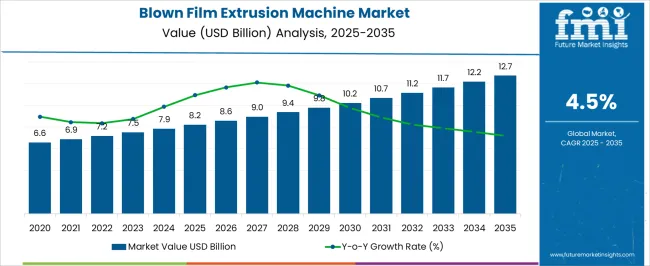

The Blown Film Extrusion Machine Market is estimated to be valued at USD 8.2 billion in 2025 and is projected to reach USD 12.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Blown Film Extrusion Machine Market Estimated Value in (2025 E) | USD 8.2 billion |

| Blown Film Extrusion Machine Market Forecast Value in (2035 F) | USD 12.7 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The blown film extrusion machine market is experiencing steady growth, propelled by the increasing demand for high-speed film production and flexible packaging solutions across industries. Rising consumer preference for lightweight, durable, and sustainable packaging has contributed to the adoption of advanced extrusion technologies. Automation capabilities, energy-efficient systems, and precision control features are being prioritized by manufacturers to enhance production throughput and reduce operational downtime.

Market growth is further supported by the rising consumption of packaged goods and expansion of food processing and pharmaceutical sectors in emerging economies. Environmental concerns have also prompted the use of recyclable and thinner film materials, driving innovations in material formulation and extrusion processes.

Additionally, the shift toward smart manufacturing and integration of IoT-enabled machinery is reshaping operational workflows Over the coming years, the industry is expected to benefit from investments in multilayer extrusion technologies and demand for high-barrier films suitable for specialty packaging, leading to increased deployment of intelligent and high-performance extrusion systems.

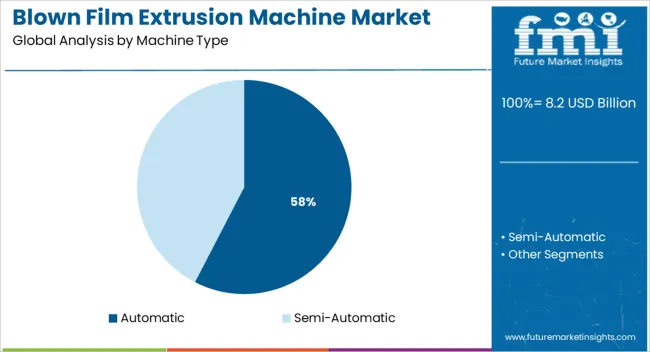

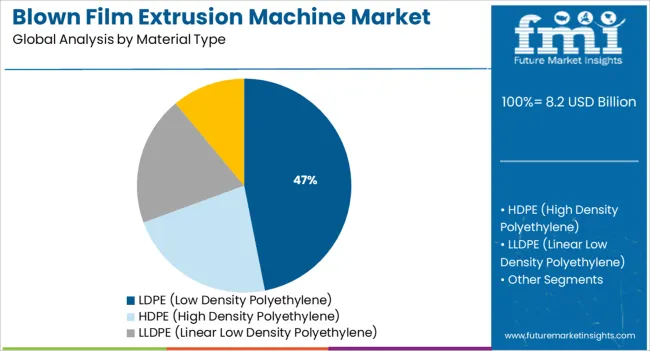

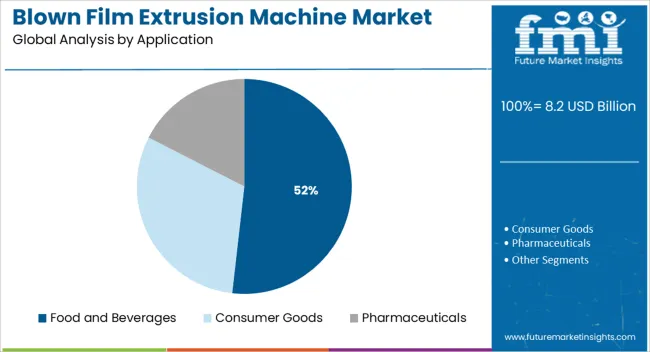

The market is segmented by Machine Type, Material Type, and Application and region. By Machine Type, the market is divided into Automatic and Semi-Automatic. In terms of Material Type, the market is classified into LDPE (Low Density Polyethylene), HDPE (High Density Polyethylene), LLDPE (Linear Low Density Polyethylene), and Polyamides & EVOH. Based on Application, the market is segmented into Food and Beverages, Consumer Goods, and Pharmaceuticals. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic segment is expected to account for 57.6% of the revenue share in the blown film extrusion machine market in 2025, making it the dominant machine type. The segment's leadership is being influenced by the demand for high-output, precision-controlled, and labor-efficient production lines. Automatic machines have been widely adopted due to their ability to operate continuously with minimal human intervention, improving both productivity and consistency in film quality.

Integration of real-time monitoring, auto-thickness control, and automated die adjustments has enhanced operational reliability and reduced film wastage. These machines also support advanced control systems that ensure uniformity in film gauge, temperature regulation, and resin blending.

The segment's growth has been further accelerated by the rising emphasis on reducing labor dependency and increasing efficiency in high-volume manufacturing environments As packaging requirements become more complex and customer expectations for precision grow, the role of automatic machines is expected to expand significantly within modern extrusion facilities.

LDPE is projected to hold 46.9% of the revenue share in the blown film extrusion machine market in 2025, emerging as the most widely used material type. The dominance of this segment is being driven by the widespread use of LDPE in packaging applications requiring clarity, flexibility, and impact resistance. Its compatibility with single and multilayer film structures has made it an ideal choice for extrusion processes.

LDPE's excellent sealing properties, low processing temperature requirements, and adaptability to various extrusion conditions have contributed to its continued use in food packaging, medical supplies, and consumer goods. Moreover, the recyclability of LDPE and its stable thermal behavior during processing have strengthened its appeal in sustainable manufacturing practices.

As regulations favor the reduction of material waste and environmental impact, LDPE’s role in producing lightweight, thin-gauge films is becoming more prominent These characteristics are making it a preferred resin type for manufacturers looking to balance performance with sustainability.

The food and beverages segment is anticipated to hold 51.8% of the revenue share in the blown film extrusion machine market in 2025, establishing itself as the largest application area. Growth in this segment is being driven by the rising global demand for packaged food, convenience meals, and extended shelf-life products.

Flexible films produced using blown film extrusion machines offer essential properties such as moisture resistance, strength, and barrier protection, which are critical for preserving food freshness and safety. The increasing need for multilayer packaging films that can incorporate oxygen barriers and antimicrobial agents has led to the adoption of advanced extrusion technologies within this segment.

Blown film extrusion systems tailored for food packaging are being equipped with automation features to enable faster changeovers, consistent output, and compliance with food-grade processing standards As food manufacturers continue to seek efficiency, product protection, and differentiation in packaging, the demand for extrusion machines in this sector is expected to rise further.

Packaging films market is growing in leaps & bounds and is anticipated to witness a strong development over the forecast period. The rising demand of packaging films has led to a surge in the blown film extrusion machine market. The blown film extrusion machine offers great versatility to the manufacturers as a variety of films can be extruded from a single machine.

Packaging film manufacturers are offering products with unique and beneficial features which are fulfilled by blown film extrusion machine as it provides the capability of biaxial orientation, which allows uniformity in all mechanical properties. Also, a flat, as well as gusseted tubing, can be formed in a single operation which in turn maximizes the profitability margins of the manufacturers.

The rising demand for packaging films from the food & beverages market is directly proportional to the growth of the global blown film extrusion machine market. The Blown film extrusion machine caters to both barrier as well as non-barrier packaging applications. Moreover, blown film extrusion machine also facilitates the processing of a wide range of polymers which further propels the growth of the global blown film extrusion machine market.

Blown film extrusion machines are highly efficient as compared to their counterparts which is expected to spur the demand of the global market. Blown film extrusion machines cannot sustain high temperatures and also have cooling issues which is expected to hamper the growth of the blown film extrusion machine market share.

Also, the initial cost of installation of the blown film extrusion machines is high which is hampering the growth because the local manufacturers witness a lack of financial capabilities. Blown film extrusion machine market is expected to grow on the backdrop of growing food & beverages end use sector is expected to offer remunerative opportunities.

On the basis of geography, the global blown film extrusion machine market is segmented into North America, Europe, Asia Pacific, Middle East & Africa (MEA), and Latin America. North America and Asia Pacific are expected to collectively dominate the market throughout the forecast period.

However, many packaging film suppliers and converter companies are investing in Asia Pacific to tap the growing demand. Furthermore, Asia Pacific is anticipated to witness a steady growth in the blown film extrusion machine market over the forecast period primarily driven by industrialization in economies like China and Japan.

In Middle East & Africa, industrialization is comparatively deprived due to which the blown film extrusion machine market is expected to witness sluggish growth in the region. Economic downturns in the Latin American region represents low opportunities of growth for the blown film extrusion machine market.

Some of the key players of the global blown film extrusion machine market are Plasco Engineering Inc., Ye I Machinery Factory Co. Ltd., Windsor Machines Ltd., Polystar Machinery Co. Ltd., Karlville Development LLC., Chyi Yang Industrial Co., Ltd., Kung Hsing Plastic Machinery Co. Ltd., Fong Kee International Machinery Co. Ltd., Friul Filiere SpA, Alpha Marathon Technologies Group, Brampton Engineering Inc.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global blown film extrusion machine market is estimated to be valued at USD 8.2 billion in 2025.

The market size for the blown film extrusion machine market is projected to reach USD 12.7 billion by 2035.

The blown film extrusion machine market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in blown film extrusion machine market are automatic and semi-automatic.

In terms of material type, ldpe (low density polyethylene) segment to command 46.9% share in the blown film extrusion machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Players & Market Share in Blown Film Extrusion Machine Market

Blown oils Market Size and Share Forecast Outlook 2025 to 2035

Blown Stretch Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Melt-Blown Polypropylene Filters Market Size and Share Forecast Outlook 2025 to 2035

Film Wrapped Wire Market Size and Share Forecast Outlook 2025 to 2035

Film-Insulated Wire Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Filmic Tapes Market

PE Film Market Insights – Growth & Forecast 2024-2034

VCI Film Market Forecast and Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

PSA Film Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

PBS Film Market Trends & Industry Growth Forecast 2024-2034

Microfilm Reader Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA