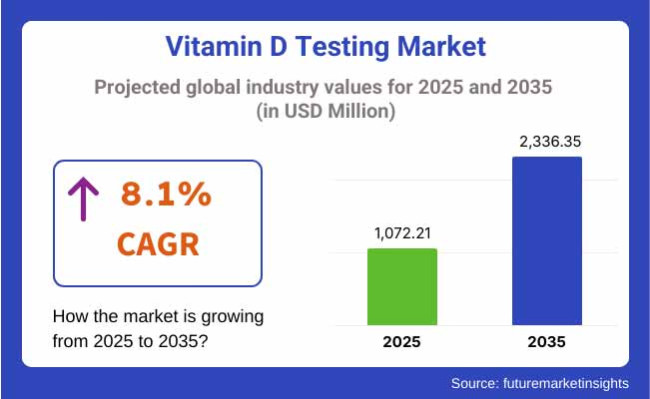

The Vitamin D Testing Market is valued at USD 1,072.21 million in 2025. As per FMI's analysis, the Vitamin D Testing Market will grow at a CAGR of 8.1% and reach USD 2,336.35 million by 2035. There will be high growth in the market from 2025 to 2035 due to the increasing deficiency of vitamin D in both elderly men and women who are prone because of sun avoidance.

Innovations in diagnostic methods, from AI-based analysis to home test kits, will make the diagnosis more accurate and convenient, thereby encouraging more users. Preventive healthcare and early diagnosis of vitamin D-related disorders will be supported by the government, which will thus augment market fortunes further.

The surging demand for vitamin D testing will be enhanced mainly in the coming years due to its introduction and spurred focus on customized medicine and nutrition-based healthcare approaches. Combined, digital health platforms should ease the analysis of test results and patient management processes, further streamlining the diagnostics.

More collaborations between diagnostic companies and health care providers should emerge in the market above, with a view to improving efficiency and extending their scope into currently reserved regions.

Emerging economies, too, will continue to show very promising growth due to an improvement in health care infrastructures along with rising awareness regarding campaigns. Overall, the Vitamin D Testing Market is gearing up for explosive growth, powered by the thrust of continuing technological innovations and changing trends towards proactive health management.

The Vitamin D Testing Market is expected to grow steadily owing to increasing awareness regarding vitamin D deficiency and rising needs for early diagnosis and preventive healthcare. Technology advancement including AI-based diagnostics and home-testing kits increases accessibility and efficiency in diagnostic companies and healthcare providers. However, high cost and less availability in the developing regions may hinder its penetration into the market.

Over the projection period 2025 to 2035, the 1, 25-dihydroxy vitamin D test segment is anticipated to have profitable expansion. Patients with hypercalcemia, vitamin D-dependent rickets, or congenital 1-alpha-hydroxylase deficiency are the people who can use this test.

These testing include 25-Hydroxy Vitamin D Testing and 1,25-Dihydroxy Vitamin D Testing. 25-Hydroxy Vitamin D Testing is expected to hold the major foraminifer due to higher usage in the diagnosis of vitamin D deficiency and other associated disorders.

More tests will be administered by several health care clinicians as public awareness continues to grow regarding vitamin D levels in the whole health context as part of routine screening. The category of 1,25-Dihydroxy Vitamin D Testing will experience growth, especially due to the relevance of this test in measuring kidney function as well as endocrine disorders.

Advances in diagnostic accuracy and automation will take these tests in an added reliability endorsement in all health care settings. The geriatric population goes up, as well as the number of diseases associated with vitamin D, which assures these two contributors' steady demand. Adding technological enhancements and regulatory support will further expand testing options and contribute to market growth at large.

The Vitamin D Testing Market utilizes various technologies, including radioimmunoassay, ELISA, HPLC, and LC-MS. Radioimmunoassay remains a trusted method for its sensitivity and specificity, although it faces competition from newer techniques.

ELISA is gaining traction due to its cost-effectiveness and ease of use, making it a preferred choice for high-throughput laboratories. HPLC is valued for its precision and reliability in complex sample analysis, ensuring accurate results for both research and clinical applications. LC-MS, known for its high sensitivity and specificity, is becoming the gold standard in vitamin D testing, particularly in specialized diagnostic centers.

Other emerging technologies continue to refine testing capabilities, improving turnaround times and enhancing patient convenience. With increasing demand for faster, more accurate diagnostic solutions, innovations in testing methodologies will shape the market’s future, ensuring better integration with digital health solutions and personalized medicine initiatives.

The market is segmented into adult and pediatric vitamin D testing. Adults account for the majority of testing demand, driven by rising concerns over osteoporosis, cardiovascular diseases, and immune system disorders linked to vitamin D deficiency. Lifestyle factors, including limited outdoor activity and dietary habits, contribute to the growing need for routine testing among adults.

The pediatric segment is also expanding as awareness increases regarding vitamin D’s crucial role in childhood development, particularly in preventing rickets and supporting bone growth. Physicians and pediatricians are increasingly recommending early screening to address potential deficiencies before they result in long-term health issues.

Government health programs and educational campaigns further drive the adoption of vitamin D testing in both segments. As research continues to uncover broader implications of vitamin D deficiency, the demand for routine testing across all age groups will remain a significant market driver throughout the forecast period.

Vitamin D testing is performed at point-of-care facilities and other healthcare settings, including laboratories and hospitals. Point-of-care testing is gaining momentum as it offers rapid results, allowing immediate clinical decisions without the need for specialized laboratory infrastructure.

The growing demand for convenience and accessibility is driving the adoption of these tests in pharmacies, clinics, and home-based settings. Other testing locations, including traditional hospital and laboratory-based diagnostics, continue to dominate due to their high accuracy and ability to process large sample volumes.

The integration of digital health tools is expected to enhance patient engagement by providing easy access to test results through mobile apps and telemedicine platforms.

As consumer preference shifts toward fast and reliable testing solutions, healthcare providers and diagnostic companies will focus on expanding test accessibility through multiple locations, ensuring that vitamin D testing becomes a standard part of routine health assessments.

Hospitals, diagnostic laboratories, homecare, and other healthcare providers contribute to the market’s end-use segmentation. Hospitals remain a major segment due to their role in diagnosing and managing vitamin D-related disorders. As hospital networks expand and incorporate advanced diagnostic technologies, the efficiency of vitamin D testing is expected to improve.

Diagnostic laboratories continue to hold a significant market share, leveraging high-throughput testing capabilities to serve both healthcare providers and direct-to-consumer markets. The homecare segment is witnessing rapid growth, fueled by the increasing availability of self-testing kits and telehealth services.

Patients are opting for at-home vitamin D testing to avoid hospital visits, a trend accelerated by digital health innovations. Other healthcare providers, including specialty clinics and wellness centers, are also integrating vitamin D testing into their services. With greater emphasis on preventive care, all end-use segments will experience steady growth, making vitamin D testing more accessible worldwide.

Invest in Advanced Diagnostic Technologies

Stakeholders should prioritize investments in innovative diagnostic technologies such as AI-driven analysis, LC-MS advancements, and home-based testing solutions. These investments will enhance test accuracy, improve turnaround times, and expand accessibility, catering to the growing demand for personalized and preventive healthcare.

Adapt to Shifting Consumer and Regulatory Trends

Companies must align their offerings with evolving consumer preferences for convenient, rapid, and cost-effective testing solutions. Additionally, staying ahead of regulatory changes in diagnostic testing standards will be crucial to ensuring compliance, avoiding disruptions, and leveraging new market opportunities in emerging economies.

Expand Distribution Networks and Strategic Partnerships

Building strong partnerships with hospitals, diagnostic labs, and digital health platforms will accelerate market penetration. Expanding direct-to-consumer channels, investing in supply chain efficiencies, and pursuing strategic M&A opportunities will strengthen competitive positioning and unlock new revenue streams.

| Risk | Probability - Impact |

|---|---|

| Regulatory Hurdles | Medium - High |

| Pricing Pressure and Reimbursement Challenges | High - High |

| Supply Chain Disruptions | Medium - Medium |

| Priority | Immediate Action |

|---|---|

| Technology Integration | Assess AI and automation feasibility for diagnostics |

| Market Expansion | Develop partnerships for increased global reach |

| Regulatory Readiness | Engage with policymakers to influence favorable regulations |

Executives must act decisively to capture the growing demand for vitamin D testing by investing in cutting-edge diagnostic technologies and expanding distribution channels. As the industry shifts toward digital health and at-home testing solutions, companies that adapt quickly will gain a competitive edge. Regulatory compliance and strategic partnerships will be crucial in navigating pricing pressures and market expansion.

By focusing on innovation, operational efficiency, and customer accessibility, stakeholders can future proof their business and drive sustained growth in the evolving healthcare landscape.

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across diagnostic companies, healthcare providers, laboratories, and regulatory agencies in North America, Europe, Asia-Pacific, and Latin America.)

Expanding Access to Testing:

79% of stakeholders globally identified increasing access to affordable and efficient vitamin D testing as a "critical" priority.

Improving Diagnostic Accuracy:

73% highlighted the importance of investing in high-precision methods like LC-MS to ensure consistent and reliable results.

Regional Variance:

High Variance:

Convergent and Divergent ROI Perspectives:

69% of North American stakeholders believed investing in automation was "worth the cost," while 35% in Latin America favored manual lab-based methods due to budget constraints.

Consensus:

Lab-Based Testing: Chosen by 66% of stakeholders for its high accuracy and scalability, particularly in hospital and diagnostic lab settings.

Variance:

Shared Challenges:

86% of stakeholders cited rising diagnostic costs, with expenses increasing due to reagent shortages and regulatory compliance burdens.

Regional Differences:

Diagnostic Companies:

Distributors & Healthcare Providers:

End-Users (Hospitals, Labs, Patients):

Alignment:

76% of global stakeholders planned to invest in automation and digital reporting systems to improve test efficiency.

Divergence:

High Consensus:

Expanding testing accessibility, improving diagnostic accuracy, and managing cost pressures were universally critical issues.

Key Variances:

Strategic Insight:

A standardized global approach will not succeed. Companies must adopt region-specific strategies, such as AI-powered home tests in North America, regulatory-driven lab advancements in Europe, and affordable ELISA-based solutions in Asia-Pacific and Latin America.

| Country/Region | Policies, Regulations, and Mandatory Certifications |

|---|---|

| United States | The FDA (Food and Drug Administration) regulates vitamin D testing devices under the Clinical Laboratory Improvement Amendments (CLIA). Laboratories conducting these tests must be CLIA-certified. The Centers for Medicare & Medicaid Services (CMS) imposes strict reimbursement policies, impacting test affordability. The EPA monitors the environmental impact of laboratory reagents used in testing. |

| European Union | The In Vitro Diagnostic Medical Devices Regulation (IVDR) (EU 2017/746) mandates stringent accuracy, quality control, and labeling standards. Labs and manufacturers must comply with CE Marking to sell vitamin D test kits. The General Data Protection Regulation (GDPR) governs patient data security in digital diagnostic tools. |

| United Kingdom | Post-Brexit, the UK Medical Device Regulations (UK MDR 2002, amended in 2021) replace EU IVDR, requiring vitamin D test manufacturers to obtain a UKCA (UK Conformity Assessed) Mark. The National Health Service (NHS) reimbursement framework influences test adoption and pricing. |

| Canada | Health Canada classifies vitamin D test kits as Class II or III medical devices, requiring Medical Device License (MDL) approval. The Laboratory Accreditation Program (LAP) ensures compliance with national standards. The Patented Medicine Prices Review Board (PMPRB) regulates test pricing under public healthcare. |

| China | The National Medical Products Administration (NMPA) requires foreign diagnostic test manufacturers to undergo local clinical trials before market entry. The Healthy China 2030 Plan promotes wider vitamin D deficiency screening, increasing demand for certified testing solutions. |

| Japan | The Pharmaceutical and Medical Device Act (PMDA) governs diagnostic approvals. Local labs must be certified under the Japan Accreditation Board (JAB) standards. Reimbursement policies under the National Health Insurance (NHI) system impact vitamin D test affordability. |

| India | The Medical Devices Rules, 2017, categorize vitamin D tests as regulated devices under the Central Drugs Standard Control Organization (CDSCO). Laboratories must obtain National Accreditation Board for Testing and Calibration Laboratories (NABL) certification to conduct testing. The Ayushman Bharat scheme aims to expand access to affordable diagnostics. |

| Australia | The Therapeutic Goods Administration (TGA) mandates compliance with the Australian Register of Therapeutic Goods (ARTG) for diagnostic test manufacturers. Medicare reimbursement for vitamin D testing has been reduced to curb unnecessary testing. |

| Brazil | The National Health Surveillance Agency (ANVISA) regulates diagnostic test approvals. The government mandates Good Manufacturing Practices (GMP) certification for companies producing vitamin D test kits. Public health insurance (SUS) covers limited vitamin D testing based on physician referrals. |

| Middle East (UAE, Saudi Arabia) | The Saudi Food and Drug Authority (SFDA) and the Emirates Authority for Standardization and Metrology (ESMA) regulate medical device imports. Government initiatives promote preventive healthcare, increasing vitamin D deficiency screening. Reimbursement policies vary by country. |

| Company | Estimated Market Share (%) |

|---|---|

| Abbott Laboratories | 18.5% |

| F. Hoffmann-La Roche Ltd. | 16.2% |

| Siemens Healthineers | 14.8% |

| DiaSorin S.p.A. | 12.5% |

| Thermo Fisher Scientific Inc. | 10.9% |

| Quest Diagnostics | 8.3% |

| BioMérieux SA | 6.7% |

| Other Regional & Emerging Players | 12.1% |

The Vitamin D Testing Market in the United States is expected to grow at a CAGR of 7.5% from 2025 to 2035 due to increasing awareness of vitamin D deficiency and its link to chronic diseases such as osteoporosis and cardiovascular disorders. Government initiatives supporting preventive healthcare and rising adoption of at-home testing kits are further fueling demand.

The Centers for Medicare & Medicaid Services (CMS) policies play a critical role in shaping reimbursement dynamics, impacting accessibility. Leading diagnostic firms such as Abbott, Roche, and Quest Diagnostics continue to invest in advanced testing solutions to enhance accuracy and speed.

However, restrictions on unnecessary testing could slow market growth. Telehealth integration and automation in diagnostics are expected to sustain market expansion.

The Vitamin D Testing Market in the United Kingdom is projected to grow at a CAGR of 7.2% from 2025 to 2035, driven by strong government initiatives promoting early diagnosis and preventive healthcare.

The National Health Service (NHS) plays a crucial role in providing subsidized vitamin D tests, ensuring accessibility across various population segments. Adoption of ELISA and LC-MS-based testing is increasing due to their high accuracy. Growing awareness campaigns led by public health organizations are further pushing demand.

Key players such as Siemens Healthineers and Roche are expanding their presence through strategic partnerships. Regulatory changes post-Brexit have led to new compliance requirements, but investments in advanced diagnostic solutions are expected to drive market growth.

The Vitamin D Testing Market in France is estimated to expand at a CAGR of 7.0% from 2025 to 2035, supported by government-backed preventive health programs and increased reimbursement for diagnostic tests. France has a high prevalence of vitamin D deficiency, particularly among older adults and individuals with limited sun exposure.

The demand for high-precision LC-MS and HPLC testing technologies is rising due to their accuracy in detecting deficiency levels. Private laboratories and hospitals are leading adopters of advanced vitamin D testing methods.

The presence of strict EU regulatory frameworks ensures quality and standardization in diagnostic procedures. However, budget constraints in public healthcare may slow market penetration, but private sector investment will likely offset this limitation.

The Vitamin D Testing Market in Germany is expected to grow at a CAGR of 7.8% from 2025 to 2035, making it one of the fastest-growing markets in Europe. Germany has one of the highest vitamin D deficiency rates in Europe, driving significant demand for routine testing.

The country has a well-established healthcare system, with universal insurance coverage ensuring accessibility to diagnostic services. Adoption of radioimmunoassay and automated ELISA technologies is increasing due to their precision and efficiency.

The European Union’s IVDR regulations mandate strict compliance for diagnostic manufacturers, enhancing testing reliability. Key industry players such as Roche and Siemens Healthineers are expanding their product offerings. Continued government support for research in bone health and preventive care will drive further growth.

The Vitamin D Testing Market in Italy is projected to grow at a CAGR of 6.9% from 2025 to 2035, driven by an aging population and a high prevalence of osteoporosis and vitamin D deficiency. The Italian government is actively promoting preventive screening programs, encouraging regular vitamin D testing, particularly among elderly individuals.

Diagnostic laboratories and hospitals are increasing their adoption of LC-MS and HPLC-based tests, known for their high accuracy. However, reimbursement restrictions and budget constraints in the public healthcare sector may slow market growth.

Despite this, private diagnostic centers and home testing services are gaining traction, offering convenient alternatives. Increased partnerships between health tech companies and diagnostic service providers will further drive market expansion.

The Vitamin D Testing Market in New Zealand is expected to grow at a CAGR of 6.5% from 2025 to 2035, supported by rising awareness campaigns on vitamin D deficiency and government initiatives for preventive care.

The country experiences seasonal vitamin D deficiency, particularly in winter, leading to periodic surges in testing demand. Point-of-care and home testing solutions are gaining popularity due to their convenience and accessibility in remote areas.

However, reimbursement limitations under the national healthcare system may pose challenges to widespread adoption. The integration of digital diagnostics with telehealth platforms is expected to expand market reach. Key players in the industry are investing in research to develop cost-effective and faster vitamin D testing methods.

The Vitamin D Testing Market in South Korea is set to grow at a CAGR of 7.3% from 2025 to 2035, driven by urbanization, dietary habits, and increased awareness of vitamin D deficiency. The government is actively investing in preventive healthcare initiatives, boosting the demand for advanced diagnostic solutions.

South Korea’s strong digital healthcare infrastructure is enabling the rise of telemedicine-based vitamin D testing services. The market is witnessing higher adoption of LC-MS and automated ELISA tests in diagnostic laboratories.

However, cost sensitivity and limited insurance coverage for routine vitamin D testing could impact growth. Strategic collaborations between global diagnostic firms and local healthcare providers are expected to expand access to affordable vitamin D testing.

The Vitamin D Testing Market in Japan is projected to grow at a CAGR of 6.8% from 2025 to 2035, driven by an aging population and government-backed preventive healthcare policies. Japan has one of the highest life expectancies, increasing the demand for osteoporosis and bone health-related testing.

The market is seeing rising adoption of high-precision LC-MS and HPLC-based testing technologies. However, cost-conscious consumers and restrictive insurance policies could slow the adoption of premium testing services.

Regulatory frameworks under the PMDA ensure high-quality standards in diagnostic testing. Investment in AI-based diagnostics and home testing solutions is expected to boost market accessibility and affordability, ensuring continued growth.

The Vitamin D Testing Market in China is anticipated to grow at a CAGR of 8.5% from 2025 to 2035, making it one of the fastest-growing markets globally. Rising urbanization, changing dietary patterns, and increasing osteoporosis cases are fueling demand for vitamin D testing.

The Chinese government’s Healthy China 2030 initiative emphasizes preventive healthcare, driving widespread adoption of diagnostic solutions. The National Medical Products Administration (NMPA) mandates local clinical validation for foreign testing solutions, influencing market entry strategies.

China’s rapid expansion of private healthcare services and growth in telemedicine platforms are accelerating at-home testing adoption. Increased R&D investments in advanced LC-MS and AI-driven diagnostic tools will support long-term market expansion.

The Vitamin D Testing Market in Australia is expected to grow at a CAGR of 7.0% from 2025 to 2035, driven by high rates of vitamin D deficiency among the population. Australia has implemented strict healthcare policies to curb unnecessary testing, limiting public healthcare reimbursements. However, demand remains strong due to growing awareness campaigns and private-sector initiatives.

The rise of point-of-care testing solutions and telehealth-based diagnostics is addressing accessibility concerns, particularly in rural areas. The Therapeutic Goods Administration (TGA) mandates compliance with ARTG standards, ensuring quality control in vitamin D testing solutions. Investments in AI-driven diagnostics and integrated lab automation systems are expected to enhance testing efficiency and affordability in the coming years.

25-Hydroxy Vitamin D Testing, 1,25-Dihydroxy Vitamin D Testing

Vitamin D Testing for Osteoporosis, Vitamin D Testing for Rickets, Vitamin D Testing for Thyroid Disorders, Vitamin D Testing for Vitamin D Deficiency, Others

Radioimmunoassay, ELISA, HPLC, LC-MS, Others

Adult, Pediatric

Vitamin D Testing at Point-of-Care, Others

Vitamin D Testing for Hospitals, Vitamin D Testing for Diagnostic Laboratories, Vitamin D Testing for Homecare, Others

North America, Latin America, Europe, East Asia, South Asia & Pacific, the Middle East and Africa (MEA)

The growing awareness about vitamin D deficiency, rising prevalence of osteoporosis and thyroid disorders, and increasing adoption of advanced diagnostic technologies are major factors contributing to the rising demand for testing solutions.

Various technologies such as ELISA, radioimmunoassay, HPLC, and LC-MS are utilized for precise detection and quantification of vitamin D levels in patients.

Hospitals, diagnostic laboratories, and homecare settings are the primary users of these testing solutions, with an increasing shift toward point-of-care diagnostics for quicker results.

Stringent regulatory standards and mandatory certifications ensure the reliability and accuracy of test kits and equipment, influencing their adoption across healthcare facilities.

Continuous innovation in testing methodologies, automation in laboratory workflows, and integration of digital health solutions are enhancing efficiency and accessibility in vitamin D diagnostics.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Patient, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Patient, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Patient, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 22: Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Patient, 2018 to 2033

Table 24: Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: South Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 27: South Asia Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 28: South Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 29: South Asia Market Value (US$ Million) Forecast by Patient, 2018 to 2033

Table 30: South Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Patient, 2018 to 2033

Table 36: East Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 40: Oceania Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by Patient, 2018 to 2033

Table 42: Oceania Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 46: MEA Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Patient, 2018 to 2033

Table 48: MEA Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Indication, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Patient, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by End-use, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Patient, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Patient, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Patient, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 25: Global Market Attractiveness by Product, 2023 to 2033

Figure 26: Global Market Attractiveness by Indication, 2023 to 2033

Figure 27: Global Market Attractiveness by Technology, 2023 to 2033

Figure 28: Global Market Attractiveness by Patient, 2023 to 2033

Figure 29: Global Market Attractiveness by End-use, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Patient, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Patient, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Patient, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Patient, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 55: North America Market Attractiveness by Product, 2023 to 2033

Figure 56: North America Market Attractiveness by Indication, 2023 to 2033

Figure 57: North America Market Attractiveness by Technology, 2023 to 2033

Figure 58: North America Market Attractiveness by Patient, 2023 to 2033

Figure 59: North America Market Attractiveness by End-use, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Patient, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Patient, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Patient, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Patient, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Indication, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Patient, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End-use, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Indication, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Patient, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 101: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 102: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 103: Europe Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 104: Europe Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 105: Europe Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 106: Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 107: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 108: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) Analysis by Patient, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Patient, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Patient, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 113: Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 114: Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 115: Europe Market Attractiveness by Product, 2023 to 2033

Figure 116: Europe Market Attractiveness by Indication, 2023 to 2033

Figure 117: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 118: Europe Market Attractiveness by Patient, 2023 to 2033

Figure 119: Europe Market Attractiveness by End-use, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Indication, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Patient, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) by End-use, 2023 to 2033

Figure 126: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: South Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 134: South Asia Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 135: South Asia Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 136: South Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 137: South Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 138: South Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 139: South Asia Market Value (US$ Million) Analysis by Patient, 2018 to 2033

Figure 140: South Asia Market Value Share (%) and BPS Analysis by Patient, 2023 to 2033

Figure 141: South Asia Market Y-o-Y Growth (%) Projections by Patient, 2023 to 2033

Figure 142: South Asia Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 143: South Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 144: South Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 145: South Asia Market Attractiveness by Product, 2023 to 2033

Figure 146: South Asia Market Attractiveness by Indication, 2023 to 2033

Figure 147: South Asia Market Attractiveness by Technology, 2023 to 2033

Figure 148: South Asia Market Attractiveness by Patient, 2023 to 2033

Figure 149: South Asia Market Attractiveness by End-use, 2023 to 2033

Figure 150: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Indication, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Patient, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by End-use, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 163: East Asia Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 164: East Asia Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 165: East Asia Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 166: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 167: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 168: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 169: East Asia Market Value (US$ Million) Analysis by Patient, 2018 to 2033

Figure 170: East Asia Market Value Share (%) and BPS Analysis by Patient, 2023 to 2033

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by Patient, 2023 to 2033

Figure 172: East Asia Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 173: East Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Indication, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 178: East Asia Market Attractiveness by Patient, 2023 to 2033

Figure 179: East Asia Market Attractiveness by End-use, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Product, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Indication, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Technology, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Patient, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by End-use, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 191: Oceania Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 192: Oceania Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 193: Oceania Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 194: Oceania Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 195: Oceania Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 196: Oceania Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 197: Oceania Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 198: Oceania Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 199: Oceania Market Value (US$ Million) Analysis by Patient, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Patient, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Patient, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 203: Oceania Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 204: Oceania Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 205: Oceania Market Attractiveness by Product, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Indication, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Technology, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Patient, 2023 to 2033

Figure 209: Oceania Market Attractiveness by End-use, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 212: MEA Market Value (US$ Million) by Indication, 2023 to 2033

Figure 213: MEA Market Value (US$ Million) by Technology, 2023 to 2033

Figure 214: MEA Market Value (US$ Million) by Patient, 2023 to 2033

Figure 215: MEA Market Value (US$ Million) by End-use, 2023 to 2033

Figure 216: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 221: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 222: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 223: MEA Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 224: MEA Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 225: MEA Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 226: MEA Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 227: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 228: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 229: MEA Market Value (US$ Million) Analysis by Patient, 2018 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Patient, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Patient, 2023 to 2033

Figure 232: MEA Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 233: MEA Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 234: MEA Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 235: MEA Market Attractiveness by Product, 2023 to 2033

Figure 236: MEA Market Attractiveness by Indication, 2023 to 2033

Figure 237: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 238: MEA Market Attractiveness by Patient, 2023 to 2033

Figure 239: MEA Market Attractiveness by End-use, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Tonics Market Size and Share Forecast Outlook 2025 to 2035

Vitamin A Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Premix Market Analysis - Size, Growth, and Forecast 2025 to 2035

Vitamin Patches Market - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Yeast Market Analysis by Vitamin Composition, Application, Product Claim andOther Types Through 2035

Vitamin Supplement Market Insights - Wellness & Industry Growth 2025 to 2035

Vitamin B Test Market Insights - Size, Trends & Forecast 2025 to 2035

Vitamin Shot Market – Growth, Demand & Functional Benefits

Vitamin D Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Vitamin D Deficiency Treatment Market

Vitamin and Mineral Supplement Market Insights - Trends & Forecast 2025 to 2035

Vitamin and Mineral Market – Growth, Innovations & Health Trends

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin C Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin B12 Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA