The ferrous sulfate market is set to reach a valuation of USD 2.52 billion in 2025 and is anticipated to expand at a 3.2% CAGR during the forecast period. It is expected to reach USD 3.46 billion by 2035. One of the major drivers for this growth is the rising demand for ferrous sulfate as a soil conditioner and micronutrient in agriculture, especially on iron-deficient soils, and for wastewater treatment and pharmaceutical applications.

This compound is an invaluable agricultural fertilizer additive utilized to correct iron chlorosis and boost production. As international agricultural activity expands and agriculture is more intensive, demand for iron soil conditioners continues to grow, particularly among Latin American and Asian-Pacific nations where micronutrient deficiencies are more common.

In the pharmaceutical industry, this compound is used for the treatment of iron-deficiency anemia. While aging populations and rising nutritional deficiency rates increase the demand for pharma-grade products, the segment is expected to continue growing moderately. Its uses for pigment production, cement production, and as a feed additive for animals also continue to expand its base for use applications.

Despite being a developed economy for centuries, technological innovation in the production and recycling of the waste products formed during the process of manufacturing titanium dioxide are contributing to maximizing supply chain efficiency and pollution. As investment in agriculture and urban water supplies gains prominence among emerging economies, ferrous sulfate is likely to gain from long-term volume consumption and industry applicability.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.52 billion |

| Industry Value (2035F) | USD 3.46 billion |

| CAGR (2025 to 2035) | 3.2% |

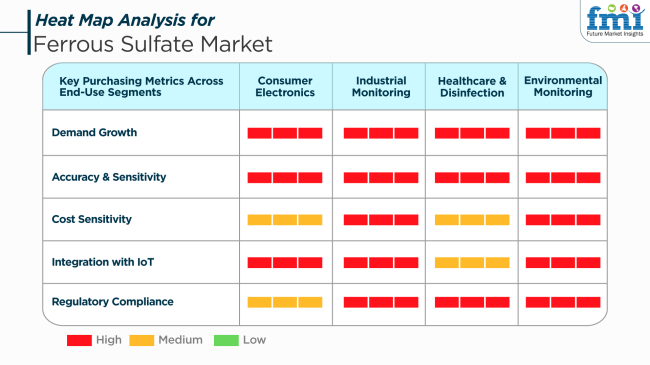

The end-user preference is diversified because of the wide range of uses of the chemical. Within consumer electronics, chemical processes are allied with ferrous sulfate cleaning routines in which precision and control are concerned. Its role in such use is indirect yet inseparable, particularly within factory settings.

Industrial monitoring systems use this compound mostly in effluent treatment plants, where high sensitivity and good conformity with environmental standards are required. These applications are typically associated with sustainability objectives, and cost sensitivity and operational reliability are thus equally important purchasing factors.

Key Purchasing Metrics Across End-Use Segments

Disinfection and health applications rely on the compound for both sterilization and therapeutic purposes. Tablet and liquid iron preparations have a pivotal role in the medical treatment of anemia, with the antimicrobial effect complementing sanitary facility routines. Concomitantly, environmental surveillance needs constant access and reliable action of the chemicals during water cleansing, further attesting to the necessity for regulatory compliance and process improvement to be adhered to rigorously.

Between the years 2020 and 2024, the industry grew because of the widespread applications of chemicals in water treatment, agriculture, and pharmaceuticals. It was employed in water treatment as a coagulant to remove impurities and as an agricultural soil amendment and micronutrient fertilizer.

The drug industry also created demand, using ferrous sulfate as an ingredient in iron tablets used to treat anemia.

From 2025 to 2035, there will be advancements in technology, and industry demands will keep fluctuating. The growing interest in clean water programs and sustainable agriculture will propel the demand for the compound. New applications, such as energy storage systems, may also open further possibilities. However, there might be challenges in terms of considering the environmental impacts and competition from other chemicals.

Comparative Market Shift Analysis: Ferrous Sulfate Market

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Water treatment, agriculture, pharmaceuticals | Sustainable agriculture, clean water projects, possible energy storage |

| Traditional production techniques | Establishment of environment-friendly and efficient production technologies |

| Water purification and soil fertilization demand | Focus on sustainability and the creation of new applications |

| The dominance of traditional markets in North America and Europe | High growth in Asia-Pacific and Latin America |

| Generic compounds | Investigation of high-purity and specialty formulations |

| First steps towards green practices | High emphasis on sustainable manufacturing and circular economy concepts |

The industry is stable but exposed to several risks regarding raw material availability and price sensitivity. Because the compound tends to be recovered as a byproduct of titanium dioxide production, fluctuations in TiO₂ production can directly affect its supply and price. This reliance leaves it open to exposure during downturns in the paints or pigments industry, which can create short-term shortages.

Regulatory and environmental factors also present risks, particularly where waste from production is involved and with handling practices. Tighter controls over effluent and air emissions would compel producers to upgrade their factories at a greater cost, increasing the cost of production. Unpredictable enforcement also creates barriers to access trade in areas of regulatory ambiguity.

Yet another significant threat is substitution by alternative micronutrient or water treatment chemicals in agro and environmental industries. With highly regulated countries or regions and high-end substitute products being provided, the compound may be replaced with higher efficiency or more soluble chelated or synthetic materials. Suppliers must prioritize proper costing, quality reliability, and sustainable sourcing practices in order to compete.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

| UK | 3.7% |

| France | 3.6% |

| Germany | 3.9% |

| Italy | 3.4% |

| South Korea | 4.3% |

| Japan | 3.5% |

| China | 5.0% |

| Australia | 3.3% |

| New Zealand | 3.1% |

The USA is poised to grow at a CAGR of 4.1% during the forecast period of 2025 to 2035. The drivers for growth include increasing demand for water treatment chemicals and increasing rates of iron deficiency anemia, which supports the demand for pharmaceutical-grade ferrous sulfate. Increasing wastewater treatment infrastructure in the municipal and industrial segments supports demand.

Companies such as Venator Materials, Kemira, and Crown Technology are at the forefront of process optimization and capacity building. The farm segment also shows mild demand, with ferrous sulfate being used to correct chlorosis of crops resulting from a lack of iron in alkaline soils.

The UK is expected to grow at a CAGR of 3.7% over the forecast period with increasing environmental awareness and strict regulations on water quality. An enhanced application in sewage treatment processes is seen, where the compound is used as a coagulant for phosphorus.

Producers such as ReAgent Chemicals and domestic multinational operations ship technical-grade and high-purity ferrous sulfate to multiple end-use purposes. End uses in agricultural use are always constant, that is, turf care and decontamination of soil in commercial turf management and sporting complexes.

France is likely to register a CAGR of 3.6% during 2025 to 2035, primarily on account of its application in water treatment plants and public sanitation systems. Ferrous sulfate continues to be in extensive application for odor control and sludge conditioning, which is beneficial to national environmental protection policies.

Industrial customers such as Kemira France and small-to-medium regional producers are focusing on efficient logistics and eco-friendly packaging. Agricultural use is level, although regulatory issues regarding heavy metals in fertilizers are driving a shift towards high-grade, low-contaminant products.

Germany is expected to develop at a CAGR of 3.9% during the forecast period. The growing focus of the industrial sector on green chemistry, combined with the regulatory requirements of wastewater treatment in the EU, is fueling demand for ferrous sulfate in flue gas desulfurization and effluent treatment.

Major players such as BASF and other chemical distributors are providing a balanced supply for the modernization of urban infrastructure. Pharmacy formula and nutrition fortification schemes generate further demand and also replenish the industry, primarily from health- and nutrition-aware communities.

Italy will grow at 3.4% CAGR from 2025 to 2035 on account of applications in agriculture and treatment of wastes. Ferrous sulfate is finding enhanced use in the ecologically sound management of olive orchards and vineyards, where a balance of micronutrients becomes critical for product quality and output.

Local distributors and local suppliers are providing small-scale farm cooperatives and municipal sanitation programs. Intelligent irrigation systems and fertilizer blends that are nutrient-efficient will witness investments creating incremental ferrous sulfate opportunities in the farm segment.

South Korea is expected to exhibit a CAGR of 4.3% throughout the forecast period. Urbanization is occurring at a very fast rate, and there is a growing need for high-performance water treatment solutions, which is giving a strong momentum. Ferrous sulfate is widely applied in the treatment of industrial effluents and chemical oxygen demand removal in wastewater.

Manufacturers such as OCI Company and other chemical manufacturers are enhancing the purity levels of products for pharmaceutical and food-grade applications. Government-led initiatives for environment recovery and recycling waste are also aiding in improving the use of ferrous sulfate.

Japan is expected to grow at a CAGR of 3.5% from 2025 to 2035. Advanced urban infrastructure and a highly developed pharmaceutical sector support stable demand for technical-grade and medicinal-grade ferrous sulfate. The compound is still a key ingredient in formulations for anemia treatment and dietary supplements.

Companies like Fuji Chemical Group and Nippon Chemical Industrial are focusing on better quality control and efficient manufacturing practices. Environmental application, particularly odor neutralization and sludge treatment, is also maintaining steady trends in city municipalities.

China is likely to lead with a CAGR of 5.0% over the next decade. Application of the compound in bulk water treatment plants, agri-micronutrient products, and industrial effluent systems is driving demand across different end-use industries. Urbanization and population growth are driving investments in clean water technologies.

Key players such as Hong Yield Chemical and Zouping County Runzi Chemical are increasing production and focusing on cost-effectiveness to cater to domestic and export industries. Industrial park development and agricultural modernization programs are making China a prominent global consumer and supplier of this compound.

Australia is estimated to grow with a CAGR of 3.3% during the forecast period from 2025 to 2035. Key applications for mining wastewater treatment, agricultural soil correction, and animal feed supplementation sustain stable performance. The compound is utilized increasingly in remote and arid regions where managing water quality becomes critical.

Chemical suppliers and distributors are reaching the market through localized cooperation, offering both specialty and bulk grades with easy access. Government-supported initiatives on sustainable agriculture, as well as water reuse systems, are also constructing the material's usability for industrial and agricultural applications.

New Zealand will grow at a CAGR of 3.1% throughout the forecast period. Special applications in municipal water treatment, livestock feed, and horticulture offset limited industrial base. The product is valued for its use in correcting iron deficiency in pasture and fruit production.

Chemical distributors serving agribusiness and local authorities have import-reliant supply chains. Emphasis on clean water initiatives and organic farming practices is likely to propel consistent, sustainable expansion of sales in the country.

Ferrous sulfate heptahydrate and ferrous sulfate monohydrate are key product types dictating the export market for ferrous sulfate in 2025. Ferrous sulfate heptahydrate, with a market share of 42%, is followed by ferrous sulfate monohydrate, with a share of 28%.

Ferrous sulfate heptahydrate (FeSO₄·7H₂O) is famous for its use in many applications like water treatment, agriculture, and medicinal purposes due to its high solubility and effectiveness as a source of iron and a coagulant. With the global trend of cities adopting phosphate removal technologies to comply with environmental regulations, the compound is becoming important in municipal wastewater treatment.

Companies like Rech Chemical Co. Ltd., Cleveland Industries, and Titan Chemical Corporation have added production facilities aimed at urban infrastructure development in the Asia-Pacific and Latin America regions. Titan Chemical supplies heptahydrate-grade compounds to large-scale fertilizer manufacturers in Brazil and Argentina, where they are used to rectify iron-deficient soils and enhance crop yields.

Rech Chemical exports further southeast to Asia and Africa, where its heptahydrate is to be included as a micronutrient in compound fertilizers. This product is useful for the enhancement of soil fertility and the induction of chlorophyll in plants. Meanwhile, Cleveland Industries provides industrial clients in North America with heptahydrate as a reducing agent and pigment base for various chemical processes.

The 28% share of the ferrous sulfate monohydrate (FeSO₄·H₂O) market is attributed to its higher concentration of elemental iron, thus making it a preferred product for feed, food, and pharmaceutical applications. It is utilized in livestock nutrition for hemoglobin formation and metabolic activities.

Due to the product's important roles for swine, poultry, and ruminants, global players DSM Nutritional Products and Nutreco put monohydrate in their feed premixes. In particular, DSM produces pharmaceutical and feed-grade ferrous sulfate monohydrates according to European Feed Additive regulations.

High-purity monohydrate variants are being manufactured by Jost Chemical Co. in America and Hunan Yide Chemical Co., Ltd. in China for use in products such as human iron supplements in the form of tablets, capsules, or effervescent powders. Such products have been gaining increased demand owing to the rise of iron-deficiency anemia awareness, especially for pregnant women and children in developing countries.

By form, granules/powder occupies 67.0% of the share, while liquid ferrous sulfate is found to have a share of 33.0%.

Granule or powdered ferrous sulfate is preferred due to its stability, packaging convenience, longer shelf life, and cost-effectiveness. It is widely used in agriculture. The major economies of India, China, and Brazil use the powdered form in the NPK fertilizer to enhance the micronutrient content.

Some of the major companies leading the manufacturing of the powdered form, specifically in the fertilizers and pigments markets, are Lomon Billions Group, Crown Technology, and Changsha Haolin Chemicals Co., Ltd. Crown Technology will ship products to several agricultural co-ops in the USA Midwest, where the granular form is used as turfgrass micronutrient on golf courses and parks.

In wastewater treatment, powdered form is also used for odor control and phosphate reduction. This allows easier handling and dosing in decentralized treatment systems because it is in solid form. In emerging economies, the powdered form is preferred as the costs of transportation are lower, and the methods of application are quite simple and basic.

Liquid form, although small in size, plays a key role in continuous treatment systems, especially in urban sewage and wastewater treatment plants. Its one-glance solubility makes it the best possible option for on-the-move use in dose automation. Significant companies in this area are Kemira Oyj, Solenis, and Chemtrade Logistics.

Kemira provides high-purity liquid ferrous sulfate to cities across Scandinavia and North America for use in tertiary wastewater treatment systems. In Singapore and the UAE, the liquid form is deployable in smart water infrastructure where real-time doses of chemicals are controlled against automated feedback loops.

A variety of large multinational producers of chemicals, customized agricultural companies, and local producers within various end-user applications characterize the industry. Major international players like Venator Materials, KRONOS Worldwide, and Merck KGaA occupy the market on top by having strong production capacity manufacturing ferrous sulfate for water treatment, pigments, and pharmaceutical applications. These firms also enjoy integrated supply chains with advanced production technologies, enabling consistency in the quality of output and compliance with regulations.

Firms such as Verdesian Life Sciences and Crown Technology have ventured into agriculture and nutrition from their contribution to soil amendments as well as animal feed supplements containing this compound. They have adopted sustainable formulations and research proprietary technologies that improve nutrient absorption and bioavailability of the nutrients in crops and livestock.

Other regional manufacturers like Guangxi Jintao Titanium and Chemland Group serve up economical solutions directed mostly to markets like those of industrial water treatment and pigment-related applications.

The investment in producing the recycled compound also increased as a result of initiatives dedicated to the circular economy. Innovations are being developed in the recovery of byproducts, such as titanium dioxide and steel production, in a bid to mitigate impacts further and add sustainability. Increasingly stringent regulations on industrial waste management attentively monitor firms that integrate eco-friendly production processes, thus creating a competitive edge.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Venator Materials PLC | 15-19% |

| KRONOS Worldwide, Inc. | 12-16% |

| Merck KGaA | 10-14% |

| Verdesian Life Sciences LLC | 8-12% |

| Crown Technology, Inc. | 6-10% |

| Others (combined) | 40-50% |

| Company Name | Key Offering and Activities |

|---|---|

| Venator Materials PLC | It produces the compound as a byproduct of titanium dioxide and supplies water treatment and pigment industries. |

| KRONOS Worldwide, Inc. | Manufactures high-purity compounds for industrial applications, focusing on sustainability. |

| Merck KGaA | Supplies pharmaceutical-grade chemicals for medical and laboratory use. |

| Verdesian Life Sciences LLC | Specializes in agricultural-grade chemicals for soil enhancement and crop nutrient absorption. |

| Crown Technology, Inc. | Provides industrial and feed-grade compounds for chemical, agricultural, and water treatment applications. |

Key Company Insights

Venator Materials PLC (15-19%)

A leading producer of compounds derived from titanium dioxide production, emphasizing sustainable byproduct utilization and global supply chain efficiency.

KRONOS Worldwide, Inc. (12-16%)

Focuses on high-purity solutions with a commitment to sustainable sourcing and closed-loop production systems.

Merck KGaA (10-14%)

Supplies pharmaceutical and laboratory-grade ferrous sulfate, leveraging strong regulatory compliance and innovation in chemical refinement.

Verdesian Life Sciences LLC (8-12%)

Pioneers nutrient efficiency solutions in agriculture, with formulations designed to enhance soil fertility and plant health.

Crown Technology, Inc. (6-10%)

Offers customized solutions for feed, industrial, and water treatment sectors, with a focus on supply chain optimization.

Other Key Players

The industry is segmented into Ferrous Sulfate Heptahydrate, Ferrous Sulfate Monohydrate, Ferrous Sulfate Tetrahydrate, Ferrous Sulfate Anhydrous, and Others.

The segmentation is into Granule/Powder and Liquid forms.

The segmentation is into Pharmaceuticals, Water Treatment, Pigments, Construction, Animal Feed, Chemical Production, Agrochemicals, Food & Beverages, and Others.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Japan, and the Middle East & Africa.

The valuation is estimated to be worth USD 2.52 billion in 2025.

Sales are projected to grow steadily, reaching USD 3.46 billion by 2035, driven by rising demand in agriculture, water treatment, and pharmaceutical applications.

China is expected to see a CAGR of 5.0%, supported by increased usage of ferrous sulfate in fertilizers and industrial processes.

Ferrous sulfate heptahydrate leads the segment primarily due to its wide application in soil conditioning, animal feed, and water purification.

Major players include Venator Materials PLC, KRONOS Worldwide, Inc., Verdesian Life Sciences LLC, Crown Technology, Inc., Guangxi Jintao Titanium Co. Ltd., Chemland Group, Coogee Chemicals Pty Ltd, Merck KGaA, Pencco, Inc., and Röchling Group.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ferrous Fumarate Market Size and Share Forecast Outlook 2025 to 2035

Ferrous Gluconate Market Size and Share Forecast Outlook 2025 to 2035

Sulfate-Free Shampoos Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Persulfates Market Size and Share Forecast Outlook 2025 to 2035

Crude Sulfate Turpentine Market Analysis by Product Type, Source, Processing Method, Application, and Region through 2035

Nickel Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Ferric Sulfate Market Growth - Trends & Forecast 2025 to 2035

Barium Sulfate Market Analysis - Size, Share & Forecast 2025 to 2035

Ferric Sulfate & Polyferric Sulfate Market 2024-2034

Calcium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Diethyl Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Sulfate Food Grade Market Report - Industry Insights 2025 to 2035

Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

UK Ferric Sulfate Market Trends – Size, Share & Industry Growth 2025-2035

USA Ferric Sulfate Market Analysis – Demand, Growth & Forecast 2025-2035

Polyferric Sulfate Market

Ammonium Thiosulfate Market – Size, Share, and Forecast 2025 to 2035

Japan Ferric Sulfate Market Report – Demand, Trends & Industry Forecast 2025-2035

ASEAN Ferric Sulfate Market Trends – Size, Share & Growth 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA