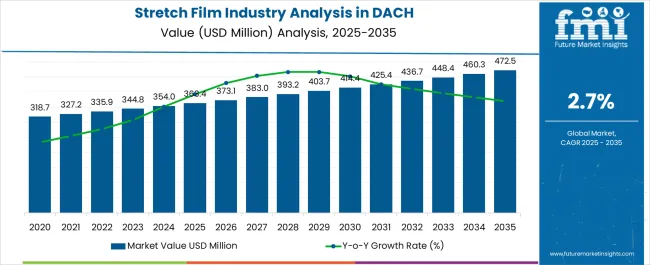

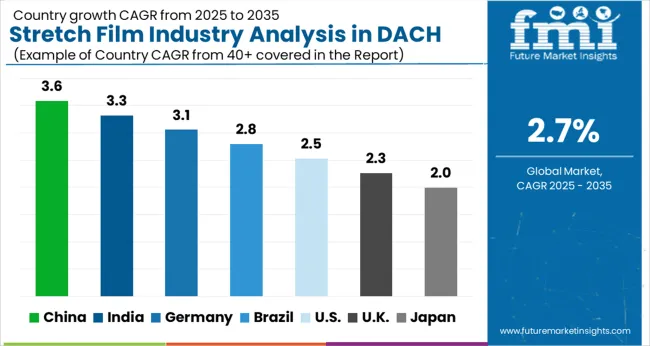

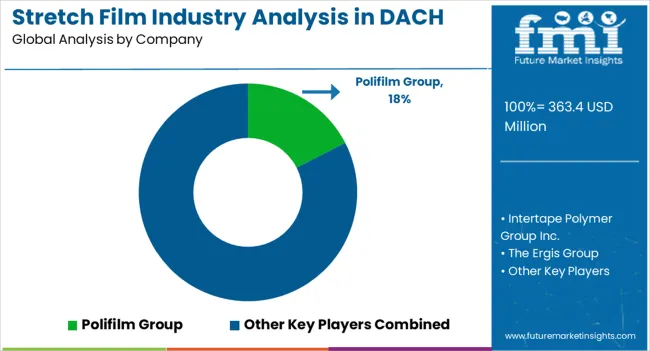

The Stretch Film Industry Analysis in DACH is estimated to be valued at USD 363.4 million in 2025 and is projected to reach USD 472.5 million by 2035, registering a compound annual growth rate (CAGR) of 2.7% over the forecast period.

| Metric | Value |

|---|---|

| Stretch Film Industry Analysis in DACH Estimated Value in (2025 E) | USD 363.4 million |

| Stretch Film Industry Analysis in DACH Forecast Value in (2035 F) | USD 472.5 million |

| Forecast CAGR (2025 to 2035) | 2.7% |

The stretch film industry in the DACH region is experiencing robust growth. Increasing demand for efficient packaging solutions, rising e-commerce activities, and stringent regulatory requirements for product protection are driving market expansion. Current dynamics are shaped by innovations in material technology, optimization of manufacturing processes, and heightened focus on sustainability and recyclability.

The industry is benefitting from the adoption of high-performance films that provide superior load stability and reduce material usage. Future outlook is underpinned by continued industrialization, growth in the food and beverage sector, and rising logistics and warehouse operations across the region. Strategic investments in research and development, coupled with improvements in production efficiency and cost management, are expected to strengthen competitive positioning.

Growth rationale is based on the ability of market participants to deliver durable, lightweight, and eco-friendly films Increasing awareness regarding supply chain efficiency, coupled with advancements in distribution networks, is anticipated to sustain market expansion and ensure broader penetration across industrial and commercial end-use segments.

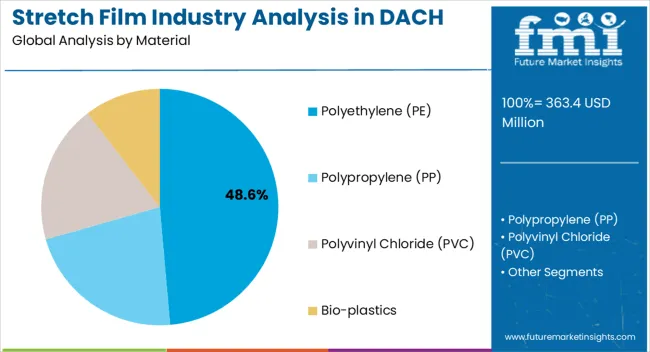

The polyethylene (PE) segment, holding 48.60% of the material category, has been leading due to its favorable mechanical properties, high clarity, and cost-effectiveness. Adoption has been driven by widespread applicability in packaging, enhanced stretchability, and compatibility with automated wrapping equipment. Consistent supply of high-quality PE resin and advancements in extrusion technology have reinforced market confidence.

Sustainability initiatives, including recycling and reduced material thickness, have supported continued usage without compromising performance. Demand stability has been maintained through integration into both industrial and retail packaging processes.

Technological enhancements in co-extrusion and multilayer films have further improved load retention and puncture resistance Strategic partnerships with resin suppliers and continuous product development are expected to maintain the segment’s market share and strengthen its leadership position within the stretch film material landscape.

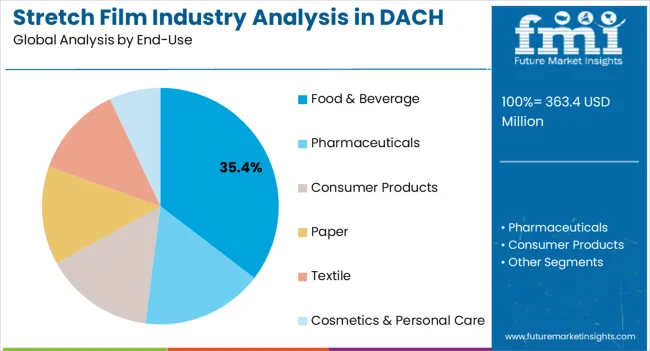

The food and beverage segment, accounting for 35.40% of the end-use category, has maintained a leading position due to the critical role of stretch films in protecting perishable goods during transportation and storage. Adoption has been supported by stringent hygiene standards, regulatory compliance, and the need for extended shelf life.

Demand has been reinforced by increasing cold chain logistics and the growth of retail and foodservice channels. High performance films that preserve product integrity and minimize waste have strengthened market preference.

Ongoing innovations in barrier properties, puncture resistance, and film clarity have enhanced usability and reduced operational costs Expansion of food processing facilities and e-commerce-driven packaging requirements are expected to sustain the segment’s market share and support continued growth in the DACH stretch film market.

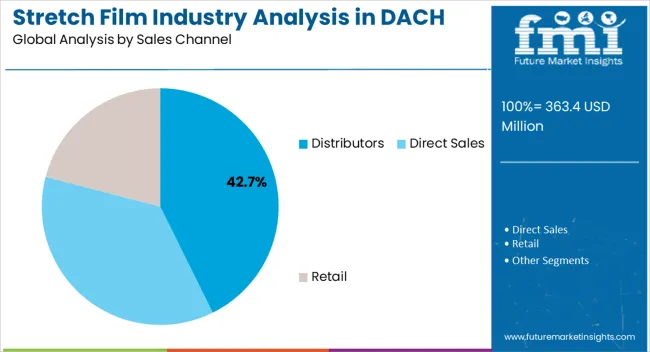

The distributors segment, holding 42.70% of the sales channel category, has emerged as the leading channel owing to its extensive network and ability to provide timely and flexible supply solutions. Adoption has been driven by established relationships with end-users, efficient inventory management, and localized service support.

Distribution channels have facilitated access to a wide range of product variants and enabled responsiveness to fluctuating demand. Operational efficiencies, reliability, and value-added services, including just-in-time delivery and technical support, have strengthened market acceptance.

Partnerships between manufacturers and distributors have enhanced product availability and market penetration Continued expansion of distribution networks, coupled with strategic logistics and supply chain optimization, is expected to maintain segment leadership and support sustained market growth across the DACH region.

The DACH stretch film industry witnessed a CAGR of about 1.5% in the historical period between 2020 and 2025. It reached a valuation of around USD 363.4 million in 2025 from USD 318.7 million in 2020.

| Historical CAGR (2020 to 2025) | 1.5% |

|---|---|

| Historical Value (2025) | USD 363.4 million |

Due to the strong presence of well-established industrial sectors in Germany, Switzerland, and Austria, this regional industry has experienced incremental growth in the historical period. The path of evolution toward environmentally friendly and highly effective stretch packaging solutions can be seen in the historical trajectory.

Advanced innovations in polymer technologies have been crucial in producing the new generation of stretch films that reduce environmental impact. There is an increasing demand from several sectors, such as logistics and food & beverage, where stretch film’s flexibility for palletizing and packaging has proved crucial.

Making strategic decisions in the ever-changing wrapping film industry in DACH requires being knowledgeable. A thorough summary of crucial performance indicators is given in this semi-annual table.

The first piece of data, which covers the initial part of the decade, shows a consistent development with a 2.6% CAGR (H1: 2025 to 2035). Moving into the second half of that decade, there is a slight increase, displaying a 2.7% CAGR (H2: 2025 to 2035).

The second half examines the value CAGR for both the first and second halves of the future decade. The data reveals a notable acceleration in growth, with a 2.7% CAGR in the first half, indicating a sustained upward trajectory (H1: 2025 to 2035). Anticipating the latter part of the era, the growth momentum picks up speed, culminating in a 2.9% CAGR (H2: 2025 to 2035).

| Particular | Value CAGR |

|---|---|

| H1 | 2.6% (2025 to 2035) |

| H2 | 2.7% (2025 to 2035) |

| H1 | 2.7% (2025 to 2035) |

| H2 | 2.9% (2025 to 2035) |

Durable and Tear Resistant Flexible Packaging Formats Amplifying Growth

Flexible packaging films, especially stretch films, are gaining popularity due to their high durability, cost-effectiveness, and lightweight nature. As industrial stretch wrapping films optimize both packaging time and surface area, these are set to be ideal for manufacturers.

The aesthetic properties of stretch films and their ability to enhance productivity would also contribute to their popularity. The flexibility of stretch films meets strict industry requirements, mainly in the food and pharmaceutical industries, further increasing their demand.

The tear-resistant properties of stretch films enhance reliability, especially in packaging applications and manufacturing. This trend is expected to drive the demand for stretch films in several industries.

Transparent Packaging Solutions Gain Impetus to Boost Visual Attractiveness

There seems to be an increasing demand for transparent packaging across DACH, which is primarily related to food and drinks. This is because of consumer's desire for attractive packaging with visible content.

Transparent packaging is considered one of the key factors for determining the quality of a product and can directly influence on buyer's decision-making process. This trend is especially important for the consumer goods industry, as it focuses on the differentiation of their product by manufacturers.

As per the packaging film industry outlook in DACH, stretch films perform an important function in obtaining smooth surfaces that are clearer and glossier than packaged films. These not only create an appealing look for the users but also save other expenses such as printing, labeling, and decoration.

Modern consumers often make their purchase decisions on-site. This makes the packaging format and appearance, as well as the transparency offered by stretch films, crucial factors. DACH is anticipated to witness a surging demand for clear, transparent packaging that uses stretch films, which would stimulate growth in the estimated period.

Awareness of Efficient Plastic Waste Management to Create Opportunities

The production of plastic items has skyrocketed across DACH. Hence, they permeate everyday life in DACH. In a very short time, about 70% of all plastic products would have become plastic waste.

One main cause of soil and groundwater pollution is improper plastic waste management. Governments of different countries have come up with strict rules and regulations to control this type of waste. The next step toward solving problems associated with increasing volumes of plastic waste is recycling.

There are, however, more end-use industries across DACH that use recyclable plastic packaging. This is mainly because of growing consciousness regarding the way plastic waste should be handled. These factors would provide great opportunities for renowned packaging producers across DACH to come up with reusable stretch films.

The three main countries in the region include Germany, Austria, and Switzerland. According to the analysis, Austria is set to lead the DACH region by showcasing a CAGR of 3.9% in the forecast period. The country is anticipated to be followed by Switzerland and Germany, with CAGRs of 3.6% and 2.1%, respectively.

| Country | Value-based CAGR (2025 to 2035) |

|---|---|

| Germany | 2.1% |

| Austria | 3.9% |

| Switzerland | 3.6% |

The leading position of Germany as the most prominent economy in the DACH stretch wrap industry plays an important role in pushing growth. High-performance stretch films would find extensive use in packaging and transportation as advanced manufacturing takes a significant lead in industries including automotive, machinery, and logistics.

The modern trend of environmental approach in Germany is also expected to propel the use of sustainably sourced raw materials and unique technology.

The country’s emphasis on precision and efficiency in terms of packaging is projected to promote the use of stretch films. These are anticipated to be utilized as a strategy to ensure safe palletization and packaging, thereby augmenting demand.

Germany is estimated to dominate the field of pallet wrapping solutions and showcase a value CAGR of around 2.1% by 2035. This is due to the rising demand for online packaging solutions and the growing preference for plastic packaging.

Based on the analysis, Austria’s stretch film industry is expected to witness a 3.9% CAGR in the forecast period. The booming e-commerce sector and the trend for online shopping in Austria are set to contribute to growth.

The growing need for safe and efficient packaging solutions among e-commerce platforms to prevent damage to products during shipping is expected to bolster sales. The ability of stretch films to offer a unique solution to secure and bundle products on pallets is anticipated to help ensure safe delivery and prevent damage.

Switzerland’s stretch film industry will likely exhibit a CAGR of 3.6% from 2025 to 2035. The supply chain and logistics industry in Switzerland is expected to use elastic film technology to optimize and secure palletized products. The technology would also enable companies to enhance their supply chain, lower labor costs, and improve the packaging of products.

Stretch film suppliers in Switzerland are constantly investing in research & development activities to discover novel properties. By doing so, they are aiming to cater to the different needs of several industries. Leading companies in Switzerland are expected to come up with innovative stretch films with UV resistance and high performance.

The tables below showcase the growth rates of leading segments in the DACH stretch film industry. In terms of material, the polyethylene (PE) segment will likely witness a CAGR of 2.4% in the estimated period. Based on end-use, the food & beverage segment is set to exhibit a CAGR of 2.5% from 2025 to 2035.

| Material | Value CAGR |

|---|---|

| Polyethylene (PE) | 2.4% |

| Polypropylene (PP) | 2.9% |

| Polyvinyl Chloride (PVC) | 1.8% |

| Bio-plastic | 3.2% |

| End-use | Value CAGR |

|---|---|

| Food & Beverage | 2.5% |

| Pharmaceuticals | 2.3% |

| Consumer Products | 3.1% |

| Paper | 1.6% |

| Textile | 1.3% |

| Cosmetics & Personal Care | 3.6% |

| Building & Construction | 2.7% |

| Chemical & Fertilizer | 1.9% |

Polyethylene is one of the most flexible and affordable materials available in DACH. This makes it one of the most commonly used materials for packaging. The material stands out due to its admirable flexibility and durability, which are both necessary for making pallets as well as maintaining load stability.

The polyethylene (PE) segment is projected to expand 1.3 times the current value during the forecast period. It is anticipated that the segment will witness a CAGR of 2.4% in the same period.

In DACH, the food & beverage industry is anticipated to look for unique stretch films to ensure the integrity of products and maintain their freshness. The rising consumer preference for easy-to-use and hygienic packaging solutions is also set to drive demand.

Stretch films are expected to have a high level of adaptability for several packaging needs, including wrapping individual items of food and securing pallet loads. This property is anticipated to augment stretch film sales across DACH through 2035. The food & beverage segment is projected to showcase a 2.5% CAGR in the forecast period and generate a share of 25.2% in 2035.

Leading players in the DACH stretch film industry are gaining high shares by developing advanced products with several innovative properties. They are also focusing on collaborations and partnerships with food manufacturers, cosmetics companies, and textile producers to provide them with enhanced stretch films.

Recent developments of leading stretch film manufacturers in DACH

| Attribute | Details |

|---|---|

| Estimated Industry Value (2025) | USD 363.4 million |

| Projected Industry Value (2035) | USD 472.5 million |

| Anticipated Growth Rate (2025 to 2035) | 2.7% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value in USD million, Volume in 000 tons |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

Material, End-use, Sales Channel, Country |

| Key Companies Profiled | Intertape Polymer Group Inc.; The Ergis Group; Scientex Berhad; Coveris Holdings Inc.; Megaplast Sa; Gebr. Dürrbeck Kunststoffe Gmbh; Polifilm Group; Manupackaging Deutschland Gmbh; Eurapack Gmbh; Duoplast AG |

The global stretch film industry analysis in DACH is estimated to be valued at USD 363.4 million in 2025.

The market size for the stretch film industry analysis in DACH is projected to reach USD 473.2 million by 2035.

The stretch film industry analysis in DACH is expected to grow at a 2.7% CAGR between 2025 and 2035.

The key product types in stretch film industry analysis in DACH are polyethylene (pe), _lldpe, _ldpe, polypropylene (pp), polyvinyl chloride (pvc) and bio-plastics.

In terms of end-use, food & beverage segment to command 35.4% share in the stretch film industry analysis in DACH in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stretch Film Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Stretch Film Packs Market Insights on Type, Product, Application, Industry, and Region - 2025 to 2035

Stretch Films Market Outlook - Size, Demand & Industry Trends 2025 to 2035

Market Positioning & Share in the Stretch Film Industry

Stretch Hood Films Market Analysis by Up to 50 microns, 50-100 microns, 100-150 microns, 150 microns & above Through 2035

UVI Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

Cast Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

Stretch and Shrink Films Market Size and Share Forecast Outlook 2025 to 2035

Europe MDO-PE Film Market Trends & Growth Forecast 2024-2034

Korea Stretch Film Market Analysis by Material, Manufacturing Process, End-use, and Region Forecast Through 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Blown Stretch Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Stretch Films Market - Analysis Size, Share, and Forecast 2025 to 2035

Western Europe Stretch Film Market Analysis by Material, Manufacturing Process, End-use, and Region Forecast Through 2035

Film and TV IP Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

Film Wrapped Wire Market Size and Share Forecast Outlook 2025 to 2035

Film-Insulated Wire Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA