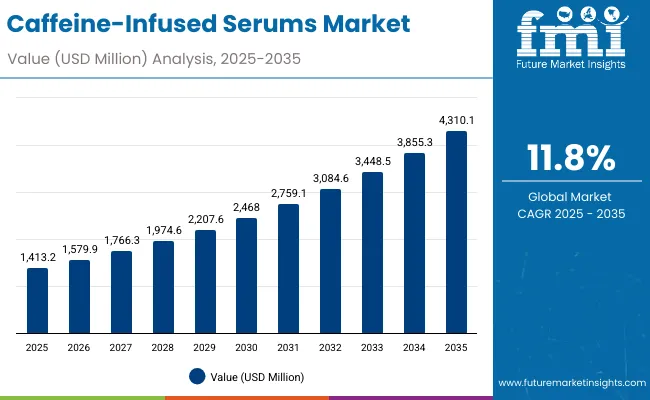

The global market for caffeine-infused serums has been valued at USD 1,413.2 million in 2025, and it is projected to reach USD 4,310.1 million by 2035. This expansion indicates an addition of USD 2,896.9 million over the decade, reflecting nearly a threefold increase in overall market size. The anticipated growth equates to a CAGR of 11.8% from 2025 to 2035.

Caffeine-Infused Serums Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value In (2025E) | USD 1,413.2 million |

| Market Forecast Value In (2035F) | USD 4,310.1 million |

| Forecast CAGR (2025 to 2035) | 11.80% |

During the initial phase between 2025 and 2030, the market is expected to grow from USD 1,413.2 million to USD 2,468.0 million, contributing USD 1,054.8 million and accounting for more than one-third of total decade growth. This period is expected to be shaped by rising consumer preference for targeted skincare benefits such as anti-puffiness and brightening, along with the increasing shift toward natural caffeine formulations.

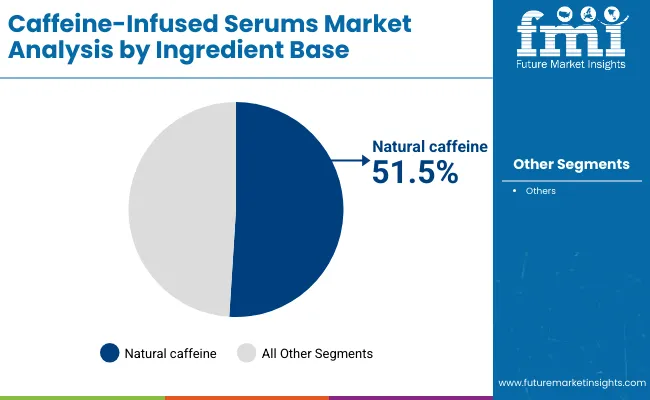

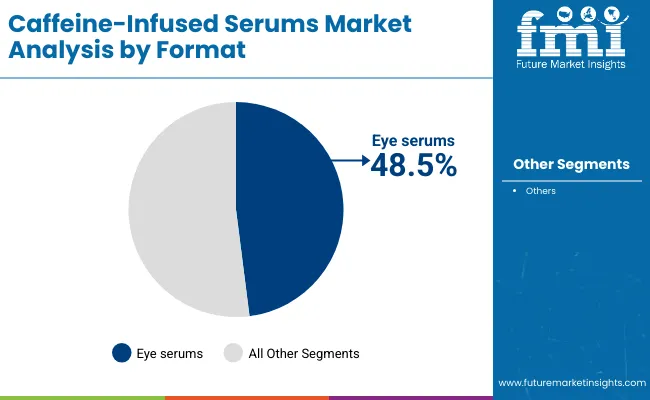

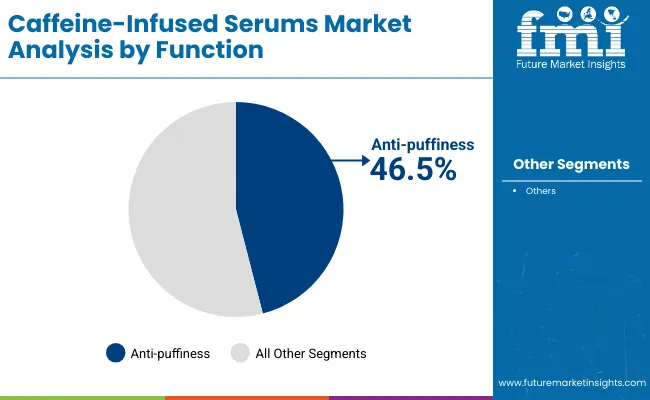

The latter half of the forecast, from 2030 to 2035, is set to accelerate further, with the market adding USD 1,842.1 million as it climbs from USD 2,468.0 million to USD 4,310.1 million. This phase is projected to represent nearly two-thirds of the total decade growth, underscoring the rapid scale-up of premium and functional skincare routines globally. Natural caffeine is expected to dominate the ingredient base, accounting for 51.5% of market share in 2025, while eye serums are forecast to lead the format category with a 48.5% share. The dominance of these segments reflects sustained consumer trust in efficacy-driven formulations. The outlook points toward an industry where efficacy validation, sustainability in sourcing, and digital-driven retail strategies are anticipated to shape competitive advantage, ensuring consistent demand momentum through 2035.

The caffeine-infused serums market is experiencing steady expansion as consumer demand for targeted skincare benefits has been rising globally. Growth is being driven by the proven efficacy of caffeine in reducing puffiness, brightening under-eye areas, and improving overall skin vitality. Increasing awareness of lifestyle-related stress, screen fatigue, and sleep-deprivation effects has been fueling demand for functional products with quick visible results.

The preference for natural and plant-based ingredients is also accelerating the adoption of caffeine sourced from coffee and tea extracts, strengthening the appeal of clean-label solutions. Digital retail platforms and direct-to-consumer strategies have been amplifying access to a wider customer base, while influencer-driven campaigns have been shaping awareness and trust. Innovation in lightweight formats such as roll-ons and eye serums has been improving consumer convenience, supporting frequent use. As clinical validation, sustainability commitments, and premium positioning become central, the market is expected to capture accelerated momentum through 2035.

The caffeine-infused serums market has been structured around key segmentation parameters that reflect consumer preferences and functional performance. Segmentation by ingredient base highlights the distinction between natural caffeine derived from coffee or tea and other synthetic or blended bases, showing how sourcing influences adoption trends. Format-based segmentation emphasizes the growing appeal of targeted solutions such as eye serums, while broader product forms continue to contribute significantly to overall revenues.

Function-based segmentation focuses on consumer-driven needs, with anti-puffiness treatments commanding strong traction alongside other multi-functional benefits. Together, these segments illustrate the evolving balance between natural sourcing, functional efficacy, and format innovation, indicating where demand momentum is expected to accelerate over the next decade. Each segment provides a unique lens into future opportunities, competitive strengths, and consumer trust-building strategies.

| Segment | Market Value Share, 2025 |

|---|---|

| Natural caffeine | 51.50% |

| Others | 48.50% |

Natural caffeine is expected to dominate the caffeine-infused serums market in 2025 with a 51.5% share, equating to USD 720.7 million in revenues. This leadership is driven by rising consumer inclination toward naturally derived and traceable ingredients that align with clean beauty trends. Enhanced credibility around the safety and efficacy of coffee and tea extracts has been strengthening demand. Trust in natural-origin formulations is being further reinforced by consumer concerns about synthetic actives, thereby supporting consistent premium pricing. It is projected that brands leveraging natural caffeine will gain competitive differentiation through sourcing transparency and sustainable farming practices. Over the forecast period, this segment is expected to remain central to innovation and consumer loyalty, ensuring strong growth momentum globally.

| Segment | Market Value Share, 2025 |

|---|---|

| Eye serums | 48.50% |

| Others | 51.50% |

Eye serums are projected to hold a 48.5% share of the market in 2025, equating to USD 679.1 million. The dominance of this format is being reinforced by growing awareness of delicate under-eye concerns, including puffiness and dark circles. Demand for lightweight, fast-absorbing products has been shaping preferences in this segment, with consumers increasingly seeking targeted solutions that integrate seamlessly into daily routines. Formulation advances in delivery systems, alongside ergonomic packaging such as roll-ons, are being positioned as enablers of efficacy and convenience. The ongoing preference for eye-area solutions underscores the role of caffeine in delivering quick, visible results. As consumer self-care rituals intensify, eye serums are expected to remain a priority category, driving sustained segment expansion through 2035.

| Segment | Market Value Share, 2025 |

|---|---|

| Anti-puffiness | 46.50% |

| Others | 53.50% |

Anti-puffiness is projected to capture 46.5% of market value in 2025, contributing USD 651.4 million. This function has been positioned as one of the most compelling claims, particularly in relation to stress, lifestyle fatigue, and screen-related eye strain. Caffeine’s proven vasoconstrictive and circulation-enhancing properties are being leveraged to deliver immediate and visible improvements, strengthening consumer trust in its application. The segment’s growth is further supported by strong marketing narratives around rejuvenation and freshness, resonating with both mass and premium product tiers. As lifestyles remain increasingly demanding, anti-puffiness solutions are expected to secure wider adoption across age groups. With efficacy data and clinical validation shaping consumer choices, this functional segment is likely to remain a core growth pillar for the industry.

The caffeine-infused serums market is expanding under the influence of multiple demand drivers, while certain structural restraints continue to shape adoption strategies. Industry stakeholders are aligning product development and distribution with evolving consumer expectations, regulatory frameworks, and innovation cycles.

Increasing Clinical Validation and Dermatologist Endorsements

A critical driver for the caffeine-infused serums market is the intensification of clinical validation and professional endorsements. As efficacy data on caffeine’s role in reducing under-eye puffiness and enhancing microcirculation is substantiated, stronger credibility is being established across consumer and professional segments. Dermatologist-backed trials and peer-reviewed publications are elevating trust, enabling premium price capture, and reinforcing long-term loyalty. This scientific backing is expected to shift consumer perception from experimental beauty claims to evidence-based skincare, ensuring more sustainable demand and higher lifetime value.

Raw Material Volatility and Supply Concentration Risks

A significant restraint lies in the volatility of natural caffeine sourcing and concentration of supply chains. Coffee and tea harvest fluctuations, combined with geographic dependency, expose the segment to raw material cost instability and potential quality inconsistencies. Sustainability certifications and traceability protocols increase costs further, creating challenges for brands competing in price-sensitive categories. Without diversified sourcing strategies and investment in synthetic alternatives, companies may face margin compression. This supply-side unpredictability is expected to remain a barrier, particularly for smaller brands lacking robust procurement networks, potentially slowing expansion in fast-growing but cost-conscious markets.

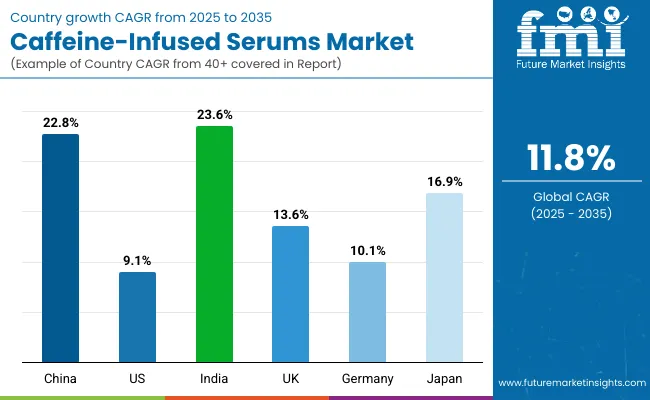

| Countries | CAGR |

|---|---|

| China | 22.8% |

| USA | 9.1% |

| India | 23.6% |

| UK | 13.6% |

| Germany | 10.1% |

| Japan | 16.9% |

The global caffeine-infused serums market demonstrates marked differences in growth trajectories across key countries, shaped by demographic patterns, consumer preferences, and retail structures. Asia is positioned as the primary growth hub, with India forecasted at a CAGR of 23.6% and China at 22.8%. Growth in these markets is being accelerated by the younger population base, increasing disposable incomes, and heightened awareness of skincare regimes focused on anti-puffiness and brightening. Strong penetration of digital commerce and influencer-led beauty culture in both countries is expected to amplify accessibility and adoption.

Japan, advancing at 16.9% CAGR, reflects a preference for clinically validated and technologically advanced formulations, with established cosmetic houses investing in premium caffeine-based solutions. In Europe, the UK (13.6%) and Germany (10.1%) are maintaining steady growth supported by regulatory emphasis on ingredient transparency and sustainable sourcing, aligning with consumer expectations of clean-label products. Premium retail channels and rising demand for masstige skincare formats are reinforcing this trajectory.

The USA, growing at 9.1% CAGR, displays a mature but stable profile, where brand differentiation is expected to be built on dermatologist endorsements, subscription-driven models, and digital-native challenger brands. Overall, the interplay between premiumization in mature economies and volume-led expansion in Asia is projected to define the next decade of market evolution.

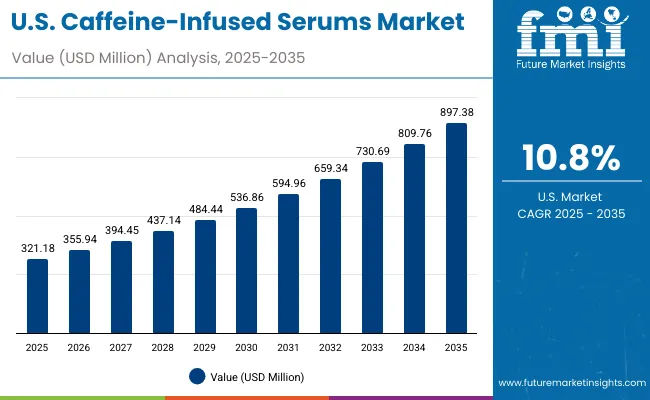

| Year | USA Caffeine-Infused Serums Market (USD Million) |

|---|---|

| 2025 | 321.18 |

| 2026 | 355.94 |

| 2027 | 394.45 |

| 2028 | 437.14 |

| 2029 | 484.44 |

| 2030 | 536.86 |

| 2031 | 594.96 |

| 2032 | 659.34 |

| 2033 | 730.69 |

| 2034 | 809.76 |

| 2035 | 897.38 |

The caffeine-infused serums market in the United States is projected to grow at a CAGR of 10.8%, increasing from USD 321.18 million in 2025 to USD 897.38 million by 2035. This trajectory reflects an almost threefold rise in market revenues across the decade. During the first five-year phase from 2025 to 2030, growth of over USD 215 million is expected, driven by expanding demand for anti-puffiness and brightening formulations suited to fast-paced lifestyles.

Between 2030 and 2035, more than USD 360 million in additional revenues are anticipated, with stronger traction achieved through premium and clinically validated product lines. Adoption is forecasted to be supported by dermatologist endorsements, sustainability-driven packaging innovations, and wider subscription-based direct-to-consumer offerings.

The caffeine-infused serums market in the United Kingdom is projected to grow at a CAGR of 13.6% between 2025 and 2035, reflecting robust adoption of masstige and premium skincare solutions. Growth will be anchored by the country’s strong beauty retail ecosystem and stringent regulatory emphasis on ingredient transparency. Over the first half of the forecast, accelerated demand is expected from younger consumers seeking under-eye and brightening solutions aligned with fast-paced, digitally influenced lifestyles. In the second half, premiumization and sustainability commitments are anticipated to strengthen brand differentiation, adding incremental value to the market.

The caffeine-infused serums market in India is forecasted to grow at a CAGR of 23.6% during 2025-2035, making it the fastest-growing market globally. Rapid urbanization, digital-first consumer behavior, and aspirational middle-class spending are expected to fuel widespread adoption. In the early forecast years, affordability and availability across mass retail are anticipated to drive penetration. From 2030 onward, premium and clinically backed formulations are projected to expand as disposable incomes rise and skincare routines mature. The market’s momentum is likely to be amplified by regional influencer ecosystems and localized e-commerce platforms.

The caffeine-infused serums market in China is expected to grow at a CAGR of 22.8% between 2025 and 2035, driven by strong digital retail penetration and consumer focus on functional skincare. The first half of the decade is projected to see growth led by e-commerce-led discovery and trial, supported by large-scale promotional campaigns. In the later half, premium international and domestic brands are expected to strengthen their presence through clinical validation and sustainability-led positioning. China’s regulatory environment around ingredient safety is anticipated to support trust and premium adoption.

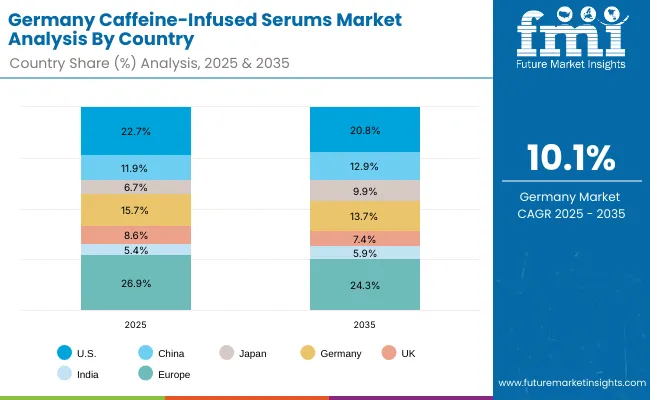

| Countries | 2025 |

|---|---|

| USA | 22.7% |

| China | 11.9% |

| Japan | 6.7% |

| Germany | 15.7% |

| UK | 8.6% |

| India | 5.4% |

| Countries | 2035 |

|---|---|

| USA | 20.8% |

| China | 12.9% |

| Japan | 9.9% |

| Germany | 13.7% |

| UK | 7.4% |

| India | 5.9% |

The caffeine-infused serums market in Germany is projected to expand at a CAGR of 10.1% during 2025-2035, supported by strong consumer alignment with clean-label, dermatologically tested formulations. Initial growth will be driven by widespread adoption in pharmacy and specialty retail channels, where consumer trust in evidence-backed products is high. From 2030 onward, demand for sustainable packaging, traceable natural caffeine sourcing, and clinically validated claims is expected to define competitive advantage. Germany’s role as a key European beauty hub is anticipated to keep it central to innovation and premium adoption.

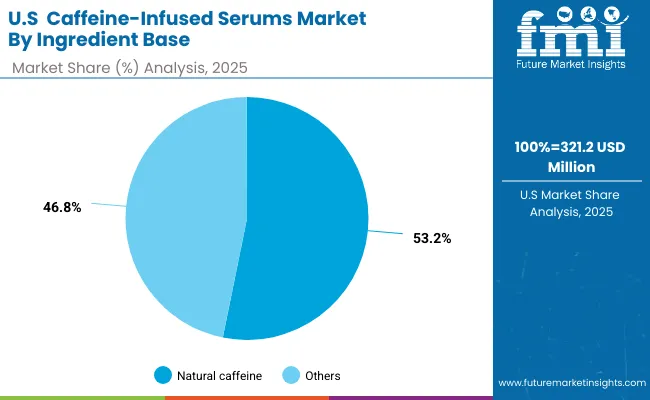

| Segment | Market Value Share, 2025 |

|---|---|

| Natural caffeine | 53.2% |

| Others | 46.8% |

The caffeine-infused serums market in the USA is projected at USD 321.2 million in 2025. Natural caffeine contributes 53.2% (USD 170.9 Million), while other ingredient bases hold 46.8% (USD 150.3 Million), indicating a clear consumer inclination toward botanical and recognizable sources. This natural caffeine leadership is expected to be reinforced by the growing preference for clean-label, traceable formulations that align with evolving retailer ingredient standards and consumer wellness narratives.

The rising dominance of natural caffeine is being attributed to heightened awareness of its antioxidant potential, vasoconstrictive benefits for puffiness reduction, and ability to enhance microcirculation in the under-eye area. Consumers are expected to increasingly seek solutions that offer clinically substantiated claims, which will support the continued expansion of natural caffeine’s share. Sustainability storytelling particularly upcycling coffee bean byproducts is likely to add a premium halo, driving higher willingness to pay among USA consumers.

As competition intensifies, formulators are projected to combine natural caffeine with complementary actives such as peptides and niacinamide, enhancing multi-targeted benefits and justifying premium positioning. Retailers are expected to favor brands that present assay-verified caffeine content and dermatologically validated results, ensuring faster shelf approvals.

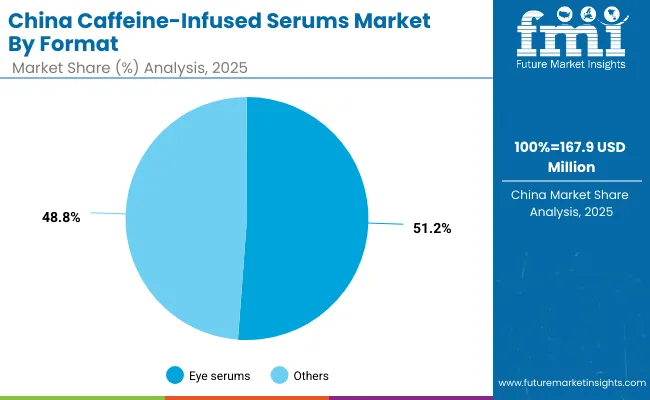

| Segment | Market Value Share, 2025 |

|---|---|

| Eye serums | 51.2% |

| Others | 48.8% |

The caffeine-infused serums market in China is projected at USD 167.9 million in 2025. Eye serums contribute 51.2% (USD 86.0 Million), while other serum formats account for 48.8% (USD 81.9 Million), signaling a strong consumer orientation toward targeted eye-care solutions. This slight eye-serum leadership is expected to strengthen as screen-related eye fatigue, late-night work culture, and urban stress continue to heighten demand for de-puffing and anti-dark-circle treatments.

The dominance of eye serums is being driven by China’s digitally native consumers, who are increasingly influenced by social commerce trends and dermatologist-endorsed KOL campaigns. The format’s precision application is expected to resonate with younger demographics seeking fast-acting, problem-specific solutions. This will likely encourage premiumization within the category, as cooling applicators, metal-tip roll-ons, and serum-in-ampoule innovations become mainstream.

Double-digit expansion is projected, with the market expected to grow at 22.8% CAGR (2025-2035), outpacing most developed regions. Cross-border e-commerce and local C-beauty brand innovation are anticipated to accelerate adoption, supported by live-streaming platforms that drive real-time education and conversion. Furthermore, ingredient storytelling around naturally sourced caffeine is projected to gain traction, reinforcing consumer trust and enabling price mix improvements.

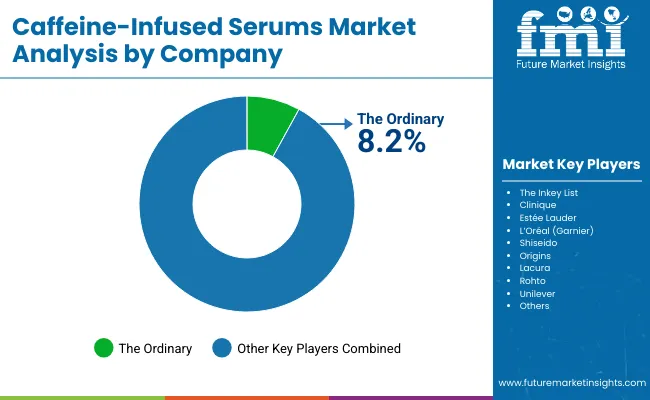

The caffeine-infused serums market is moderately fragmented, with global leaders, established skincare giants, and niche-focused specialists competing across diverse regions. Leading players such as The Ordinary, Clinique, Estée Lauder, L’Oréal (Garnier), and Shiseido hold significant market presence, leveraging brand equity, research capabilities, and global retail networks. Their strategies are increasingly focused on clinical validation, clean-label claims, and dermatologist endorsements, which are expected to strengthen premium positioning and consumer trust.

Mid-sized innovators including The Inkey List, Origins, and Rohto are addressing demand for targeted formats such as eye serums, roll-ons, and lightweight brightening solutions. These companies are expanding relevance through e-commerce-driven visibility, competitive pricing, and rapid product launches tailored for younger demographics. Their agility in responding to fast-evolving trends is projected to reinforce adoption in both mass and masstige segments.

Private-label and niche specialists such as Lacura are contributing by offering cost-effective alternatives within retail-exclusive environments. These brands emphasize affordability while capitalizing on rising consumer interest in anti-puffiness and brightening claims, particularly in value-driven markets.

Competitive differentiation is shifting from simple caffeine inclusion toward integrated narratives around efficacy data, sustainability, and clean beauty positioning. Subscription-driven models, recyclable packaging, and transparency in sourcing are expected to define the next phase of competitive advantage.

Key Developments in Caffeine-Infused Serums Market

| Item | Value |

|---|---|

| Market size, 2025 | USD 1,413.2 million |

| Market size, 2035 | USD 4,310.1 million |

| Incremental value, 2025-2035 | USD 2,896.9 million |

| CAGR, 2025-2035 | 11.80% |

| Ingredient base (2025) | Natural caffeine: 51.5% (USD 720.7 million); Others: 48.5% (USD 685.7 million) |

| Format (2025) | Eye serums: 48.5% (USD 679.1 million); Others: 51.5% (USD 727.7 million) |

| Function (2025) | Anti-puffiness: 46.5% (USD 651.4 million); Others: 53.5% (USD 755.6 million) |

| Primary channels | E-commerce; Specialty beauty retail; Direct-to-Consumer (D2C); Pharmacies |

| Price tiers | Mass; Masstige; Premium |

| Regions covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries covered (key) | United States; China; Japan; Germany; United Kingdom; India |

| Key companies profiled | The Ordinary; The Inkey List; Clinique; Estée Lauder; L’Oréal (Garnier); Shiseido; Origins; Lacura; Rohto; Unilever |

| Time horizon | 2025-2035 |

| Additional attributes | Clinical validation, clean-label sourcing, sustainability packaging, D2C subscriptions, digital commerce, influencer activation, premiumization strategies |

The global Caffeine-Infused Serums Market is estimated to be valued at USD 1,413.2 million in 2025.

The market size for the Caffeine-Infused Serums Market is projected to reach USD 4,310.1 million by 2035.

The Caffeine-Infused Serums Market is expected to expand at a CAGR of 11.8% between 2025 and 2035, adding nearly USD 2,896.9 million in incremental value.

The key product types in the Caffeine-Infused Serums Market include eye serums, face serums, roll-ons, and ampoules, catering to functions such as anti-puffiness, brightening, and anti-dark circles.

In terms of format, eye serums are projected to command 48.5% share in 2025, equivalent to USD 679.1 million, making them one of the most influential categories.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Cryo Serums Market Size and Share Forecast Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Aging Serums Market Analysis by Type, Application and Region from 2025 to 2035

Niacinamide Serums Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Almond Oil-Based Serums Market Size and Share Forecast Outlook 2025 to 2035

Firming Creams and Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Aging Creams & Serums Market Size and Share Forecast Outlook 2025 to 2035

AI-Formulated Custom Serums Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alpha Hydroxy Acid (AHA) Serums Market Size and Share Forecast Outlook 2025 to 2035

Peptide-Infused Anti-Aging Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA