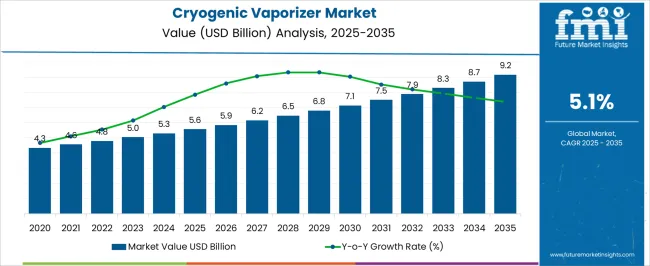

The cryogenic vaporizer market is expected to grow from USD 5.6 billion in 2025 to USD 9.2 billion in 2035, reflecting a CAGR of 5.1%. This represents an absolute dollar opportunity of USD 3.6 billion over the ten-year period. Early growth sees the market expand from USD 5.9 billion in 2026 to USD 6.5 billion in 2029, indicating steady incremental gains.

By 2031, the market will reach USD 7.5 billion, demonstrating healthy mid-term growth. These increases offer manufacturers and distributors the chance to optimize production, improve supply chains, and capture consistent revenue while meeting growing demand across industrial applications. In the latter phase, the market delivers the largest incremental gains, increasing from USD 7.9 billion in 2032 to USD 9.2 billion in 2035. This late-stage expansion contributes nearly USD 1.3 billion of the total opportunity, with annual increments rising to USD 0.4 billion per year toward the end of the forecast. Intermediate benchmarks, such as USD 8.3 billion in 2033 and USD 8.7 billion in 2034, illustrate bridging periods that sustain growth momentum. The cumulative USD 3.6 billion absolute dollar opportunity underscores significant potential for long-term revenue generation in the cryogenic vaporizer market.

| Metric | Value |

|---|---|

| Cryogenic Vaporizer Market Estimated Value in (2025 E) | USD 5.6 billion |

| Cryogenic Vaporizer Market Forecast Value in (2035 F) | USD 9.2 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

In the cryogenic vaporizer market, the first breakpoint occurs between 2025 and 2027, as the market grows from USD 5.6 billion to USD 5.9 billion. This early phase reflects steady adoption with moderate annual increments of around USD 0.2 billion, setting a solid foundation for future expansion. The next critical breakpoint emerges between 2029 and 2031, when the market advances from USD 6.5 billion to USD 7.5 billion. This period shows accelerated growth, highlighting higher absolute dollar gains and creating opportunities for manufacturers and distributors to scale operations, strengthen supply chains, and capture incremental revenue during mid-stage market expansion.

A major breakpoint is observed between 2032 and 2035, when the market surges from USD 7.9 billion to USD 9.2 billion, representing the largest absolute dollar growth in the forecast horizon. Intermediate years, such as USD 8.3 billion in 2033 and USD 8.7 billion in 2034, act as bridging periods, sustaining momentum and preparing for peak market values. Recognizing these breakpoints allows stakeholders to strategically plan investments, optimize production and distribution, and fully capture the cumulative USD 3.6 billion opportunity, ensuring maximum revenue potential in the cryogenic vaporizer market.

The cryogenic vaporizer market is experiencing robust growth driven by increasing demand for efficient and reliable vaporization solutions across various industries. The current landscape is shaped by the expanding use of liquefied gases in industrial applications, including energy, manufacturing, and healthcare.

Technological advancements in vaporizer design and rising emphasis on safety and environmental compliance are further fueling market expansion. Growing investments in oil and gas infrastructure and the shift toward cleaner fuels are influencing the adoption of cryogenic vaporizers globally.

The future outlook is favorable as industries seek improved operational efficiency and reduced emissions through advanced vaporization technologies. Additionally, increasing industrial gas consumption and expanding end-use sectors are expected to create sustained growth opportunities in the coming years.

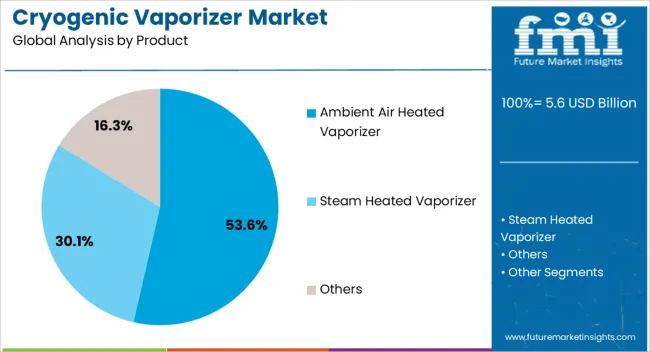

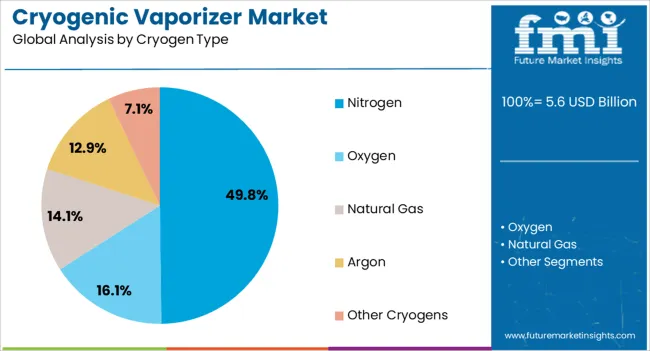

The cryogenic vaporizer market is segmented by product, cryogen type, end use, and geographic regions. By product, cryogenic vaporizer market is divided into Ambient Air Heated Vaporizer, Steam Heated Vaporizer, and Others. In terms of cryogen type, cryogenic vaporizer market is classified into Nitrogen, Oxygen, Natural Gas, Argon, and Other Cryogens.

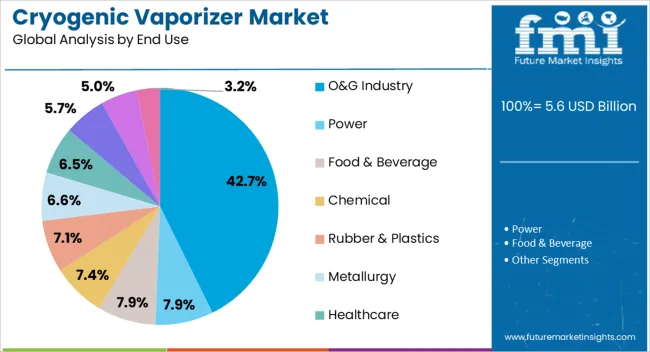

Based on end use, the cryogenic vaporizer market is segmented into the O&G Industry, Power, Food & Beverage, Chemical, Rubber & Plastics, Metallurgy, Healthcare, Shipping, Agriculture, Forestry & Fishing, and Other. Regionally, the cryogenic vaporizer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Ambient Air Heated Vaporizer segment is anticipated to hold 53.6% of the Cryogenic Vaporizer market revenue share in 2025, emerging as the leading product category. This position is owed to its operational simplicity, energy efficiency, and cost-effectiveness in converting liquefied gases to gas form using ambient heat.

Its widespread applicability in diverse industrial environments and low maintenance requirements have driven adoption. The segment benefits from the ability to operate without external energy sources, reducing operational costs and supporting sustainability goals.

Additionally, the modular design and scalability of ambient air heated vaporizers facilitate easy integration into existing systems, enhancing their appeal across sectors with fluctuating demand patterns.

The Nitrogen cryogen type segment is projected to account for 49.8% of the market revenue in 2025, reflecting its dominance among cryogen types. The growth of this segment is driven by the extensive use of nitrogen in industrial processes such as inerting, purging, and cooling.

Nitrogen’s abundant availability, relatively low cost, and inert properties make it a preferred choice across many applications. The increasing demand for nitrogen vaporization in oil and gas, chemical manufacturing, and food processing industries has further propelled this segment.

Additionally, stringent regulations on safety and environmental protection have underscored the importance of reliable nitrogen vaporization technologies, supporting sustained market expansion.

The Oil and Gas industry is expected to hold 42.7% of the Cryogenic Vaporizer market revenue share in 2025, making it the largest end-use sector. This prominence is due to the extensive use of liquefied gases in exploration, production, and transportation activities.

The industry’s focus on optimizing operational efficiency, reducing greenhouse gas emissions, and enhancing safety standards has accelerated the adoption of advanced cryogenic vaporizers. Infrastructure expansions, including liquefied natural gas terminals and refineries, require reliable vaporization equipment to ensure a steady gas supply.

Furthermore, rising global energy demand and the transition toward cleaner fuels are expected to sustain the industry’s significant contribution to market growth.

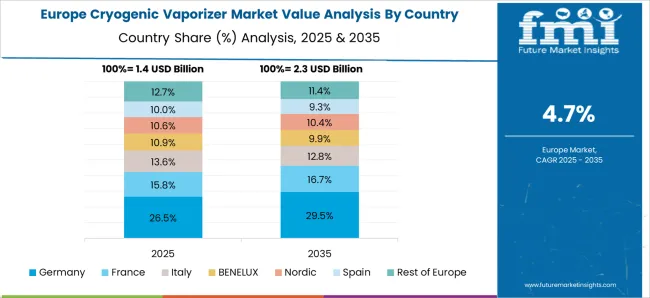

The cryogenic vaporizer market is expanding due to growing industrial gas demand, LNG regasification, and increased adoption in chemical, healthcare, and energy sectors. North America and Europe lead with high-capacity, safety-compliant vaporizers for industrial and energy applications. Asia-Pacific demonstrates rapid growth, driven by LNG import infrastructure, industrial gas usage, and urban energy expansion. Manufacturers differentiate through vaporization efficiency, thermal capacity, safety features, and operational reliability. Regional variations in infrastructure, regulatory requirements, and energy demand influence adoption, procurement strategies, and competitive positioning globally.

Cryogenic vaporizers vary by capacity, heat exchange efficiency, and output pressure, determining suitability across industrial and energy applications. North America and Europe emphasize high-capacity units for LNG terminals, industrial gas distribution, and large-scale energy applications, prioritizing efficiency and continuous operation. Asia-Pacific often deploys mid-range vaporizers for smaller LNG import terminals and industrial facilities where cost-effectiveness is critical. Differences in vaporization capacity affect operational throughput, energy consumption, and overall system efficiency. Leading suppliers target premium high-capacity segments with advanced heat transfer technology, while regional producers focus on reliable, cost-effective mid-scale solutions. Capacity and efficiency contrasts directly shape adoption rates, operational performance, and competitiveness across global energy and industrial markets.

Compliance with safety standards, pressure vessel codes, and industrial gas regulations is vital for cryogenic vaporizer adoption. Europe and North America enforce strict standards covering pressure integrity, leak prevention, and operational safety, demanding advanced monitoring systems and certifications. Asia-Pacific regulations vary, with high-budget projects adhering to similar standards while smaller facilities focus on basic compliance due to cost considerations. Differences in regulatory adherence affect installation approvals, operational risk management, and procurement decisions. Suppliers providing certified, safety-compliant vaporizers gain premium market access, while regional manufacturers focus on affordable, functional solutions. Regulatory contrasts influence adoption timelines, operational reliability, and competitiveness in energy and industrial applications globally.

Cryogenic vaporizers are integral to LNG regasification, industrial gas delivery, and chemical processing systems. North America and Europe emphasize seamless integration with pipeline networks, storage tanks, and downstream industrial systems to optimize efficiency and minimize operational interruptions. Asia-Pacific facilities often deploy standalone vaporizers for flexible deployment and gradual infrastructure expansion. Differences in system integration affect installation complexity, operational efficiency, and project ROI. Suppliers offering vaporizer solutions compatible with advanced distribution networks gain competitive advantages, while regional producers provide simpler, modular systems for flexible deployment. Integration contrasts shape adoption strategies, performance outcomes, and long-term operational planning in industrial and energy sectors globally.

Effective maintenance and service capabilities are crucial for cryogenic vaporizer reliability. North America and Europe rely on structured OEM service programs, long-term maintenance contracts, and rapid technical support to ensure continuous operation in critical energy and industrial facilities. Asia-Pacific utilizes regional service providers, local contractors, and in-house maintenance teams, especially in cost-sensitive projects.

Differences in service availability affect operational uptime, equipment lifespan, and end-user confidence. Suppliers with comprehensive maintenance infrastructure and technical assistance gain higher-value contracts, while regional providers focus on accessibility and cost-efficient support. Service contrasts determine adoption rates, reliability perception, and competitive positioning across industrial, chemical, and energy applications globally.

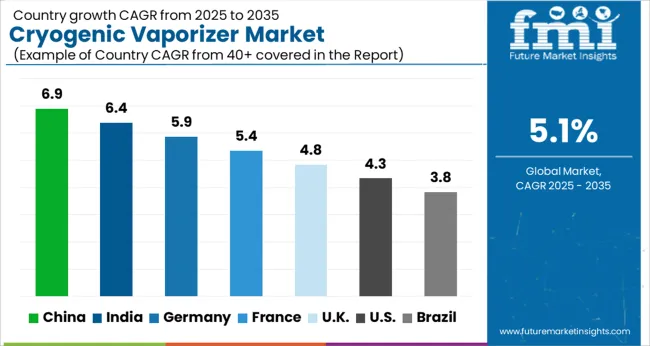

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global cryogenic vaporizer market was projected to grow at a 5.1% CAGR through 2035, driven by demand in industrial gas, chemical processing, and energy applications. Among BRICS nations, China recorded 6.9% growth as large-scale manufacturing and deployment facilities were commissioned and compliance with industrial and safety standards was enforced, while India at 6.4% growth saw expansion of production units to meet rising regional demand. In the OECD region, Germany at 5.9% maintained substantial output under strict industrial and operational regulations, while the United Kingdom at 4.8% relied on moderate-scale operations for industrial and energy applications. The USA, expanding at 4.3%, remained a mature market with steady demand across commercial, industrial, and energy segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The cryogenic vaporizer market in China is growing at a CAGR of 6.9% driven by rising demand from industrial gas applications, energy production, and chemical processing sectors. Industries are adopting cryogenic vaporizers to convert liquid gases such as LNG, oxygen, nitrogen, and argon into vapor for use in pipelines, storage, and industrial processes. Growth is supported by increasing industrial gas consumption, expansion of energy infrastructure, and investments in chemical and manufacturing industries. Suppliers offer advanced cryogenic vaporizers with high efficiency, safety compliance, and low maintenance requirements suitable for various industrial applications. Distribution through industrial equipment dealers, gas suppliers, and direct sales networks ensures broad market accessibility. Adoption is further supported by the need for reliable gas supply, operational efficiency, and safety standards. China remains a leading market due to its industrial base, energy infrastructure expansion, and growing demand for industrial gases.

India is witnessing growth at a CAGR of 6.4% in the cryogenic vaporizer market due to rising adoption in energy, industrial gases, and chemical processing sectors. Industries are implementing vaporizers to convert liquid gases into usable vapor for pipelines, storage, and production processes. Growth is supported by increasing industrial gas consumption, expansion of chemical plants, and rising energy demand in urban and industrial regions. Suppliers provide cryogenic vaporizers with high efficiency, safety compliance, and robust performance for diverse industrial applications. Distribution through industrial equipment suppliers, gas distributors, and direct channels ensures wide accessibility. Adoption is further driven by the need for operational efficiency, safe gas handling, and reliable supply. India continues to experience strong market growth due to industrial expansion, increasing chemical and gas infrastructure, and rising demand for efficient vaporization solutions.

Germany is growing at a CAGR of 5.9% in the cryogenic vaporizer market due to rising demand from industrial gases, chemical processing, and energy sectors. Companies are adopting vaporizers to convert liquid gases such as nitrogen, oxygen, and LNG into vapor for pipelines, production, and storage applications. Growth is supported by regulatory standards for safety, energy efficiency, and operational reliability. Suppliers provide advanced vaporizers with high performance, safety features, and durability suitable for industrial applications. Distribution channels include industrial equipment dealers, gas suppliers, and direct sales networks, ensuring wide accessibility. Adoption is further driven by the need for reliable gas supply, operational efficiency, and compliance with industrial safety standards. Germany remains a key European market due to its strong chemical, energy, and industrial gas sectors.

The United Kingdom market is expanding at a CAGR of 4.8% due to increasing adoption of cryogenic vaporizers in industrial gas, chemical, and energy applications. Companies implement vaporizers to convert liquid gases into usable vapor for pipelines, storage, and production processes. Growth is supported by industrial gas demand, chemical plant expansion, and energy infrastructure development. Suppliers provide high efficiency, safe, and durable vaporizers suitable for a range of industrial applications. Distribution through equipment dealers, gas suppliers, and service providers ensures broad accessibility. Adoption is further driven by the need for operational efficiency, reliable gas supply, and adherence to industrial safety standards. The United Kingdom continues to see steady market growth due to rising industrial gas consumption and increasing demand for efficient vaporization technologies.

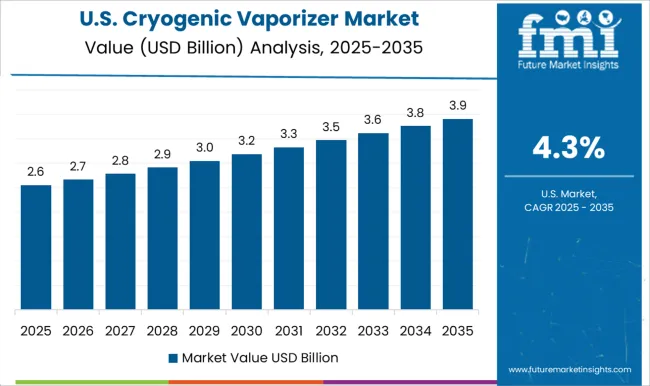

The United States market is growing at a CAGR of 4.3% supported by rising adoption in energy, chemical, and industrial gas sectors. Cryogenic vaporizers are used to convert liquid gases such as LNG, oxygen, and nitrogen into vapor for pipelines, production, and storage applications. Growth is supported by the expansion of industrial gas infrastructure, energy facilities, and chemical processing plants. Suppliers offer durable, efficient, and safety compliant vaporizers suitable for industrial applications. Distribution through equipment dealers, gas suppliers, and service networks ensures market accessibility. Adoption is further driven by the need for operational efficiency, reliable gas supply, and compliance with industrial safety standards. The United States remains a key market due to its large energy and industrial gas sectors, rising chemical production, and growing demand for reliable vaporization solutions.

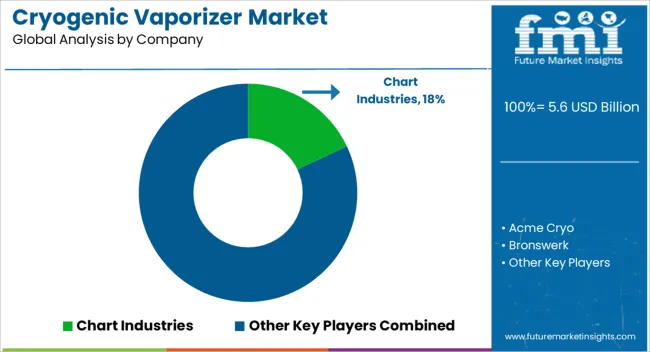

The cryogenic vaporizer market is led by prominent suppliers including Chart Industries, Acme Cryo, Bronswerk, Cryo-Tech Industrial, Cryogas Equipment, Cryolor, Cryonorm, Cryostar, Cryotek, FIBA Technologies, Inox India, Linde, Nikkiso, Ratermann, Super Cryogenic Systems, and Taylor-Wharton. These companies specialize in equipment that converts liquefied gases such as LNG, oxygen, nitrogen, and argon into their gaseous forms for industrial, medical, and energy applications. Cryogenic vaporizers are essential for processes that require controlled gas flow and temperature regulation, ensuring safety and efficiency in various operations. Key players like Chart Industries, Linde, and Taylor-Wharton focus on high-capacity, industrial-grade vaporizers with robust automation and remote monitoring features.

Companies such as Cryostar, Cryotek, and Nikkiso provide customized solutions for specific applications in oil & gas, chemical processing, and energy sectors. Regional suppliers like Inox India, Cryolor, and Ratermann cater to localized demands, offering compact and mid-scale vaporizers that balance performance and cost efficiency. The market is advancing with an emphasis on energy efficiency, operational safety, and modular designs. Modern cryogenic vaporizers are increasingly equipped with integrated control systems, leak detection, and anti-freeze technologies to improve reliability. Rising industrial demand for liquefied gases, the growth of LNG infrastructure, and the expansion of chemical and healthcare industries are driving the adoption of advanced vaporization systems. Suppliers are also investing in after-sales support, maintenance services, and training to ensure seamless operation and long-term performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.6 Billion |

| Product | Ambient Air Heated Vaporizer, Steam Heated Vaporizer, and Others |

| Cryogen Type | Nitrogen, Oxygen, Natural Gas, Argon, and Other Cryogens |

| End Use | O&G Industry, Power, Food & Beverage, Chemical, Rubber & Plastics, Metallurgy, Healthcare, Shipping, Agriculture, Forestry & Fishing, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Chart Industries, Acme Cryo, Bronswerk, Cryo-Tech Industrial, Cryogas Equipment, Cryolor, Cryonorm, Cryostar, Cryotek, FIBA Technologies, Inox India, Linde, Nikkiso, Ratermann, Super Cryogenic Systems, and Taylor-Wharton |

| Additional Attributes | Dollar sales vary by vaporizer type, including ambient air, water bath, and electrically heated vaporizers; by application, such as LNG regasification, industrial gas supply, and medical oxygen; by end-use industry, spanning oil & gas, chemicals, healthcare, and energy; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising LNG demand, industrial gas consumption, and expanding cryogenic infrastructure. |

The global cryogenic vaporizer market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the cryogenic vaporizer market is projected to reach USD 9.2 billion by 2035.

The cryogenic vaporizer market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in cryogenic vaporizer market are ambient air heated vaporizer, steam heated vaporizer and others.

In terms of cryogen type, nitrogen segment to command 49.8% share in the cryogenic vaporizer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cryogenic Label Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Freezers Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Tanks Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Capsules Market Growth - Demand & Forecast 2025 to 2035

Cryogenic Vials and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Pump Market Size & Trends 2025 to 2035

Cryogenic Valves Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Cryogenic Insulation Films Companies

Market Share Distribution Among Cryogenic Label Providers

Cryogenic Insulation Films Market Report – Demand, Trends & Industry Forecast 2025-2035

Analyzing Cryogenic Ampoules Market Share & Industry Leaders

Cryogenic Vial Market from 2024 to 2034

Cryogenic Technology Market

Cryogenic vial rack Market

Non-Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA