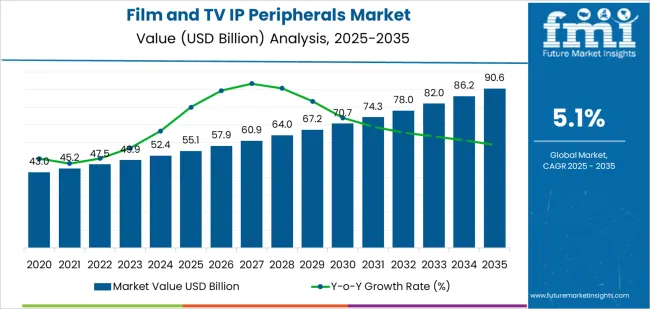

The global film and TV IP peripherals market is valued at USD 55.1 billion in 2025 and is projected to reach USD 90.7 billion by 2035, reflecting a CAGR of 5.1%. Growth during the first half of the forecast window is supported by expanding demand for licensed merchandise tied to established film and television properties. As media franchises broaden their global reach, peripheral categories such as collectibles, apparel, toys, digital accessories, and themed consumer products gain wider distribution. The rise of streaming platforms contributes to more frequent content releases, increasing the number of properties that generate marketable IP-driven products. This leads to steady procurement by retailers seeking predictable, character-based product lines.

During the latter half of the forecast period, growth becomes more moderate as mature franchises stabilize and peripheral product cycles align more closely with major content launches. Market momentum is influenced by periodic surges linked to high-profile releases while maintaining a consistent baseline driven by evergreen franchises. Product strategies increasingly emphasize design refreshes, limited editions, and cross-platform tie-ins to sustain consumer interest. Even as annual increases become steadier, the continued expansion of global content production and diversified merchandising partnerships supports a persistent upward trajectory through 2035.

From 2025 to 2030, the Film and TV IP Peripherals Market increases from USD 55.1 billion to USD 70.7 billion, creating USD 15.6 billion in additional value over five years. Annual gains rise from USD 2.4 billion in the early stage to USD 3.4 billion by 2030. This period reflects a strengthening demand cycle driven by expanded global streaming audiences, higher merchandising penetration across apparel, collectibles, gaming tie-ins, and character-based consumer products. Franchise extensions, reboot activity, and localization of international IPs support continuous volume expansion, while licensing ecosystems deepen across both digital and physical retail channels.

Between 2030 and 2035, the market advances from USD 70.7 billion to USD 90.7 billion, adding USD 20.0 billion—outpacing the previous five-year interval. Annual increases accelerate into the USD 3.8–4.4 billion range as studios broaden cross-platform content strategies and integrate IP peripherals into experiential channels such as themed attractions, interactive events, and immersive consumer products. Growth is reinforced by stronger fan-economy monetization, wider adoption of limited-edition merchandising, and rising IP commercialization in developing markets. Across the full decade, total growth reaches USD 35.6 billion, highlighting the expanding economic influence of global entertainment franchises on consumer-goods ecosystems.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 55.1 billion |

| Market Forecast Value (2035) | USD 90.7 billion |

| Forecast CAGR (2025–2035) | 5.1% |

Demand for Film and TV IP peripherals is rising as studios and rights holders expand revenue streams through licensed merchandise tied to popular characters, franchises, and episodic releases. Peripherals including toys, collectibles, apparel, props, décor, and themed accessories benefit from predictable demand cycles linked to theatrical launches and streaming premieres. Studios use licensing programs to extend brand visibility while controlling quality and brand-consistency standards across global manufacturing partners. Producers refine contract structures, royalty models, and approval workflows to support timely product rollouts aligned with marketing campaigns. Growth in international streaming platforms has broadened the global audience for genre franchises, increasing the market viability of peripherals in regions where direct box-office releases were previously limited. These conditions sustain stable demand across retail and e-commerce channels.

Market expansion is also influenced by collectors’ markets, fan conventions, and social-media engagement that elevate demand for limited-edition and premium-format merchandise. Manufacturers invest in improved molding, printing, and finishing techniques to produce peripherals with higher fidelity to on-screen designs. Retailers integrate demand-forecasting tools and rapid-fulfillment logistics to match release schedules and minimize inventory risk. Rights holders strengthen enforcement of anti-counterfeiting measures as unauthorized merchandise remains a persistent issue in global markets. Although licensing fees and production lead times present challenges for small brands, ongoing growth in franchise-driven entertainment and the rise of direct-to-consumer retail channels continue to reinforce long-term adoption of Film and TV IP peripherals across global consumer-product categories.

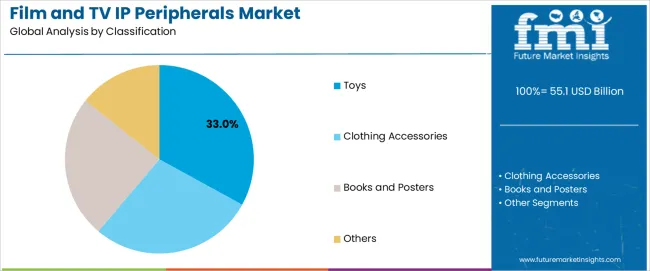

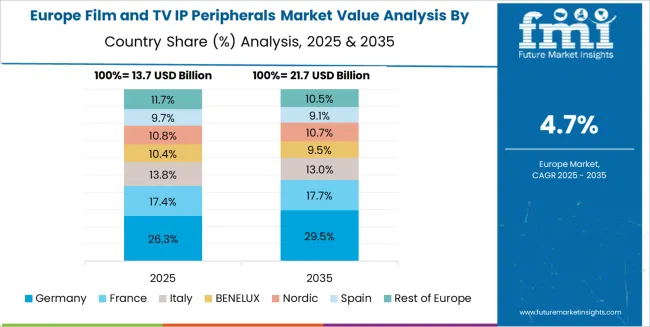

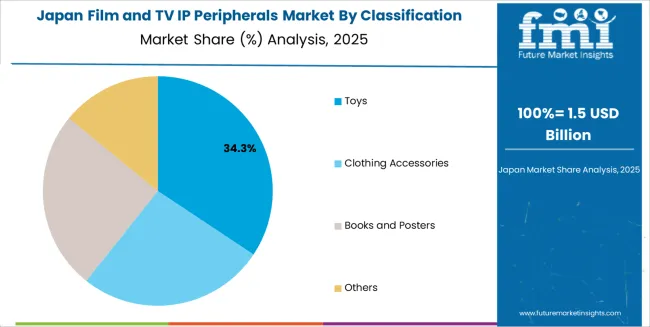

The film and TV IP peripherals market is segmented by classification, application, and region. By classification, the market includes toys, clothing accessories, books and posters, and others. Based on application, it is divided into online, retail, and specialty stores. Regionally, it is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect differences in consumer purchasing behavior, media-franchise popularity, and regional merchandising practices.

The toys segment accounts for approximately 33.0% of the global film and TV IP peripherals market in 2025, making it the leading product category. This position is linked to the long-standing role of character-based toys in merchandising programs associated with animated series, children’s content, and major film franchises. Toys provide tangible extensions of on-screen characters, and many franchises depend on sustained toy demand to support multi-year licensing cycles. Their wide age appeal and recurring seasonal sales patterns further strengthen demand.

Manufacturers produce action figures, collectibles, model kits, and themed playsets aligned with current releases and continuing franchises. Adoption is strong in North America and East Asia, where large entertainment companies coordinate synchronized product launches alongside film or series releases. Europe contributes additional demand through established specialty chains supporting character merchandise. Toy lines maintain their lead because they can be renewed with each sequel or series update, providing predictable merchandising continuity across varied franchise lifecycles while fitting distribution models that support both mass retail and collector-oriented markets.

The online segment represents about 64.0% of the total film and TV IP peripherals market in 2025, making it the dominant application category. This share reflects the shift toward digital purchasing channels where consumers access a wider range of licensed merchandise, including limited editions and region-specific items. Online platforms support rapid product availability during peak franchise activity and allow buyers to compare designs, editions, and bundled offerings without geographic constraints.

Vendors use online channels to coordinate releases with promotional campaigns tied to film premieres and episodic streaming schedules. Adoption is strong in North America, Europe, and East Asia, where e-commerce infrastructure supports fast delivery and broad catalog access. Online distribution also enables smaller studios and independent creators to market peripheral items without maintaining physical retail presence. The segment holds its leading position because online channels accommodate fluctuating demand tied to franchise cycles, allow continuous catalog expansion, and provide distribution flexibility suited to both high-volume merchandise and niche collector products.

The film and television IP peripherals market is expanding as major franchises and streaming platforms increasingly monetize created content through ancillary and peripheral products—such as branded merchandise, licensing partnerships, video games, theme park attractions and character based items. These peripherals extend the value of core IP by engaging fans beyond the screen and creating diverse revenue streams. Growth is driven by rising global consumption of film/TV content, increased licensing activity in emerging markets and demand for branded consumer experiences. Adoption is constrained by the need to protect IP rights in multiple jurisdictions, high entry costs for peripheral production and the risk of market saturation with over licensed products. Manufacturers and licensors are enhancing control over brand consistency, licensing compliance and global distribution of peripheral offerings.

Major film and television series with strong fan followings provide opportunities for peripheral products that build on characters, storylines and brand worlds. Merchandising, apparel, toys, collectibles and game tie ins allow studios to capitalise on viewer loyalty and generate long tail revenue beyond initial content release. Demand rises globally as platforms translate popular content into physical goods and localized experiences, especially in regions with growing consumer spending. As franchise content becomes central to brand strategy for studios and streamers, peripherals take on greater importance in sustaining IP value and audience engagement.

Expansion is constrained by multiple challenges including IP protection complexities across regions, manufacturing and supply chain costs for high quality licensed products and changing consumer behaviour. Some franchises may endure licensing fatigue when too many peripheral products dilute brand impact or quality. Regional differences in consumer tastes, regulatory compliance for product safety and the logistics of global merchandise distribution also add complexity. Smaller studios or independent series may struggle to secure meaningful peripheral licensing deals, limiting the scope of product expansion.

Trends include deeper integration of digital and physical merchandise—such as collectibles that link to apps or AR experiences, limited edition drops tied to streaming releases and direct to consumer brand stores. Studios and IP holders are leveraging global e commerce platforms to reach international fans and bypass traditional retail only distribution. Co branded collaborations with lifestyle, fashion or gaming brands are increasingly common, helping IP reach new demographic segments. As streaming platforms expand internationally, localisation of peripheral content and merchandise is gaining priority—product offerings are tailored for regional markets and culture specific franchises.

| Country | CAGR (%) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| USA | 4.8% |

| UK | 4.3% |

| Japan | 3.8% |

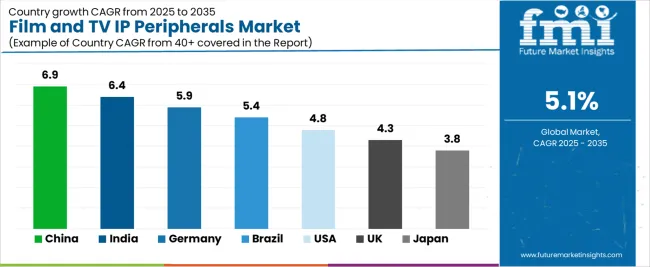

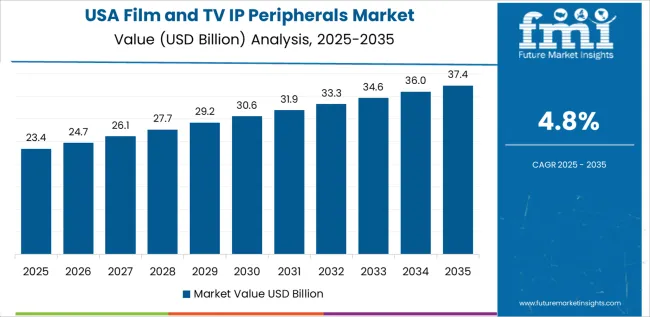

The Film and TV IP Peripherals Market is growing steadily worldwide, with China leading at a 6.9% CAGR through 2035, fueled by strong domestic entertainment franchises, rising fan merchandise demand, and rapid expansion of digital and physical IP-based product lines. India follows at 6.4%, supported by a booming film industry, increasing consumer spending on licensed goods, and growth in online fan communities. Germany records 5.9%, reflecting high-quality manufacturing, strong collector culture, and strong licensing partnerships. Brazil grows at 5.4%, benefitting from expanding streaming audiences and rising interest in localized IP merchandise. The USA, at 4.8%, remains a mature but innovation-driven market emphasizing premium collectibles, digital IP extensions, and cross-media merchandising, while the UK (4.3%) and Japan (3.8%) focus on high-value collectibles, character goods, and strong fan engagement ecosystems.

China is projected to grow at a CAGR of 6.9% through 2035 in the film and TV IP peripherals market. Increasing investments in digital media, online streaming platforms, and content production facilities drive demand for peripherals that support content protection, distribution, and editing. Service providers focus on high-performance encoders, multi-format converters, and digital rights management (DRM) technologies. Manufacturers supply hardware solutions that integrate with cloud-based workflows to ensure seamless content delivery and security. Growth is fueled by the rapid shift to digital broadcasting, OTT services, and domestic production of premium video content.

India is projected to grow at a CAGR of 6.4% through 2035 in the film and TV IP peripherals market. The increasing rise of OTT platforms, digital media consumption, and regional content creation drives the need for high-quality peripherals that enable efficient production, protection, and distribution. Manufacturers provide video editing systems, encoding solutions, and robust security technologies tailored for growing regional markets. Service providers focus on offering flexible, scalable solutions for content creators and distributors. Market growth is also spurred by the government’s push for digital infrastructure and multimedia projects nationwide.

Germany is projected to grow at a CAGR of 5.9% through 2035 in the film and TV IP peripherals market. Growing investments in broadcast infrastructure, digital transmission upgrades, and 4K/8K video technology increase demand for professional-grade IP peripherals. Service providers deliver comprehensive solutions including video encoders, signal processors, and broadcast control equipment. Manufacturers focus on high-definition video capture, secure content distribution, and modular hardware systems that integrate with advanced IP networks. Market growth is driven by broadcasters upgrading their facilities for digital broadcasting and the increasing demand for content across streaming platforms.

Brazil is projected to grow at a CAGR of 5.4% through 2035 in the film and TV IP peripherals market. Expanding content creation hubs, rising local production, and the increasing adoption of OTT platforms drive demand for peripherals that support production, editing, and distribution. Manufacturers provide video production hardware, high-capacity storage solutions, and IP-based broadcasting systems. Regional distributors offer tailored solutions to match local infrastructure needs, with an emphasis on scalability and reliability. Growth is further supported by increased consumer demand for original Brazilian content on both traditional and digital media channels.

USA is projected to grow at a CAGR of 4.8% through 2035 in the film and TV IP peripherals market. The continued expansion of Hollywood and the rapidly growing streaming sector increase the demand for high-quality peripherals supporting content creation, editing, and security. Service providers supply video editing systems, secure distribution solutions, and advanced hardware for managing high-definition video. Manufacturers focus on providing scalable solutions that integrate with cloud workflows and advanced content protection technologies. The market also benefits from the shift towards IP-based infrastructures in the broadcast and entertainment sectors.

UK is projected to grow at a CAGR of 4.3% through 2035 in the film and TV IP peripherals market. The UK’s commitment to high broadcasting standards, especially in public service broadcasting, increases the need for reliable peripherals that support video quality, distribution, and protection. Manufacturers provide professional-grade encoders, video switchers, and post-production tools that meet stringent European standards. Service providers offer tailored solutions to broadcast networks, content creators, and post-production houses. The market is supported by increasing demand for UHD video and the rise of digital platforms requiring high-quality content delivery.

Japan is projected to grow at a CAGR of 3.8% through 2035 in the film and TV IP peripherals market. The strong presence of consumer electronics companies and growing production demand in anime, gaming, and digital media increase the need for reliable peripherals. Manufacturers focus on providing video encoders, capture cards, and editing equipment for both professional studios and content creators. The demand for HD video, real-time streaming, and content protection systems is rising as Japan increasingly focuses on premium entertainment production for both domestic and global audiences.

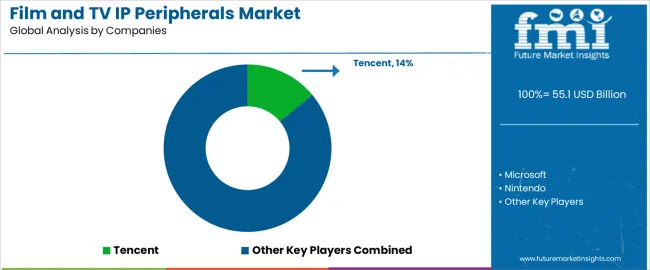

The global film and TV intellectual property (IP) peripherals market is moderately competitive, shaped by major entertainment and gaming companies producing merchandise, collectibles, and licensing-based products associated with film and TV franchises. Tencent, Microsoft, and Nintendo hold dominant positions through their extensive portfolios of gaming and entertainment IPs, using licensed peripherals such as gaming consoles, figurines, and accessories to expand brand engagement. SONY and NetEase strengthen their position by integrating IP-based peripherals into gaming ecosystems and expanding into complementary product markets like virtual reality devices, sound systems, and limited-edition merchandise. Disney leverages its vast film and TV content, from Marvel to Star Wars, to drive peripheral sales through toys, apparel, and interactive experiences.

Nexon, Ubisoft, and miHoYo contribute to the market by licensing video-game-related peripherals like controllers, plush toys, and game-specific merchandise, creating crossover appeal with their fanbases. Square Enix drives brand loyalty through limited-edition collectibles tied to franchises like Final Fantasy, alongside digital products that enhance fan engagement. Fangamer and McFarlane Toys broaden the market by creating niche, high-quality collectible action figures and art prints tied to popular games and TV series. Competition is influenced by the popularity of intellectual properties, product quality, and innovative designs. Strategic differentiation relies on the ability to create exclusive, high-demand collectibles and establish strong relationships with IP owners, with companies leveraging IPs to generate deeper fan loyalty and product cross-selling.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Toys, Clothing Accessories, Books and Posters, Others |

| Application | Online, Retail, Specialty Stores |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | Tencent, Microsoft, Nintendo, SONY, NetEase, Disney, Nexon, Ubisoft, miHoYo, Square Enix, Fangamer, McFarlane Toys |

| Additional Attributes | Dollar sales by classification and application categories, regional merchandising trends, licensing partner strategies, cross-platform IP commercialization, seasonal release cycles, competitive landscape analysis, fan engagement trends, product quality and IP protection dynamics across key markets. |

The global film and tv ip peripherals market is estimated to be valued at USD 55.1 billion in 2025.

The market size for the film and tv ip peripherals market is projected to reach USD 90.6 billion by 2035.

The film and tv ip peripherals market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in film and tv ip peripherals market are toys, clothing accessories, books and posters and others.

In terms of application, online segment to command 64.0% share in the film and tv ip peripherals market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Film Wrapped Wire Market Size and Share Forecast Outlook 2025 to 2035

Film-Insulated Wire Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Filmic Tapes Market

PC Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

PE Film Market Insights – Growth & Forecast 2024-2034

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

VCI Film Market Forecast and Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

PSA Film Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

PBS Film Market Trends & Industry Growth Forecast 2024-2034

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

Microfilm Reader Market Size and Share Forecast Outlook 2025 to 2035

PDLC Film for Building Market Size and Share Forecast Outlook 2025 to 2035

APET Film Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA