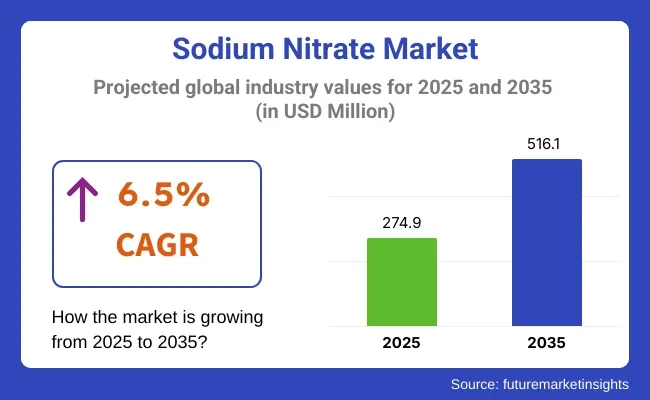

The global sodium nitrate market is anticipated to grow from USD 274.9 million in 2025 to USD 516.1 million by 2035, achieving a CAGR of 6.5% during the forecast period. Demand growth is being supported by widespread application in fertilizers, thermal energy storage systems, explosives, food preservation, and chemical manufacturing.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 274.9 million |

| Projected Market Size in 2035 | USD 516.1 million |

| CAGR (2025 to 2035) | 6.5% |

Sodium nitrate is being utilized as a nitrogen-rich fertilizer component, primarily in agricultural regions where soil nutrient replenishment is essential for yield optimization. Usage is particularly pronounced in Asia Pacific and Latin America, where population growth and arable land constraints are driving the adoption of nitrate-based fertilizers. According to the Food and Agriculture Organization, nitrogenous fertilizer use has continued to rise, influencing market demand for compounds such as sodium nitrate.

In the food industry, sodium nitrate is being incorporated as a curing agent and preservative, particularly in processed meats. Its function in inhibiting microbial growth and maintaining product quality is being acknowledged under strict regulatory standards. The USA Food and Drug Administration and the European Food Safety Authority permit its use within specified limits to ensure food safety while maintaining efficacy.

Industrial applications are expanding with sodium nitrate being deployed in explosives manufacturing, metal treatment, glass production, and solar thermal storage. In concentrated solar power systems, sodium nitrate-based molten salt is being utilized for its excellent thermal retention capabilities. As reported by the International Renewable Energy Agency, CSP adoption is gaining traction in countries such as Spain, India, and the United Arab Emirates, where grid-scale energy storage solutions are being prioritized.

Producers are investing in purification technologies to meet the performance standards of specialty applications, including electronics and pharmaceuticals. The market is characterized by stable supply from key mineral sources in Chile and China, where natural deposits are refined to meet industrial and agricultural specifications.

The sodium nitrate market is expected to continue expanding as downstream users seek reliable, multifunctional chemical inputs to meet global performance, sustainability, and productivity targets through 2035.

Industrial grade sodium nitrate is estimated to account for approximately 72% of the global sodium nitrate market share in 2025 and is projected to grow at a CAGR of 6.6% through 2035. This grade is extensively used in nitrogen-based fertilizer production, thermal energy storage, and as an oxidizing agent in explosives and pyrotechnics.

Large-scale demand continues to be driven by agricultural and mining sectors in countries such as China, India, and Brazil. In metal processing, it is also employed as a fluxing and heat treatment additive. Suppliers are focusing on product purity and process consistency to meet the specifications of downstream industries that require efficient nitrate performance in varying operating conditions.

The fertilizer segment is projected to hold approximately 49% of the global sodium nitrate market share in 2025 and is expected to grow at a CAGR of 6.7% through 2035. Sodium nitrate is favored for its high solubility, fast nutrient release, and compatibility with alkaline soils.

It plays a key role in boosting nitrogen availability in high-value crops such as fruits, vegetables, and sugar beets. With the rise of intensive farming practices and increased focus on yield optimization, sodium nitrate continues to gain traction in compound fertilizers and foliar application products. Demand is particularly strong across Latin America, South Asia, and parts of Africa, where balanced nutrient input is essential for maintaining soil health and agricultural productivity.

Environmental Regulations, Health Concerns, and Raw Material Constraints

The market is challenged by the imposition of tight regulations on the use of sodium nitrate in food because of the health risks associated with the possible formation of nitrosamines. Furthermore, reliance on natural sources of sodium nitrate (such as caliche ore) and price instability can affect supply chains.

Renewable Energy Storage, Mining Sector, and Organic Synthesis

Prospects exist in the thermal energy storage division, where sodium nitrate finds more application in molten salt technologies for CSP (Concentrated Solar Power). Increased activity in mining and quarrying usage and increasing interest in green fertilizers and clean synthesis pathways leave space for development and growth.

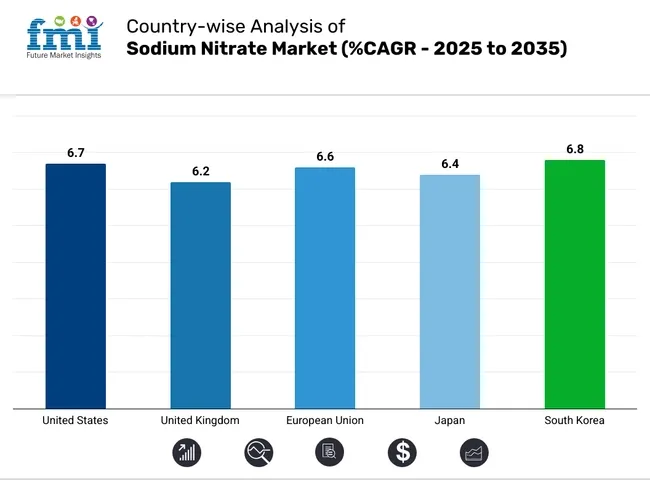

The USA sodium nitrate market is strong as a result of high use in explosives manufacturing, fertilizer production, and food preservation. Also coming on the radar are new applications for sodium nitrate in concentrated solar power (CSP) systems, where the chemical is used in heat storage and transfer systems. Demand is projected to increase as existing investments are in CSP projects in California and Nevada.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.7% |

In the UK, demand for sodium nitrate is transitioning from food additives toward CSP and green fertilizer formulations. The UK's push toward decarbonisation and net-zero farming is encouraging companies to adopt slow-release nitrate formulations with reduced leaching impact.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.2% |

Strict environmental policies in the EU have reshaped sodium nitrate demand. Countries like Spain and Italy are seeing a surge in its use for thermal energy storage in CSP plants. Meanwhile, nitrate application in fertilizers is being refined through precision agriculture technologies to reduce runoff and meet nitrogen cap targets.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.6% |

Japan’s sodium nitrate market remains niche but innovative. Manufacturers are leveraging sodium nitrate for high-purity electronics-grade fluxes and ultra-clean food additive production. Japan is also testing small-scale solar thermal pilot projects incorporating nitrate salt-based TES technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

In South Korea, sodium nitrate is witnessing increasing adoption in eco-friendly glass manufacturing and specialty fertilizer blends. As Korea expands its renewable energy portfolio, sodium nitrate is being evaluated for large-scale thermal storage solutions in solar parks and hydrogen infrastructure projects.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.8% |

The sodium nitrate market is characterized by moderate competition, with established players such as Yara International, EuroChem, and Solvay holding significant market share across key industries, including fertilizers, explosives, and food preservation.

These companies are focused on scaling production capabilities and improving product formulations to meet growing global demand. Regional players are increasingly targeting niche segments, offering tailored, cost-effective solutions that cater to local market needs. With the rising emphasis on environmental sustainability, industry leaders are investing in cleaner, more efficient manufacturing processes to comply with tightening regulations.

The sodium nitrate market was valued at approximately USD 274.9 million in 2025.

The market is projected to reach around USD 516.1 million by 2035.

The increasing demand for fertilizers in agriculture and its applications in industrial processes are key drivers of market growth.

The leading countries in the sodium nitrate market include China, Germany, the United States, India, and Japan.

The industrial-grade sodium nitrate segment is expected to command a significant market share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauroyl Isethionate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA