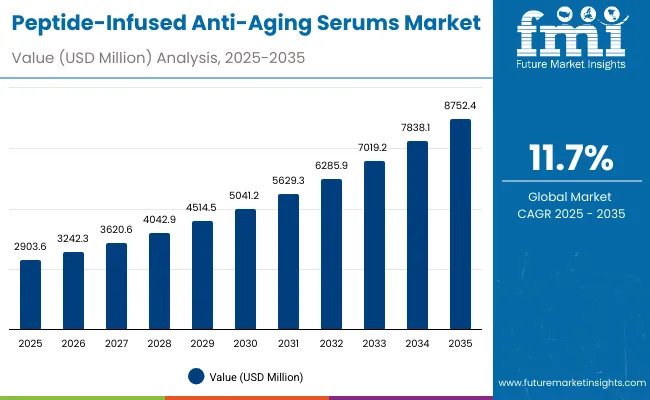

The valuation of the peptide-infused anti-aging serums market is anticipated to reach USD 2,903.6 million in 2025, expanding to USD 8,752.4 million by 2035. This trajectory represents an addition of nearly USD 5,849 million over the decade, translating into a growth of approximately 193%. The market is forecast to advance at a compound annual growth rate of 11.7%, highlighting a significant expansion path.

Peptide-Infused Anti-Aging Serums Market Key Takeaways

| Metric | Value |

|---|---|

| Peptide-Infused Anti-Aging Serums Market Estimated Value in (2025E) | USD 2,903.6 million |

| Peptide-Infused Anti-Aging Serums Market Forecast Value in (2035F) | USD 8,752.4 million |

| Forecast CAGR (2025 to 2035) | 11.70% |

The first half of the forecast period, from 2025 to 2030, will witness the market moving from USD 2,903.6 million to USD 5,041.2 million, accounting for a notable share of total decade growth. This period will be marked by growing adoption of scientifically backed formulations and a rising preference for high-performance skincare that delivers measurable results.

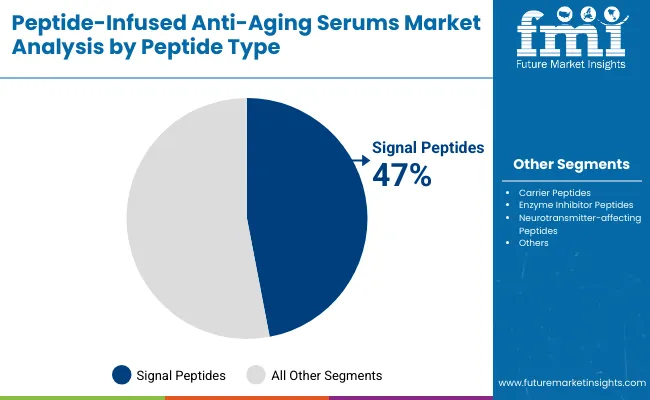

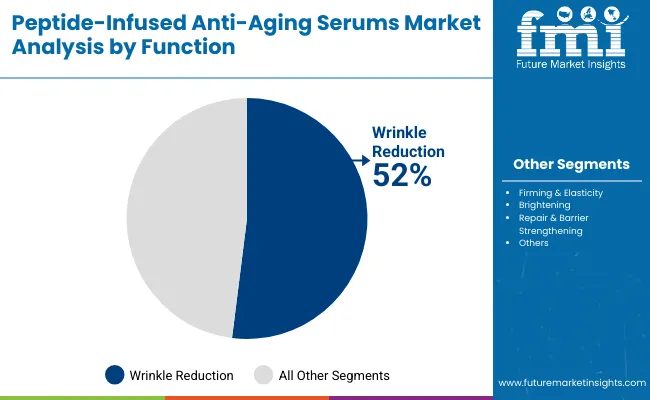

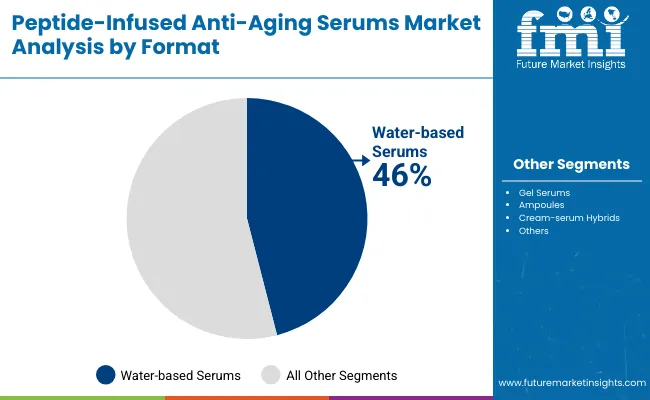

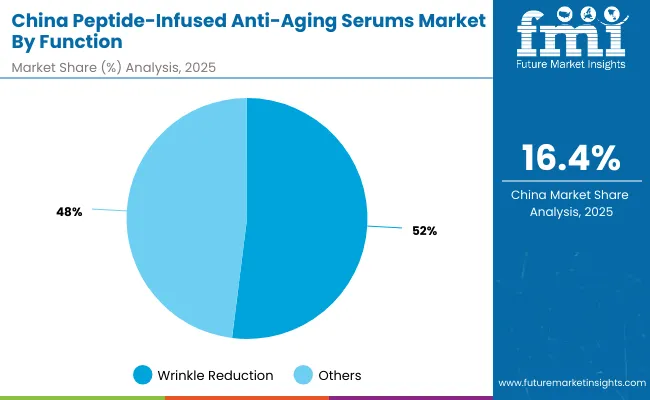

During the second half, from 2030 to 2035, an acceleration in growth is projected, as the market expands from USD 5,041.2 million to USD 8,752.4 million. This phase will contribute the larger share of absolute value gains, underpinned by broadening consumer bases in Asia-Pacific and the strengthening of luxury skincare demand globally. Signal peptides are expected to maintain dominance with a 47% share in 2025, reflecting their established efficacy in wrinkle reduction. Within functional segmentation, wrinkle reduction is projected to lead with a 52% share, while water-based serums are expected to capture 46% of sales through e-commerce channels, underscoring the influence of digital-first distribution.

Overall, the decade ahead is anticipated to be defined by scientific innovation, regional expansion, and the premiumization of peptide-driven skincare solutions.

From 2025 to 2035, the market is expected to expand significantly, driven by the rising preference for clinically validated formulations and premium anti-aging solutions. Competitive intensity is projected to remain high as both global brands and niche entrants compete for share. The advantage is anticipated to shift toward players capable of delivering science-backed efficacy, digital-first engagement, and sustainable positioning.

The growth of the peptide-infused anti-aging serums market is being fueled by the increasing consumer demand for clinically validated skincare solutions that deliver visible results. Rising awareness of preventive skin health and the preference for evidence-backed formulations are expected to drive steady adoption across both mass and premium categories. E-commerce penetration is expanding accessibility, while digital-first marketing strategies are enhancing consumer engagement and personalization.

The influence of clean-label, vegan, and fragrance-free claims is resonating strongly with younger demographics and sensitive-skin users, strengthening product appeal. Rapid urbanization and rising disposable incomes in emerging economies, particularly in Asia-Pacific, are anticipated to accelerate demand further. In addition, ongoing innovation in peptide technologies is enhancing efficacy in wrinkle reduction, skin firmness, and barrier strengthening, reinforcing consumer trust in these products. As the market shifts toward holistic skincare and luxury positioning, growth is expected to remain robust, creating long-term opportunities for established and emerging players alike.

The peptide-infused anti-aging serums market has been segmented based on peptide type, function, and format, highlighting the distinct product attributes shaping demand patterns. Each segment contributes uniquely to market growth, reflecting evolving consumer expectations for clinically proven outcomes, multi-functional efficacy, and convenient application. Signal peptides are driving adoption within peptide type due to their proven role in wrinkle reduction and skin regeneration. From a functional standpoint, wrinkle reduction remains the most prominent, supported by consumer demand for visible anti-aging benefits. In terms of format, water-based serums continue to capture a strong presence owing to their lightweight texture and adaptability across skin types. Together, these segments underline the innovation-driven growth path of the category..

| Segment | Market Value Share, 2025 |

|---|---|

| Signal peptides | 47% |

| Others | 53.0% |

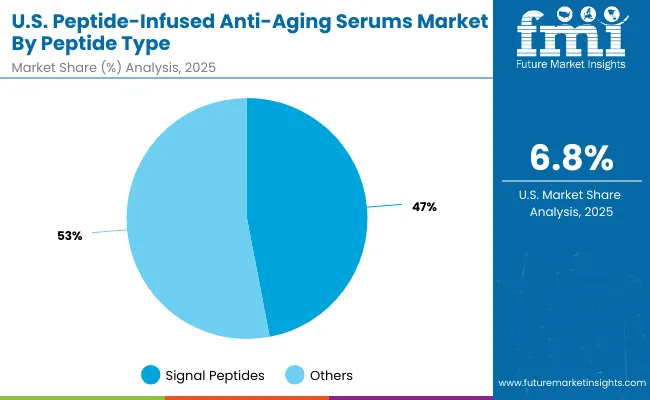

The peptide type segment is expected to showcase strong performance, with signal peptides projected to command 47% of the market in 2025, equivalent to USD 1,364.69 million. Their dominance will be supported by well-documented efficacy in wrinkle reduction and skin regeneration, making them highly trusted among consumers. The remaining 53% share, valued at USD 1,538.91 million, will be attributed to other peptide types, reflecting diversity in formulation strategies. Growth in this segment will be driven by innovations in advanced bioactive ingredients and the increasing integration of multi-functional peptides in anti-aging serums. As consumer expectations evolve, formulations with proven peptide efficacy will remain critical in sustaining premium positioning and consumer trust.

| Segment | Market Value Share, 2025 |

|---|---|

| Wrinkle reduction | 52% |

| Others | 48.0% |

The function segment is projected to be led by wrinkle reduction, accounting for 52% of the market in 2025, equal to USD 1,509.87 million. Demand will be supported by the growing consumer priority for visible anti-aging outcomes, with wrinkle reduction remaining the most recognized benefit of peptide-infused serums. The remaining 48% share, valued at USD 1,393.73 million, will be represented by other functions, including elasticity and barrier support. Rising consumer confidence in dermatology-inspired solutions is expected to fuel adoption, with peptide efficacy becoming a key differentiator in brand positioning. Over the forecast period, sustained preference for proven results is anticipated to anchor wrinkle reduction as the most prominent function.

| Segment | Market Value Share, 2025 |

|---|---|

| Water-based serums | 46% |

| Others | 54.0% |

The format segment is projected to see water-based serums capture 46% of the market in 2025, valued at USD 1,335.66 million. Their popularity will be driven by lightweight texture, high absorption, and suitability across diverse skin types, especially for younger and sensitive-skin users. The remaining 54% share, valued at USD 1,567.94 million, will be commanded by other formats, reflecting the growing consumer appetite for variety, including gel and hybrid innovations. As e-commerce continues to expand, water-based formulations will retain relevance, supported by affordability and ease of application. The long-term outlook suggests that innovation in textures and hybridization with other delivery systems will sustain growth across both water-based and alternative serum formats.

Complex formulation requirements and evolving regulatory landscapes continue to shape the peptide-infused anti-aging serums market, even as consumer expectations for clinically validated, multifunctional, and science-driven skincare solutions are being amplified across both premium and mass-market categories.

Scientific Validation as a Differentiation Catalyst

Market growth is being advanced through the increasing reliance on clinical validation as a decisive differentiator. Consumers are no longer engaging solely with marketing narratives but are expected to align preferences with evidence-supported efficacy. Peer-reviewed dermatological studies, combined with in-vitro and in-vivo performance data, are being positioned as competitive assets. This shift is anticipated to elevate the role of R&D investments, as companies will be required to establish credibility through partnerships with dermatologists and clinical research organizations. The emphasis on verifiable results is forecast to support premium pricing strategies while reducing consumer skepticism in highly saturated skincare segments.

Hybridization of Serum Formats with Emerging Delivery Systems

A defining trend is the hybridization of peptide serums with novel delivery mechanisms that go beyond traditional liquid applications. Encapsulation technologies, microfluidic dispersions, and cream-serum hybrids are increasingly being integrated to enhance peptide stability and optimize skin penetration. This innovation is expected to address a longstanding challenge in peptide-based skincare: degradation during formulation and reduced bioavailability upon topical application. Hybrid systems will be positioned not only as functional enhancers but also as lifestyle-oriented products, offering lightweight textures and multifunctional benefits in a single format. Over the next decade, this trend is forecast to redefine consumer expectations by merging scientific rigor with sensorial appeal.

| Countries | CAGR |

|---|---|

| China | 16.4% |

| USA | 6.8% |

| India | 18.5% |

| UK | 10.7% |

| Germany | 8.0% |

| Japan | 13.3% |

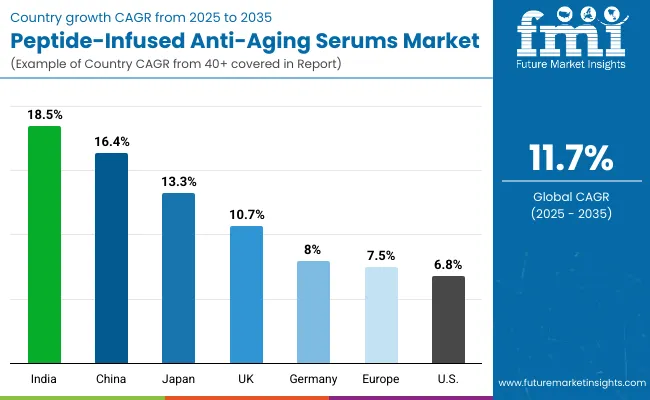

The growth trajectory of the peptide-infused anti-aging serums market demonstrates distinct variations across key countries, shaped by consumer behavior, income dynamics, and innovation ecosystems. India is expected to emerge as the fastest-growing market, with an estimated CAGR of 18.5% between 2025 and 2035. This acceleration will be supported by expanding middle-class consumption, rapid urbanization, and a heightened focus on premium skincare routines, positioning the country as a future demand hub. China follows closely with a 16.4% CAGR, propelled by an advanced beauty retail ecosystem, heavy digital marketing investments, and strong cultural acceptance of skincare innovation.

Japan is projected to grow at 13.3%, supported by its established reputation for advanced cosmetic science and high consumer willingness to pay for clinically proven skincare. In Europe, the UK and Germany are expected to deliver CAGRs of 10.7% and 8.0% respectively, driven by strong regulatory emphasis on product safety and sustainability in formulations. Broader Europe is anticipated to post a 7.5% CAGR, reflecting steady but slower expansion in mature markets. By contrast, the USA is expected to advance at a modest 6.8%, reflecting market maturity, with growth relying on innovation in personalization and digital-first distribution models rather than volume expansion.

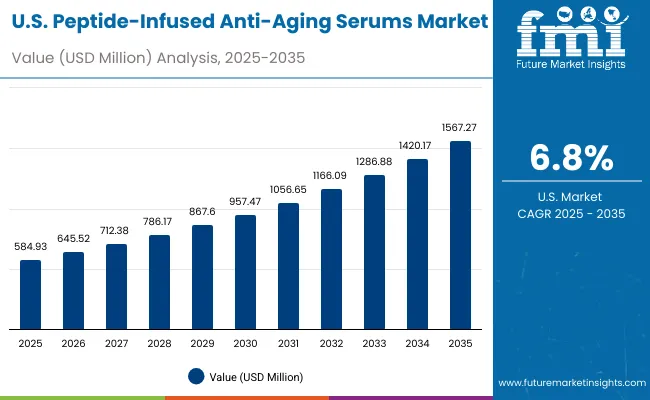

| Year | USAPeptide-Infused Anti-Aging Serums Market (USD Million) |

|---|---|

| 2025 | 584.93 |

| 2026 | 645.52 |

| 2027 | 712.38 |

| 2028 | 786.17 |

| 2029 | 867.60 |

| 2030 | 957.47 |

| 2031 | 1056.65 |

| 2032 | 1166.09 |

| 2033 | 1286.88 |

| 2034 | 1420.17 |

| 2035 | 1567.27 |

The peptide-infused anti-aging serums market in the United States is projected to grow at a CAGR of 10.5% from 2025 to 2035, supported by evolving consumer demand for premium and clinically validated skincare solutions. Market revenues are expected to rise steadily from USD 584.93 million in 2025 to USD 1,567.27 million in 2035. Strong preference for wrinkle-reduction benefits among women aged 30+ is anticipated to remain central to growth, while vegan, fragrance-free, and clean-label claims are expected to appeal to health-conscious and sensitive-skin consumers. Digital-first retail, combined with specialty beauty channels, is forecast to reinforce accessibility and consumer engagement.

The peptide-infused anti-aging serums market in the UK is projected to expand at a CAGR of 10.7% from 2025 to 2035, reflecting steady adoption in a mature but innovation-driven beauty industry. Growth will be supported by consumer demand for premium skincare rooted in scientific efficacy, coupled with sustainability-focused preferences. Digital platforms are expected to remain central in shaping consumer decisions, with e-commerce and influencer-driven awareness continuing to accelerate product discovery. Regulatory rigor on ingredient transparency will enhance consumer trust, favoring brands with clinically proven formulations.

The peptide-infused anti-aging serums market in India is expected to register a CAGR of 18.5% between 2025 and 2035, making it the fastest-growing global market. Rising disposable incomes, rapid urbanization, and a growing middle-class are anticipated to fuel demand for advanced skincare solutions. Awareness of preventive skincare among younger demographics is forecast to rise, with digital-first platforms accelerating adoption beyond metropolitan cities. International brands are likely to expand aggressively, while local companies integrate peptides into affordable formulations to appeal to wider consumer segments.

The peptide-infused anti-aging serums market in China is forecast to grow at a CAGR of 16.4% from 2025 to 2035, supported by a highly sophisticated beauty ecosystem. Advanced retail platforms, social commerce, and strong acceptance of innovative ingredients are expected to drive adoption. Rapid consumer education about the clinical efficacy of peptides is strengthening premium brand positioning, while domestic players are enhancing competitiveness with affordable yet effective formulations. Regulatory emphasis on quality assurance and authenticity will further reinforce consumer trust.

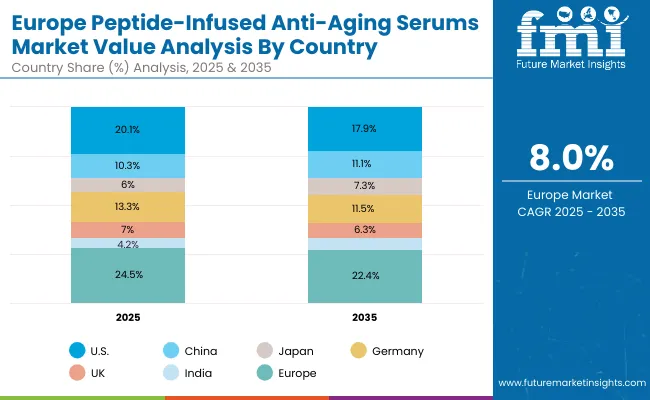

| Countries | 2025 |

|---|---|

| USA | 20.1% |

| China | 10.3% |

| Japan | 6.0% |

| Germany | 13.3% |

| UK | 7.0% |

| India | 4.2% |

| Countries | 2035 |

|---|---|

| USA | 17.9% |

| China | 11.1% |

| Japan | 7.3% |

| Germany | 11.5% |

| UK | 6.3% |

| India | 5.1% |

The peptide-infused anti-aging serums market in Germany is projected to expand at a CAGR of 8.0% over 2025-2035, reflecting stable growth within a mature European skincare market. Consumer behavior will remain strongly influenced by regulatory oversight on safety and sustainability. Premium skincare demand is forecast to be sustained by the country’s high-income base, while innovation in clean-label and vegan peptide formulations is expected to attract health-conscious consumers. Distribution through pharmacies and dermatology clinics will remain significant, reinforcing trust in clinically validated products.

| Segment | Market Value Share, 2025 |

|---|---|

| Signal peptides | 47% |

| Others | 53.0% |

The peptide-infused anti-aging serums market in the USA is projected at USD 584.93 million in 2025. Signal peptides contribute 47%, while other peptide categories account for 53%, indicating a balanced demand environment. The slight dominance of broader peptide groups reflects ongoing experimentation with multifunctional formulations designed to address elasticity, hydration, and barrier health alongside wrinkle reduction.

Scientific communication has been central in reinforcing peptide efficacy, with USA consumers increasingly aligning purchases with evidence-based outcomes. Retail growth is being shaped by specialty beauty stores and digital platforms, where clinical validation and transparency serve as key differentiators. As personalization in skincare advances, peptide diversification is expected to expand further, positioning the category for sustained innovation.

| Segment | Market Value Share, 2025 |

|---|---|

| Wrinkle reduction | 52% |

| Others | 48.0% |

The peptide-infused anti-aging serums market in China is projected at USD 298.97 million in 2025. Wrinkle reduction functions are expected to dominate with 52% of value share, equal to USD 155.46 million, while other functions will account for 48%, valued at USD 143.50 million. The clear preference for wrinkle reduction is being reinforced by heightened consumer focus on visible and measurable skincare outcomes. Rising middle-class spending power, combined with cultural emphasis on youthful appearance, is anticipated to accelerate adoption further.

The growing role of dermatology-inspired marketing and advanced e-commerce platforms is reshaping consumer preferences, with products positioned around clinically validated efficacy gaining higher traction. As innovation in barrier-strengthening and brightening functions expands, a more balanced mix is expected over time, though wrinkle reduction will remain the dominant anchor for demand.

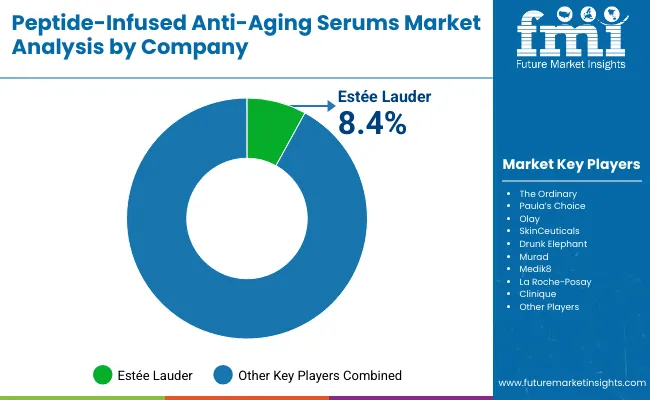

The peptide-infused anti-aging serums market is moderately fragmented, with global leaders, niche specialists, and emerging innovators competing across diverse consumer segments. Estée Lauder holds the largest identifiable global share, accounting for 8.4% of market value in 2025, while the remaining 91.6% is distributed among a broad set of established and indie players. This distribution highlights the highly competitive nature of the category, where brand differentiation is increasingly defined by clinical validation, clean-label positioning, and digital-first strategies rather than scale alone.

Estée Lauder’s stronghold has been reinforced through diversified brand portfolios, spanning luxury, masstige, and accessible premium lines. Its global footprint, combined with investments in R&D and dermatologist-backed marketing campaigns, has enabled the group to establish a leading position. Other major players such as The Ordinary, Paula’s Choice, Olay, SkinCeuticals, Drunk Elephant, and Clinique have been enhancing consumer engagement through digital platforms, influencer-driven strategies, and specialized peptide formulations.

Competitive differentiation is expected to shift toward hybrid product innovation, sustainable sourcing, and advanced delivery systems that extend peptide stability and efficacy. Over the next decade, dominance is likely to be challenged as indie brands and regional players capture share through affordability, innovation, and agile distribution models.

Key Developments in Peptide-Infused Anti-Aging Serums Market

| Item | Value |

|---|---|

| Market Size (2025E) | USD 2,903.6 million |

| Market Forecast (2035F) | USD 8,752.4 million |

| Quantitative Units | USD Million |

| Peptide Type | Signal peptides, Carrier peptides, Enzyme inhibitor peptides, Neurotransmitter-affecting peptides |

| Function | Wrinkle reduction, Firming & elasticity, Brightening, Repair & barrier strengthening |

| Format | Water-based serums, Gel serums, Ampoules, Cream-serum hybrids |

| Distribution Channels | E-commerce, Specialty beauty retail, Pharmacies, Dermatology clinics |

| End Users | Women (30+), Men, Luxury skincare users, Sensitive skin users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Estée Lauder, The Ordinary, Paula’s Choice, Olay, SkinCeuticals, Drunk Elephant, Murad, Medik8, La Roche-Posay, Clinique |

| Additional Attributes | Dollar sales by peptide type, function, and format; adoption of clean-label, vegan, and fragrance-free claims; growth in e-commerce and specialty retail; rising focus on clinically validated skincare; innovation in hybrid and multifunctional serum formulations. |

The global peptide-infused anti-aging serums market is estimated to be valued at USD 2,903.6 million in 2025.

The market size for the peptide-infused anti-aging serums market is projected to reach USD 8,752.4 million by 2035.

The peptide-infused anti-aging serums market is expected to grow at an 11.7% CAGR between 2025 and 2035.

The key peptide types in the market include signal peptides, carrier peptides, enzyme inhibitor peptides, and neurotransmitter-affecting peptides.

In terms of function, wrinkle reduction is projected to command a 52% share of the peptide-infused anti-aging serums market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Aging Serums Market Analysis by Type, Application and Region from 2025 to 2035

Anti-Aging Creams & Serums Market Size and Share Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Cryo Serums Market Size and Share Forecast Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Niacinamide Serums Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Caffeine-Infused Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Almond Oil-Based Serums Market Size and Share Forecast Outlook 2025 to 2035

Firming Creams and Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

AI-Formulated Custom Serums Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alpha Hydroxy Acid (AHA) Serums Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA