against chemicals, as well as its smooth surface finish.

Precipitated barium sulphate in automotive coatings does it all: enhances scratch resistance, ups gloss and makes sure your car looks even more beautiful for longer years (or miles). In industrial and architectural coatings, barium sulphate provides properties such as protection from light-degradation which could mean dramatic consequences not only for consumer goods but also our global environment.

New and old approaches honestly coexist today owing largely to the growing global infrastructure and construction activities necessitating paints as well as coatings.

The precipitated barium sulphate market is expanding steadily, driven by rising demand from end-use industries such as paints & coatings, plastics, and rubber manufacturing. Its superior whiteness, high density, and chemical inertness make it an essential material in industrial and specialty applications.

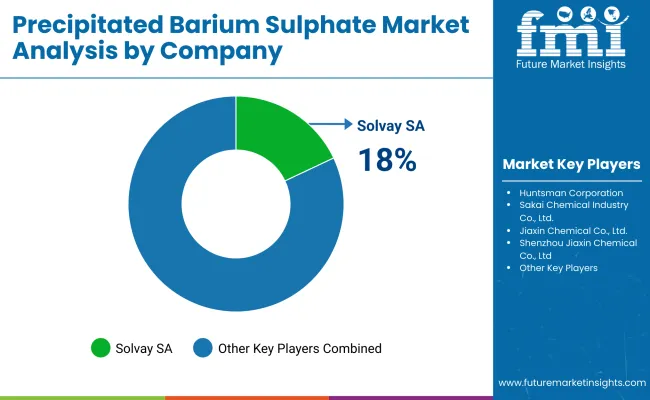

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Solvay SA | 18-22% |

| Huntsman Corporation | 15-19% |

| Sakai Chemical Industry Co., Ltd. | 12-16% |

| Jiaxin Chemical Co., Ltd. | 8-12% |

| Shenzhou Jiaxin Chemical Co., Ltd. | 5-9% |

| Other Manufacturers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Solvay SA | High-purity precipitated barium sulphate for paints, coatings, and plastics with superior brightness. |

| Huntsman Corporation | Advanced grades of precipitated barium sulphate for automotive, architectural, and industrial applications. |

| Sakai Chemical Industry Co., Ltd. | Specialty barium sulphate solutions for electronics, rubber, and polymer-based industries. |

| Jiaxin Chemical Co., Ltd. | Cost-effective barium sulphate products for regional coatings and plastics markets. |

| Shenzhou Jiaxin Chemical Co., Ltd. | High-performance precipitated barium sulphate for industrial and specialty coatings. |

Key Market Insights

Solvay SA (18-22%)

Solvay is a market leader with a diversified portfolio of high-performance barium sulphate products catering to multiple industries.

Huntsman Corporation (15-19%)

Huntsman specializes in supplying advanced barium sulphate grades used in high-end paints, plastics, and rubber manufacturing.

Sakai Chemical Industry Co., Ltd. (12-16%)

Sakai Chemical focuses on electronic and polymer industries with its specialty precipitated barium sulphate offerings.

Jiaxin Chemical Co., Ltd. (8-12%)

Jiaxin Chemical serves local and international clients with competitive pricing and consistent product quality.

Shenzhou Jiaxin Chemical Co., Ltd. (5-9%)

Shenzhou Jiaxin is known for its tailored barium sulphate formulations designed for high-durability industrial coatings.

Other Key Players (30-40% Combined)

Key contributors also include:

The overall market size for precipitated barium sulphate market was USD 7,95.58 Million In 2025.

The precipitated barium sulphate market is expected to reach USD 11,00.7 Million in 2035.

The demand for precipitated barium sulphate will be driven by growing applications in paints & coatings, plastics & polymers, and rubber industries, coupled with rising demand for ultra-fine particle sizes (up to 1 μm) for enhanced performance and durability.

The top 5 countries which drives the development of precipitated barium sulphate market are USA, European Union, Japan, South Korea and UK.

Paints & Coatings demand supplier to command significant share over the assessment period.

Table 01: Global Market Size (US$ Million) & Volume (Kilotons) Forecast by Particle Size, 2018 to 2033

Table 02: Global Market Size (US$ Million) & Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 03: Global Market Size (US$ Million) & Volume (Kilotons) Forecast by Region, 2018 to 2033

Table 04: North America Market Value (US$ Million) and Volume (Kilotons) Analysis by Country, 2018 to 2033

Table 05: North America Market Size (US$ Million) & Volume (Kilotons) Forecast by Particle Size, 2018 to 2033

Table 06: North America Market Size (US$ Million) & Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 07: Latin America Market Value (US$ Million) and Volume (Kilotons) Analysis by Country, 2018 to 2033

Table 08: Latin America Market Size (US$ Million) & Volume (Kilotons) Forecast by Particle Size, 2018 to 2033

Table 09: Latin America Market Size (US$ Million) & Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 10: Europe Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Table 12: Europe Market Size (US$ Million) & Volume (Kilotons) Forecast by Particle Size, 2018 to 2033

Table 13: Europe Market Size (US$ Million) & Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 14: East Asia Market Value (US$ Million) and Volume (Kilotons) Analysis by Country, 2018 to 2033

Table 15: East Asia Market Size (US$ Million) & Volume (Kilotons) Forecast by Particle Size, 2018 to 2033

Table 16: East Asia Market Size (US$ Million) & Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 17: South Asia & Pacific Market Value (US$ Million) and Volume (Kilotons) Analysis by Country, 2018 to 2033

Table 18: South Asia and Pacific Market Size (US$ Million) & Volume (Kilotons) Forecast by Particle Size, 2018 to 2033

Table 19: South Asia and Pacific Market Size (US$ Million) & Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 20: Middle East & Africa Market Value (US$ Million) and Volume (Kilotons) Analysis by Country, 2018 to 2033

Table 21: Middle East & Africa Market Size (US$ Million) & Volume (Kilotons) Forecast by Particle Size, 2018 to 2033

Table 22: Middle East & Africa Market Size (US$ Million) & Volume (Kilotons) Forecast by Application, 2018 to 2033

Figure 01: Global Market Historical Volume (Kilotons), 2018 to 2022

Figure 02: Global Market Volume (Kilotons) Forecast, 2023 to 2033

Figure 03: Global Market Value (US$ Million) Forecast, 2018 to 2033

Figure 04: Global Market Absolute US$ Opportunity, 2018 to 2033

Figure 05: Global Market Share and BPS Analysis by Particle Size, 2023 & 2033

Figure 06: Global Market Y-o-Y Growth by Particle Size, 2023 to 2033

Figure 07: Global Market Attractiveness Analysis by Particle Size, 2023 to 2033

Figure 08: Up to 1 μm Market Incremental $ Opportunity, 2022 to 2033

Figure 09: Up to 3 μm Market Incremental $ Opportunity, 2022 to 2033

Figure 10: Up to 5 μm and above Market Incremental $ Opportunity, 2022 to 2033

Figure 11: Global Market Share and BPS Analysis by Application, 2023 & 2033

Figure 12: Global Market Y-o-Y Growth by Application, 2023 to 2033

Figure 13: Global Market Attractiveness Analysis by Application, 2023 to 2033

Figure 14: Paints & Coatings Market Incremental $ Opportunity, 2022 to 2033

Figure 15: Pulp & Paper Market Incremental $ Opportunity, 2022 to 2033

Figure 16: Plastics & Polymers Market Incremental $ Opportunity, 2022 to 2033

Figure 17: Rubber Market Incremental $ Opportunity, 2022 to 2033

Figure 18: Others Market Incremental $ Opportunity, 2022 to 2033

Figure 19: Global Market Share and BPS Analysis by Region, 2023 & 2033

Figure 20: Global Market Y-o-Y Growth by Region, 2023 to 2033

Figure 21: Global Market Attractiveness Analysis by Region, 2023 to 2033

Figure 22: North America Market Incremental $ Opportunity, 2022 to 2033

Figure 23: Latin America Market Incremental $ Opportunity, 2022 to 2033

Figure 24: Europe Market Incremental $ Opportunity, 2022 to 2033

Figure 25: East Asia Market Incremental $ Opportunity, 2022 to 2033

Figure 26: South Asia & Pacific Market Incremental $ Opportunity, 2022 to 2033

Figure 27: Middle East & Africa Market Incremental $ Opportunity, 2022 to 2033

Figure 28: North America Market Share and BPS Analysis by Country 2023 & 2033

Figure 29: North America Market Y-o-Y Growth by Country, 2023 to 2033

Figure 30: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 31: US Market Incremental $ Opportunity, 2022 to 2033

Figure 32: Canada Market Incremental $ Opportunity, 2022 to 2033

Figure 33: North America Market Share and BPS Analysis by Particle Size, 2023 & 2033

Figure 34: North America Market Y-o-Y Growth by Particle Size, 2023 to 2033

Figure 35: North America Market Attractiveness Analysis by Particle Size, 2023 to 2033

Figure 36: North America Market Share and BPS Analysis by Application, 2023 & 2033

Figure 37: North America Market Y-o-Y Growth by Application, 2023 to 2033

Figure 38: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 39: Latin America Market Share and BPS Analysis by Country 2023 & 2033

Figure 40: Latin America Market Y-o-Y Growth by Country, 2023 to 2033

Figure 41: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 42: Brazil Market Incremental $ Opportunity, 2022 to 2033

Figure 43: Mexico Market Incremental $ Opportunity, 2022 to 2033

Figure 44: Rest of LA Market Incremental $ Opportunity, 2022 to 2033

Figure 45: Latin America Market Share and BPS Analysis by Particle Size, 2023 & 2033

Figure 46: Latin America Market Y-o-Y Growth by Particle Size, 2023 to 2033

Figure 47: Latin America Market Attractiveness Analysis by Particle Size, 2023 to 2033

Figure 48: Latin America Market Share and BPS Analysis by Application, 2023 & 2033

Figure 49: Latin America Market Y-o-Y Growth by Application, 2023 to 2033

Figure 50: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 51: Europe Market Share and BPS Analysis by Country 2023 & 2033

Figure 52: Europe Market Y-o-Y Growth by Country, 2023 to 2033

Figure 53: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 54: Germany Market Incremental $ Opportunity, 2022 to 2033

Figure 55: Italy Market Incremental $ Opportunity, 2022 to 2033

Figure 56: France Market Incremental $ Opportunity, 2022 to 2033

Figure 57: United Kingdom Market Incremental $ Opportunity, 2022 to 2033

Figure 58: Spain Market Incremental $ Opportunity, 2022 to 2033

Figure 59: Nordic Market Incremental $ Opportunity, 2022 to 2033

Figure 60: Russia Market Incremental $ Opportunity, 2022 to 2033

Figure 61: Rest of Europe Market Incremental $ Opportunity, 2022 to 2033

Figure 62: Europe Market Share and BPS Analysis by Particle Size, 2023 & 2033

Figure 63: Europe Market Y-o-Y Growth by Particle Size, 2023 to 2033

Figure 64: Europe Market Attractiveness Analysis by Particle Size, 2023 to 2033

Figure 65: Europe Market Share and BPS Analysis by Application, 2023 & 2033

Figure 66: Europe Market Y-o-Y Growth by Application, 2023 to 2033

Figure 67: Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 68: East Asia Market Share and BPS Analysis by Country 2023 & 2033

Figure 69: East Asia Market Y-o-Y Growth by Country, 2023 to 2033

Figure 70: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 71: China Market Incremental $ Opportunity, 2022 to 2033

Figure 72: Japan Market Incremental $ Opportunity, 2022 to 2033

Figure 73: South Korea Market Incremental $ Opportunity, 2022 to 2033

Figure 74: East Asia Market Share and BPS Analysis by Particle Size, 2023 & 2033

Figure 75: East Asia Market Y-o-Y Growth by Particle Size, 2023 to 2033

Figure 76: East Asia Market Attractiveness Analysis by Particle Size, 2023 to 2033

Figure 77: East Asia Market Share and BPS Analysis by Application, 2023 & 2033

Figure 78: East Asia Market Y-o-Y Growth by Application, 2023 to 2033

Figure 79: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 80: South Asia & Pacific Market Share and BPS Analysis by Country 2023 & 2033

Figure 81: South Asia & Pacific Market Y-o-Y Growth by Country, 2023 to 2033

Figure 82: South Asia & Pacific Market Attractiveness Analysis by Country, 2023 to 2033

Figure 83: India Market Incremental $ Opportunity, 2022 to 2033

Figure 84: ASEAN Countries Market Incremental $ Opportunity, 2022 to 2033

Figure 85: Australia & New Zealand Market Incremental $ Opportunity, 2022 to 2033

Figure 86: Rest of SAP Market Incremental $ Opportunity, 2022 to 2033

Figure 87: South Asia and Pacific Market Share and BPS Analysis by Particle Size, 2023 & 2033

Figure 88: South Asia and Pacific Market Y-o-Y Growth by Particle Size, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness Analysis by Particle Size, 2023 to 2033

Figure 90: South Asia and Pacific Market Share and BPS Analysis by Application, 2023 & 2033

Figure 91: South Asia and Pacific Market Y-o-Y Growth by Application, 2023 to 2033

Figure 92: South Asia and Pacific Market Attractiveness Analysis by Application, 2023 to 2033

Figure 93: Middle East & Africa Market Share and BPS Analysis by Country 2023 & 2033

Figure 94: Middle East & Africa Market Y-o-Y Growth by Country, 2023 to 2033

Figure 95: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 96: GCC Countries Market Incremental $ Opportunity, 2022 to 2033

Figure 97: Turkey Market Incremental $ Opportunity, 2022 to 2033

Figure 98: Northern Africa Market Incremental $ Opportunity, 2022 to 2033

Figure 99: South Africa Market Incremental $ Opportunity, 2022 to 2033

Figure 100: Rest of MEA Market Incremental $ Opportunity, 2022 to 2033

Figure 101: Middle East & Africa Market Share and BPS Analysis by Particle Size, 2023 & 2033

Figure 102: Middle East & Africa Market Y-o-Y Growth by Particle Size, 2023 to 2033

Figure 103: Middle East & Africa Market Attractiveness Analysis by Particle Size, 2023 to 2033

Figure 104: Middle East & Africa Market Share and BPS Analysis by Application, 2023 & 2033

Figure 105: Middle East & Africa Market Y-o-Y Growth by Application, 2023 to 2033

Figure 106: Middle East & Africa Market Attractiveness Analysis by Application, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Precipitated Silica Market Size and Share Forecast Outlook 2025 to 2035

Barium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Barium Fluoride Market Size and Share Forecast Outlook 2025 to 2035

Barium Nitrate Market Size and Share Forecast Outlook 2025 to 2035

Barium Titanate Market Size and Share Forecast Outlook 2025 to 2035

Barium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Barium Sulfate Market Analysis - Size, Share & Forecast 2025 to 2035

Nano Precipitated Calcium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Zinc Sulphate Market Size, Growth, and Forecast 2025 to 2035

Silver Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Sulphate Supply Market-Trends & Forecast 2025 to 2035

Rare-earth Barium Copper Oxide (REBCO) Wire Market Size and Share Forecast Outlook 2025 to 2035

Ground and Precipitated Calcium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Mercury (I) Sulphate Market

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Aluminium Ammonium Sulphate Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Northern Europe Calcium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA