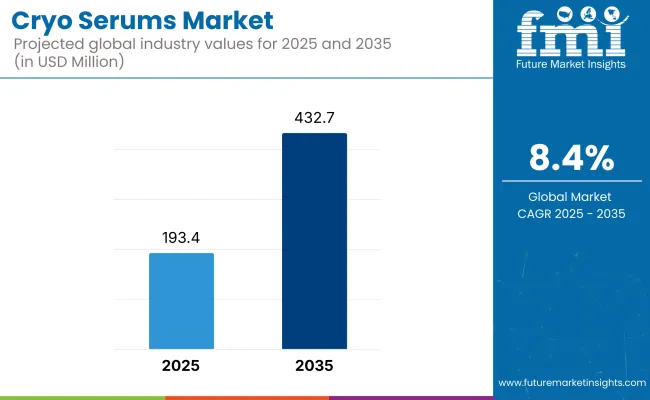

The Cryo Serums Market is expected to record a valuation of USD 193.4 million in 2025 and USD 432.7 million in 2035, with an increase of USD 239 million, which equals a growth of 123.8% over the decade. The overall expansion represents a CAGR of 8.44% and a 2.2X increase in market size.

Cryo SerumsMarket Key Takeaways

| Metric | Value |

|---|---|

| Cryo Serums Market Estimated Value in (2025E) | USD 193.4 million |

| Cryo Serums Market Forecast Value in (2035F) | USD 432.7 million |

| Forecast CAGR (2025 to 2035) | 8.44% |

During the first five-year period from 2025 to 2030, the market increases from USD 193 million to USD 286 million, adding USD 93 million, which accounts for 38.9% of the total decade growth. This phase records steady adoption in premium skincare, facial contouring regimens, and post-procedure dermatology, driven by the need for soothing and firming effects. Face serums dominate this period as they cater to over 65% of applications targeting facial lines, hydration, and toning.

The second half from 2030 to 2035 contributes USD 146 million, equal to 61.1% of total growth, as the market jumps from USD 286 million to USD 432 million. This acceleration is powered by widespread deployment of cryotherapy-inspired routines, AI-personalized skincare regimens, and bio-cooling delivery formats in clinical and home settings. Neck & décolleté serums and under-eye formats together capture a larger share above 35% by the end of the decade. Digital skin analysis tools and subscription-based skincare platforms add recurring revenue, increasing the e-commerce and DTC channel share beyond 40% in total value.

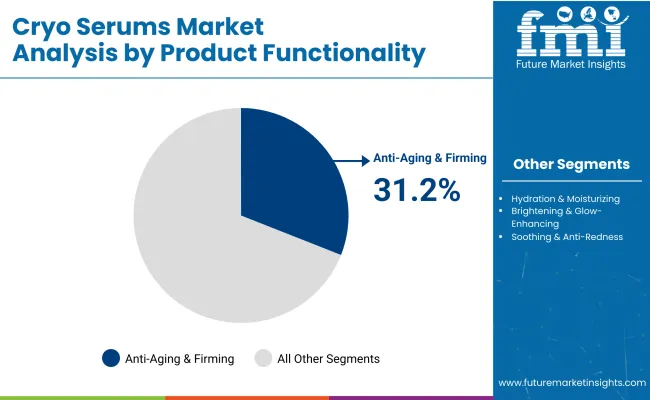

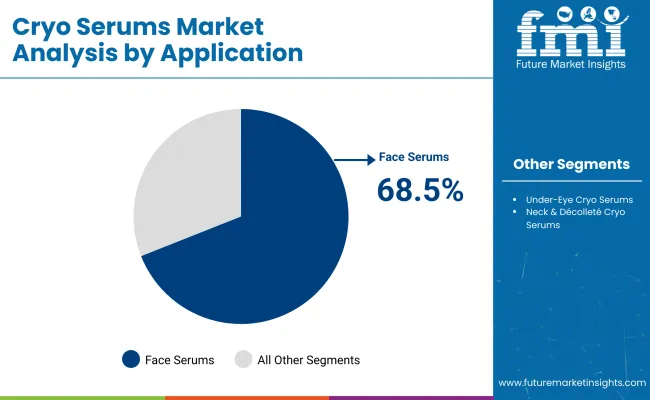

The Cryo Serums Market is projected to expand from USD 193.4 million in 2025 to USD 432.7 million by 2035, registering a CAGR of 8.44%. Anti-aging and firming cryo serums dominate the category with a 31.2% value share in 2025, driven by high consumer preference for wrinkle-reduction and skin-tightening solutions. Face serums lead the Application, accounting for over 68.5% of total sales, while the USA and China collectively represent nearly half the global market due to early product adoption and growing demand for premium skincare routines.

Significant growth is also expected in India and Japan, supported by rising awareness and expanding e-commerce platforms. Evolving skincare routines, cryotherapy-inspired formats, and bio-cooling technologies continue to shape product innovation. North America, Asia-Pacific, and Europe remain the key growth regions, with Charlotte Tilbury, Skin Gym, Mila Moursi, AMEŌN Skin, SiO Beauty, Votre Vu, Wild Ice Botanicals, La Luer, Boscia, and 111 Skin emerging as leading players in the global cryo serums market.

The growth of the Cryo Serums Market is being fueled by the convergence of advanced skincare science and rising consumer demand for temperature-responsive, high-performance formulations. Cryo serums are increasingly perceived as a premium solution for firming, de-puffing, and calming the skin through cold-activated mechanisms that mimic clinical cryotherapy treatments.

This perception is further strengthened by the integration of cryo-inspired tools (like metal applicators and roller tips) and bioactive ingredient systems that perform optimally when applied cold, offering visible results for aging, inflammation, and sensitivity. The shift toward results-driven skincare, especially in the USA, Japan, and China, has pushed consumers to seek multi-functional products that not only hydrate but also stimulate microcirculation and skin toning areas where cryo serums are showing strong efficacy.

Additionally, cryo serums are gaining traction through high-end DTC skincare brands and dermatology clinics that position these products as post-procedure essentials for micro needling, lasers, or chemical peels. Their rapid adoption is supported by the rise of refrigerated skincare storage habits, cold-chain DTC delivery infrastructure, and social media promotion of “cool-down” skincare routines.

The demand is also expanding beyond facial care into neck, décolleté, and under-eye segments, opening new use-case verticals. As consumers in APAC and Europe increasingly embrace ingredient transparency and format innovation, cryo serums are seen as a functional upgrade from conventional serums not just a luxury trend, but a results-backed, clinically inspired category.

The Cryo Serums Market is witnessing strong growth across all major segments, with Anti-Aging & Firming Cryo Serums leading product functionality in 2025, accounting for approximately 31.2% of global value share, driven by rising demand for skin-tightening and wrinkle-reduction solutions.

Face serums dominate Applications with a 68.5% share, supported by their broad adoption in both daily routines and post-treatment care. Packaging-wise, dropper bottles remain the most widely used format at 44.7%, offering precision dosing and compatibility with cryo-preserved formulations.

On the distribution front, e-commerce and DTC skincare brands capture nearly 39.4% of total sales, reflecting the shift toward online cold-chain delivery and personalized skincare solutions. Under-eye cryo serums and roll-on applicators are gaining momentum as consumers seek targeted solutions for puffiness and facial contouring, while ampoules and single-dose capsules continue to grow within luxury and travel-oriented segments.

Dermatology clinics and medispas are also emerging as key channels for premium, post-procedure cryo skincare, especially in North America and Europe. The Cryo Serums Market is regionally led by North America, followed by rapid growth in Asia-Pacific and stable demand in Europe, with emerging opportunities in Latin America and the Middle East.

| Product Functionality | Value Share % 2025 |

|---|---|

| Anti-Aging & Firming Cryo Serums | 31.2% |

| Others | 68.8% |

Anti-Aging & Firming Cryo Serums dominate the product functionality segment with a value share of 31.2% in 2025, reflecting the growing consumer focus on skin-tightening, wrinkle reduction, and collagen stimulation. This segment's leadership is driven by its compatibility with cryotherapy benefits, such as improved microcirculation and facial contouring, making it a preferred choice in premium skincare routines across North America, Europe, and East Asia.

The remaining 68.8% market share is shared among hydration, brightening, soothing, and acne-control cryo serums, which continue to gain traction due to their functionality in addressing dryness, sensitivity, and skin tone irregularities. However, none have matched the broad appeal and high repurchase rates seen in anti-aging formulations.

| Application | Value Share % 2025 |

|---|---|

| Face Serums | 68.50% |

| Others | 31.5% |

Face serums dominate the Application segment of the Cryo Serums Market, accounting for 68.5% of the total value share in 2025. This dominance is attributed to the versatility of face serums in daily skincare routines and their compatibility with cryo-activated technologies such as metal-tip applicators, facial rollers, and refrigerated skincare storage.

Consumers across North America, China, and Japan are increasingly adopting cryo face serums for their benefits in reducing puffiness, enhancing firmness, and delivering fast-absorbing hydration with a cooling effect. The remaining 31.5% share is split among under-eye and neck & décolleté applications, which are gradually gaining traction as brands expand their cryo serum portfolios to target more specific aging-prone and sensitive areas

| Packaging Format | Value Share % 2025 |

|---|---|

| Dropper Bottles (Glass or Plastic) | 44.7% |

| Others | 55.3% |

Dropper bottles, whether glass or plastic, lead the packaging format segment in the Cryo Serums Market with a 44.7% value share in 2025, owing to their precision dosing, consumer familiarity, and compatibility with liquid cryo formulations. These bottles are especially favored for anti-aging and hydration-focused serums where controlled application and preservation of active ingredients are critical.

Glass variants appeal to premium and eco-conscious consumers, while plastic droppers offer lightweight, travel-friendly solutions. The remaining 55.3% includes airless pump bottles, roll-on applicators, and single-dose ampoules, each serving targeted use-cases such as post-procedure care or under-eye application. However, the widespread acceptance of droppers across both clinical and at-home skincare routines continues to position them as the most trusted packaging format.

Rising Adoption of Cryotherapy-Inspired Skincare

The increasing popularity of cryotherapy in aesthetic and dermatological treatments has significantly influenced the growth of cryo serums in the skincare industry. Consumers are becoming more aware of the skin benefits associated with cold-based treatments, including reduced puffiness, improved circulation, and firmer skin texture.

Cryo serums mimic these effects by integrating cold-active ingredients and applicators such as metal-tipped rollers or cryo-massagers that deliver instant tightening and calming effects. This trend is particularly strong among consumers aged 25-45 seeking non-invasive, results-driven skincare solutions without downtime.

As these serums offer multifunctional benefits hydration, soothing, anti-aging, and brightening they are increasingly favored in premium skincare routines. The popularity of cryo facials on social media platforms and influencer content also reinforces the product’s appeal, making cryo serums not just functional but aspirational. Their alignment with wellness, minimalism, and clinical aesthetics gives them a unique positioning in a crowded skincare market, driving rapid category growth across North America, East Asia, and Western Europe.

Expansion of Cold-Chain DTC Models and Refrigerated Beauty Habits

The growth of e-commerce and direct-to-consumer (DTC) skincare brands has enabled cryo serums to scale beyond spas and dermatology clinics. Many premium cryo serum brands now rely on refrigerated or cold-chain logistics to preserve the potency of bio-active ingredients such as peptides, postbiotics, and vitamin C derivatives.

These delivery models are now technically feasible due to improvements in insulated packaging, temperature-controlled shipping, and local fulfillment networks. In parallel, consumer habits have shifted, with skincare fridges becoming a mainstream category in both Western and Asian markets.

This has allowed at-home users to store and apply cryo serums at their ideal temperature, preserving both efficacy and sensory appeal. Brands such as Charlotte Tilbury and AMEŌN Skin have successfully leveraged this intersection of skincare science and lifestyle to promote cryo routines as part of holistic beauty. The enhanced infrastructure and consumer readiness around cold-stored skincare create the ideal conditions for cryo serums to scale, making them not just a luxury add-on but a permanent fixture in next-gen beauty regimens.

Formulation Stability and Cost Challenges

Despite their rising appeal, cryo serums face notable barriers related to formulation complexity and cost. These serums often require cold-activated or cold-stable active ingredients, which must retain efficacy under fluctuating temperature sposing formulation and preservation challenges.

The inclusion of peptides, antioxidants, and postbiotics adds to the technical requirements, demanding pH-balanced systems, encapsulation, or cold emulsions. Additionally, the need for specialized packaging such as dropper glass bottles, airless pumps, or metal roller applicators increases unit costs.

On the logistics side, brands entering this category must invest in temperature-controlled supply chains or risk product degradation during transit particularly in warmer or humid geographies. These factors together inflate production and delivery costs, making it difficult for mass-market or drugstore brands to compete. As a result, cryo serums remain concentrated in the premium and niche skincare segment. Without economies of scale or widespread cold-chain infrastructure in emerging markets, adoption is likely to remain geographically and economically segmented in the near term.

Targeted Cryo Serums for Sensitive and Post-Procedure Skin

An emerging trend in the cryo serums space is the development of products specifically formulated for sensitive, inflamed, or post-procedure skin. These serums are designed for use after clinical treatments such as microneedling, laser resurfacing, or chemical peels, where the skin barrier is compromised and requires both cooling and repair.

Formulations in this subcategory typically contain anti-inflammatory and healing ingredients such as CentellaAsiatica (CICA), panthenol, beta-glucan, and ceramides, often combined with cryo delivery formats like metal applicators or chilled ampoules. The cold application not only reduces inflammation and redness but also enhances absorption while delivering a soothing experience.

As more dermatologists and aesthetic clinics recommend cryo-based recovery products, brands are positioning these serums within medical-grade or hybrid cosmeceutical lines. This trend aligns with the rise of skin minimalism, where consumers prioritize barrier repair and functionally focused ingredients over aggressive actives. The clinical validation of cryo serums in post-treatment protocols is expected to expand their reach in both professional and at-home skincare routines, particularly in North America, South Korea, Germany, and Japan.

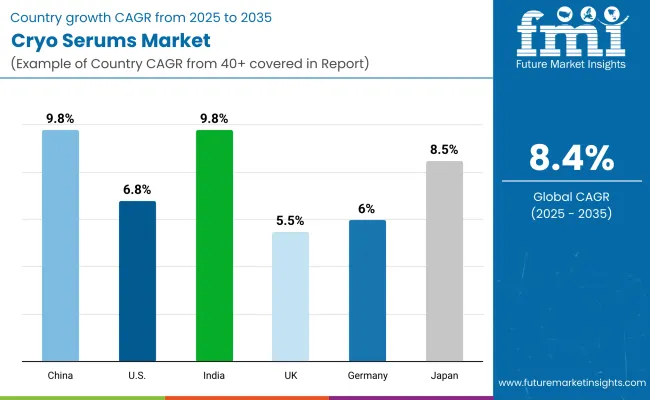

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 9.8% |

| USA | 6.8% |

| India | 9.8% |

| UK | 5.5% |

| Germany | 6.0% |

| Japan | 8.5% |

Between 2025 and 2035, China is projected to witness the fastest growth in the global cryo serums market, registering a CAGR of 10.3% owing to rising demand for high-performance skincare and increasing penetration of premium cosmetic products. India is expected to follow closely with a CAGR of 9.8%, driven by rapid urbanization, growing influence of international beauty trends, and the rising popularity of derma-cosmetic routines.

Japan is forecasted to grow at 8.5% CAGR, supported by its innovation-driven skincare landscape and strong consumer preference for technologically advanced products. The USA market is likely to expand at a moderate CAGR of 6.8%, influenced by its mature beauty segment and sustained demand for science-backed skincare. Germany and the UK are anticipated to grow at 6.0% and 5.5% respectively, primarily due to a rise in the adoption of functional beauty products and expanding availability of cryo serums across professional and retail channels.

Collectively, the Asia-Pacific regionled by China, India, and Japan is expected to remain the primary driver of market expansion, significantly outpacing Western counterparts in terms of CAGR, fueled by demographic shifts, beauty-tech experimentation, and widening access to clinical-grade skincare formats.

| Year | USA Cryo Serums Market |

|---|---|

| 2025 | 56.86 |

| 2026 | 60.59 |

| 2027 | 64.56 |

| 2028 | 68.79 |

| 2029 | 73.31 |

| 2030 | 78.11 |

| 2031 | 83.23 |

| 2032 | 88.69 |

| 2033 | 94.51 |

| 2034 | 100.71 |

| 2035 | 107.31 |

The Cryo Serums Market in the United States is projected to grow at a CAGR of 6.8%, rising from USD 56.86 million in 2025 to USD 107.31 million by 2035. Growth is being driven by sustained demand for targeted, science-backed skincare solutions and a rising preference for temperature-based delivery systems in dermatological care. Professional-grade cryo serums are gaining traction across dermatology clinics and medispas, with increased bundling into cryotherapy facial routines and post-laser treatments.

Functional skincare consumers are seeking products that deliver visible results without invasive procedures, boosting trial and adoption in the premium skincare aisle. Brands are introducing formulations tailored for issues like puffiness, redness, and loss of firmness, backed by peptides, niacinamide, and advanced cooling agents.

Retail expansion through dermatologists, aesthetic practitioners, and high-end online platforms is contributing to wider consumer access. Meanwhile, digital marketing campaigns are playing a crucial role in converting awareness into first-time purchase, especially among Gen Z and Millennial audiences.

The Cryo Serums Market in the United Kingdom is projected to expand steadily, supported by growing interest in cold-based skincare formulations and performance-driven beauty routines and is growing at a CAGR of 5.5%. Rising consumer demand for products targeting inflammation, puffiness, and skin recovery has enhanced market penetration across retail and aesthetic clinics. Brands are leveraging cryo serums in combination with facial tools to elevate cooling and firming effects. The wellness-focused beauty movement and seasonal skin concerns have further supported category adoption.

India is witnessing accelerated growth in the Cryo Serums Market, projected to expand at a CAGR of 9.8% through 2035, supported by rising urban beauty trends and increasing skincare awareness beyond metropolitan cities. Demand for cryo-based products has intensified among younger consumers seeking anti-fatigue, anti-puffiness, and cooling skincare solutions.

Local D2C brands have been introducing cryo serums as part of ingredient-focused skincare collections, aimed at climate-responsive and minimal skincare routines. Clinics and salons across tier-2 and tier-3 cities are incorporating cryo facials using such serums, addressing the evolving aspirations of mid-income consumers.

The Cryo Serums Market in China is expected to grow at a CAGR of 10.3%, the highest among leading beauty economies. This rapid growth is being fueled by the expansion of tech-integrated skincare solutions, Gen-Z demand for sensorial products, and the accelerated innovation cycles of local beauty-tech companies.

Skincare routines in urban China are becoming increasingly multifunctional, with cryo serums positioned as must-haves in both summer and post-procedure regimens. Cooling actives, skin-tightening ingredients, and packaging innovations are being rapidly adopted by Chinese brands aiming to disrupt the premium and massive categories. Cross-category demand from dermo cosmetics, spa chains, and livestream shopping platforms is intensifying product visibility and sales traction.

| Countries | 2025 Share (%) |

|---|---|

| USA | 29.40% |

| China | 17.60% |

| Japan | 11.30% |

| Germany | 13.50% |

| UK | 10.80% |

| India | 6.20% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 24.80% |

| China | 21.50% |

| Japan | 12.40% |

| Germany | 12.10% |

| UK | 9.20% |

| India | 10.30% |

Germany’s cryo serum market is estimated to grow at a modest CAGR of 6.1% between 2025 and 2035, with its global market share anticipated to decline from 13.5% in 2025 to 12.1% by 2035. While Germany remains a crucial market within Europe, its relatively slower expansion compared to countries like India and China reflects the market’s maturity and saturation.

The uptake of cryo serums continues to be shaped by Germany’s strong foundation in dermatological research, advanced skin care formulations, and high consumer trust in clinical efficacy. Demand remains anchored in the aging population, which increasingly prioritizes non-invasive dermo-cosmetic interventions.

Additionally, German consumers display heightened preference for serums with clean-label, biotech-enhanced, and temperature-activated formulations. However, the pace of growth is being gradually challenged by price sensitivity, regulatory complexities, and intense competition from both domestic cosmeceutical labs and international players entering via cross-border e-commerce.

Domestic brands have focused on positioning cryo serums as functional treatments, often paired with high-tech delivery systems and in-clinic cryotherapy experiences to drive perceived value. Innovation in formulation texture and application modalities such as cryo roller tips and refrigeration-activated serums is helping retain premium positioning.

In the premium retail segment, cryo serums are increasingly merchandised as post-procedure repair products within aesthetic clinics and medi-spas. While the overall trajectory remains positive, Germany's relative share erosion over the decade indicates that the next growth wave is expected to come more strongly from faster-growing Asian markets. However, Germany is expected to retain strategic relevance for global brands seeking regulatory credibility and clinical validation, especially for launches targeting EU-wide expansion.

| USA By Product Functionality | Value Share% 2025 |

|---|---|

| Anti-Aging & Firming Cryo Serums | 31.20% |

| Others | 68.8% |

The Cryo Serums Market in the USA is projected at USD 398.3 million in 2025. Anti-aging & firming cryo serums account for a substantial 31.2% value share, underpinned by a consumer shift toward targeted cold therapy skincare. This functional segment has gained traction owing to its visible short-term skin tightening effects and long-term dermal rejuvenation potential.

While the broader market includes a wide array of hydration, detox, and soothing variants, firming and anti-aging cryo serums remain the anchor category for brands positioning themselves in the premium clinical skincare segment. These formulations often feature encapsulated peptides, menthol derivatives, and cryo-delivery technologies features designed to trigger vasoconstriction and boost collagen stimulation.

Rising demand from urban wellness consumers, medical spas, and dermatology clinics is creating stronger shelf presence for cryo skincare in USA retail and e-commerce channels. Additionally, minimalist multi-functional regimens are driving preference for potent, compact products like cryo serums. The trend is reinforced by social media influencers promoting post-treatment cryo routines and brands integrating cryo actives with aesthetic devices. A significant boost is also being observed through travel-friendly serum packaging suited for cold chain preservation and on-the-go skincare.

| China By Application | Value Share% 2025 |

|---|---|

| Face Serums | 68.5% |

| Others | 31.5% |

The Cryo Serums Market in China is valued at approximately USD 58.86 million in 2025, with face serums dominating at 68.5%, followed by under-eye and neck & décolleté segments collectively at 31.5%. This dominance of face-format cryo serums reflects China’s skincare consumption patterns, where innovation-led facial routines and “cool-down” effects align closely with consumer beliefs about skin health and efficacy. Brands are leveraging these insights, promoting cryo face serums as daily essentials for hydration, firming, and brightening.

This strong position creates clear growth opportunity: targeted cryo serums for under-eye puffiness and neck & décolleté treatments are underpenetrated, representing an addressable share of over 30%. As local and cross-border brands introduce regionally customized cryo formulationswith cooling applicators and climate-aware activesthe adoption of niche Applications is set to accelerate. With expanding cold-chain logistics and livestream beauty platforms driving reach, face serums remain foundational, but ancillary segments are gaining traction rapidly for specialized skincare demands.

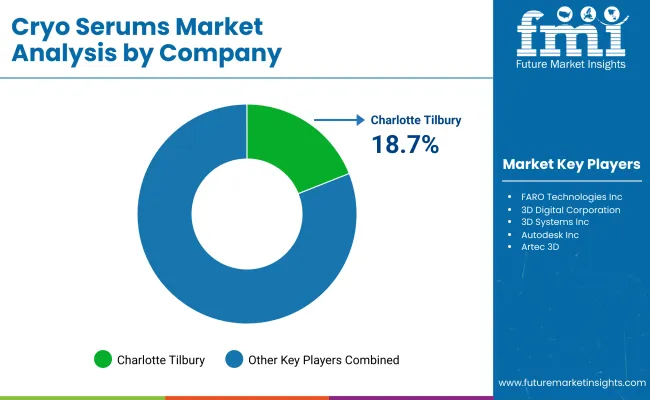

| Players | Global Value Share 2025 |

|---|---|

| Charlotte Tilbury | 18.7% |

| Others | 81.3% |

Charlotte Tilbury is anticipated to hold a commanding 18.7% value share in the global cryo serums market in 2025. The remaining 81.3% of the market is projected to be distributed among other prominent and emerging players such as Skin Gym, Mila Moursi, AMEŌN Skin, SiO Beauty, Votre Vu, Wild Ice Botanicals, La Luer, Boscia, and 111Skin. These companies are actively diversifying their cryo serum portfolios, leveraging innovations in cryogenic technology, packaging aesthetics, and hybrid skincare functionalities to expand market presence.

While Charlotte Tilbury’s stronghold is maintained through brand recognition and strategic product positioning within luxury skincare segments, the competition is intensifying through digital-first outreach, niche formulations, and dermo cosmetic positioning by smaller brands. With wellness and rejuvenation-based claims gaining traction, these companies are adopting ingredient-centric narratives and investing in influencer-driven campaigns to build trust.

The fragmented nature of the remaining market underscores the opportunities for niche and clean beauty players to secure differentiated positioning, particularly in e-commerce-led and DTC environments.

Key Developments in Cryo Serums Market

| Item | Value |

|---|---|

| Quantitative Units | USD 193.4 Million |

| Product Functionality | Anti-Aging & Firming Cryo Serums, Hydration & Moisturizing Cryo Serums, Brightening & Glow-Enhancing Cryo Serums, Soothing & Anti-Redness Cryo Serums, Pore-Refining & Acne Control Cryo Serums |

| Application | Face Serums, Under-Eye Cryo Serums, Neck & Décolleté Cryo Serums |

| Packaging Format | Dropper Bottles (Glass or Plastic), Airless Pump Bottles, Roll-on Applicators, Ampoules / Capsules (Single-Dose) |

| Distribution Channel | Beauty Retail Chains, E-commerce / DTC Skincare Brands, Dermatology Clinics / Medispas, Pharmacies & Drugstores, Hotels, Spa Amenities & Wellness Chains |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FARO Technologies, Inc., 3D Digital Corporation, 3D Systems, Inc., Autodesk, Inc., Artec 3D, Automated Precision, Inc. (API), Carl Zeiss Optotechnik GmbH, Creaform Inc., Direct Dimensions Inc., GOM GmbH, Hexagon AB, Konica Minolta, Inc., NextEngine Inc., Nikon Corporation, OGI Systems Ltd, and ShapeGrabber |

| Additional Attributes | Dollar sales by scanner type and end-use industry, adoption trends in reverse engineering and quality control, rising demand for handheld and portable 3D scanners, sector-specific growth in aerospace, automotive, and healthcare, software and services revenue segmentation, integration with AR/VR and digital twin technologies, regional trends influenced by digitization initiatives, and innovations in laser triangulation, structured light, and photogrammetry methods. |

The global Cryo Serums Market is estimated to be valued at USD 193.4 million in 2025.

The market size for the Cryo Serums Market is projected to reach USD 432.7 million by 2035.

The Cryo Serums Market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in the Cryo Serums Market include Anti-Aging & Firming Cryo Serums, Hydration & Moisturizing Cryo Serums, Brightening & Glow-Enhancing Cryo Serums, Soothing & Anti-Redness Cryo Serums, and Pore-Refining & Acne Control Cryo Serums.

In terms of product functionality, the Anti-Aging & Firming Cryo Serums segment is expected to command the largest share in the Cryo Serums Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cryogenic Helium Cycling System Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vial Market Size and Share Forecast Outlook 2025 to 2035

Cryoglobulinemic Vasculitis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Label Market Size and Share Forecast Outlook 2025 to 2035

Cryo-electron Microscopy Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Cryopreservation Systems Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Cryo-Emulsification Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Freezers Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Tanks Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Cryoboxes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Capsules Market Growth - Demand & Forecast 2025 to 2035

Cryogenic Vials and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Pump Market Size & Trends 2025 to 2035

Cryopreservation Freezers Market Outlook – Size & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA