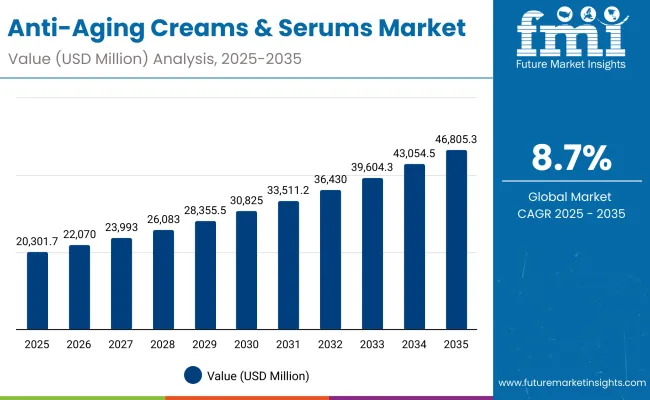

The Global Anti-Aging Creams & Serums Market is expected to record a valuation of USD 20,301.7 million in 2025 and USD 46,805.3 million in 2035, with an increase of USD 26,503.6 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 8.7% and a 2X increase in market size.

Global Anti-Aging Creams & Serums Market Key Takeaways

| Metric | Value |

|---|---|

| global Anti-Aging Creams & Serums Market Estimated Value (2025E) | USD 20,301.7 million |

| global Anti-Aging Creams & Serums Market Forecast Value (2035F) | USD 46,805.3 million |

| Forecast CAGR (2025 to 2035) | 8.7% |

During the first five-year period from 2025 to 2030, the market increases from USD 20,301.7 million to USD 30,825.8 million, adding USD 10,524.1 million, which accounts for nearly 40% of the total decade growth. This phase records steady adoption in wrinkle-targeting formulations, retinol-driven night creams, and peptide-based serums.

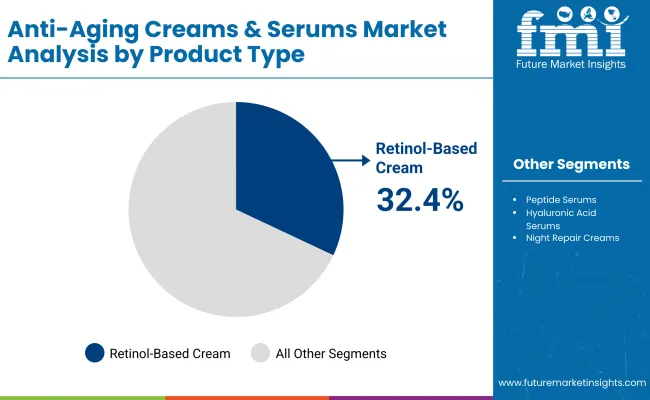

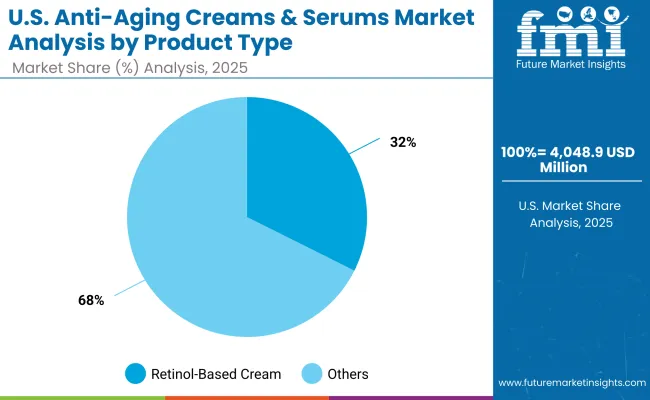

Consumers in the USA and Europe show preference for dermatologist-tested products, while East Asia emerges as a hotbed for innovation in hyaluronic acid and antioxidant-rich solutions. Retinol-based creams dominate this period as they cater to over 32% of users focused on visible wrinkle reduction and skin repair.

The second half from 2030 to 2035 contributes USD 15,979.5 million, equal to nearly 60% of total growth, as the market jumps from USD 30,825.8 million to USD 46,805.3 million. This acceleration is powered by widespread deployment of AI-personalized skincare, premium dermocosmetic positioning, and rising acceptance of men’s and unisex formulations.

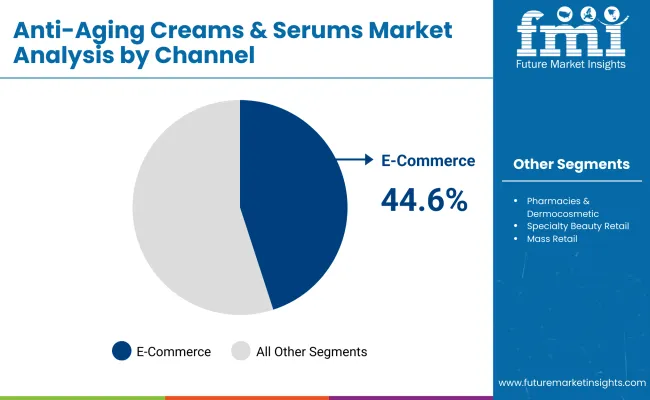

India and China fuel double-digit CAGR growth rates, as affordability of peptide and hyaluronic acid serums expands access beyond urban premium channels. Online-exclusive launches, subscription models, and eco-conscious packaging further drive consumer loyalty. E-commerce and specialty beauty retail together surpass 65% share by 2035, reinforcing digital-first brand building.

From 2020 to 2024, the Global Anti-Aging Creams & Serums Market grew from a hardware-centric skincare approach focused on retinol and antioxidant formulations to a more balanced mix of multi-functional serums and night repair creams.

During this period, the competitive landscape was dominated by multinationals controlling nearly 70% of revenue, with leaders such as L’Oréal, Estée Lauder, and Shiseido focusing on global distribution strength and premium positioning. Competitive differentiation relied on anti-wrinkle efficacy, dermatological backing, and clinical trial validation, while digital-first brands were still emerging. Service-based personalization, such as AI skin diagnostics, had minimal traction, contributing less than 5% of total market value.

Demand for anti-aging solutions expands further to USD 20,301.7 million in 2025, and the revenue mix shifts as serums and specialty solutions grow to over 40% share. Traditional cream-based leaders face rising competition from niche players offering clean-label, vegan-certified, and AI-driven customized formulations.

Major brands are pivoting to hybrid models, integrating digital consultations, subscription-driven D2C models, and refillable packaging to retain relevance. Emerging entrants specializing in eco-conscious ingredients, microbiome-friendly serums, and AR/VR-enabled try-on platforms are gaining share. The competitive advantage is moving away from brand heritage alone to ecosystem strength, retail footprint, and recurring consumer engagement models.

Advances in active ingredients such as retinol, peptides, and hyaluronic acid have improved efficacy and speed, allowing for more visible results across diverse skin types. Retinol-based creams continue to dominate due to their strong clinical validation in wrinkle reduction, while serums deliver higher absorption rates and are increasingly positioned as premium, fast-acting solutions. Antioxidant-rich moisturizers, supported by vitamin C, niacinamide, and botanical extracts, are gaining traction for their brightening and tone-correcting capabilities.

The rise of digital channels has accelerated consumer access. E-commerce platforms provide not only availability but also personalized recommendations, virtual skin assessments, and bundled subscription options. This shift is especially evident in Asia-Pacific, where cross-border e-commerce platforms dominate skincare distribution. Meanwhile, pharmacies and dermocosmetic clinics strengthen credibility, especially in Europe and North America, where clinical endorsement is a key purchase driver.

Expansion of anti-aging adoption among men and unisex premium users has fueled additional growth. Innovations in lightweight, non-greasy formulations and gender-neutral branding are expanding target demographics. Segment growth is expected to be led by retinol-based creams, wrinkle reduction products, and e-commerce channels, while India and China deliver the strongest CAGR growth due to urban middle-class expansion, rising beauty consciousness, and premiumization trends.

The Global Anti-Aging Creams & Serums Market is segmented by product type, function, channel, end user, and geography. Product types include retinol-based creams, peptide serums, hyaluronic acid serums, antioxidant-rich moisturizers, and night repair creams, each serving unique consumer needs. Functional segmentation includes wrinkle reduction, skin firming & elasticity, brightening & tone correction, and hydration & barrier repair, reflecting demand for comprehensive anti-aging solutions.

Distribution channels span e-commerce, specialty beauty retail, pharmacies & dermocosmetic clinics, and mass retail, highlighting the balance between clinical trust and online convenience. End-user segmentation covers women aged 35-55, women aged 55+, men, and unisex premium users, underscoring gender and age-driven consumption patterns.

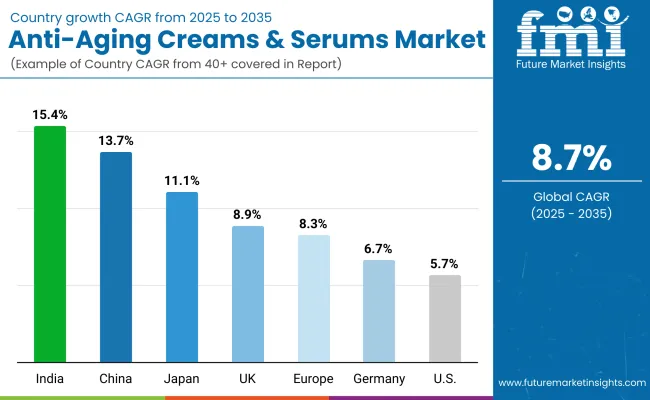

Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with India (15.4% CAGR) and China (13.7% CAGR) leading Global growth, while the USA remains the largest single market in absolute value.

| Product Type | Value Share % 2025 |

|---|---|

| Retinol-based creams | 32.4% |

| Others | 67.6% |

The retinol-based creams segment is projected to contribute 32.4% of the Global Anti-Aging Creams & Serums Market revenue in 2025, maintaining its lead as the dominant product category. This is driven by ongoing consumer preference for proven retinoid formulations that deliver visible wrinkle reduction, improved skin texture, and enhanced cell turnover. Dermatologists continue to recommend retinol as a gold-standard active, reinforcing its credibility and widespread adoption across premium and mass-market brands alike.

The segment’s growth is also supported by the rise of night repair and corrective formulations that feature encapsulated retinol, designed to improve stability and reduce irritation, thereby expanding the user base to sensitive-skin consumers.

As clean beauty trends intensify, brands are investing in plant-derived retinol alternatives (bakuchiol, algae extracts) but positioning them under the same efficacy promise. The retinol-based creams segment is expected to retain its position as the backbone of anti-aging routines, balancing tradition with innovation and premium clinical trust.

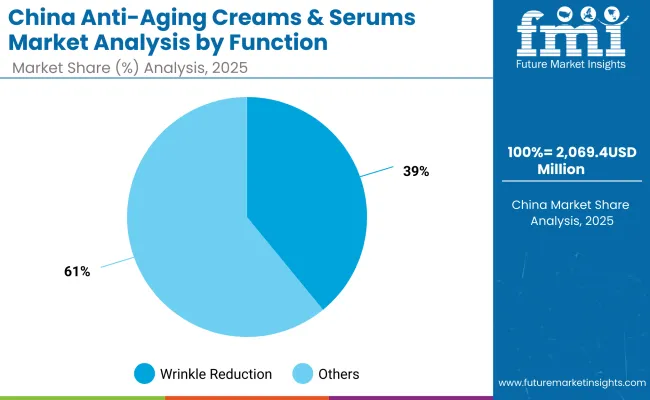

| Function | Value Share % 2025 |

|---|---|

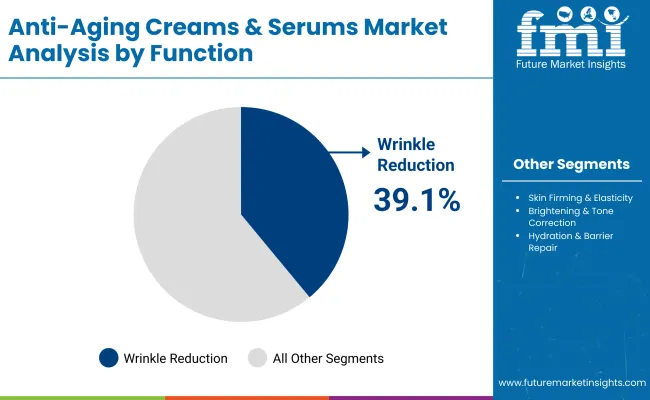

| Wrinkle reduction | 39.1% |

| Others | 60.9% |

The wrinkle reduction segment is forecasted to hold 39.1% of the Global Anti-Aging Creams & Serums Market share in 2025, led by its critical role in meeting the core consumer demand for visible age reversal. Wrinkle reduction products are favored for their high concentration of active ingredients such as retinol, peptides, and hyaluronic acid, which target fine lines and deep wrinkles, making them indispensable across mid-age and mature skin categories.

Their positioning as “first-line defense against aging” has facilitated widespread adoption across both women and men’s skincare lines. The segment’s growth is bolstered by advancements in multi-functional actives, where wrinkle repair is combined with brightening, hydration, and barrier support, ensuring consumers experience holistic benefits in a single product.

With aging concerns starting as early as the 30s in emerging markets, demand for wrinkle-focused formulations is expected to continue its dominance in the Global market, driving innovation pipelines for dermatology-backed skincare.

| Channel | Value Share % 2025 |

|---|---|

| E-commerce | 44.6% |

| Others | 55.4% |

The e-commerce segment is projected to account for 44.6% of the Global Anti-Aging Creams & Serums Market revenue in 2025, establishing it as the leading distribution channel. This channel is preferred for its ability to provide consumers with convenient access to a broad range of brands, from luxury serums to affordable mass-market creams, alongside detailed ingredient transparency, peer reviews, and dermatologist endorsements.

Its suitability for personalized recommendations, subscription-based delivery, and AI-powered skincare diagnostics has made e-commerce central to the buying journey. Developments in cross-border logistics and live-streaming e-commerce in Asia-Pacific markets have further enhanced speed, accessibility, and consumer engagement. Given its balance of reach, personalization, and cost efficiency, the e-commerce channel is expected to maintain its leading role in the Global Anti-Aging Creams & Serums Market, capturing growth as consumers increasingly adopt digital-first shopping behaviors.

Rising Middle-Class Beauty Spending in Asia (India & China as Core Growth Engines)

The Global Anti-Aging Creams & Serums Market is being propelled by the rapid expansion of the middle-class population in Asia, particularly India and China, which show CAGRs of 15.4% and 13.7%, respectively. Consumers in these markets are increasingly prioritizing skincare in their monthly budgets, shifting from basic moisturizers to targeted anti-aging solutions.

In India, rising urbanization and the influence of K-beauty and J-beauty routines are pushing younger demographics (late 20s to early 30s) to begin preventative anti-aging regimens earlier. In China, post-pandemic digitalization has accelerated cross-border e-commerce imports of high-end serums and creams, especially from L’Oréal, Estée Lauder, and Shiseido, which dominate the online luxury segment.

This localized surge in aspirational purchasing is a structural driver, ensuring that Asia-Pacific delivers disproportionate contributions to Global revenue growth over the decade.

Clinical Validation and Dermatology-Backed Marketing

Another strong driver is the growing reliance on dermatology and clinical testing as a trust anchor for consumers. Anti-aging is a premium and sensitive category, where efficacy claims are scrutinized more than in basic skincare. Products such as retinol-based creams (32.4% share) and wrinkle-reduction solutions (39.1% share) are backed by a growing body of clinical evidence, which brands amplify in their marketing campaigns.

Clinics and dermocosmetic chains in Europe and North America are increasingly recommending products aligned with prescription-grade actives, while mass retail players like Olay and Neutrogena are reformulating with encapsulated retinol and stabilized vitamin C to meet clinical credibility expectations. This blend of science-led branding with mass accessibility is a key driver differentiating winners in this market.

Irritation and Side-Effect Concerns with Potent Actives

While retinol remains the cornerstone of the Global Anti-Aging Creams & Serums Market, its side effects such as dryness, redness, and peeling are limiting wider adoption, particularly among consumers with sensitive skin. Even with encapsulated or slow-release formulas, consumer perception of irritation risk remains high, creating hesitancy in first-time buyers.

This concern is amplified in emerging markets where dermatology access is limited, and self-diagnosis leads to improper usage. The barrier here is not just technical but behavioral and educational, as consumers require more guidance on how to integrate retinol and peptides safely into daily routines. Brands must invest in dermatology-driven consumer education to overcome this restraint.

Premium Pricing Limiting Mass Adoption in Developing Markets

The strongest growth markets, such as India and China, still face challenges around price accessibility. While consumers are aspirational, high-quality peptide serums and branded retinol creams are often priced at levels that restrict consistent use outside urban Tier-1 cities. This has led to a growing gap between aspirational demand and actual repeat purchase rates.

Domestic players in Asia are attempting to close this gap with more affordable SKUs and sachet-style packaging, but global leaders remain concentrated in the premium tier. Unless more price-tier innovation is introduced, premium positioning could restrain penetration across the broader consumer base in high-growth economies.

Rise of Preventive Anti-Aging Among Younger Consumers

A major trend reshaping the Global Anti-Aging Creams & Serums Market is the early adoption of preventive anti-aging routines among millennials and Gen Z. Unlike earlier decades where anti-aging products targeted women 40+, younger demographics (25-35) are now using hyaluronic acid serums, antioxidant-rich moisturizers, and light retinol night creams as part of “prejuvenation” strategies.

Social media influencers and dermatologists on platforms like TikTok, Instagram, and Xiaohongshu are fueling this shift by promoting anti-aging as an essential lifestyle step, not just a corrective measure. This trend is particularly visible in East Asia and the USA, where demand for entry-level serums is rising at double-digit growth, expanding the total addressable market beyond its traditional core.

E-commerce Subscription and D2C Loyalty Ecosystems

Another defining trend is the integration of subscription-driven models and loyalty ecosystems in e-commerce. With e-commerce already accounting for 44.6% share in 2025, leading brands are leveraging D2C channels to lock in recurring sales. Subscription programs offering 10-15% discounts on monthly deliveries of serums or night creams are not only stabilizing revenue streams but also building consumer loyalty.

Additionally, AI-driven virtual consultations, skin analysis tools, and AR try-on experiences are transforming how consumers shop for anti-aging products online. This trend is strongest in the USA and China, where digital-first players like Drunk Elephant and Paula’s Choice, alongside incumbents like Estée Lauder, are investing heavily in tech-enabled consumer retention strategies.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 13.7% |

| USA | 5.7% |

| India | 15.4% |

| UK | 8.9% |

| Germany | 6.7% |

| Japan | 11.1% |

| Europe | 8.3% |

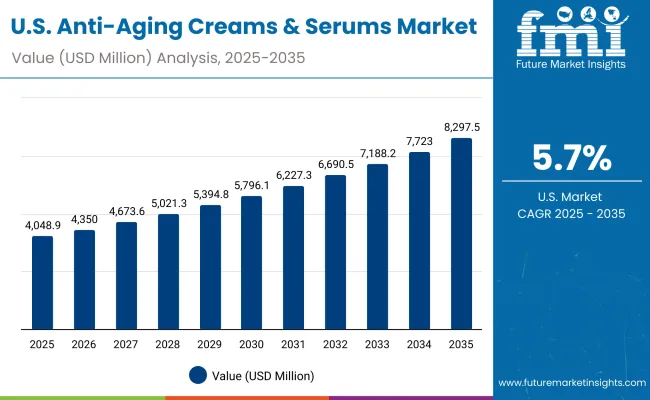

| Year | USA Anti-Aging Creams & Serums Market (USD Million) |

|---|---|

| 2025 | 4048.90 |

| 2026 | 4350.09 |

| 2027 | 4673.68 |

| 2028 | 5021.35 |

| 2029 | 5394.87 |

| 2030 | 5796.19 |

| 2031 | 6227.35 |

| 2032 | 6690.59 |

| 2033 | 7188.29 |

| 2034 | 7723.01 |

| 2035 | 8297.50 |

The Global Anti-Aging Creams & Serums Market in the United States is projected to grow at a CAGR of 5.7%, driven by strong consumer demand for retinol-based creams and multi-functional serums. Growth is supported by the mature presence of leading brands such as Estée Lauder, Clinique, and Olay, who are introducing dermatologist-tested, fragrance-free, and clinical-grade formulations to retain consumer trust.

While retinol-based creams account for 32.4% share in 2025, newer peptide and hyaluronic acid serums are expanding among younger demographics, creating incremental revenue. Digital adoption is also advancing rapidly, with e-commerce platforms gaining traction through subscription programs and personalized virtual consultations.

The Global Anti-Aging Creams & Serums Market in the United Kingdom is expected to grow at a CAGR of 8.9%, supported by strong consumer demand for dermocosmetic-grade products and clinical endorsements. British consumers are increasingly drawn to pharmacy-backed formulations and premium European brands such as Lancôme and La Mer.

Growth is also supported by innovation in sustainable packaging and clean-label positioning, as U.K. buyers place high value on eco-conscious and vegan-certified claims. Demand from women aged 55+ is particularly strong, while men’s grooming is steadily increasing share, creating opportunities for unisex premium positioning.

India is witnessing rapid growth in the Global Anti-Aging Creams & Serums Market, which is forecast to expand at a CAGR of 15.4% through 2035, the highest among leading markets. The rise of an aspirational middle class, coupled with early adoption of preventive skincare by millennials, is driving this momentum.

Domestic beauty brands are entering the market with affordable retinol and hyaluronic acid serums, while international players are leveraging e-commerce to reach Tier-2 and Tier-3 cities. Strong demand exists for hydration-focused products and wrinkle-reduction creams, particularly among urban professionals. Educational campaigns around sun protection and early anti-aging care are further boosting adoption.

The Global Anti-Aging Creams & Serums Market in China is expected to grow at a CAGR of 13.7%, supported by strong momentum in e-commerce platforms and cross-border imports. Demand is being accelerated by younger urban consumers integrating serums into daily routines, with wrinkle reduction accounting for 39.1% share in 2025.

Local digital-first beauty startups are competing with global leaders through affordable pricing and innovative packaging, while premium brands like Shiseido and Estée Lauder dominate the luxury tier. City-specific demand for brightening and hydration products is particularly strong in Tier-1 cities, while price-sensitive segments are expanding in lower-tier markets.

| Country | 2025 Share (%) |

|---|---|

| USA | 19.9% |

| China | 10.2% |

| Japan | 5.9% |

| Germany | 13.1% |

| UK | 6.9% |

| India | 4.2% |

| Europe | 18.8% |

| Country | 2035 Share (%) |

|---|---|

| USA | 17.7% |

| China | 11.0% |

| Japan | 7.2% |

| Germany | 11.4% |

| UK | 6.2% |

| India | 5.1% |

| Europe | 17.2% |

| USA By Product Type | Value Share % 2025 |

|---|---|

| Retinol-based creams | 32.4% |

| Others | 67.6% |

The Global Anti-Aging Creams & Serums Market in the USA is projected at USD 4,048.9 million in 2025, expanding at a CAGR of 5.7% through 2035. Retinol-based creams contribute 32.4%, while the remainder is split across peptide serums, hyaluronic acid serums, and antioxidant-rich moisturizers.

The continued dominance of retinol stems from its strong clinical validation for wrinkle reduction, which aligns with consumer demand for visible results. However, serums are growing faster, particularly among younger demographics, due to their lightweight textures and compatibility with multi-step skincare routines.

This balance between tradition and innovation reflects a market transition in the USA: retinol creams serve as the foundation of anti-aging, while serums provide premium differentiation. Growth is further supported by subscription-based e-commerce platforms, pharmacy recommendations, and clinical endorsements, which together boost consumer trust. With dermatologist-backed marketing playing a pivotal role, the USA market is expected to retain its status as a major global revenue contributor.

| China By Function | Value Share % 2025 |

|---|---|

| Wrinkle reduction | 39.1% |

| Others | 60.9% |

The Global Anti-Aging Creams & Serums Market in China is valued at USD 2,069.4 million in 2025, with wrinkle reduction leading at 39.1% share. The dominance of wrinkle reduction stems from urban consumers’ increasing demand for products that deliver visible improvements in skin elasticity and tone, particularly among women aged 30-45.

High engagement with cross-border e-commerce platforms such as Tmall Global and JD.com has made premium imported creams and serums from brands like Estée Lauder and Shiseido more accessible, while domestic players are innovating with affordable peptide and antioxidant-rich options.

This advantage positions wrinkle reduction as the gateway segment in China, where aspirational purchasing and willingness to experiment with international brands remain high. Hydration and brightening products also see rapid uptake, driven by strong cultural emphasis on “glass skin” and even tone. As online consultations, influencer-driven tutorials, and subscription delivery models expand, wrinkle reduction is expected to anchor growth while newer functions continue to diversify the demand base.

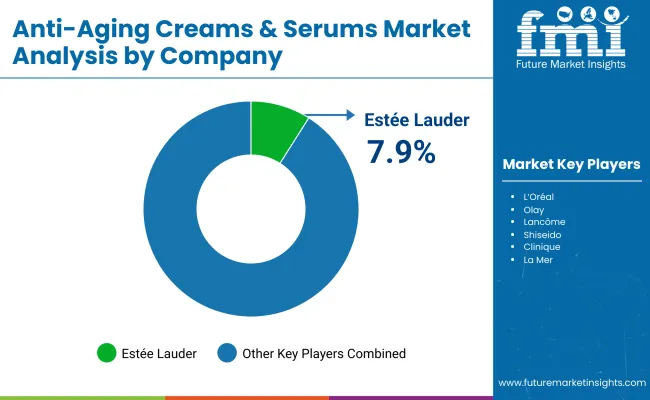

| Company | Global Value Share 2025 |

|---|---|

| Estée Lauder | 7.9% |

| Others | 92.1% |

The Global Anti-Aging Creams & Serums Market is moderately fragmented, with multinational giants, digital-first innovators, and niche premium brands competing across segments. Global leaders such as Estée Lauder, L’Oréal, and Shiseido hold significant market share, leveraging their heritage, distribution networks, and premium brand portfolios. Their strategies emphasize clinical validation, digital personalization, and cross-border e-commerce presence, positioning them as the most trusted players in both developed and emerging markets.

Established mid-sized brands such as Olay, Neutrogena, and Lancôme cater to mass-premium consumers with dermatologist-tested retinol creams and peptide serums. These companies focus on affordability without compromising scientific credibility, which makes them highly relevant in North America and Europe.

Meanwhile, digital-native brands like Drunk Elephant and Paula’s Choice thrive in e-commerce channels, capitalizing on clean-label, vegan-certified, and influencer-driven marketing. Competitive differentiation is shifting away from single-ingredient marketing toward ecosystem-driven strategies that combine science, sustainability, and digital engagement.

Brands are moving into AI-powered skin diagnostics, refillable packaging, and AR/VR-enabled try-ons, signaling that consumer loyalty will increasingly hinge on personalization and recurring service models rather than product claims alone.

Key Developments in Global Anti-Aging Creams & Serums Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Product Type | Retinol-based creams, Peptide serums, Hyaluronic acid serums, Antioxidant-rich moisturizers, Night repair creams |

| Function | Wrinkle reduction, Skin firming & elasticity, Brightening & tone correction, Hydration & barrier repair |

| Channel | E-commerce, Specialty beauty retail, Pharmacies & dermocosmetic clinics, Mass retail |

| End User | Women 35-55, Women 55+, Men, Unisex premium users |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Estée Lauder, L’Oréal, Olay, Lancôme, Shiseido, Clinique, La Mer , Neutrogena, Drunk Elephant, Paula’s Choice |

| Additional Attributes | Dollar sales by product type and function, adoption trends in preventive and corrective skincare, rising demand for retinol and peptide-based formulations, sector-specific growth in e-commerce and pharmacy channels, software-like subscription and refill programs driving recurring sales, integration with AI-powered skin analysis and AR/VR try-on technologies, regional trends influenced by middle-class expansion and premiumization in Asia, and innovations in encapsulated retinol, stabilized vitamin C, hyaluronic acid blends, and clean-label, vegan-certified formulations. |

The Global Anti-Aging Creams & Serums Market is estimated to be valued at USD 20,301.7 million in 2025.

The market size for the Global Anti-Aging Creams & Serums Market is projected to reach USD 46,805.3 million by 2035.

The Global Anti-Aging Creams & Serums Market is expected to grow at a CAGR of 8.7% between 2025 and 2035.

The key product types in the Global Anti-Aging Creams & Serums Market are retinol-based creams, peptide serums, hyaluronic acid serums, antioxidant-rich moisturizers, and night repair creams.

In terms of function, the wrinkle reduction segment is projected to command 39.1% share in 2025 in the Global Anti-Aging Creams & Serums Market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Firming Creams and Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Cryo Serums Market Size and Share Forecast Outlook 2025 to 2035

Slugging Creams Market Size and Share Forecast Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Aging Serums Market Analysis by Type, Application and Region from 2025 to 2035

Niacinamide Serums Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Wrinkle Creams Market Size and Share Forecast Outlook 2025 to 2035

Body Firming Creams Market Growth & Forecast 2025-2035

Eczema Relief Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Muscle Relaxing Creams Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Ice Creams Market Analysis by Form, Product Type, Flavor, Source, Sales Channel, and Region through 2035

Caffeine-Infused Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Almond Oil-Based Serums Market Size and Share Forecast Outlook 2025 to 2035

Moisturizing Body Creams Market Size and Share Forecast Outlook 2025 to 2035

Age-Defying Night Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Hydrating Emollient Creams Market Size and Share Forecast Outlook 2025 to 2035

Cica-Infused Healing Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA