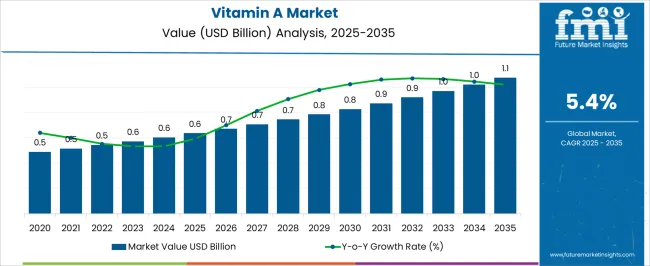

The vitamin A market is estimated to be valued at USD 0.6 billion in 2025 and is projected to reach USD 1.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

From 2021 to 2025, the market grows from USD 0.5 billion to 0.6 billion, with intermediate values passing through USD 0.5 billion and reflecting a steady, low-growth phase. This early period sees stable demand driven by the ongoing need for vitamin A in food, animal feed, and pharmaceutical applications, with minimal fluctuation in growth rates. Between 2026 and 2030, the market progresses more noticeably, moving from USD 0.6 billion to 0.9 billion, with intermediate values of USD 0.7 billion and 0.8 billion.

The growth rate begins to accelerate in this period as awareness increases regarding the health benefits of vitamin A and its role in combating deficiencies, particularly in developing regions. This phase shows slight volatility due to demand spikes related to health trends and dietary supplementation. From 2031 to 2035, the market accelerates further, moving from USD 0.9 billion to 1.1 billion, with intermediate values at USD 1.0 billion. The growth rate stabilizes, driven by continued demand for fortified foods, animal nutrition, and supplements, resulting in steady growth without sharp fluctuations.

The vitamin A market is shaped by five key parent markets that collectively drive its growth, demand, and innovation. The food and beverages/nutrition market contributes the largest share, around 30–35%, as vitamin A is widely used in fortified foods, dairy products, beverages, and dietary supplements. This segment is critical for addressing global micronutrient deficiencies and improving consumer health outcomes, particularly in regions with government-backed nutrition programs.

The pharmaceuticals and healthcare sector accounts for approximately 20–24% of demand. Vitamin A and its derivatives are integral in therapeutic areas such as dermatology, ophthalmology, and immune health. Its role in prescription medicines, over-the-counter supplements, and treatment of deficiency-related conditions makes this sector a major growth driver, especially in developing markets where deficiencies are still prevalent.

The animal feed and livestock nutrition market represents 15–18% of the total demand. Vitamin A fortification is essential for the growth, immunity, and reproduction of livestock, poultry, and aquaculture. With the expansion of industrial-scale animal farming and the rising global demand for protein, this segment ensures a consistent baseline consumption of vitamin A.

The cosmetics and personal care market contributes about 12–15%, led by the use of vitamin A derivatives such as retinol and retinyl palmitate in anti-aging, skin repair, and hair care formulations. Rising consumer demand for premium skincare and the strong influence of beauty trends in Asia-Pacific markets are boosting this segment’s importance.

Finally, the agriculture and biofortification market adds around 8–10%. Though relatively smaller, it has strategic significance through initiatives like crop biofortification (e.g., Golden Rice) and fortified fertilizers aimed at combating malnutrition in developing regions. Public health programs in Africa and South Asia make this an emerging but vital contributor to the vitamin A market’s future trajectory.

| Metric | Value |

|---|---|

| Vitamin A Market Estimated Value in (2025 E) | USD 0.6 billion |

| Vitamin A Market Forecast Value in (2035 F) | USD 1.1 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The vitamin A market is showing steady expansion, supported by rising health awareness, nutritional fortification initiatives, and the growing role of vitamins in both human and animal nutrition. Industry publications and trade updates have underscored the importance of vitamin A in vision, immune function, and growth, driving demand across food, pharmaceutical, and feed sectors.

Government-led nutritional programs in emerging economies, along with mandatory fortification regulations in certain regions, have increased the inclusion of vitamin A in staple foods and supplements. Additionally, animal health industries have intensified vitamin A usage in feed formulations to improve livestock productivity, reflecting broader trends in protein consumption.

Technological advancements in synthesis and encapsulation techniques have enhanced vitamin A stability and bioavailability, widening its application scope. Future growth is expected to be reinforced by innovation in fortified functional foods, increased adoption in preventive healthcare products, and sustained demand from the animal feed sector, which remains a major end-use category globally.

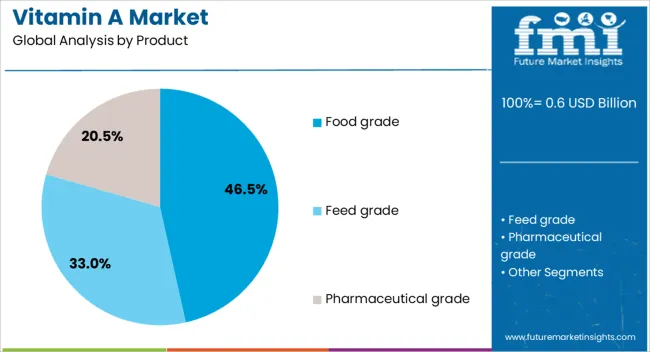

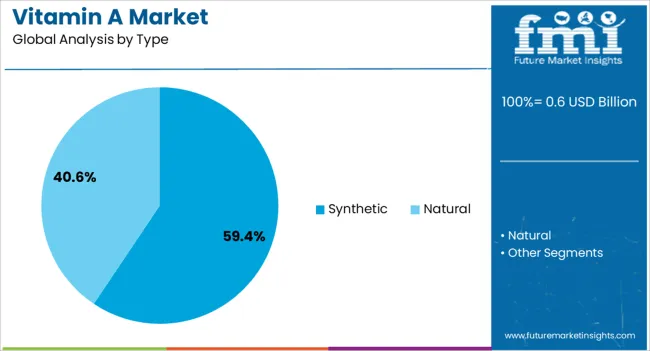

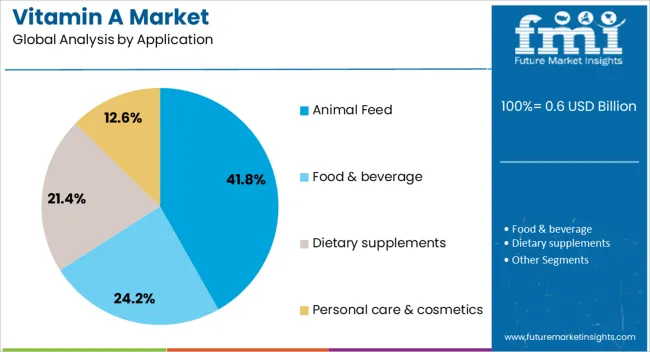

The vitamin a market is segmented by product, type, application, and geographic regions. By product, vitamin a market is divided into food grade, feed grade, and pharmaceutical grade. In terms of type, vitamin A market is classified into synthetic and natural. Based on application, vitamin a market is segmented into animal feed, food & beverage, dietary supplements, and personal care & cosmetics. Regionally, the vitamin A industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The food grade segment is projected to account for 46.5% of the vitamin A market revenue in 2025, maintaining its leadership due to strong demand from food and beverage manufacturers. This growth has been influenced by the widespread use of vitamin A in fortifying dairy, edible oils, cereals, and other staple food products to combat deficiencies in populations.

Public health initiatives and mandatory fortification programs in various countries have further accelerated adoption. Food grade vitamin A formulations have benefited from advances in microencapsulation technology, which improve stability during processing and storage.

Additionally, increasing consumer preference for functional and nutrient-rich food products has supported the steady integration of vitamin A into product lines. The segment’s position is further reinforced by collaborations between ingredient suppliers and food companies aimed at developing fortified products tailored to regional dietary needs.

The synthetic segment is projected to hold 59.4% of the vitamin A market revenue in 2025, reflecting its dominance in large-scale commercial production. This segment’s leadership has been shaped by cost efficiency, high production volumes, and consistent quality standards achievable through synthetic manufacturing processes.

The synthetic form of vitamin A is widely used in food fortification, supplements, cosmetics, and animal feed due to its stability and controlled potency. Manufacturers have invested in refining synthesis methods to enhance yield and reduce production costs, making synthetic vitamin A more accessible across diverse end-use industries.

Regulatory approvals and established safety profiles have also contributed to sustained demand. While naturally derived vitamin A has niche appeal, the scalability and affordability of synthetic production continue to secure its market advantage.

The animal feed segment is projected to contribute 41.8% of the vitamin A market revenue in 2025, leading in application share due to its critical role in livestock health and productivity. Vitamin A supplementation in animal diets has been essential for improving growth rates, reproductive performance, and disease resistance in poultry, swine, cattle, and aquaculture.

The segment’s growth has been supported by expanding meat and dairy consumption, which drives demand for nutrient-optimized feed formulations. Industry reports have highlighted that feed-grade vitamin A is often used in combination with other micronutrients to ensure balanced nutrition in intensive farming operations.

In addition, global efforts to improve animal welfare and production efficiency have reinforced the consistent inclusion of vitamin A in feed premixes. As livestock production intensifies in emerging markets, the animal feed segment is expected to sustain its market leadership, supported by both nutritional necessity and economic benefits for producers.

The vitamin A market is growing due to rising demand for health supplements, functional foods, and animal feed. Challenges include high raw material costs, regulatory compliance, and sourcing bioavailable ingredients. Opportunities exist in skin care formulations, fortified foods, and animal feed, where vitamin A’s health benefits are being increasingly recognized. Trends in synthetic production, improved bioavailability, and plant-based vitamin A are shaping the market’s future. Companies that innovate in these areas, offering cost-effective, high-quality vitamin A solutions, are well-positioned to lead in the global market, particularly in North America, Europe, and Asia-Pacific.

The vitamin A market is experiencing notable growth due to increasing consumer demand for health supplements, functional foods, and nutraceuticals. Vitamin A is a vital nutrient known for its roles in supporting vision, immune function, and skin health. As awareness of these health benefits grows, consumers are becoming more proactive in incorporating vitamin A into their daily routines through supplements. This trend is particularly prevalent in health-conscious regions such as North America, Europe, and Asia-Pacific. As more consumers seek natural and holistic approaches to health, the demand for vitamin A in various forms such as capsules, tablets, and topical has surged. Major players like BASF, DSM, and Lonza are focusing on developing high-quality, bioavailable vitamin A formulations. Their goal is to cater to the growing wellness trend, with innovative products that ensure optimal absorption and effectiveness in both oral and topical applications.

Vitamin A, especially in its natural retinol form, is derived from animal sources such as fish liver oil or synthetically produced from plant sources. The cost of these raw materials can vary, impacting the overall price structure of vitamin A products. Additionally, manufacturers must comply with stringent regulatory frameworks set by agencies like the FDA and EFSA to ensure safety, quality, and efficacy. These regulations, which are constantly evolving, increase operational costs for producers. Moreover, sourcing high-quality ingredients and ensuring their sustainability can be a time-consuming and expensive process. Companies that can manage raw material procurement effectively while navigating complex regulatory landscapes will have a competitive advantage in the market.

The vitamin A market is seeing increasing opportunities across multiple industries, including functional foods, skincare, and animal feed. As more consumers prioritize healthier eating habits, functional foods fortified with vitamin A are gaining traction. These foods provide additional nutritional value beyond basic sustenance and are seen as a key driver for vitamin A demand in the food industry. In the skincare sector, vitamin A is widely recognized for its anti-aging and skin rejuvenating properties, driving growth in both over-the-counter and prescription-based products. Moreover, the use of vitamin A in animal feed, particularly in poultry, livestock, and aquaculture, is expanding rapidly due to its role in promoting animal health and boosting productivity. Companies that focus on fortifying food products, enhancing skincare formulations, and optimizing animal feed with vitamin A are well-positioned to capitalize on these growing opportunities.

The vitamin A market is evolving with advancements in synthetic production methods and improving bioavailability, which directly impacts the market's ability to meet growing demand. As the need for affordable and accessible vitamin A increases, manufacturers are focusing on synthetic production techniques that ensure a reliable and cost-effective supply of the nutrient. These innovations aim to optimize the bioavailability of vitamin A, ensuring that the body can efficiently absorb and utilize the nutrient for maximum benefit. In addition to synthetic forms, there is a growing preference for plant-based sources of vitamin A, such as beta-carotene, which cater to the increasing demand for vegetarian and vegan products. These trends are fueling the development of new formulations for health supplements, functional foods, and cosmetics, as companies strive to meet the nutritional needs of an evolving, health-conscious consumer base.

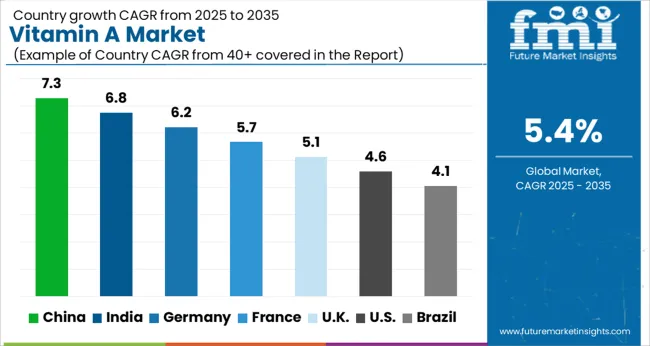

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

Global Vitamin A demand is projected to grow at a CAGR of 5.4% from 2025 to 2035. China leads with 7.3%, followed by India at 6.8% and Germany at 6.2%. The UK and the USA grow at 5.1% and 4.6%, respectively. These growth rates translate into premiums for China and India, driven by increasing food fortification needs and rising awareness about health benefits. Germany’s growth is spurred by the demand in functional foods and cosmetics, while the UK and the USA see growth fueled by skin care products and dietary supplements. Regional drivers include government initiatives, healthcare improvements, and the rising interest in wellness. The analysis spans over 40+ countries, with the leading markets shown below.

Vitamin A market in China is expected to grow at a CAGR of 7.3% from 2025 to 2035. The demand for Vitamin A is driven by its critical role in food fortification, dietary supplements, and the cosmetics sector. In the food industry, Vitamin A is widely used in dairy, infant nutrition, and cereals to address malnutrition and enhance the nutritional value of processed foods. Additionally, China’s expanding pharmaceutical industry is utilizing Vitamin A in various medical formulations for treating vision-related issues and boosting immunity. The increasing focus on wellness and skincare, especially in urban areas, is pushing demand for Vitamin A-based skincare products. With rising consumer awareness about the benefits of vitamins for skin health, immunity, and overall wellness, the demand for Vitamin A in both the food and non-food sectors is expected to grow.

Vitamin A market in India is set to grow at a CAGR of 6.8% from 2025 to 2035. With a growing population and rising disposable incomes, India is experiencing a surge in demand for food and beverage products fortified with essential vitamins, including Vitamin A. The Indian government’s initiatives to combat malnutrition are further driving the use of Vitamin A in food products. Additionally, India’s booming pharmaceutical and cosmetics industries are significant consumers of Vitamin A. It is widely used in dietary supplements, vision health products, and skin care formulations. The increasing focus on skin health, eye care, and immunity enhancement is encouraging more consumers to opt for Vitamin A-based supplements. Moreover, India’s expanding e-commerce and retail infrastructure have made Vitamin A products more accessible to a larger consumer base, boosting overall market growth.

Vitamin A market in Germany is projected to grow at a CAGR of 6.2% from 2025 to 2035. As a leader in the European food and pharmaceutical sectors, Germany’s demand for Vitamin A is primarily driven by its role in food fortification and medical applications. Vitamin A is essential in addressing nutritional deficiencies in food products such as dairy and cereals, with a focus on improving public health. The growing demand for wellness and functional foods is increasing the need for Vitamin A in the food and beverage sectors. The cosmetic industry in Germany also relies on Vitamin A for skin health and anti-aging products. As more consumers seek preventive healthcare and wellness solutions, the demand for Vitamin A-based supplements and skincare products is on the rise. Germany’s robust research and development sector continues to innovate in the production of Vitamin A to meet the needs of various industries.

The UK Vitamin A market is set to grow at a CAGR of 5.1% from 2025 to 2035. The increasing demand for Vitamin A is driven by its widespread use in food fortification, particularly in dairy, baby foods, and ready-to-eat cereals. As the demand for fortified foods grows, Vitamin A plays a vital role in improving public health, particularly in combating malnutrition in children. The UK also has a strong pharmaceutical market where Vitamin A is used in supplements aimed at improving vision, immune function, and skin health. The growing popularity of skincare products containing Vitamin A, particularly anti-aging creams, is further boosting the market. With a rising interest in wellness, preventive healthcare, and skin care, consumers in the UK are more inclined to include Vitamin A in their daily routines.

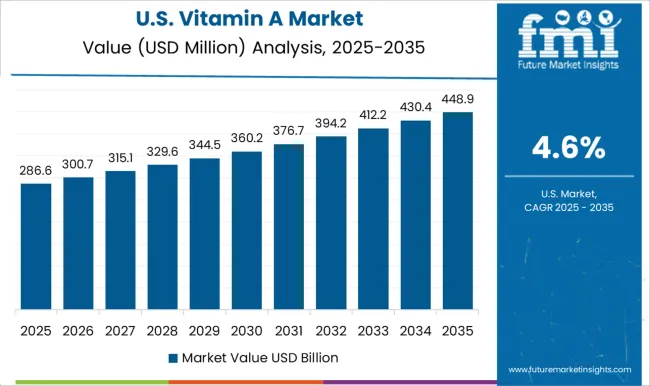

The USA Vitamin A market is projected to grow at a CAGR of 4.6% from 2025 to 2035. The demand for Vitamin A is strong in both the food and pharmaceutical industries, with its widespread use in fortified foods, dietary supplements, and skincare products. The growing focus on health and wellness in the USA has led to increased consumer demand for vitamins and supplements, including Vitamin A. In particular, the demand for Vitamin A in skin care products, such as anti-aging creams and serums, is expanding rapidly. Additionally, Vitamin A plays a key role in maintaining eye health, boosting immunity, and promoting healthy skin, making it an essential part of daily nutritional routines. The pharmaceutical sector, with its focus on vision health, also contributes significantly to market growth. Furthermore, the rise of e-commerce and retail channels is making Vitamin A-based products more accessible to a larger consumer base in the USA

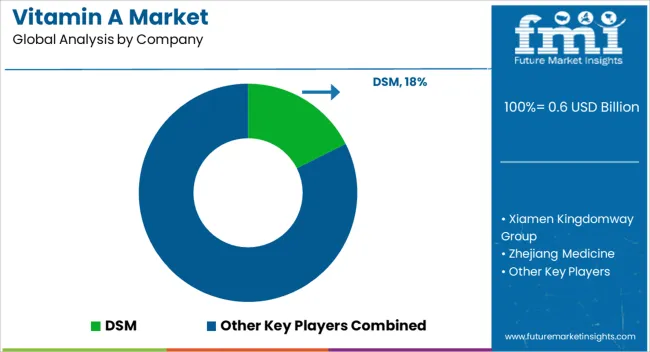

Competition in the Vitamin A market is driven by product quality, manufacturing excellence, and the ability to meet diverse consumer needs across animal feed, pharmaceuticals, and dietary supplements. DSM leads the market by offering high-quality Vitamin A products, with brochures emphasizing sustainability, precision, and product consistency. The company differentiates itself through advanced manufacturing processes, regulatory compliance, and a strong focus on delivering products that meet global standards.

Xiamen Kingdomway Group competes by providing both natural and synthetic Vitamin A, targeting affordability and large-scale distribution. Their brochures emphasize the company's versatility in offering bulk products across industries while maintaining consistent quality and competitive pricing. BASF stands out with its deep expertise in chemical manufacturing, offering Vitamin A solutions with high bioavailability, stability, and tailored formulations. Their product brochures highlight the precision of their production methods and ability to customize solutions for human health, animal nutrition, and fortified food applications.

Zhejiang NHU Co. Ltd. and Zhejiang Medicine focus on large-scale production, offering cost-effective Vitamin A products for animal feed and pharmaceuticals. Their brochures highlight supply chain reliability, efficient production processes, and competitive pricing, making them reliable suppliers for bulk orders in these sectors. Zhejiang Tianhecheng Bio-technology Shares Co., Ltd., Nutrilo GmbH, and Vitafor NV focus on niche markets by offering customized Vitamin A solutions for dietary supplements and fortified foods. Their brochures showcase specialized formulations designed to meet specific consumer needs. Adisseo and Divi's Nutraceuticals cater to the animal nutrition sector, offering Vitamin A solutions that enhance growth, immunity, and overall health in livestock. Their product brochures highlight the benefits of their Vitamin A offerings in supporting efficient animal production and long-term animal health, positioning them as reliable partners for livestock health.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.6 billion |

| Product | Food grade, Feed grade, and Pharmaceutical grade |

| Type | Synthetic and Natural |

| Application | Animal Feed, Food & beverage, Dietary supplements, and Personal care & cosmetics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DSM, Xiamen Kingdomway Group, Zhejiang Medicine, Zhejiang NHU Co. Ltd., BASF, Zhejiang Tianhecheng Bio-technology Shares Co., Ltd, Nutrilo GmbH, Vitafor NV, Adisseo, and Divi's Nutraceuticals |

| Additional Attributes | Dollar sales by product type (synthetic, natural, vitamin A derivatives), application (human nutrition, animal feed, pharmaceuticals, cosmetics), and form (powder, oil, capsules). Demand is driven by the growing awareness of the health benefits of vitamin A, including its role in immune health, vision, and skin care. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, with increasing demand for fortified foods, dietary supplements, and animal feed solutions. The rising emphasis on sustainability and natural sources of vitamin A is influencing market dynamics, particularly in the personal care and nutrition sectors. |

The global vitamin a market is estimated to be valued at USD 0.6 billion in 2025.

The market size for the vitamin a market is projected to reach USD 1.1 billion by 2035.

The vitamin a market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in vitamin a market are food grade, feed grade and pharmaceutical grade.

In terms of type, synthetic segment to command 59.4% share in the vitamin a market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vitamin B12 Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Vitamin C Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vitamin Tonics Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Premix Market Analysis - Size, Growth, and Forecast 2025 to 2035

Vitamin Patches Market - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin D Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Vitamin Yeast Market Analysis by Vitamin Composition, Application, Product Claim andOther Types Through 2035

Vitamin Supplement Market Insights - Wellness & Industry Growth 2025 to 2035

Vitamin D Testing Market Analysis by Component, Type, and Region: Forecast for 2025 to 2035

Vitamin and Mineral Supplement Market Insights - Trends & Forecast 2025 to 2035

Vitamin B Test Market Insights - Size, Trends & Forecast 2025 to 2035

Vitamin and Mineral Market – Growth, Innovations & Health Trends

Vitamin Shot Market – Growth, Demand & Functional Benefits

Vitamin D Deficiency Treatment Market

Multivitamin-Infused Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA