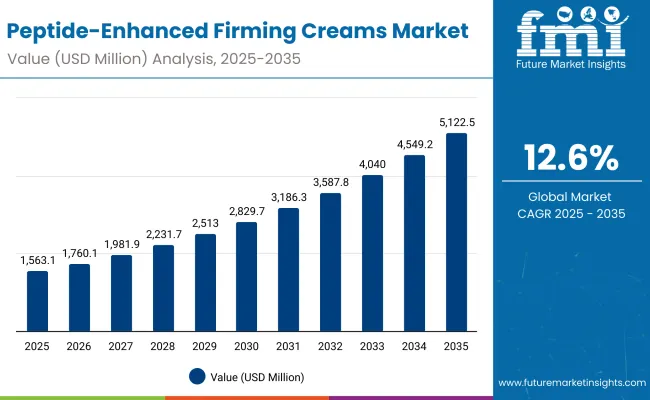

The Peptide-Enhanced Firming Creams Market is expected to record a valuation of USD 1,563.1 million in 2025 and USD 5,122.5 million in 2035, with an increase of USD 3,559.4 million, which equals a growth of 227% over the decade. The overall expansion represents a CAGR of 12.6% and a 3X increase in market size.

Peptide-Enhanced Firming Creams Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,563.1 million |

| Market Forecast Value in (2035F) | USD 5,122.5 million |

| Forecast CAGR (2025 to 2035) | 12.6% |

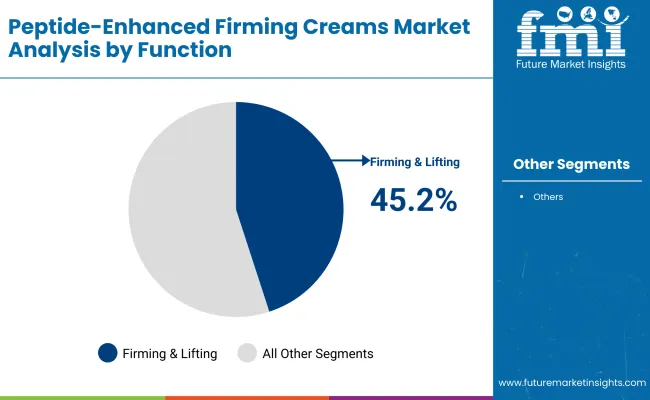

During the first five-year period from 2025 to 2030, the market increases from USD 1,563.1 million to USD 2,829.7 million, adding USD 1,266.6 million, which accounts for 35.6% of the total decade growth. This phase records steady adoption in premium skincare, dermatology-backed products, and consumer demand for visible anti-aging results, driven by the rise of peptides as clinically validated actives. Firming & lifting dominates this period as it caters to over 45% of consumers prioritizing skin-tightening and wrinkle-reduction efficacy.

The second half from 2030 to 2035 contributes USD 2,292.8 million, equal to 64.4% of total growth, as the market jumps from USD 2,829.7 million to USD 5,122.5 million. This acceleration is powered by widespread deployment of AI-personalized skincare regimens, biotech peptide innovations, and mass-market penetration via e-commerce platforms. Serums, ampoules, and peptide-loaded masks capture a larger share above 51% by the end of the decade. Claims such as clean-label, vegan, and fragrance-free gain strength, moving beyond niche to mainstream adoption across North America, Europe, and Asia.

From 2020 to 2024, the Peptide-Enhanced Firming Creams Market grew from USD 1,050 million to USD 1,420 million, driven by firming and anti-aging-centric adoption. During this period, the competitive landscape was dominated by multinational cosmetic giants controlling nearly 70% of revenue, with leaders such as Estée Lauder, L’Oréal, and Shiseido focusing on prestige and dermatologist-recommended peptide products. Competitive differentiation relied on clinical backing, ingredient innovation, and consumer trust, while mass-market lines often positioned peptides as an added benefit rather than a hero ingredient. Clean-label and vegan claims gained traction but contributed less than 15% of the total market value.

Demand for peptide-enhanced firming creams will expand to USD 1,563.1 million in 2025, and the revenue mix will shift as e-commerce and specialty channels grow to over 50% share. Traditional luxury leaders face rising competition from digital-first and indie beauty players offering biotech peptide blends, minimalist formulations, and subscription-based skincare routines. Major brands are pivoting to hybrid models, integrating dermatology credibility, influencer marketing, and personalized diagnostics to retain relevance. Emerging entrants specializing in multi-peptide complexes, adaptive delivery systems, and vegan formulations are gaining share. The competitive advantage is moving away from heritage brand loyalty alone to science-driven innovation, sustainability, and channel diversification.

Advances in cosmetic peptides have improved efficacy in boosting collagen production, skin elasticity, and moisture retention, allowing for clinically measurable anti-aging results across diverse product formats. Firming & lifting products have gained popularity due to their suitability for consumers seeking visible tightening effects and wrinkle reduction. The rise of multi-peptide complexes has contributed to enhanced skin barrier support and hydration benefits, with global consumer trust in dermatology-backed claims accelerating adoption. Industries such as premium skincare, cosmeceuticals, and professional dermatology clinics are driving demand for peptide-based firming solutions that integrate seamlessly into daily routines.

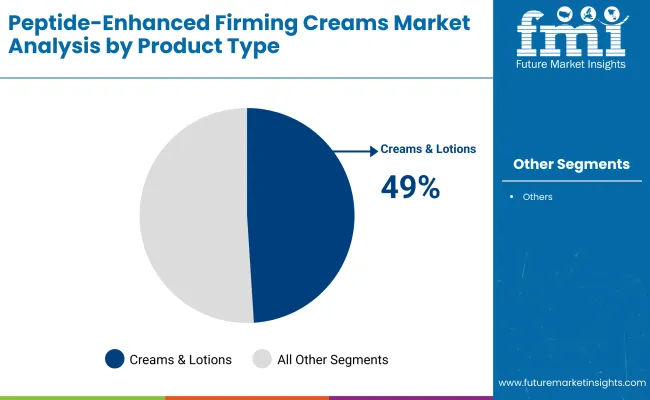

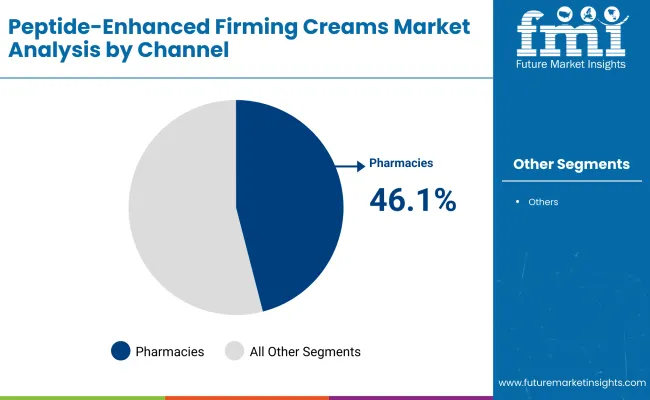

Expansion of clean-label and vegan peptide formulations has fueled market growth. Innovations in delivery formats such as serums, ampoules, and peptide masks are expected to open new application areas. Segment growth is expected to be led by firming & lifting in function, creams & lotions in product type, and pharmacies and e-commerce in distribution due to their accessibility and consumer trust.

The market is segmented by function, product type, channel, claim, and region. Functions include firming & lifting, anti-aging & wrinkle reduction, hydration, and skin barrier support, highlighting the core drivers of peptide-based adoption. Product type classification covers creams & lotions, serums, ampoules, and masks to cater to different consumer usage preferences. Based on channel, the segmentation includes pharmacies, e-commerce, specialty beauty stores, and mass retail. In terms of claims, categories encompass dermatologist-recommended, clean-label, vegan, and fragrance-free. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

| Function Segment | Market Value Share, 2025 |

|---|---|

| Firming & lifting | 45.2% |

| Others | 54.8% |

The firming & lifting segment is projected to contribute 45.2% of the Peptide-Enhanced Firming Creams Market revenue in 2025, maintaining its lead as the dominant function category. This is driven by ongoing demand for advanced collagen-boosting formulations and visible tightening effects. Consumers prioritize skin tone enhancement and wrinkle minimization, fueling consistent investment in firming peptide complexes.

The segment’s growth is also supported by the rising use of multi-functional peptides that deliver dual anti-aging and hydration benefits. As peptide science advances and formulations become more accessible through both premium and mid-tier ranges, firming & lifting products are expected to remain the backbone of peptide-enhanced skincare.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Creams & lotions | 49.0% |

| Others | 51.0% |

The creams & lotions segment is forecasted to hold 49.0% of the market share in 2025, led by its role as the most familiar and widely adopted product format. These products are favored for their versatility, convenience, and suitability for both day and night skincare routines. Creams and lotions combine peptides with other active ingredients, enhancing consumer confidence in efficacy.

Their strong positioning in pharmacies, specialty beauty stores, and mass retail has facilitated widespread adoption across demographics. The segment’s growth is further bolstered by advancements in peptide stabilization technology that improve skin penetration and bioavailability. As consumers increasingly require multifunctional daily-use products, creams & lotions are expected to continue their dominance in the market.

| Channel Segment | Market Value Share, 2025 |

|---|---|

| Pharmacies | 46.1% |

| Others | 53.9% |

The pharmacies segment is projected to account for 46.1% of the Peptide-Enhanced Firming Creams Market revenue in 2025, establishing it as the leading distribution channel. Pharmacies are preferred for their credibility, trusted dermatology positioning, and access to dermatologist-recommended brands.

This segment’s growth is also driven by the expansion of pharmacy-led beauty sections and collaborations with cosmeceutical brands. While e-commerce is scaling rapidly, pharmacies remain the cornerstone of consumer confidence, particularly in North America and Europe. The segment is expected to retain its leading role, supported by premium product launches and continued consumer reliance on professional recommendations.

Drivers

Rising Consumer Demand for Clinically Proven Anti-Aging Solutions

A primary driver of the Peptide-Enhanced Firming Creams Market is the accelerating demand for skincare solutions that deliver visible, clinically backed anti-aging outcomes. Consumers are increasingly shifting toward products that go beyond basic moisturization and target deeper concerns such as wrinkles, sagging, and fine lines. Peptides, with their proven ability to stimulate collagen synthesis and improve skin elasticity, are perceived as a gold-standard active ingredient.

The growing trust in science-backed beauty products is amplified by dermatologists endorsing peptides as safe, effective, and versatile across different skin types. This has encouraged both premium and mass-market brands to integrate peptide complexes in creams, serums, and masks, further expanding the addressable consumer base. The driver is especially strong in regions such as East Asia and North America, where awareness of peptide efficacy is amplified by strong marketing and clinical validation in brand campaigns.

Expansion of E-commerce and Specialty Beauty Retail Channels

The second major growth driver is the rapid expansion of e-commerce platforms and specialty beauty retail outlets. Online channels not only broaden product availability globally but also allow for highly personalized consumer engagement through AI-driven recommendations, subscription models, and trial-sized product offerings. Specialty beauty stores reinforce this trend by curating peptide-focused lines and providing experiential in-store demonstrations that highlight peptide efficacy.

These distribution channels bridge the gap between consumer curiosity and clinical education, boosting adoption rates. Furthermore, e-commerce has been instrumental in allowing indie and digital-first brands to compete alongside global giants, offering peptide formulations with unique claims such as vegan, fragrance-free, or clean-label positioning. The convenience of direct-to-consumer delivery has made e-commerce one of the most powerful growth accelerators for peptide-enhanced firming creams.

Restraints

High Cost of Peptide Formulations and Premium Pricing

One of the significant restraints is the high cost associated with peptide formulation, stabilization, and delivery systems. Peptides, being bioactive molecules, require advanced encapsulation and stabilization techniques to ensure they remain effective until they penetrate the skin. These technologies raise production costs, which directly influence product pricing. As a result, many peptide-enhanced firming creams are positioned as premium products, limiting their accessibility to middle-income consumers in emerging markets. The cost barrier is particularly evident in price-sensitive regions such as Latin America, South Asia, and parts of Africa, where affordability often dictates purchasing decisions. This premium price point narrows the market penetration potential despite strong consumer interest.

Competition from Alternative Anti-Aging Actives

The market also faces a restraint in the form of competition from alternative anti-aging ingredients such as retinoids, hyaluronic acid, niacinamide, and vitamin C. Many of these alternatives are widely available at lower costs, backed by decades of consumer trust and scientific validation. In fact, retinoids are often positioned as the gold standard in anti-aging, while hyaluronic acid dominates hydration and plumping claims. For consumers unfamiliar with peptides, these alternatives may seem like safer or more accessible investments. Brands must therefore invest heavily in consumer education and marketing to differentiate peptides as unique and worth the premium. Without this, peptide-enhanced creams risk being overshadowed in crowded anti-aging aisles.

Key Trends

Rise of Multi-Peptide Complexes and Personalized Skincare

A key trend shaping the Peptide-Enhanced Firming Creams Market is the shift from single-ingredient peptide creams to advanced formulations containing multi-peptide complexes. These complexes combine different peptides with complementary functions for example, one targeting collagen stimulation, another improving hydration, and a third enhancing skin barrier repair.

This “cocktail approach” not only enhances efficacy but also aligns with the consumer preference for all-in-one, multifunctional skincare solutions. Additionally, personalization is becoming central, with AI-driven diagnostic tools recommending peptide-enhanced firming creams tailored to individual skin concerns. Major players like Estée Lauder and L’Oréal are investing in peptide personalization platforms, creating a new wave of science-meets-consumer customization in beauty.

Growing Popularity of Clean-Label, Vegan, and Fragrance-Free Claims

Another trend transforming the market is the surge in demand for products that combine scientific efficacy with ethical and sustainable attributes. Clean-label, vegan, and fragrance-free claims are increasingly becoming decision-making criteria for millennial and Gen Z consumers. Brands are innovating by sourcing bio-fermented or plant-derived peptides that align with eco-conscious preferences. For instance, vegan peptide formulations are being positioned as cruelty-free alternatives to animal-derived collagen peptides.

Simultaneously, fragrance-free claims appeal to sensitive-skin consumers seeking dermatologist-recommended solutions without irritation risks. This convergence of efficacy with ethical positioning is expected to redefine the competitive landscape, with companies that adopt both innovation and sustainability gaining stronger market traction.

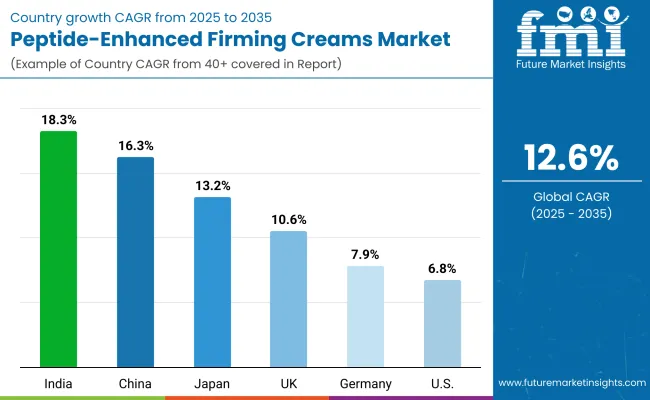

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 16.3% |

| USA | 6.8% |

| India | 18.3% |

| UK | 10.6% |

| Germany | 7.9% |

| Japan | 13.2% |

The country-level growth outlook for the Peptide-Enhanced Firming Creams Market shows clear regional contrasts, with emerging Asian economies significantly outpacing developed markets. India (18.3% CAGR) leads the forecast period, driven by rising middle-class incomes, increasing urbanization, and growing awareness of advanced skincare solutions that target aging and firming concerns. China (16.3% CAGR) follows closely, benefiting from a rapidly expanding beauty and personal care market, strong adoption of e-commerce platforms, and the willingness of consumers to experiment with innovative peptide-based formulations.

Japan (13.2% CAGR) also stands out, with a mature yet innovation-driven skincare market that values technologically advanced and functional actives such as peptides. Collectively, Asia is emerging as the powerhouse region, accounting for the fastest growth rates due to consumer demand for premium yet scientifically validated anti-aging products. In contrast, developed Western markets show moderate but steady growth. The USA (6.8% CAGR) remains the single-largest market in absolute value, supported by strong brand loyalty, dermatology-led endorsements, and rising adoption among aging demographics.

Germany (7.9% CAGR) demonstrates resilience, driven by demand for dermatologist-recommended and clean-label peptide formulations. Meanwhile, the UK (10.6% CAGR) reflects an evolving balance of luxury skincare adoption and e-commerce-driven mass-market penetration. While growth in Western regions is slower compared to Asia, these markets continue to represent high-value opportunities, particularly for premium and dermatologist-recommended peptide-enhanced firming creams. Together, these dynamics highlight how the global market’s expansion is fueled by both mature consumer trust in developed economies and surging demand in high-growth Asian markets.

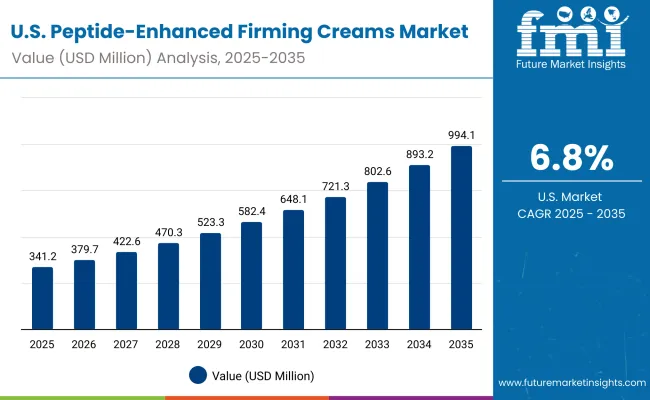

| Year | USA Peptide-Enhanced Firming Creams Market (USD Million) |

|---|---|

| 2025 | 341.3 |

| 2026 | 379.8 |

| 2027 | 422.6 |

| 2028 | 470.3 |

| 2029 | 523.4 |

| 2030 | 582.4 |

| 2031 | 648.2 |

| 2032 | 721.3 |

| 2033 | 802.7 |

| 2034 | 893.3 |

| 2035 | 994.1 |

The Peptide-Enhanced Firming Creams Market in the United States is projected to grow at a CAGR of 6.8%, supported by strong consumer preference for dermatologist-recommended and clinically proven skincare products. The USA market has a high adoption rate of firming & lifting creams, which already account for nearly 39.4% of total sales in 2025. Increasing awareness around preventive anti-aging routines, coupled with the rapid expansion of clean-label and fragrance-free claims, is shaping consumer behavior. Pharmacies and specialty beauty stores remain leading channels, while e-commerce is expanding due to subscription-based models and influencer-driven promotions.

The Peptide-Enhanced Firming Creams Market in the United Kingdom is expected to grow at a CAGR of 10.6%, driven by strong adoption in the premium skincare segment and rising consumer interest in vegan and clean-label claims. Luxury brands such as Lancôme, Estée Lauder, and Clinique dominate, but smaller indie brands leveraging sustainable packaging and cruelty-free peptides are gaining traction. The UK market also benefits from pharmacy chains and beauty retailers integrating peptide products into mainstream shelves, making them more accessible to middle-income consumers. Government-backed sustainability programs and consumer awareness campaigns are further supporting the rise of clean-label cosmetics.

India is witnessing rapid growth in the Peptide-Enhanced Firming Creams Market, forecast to expand at a CAGR of 18.3% through 2035, the fastest among major economies. Rising disposable incomes, urban lifestyle shifts, and social media influence are driving awareness and willingness to invest in peptide-based skincare. While creams & lotions dominate initially, younger consumers are adopting serums and ampoules due to their lighter textures and faster absorption. E-commerce platforms like Nykaa and Amazon India are critical in making peptide-enhanced products accessible beyond metros into tier-2 and tier-3 cities.

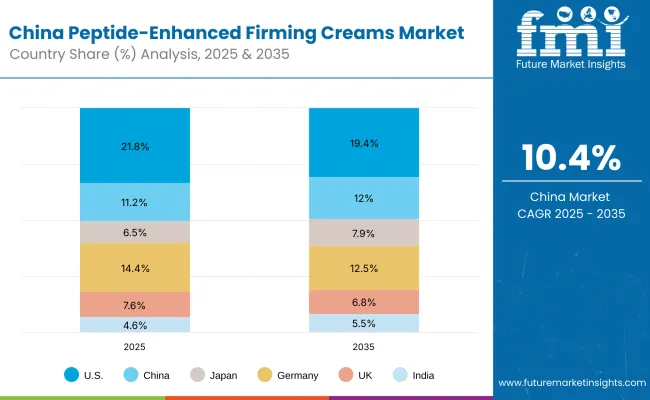

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.8% |

| China | 11.2% |

| Japan | 6.5% |

| Germany | 14.4% |

| UK | 7.6% |

| India | 4.6% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.4% |

| China | 12.0% |

| Japan | 7.9% |

| Germany | 12.5% |

| UK | 6.8% |

| India | 5.5% |

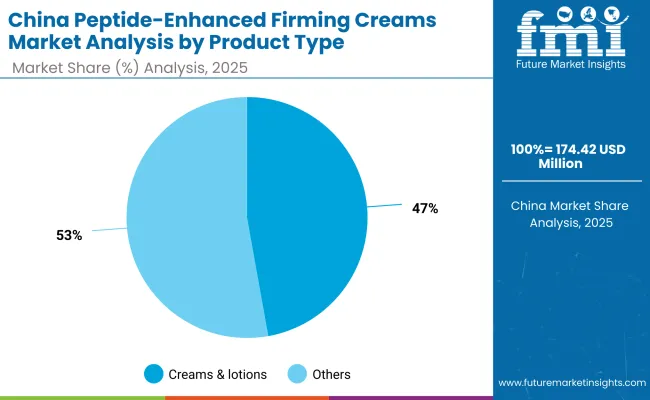

The Peptide-Enhanced Firming Creams Market in China is expected to grow at a CAGR of 16.3%, among the highest globally. Growth is led by strong demand for creams & lotions, which already account for 47.2% of the market in 2025. China’s booming e-commerce ecosystem, led by Tmall and JD.com, has made peptide-based firming creams widely accessible. Consumer appetite for innovative beauty products and functional actives is fueling adoption of both premium and mass-market peptide lines. In addition, local brands are rapidly scaling production, introducing affordable peptide products that appeal to younger consumers.

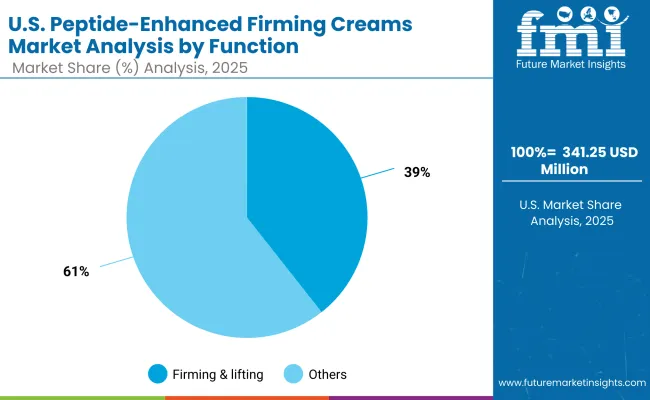

| Function Segment | Market Value Share, 2025 |

|---|---|

| Firming & lifting | 39.4% |

| Others | 60.6% |

The Peptide-Enhanced Firming Creams Market in the United States is valued at USD 341.25 million in 2025, with firming & lifting leading at 39.4%, followed by hydration, wrinkle reduction, and skin barrier support making up the remaining share. The dominance of firming & lifting reflects the USA consumer preference for visible anti-aging results, particularly among Gen X and Baby Boomer demographics who prioritize collagen-boosting actives. Dermatologist-recommended brands like Estée Lauder, Olay, and StriVectin reinforce consumer trust, further anchoring firming formulations as the core function.

This advantage positions firming & lifting creams as the backbone of the USA anti-aging segment, appealing to both high-income consumers in luxury retail and middle-income groups through pharmacy and mass-market lines. Hydration-focused creams maintain relevance in multipurpose daily skincare routines, but firming peptides remain the differentiator in premium-priced offerings. As e-commerce platforms expand subscription-based skincare bundles and AI-driven personalization tools, adoption will intensify, making the USA a mature yet steadily growing market.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Creams & lotions | 47.2% |

| Others | 52.8% |

The Peptide-Enhanced Firming Creams Market in China is valued at USD 174.42 million in 2025, with creams & lotions leading at 47.2%, followed by serums, ampoules, and masks. The dominance of creams & lotions stems from their mass appeal as versatile formats, suited to both anti-aging prevention in younger consumers and firming routines among aging populations. The rapid adoption of peptides in China reflects strong beauty culture dynamics, where skincare routines emphasize multi-step regimens and functional actives. International luxury brands compete with fast-scaling domestic players, many of whom are leveraging affordable peptide formulations to capture e-commerce-driven demand.

This advantage positions creams & lotions as the first point of entry for peptide-based skincare, especially among first-time adopters in urban middle-class segments. Serums and ampoules, however, are projected to rise faster, driven by professional dermatology clinics and K-beauty-inspired product layering. With China’s fast CAGR of 16.3%, the peptide category is evolving beyond premium exclusivity into mass-market adoption, making it one of the most dynamic growth opportunities globally.

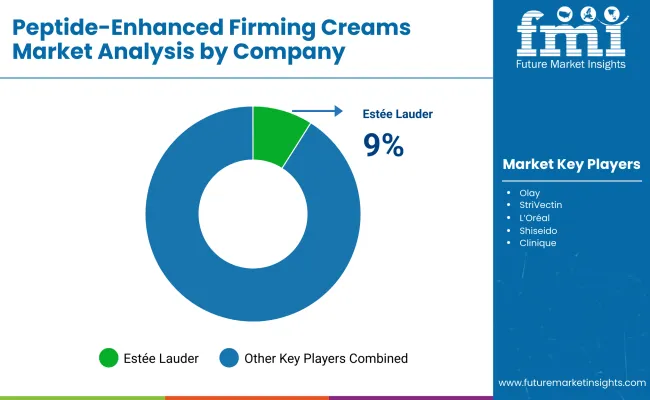

The Peptide-Enhanced Firming Creams Market is moderately fragmented, with multinational beauty giants, niche peptide specialists, and digital-first challengers competing across diverse consumer segments. Estée Lauder leads with a 9.0% share, backed by its advanced peptide lines such as Perfectionist and Clinique Smart. Its dominance is driven by clinical validation, strong dermatologist endorsements, and a powerful retail and e-commerce footprint. L’Oréal, Olay, Shiseido, and Lancôme closely follow, emphasizing innovation in multi-peptide complexes, luxury brand positioning, and aggressive marketing through pharmacies and specialty beauty stores.

Established mid-tier players like StriVectin, Murad, Paula’s Choice, and Dr. Dennis Gross focus on targeted, science-driven positioning. Their strength lies in concentrated peptide serums, anti-wrinkle ampoules, and dermatologist-approved claims, which resonate strongly with informed consumers seeking clinical-grade efficacy. Many of these brands are expanding through e-commerce exclusives, direct-to-consumer subscriptions, and international cross-border sales into Asia-Pacific.

Meanwhile, niche players and indie beauty brands are gaining visibility by offering vegan, fragrance-free, and clean-label peptide formulations. Their agility in responding to ethical beauty trends and transparency in ingredient sourcing gives them an edge in markets like the UK, Germany, and South Korea. Competitive differentiation is shifting away from luxury branding alone to a combination of scientific efficacy, sustainability, and digital personalization. Brands that successfully integrate peptide innovation with broader consumer values are expected to secure long-term loyalty.

Key Developments in Peptide-Enhanced Firming Creams Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,563.1 million |

| Function | Firming & lifting, Anti-aging & wrinkle reduction, Hydration, Skin barrier support |

| Product Type | Creams & lotions, Serums, Ampoules, Masks |

| Channel | Pharmacies, E-commerce, Specialty beauty stores, Mass retail |

| Claim | Dermatologist-recommended, Clean-label, Vegan, Fragrance-free |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Estée Lauder, Olay, StriVectin, L’Oréal, Shiseido, Clinique, Paula’s Choice, Murad, Lancôme, Dr. Dennis Gross |

| Additional Attributes | Dollar sales by function and product type, adoption trends in firming & lifting and hydration skincare, rising demand for dermatologist-recommended and clean-label claims, segment-specific growth in creams & lotions and serums, expansion of e-commerce and specialty retail channels, integration of vegan and fragrance-free attributes, regional trends influenced by K-beauty and Western dermatology, and innovations in multi-peptide complexes and advanced delivery systems. |

The Peptide-Enhanced Firming Creams Market is estimated to be valued at USD 1,563.1 million in 2025.

The market size for the Peptide-Enhanced Firming Creams Market is projected to reach USD 5,122.5 million by 2035.

The Peptide-Enhanced Firming Creams Market is expected to grow at a 12.6% CAGR between 2025 and 2035.

The key product types in the Peptide-Enhanced Firming Creams Market are creams & lotions, serums, ampoules, and masks.

In terms of function, the firming & lifting segment is projected to command USD 706.4 million (45.2% share) in the Peptide-Enhanced Firming Creams Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Firming Creams and Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Body Firming Creams Market Growth & Forecast 2025-2035

Slugging Creams Market Size and Share Forecast Outlook 2025 to 2035

Anti-Aging Creams & Serums Market Size and Share Forecast Outlook 2025 to 2035

Anti-Wrinkle Creams Market Size and Share Forecast Outlook 2025 to 2035

Eczema Relief Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Muscle Relaxing Creams Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Ice Creams Market Analysis by Form, Product Type, Flavor, Source, Sales Channel, and Region through 2035

Moisturizing Body Creams Market Size and Share Forecast Outlook 2025 to 2035

Age-Defying Night Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Hydrating Emollient Creams Market Size and Share Forecast Outlook 2025 to 2035

Cica-Infused Healing Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Retinoid-Infused Night Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Depilatory Hair Removal Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Stretch Mark Prevention Creams Market Size and Share Forecast Outlook 2025 to 2035

Lip Plumping and Filler Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA