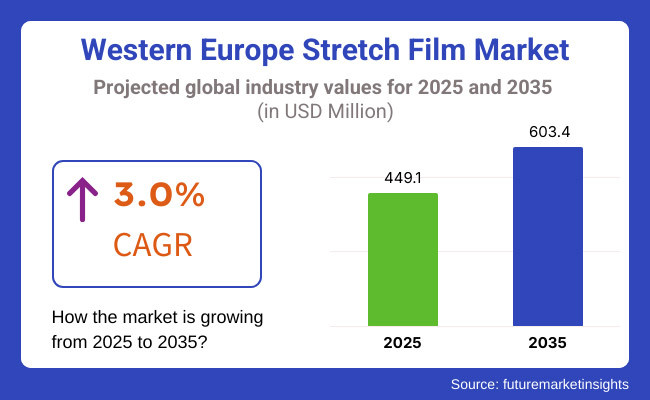

The Western Europe stretch film market is anticipated to be valued at USD 449.1 million in 2025. It is expected to grow at a CAGR of 3.0% during the forecast period and reach a value of USD 603.4 million in 2035.

Western Europe’s stretch films are highly stretchable plastics used in warehousing, logistics, food packaging, and industrial applications to secure palletized goods, prevent damage, and ensure load stability. There is a growing preference for sustainable and recyclable packaging, which is leading the retail, e-commerce, and manufacturing industries to more and more adopt advanced films to gain increased efficiency and do justice to wastage.

The manufacture and supply of stretch films for packaging and logistics comprises the Western Europe stretch film market. Growth in the market is driven by flourishing e-commerce businesses, enhanced automation in warehousing, and the need for sustainable packaging solutions. The most important influencing factor in the industry has been the shift toward biodegradable and recyclable films.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Steady demand in logistics, food packaging, and industrial applications, with emphasis on load stability, product protection, and transportation efficiency. | Environmental issues and sustainability will lead to a move towards biodegradable, recyclable, and compostable stretch films to minimize plastic waste. |

| Petroleum-based stretch films were the norm because they were cheap, flexible, and strong at holding pallet loads together. | Companies will increasingly embrace bio-based polymers, recyclable high-performance films, and light materials with retained strength while minimizing environmental footprints. |

| The European Union (EU) established early plastic waste reduction measures, but enforcement was slow, with single-use films remaining widespread. | Increased EU regulations on plastic packaging waste, carbon neutrality, and extended producer responsibility (EPR) will drive the uptake of sustainable stretch films. |

| Stretch film recycling was slowed by contamination, material complexity, and poor waste collection infrastructure. | Sophisticated recycling technologies and closed-loop systems will maximize reuse, enhancing recyclability and supporting circular economy models. |

| Cost efficiency and reliability in the supply chain remain important factors that inhibited the adoption of eco-friendly films. | Green packaging cost savings will be realized in the long run, leading companies to transition to green alternatives to meet legislation and prevent fines. |

| Stretch films of food grade became popular in maintaining product freshness, avoiding contamination, and maintaining shelf life. | Biodegradable and antimicrobial stretch films supported by sophisticated barrier technologies will predominate food packaging, enhancing safety and sustainability. |

| E-commerce boom stimulated demand for pallet stretch films for bulk purchasing and last-mile delivery. | Retail and e-commerce leaders will increasingly use biodegradable wraps, reusable pallet wraps, and smart-tracking technologies to streamline supply chains. |

| Automated packaging helped to increase efficiency, reduce waste material, and improve operational speeds. | AI-driven stretch films with RFID and IoT sensors will transform packaging, allowing real-time tracking, supply chain visibility, and automatic waste elimination. |

Ultra-Thin and High-Stretch Films Reducing Material Waste

Western Europe's stretch film industry is moving towards ultra-thin, high-stretch films that maximize packaging efficiency without harming the environment. Industry players are creating multi-layered films that are more elastic and puncture-resistant, enabling companies to reduce material usage without affecting load stability. This helps brands meet stringent EU packaging regulations while improving logistics and warehousing effectiveness.

Customizable and Smart Films Enhancing Brand Identity

Personalization and intelligent technology are revolutionizing the market. Companies are incorporating custom printing capabilities, such as logos, QR codes, as well as promotional designs, making stretch films marketing tools.

RFID-enabled films and tamper-evident seals enhance tracking and authentication, improving supply chain transparency. UV-resistant and color-changing films also provide added protection while improving product appeal.

| Metric | Value |

|---|---|

| Top Manufacturing Process | Cast Stretch Film |

| Market Share in 2025 | 64.5% |

The cast stretch film segment in Western Europe is expected to hold a 64.5% market share in 2025, reinforcing its dominance in the industry. The cast process creates thin films of high transparency with satisfactory tensile strength and is therefore suited for pallet wrapping and industrial packaging.

It comprises forcing molten resin through a flat die and fast cooling on a chill roll, which yields a consistent thickness, satisfactory stretchability, and puncture resistance.

Cast stretching films are also preferred due to their cost-effectiveness and greater cling strength. Their application across industries and logistics also drives market expansion. Additionally, increasing environmental issues have prompted the creation of environmentally friendly cast films, driving the shift toward sustainable packaging solutions.

| Metric | Value |

|---|---|

| Top End-use | Food and Beverages |

| Market Share in 2025 | 27.2% |

As per FMI analysis, the food and beverages segment is projected to account for a 27.2% market share in 2025, led by the growing demand for safe, clean packaging solutions.

Stretch films safeguard perishable products, keep them free from contamination, and ensure product freshness during storage and transportation. Growth in ready-to-eat meals, fresh fruits and vegetables, and beverage packaging also drives demand for sophisticated stretch films.

Industry players are moving towards new-generation stretch films with better barrier functionality, antimicrobial treatment, and biodegradability to address the changing requirements of the industry. Such developments improve food safety and meet sustainability requirements as well as European Union policies on packaging waste and recyclability.

The Western Europe stretch film market is dominated by polyethylene (PE)-based materials, particularly low-density polyethylene (LDPE) and high-density polyethylene (HDPE), due to their flexibility, durability, and superior stretchability. These products are used extensively in numerous industries because they can wrap and cover products tightly while transporting and storing them.

Greater environmental regulations in Western Europe create opportunities for recyclable and biodegradable stretch film demand. Bio-based PE and high-performance recycle films are seeing increased popularity from innovations in the field of environment-friendly polyethylene formulations.

While PP and PVC are also in use, PE is the most popular material taken up due to its affordability, versatility, and ability to pass the tough standards of the environmental regulations of the region.

The Western Europe stretch film industry is fragmented. Leading companies such as Berry Global, Mondi Group, and Manuli Stretch dominate production, focusing on advanced packaging solutions. These firms invest in research and development to enhance product performance, ensuring superior stretchability and durability while maintaining cost efficiency for various industrial applications across the region.

Sustainability drives innovation, with manufacturers prioritizing recyclable and biodegradable materials. Companies adopt energy-efficient production methods and circular economy strategies to reduce environmental impact.

Regulatory compliance plays an important role, pushing firms to develop eco-friendly alternatives. These efforts align with stringent European Union regulations, fostering a shift toward greener packaging solutions in multiple industries.

The logistics and retail sectors significantly influence stretch film demand, with growing e-commerce fueling the need for secure, high-performance packaging. Stretch films ensure product protection during transit, reducing damage and improving handling efficiency. Companies continuously develop lightweight yet strong films to optimize shipping costs and enhance operational sustainability across supply chains.

Technological advancements improve stretch film functionality, with producers integrating nanotechnology and multi-layered film structures for enhanced performance. Features such as superior puncture resistance, increased elasticity, and tamper-proof properties cater to diverse industrial needs. These innovations support sectors such as food packaging, pharmaceuticals, and automotive, ensuring reliable and effective load stability solutions.

Despite market fragmentation, dominant players maintain their competitive edge through strategic acquisitions, product diversification, and sustainability initiatives. As industry regulations evolve, companies focus on expanding their portfolios with bio-based and recycled materials. The ongoing emphasis on innovation, efficiency, and sustainability underscores the dynamic nature of the Western Europe stretch film industry.

The Western European stretch film market is experiencing steady growth, driven by increasing demand for efficient packaging solutions across various industries. This trend is fueled by the need for secure and cost-effective methods to protect goods during transportation and storage.

Technological advancements have led to the development of high-performance stretch films with enhanced durability and elasticity. These innovations cater to diverse industrial applications, meeting the evolving requirements of sectors such as food and beverage, pharmaceuticals, and consumer products.

Environmental sustainability is a growing concern, prompting manufacturers to adopt eco-friendly materials and production processes. This shift aligns with global trends toward reducing plastic waste and promoting recyclable packaging solutions, reflecting the industry's commitment to environmental responsibility.

The competitive landscape features both domestic and international players striving to expand their market share. Companies are focusing on product innovation, strategic partnerships, and improved distribution networks to meet the increasing demand and maintain a competitive edge in the market.

The market is segmented by material into polyethylene (PE), polyvinyl chloride (PVC), polypropylene (PP), and others.

Based on the manufacturing process, the market is bifurcated into cast stretch film and blown stretch film.

The market are categories based on end-use, including constructions, food and beverages, pharmaceutical, consumer product, paper, textile, and chemicals & fertilizers.

The Western Europe stretch film market is expected to reach USD 449.1 million in 2025 and grow to USD 603.4 million by 2035 at a CAGR of 3.0%.

Western Europe stretch film product sales are driven by increasing demand for sustainable packaging, e-commerce expansion, and advancements in high-performance stretch films.

Key manufacturers of Western Europe stretch film include Italdibipack Group, Coveris, Inc., Smurfit Kappa Group, Vishakha Polyfab, Four Star Plastics, Griff Paper and Film, CS Hyde Company, International Plastics Inc., Bagla Group of Companies, Polymer Group, Inc., Berry Global Group, Inc., AEP Industries, Inc., Sigma Stretch Film Corp.

The food and beverage segment is expected to lead the industry, holding a projected market share of 27.2% in 2025.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Tons) Forecast by Country, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Tons) Forecast by Material, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Manufacturing Process, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Tons) Forecast by Manufacturing Process, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2019 to 2034

Table 9: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 10: UK Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2019 to 2034

Table 11: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 12: UK Industry Analysis and Outlook Volume (Tons) Forecast by Material, 2019 to 2034

Table 13: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Manufacturing Process, 2019 to 2034

Table 14: UK Industry Analysis and Outlook Volume (Tons) Forecast by Manufacturing Process, 2019 to 2034

Table 15: UK Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 16: UK Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2019 to 2034

Table 17: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 18: Germany Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2019 to 2034

Table 19: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 20: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Material, 2019 to 2034

Table 21: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Manufacturing Process, 2019 to 2034

Table 22: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Manufacturing Process, 2019 to 2034

Table 23: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 24: Germany Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2019 to 2034

Table 25: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 26: Italy Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2019 to 2034

Table 27: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 28: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Material, 2019 to 2034

Table 29: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Manufacturing Process, 2019 to 2034

Table 30: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Manufacturing Process, 2019 to 2034

Table 31: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 32: Italy Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2019 to 2034

Table 33: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 34: France Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2019 to 2034

Table 35: France Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 36: France Industry Analysis and Outlook Volume (Tons) Forecast by Material, 2019 to 2034

Table 37: France Industry Analysis and Outlook Value (US$ Million) Forecast by Manufacturing Process, 2019 to 2034

Table 38: France Industry Analysis and Outlook Volume (Tons) Forecast by Manufacturing Process, 2019 to 2034

Table 39: France Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 40: France Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2019 to 2034

Table 41: Spain Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 42: Spain Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2019 to 2034

Table 43: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 44: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Material, 2019 to 2034

Table 45: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Manufacturing Process, 2019 to 2034

Table 46: Spain Industry Analysis and Outlook Volume (Tons) Forecast by Manufacturing Process, 2019 to 2034

Table 47: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 48: Spain Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2019 to 2034

Table 49: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 50: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Material, 2019 to 2034

Table 51: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Manufacturing Process, 2019 to 2034

Table 52: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Manufacturing Process, 2019 to 2034

Table 53: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 54: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Manufacturing Process, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by End-use, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Country, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 6: Industry Analysis and Outlook Volume (Tons) Analysis by Country, 2019 to 2034

Figure 7: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 8: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 9: Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 10: Industry Analysis and Outlook Volume (Tons) Analysis by Material, 2019 to 2034

Figure 11: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 12: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 13: Industry Analysis and Outlook Value (US$ Million) Analysis by Manufacturing Process, 2019 to 2034

Figure 14: Industry Analysis and Outlook Volume (Tons) Analysis by Manufacturing Process, 2019 to 2034

Figure 15: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Manufacturing Process, 2024 to 2034

Figure 16: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Manufacturing Process, 2024 to 2034

Figure 17: Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 18: Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2019 to 2034

Figure 19: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 20: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 21: Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 22: Industry Analysis and Outlook Attractiveness by Manufacturing Process, 2024 to 2034

Figure 23: Industry Analysis and Outlook Attractiveness by End-use, 2024 to 2034

Figure 24: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 25: UK Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 26: UK Industry Analysis and Outlook Value (US$ Million) by Manufacturing Process, 2024 to 2034

Figure 27: UK Industry Analysis and Outlook Value (US$ Million) by End-use, 2024 to 2034

Figure 28: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 29: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 30: UK Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2019 to 2034

Figure 31: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 32: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 33: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 34: UK Industry Analysis and Outlook Volume (Tons) Analysis by Material, 2019 to 2034

Figure 35: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 36: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 37: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Manufacturing Process, 2019 to 2034

Figure 38: UK Industry Analysis and Outlook Volume (Tons) Analysis by Manufacturing Process, 2019 to 2034

Figure 39: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Manufacturing Process, 2024 to 2034

Figure 40: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Manufacturing Process, 2024 to 2034

Figure 41: UK Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 42: UK Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2019 to 2034

Figure 43: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 44: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 45: UK Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 46: UK Industry Analysis and Outlook Attractiveness by Manufacturing Process, 2024 to 2034

Figure 47: UK Industry Analysis and Outlook Attractiveness by End-use, 2024 to 2034

Figure 48: UK Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 49: Germany Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 50: Germany Industry Analysis and Outlook Value (US$ Million) by Manufacturing Process, 2024 to 2034

Figure 51: Germany Industry Analysis and Outlook Value (US$ Million) by End-use, 2024 to 2034

Figure 52: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 53: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 54: Germany Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2019 to 2034

Figure 55: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 56: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 57: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 58: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Material, 2019 to 2034

Figure 59: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 60: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 61: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Manufacturing Process, 2019 to 2034

Figure 62: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Manufacturing Process, 2019 to 2034

Figure 63: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Manufacturing Process, 2024 to 2034

Figure 64: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Manufacturing Process, 2024 to 2034

Figure 65: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 66: Germany Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2019 to 2034

Figure 67: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 68: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 69: Germany Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 70: Germany Industry Analysis and Outlook Attractiveness by Manufacturing Process, 2024 to 2034

Figure 71: Germany Industry Analysis and Outlook Attractiveness by End-use, 2024 to 2034

Figure 72: Germany Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 73: Italy Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 74: Italy Industry Analysis and Outlook Value (US$ Million) by Manufacturing Process, 2024 to 2034

Figure 75: Italy Industry Analysis and Outlook Value (US$ Million) by End-use, 2024 to 2034

Figure 76: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 77: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 78: Italy Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2019 to 2034

Figure 79: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 80: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 81: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 82: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Material, 2019 to 2034

Figure 83: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 84: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 85: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Manufacturing Process, 2019 to 2034

Figure 86: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Manufacturing Process, 2019 to 2034

Figure 87: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Manufacturing Process, 2024 to 2034

Figure 88: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Manufacturing Process, 2024 to 2034

Figure 89: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 90: Italy Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2019 to 2034

Figure 91: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 92: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 93: Italy Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 94: Italy Industry Analysis and Outlook Attractiveness by Manufacturing Process, 2024 to 2034

Figure 95: Italy Industry Analysis and Outlook Attractiveness by End-use, 2024 to 2034

Figure 96: Italy Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 97: France Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 98: France Industry Analysis and Outlook Value (US$ Million) by Manufacturing Process, 2024 to 2034

Figure 99: France Industry Analysis and Outlook Value (US$ Million) by End-use, 2024 to 2034

Figure 100: France Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 101: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 102: France Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2019 to 2034

Figure 103: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 104: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 105: France Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 106: France Industry Analysis and Outlook Volume (Tons) Analysis by Material, 2019 to 2034

Figure 107: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 108: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 109: France Industry Analysis and Outlook Value (US$ Million) Analysis by Manufacturing Process, 2019 to 2034

Figure 110: France Industry Analysis and Outlook Volume (Tons) Analysis by Manufacturing Process, 2019 to 2034

Figure 111: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Manufacturing Process, 2024 to 2034

Figure 112: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Manufacturing Process, 2024 to 2034

Figure 113: France Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 114: France Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2019 to 2034

Figure 115: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 116: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 117: France Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 118: France Industry Analysis and Outlook Attractiveness by Manufacturing Process, 2024 to 2034

Figure 119: France Industry Analysis and Outlook Attractiveness by End-use, 2024 to 2034

Figure 120: France Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 121: Spain Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 122: Spain Industry Analysis and Outlook Value (US$ Million) by Manufacturing Process, 2024 to 2034

Figure 123: Spain Industry Analysis and Outlook Value (US$ Million) by End-use, 2024 to 2034

Figure 124: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 125: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 126: Spain Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2019 to 2034

Figure 127: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 128: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 129: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 130: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Material, 2019 to 2034

Figure 131: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 132: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 133: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Manufacturing Process, 2019 to 2034

Figure 134: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Manufacturing Process, 2019 to 2034

Figure 135: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Manufacturing Process, 2024 to 2034

Figure 136: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Manufacturing Process, 2024 to 2034

Figure 137: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 138: Spain Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2019 to 2034

Figure 139: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 140: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 141: Spain Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 142: Spain Industry Analysis and Outlook Attractiveness by Manufacturing Process, 2024 to 2034

Figure 143: Spain Industry Analysis and Outlook Attractiveness by End-use, 2024 to 2034

Figure 144: Spain Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 145: Rest of Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 146: Rest of Industry Analysis and Outlook Value (US$ Million) by Manufacturing Process, 2024 to 2034

Figure 147: Rest of Industry Analysis and Outlook Value (US$ Million) by End-use, 2024 to 2034

Figure 148: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 149: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Material, 2019 to 2034

Figure 150: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 151: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 152: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Manufacturing Process, 2019 to 2034

Figure 153: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Manufacturing Process, 2019 to 2034

Figure 154: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Manufacturing Process, 2024 to 2034

Figure 155: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Manufacturing Process, 2024 to 2034

Figure 156: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 157: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2019 to 2034

Figure 158: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 159: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 160: Rest of Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 161: Rest of Industry Analysis and Outlook Attractiveness by Manufacturing Process, 2024 to 2034

Figure 162: Rest of Industry Analysis and Outlook Attractiveness by End-use, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA