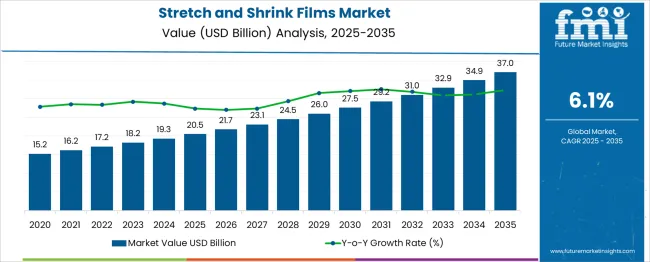

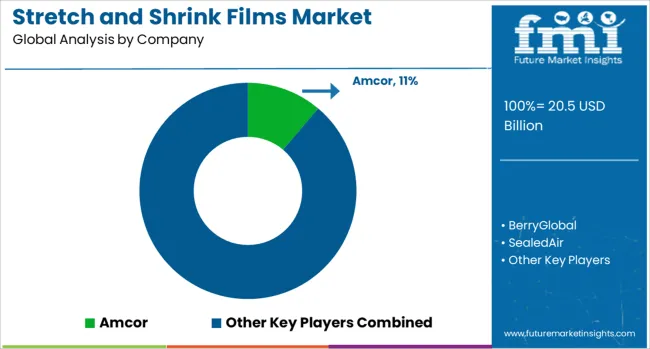

The Stretch and Shrink Films Market is estimated to be valued at USD 20.5 billion in 2025 and is projected to reach USD 37.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

The first half of the forecast period, reaching USD 26.0 billion, adds about USD 5.5 billion, accounting for nearly one-third of the total gain. In contrast, the second half contributes USD 11 billion, indicating accelerated growth driven by expanding end-user sectors.

This back-loaded growth suggests increasing penetration in high-volume packaging applications such as bulk retail, e-commerce fulfillment, and industrial logistics. Mid-phase values, crossing USD 29.2 billion, reflect heightened adoption of high-performance shrink films and stretch wraps for improved load stability and protection.

The overall trajectory underscores rising preference for films offering better barrier properties, puncture resistance, and recyclability. Adoption of multilayer films and advanced resin formulations is expected to strengthen during the latter phase as sustainability pressures and performance needs converge.

Companies focusing on production scalability, automated film application systems, and cost optimization through downgauging technologies will remain well-positioned to capture share in this expanding segment. The market outlook reinforces a stable yet accelerating path supported by diversified end-user demand and innovation in material engineering.

| Metric | Value |

|---|---|

| Stretch and Shrink Films Market Estimated Value in (2025 E) | USD 20.5 billion |

| Stretch and Shrink Films Market Forecast Value in (2035 F) | USD 37.0 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The stretch and shrink films market holds a notable position across several parent segments, driven by demand for secure packaging and efficient load stability. In the flexible packaging market, its share is estimated at 12-15%, as these films are widely used in pallet wrapping, food packaging, and consumer goods. Within the plastic film and sheeting market, the share stands at about 10-12%, given the dominance of agricultural films, barrier films, and industrial sheets.

In the e-commerce and logistics packaging market, stretch and shrink films contribute approximately 8-10%, as they are critical for protecting shipments during storage and transportation. For the industrial packaging market, the share is relatively higher at 15-18%, because these films are essential for securing bulk products and palletized loads.

In the protective packaging materials market, their share remains close to 7-9%, with other solutions like foams and corrugated materials holding major portions. Despite moderate shares, the segment is expanding steadily due to the rise in online retail, global trade, and food supply chain networks.

The growing use of downgauged films and recyclable materials is also influencing adoption patterns, positioning stretch and shrink films as indispensable components in modern packaging and distribution systems across multiple industries.

The stretch and shrink films market is experiencing strong growth, supported by the expanding need for secure, tamper-evident, and space-efficient packaging across multiple end-use sectors. The increasing adoption of unitized packaging in logistics and food distribution has led to greater reliance on films that offer high durability, elasticity, and puncture resistance. Polyethylene-based formulations have gained prominence due to their recyclability, cost efficiency, and compatibility with a wide range of packaging equipment.

The growth in e-commerce, modernization of retail supply chains, and rising preference for single-use, disposable packaging in hygiene-sensitive environments are further reinforcing demand. Regulatory focus on reducing carbon footprints and improving recyclability is pushing manufacturers to invest in bio-based and downgauged film technologies.

With advancements in multilayer extrusion and film orientation techniques, manufacturers are delivering improved clarity, strength, and barrier properties, making stretch and shrink films indispensable in temperature-sensitive and high-volume packaging operations. Continued innovation in sustainable materials and increased automation in industrial packaging lines are expected to bolster long-term market expansion.

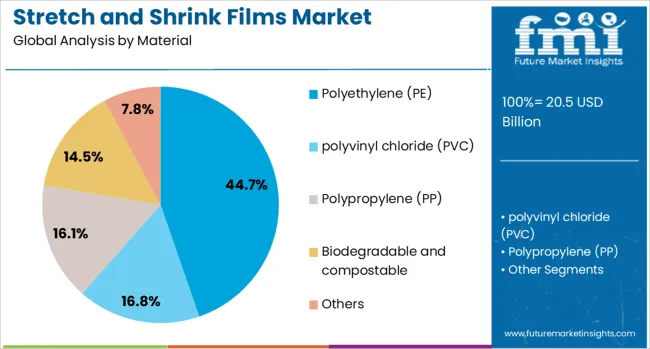

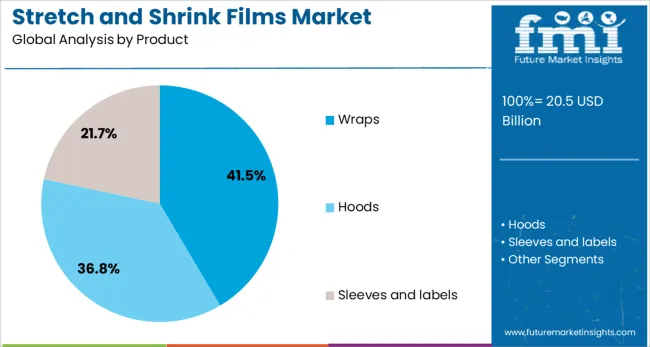

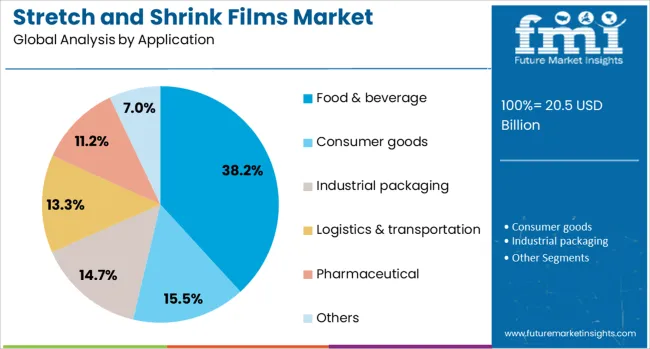

The stretch and shrink films market is segmented by material, product, application, and geographic regions. The stretch and shrink films market is divided by material into Polyethylene (PE), polyvinyl chloride (PVC), Polypropylene (PP), Biodegradable and compostable, and Others.

In terms of the product of the stretch and shrink films market, it is classified into Wraps, Hoods, and Sleeves and labels. Based on the application of the stretch and shrink films, the market is segmented into Food & beverage, Consumer goods, Industrial packaging, Logistics & transportation, Pharmaceutical, and Others. Regionally, the stretch and shrink films industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyethylene is expected to account for 44.7% of the stretch and shrink films market revenue in 2025, emerging as the most widely used material. The dominance of this segment is attributed to the superior stretchability, cost-efficiency, and ease of processing associated with polyethylene resins, particularly low-density and linear low-density variants.

Polyethylene has been increasingly adopted across various packaging operations due to its compatibility with advanced extrusion techniques and its ability to offer high impact strength while maintaining product visibility. Its recyclability and chemical resistance have further reinforced its use in food, beverage, and industrial packaging, where product integrity and safety are critical.

The material’s adaptability to downgauging techniques without compromising performance has allowed producers to meet sustainability goals and reduce raw material consumption. As regulatory compliance and consumer demand continue to align with eco-friendly packaging, polyethylene-based films are positioned to maintain their dominance across both developed and emerging economies.

Wraps are projected to hold 41.5% of the total revenue share in the stretch and shrink films market in 2025, making them the leading product type. The growth of this segment is being influenced by their widespread usage in securing palletized loads, unitizing retail products, and providing tamper-evident protection during transit.

Wraps have been favored for their operational flexibility, as they can be applied both manually and through high-speed automated systems, ensuring compatibility across various production scales. Their ability to conform tightly around irregularly shaped products while maintaining film integrity has positioned them as an optimal solution for high-volume packaging environments.

Technological innovations such as multi-layered and pre-stretched wrap films have enhanced film performance, reducing the amount of material used while maintaining strength and clarity. The increasing need for cost control and product protection in logistics and warehousing operations has reinforced the dominance of wraps in this market, especially in sectors such as food distribution and consumer goods.

The food and beverage segment is expected to capture 38.2% of the stretch and shrink films market revenue in 2025, making it the leading application area. This dominance is being driven by the sector’s high-volume packaging requirements and the critical need for hygiene, safety, and shelf-life extension.

Stretch and shrink films are being extensively used for packaging bottled beverages, meat products, dairy items, and ready-to-eat foods due to their barrier properties, transparency, and resistance to external contaminants. The ability of these films to accommodate high-speed packaging lines and to maintain form-fitted packaging has supported their adoption in both industrial food processing units and retail applications.

As food safety regulations and global export standards become more stringent, the need for films that ensure product integrity during transportation and storage has grown substantially. Additionally, the emphasis on reducing food waste through protective packaging and the shift towards smaller portion sizes in urban markets have contributed to the continued growth of stretch and shrink film usage in the food and beverage industry.

Stretch and shrink film products are being applied across packaging sectors, including food, beverage, retail and industrial goods to provide load stabilization, tamper evidence and visual branding. Stretch films are used for palletizing and bundling, while shrink films are heated to conform tightly around packaged products to protect against contamination and improve shelf presentation. Opportunities are arising in films formulated for energy-efficient processing, tear resistance and multi-layer barrier performance. Suppliers offering consistent gauge control, optical clarity and automated application compatibility are poised to lead this segment.

Stretch films have been preferred for pallet load containment due to their elasticity and high puncture resistance, which minimize load shift and product damage during transport. Films with pre-stretch features and advanced winding architecture have enabled reduced material usage while maintaining wrap integrity across heavy or uneven loads. Shrink films have been selected for beverage multipacks and retail-ready packaging where tight conformity and visual clarity are required. Films compatible with high-speed shrink tunnels and shrink wrapping machines have supported rapid line throughput. As package presentation and damage reduction have been prioritized by retailers and logistics providers, stretch and shrink film adoption has been reinforced in warehouse automation and retail packaging environments.

Challenges have been experienced due to wide variation in film thickness, pre-stretch performance and shrink ratio specifications, which can cause inconsistent packaging outcomes across different application lines. Film waste and environmental disposal concerns have arisen where film recycling infrastructure is limited, particularly for multi-layer oriented shrink variants. Compatibility issues between film types and application machines, including stretch wrapping robots and shrink tunnels, have resulted in machine downtime and operator training needs. Differing film formulations may require distinct sealing or heat activation temperatures, increasing setup complexity. Maintenance of film unwind equipment and sealing jaws has added operational overhead. As packaging throughput has grown, continuous monitoring of film quality and integration logistics has remained essential to maintain line efficiency.

Significant opportunities have arisen from the rapid increase in e-commerce transactions, leading to higher demand for stretch and shrink films for secure packaging and efficient transportation. Expanding use in packaged food, beverages, and pharmaceuticals has created strong prospects for films that offer product protection, tamper resistance, and extended shelf life. Growth in warehousing and distribution centers has encouraged the adoption of films optimized for automated pallet wrapping systems. The rising demand from manufacturing and retail sectors for improved load stability and material efficiency is generating additional scope for advanced film formulations. Emerging markets with strong trade volumes and industrial development are further expected to accelerate the utilization of these packaging solutions globally.

Recent trends indicate a move toward advanced polyethylene grades designed to improve durability, clarity, and mechanical performance in demanding applications. Development of multi-layer structures is becoming more common, ensuring better load containment and film efficiency. Increased reliance on automated packaging lines has resulted in higher demand for films compatible with high-speed wrapping systems. Lightweight film designs are gaining prominence to reduce overall material consumption without compromising strength. Enhanced stretchability and puncture resistance features are being incorporated to meet evolving logistics requirements. Integration of digital systems for performance monitoring and predictive maintenance in large-scale distribution environments is emerging as a key trend in the industry.

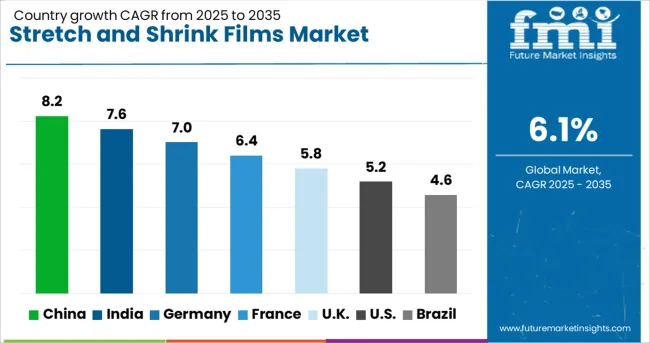

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The global market is projected to grow at 6.1% CAGR from 2025 to 2035, supported by the need for resilient energy solutions and reduced reliance on conventional power sources. China leads at 8.2% CAGR. India follows with 7.6%. Among OECD nations, Germany posts 7% CAGR and France records 6.4% CAGR during the forecast period. The analysis includes over 40 countries, with the top markets detailed below.

China is projected to grow at 8.2% CAGR, driven by large-scale manufacturing and rapid expansion of e-commerce and cold chain logistics. Demand for pallet wrapping films is increasing due to high-volume exports of industrial goods. The food and beverage sector requires advanced barrier films for extended shelf life and product protection.

Domestic film manufacturers are investing in multilayer technology to improve puncture resistance and load stability for long-distance shipping. The adoption of high-performance polyethylene blends is rising across FMCG and industrial packaging. Strategic partnerships with logistics providers are accelerating custom solutions tailored for high-speed wrapping equipment.

India is forecast to grow at 7.6% CAGR, supported by rising FMCG and food processing output. Demand is strong in beverage bottling, dairy packaging, and meat distribution chains that require efficient shrink-wrapping solutions. Growth in organized retail and regional distribution hubs is driving higher consumption of pallet stretch films. Domestic producers are introducing thinner yet stronger film variants to optimize material usage without compromising strength. Manufacturers are also expanding co-extrusion capabilities to produce films with enhanced clarity and sealing properties for display packaging. Increasing use of automated wrapping equipment in warehousing and 3PL logistics supports market penetration.

Germany is expected to grow at 7% CAGR, with demand concentrated in high-value industrial packaging and export-oriented sectors. Automotive component and chemical product shipments are major drivers for strong load containment films. Advanced film solutions designed for robotic stretch wrapping systems are gaining preference among large warehouses and production plants.

Manufacturers emphasize puncture-resistant, low-memory films for precision palletization of irregular loads. Co-extruded polyethylene blends dominate due to their high tensile strength and flexibility. Strategic alliances between packaging OEMs and film producers focus on integrating smart wrapping technology with film properties tailored for automation.

France is projected to grow at a 6.4% CAGR, driven by increased packaged food consumption and growth in beverage production. Shrink films are widely applied in multipack beverage packaging and retail-ready formats for convenience stores. Advanced barrier films with sealing integrity are preferred for perishable items in cold chain distribution.

Regional packaging companies are upgrading machinery to support faster wrapping cycles, boosting demand for high-performance films. Customized printing on shrink wraps for brand visibility is another emerging trend. Partnerships between retailers and packaging converters focus on delivering high-clarity display films to enhance shelf appeal while ensuring load stability.

The United Kingdom is forecast to grow at 5.8% CAGR, supported by pallet load security in retail and third-party logistics. Demand for stretch films with high elongation properties is growing to optimize film usage and wrapping efficiency. Shrink films find application in beverage multipacks and ready-meal packaging for supermarkets.

Packaging OEMs are collaborating with film producers to create solutions compatible with high-speed automated lines. Film recyclability and downgauging efforts are enhancing material efficiency in large-scale distribution hubs. Retail supply chain optimization and compliance with packaging standards strengthen market penetration in key segments such as food and industrial packaging.

The stretch and shrink films market is highly competitive, driven by a mix of global leaders and regional players offering advanced packaging solutions for food, beverage, industrial, and logistics sectors. Berry Global and Sealed Air dominate through large-scale manufacturing, innovative product development, and extensive distribution networks, while Dow and LyondellBasell Industries focus on resin innovations that deliver superior strength, clarity, and recyclability.

Intertape Polymer Group and Bollore provide value-added shrink films tailored for branding, shelf appeal, and compliance with safety standards, whereas SABIC plays a pivotal role as a raw material innovator, supplying advanced resins with enhanced barrier properties. Scientex Berhad and Paragon Films emphasize downgauged and lightweight stretch films that reduce material consumption without sacrificing performance, catering to cost and sustainability-driven preferences.

Coveris Holdings, RKW Group, and Klockner Pentaplast target niche applications, including pharmaceutical and protective packaging, using advanced multilayer extrusion technologies for high-performance films. Regional players such as Shaktiman Packaging, LUBANPACK, and A-Z Packaging compete aggressively in price-sensitive markets with cost-effective offerings and localized supply chains.

Competitive strategies include investments in recyclable and bio-based film technologies, expansion into high-growth markets such as Asia-Pacific and Latin America, and integration of automation-ready films to meet growing e-commerce and logistics demands. Strategic collaborations with retailers and fulfillment centers, along with a focus on downgauging and circular economy initiatives, are key differentiators. Companies combining product innovation, operational efficiency, and global scalability are best positioned to strengthen their presence in this rapidly evolving packaging market.

On February 17, 2025, Berry Global officially announced the launch of its next-generation Bontite® Sustane™ Stretch Film, which now includes 30% certified post-consumer recycled (PCR) content. This product was introduced at Packaging Innovations Birmingham in February 2025

| Item | Value |

|---|---|

| Quantitative Units | USD 20.5 Billion |

| Material | Polyethylene (PE), polyvinyl chloride (PVC), Polypropylene (PP), Biodegradable and compostable, and Others |

| Product | Wraps, Hoods, and Sleeves and labels |

| Application | Food & beverage, Consumer goods, Industrial packaging, Logistics & transportation, Pharmaceutical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, BerryGlobal, SealedAir, Dow, LyondellBasellIndustries, IntertapePolymerGroup, Bollore, SABIC, ScientexBerhad, ParagonFilms, CoverisHoldings, RKWGroup, KlocknerPentaplast, ShaktimanPackaging, BalcanInnovations, Italdibipack, HIPAC, LUBANPACK, A-ZPackaging, and FilmsourcePackaging |

| Additional Attributes | Dollar sales by film type (stretch wrap, shrink wrap) and material (LDPE, LLDPE, PVC, polypropylene), with demand driven by food packaging, industrial bundling, and logistics applications. Regional trends are led by North America and Europe, while Asia-Pacific shows rapid growth due to expanding retail and e-commerce. Innovations focus on bio-based resins, downgauged films, and recyclable materials to meet regulatory standards and enhance operational efficiency. |

The global stretch and shrink films market is estimated to be valued at USD 20.5 billion in 2025.

The market size for the stretch and shrink films market is projected to reach USD 37.0 billion by 2035.

The stretch and shrink films market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in stretch and shrink films market are polyethylene (pe), polyvinyl chloride (pvc), polypropylene (pp), biodegradable and compostable and others.

In terms of product, wraps segment to command 41.5% share in the stretch and shrink films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stretch Film Industry Analysis in DACH Size and Share Forecast Outlook 2025 to 2035

Stretch Film Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Stretch Mark Prevention Creams Market Size and Share Forecast Outlook 2025 to 2035

Stretch Marks Treatment Market Size and Share Forecast Outlook 2025 to 2035

Stretcher Accessories Market Size and Share Forecast Outlook 2025 to 2035

Stretch Film Packs Market Insights on Type, Product, Application, Industry, and Region - 2025 to 2035

Stretch Mark Removal Products Market Insights - Growth & Forecast 2025 to 2035

Stretch Hood Films Market Analysis by Up to 50 microns, 50-100 microns, 100-150 microns, 150 microns & above Through 2035

Stretchable Electronics Market Trends - Growth & Forecast 2025 to 2035

Stretch Wrapper Market Growth - Demand & Forecast 2025 to 2035

Stretch Blow Molding Machines Market Segmentation based on Technology Type, Orientation Type, End Use, and Region: A Forecast for 2025 and 2035

Stretchable Conductive Material Analysis by Material, Fillers, Stretching Mechanism, Fabrication, Function, Application, End-User and Region - Forecast for 2025 to 2035

Market Share Insights of Leading Stretch Blow Molding Machines Providers

Market Positioning & Share in the Stretch Film Industry

Stretch Sleeve Label Market Insights – Growth & Demand 2024-2034

Stretch Hood Pallet Wrapping Market

Stretch Films Market Outlook - Size, Demand & Industry Trends 2025 to 2035

Stretchable and Conformal Electronics Market

Stretch Sleeve and Shrink Sleeve Labels Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA