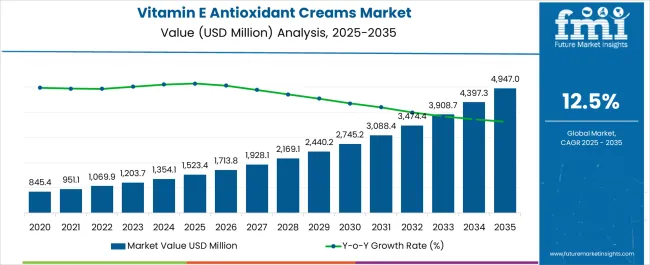

The global vitamin E antioxidant creams market is projected to grow from USD 1,523.4 million in 2025 to approximately USD 4,947 million by 2035, recording an absolute increase of USD 3,440.3 million over the forecast period. This translates into a total growth of 227.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 12.5% between 2025 and 2035. The overall market size is expected to grow by nearly 3.28X during the same period, supported by increasing consumer awareness about antioxidant benefits, rising demand for anti-aging products, and growing focus on UV protection and skin barrier enhancement.

Between 2025 and 2030, the vitamin E antioxidant creams market is projected to expand from USD 1,523.4 million to USD 2,746.3 million, resulting in a value increase of USD 1,235.9 million, which represents 35.9% of the total forecast growth for the decade. This phase of growth will be shaped by rising consumer awareness about skin protection benefits, increasing demand for natural and organic formulations, and growing penetration of premium skincare products in emerging markets. Beauty and skincare brands are expanding their vitamin E product portfolios to address the growing demand for multifunctional antioxidant solutions.

From 2030 to 2035, the market is forecast to grow from USD 2,746.3 million to USD 4,947 million, adding another USD 2,204.4 million, which constitutes 64.1% of the overall ten-year expansion. This period is expected to be characterized by expansion of e-commerce channels, integration of advanced delivery systems in formulations, and development of personalized skincare solutions. The growing adoption of clean beauty trends and dermatologist-recommended products will drive demand for premium vitamin E antioxidant creams with enhanced efficacy and safety profiles.

Between 2020 and 2025, the vitamin E antioxidant creams market experienced robust expansion, driven by increasing consumer focus on preventive skincare and growing awareness of environmental skin damage. The market developed as beauty brands recognized the need for effective antioxidant solutions to combat pollution, UV exposure, and aging concerns. Social media influence and dermatologist recommendations began emphasizing the importance of vitamin E in daily skincare routines for maintaining healthy skin barrier function.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,523.4 million |

| Forecast Value in (2035F) | USD 4,947 million |

| Forecast CAGR (2025 to 2035) | 12.5% |

Market expansion is being supported by the increasing consumer awareness about the harmful effects of free radicals on skin health and the corresponding demand for effective antioxidant protection. Modern consumers are increasingly focused on preventive skincare measures that can protect against environmental damage, premature aging, and UV-induced skin damage. Vitamin E's proven efficacy in neutralizing free radicals and supporting skin barrier function makes it a preferred ingredient in premium skincare formulations.

The growing emphasis on clean beauty and natural ingredients is driving demand for vitamin E products derived from natural sources such as soy, sunflower, and wheat germ. Consumer preference for multifunctional products that combine antioxidant protection with moisturizing and anti-aging benefits is creating opportunities for innovative formulations. The rising influence of social media beauty trends and dermatologist recommendations is also contributing to increased product adoption across different age groups and demographics.

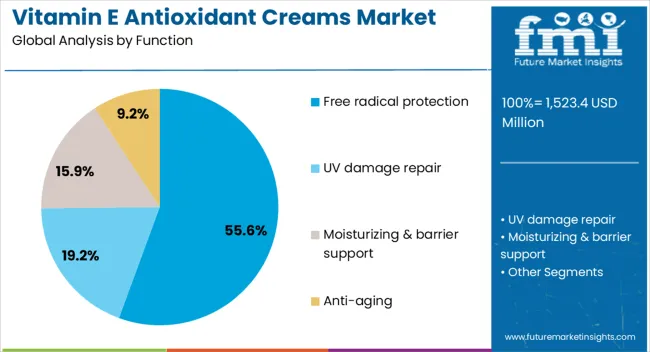

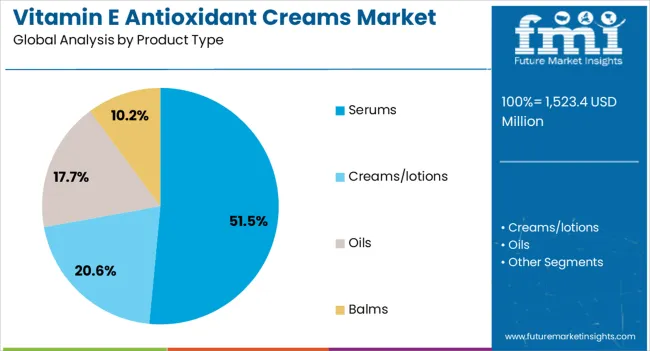

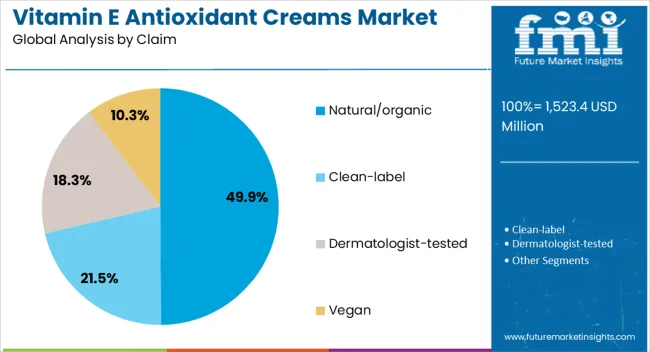

The market is segmented by function, source, product type, channel, claim, and region. By function, the market is divided into free radical protection, UV damage repair, moisturizing & barrier support, and anti-aging. Based on source, the market is categorized into synthetic tocopherol, natural tocopherol (soy, sunflower, wheat germ), mixed tocopherols, and tocotrienols. In terms of product type, the market is segmented into creams/lotions, serums, oils, and balms. By channel, the market is classified into e-commerce, pharmacies, mass retail, and specialty beauty retail. By claim, the market is divided into natural/organic, clean-label, dermatologist-tested, and vegan. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

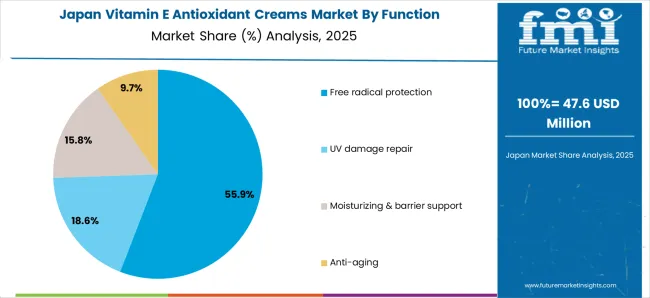

The free radical protection function is projected to account for 55.6% of the vitamin E antioxidant creams market in 2025, reaffirming its position as the category’s core benefit. Consumers increasingly understand the link between environmental stressors, such as pollution, UV exposure, and digital blue light, and premature skin aging. Vitamin E’s well-documented antioxidant properties directly address these concerns by neutralizing free radicals, preventing oxidative stress, and supporting skin resilience.

This function forms the foundation of most product positioning, as it represents the most recognizable and science-backed benefit of Vitamin E in skincare. Dermatologist endorsements and ongoing clinical validation continue to strengthen trust in Vitamin E formulations. With consumer lifestyles exposing skin to more environmental aggressors, free radical protection aligns with both preventative and corrective skincare goals. Its broad appeal across demographics ensures sustained dominance, making it the central growth driver of Vitamin E antioxidant cream demand.

Serums are projected to represent 51.5% of vitamin E antioxidant cream demand in 2025, underscoring their role as the preferred product type for concentrated antioxidant delivery. Consumers gravitate toward serums for their lightweight textures, rapid absorption, and ability to penetrate deeply into the skin, maximizing the efficacy of Vitamin E actives. Positioned as premium, targeted treatments, serums offer both preventative benefits, such as protecting against oxidative stress, and corrective benefits, including improving skin tone and texture.

The segment is supported by the rising popularity of multi-step routines, where serums play a central role in layering strategies. Additionally, brands are increasingly combining Vitamin E with complementary actives like Vitamin C, hyaluronic acid, or peptides, enhancing appeal and justifying higher price points. As ingredient-savvy consumers prioritize efficacy and performance, Vitamin E-based serums will continue to dominate demand, reinforcing their premium positioning within the antioxidant skincare market.

The natural/organic claim is forecasted to contribute 49.9% of the vitamin E antioxidant creams market in 2025, reflecting the growing intersection of clean beauty and efficacy-driven skincare. Consumers are increasingly attentive to ingredient sourcing, preferring Vitamin E derived from natural plant oils such as sunflower, wheat germ, or soybean. This aligns with the clean beauty movement, which emphasizes transparency, safety, and environmentally responsible production methods.

Certifications and organic labeling provide credibility, reassuring buyers about product integrity and purity. The segment also benefits from consumer willingness to pay premium prices for natural formulations that combine performance with ethical and sustainable values. With heightened regulatory oversight and rising awareness of synthetic ingredient controversies, natural and organic claims serve as powerful differentiators, making them a critical driver of trust and loyalty in the Vitamin E antioxidant creams category.

The vitamin E antioxidant creams market is advancing rapidly due to increasing consumer awareness about skin protection and growing demand for multifunctional skincare products. However, the market faces challenges including ingredient sourcing volatility, formulation stability issues, and competition from other antioxidant ingredients. Innovation in delivery systems and sustainable sourcing practices continue to influence product development and market expansion patterns.

The growing adoption of e-commerce platforms is enabling brands to reach consumers directly and provide personalized skincare recommendations. Online channels offer convenience, detailed product information, and customer reviews that influence purchasing decisions. Social media marketing and influencer partnerships are driving brand awareness and product adoption, particularly among younger demographics who prefer online shopping experiences.

Modern vitamin E cream manufacturers are incorporating advanced delivery systems such as liposomes, microencapsulation, and nanotechnology to enhance ingredient stability and skin penetration. These technologies improve the efficacy of vitamin E while extending product shelf life and providing better user experience. Advanced formulation techniques also enable combination products that deliver multiple skincare benefits in single applications.

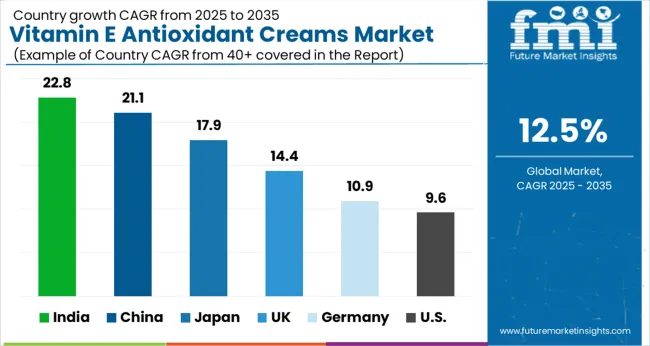

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 22.8% |

| China | 21.1% |

| Japan | 17.9% |

| UK | 14.4% |

| Germany | 10.9% |

| USA | 9.6% |

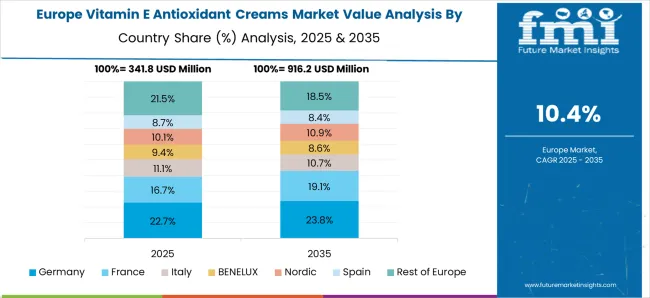

The vitamin E antioxidant creams market is experiencing robust growth globally, with India leading at a 22.8% CAGR through 2035, driven by rising disposable income, increasing beauty consciousness, and growing penetration of international skincare brands. China follows closely at 21.1%, supported by strong e-commerce infrastructure, social media influence, and increasing demand for premium skincare products. Japan shows steady growth at 17.9%, emphasizing quality formulations and advanced skincare technologies. The UK records 14.4%, focusing on clean beauty trends and dermatologist-recommended products. Germany shows 10.9% growth, prioritizing natural ingredients and sustainable beauty practices.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from vitamin E antioxidant creams in China is projected to exhibit strong growth with a CAGR of 21.1% through 2035, driven by rapid adoption of skincare routines among younger consumers and increasing influence of social media beauty trends. The country's expanding middle class and growing beauty consciousness are creating significant demand for premium antioxidant skincare products. Major international and domestic beauty brands are establishing comprehensive distribution networks to serve the growing population of skincare-conscious consumers across tier-1 and tier-2 cities.

Revenue from vitamin E antioxidant creams in India is expanding at a CAGR of 22.8%, supported by increasing disposable income, growing beauty awareness, and rising penetration of premium skincare brands. The country's young demographic profile and increasing exposure to global beauty trends are driving demand for effective antioxidant skincare solutions. International beauty brands and domestic manufacturers are establishing distribution channels to serve the growing demand for quality skincare products.

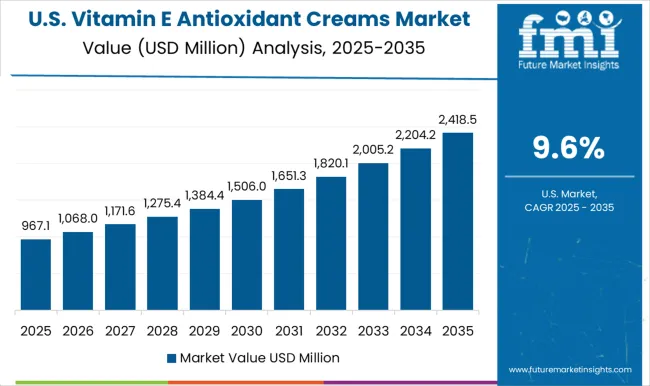

Demand for vitamin E antioxidant creams in the USA is projected to grow at a CAGR of 9.6%, supported by consumer preference for clean beauty products and dermatologist-recommended skincare solutions. American consumers are increasingly focused on ingredient transparency, product efficacy, and sustainable beauty practices. The market is characterized by strong demand for premium formulations that combine vitamin E with other active ingredients for enhanced skincare benefits.

Revenue from vitamin E antioxidant creams in Japan is projected to grow at a CAGR of 17.9% through 2035, driven by the country’s strong focus on skincare technology, premium product positioning, and consumer preference for clinically proven formulations. Japanese consumers consistently demand high-quality, multifunctional products that deliver visible results while maintaining ingredient safety.

Revenue from vitamin E antioxidant creams in the UK is projected to grow at a CAGR of 14.4% through 2035, supported by rising consumer interest in clean beauty and multifunctional skincare solutions. British consumers value ingredient transparency, sustainability, and proven efficacy, positioning vitamin E creams as a core component of premium skincare routines.

Revenue from vitamin E antioxidant creams in Germany is projected to grow at a CAGR of 10.9% through 2035, supported by the country’s strong emphasis on dermatological validation, product safety, and clean-label transparency. German consumers prioritize clinically proven efficacy and natural origins, making vitamin E antioxidant creams a trusted choice in the premium skincare segment.

The vitamin E antioxidant creams market is characterized by competition among established skincare brands, specialty beauty companies, and emerging clean beauty players. Companies are investing in advanced formulation technologies, sustainable sourcing practices, premium packaging, and digital marketing strategies to deliver effective, appealing, and accessible antioxidant skincare solutions. Brand positioning, ingredient innovation, and channel expansion are central to strengthening product portfolios and market presence.

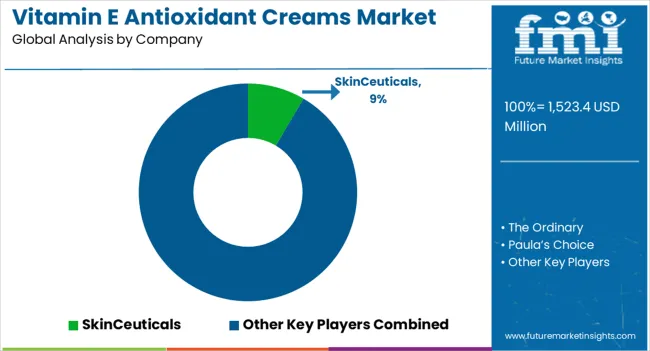

SkinCeuticals, USA-based, leads the market with 9% global value share, offering clinically-proven vitamin E formulations with a focus on antioxidant protection and skin health. The Ordinary, UK, provides accessible, high-concentration vitamin E products with transparent ingredient communication and minimalist packaging. Paula's Choice, USA, delivers science-backed formulations with emphasis on ingredient efficacy and consumer education. Drunk Elephant, USA, focuses on clean, effective formulations that combine vitamin E with complementary active ingredients.

Estée Lauder and L'Oréal, operating globally, provide comprehensive vitamin E product ranges across multiple price points and distribution channels. Kiehl's, USA, emphasizes natural ingredients and heritage formulations with premium positioning. Clinique, USA, offers dermatologist-developed products with clinical testing and hypoallergenic formulations. Murad and Derma E provide specialized antioxidant solutions with focus on specific skin concerns and natural ingredient preferences.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,523.4 million |

| Function | Free radical protection, UV damage repair, Moisturizing & barrier support, Anti-aging |

| Source | Synthetic tocopherol, Natural tocopherol, Mixed tocopherols, Tocotrienols |

| Product Type | Creams/lotions, Serums, Oils, Balms |

| Channel | E-commerce, Pharmacies, Mass retail, Specialty beauty retail |

| Claim | Natural/organic, Clean-label, Dermatologist-tested, Vegan |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | SkinCeuticals, The Ordinary, Paula's Choice, Drunk Elephant, Estée Lauder, L'Oréal, Kiehl's, Clinique, Murad, and Derma E |

| Additional Attributes | Dollar sales by vitamin E type and concentration level, regional demand trends, competitive landscape, buyer preferences for natural versus synthetic sources, integration with clean-label/dermatologist-tested positioning, innovations in nanoencapsulation, controlled release, and sustainable sourcing practices |

The global vitamin e antioxidant creams market is estimated to be valued at USD 1,523.4 million in 2025.

The market size for the vitamin e antioxidant creams market is projected to reach USD 4,947.0 million by 2035.

The vitamin e antioxidant creams market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in vitamin e antioxidant creams market are free radical protection , uv damage repair, moisturizing & barrier support and anti-aging.

In terms of product type , serums segment to command 51.5% share in the vitamin e antioxidant creams market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vitamin Yeast Market Analysis by Vitamin Composition, Application, Product Claim andOther Types Through 2035

Vitamin Premix Market Analysis - Size, Growth, and Forecast 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vitamin D Testing Market Analysis by Component, Type, and Region: Forecast for 2025 to 2035

Vitamin B Test Market Insights - Size, Trends & Forecast 2025 to 2035

Vitamin D Deficiency Treatment Market

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Patches Market - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Supplement Market Insights - Wellness & Industry Growth 2025 to 2035

Vitamin C Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin A Market Size and Share Forecast Outlook 2025 to 2035

Vitamin D Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Vitamin and Mineral Supplement Market Insights - Trends & Forecast 2025 to 2035

Vitamin and Mineral Market – Growth, Innovations & Health Trends

Vitamin B12 Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Shot Market – Growth, Demand & Functional Benefits

Vitamin Tonics Market Size and Share Forecast Outlook 2025 to 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA