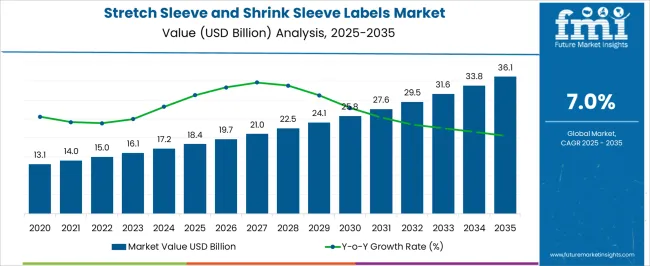

The stretch sleeve and shrink sleeve labels market is estimated to be valued at USD 18.4 billion in 2025 and is projected to reach USD 36.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

The stretch sleeve and shrink sleeve labels market is projected to grow from USD 18.4 billion in 2025 to USD 36.1 billion in 2035, reflecting a CAGR of 7.0%. This growth represents an absolute dollar opportunity of USD 17.7 billion over the decade. Annual increments show consistent expansion, starting from USD 18.4 billion in 2025, reaching USD 21.0 billion in 2028, USD 25.8 billion in 2031, and progressing to USD 33.8 billion by 2034. The steady upward trend highlights strong market potential, providing suppliers and manufacturers with a predictable revenue trajectory and opportunities to expand production and distribution to meet rising demand.

The absolute dollar opportunity emphasizes the growing value of the stretch sleeve and shrink sleeve labels market over the next ten years. Incremental growth from USD 18.4 billion in 2025 to USD 36.1 billion in 2035 underscores a cumulative increase of USD 17.7 billion. Key years such as USD 22.5 billion in 2029 and USD 29.5 billion in 2033 indicate periods of accelerated adoption. This trend offers stakeholders opportunities to enhance product lines, optimize inventory management, and align investments with predictable market growth, ensuring they capture a significant portion of the expanding market value.

| Metric | Value |

|---|---|

| Stretch Sleeve and Shrink Sleeve Labels Market Estimated Value in (2025 E) | USD 18.4 billion |

| Stretch Sleeve and Shrink Sleeve Labels Market Forecast Value in (2035 F) | USD 36.1 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The stretch sleeve and shrink sleeve labels market is part of the broader labeling and packaging materials market, which includes pressure-sensitive labels, flexible packaging, cartons, and printed films. In 2025, stretch and shrink sleeve labels account for roughly 22% of the total labeling and packaging materials market, highlighting their significant contribution. With the parent market projected to grow from approximately USD 83.6 billion in 2025 to USD 137.0 billion in 2035, the sleeve labels segment’s growth from USD 18.4 billion in 2025 to USD 36.1 billion in 2035 at a CAGR of 7.0% represents a substantial share of the total market expansion, contributing about 20% of the incremental growth in the parent market.

Within the parent market, pressure-sensitive labels hold around 30% of total value, flexible packaging accounts for 28%, and cartons contribute 20%. The stretch and shrink sleeve labels segment, with a CAGR of 7.0%, demonstrates faster growth compared to several other segments, emphasizing its rising importance in packaging applications. Incremental growth of USD 17.7 billion over the decade represents roughly 13% of total parent market growth. This consistent expansion provides manufacturers and suppliers with opportunities to increase production, optimize distribution, and capture a larger share of the growing global labeling and packaging materials market.

The stretch sleeve and shrink sleeve labels market is experiencing steady growth, driven by the rising demand for visually impactful and functional packaging solutions across food and beverages, personal care, household products, and industrial goods. Brand owners are increasingly adopting these labels to achieve 360-degree product coverage, high-quality graphics, and the ability to incorporate innovative shapes and contours without compromising label integrity.

Advancements in printing technologies and embellishing techniques are enabling greater customization, premium finishes, and enhanced shelf appeal, which are influencing consumer purchasing decisions. Sustainability considerations are also shaping market developments, with growing adoption of recyclable polymer films and eco-friendly inks to comply with environmental regulations and corporate responsibility goals.

The ability of sleeve labels to support high-speed application processes while maintaining durability during distribution is further enhancing their appeal for manufacturers As global competition in consumer goods intensifies and the demand for product differentiation rises, the market is positioned for continued expansion, supported by technological innovation and the increasing premiumization of packaging solutions.

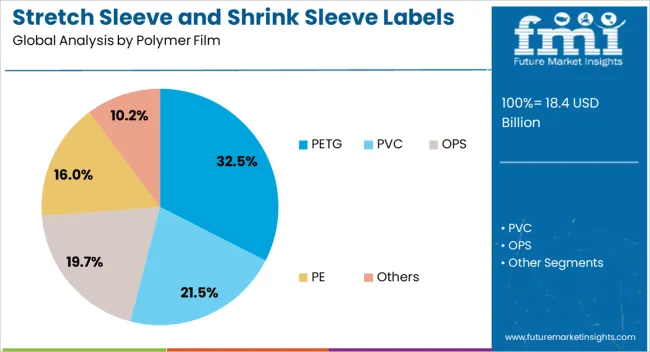

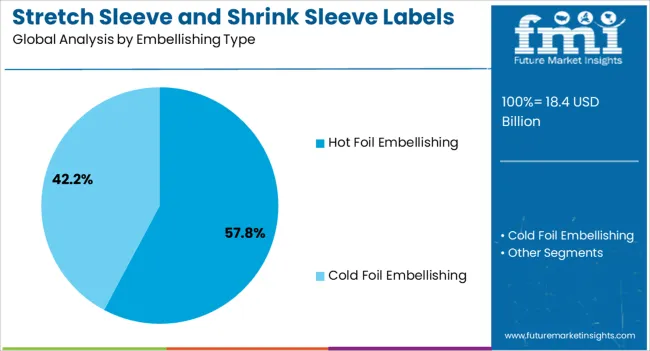

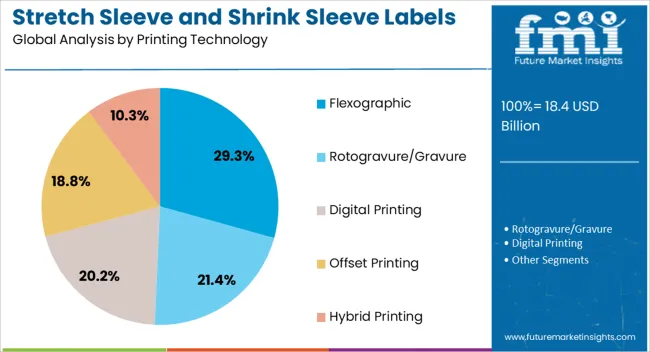

The stretch sleeve and shrink sleeve labels market is segmented by polymer film, embellishing type, printing technology, application, and geographic regions. By polymer film, stretch sleeve and shrink sleeve labels market is divided into PETG, PVC, OPS, PE, and others. In terms of embellishing type, stretch sleeve and shrink sleeve labels market is classified into hot foil embellishing and cold foil embellishing. Based on printing technology, stretch sleeve and shrink sleeve labels market is segmented into flexographic, rotogravure/gravure, digital printing, offset printing, and hybrid printing. By application, stretch sleeve and shrink sleeve labels market is segmented into food, beauty & personal care, healthcare, soft drinks, wine & spirit, and others. Regionally, the stretch sleeve and shrink sleeve labels industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The PETG polymer film segment is projected to account for 32.5% of the stretch sleeve and shrink sleeve labels market revenue share in 2025, positioning it as the leading polymer type. Its dominance is being driven by its excellent shrinkage properties, high clarity, and superior printability, which allow for vibrant graphics and precise brand representation. PETG films offer strong dimensional stability during the shrinking process, ensuring a wrinkle-free and form-fitting application on complex container shapes.

Their compatibility with various printing methods, including flexographic, digital, and gravure, enhances design flexibility for brand owners. In addition, PETG films demonstrate high resistance to moisture, chemicals, and abrasion, making them suitable for both premium and mass-market applications.

As sustainability gains importance, the recyclability and lightweight nature of PETG films are aligning with brand commitments to reduce environmental impact With increasing use across industries seeking premium visual appeal and performance reliability, PETG is expected to maintain its leadership within the polymer category.

The hot foil embellishing type segment is anticipated to represent 57.8% of the stretch sleeve and shrink sleeve labels market revenue share in 2025, establishing itself as the leading embellishing technique. Its market dominance is supported by the premium visual effects it offers, including metallic finishes, holographic patterns, and reflective surfaces that enhance product shelf presence. Hot foil stamping allows brand owners to achieve high-end aesthetics that convey quality and exclusivity, which is increasingly valued in competitive retail environments.

This technique also offers durability, as the foiled designs are resistant to fading, moisture, and abrasion, maintaining their appeal throughout the product lifecycle. The versatility of hot foil embellishing enables its application on various polymer substrates, including PETG, PVC, and OPS films, without compromising label performance.

Rising consumer preference for visually distinctive packaging and the growing adoption of premium packaging formats in beverages, cosmetics, and luxury goods are driving demand for this segment Continuous advancements in foil application machinery and eco-friendly foiling materials are expected to further enhance its adoption.

The flexographic printing technology segment is expected to hold 29.3% of the stretch sleeve and shrink sleeve labels market revenue share in 2025, making it a leading printing method. This dominance is attributed to its high-speed production capabilities, cost-effectiveness for large-volume runs, and adaptability to a wide range of inks and substrates. Flexographic printing offers excellent color vibrancy and consistency, which is essential for maintaining brand identity across multiple product lines.

Advancements in plate-making technology have improved print resolution, enabling sharper graphics and more intricate designs that meet the demands of modern packaging aesthetics. The ability to use water-based and UV-curable inks aligns flexographic printing with sustainability goals, reducing environmental impact while maintaining high production efficiency.

Its versatility in accommodating various polymer films, including PETG and PVC, further supports its widespread adoption As manufacturers prioritize efficiency, print quality, and cost optimization, flexographic printing is expected to remain a preferred choice for sleeve label production in both established and emerging markets.

The stretch sleeve and shrink sleeve labels market is expanding due to growing demand for premium, tamper-evident, and full-body labeling solutions in food, beverage, and personal care products. North America and Europe lead adoption with high-quality, durable, and visually appealing labels supported by advanced printing technologies. Asia-Pacific shows rapid growth driven by packaging modernization, e-commerce growth, and brand differentiation needs. Manufacturers differentiate through material strength, print quality, and application flexibility. Regional contrasts in labeling standards, consumer preferences, and packaging trends influence adoption and market competitiveness globally.

Adoption of stretch and shrink sleeve labels is primarily driven by the beverage and fast-moving consumer goods (FMCG) sectors. North America and Europe focus on high-quality, full-body labels for premium products, ensuring tamper evidence, shelf appeal, and brand visibility. Asia-Pacific markets emphasize cost-effective, durable labels suitable for large-scale production of bottled beverages, sauces, and personal care items. Differences in package shapes, consumer expectations, and marketing priorities affect material selection, adhesive performance, and print resolution. Leading suppliers provide high-performance, shrinkable films with advanced graphics and UV resistance, while regional manufacturers offer practical, scalable solutions. Demand variations between premium branding and high-volume, cost-sensitive production directly shape adoption, product design, and competitive positioning globally.

Material quality and durability are critical factors for stretch and shrink sleeve label adoption. North America and Europe emphasize labels resistant to moisture, abrasion, and temperature variations, ensuring consistent appearance during transport, storage, and retail display. Asia-Pacific markets often prioritize affordable, flexible films that balance durability with cost efficiency for high-volume production. Differences in substrate strength, shrink properties, and barrier performance influence label application, printing quality, and lifecycle performance. Leading suppliers develop films with superior shrink ratio, clarity, and adhesion for complex containers, while regional manufacturers provide reliable, cost-effective alternatives. Material and durability contrasts shape adoption, operational reliability, and competitiveness across global labeling markets.

Advancements in printing technology and label customization significantly enhance market adoption. North America and Europe focus on digitally printed labels, high-resolution graphics, and variable data printing to support branding, product differentiation, and regulatory compliance. Asia-Pacific markets adopt high-speed flexographic and gravure printing for cost-efficient large-scale production, with limited customization. Differences in printing capabilities, brand expectations, and production volume influence label aesthetics, lead times, and market adoption. Leading suppliers integrate high-clarity films, UV-resistant inks, and anti-counterfeit features, while regional players prioritize scalable, practical solutions. Printing technology contrasts shape adoption, brand appeal, and competitive differentiation globally.

Regulatory standards and sustainability concerns significantly influence the adoption of stretch and shrink sleeve labels. North America and Europe enforce strict labeling requirements, including ingredient declaration, tamper-evidence, and recyclability. Asia-Pacific markets show varied enforcement levels, with emerging regulations encouraging environmentally friendly films. Differences in recyclability requirements, material compliance, and environmental regulations influence substrate selection, adhesive formulation, and production processes. Leading suppliers invest in recyclable, biodegradable, and compliant labels, while regional manufacturers focus on affordable, locally compliant alternatives. Compliance and sustainability contrasts shape adoption, brand reputation, and competitiveness globally.

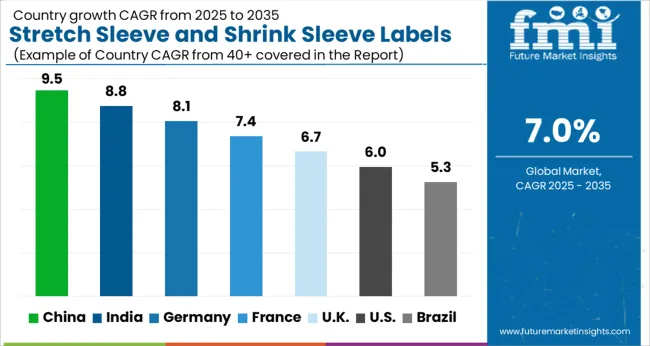

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global stretch sleeve and shrink sleeve labels market is projected to grow at a 7.0% CAGR through 2035, driven by demand in packaging, branding, and labeling applications across food, beverage, and consumer goods. Among BRICS nations, China led with 9.5% growth as large-scale manufacturing and deployment across packaging lines were undertaken, while India at 8.8% expanded production and adoption to support growing commercial and industrial labeling requirements. In the OECD region, Germany at 8.1% maintained steady integration under strict regulatory and quality standards, while the United Kingdom at 6.7% implemented these labeling solutions across commercial and retail supply chains. The USA, growing at 6.0%, advanced deployment in food, beverage, and consumer goods packaging while complying with federal and state-level labeling regulations. This report includes insights on 40+ countries; the top countries are shown here for reference.

The stretch sleeve and shrink sleeve labels market in China is projected to grow at a CAGR of 9.5%, driven by rising demand from beverage, food, and personal care packaging sectors. Adoption is being encouraged by labels that offer high clarity, durability, and excellent printability. Manufacturers are being urged to supply cost effective, visually appealing, and customizable solutions. Distribution through packaging suppliers, retail brands, and industrial partners is being strengthened. Research in material efficiency, label adhesion, and shrink performance is being conducted. Increasing consumption of packaged beverages, cosmetic products, and convenience foods are considered key factors driving the stretch sleeve and shrink sleeve labels market in China.

In India, the stretch sleeve and shrink sleeve labels market is expected to grow at a CAGR of 8.8%, supported by demand in beverages, personal care, and food packaging. Emphasis is being placed on labels that provide strong adhesion, high clarity, and design flexibility. Local manufacturers are being encouraged to enhance production capabilities and offer innovative printing solutions. Distribution through packaging companies, industrial suppliers, and retail brands is being expanded. Awareness campaigns highlighting visual appeal and branding benefits are being promoted. Rapid growth of packaged beverages, cosmetics, and processed foods are recognized as primary drivers of the stretch sleeve and shrink sleeve labels market in India.

Germany is witnessing steady growth in the stretch sleeve and shrink sleeve labels market at a CAGR of 8.1%, driven by demand from food, beverage, and cosmetic industries. Adoption is being encouraged by labels that ensure durability, print quality, and environmental compliance. Manufacturers are being urged to provide advanced, recyclable, and high performance solutions. Distribution through industrial suppliers, packaging companies, and retail brands is being optimized. Research in adhesive strength, shrink accuracy, and print resolution is being pursued. Increasing packaged food consumption, beverage sales, and cosmetic product launches are considered key factors driving the stretch sleeve and shrink sleeve labels market in Germany.

The stretch sleeve and shrink sleeve labels market in the United Kingdom is projected to grow at a CAGR of 6.7%, supported by demand from retail beverages, personal care, and packaged food. Adoption is being emphasized for labels that provide visual appeal, durability, and ease of application. Manufacturers are being encouraged to supply reliable, high clarity, and environmentally friendly solutions. Distribution through packaging suppliers, retail chains, and industrial partners is being strengthened. Demonstrations and campaigns promoting effective labeling and product differentiation are being conducted. Growth in packaged beverages, cosmetic items, and convenience foods are recognized as major contributors to the stretch sleeve and shrink sleeve labels market in the United Kingdom.

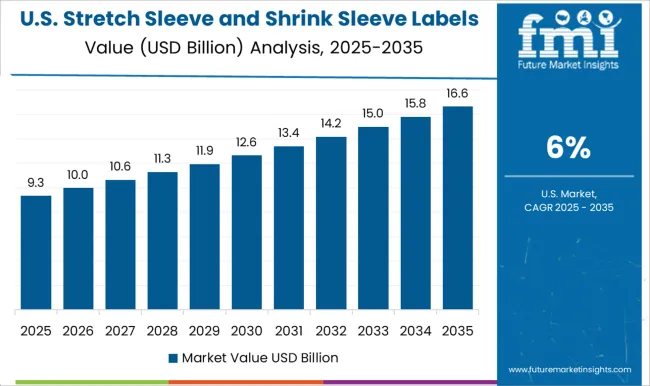

The stretch sleeve and shrink sleeve labels market in the United States is projected to grow at a CAGR of 6.0%, driven by demand in food, beverage, and personal care packaging industries. Adoption is being encouraged by labels that offer durability, print quality, and shrink accuracy for various packaging formats. Manufacturers are being urged to develop advanced, cost effective, and visually appealing products. Distribution through packaging suppliers, retail brands, and industrial partners is being maintained. Research in material strength, shrink consistency, and high resolution printing is being pursued. Expanding beverage and cosmetic sectors, packaged foods, and branding requirements are considered key drivers of the stretch sleeve and shrink sleeve labels market in the United States.

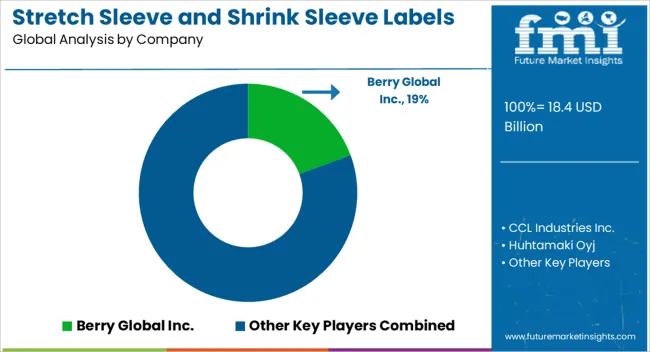

The stretch sleeve and shrink sleeve labels market is shaped by several leading suppliers who have established themselves as key players through innovation, global reach, and specialized product offerings. Among the most prominent companies in this market are Berry Global Inc., CCL Industries Inc., Huhtamaki Oyj, Klöckner Pentaplast, Amcor PLC, Fuji Seal International, and Taghleef Industries. These suppliers cater to a wide range of industries including food and beverage, personal care, pharmaceuticals, household products, and consumer goods. Their label solutions are designed to enhance packaging aesthetics, improve brand visibility, and provide functional benefits such as tamper-evidence and protection against environmental factors.

Market growth has been significantly driven by rising consumer demand for visually appealing, sustainable, and flexible packaging. Companies such as Berry Global Inc., CCL Industries Inc., and Huhtamaki Oyj have focused heavily on developing eco-friendly label materials that balance recyclability with durability, ensuring high clarity, strong adhesion, and resistance to wear and tear. Klöckner Pentaplast, Amcor PLC, and Fuji Seal International have distinguished themselves through advanced printing technologies that allow vibrant graphics, unique textures, and customization options for different container shapes. These innovations allow brands to differentiate themselves on the shelf, enhancing consumer engagement and loyalty. In addition to sustainability and aesthetics, technological innovation remains a critical factor in maintaining market leadership.

Taghleef Industries and other market players invest in research and development to produce stretch and shrink sleeve materials that can withstand high temperatures, complex container geometries, and various processing conditions, ensuring consistent performance across different applications. The adoption of cutting-edge manufacturing processes, combined with global distribution networks, allows these suppliers to meet growing demands in emerging and established markets.

Furthermore, collaborations with end-use industries and ongoing improvements in material science, printing, and labeling techniques reinforce the market positions of these companies. Their ability to balance quality, environmental considerations, and consumer preferences has positioned them as leaders in the stretch sleeve and shrink sleeve labels market. As global demand for innovative, sustainable, and visually appealing packaging solutions continues to rise, these suppliers are expected to play a pivotal role in shaping the future of the industry, ensuring long-term growth and competitiveness.

| Items | Values |

|---|---|

| Quantitative Units | USD 18.4 billion |

| Polymer Film | PETG, PVC, OPS, PE, and Others |

| Embellishing Type | Hot Foil Embellishing and Cold Foil Embellishing |

| Printing Technology | Flexographic, Rotogravure/Gravure, Digital Printing, Offset Printing, and Hybrid Printing |

| Application | Food, Beauty & Personal care, Healthcare, Soft Drinks, Wine & Spirit, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Berry Global Inc., CCL Industries Inc., Huhtamaki Oyj, Klöckner Pentaplast, Amcor PLC, Fuji Seal International, and Taghleef Industries |

| Additional Attributes | Dollar sales vary by label type, including shrink sleeves, stretch sleeves, and full-body wraps; by material, spanning PET, PVC, OPS, and PLA; by application, such as beverages, personal care, food products, and household chemicals; by end-use, covering FMCG companies, packaging converters, and retail brands; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by branding needs, sustainability trends, and advanced labeling technologies. |

The global stretch sleeve and shrink sleeve labels market is estimated to be valued at USD 18.4 billion in 2025.

The market size for the stretch sleeve and shrink sleeve labels market is projected to reach USD 36.1 billion by 2035.

The stretch sleeve and shrink sleeve labels market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in stretch sleeve and shrink sleeve labels market are petg, pvc, ops, pe and others.

In terms of embellishing type, hot foil embellishing segment to command 57.8% share in the stretch sleeve and shrink sleeve labels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stretch Film Industry Analysis in DACH Size and Share Forecast Outlook 2025 to 2035

Stretch Film Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Stretch Mark Prevention Creams Market Size and Share Forecast Outlook 2025 to 2035

Stretch Marks Treatment Market Size and Share Forecast Outlook 2025 to 2035

Stretcher Accessories Market Size and Share Forecast Outlook 2025 to 2035

Stretch Film Packs Market Insights on Type, Product, Application, Industry, and Region - 2025 to 2035

Stretch Films Market Outlook - Size, Demand & Industry Trends 2025 to 2035

Stretch Mark Removal Products Market Insights - Growth & Forecast 2025 to 2035

Stretch Hood Films Market Analysis by Up to 50 microns, 50-100 microns, 100-150 microns, 150 microns & above Through 2035

Stretchable Electronics Market Trends - Growth & Forecast 2025 to 2035

Stretch Wrapper Market Growth - Demand & Forecast 2025 to 2035

Stretch Blow Molding Machines Market Segmentation based on Technology Type, Orientation Type, End Use, and Region: A Forecast for 2025 and 2035

Stretchable Conductive Material Analysis by Material, Fillers, Stretching Mechanism, Fabrication, Function, Application, End-User and Region - Forecast for 2025 to 2035

Market Share Insights of Leading Stretch Blow Molding Machines Providers

Market Positioning & Share in the Stretch Film Industry

Stretch Hood Pallet Wrapping Market

Stretch and Shrink Films Market Size and Share Forecast Outlook 2025 to 2035

Stretchable and Conformal Electronics Market

Stretch Sleeve Label Market Insights – Growth & Demand 2024-2034

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA