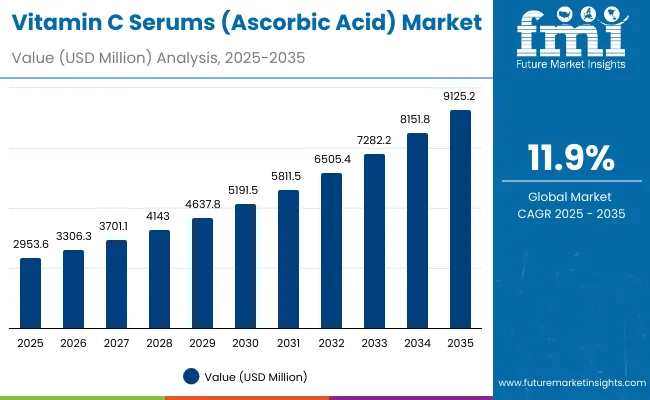

The Vitamin C Serums (Ascorbic Acid) Market is expected to record a valuation of USD 2,953.6 million in 2025 and USD 9,125.2 million in 2035, with an increase of USD 6,171.6 million, which equals a growth of 208% over the decade. The overall expansion represents a CAGR of 11.9% and a 3X increase in market size.

Vitamin C Serums (Ascorbic Acid) Market Key Takeaways

| Metric | Value |

|---|---|

| Vitamin C Serums (Ascorbic Acid) Market Estimated Value in (2025E) | USD 2,953.6 million |

| Vitamin C Serums (Ascorbic Acid) Market Forecast Value in (2035F) | USD 9,125.2 million |

| Forecast CAGR (2025 to 2035) | 11.9% |

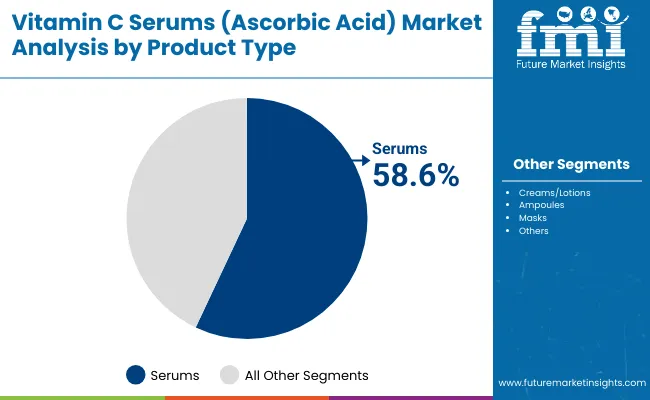

During the first five-year period from 2025 to 2030, the market increases from USD 2,953.6 million to USD 5,191.5 million, adding USD 2,237.9 million, which accounts for 36.2% of the total decade growth. This phase records steady adoption of Vitamin C serums in North America and Europe, driven by the dermatologically tested claim and expansion of anti-aging product portfolios. Serums dominate this period as they cater to over 58% of global consumer demand, favored for their lightweight texture, faster absorption, and compatibility with layering routines in skincare regimens.

The second half from 2030 to 2035 contributes USD 3,933.7 million, equal to 63.8% of total growth, as the market jumps from USD 5,191.5 million to USD 9,125.2 million. This acceleration is powered by widespread adoption in Asia-Pacific markets, particularly China and India, where CAGR exceeds 20%. Innovations in clean-label formulations, ampoule packaging, and multi-functional masks gain traction, while e-commerce platforms enhance global availability. Dermatologist-tested and natural/organic claims fuel trust among new users, ensuring long-term loyalty. By the end of the decade, China, India, and Japan collectively account for more than one-third of the market’s incremental value.

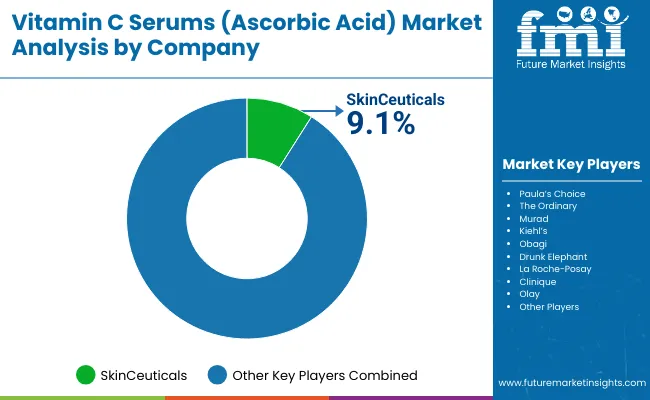

From 2020 to 2024, the Vitamin C Serums (Ascorbic Acid) Market grew steadily, supported by heightened consumer focus on skincare routines accelerated by the pandemic-driven self-care trend. During this period, the competitive landscape was dominated by dermatologist-backed brands such as SkinCeuticals and La Roche-Posay, which commanded strong loyalty in premium retail and clinical channels. Competitive differentiation relied on product stability, potency of L-ascorbic acid formulations, and dermatological endorsements. Mass retail players such as Olay and The Ordinary disrupted pricing strategies, ensuring accessibility to a broader consumer base, while clinical-grade brands consolidated positioning among dermatologists and aestheticians.

Demand for Vitamin C Serums will expand to USD 2,953.6 million in 2025, and the revenue mix will shift as clean-label and vegan formulations grow to more than 40% of the global portfolio. Traditional serum leaders face rising competition from new entrants leveraging encapsulation technologies, oil-soluble derivatives like tetrahexyldecyl ascorbate, and AI-driven personalized skincare solutions. Major brands are pivoting to hybrid models, integrating Vitamin C with complementary antioxidants such as Vitamin E and ferulic acid to strengthen consumer trust. Emerging entrants specializing in K-beauty formulations, high-concentration ampoules, and subscription-based direct-to-consumer (D2C) models are gaining share. The competitive advantage is shifting from pure concentration claims to ecosystem-driven product positioning combining efficacy, safety, and transparency.

Advances in skincare formulation technologies have significantly enhanced the stability and bioavailability of Vitamin C serums. Encapsulation and derivative technologies now allow longer shelf life and deeper skin penetration, boosting consumer confidence in daily use. Serums, which account for nearly 60% of global market share, have gained popularity due to their high concentration of active ascorbic acid, lightweight application, and proven ability to improve skin brightness and elasticity.

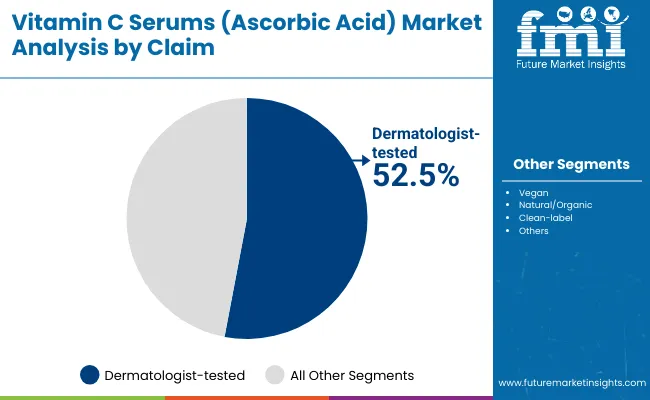

The rise of dermatologist-tested formulations has further contributed to consumer adoption, as clinical validation ensures safety for sensitive skin. With 52.5% of global demand tied to dermatologist-tested claims in 2025, this segment highlights the importance of professional endorsements in driving consumer trust. Moreover, the surge in online skincare education and influencer marketing has democratized knowledge about Vitamin C benefits, prompting higher first-time purchases.

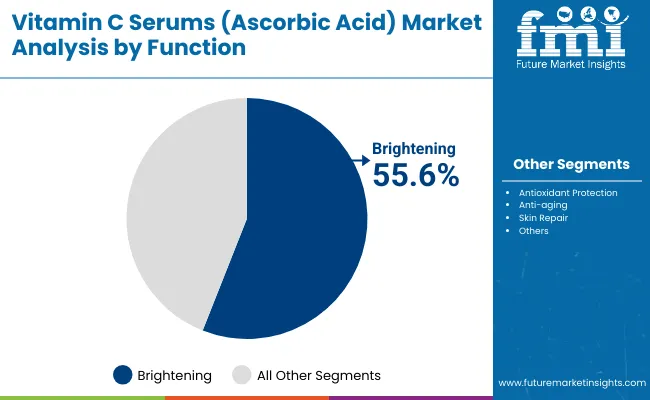

Expansion of digital commerce has accelerated availability across emerging markets. E-commerce platforms such as Amazon, Sephora online, and Tmall Global have made it easier for brands to reach a broader demographic, particularly in Asia-Pacific. Coupled with younger consumer segments seeking preventive anti-aging solutions and older populations targeting fine line reduction, the market caters to diverse age groups. Segment growth is expected to be led by serums in product types, brightening in functional claims, and dermatologist-tested positioning due to their precision, trust, and adaptability.

The market is segmented by function, product type, channel, and claim. Functions include brightening, antioxidant protection, anti-aging, and skin repair, highlighting the core consumer needs driving adoption. Product type classification covers serums, creams/lotions, ampoules, and masks, enabling multiple application forms for different consumer preferences. Based on channel, the segmentation includes e-commerce, pharmacies, specialty beauty stores, and mass retail. In terms of claim, categories encompass dermatologist-tested, vegan, natural/organic, and clean-label formulations. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, Asia-Pacific, South Asia, and the Middle East & Africa.

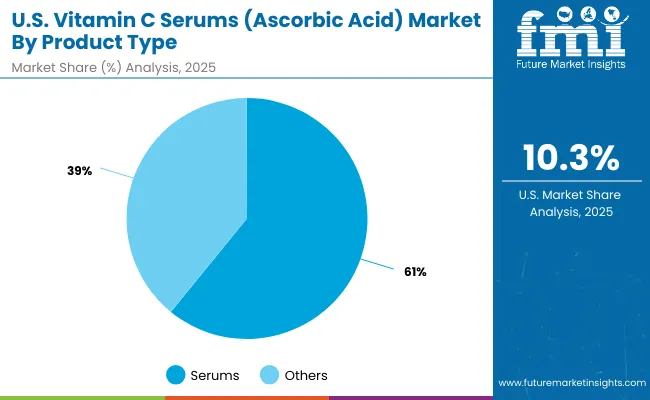

| Product Type | Value Share% 2025 |

|---|---|

| Serums | 58.6% |

| Others | 41.4% |

The serum segment is projected to contribute 58.6% of the Vitamin C Serums (Ascorbic Acid) Market revenue in 2025, maintaining its lead as the dominant product category. This dominance is driven by ongoing consumer demand for high-potency formulations that deliver fast-absorbing Vitamin C with proven clinical outcomes. Serums are widely perceived as the gold standard in Vitamin C delivery, used both as standalone treatments and as boosters under moisturizers and sunscreens.

The segment’s growth is also supported by the expansion of multi-functional serums combining Vitamin C with niacinamide, hyaluronic acid, or peptides. As new derivatives overcome limitations of oxidation and skin irritation, serums remain the backbone of the category, appealing to both entry-level skincare adopters and advanced regimen users.

| Function | Value Share% 2025 |

|---|---|

| Brightening | 55.6% |

| Others | 44.4% |

The brightening function segment is forecasted to hold 55.6% of the global market share in 2025, led by its association with skin tone evening, hyperpigmentation reduction, and prevention of dullness caused by pollution and UV damage. This category resonates strongly across Asia-Pacific, where demand for skin tone uniformity is culturally significant, and in Western markets, where glow-enhancing products dominate social media trends.

The segment’s growth is further bolstered by advancements in stable Vitamin C derivatives such as magnesium ascorbyl phosphate and sodium ascorbyl phosphate, which ensure consistent brightening efficacy with minimal irritation. As consumers increasingly seek preventive skincare, brightening claims continue to outperform other functional categories, reinforcing their central role in the Vitamin C serums market.

| Claim | Value Share% 2025 |

|---|---|

| Dermatologist-tested | 52.5% |

| Others | 47.5% |

The dermatologist-tested segment is projected to contribute 52.5% of Vitamin C Serums (Ascorbic Acid) Market revenue in 2025, maintaining its dominance as the most trusted claim among consumers. Rising concerns around product safety, ingredient concentrations, and skin sensitivity have amplified the role of clinical validation in shaping consumer choices.

Dermatologist-tested products are often associated with clinical efficacy, minimal irritation, and science-backed results, making them highly preferred in premium and pharmacy-led retail channels. As more consumers integrate Vitamin C into multi-step routines, dermatologist-tested labels reinforce safety and effectiveness, building confidence across both first-time and repeat buyers.

Rising Dermatologist-Backed Adoption and Clinical Positioning

One of the strongest growth drivers for the Vitamin C Serums (Ascorbic Acid) Market is the clinical validation and dermatologist-backed positioning of products. In 2025, dermatologist-tested claims account for 52.5% of the global market value (USD 1,549.5 million), making it the single largest claim category. Unlike other skincare ingredients that rely heavily on marketing-led messaging, Vitamin C requires reassurance on stability, concentration, and irritation potential.

Brands like SkinCeuticals, La Roche-Posay, and Obagi have leveraged dermatologist partnerships and in-clinic presence to dominate early adoption in North America and Europe. This trust-building has created a spillover effect into mass retail, where even consumer-driven brands such as The Ordinary and Olay prominently highlight dermatologist recommendations in their product narratives. This clinical endorsement not only drives higher penetration among first-time buyers but also encourages repeat purchases by consumers integrating Vitamin C into long-term preventive routines.

Accelerated Penetration in Asia-Pacific with Double-Digit CAGR

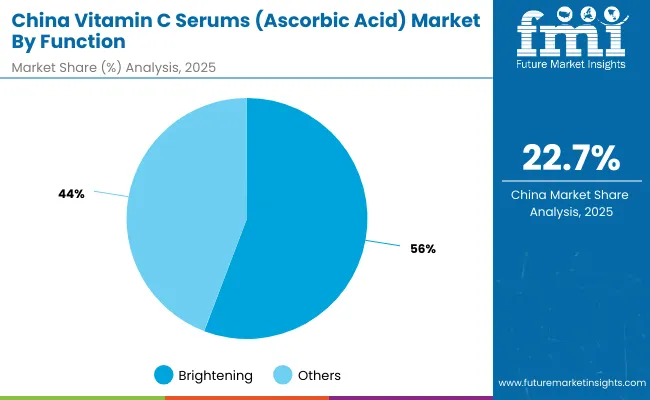

The second driver is the outsized growth from Asia-Pacific markets, particularly China (22.7% CAGR) and India (24.9% CAGR), where Vitamin C serums are rapidly becoming essential skincare products. In China, brightening functions already account for 55.8% of national demand in 2025 (USD 208 million), reflecting cultural preferences for skin luminosity and tone evenness. This aligns with long-standing K-beauty and C-beauty formulations, which are increasingly incorporating Vitamin C derivatives in ampoules and masks.

In India, strong CAGR growth is supported by rising disposable incomes, a younger demographic embracing e-commerce, and growing awareness of preventive skincare. The surge in online retail particularly through platforms like Nykaa, Tmall, and Amazon India has lowered entry barriers, allowing global and domestic brands to compete simultaneously. These regional growth dynamics ensure that Asia-Pacific will contribute disproportionately to the global market’s incremental value, becoming the engine of market acceleration post-2030.

Stability and Oxidation Challenges of Ascorbic Acid

Despite strong demand, the market continues to face significant technical barriers related to Vitamin C stability. Pure L-ascorbic acid is notoriously unstable it oxidizes rapidly upon exposure to light, air, and heat, losing potency and causing potential irritation. Even leading formulations with high concentrations (15-20%) risk degradation before the end of their shelf life, making consumers skeptical about efficacy.

This issue disproportionately affects mass retail and e-commerce segments, where longer supply chain times and varied storage conditions increase the risk of oxidized or ineffective products reaching consumers. Although encapsulation technologies and stabilized derivatives are mitigating these risks, they often increase formulation costs, limiting accessibility in price-sensitive markets. This restraint could cap growth in regions such as Latin America and Africa, where affordability is a key factor.

Intensifying Competition and Price Erosion in Serums

With serums holding 58.6% of the global market value (USD 1,728.3 million in 2025), the category has become overcrowded, leading to price pressure. Premium brands such as SkinCeuticals and Obagi command loyalty in clinical settings but face margin erosion from mass players like The Ordinary, which offer highly concentrated formulations at less than one-third of the price.

This price war dilutes differentiation based purely on concentration claims and forces brands to innovate with added actives (Vitamin E, ferulic acid, niacinamide) or packaging (airless pumps, amber glass droppers). However, frequent new launches and rapid product cycles also saturate the market, making it difficult for consumers to distinguish meaningful innovation from marketing-driven differentiation. The result is margin compression, especially for mid-tier brands caught between premium loyalty and budget disruptors.

Rise of Hybrid and Multi-Active Formulations

A key trend shaping the Vitamin C Serums (Ascorbic Acid) Market is the integration of Vitamin C with other complementary actives. Consumers increasingly demand multi-functional products that combine brightening, antioxidant protection, hydration, and anti-aging in a single formula. Leading examples include Vitamin C serums paired with ferulic acid and Vitamin E for enhanced antioxidant synergy, or hybrid formulations incorporating niacinamide and hyaluronic acid for barrier support and hydration. This trend is not just consumer-driven but also a defensive response by brands to counter product commoditization in the serum category. Hybrid formulations allow brands to justify premium pricing and differentiate offerings in a crowded space.

E-commerce and D2C Dominance with Influencer-Driven Uptake

Another critical trend is the shift to digital-first retail and D2C distribution, which is disproportionately driving growth in emerging markets. In 2025, e-commerce already accounts for nearly half of distribution in global skincare, and Vitamin C serums are among the most purchased online skincare products due to their high awareness and social media-driven education. Influencers, dermatologists on TikTok/Instagram, and beauty vloggers on YouTube play a decisive role in shaping consumer perceptions of efficacy, safety, and product rankings.

This trend is especially visible in China and India, where local influencers promote both international and domestic Vitamin C serum brands, democratizing access to new product launches. Subscription-based D2C models (like those of Drunk Elephant and Paula’s Choice) are further capitalizing on repeat usage behavior, ensuring consistent revenue streams for brands while deepening consumer loyalty.

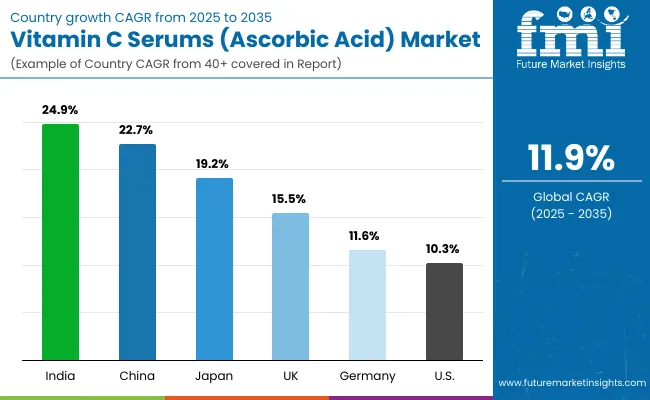

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 22.7% |

| USA | 10.3% |

| India | 24.9% |

| UK | 15.5% |

| Germany | 11.6% |

| Japan | 19.2% |

China, India, and Japan are expected to be the growth engines of the Vitamin C Serums (Ascorbic Acid) Market, with CAGRs of 22.7%, 24.9%, and 19.2% respectively from 2025 to 2035. India leads with the highest CAGR, supported by a rapidly expanding middle class, increased awareness of preventive skincare, and the widespread availability of dermatologist-tested serums through e-commerce channels like Nykaa and Amazon.

China shows equally robust growth, where brightening functions already account for 55.8% of national demand, reflecting cultural priorities around skin tone and luminosity. Japan’s growth, though slightly lower, is propelled by a combination of consumer trust in high-quality formulations and rising adoption of hybrid solutions such as ampoules and multi-active serums. Collectively, these three countries will add disproportionate value to the global market, shifting its demand center decisively toward Asia-Pacific.

In contrast, mature Western markets such as the USA (10.3%), UK (15.5%), and Germany (11.6%) will grow at steadier rates. The USA remains the largest single-country contributor by absolute market value, with serums accounting for over 60% of national sales in 2025 (USD 425 million). However, growth is more incremental as penetration levels are already high, and competitive pressures among premium, clinical, and mass brands restrain acceleration. The UK outpaces Germany in CAGR due to faster adoption of clean-label and vegan claims, while Germany’s moderate growth reflects consumer caution around product safety and ingredient stability. These Western markets will remain profitable but less dynamic compared to Asia, where first-time buyers and younger demographics are driving exponential demand.

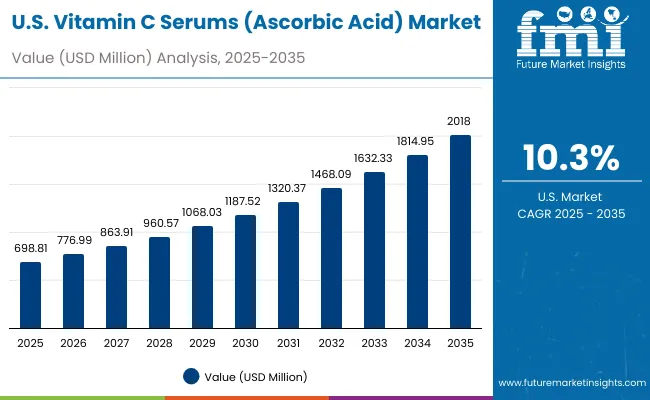

| Year | USA Vitamin C Serums (Ascorbic Acid) Market (USD Million) |

|---|---|

| 2025 | 698.8 |

| 2026 | 777.0 |

| 2027 | 863.9 |

| 2028 | 960.6 |

| 2029 | 1,068.0 |

| 2030 | 1,187.5 |

| 2031 | 1,320.4 |

| 2032 | 1,468.1 |

| 2033 | 1,632.3 |

| 2034 | 1,814.9 |

| 2035 | 2,018.0 |

The Vitamin C Serums (Ascorbic Acid) Market in the United States is projected to grow at a CAGR of 10.3%, led by strong demand for dermatologist-tested products and clinical-grade serums. Reverse aging and brightening applications recorded consistent year-on-year growth, particularly among mid to premium consumer segments. The healthcare-aligned retail channel, including dermatology clinics and pharmacies, has accelerated adoption of stable formulations. Mass retail and e-commerce platforms are expanding availability, while digital marketing campaigns and influencer-driven education enhance awareness. Growth opportunities are anchored in bundled skincare routines where Vitamin C is positioned alongside sunscreens and moisturizers.

The Vitamin C Serums (Ascorbic Acid) Market in the United Kingdom is expected to grow at a CAGR of 15.5%, supported by high adoption of clean-label and vegan skincare. Premium skincare brands and clinical formulations are strengthening their retail presence, while smaller indie labels are rapidly scaling through online platforms. British consumers are showing a preference for transparency and ingredient safety, driving momentum for dermatologist-tested and natural formulations. Specialty beauty stores and pharmacies are expanding Vitamin C product lines, while mass-market retailers are introducing affordable serums and creams. Cultural emphasis on innovation in skincare and increased use of subscription-based D2C models continue to shape market expansion.

India is witnessing rapid growth in the Vitamin C Serums (Ascorbic Acid) Market, which is forecast to expand at a CAGR of 24.9% through 2035. Strong adoption in tier-1 cities is now extending into tier-2 and tier-3 urban centers, aided by affordability improvements and online retail penetration. Domestic skincare brands are introducing cost-effective Vitamin C creams and serums, while international brands are leveraging D2C platforms such as Nykaa and Amazon India to tap into younger consumer demographics. Preventive skincare routines are gaining traction, with millennials and Gen Z consumers integrating Vitamin C products into daily regimes to address pigmentation and early aging. Educational campaigns and dermatologist-led endorsements are also reinforcing trust and expanding adoption beyond metros.

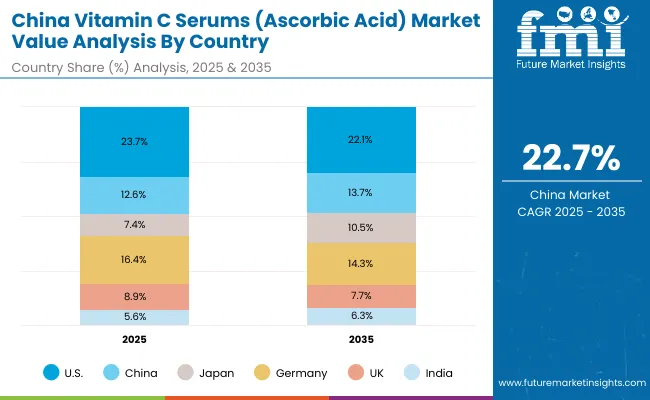

| Countries | 2025 Share (%) |

|---|---|

| USA | 23.7% |

| China | 12.6% |

| Japan | 7.4% |

| Germany | 16.4% |

| UK | 8.9% |

| India | 5.6% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 22.1% |

| China | 13.7% |

| Japan | 10.5% |

| Germany | 14.3% |

| UK | 7.7% |

| India | 6.3% |

The Vitamin C Serums (Ascorbic Acid) Market in China is expected to grow at a CAGR of 22.7%, one of the highest among leading economies. Growth is powered by brightening products, which already account for 55.8% of Chinese demand in 2025 (USD 208 million), aligning with cultural preferences for skin luminosity and tone uniformity. Domestic skincare companies are launching competitively priced serums and ampoules, while international players are leveraging Tmall and JD.com to expand penetration. Urban consumers are rapidly adopting multi-active serums combining Vitamin C with niacinamide and peptides, while K-beauty and C-beauty hybrids are gaining traction in younger demographics. City-level retail expansion, coupled with influencer-driven campaigns on Douyin and Xiaohongshu, is accelerating nationwide growth.

| USA by Product Type | Value Share% 2025 |

|---|---|

| Serums | 60.9% |

| Others | 39.1% |

The Vitamin C Serums (Ascorbic Acid) Market in the United States is valued at USD 698.81 million in 2025, with serums leading at 60.9% (USD 425 million), followed by creams, ampoules, and masks collectively at 39.1% (USD 273.5 million). The dominance of serums is a direct outcome of USA consumer preferences for high-potency formats that promise fast absorption, visible results, and easy integration into multi-step skincare routines. Dermatologist-tested claims are particularly strong in this market, with clinical brands such as SkinCeuticals, Obagi, and La Roche-Posay securing premium positioning through trust-building endorsements and in-clinic recommendations.

E-commerce and pharmacy-led distribution reinforce accessibility, while mass-market players like Olay and The Ordinary continue to democratize Vitamin C through affordable, high-concentration serums. This dual structure creates a market where premium, clinical-grade formulations coexist with affordable disruptors, fueling both volume and value growth. As clean-label and hybrid formulations combining Vitamin C with ferulic acid, Vitamin E, or hyaluronic acid gain momentum, the USA will remain the largest contributor to global sales, though at a more moderate CAGR of 10.3% compared to Asia-Pacific.

| China by Function | Value Share% 2025 |

|---|---|

| Brightening | 55.8% |

| Others | 44.2% |

The Vitamin C Serums (Ascorbic Acid) Market in China is valued at USD 372.77 million in 2025, with brightening leading at 55.8% (USD 208 million), followed by anti-aging, antioxidant protection, and skin repair functions at 44.2% (USD 164.9 million). The dominance of brightening is a direct outcome of cultural preferences for even-toned, luminous skin, where Vitamin C is perceived as a trusted solution for hyperpigmentation and dullness caused by pollution and UV exposure.

Rapid expansion of e-commerce platforms such as Tmall and JD.com has made Vitamin C products widely available across tier-1 to tier-3 cities, allowing both global brands and local C-beauty players to capture share. Domestic companies are innovating aggressively with competitively priced ampoules and high-stability formulations, while global leaders like La Roche-Posay and Clinique leverage premium positioning. Influencer-driven education on Douyin and Xiaohongshu accelerates first-time adoption among younger demographics, while established consumers integrate Vitamin C into multi-active routines. With a CAGR of 22.7%, China is set to surpass traditional Western markets in growth pace, positioning itself as a core driver of global expansion.

The Vitamin C Serums (Ascorbic Acid) Market is moderately fragmented, with dermatologist-backed leaders, mass-market disruptors, and indie innovators competing across diverse price points and consumer needs. Premium dermatology-aligned brands such as SkinCeuticals, Obagi, and La Roche-Posay hold significant share, driven by clinical endorsements, patented stabilization technologies, and strong presence in pharmacies and dermatology clinics. Their strategies increasingly emphasize encapsulation, hybrid antioxidant combinations, and clinical trial validation to reinforce efficacy.

Established mass and mid-tier players including The Ordinary, Olay, Paula’s Choice, and Kiehl’s focus on affordability and consumer education, democratizing access to Vitamin C serums and accelerating volume-driven growth. These brands leverage digital-first strategies, subscription-based D2C channels, and influencer partnerships to strengthen positioning among younger demographics.

Indie and niche brands such as Drunk Elephant and Murad emphasize clean-label, vegan, and multi-active formulations that appeal to conscious consumers seeking premium, ethically marketed options. Their strength lies in innovation cycles, packaging sustainability, and ability to shape consumer perception in online-driven retail ecosystems.

Competitive differentiation is shifting away from concentration and formulation stability alone toward ecosystem-driven value propositions: pairing Vitamin C with other actives, providing multi-functional benefits, ensuring digital visibility, and building consumer trust through transparency and dermatologist validation.

Key Developments in Vitamin C Serums (Ascorbic Acid) Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,953.6 million |

| Function | Brightening, Antioxidant protection, Anti-aging, and Skin repair |

| Product Type | Serums, Creams/lotions, Ampoules, and Masks |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, and Mass retail |

| Claim | Dermatologist-tested, Vegan, Natural/organic, and Clean-label |

| End-use Industry | Automotive, Aerospace & defense, Consumer electronics, Healthcare, Oil & gas, Energy and power, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SkinCeuticals, Paula’s Choice, The Ordinary, Murad, Kiehl’s, Obagi, Drunk Elephant, La Roche- Posay, Clinique, Olay |

| Additional Attributes | Dollar sales by product type, function, channel, and claim, adoption trends in brightening and anti-aging, rising demand for dermatologist-tested and vegan claims, segment-specific growth in serums and e-commerce, integration of Vitamin C with complementary antioxidants (Vitamin E, ferulic acid, and niacinamide), regional trends influenced by K-beauty and C-beauty, and innovations in encapsulation and stabilized Vitamin C derivatives. |

The Vitamin C Serums (Ascorbic Acid) Market is estimated to be valued at USD 2,953.6 million in 2025.

The market size for the Vitamin C Serums (Ascorbic Acid) Market is projected to reach USD 9,125.2 million by 2035.

The Vitamin C Serums (Ascorbic Acid) Market is expected to grow at a 11.9% CAGR between 2025 and 2035.

The key product types in the Vitamin C Serums (Ascorbic Acid) Market are serums, creams/lotions, ampoules, and masks.

In terms of function, the brightening segment is expected to command 55.6% share in the Vitamin C Serums (Ascorbic Acid) Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vitamin B12 Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Vitamin A Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Premix Market Analysis - Size, Growth, and Forecast 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin D Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Vitamin Yeast Market Analysis by Vitamin Composition, Application, Product Claim andOther Types Through 2035

Vitamin Supplement Market Insights - Wellness & Industry Growth 2025 to 2035

Vitamin D Testing Market Analysis by Component, Type, and Region: Forecast for 2025 to 2035

Vitamin and Mineral Supplement Market Insights - Trends & Forecast 2025 to 2035

Vitamin B Test Market Insights - Size, Trends & Forecast 2025 to 2035

Vitamin and Mineral Market – Growth, Innovations & Health Trends

Vitamin Shot Market – Growth, Demand & Functional Benefits

Vitamin C Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Patches Market - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Tonics Market Size and Share Forecast Outlook 2025 to 2035

Vitamin D Deficiency Treatment Market

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA