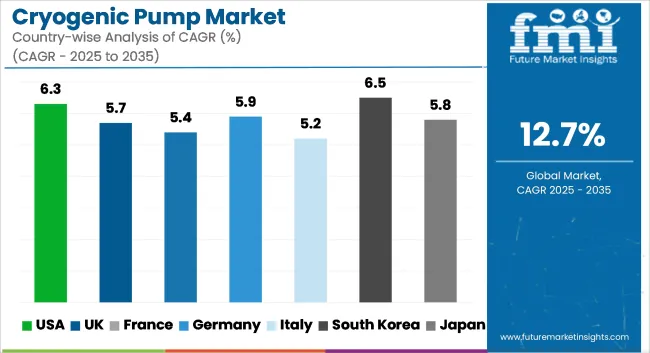

The global cryogenic pump market is estimated to be valued at USD 1,234.1 million in 2025 and is projected to reach USD 4,034.2 million by 2035, registering a compound annual growth rate (CAGR) of 12.7% over the forecast period. Market expansion is being driven by the increasing deployment of cryogenic infrastructure in clean energy sectors, notably liquefied natural gas (LNG) distribution, hydrogen fueling systems, and industrial gas processing.

Strategic acquisitions have supported portfolio diversification across major pump manufacturers. In July 2024, Flowserve Corporation announced the acquisition of LNG pumping technology from NexGen Cryo to reinforce its clean energy product line. According to its press release, the acquired cryogenic pump assets were intended to complement Flowserve’s existing offerings under its 3D strategy-Diversify, Decarbonize, and Digitize-enabling stronger participation in global decarbonization initiatives.

Dover Corporation also enhanced its exposure to cryogenic markets by integrating new pump technologies into its Pumps & Process Solutions segment in 2024. The segment now supplies critical components to LNG terminals, hydrogen fueling networks, and low-temperature gas transfer systems. These additions were engineered for performance in ultra-low-temperature environments, enabling safe and efficient handling of cryogenic fluids like LNG and liquid hydrogen.

In the aerospace and defense domains, Graham Corporation disclosed in 2024 that cryogenic pumps and turbomachinery had been selected for naval propulsion systems and launchpad fueling operations. The systems were developed to handle liquid hydrogen and oxygen transfer in space programs and high-performance marine platforms, positioning Graham to benefit from rising demand in strategic government programs.

Adoption across Asia-Pacific, Europe, and North America has been accelerated by LNG import infrastructure and floating storage and regasification units (FSRUs). Countries such as South Korea, Germany, and India have scaled procurement of cryogenic pump systems to reduce reliance on pipeline gas and bolster terminal flexibility.

Technological advancements introduced by OEMs have included enhanced thermal insulation, integrated variable frequency drives (VFDs), and stainless steel containment housings to improve pump durability and reduce energy loss. These improvements have extended pump lifespan and are expected to stimulate long-term replacement demand in industrial retrofitting projects. Regulatory pressure to accelerate hydrogen integration in mobility and manufacturing has further supported capital investment in cryogenic pumping systems across the energy, chemicals, and transportation sectors.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 1,234.1 million |

| Industry Value (2035F) | USD 4,034.2 million |

| CAGR (2025 to 2035) | 12.7% |

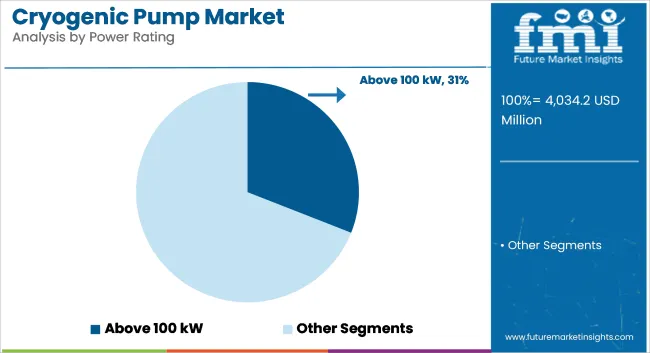

Cryogenic pumps with a power rating above 100 kW accounted for 31% of the global market share in 2025 and are projected to grow at a CAGR of 13.0% through 2035. These high-power systems were essential in large-volume liquefied natural gas (LNG) terminals, hydrogen refueling stations, and industrial gas plants requiring continuous transfer at ultra-low temperatures.

In 2025, above-100 kW pumps were deployed for high-pressure and high-flow cryogenic applications involving liquid oxygen, nitrogen, argon, and liquefied gases in both energy and metallurgy sectors. OEMs focused on pump head optimization, cryo-seal reliability, and motor thermal insulation to support prolonged duty cycles.

Demand was further supported by global investments in LNG infrastructure, green hydrogen production, and air separation units. These pumps were also incorporated into modular skid-based units in refineries and large industrial complexes requiring scalable cryogenic transfer capacity.

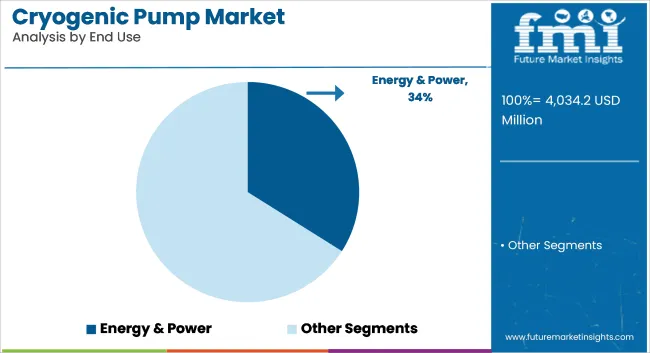

The energy and power segment held 34% of the cryogenic pump market share by end use in 2025 and is forecast to grow at a CAGR of 13.2% through 2035. Applications included LNG regasification, hydrogen liquefaction and distribution, and cryogenic fuel supply for gas turbines and backup energy systems.

In 2025, cryogenic pumps were widely used in floating storage units (FSUs), LNG-powered ships, and hydrogen fueling stations as global energy markets shifted toward cleaner fuels. Project developments in the USA, Qatar, South Korea, and the EU supported long-term cryogenic equipment procurement.

Governments and private developers emphasized infrastructure expansion aligned with decarbonization targets, reinforcing pump demand for cold energy handling and liquefied fuel mobility. Suppliers introduced high-efficiency cryogenic pump skids with advanced control systems, tailored for 24/7 operation in energy-critical environments.

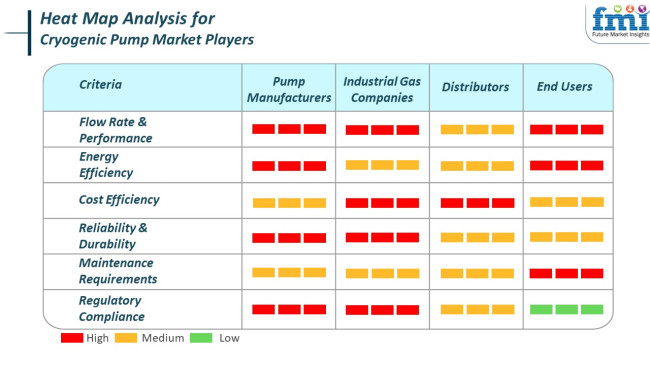

The industryis growing gradually, with growing demand for liquefied gases in the health sector, energy, and industrial applications. Industrial gas manufacturers and pump makers prioritize flow rate, reliability, and conformity to regulations to a large extent because these have a direct bearing on system efficiency and regulatory requirements.

Manufacturers also prioritize innovation and energy efficiency to achieve maximum performance and sustainability goals. Distributors, on the other hand, value cost-effectiveness and product availability for supporting supply chains and competitive pricing.

End users-like medical oxygen supply applications, LNG handling applications, and aerospace applications-value energy efficiency, performance, and low maintenance because these determine uptime operation and total cost of ownership. Upstream regulatory compliance is typically taken care of, hence it is not so much an end-user concern.

As the industry expands, particularly in Asia-Pacific and the GCC, it is imperative to connect product innovation with evolving stakeholder requirements-i.e., in energy-efficient and intelligent pump technologies-to achieve long-term success.

The global cryogenic pump market is projected to experience significant growth. This expansion is driven by the rising demand for liquefied gases across various industries, including energy and power, chemicals, metallurgy, oil and gas, and electronics. Even with this optimistic perspective, there are a number of risks that may affect the course of the industry.

One such risk is the volatility of raw material prices. These pumps need special materials that can sustain very low temperatures. Volatility in the prices of these commodities may affect production costs and margins, leading to higher prices for consumers and lower demand. The downsides to technological advancement and need to innovate also reside therein. With trade demanding better performing and more efficient pumps, companies are forced to fund research and development to stay in the game.

Falling behind in the competition and losing industry share can occur when one cannot stay current with innovation in technology. Supply chain disruption is also a risk. The production of pumps involves a highly intricate web of suppliers and producers. Geopolitical tensions, pandemics, or natural catastrophes may trigger delays and costs that bring about disruptions resulting in delayed production and higher costs affecting timely delivery of products to final customers.

Environmental and safety standards are getting stricter. Maintaining compliance with such standards necessitates continuous monitoring and adjustment of manufacturing processes. Failure to comply may lead to legal sanctions, reputational loss, and economic loss.

However, to mitigate the risks, firms in the cryogenic pump market should diversify their supply chain, invest more in technological innovation, and follow strict environmental and safety standards. By proactively addressing these challenges, businesses are better positioned to capitalize on growth opportunities in the global industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.3% |

| UK | 5.7% |

| France | 5.4% |

| Germany | 5.9% |

| Italy | 5.2% |

| South Korea | 6.5% |

| Japan | 5.8% |

| China | 7.1% |

| Australia | 5.1% |

| New Zealand | 4.8% |

The USA industry is likely to achieve a CAGR of 6.3% from 2025 to 2035, driven by high growth in industrial gas usage and heightened emphasis on liquefied natural gas (LNG) infrastructure. The increase in demand for efficient cryogenic transfer and storage applications in aerospace, metallurgy, and medical uses is expected to boost industry growth significantly. Government policies favorable to clean energy and space exploration also add further momentum to industry growth.

Cryomech Inc., Nikkiso Cryogenic Industries, and Flowserve Corporation are some of the major industry leaders. The region's well-developed technology infrastructure and consistent innovation in cryogenic engineering are creating a prime environment for emerging firms and existing companies to have fertile ground to operate. America is also seeing greater integration of cryogenic technology into hydrogen production, and as such, is a major driving force in the new energy transition economy.

The UK cryogenic pump market is projected to expand at a CAGR of 5.7% during the period 2025 to 2035. Growing investments in liquefied hydrogen systems in the national net-zero strategy are creating new opportunities in the energy and industrial sectors. Greater application of products in aerospace R&D and expansion of LNG import capacity are also driving industry growth.

Pioneers such as BOC Ltd. and Edwards Ltd. are building their manufacturing and innovation base to meet growing domestic and regional demand. The strategic location of the nation in the European energy corridor and the spotlight on decarbonization technologies are expected to drive periodic capital investments into cryogenic infrastructure. Integration with renewable gas systems and cold chain logistics also contributes to the expanding scope of the application of systems in the UK.

The French cryogenic pump market is expected to grow at a CAGR of 5.4% during the forecast period, led by significant support from government-driven initiatives towards the development of hydrogen infrastructure and LNG terminals. Increasing emphasis on sustainability, combined with heavy investment in cutting-edge manufacturing, is driving demand for cryogenic fluid handling systems.

French industry dynamics are fueled by the presence of major engineering firms like Air Liquide and Cryostar SAS, which are deeply involved in creating global exports and domestic projects. The aerospace and nuclear sectors are leading consumers of cryogenic pump technology, raising the tech maturity of the industry. Additionally, France's embracement of European green energy policies will be expected to maintain steady industry momentum throughout the decade.

Germany's cryogenic pump market is anticipated to achieve a CAGR of 5.9% from 2025 to 2035, fueled by the country's high-energy transition emphasis and hydrogen mobility. Being one of the leading industrial hubs in Europe, Germany's advanced engineering ecosystem offers ubiquitous demand for extensive adoption of cryogenic systems across chemical processing, energy, and transportation industries.

Leading industry players such as Linde GmbH and WITT-Gasetechnik GmbH are expanding their R&D capacity in order to drive the efficiency and performance of pump technology. The way ahead is further boosted by greater collaboration between research institutes and private manufacturers, enabling innovation and the transfer of technology. Regulatory initiatives by Germany toward low-emission energy facilities will play a prominent part in sustained industry growth.

Italy is expected to see a CAGR of 5.2% in the cryogenic pump market from 2025 to 2035. Expansion of LNG importation infrastructure and heightened application of cryogenic systems within the food storage and pharma supply chains are key drivers for growth. The industrial gas segment is gaining momentum due to rising activity in the petrochemical and clean energy sectors.

Key players in Italy's industry include CryoDiffusion and SIAD MacchineImpianti S.p.A., who are consolidating their position by embracing export-oriented strategies and customized engineering solutions. The industry also benefits from Italy's participation in European clean energy schemes, particularly those on alternative fuel transportation systems. Industry demand for small, energy-efficient pump systems will likely affect the product development strategies of major suppliers.

South Korea's industry is forecast to grow at a CAGR of 6.5% between 2025 and 2035. Rapid industrialization and aggressive hydrogen economy policies are driving industry growth. Investments in cryogenic storage and transportation infrastructure for liquid hydrogen are driving a robust demand for premium pump systems.

Firms such as Doosan Corporation and Hyundai Rotem are leaders in integrating pump technologies into national clean energy programs. South Korea's leadership in shipbuilding and cryogenic tanker manufacturing further enhances domestic demand. Strategic alliances with international technology providers are also driving high-speed technological assimilation, transforming South Korea into one of the most dynamic markets in East Asia for cryogenic systems.

Japan's industry will expand at a CAGR of 5.8% over the period 2025 to 2035. The nation boasts robust government encouragement for the establishment of hydrogen energy and significant demand from the semiconductor industry and medical gas, stimulating steady growth. Many industries, including electronics manufacturing and shipping liquefied fuels, are increasingly using cryogenic systems.

Key industry players such as Iwatani Corporation and Ebara Corporation are enhancing production capacities and product offerings to meet evolving industrial requirements. The emphasis of Japan on clean technology adoption and export-driven economic policies supports a favorable demand scenario for products. Continued investment in automation and material science technologies is expected to drive the industry's technology abilities forward.

The Chinese cryogenic pump market is expected to expand at a CAGR of 7.1% from 2025 to 2035. Industrial infrastructure growth at a fast pace, along with high investments in LNG, hydrogen, and air separation units, is fueling extensive industry opportunities. The country's diversification of energy and growth in steel and chemical industries further increase the demand for products.

Chinese manufacturers such as CIMC Enric and Chengdu Qianjiang Cryogenic Equipment Co., Ltd. are developing competitive positions through scale, cost advantages, and foreign partnerships. Government incentives for LNG-fueled transportation and high-capacity storage systems ensure continued infrastructure development. The country's position at the forefront of international export supply chains also positions it as a top global supplier of cryogenic technology.

The Australian cryogenic pump industry is expected to grow at a CAGR of 5.1% over the forecast period. Growth in LNG exports and advancements in hydrogen energy projects are the primary drivers of industry growth. The growing application of cryogenic technologies in mining operations and local energy transport networks also fuels demand.

Industry leaders such as Santos Ltd. and Kleenheat are driving cryogenic application innovation for the future of the Australian energy industry. Australia's role as a global LNG exporter and its proximity to fast-growing Asian markets enhance its strategic significance. Government energy diversification programs and pilot projects for green hydrogen are also driving demand for advanced cryogenic equipment.

New Zealand is expected to observe a CAGR of 4.8% in the cryogenic pump market between 2025 and 2035. Although the industry size is relatively smaller, increased emphasis on renewable energy, sustainable farming, and cold-chain logistics is creating niche demand for cryogenic solutions. Hydrogen pilot implementations and feasibility studies are beginning to generate new investments.

Local engineering firms, supported by overseas suppliers, increasingly have a role to play in the installation of cryogenic plants for industrial and scientific applications. New Zealand's efforts towards carbon neutrality, as well as fresh, clean energy developments, are likely to support modest yet consistent industry development. Use within the medical and food-grade gas supply chains provides new avenues for increased application.

The cryogenic pump market is characterized by technological developments through strategic alliances and specialization in the handling of liquefied gases such as LNG, liquid oxygen, nitrogen, and hydrogen. Major companies like ACD Cryo AG Cryostar SAS and Sumitomo Heavy Industries Ltd. have the lion's share of this industry with high-performance products for industrial gas processing, aerospace as well as energy applications. Such firms promote high-efficiency pump designs aimed at reducing energy consumption while ensuring high reliability for critical application needs.

Vertical integration and supply chain optimization have been identified as key strategies among major players. Flowserve Corporation and Nikkiso Cryo Ltd. have further cemented their positions in the industry by developing proprietary technological prowess in cryogenic pumping applications and acquiring niche companies to broaden their technical base in that area. On the other hand, Ebara Corporation and Brooks Automation Inc. are focusing on vacuum and cryogenic solutions with set precision-engineering strategies for semiconductors and medical applications that require ultra-low temperatures.

The movement toward hydrogen and LNG infrastructure development sharpens the competition. Companies such as Fives S.A and PHPK Technologies Inc. are making investments in next-generation hydrogen-compatible products to meet the sharp increase in demand for clean energy as well as hydrogen transport. Cryoquip Australia, on its part, has positioned itself in the niche industry of customized cryogenic solutions, delivering specialized systems tailored for industry-driven specifications.

The ever-diversifying industry is quite competitive, with products differentiated by automation, IoT-enabled monitoring, and longer service life through established players and newcomers. Strategic partnerships and government-initiated projects in space exploration, medical cryogenics, and energy transport will probably define the industry in the future.

ACD Cryo AG (15-20%)

A leader in high-performance cryogenic pumping systems, specializing in hydrogen and LNG applications with a focus on energy efficiency.

Cryostar SAS (12-18%)

Develops cutting-edge cryogenic pump solutions, particularly for aerospace and industrial gas storage, integrating automated monitoring systems.

Sumitomo Heavy Industries Ltd. (10-15%)

Renowned for precision cryogenic pumps in semiconductor manufacturing and healthcare, ensuring ultra-low temperature stability.

Flowserve Corporation (8-12%)

Focuses on smart cryogenic pumping solutions, leveraging IoT and predictive analytics for industrial gas applications.

Brooks Automation Inc. (6-10%)

Specializes in vacuum and cryogenic solutions, catering to space, medical, and semiconductor sectors with high-precision technology.

Other Key Players

The industry is estimated to be worth USD 1,234.1 million in 2025.

It is projected to reach USD 4,034.2 million by 2035, driven by growing applications in the liquefied natural gas (LNG), medical gases, and industrial gas sectors.

China is anticipated to grow at a CAGR of 7.1%, owing to rapid industrialization and rising investments in clean energy infrastructure.

Bath type pumps are widely used due to their efficiency and suitability for handling liquefied gases at extremely low temperatures.

Key companies operating in this space include ACD Cryo AG, Cryostar SAS, Sumitomo Heavy Industries Ltd., Flowserve Corporation, Brooks Automation Inc., Ebara Corporation, Nikkiso Cryo Ltd., PHPK Technologies Inc., Fives S.A, and Cryoquip Australia.

Table 1: Global Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ Million) Forecast by Pump Functionality, 2018 to 2033

Table 4: Global Volume (Units) Forecast by Pump Functionality, 2018 to 2033

Table 5: Global Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: Global Volume (Units) Forecast by Type, 2018 to 2033

Table 7: Global Value (US$ Million) Forecast by Application Gas, 2018 to 2033

Table 8: Global Volume (Units) Forecast by Application Gas, 2018 to 2033

Table 9: Global Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 10: Global Volume (Units) Forecast by End Use Industry, 2018 to 2033

Table 11: North America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Value (US$ Million) Forecast by Pump Functionality, 2018 to 2033

Table 14: North America Volume (Units) Forecast by Pump Functionality, 2018 to 2033

Table 15: North America Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: North America Volume (Units) Forecast by Type, 2018 to 2033

Table 17: North America Value (US$ Million) Forecast by Application Gas, 2018 to 2033

Table 18: North America Volume (Units) Forecast by Application Gas, 2018 to 2033

Table 19: North America Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 20: North America Volume (Units) Forecast by End Use Industry, 2018 to 2033

Table 21: Latin America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Value (US$ Million) Forecast by Pump Functionality, 2018 to 2033

Table 24: Latin America Volume (Units) Forecast by Pump Functionality, 2018 to 2033

Table 25: Latin America Value (US$ Million) Forecast by Type, 2018 to 2033

Table 26: Latin America Volume (Units) Forecast by Type, 2018 to 2033

Table 27: Latin America Value (US$ Million) Forecast by Application Gas, 2018 to 2033

Table 28: Latin America Volume (Units) Forecast by Application Gas, 2018 to 2033

Table 29: Latin America Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 30: Latin America Volume (Units) Forecast by End Use Industry, 2018 to 2033

Table 31: Western Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Value (US$ Million) Forecast by Pump Functionality, 2018 to 2033

Table 34: Western Europe Volume (Units) Forecast by Pump Functionality, 2018 to 2033

Table 35: Western Europe Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Western Europe Volume (Units) Forecast by Type, 2018 to 2033

Table 37: Western Europe Value (US$ Million) Forecast by Application Gas, 2018 to 2033

Table 38: Western Europe Volume (Units) Forecast by Application Gas, 2018 to 2033

Table 39: Western Europe Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 40: Western Europe Volume (Units) Forecast by End Use Industry, 2018 to 2033

Table 41: Eastern Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Value (US$ Million) Forecast by Pump Functionality, 2018 to 2033

Table 44: Eastern Europe Volume (Units) Forecast by Pump Functionality, 2018 to 2033

Table 45: Eastern Europe Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Eastern Europe Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Eastern Europe Value (US$ Million) Forecast by Application Gas, 2018 to 2033

Table 48: Eastern Europe Volume (Units) Forecast by Application Gas, 2018 to 2033

Table 49: Eastern Europe Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 50: Eastern Europe Volume (Units) Forecast by End Use Industry, 2018 to 2033

Table 51: South Asia and Pacific Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Value (US$ Million) Forecast by Pump Functionality, 2018 to 2033

Table 54: South Asia and Pacific Volume (Units) Forecast by Pump Functionality, 2018 to 2033

Table 55: South Asia and Pacific Value (US$ Million) Forecast by Type, 2018 to 2033

Table 56: South Asia and Pacific Volume (Units) Forecast by Type, 2018 to 2033

Table 57: South Asia and Pacific Value (US$ Million) Forecast by Application Gas, 2018 to 2033

Table 58: South Asia and Pacific Volume (Units) Forecast by Application Gas, 2018 to 2033

Table 59: South Asia and Pacific Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 60: South Asia and Pacific Volume (Units) Forecast by End Use Industry, 2018 to 2033

Table 61: East Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Value (US$ Million) Forecast by Pump Functionality, 2018 to 2033

Table 64: East Asia Volume (Units) Forecast by Pump Functionality, 2018 to 2033

Table 65: East Asia Value (US$ Million) Forecast by Type, 2018 to 2033

Table 66: East Asia Volume (Units) Forecast by Type, 2018 to 2033

Table 67: East Asia Value (US$ Million) Forecast by Application Gas, 2018 to 2033

Table 68: East Asia Volume (Units) Forecast by Application Gas, 2018 to 2033

Table 69: East Asia Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 70: East Asia Volume (Units) Forecast by End Use Industry, 2018 to 2033

Table 71: Middle East and Africa Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Value (US$ Million) Forecast by Pump Functionality, 2018 to 2033

Table 74: Middle East and Africa Volume (Units) Forecast by Pump Functionality, 2018 to 2033

Table 75: Middle East and Africa Value (US$ Million) Forecast by Type, 2018 to 2033

Table 76: Middle East and Africa Volume (Units) Forecast by Type, 2018 to 2033

Table 77: Middle East and Africa Value (US$ Million) Forecast by Application Gas, 2018 to 2033

Table 78: Middle East and Africa Volume (Units) Forecast by Application Gas, 2018 to 2033

Table 79: Middle East and Africa Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 80: Middle East and Africa Volume (Units) Forecast by End Use Industry, 2018 to 2033

Figure 1: Global Value (US$ Million) by Pump Functionality, 2023 to 2033

Figure 2: Global Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Value (US$ Million) by Application Gas, 2023 to 2033

Figure 4: Global Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 5: Global Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Value (US$ Million) Analysis by Pump Functionality, 2018 to 2033

Figure 11: Global Volume (Units) Analysis by Pump Functionality, 2018 to 2033

Figure 12: Global Value Share (%) and BPS Analysis by Pump Functionality, 2023 to 2033

Figure 13: Global Y-o-Y Growth (%) Projections by Pump Functionality, 2023 to 2033

Figure 14: Global Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 15: Global Volume (Units) Analysis by Type, 2018 to 2033

Figure 16: Global Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 17: Global Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 18: Global Value (US$ Million) Analysis by Application Gas, 2018 to 2033

Figure 19: Global Volume (Units) Analysis by Application Gas, 2018 to 2033

Figure 20: Global Value Share (%) and BPS Analysis by Application Gas, 2023 to 2033

Figure 21: Global Y-o-Y Growth (%) Projections by Application Gas, 2023 to 2033

Figure 22: Global Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 23: Global Volume (Units) Analysis by End Use Industry, 2018 to 2033

Figure 24: Global Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 25: Global Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 26: Global Attractiveness by Pump Functionality, 2023 to 2033

Figure 27: Global Attractiveness by Type, 2023 to 2033

Figure 28: Global Attractiveness by Application Gas, 2023 to 2033

Figure 29: Global Attractiveness by End Use Industry, 2023 to 2033

Figure 30: Global Attractiveness by Region, 2023 to 2033

Figure 31: North America Value (US$ Million) by Pump Functionality, 2023 to 2033

Figure 32: North America Value (US$ Million) by Type, 2023 to 2033

Figure 33: North America Value (US$ Million) by Application Gas, 2023 to 2033

Figure 34: North America Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 35: North America Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Value (US$ Million) Analysis by Pump Functionality, 2018 to 2033

Figure 41: North America Volume (Units) Analysis by Pump Functionality, 2018 to 2033

Figure 42: North America Value Share (%) and BPS Analysis by Pump Functionality, 2023 to 2033

Figure 43: North America Y-o-Y Growth (%) Projections by Pump Functionality, 2023 to 2033

Figure 44: North America Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: North America Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: North America Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: North America Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: North America Value (US$ Million) Analysis by Application Gas, 2018 to 2033

Figure 49: North America Volume (Units) Analysis by Application Gas, 2018 to 2033

Figure 50: North America Value Share (%) and BPS Analysis by Application Gas, 2023 to 2033

Figure 51: North America Y-o-Y Growth (%) Projections by Application Gas, 2023 to 2033

Figure 52: North America Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 53: North America Volume (Units) Analysis by End Use Industry, 2018 to 2033

Figure 54: North America Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 55: North America Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 56: North America Attractiveness by Pump Functionality, 2023 to 2033

Figure 57: North America Attractiveness by Type, 2023 to 2033

Figure 58: North America Attractiveness by Application Gas, 2023 to 2033

Figure 59: North America Attractiveness by End Use Industry, 2023 to 2033

Figure 60: North America Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Value (US$ Million) by Pump Functionality, 2023 to 2033

Figure 62: Latin America Value (US$ Million) by Type, 2023 to 2033

Figure 63: Latin America Value (US$ Million) by Application Gas, 2023 to 2033

Figure 64: Latin America Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 65: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Value (US$ Million) Analysis by Pump Functionality, 2018 to 2033

Figure 71: Latin America Volume (Units) Analysis by Pump Functionality, 2018 to 2033

Figure 72: Latin America Value Share (%) and BPS Analysis by Pump Functionality, 2023 to 2033

Figure 73: Latin America Y-o-Y Growth (%) Projections by Pump Functionality, 2023 to 2033

Figure 74: Latin America Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 75: Latin America Volume (Units) Analysis by Type, 2018 to 2033

Figure 76: Latin America Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 77: Latin America Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 78: Latin America Value (US$ Million) Analysis by Application Gas, 2018 to 2033

Figure 79: Latin America Volume (Units) Analysis by Application Gas, 2018 to 2033

Figure 80: Latin America Value Share (%) and BPS Analysis by Application Gas, 2023 to 2033

Figure 81: Latin America Y-o-Y Growth (%) Projections by Application Gas, 2023 to 2033

Figure 82: Latin America Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 83: Latin America Volume (Units) Analysis by End Use Industry, 2018 to 2033

Figure 84: Latin America Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 85: Latin America Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 86: Latin America Attractiveness by Pump Functionality, 2023 to 2033

Figure 87: Latin America Attractiveness by Type, 2023 to 2033

Figure 88: Latin America Attractiveness by Application Gas, 2023 to 2033

Figure 89: Latin America Attractiveness by End Use Industry, 2023 to 2033

Figure 90: Latin America Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Value (US$ Million) by Pump Functionality, 2023 to 2033

Figure 92: Western Europe Value (US$ Million) by Type, 2023 to 2033

Figure 93: Western Europe Value (US$ Million) by Application Gas, 2023 to 2033

Figure 94: Western Europe Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 95: Western Europe Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Value (US$ Million) Analysis by Pump Functionality, 2018 to 2033

Figure 101: Western Europe Volume (Units) Analysis by Pump Functionality, 2018 to 2033

Figure 102: Western Europe Value Share (%) and BPS Analysis by Pump Functionality, 2023 to 2033

Figure 103: Western Europe Y-o-Y Growth (%) Projections by Pump Functionality, 2023 to 2033

Figure 104: Western Europe Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 105: Western Europe Volume (Units) Analysis by Type, 2018 to 2033

Figure 106: Western Europe Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 107: Western Europe Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 108: Western Europe Value (US$ Million) Analysis by Application Gas, 2018 to 2033

Figure 109: Western Europe Volume (Units) Analysis by Application Gas, 2018 to 2033

Figure 110: Western Europe Value Share (%) and BPS Analysis by Application Gas, 2023 to 2033

Figure 111: Western Europe Y-o-Y Growth (%) Projections by Application Gas, 2023 to 2033

Figure 112: Western Europe Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 113: Western Europe Volume (Units) Analysis by End Use Industry, 2018 to 2033

Figure 114: Western Europe Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 115: Western Europe Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 116: Western Europe Attractiveness by Pump Functionality, 2023 to 2033

Figure 117: Western Europe Attractiveness by Type, 2023 to 2033

Figure 118: Western Europe Attractiveness by Application Gas, 2023 to 2033

Figure 119: Western Europe Attractiveness by End Use Industry, 2023 to 2033

Figure 120: Western Europe Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Value (US$ Million) by Pump Functionality, 2023 to 2033

Figure 122: Eastern Europe Value (US$ Million) by Type, 2023 to 2033

Figure 123: Eastern Europe Value (US$ Million) by Application Gas, 2023 to 2033

Figure 124: Eastern Europe Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 125: Eastern Europe Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Value (US$ Million) Analysis by Pump Functionality, 2018 to 2033

Figure 131: Eastern Europe Volume (Units) Analysis by Pump Functionality, 2018 to 2033

Figure 132: Eastern Europe Value Share (%) and BPS Analysis by Pump Functionality, 2023 to 2033

Figure 133: Eastern Europe Y-o-Y Growth (%) Projections by Pump Functionality, 2023 to 2033

Figure 134: Eastern Europe Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Eastern Europe Volume (Units) Analysis by Type, 2018 to 2033

Figure 136: Eastern Europe Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Eastern Europe Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Eastern Europe Value (US$ Million) Analysis by Application Gas, 2018 to 2033

Figure 139: Eastern Europe Volume (Units) Analysis by Application Gas, 2018 to 2033

Figure 140: Eastern Europe Value Share (%) and BPS Analysis by Application Gas, 2023 to 2033

Figure 141: Eastern Europe Y-o-Y Growth (%) Projections by Application Gas, 2023 to 2033

Figure 142: Eastern Europe Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 143: Eastern Europe Volume (Units) Analysis by End Use Industry, 2018 to 2033

Figure 144: Eastern Europe Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 145: Eastern Europe Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 146: Eastern Europe Attractiveness by Pump Functionality, 2023 to 2033

Figure 147: Eastern Europe Attractiveness by Type, 2023 to 2033

Figure 148: Eastern Europe Attractiveness by Application Gas, 2023 to 2033

Figure 149: Eastern Europe Attractiveness by End Use Industry, 2023 to 2033

Figure 150: Eastern Europe Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Value (US$ Million) by Pump Functionality, 2023 to 2033

Figure 152: South Asia and Pacific Value (US$ Million) by Type, 2023 to 2033

Figure 153: South Asia and Pacific Value (US$ Million) by Application Gas, 2023 to 2033

Figure 154: South Asia and Pacific Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 155: South Asia and Pacific Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Value (US$ Million) Analysis by Pump Functionality, 2018 to 2033

Figure 161: South Asia and Pacific Volume (Units) Analysis by Pump Functionality, 2018 to 2033

Figure 162: South Asia and Pacific Value Share (%) and BPS Analysis by Pump Functionality, 2023 to 2033

Figure 163: South Asia and Pacific Y-o-Y Growth (%) Projections by Pump Functionality, 2023 to 2033

Figure 164: South Asia and Pacific Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 165: South Asia and Pacific Volume (Units) Analysis by Type, 2018 to 2033

Figure 166: South Asia and Pacific Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 167: South Asia and Pacific Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 168: South Asia and Pacific Value (US$ Million) Analysis by Application Gas, 2018 to 2033

Figure 169: South Asia and Pacific Volume (Units) Analysis by Application Gas, 2018 to 2033

Figure 170: South Asia and Pacific Value Share (%) and BPS Analysis by Application Gas, 2023 to 2033

Figure 171: South Asia and Pacific Y-o-Y Growth (%) Projections by Application Gas, 2023 to 2033

Figure 172: South Asia and Pacific Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 173: South Asia and Pacific Volume (Units) Analysis by End Use Industry, 2018 to 2033

Figure 174: South Asia and Pacific Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 175: South Asia and Pacific Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 176: South Asia and Pacific Attractiveness by Pump Functionality, 2023 to 2033

Figure 177: South Asia and Pacific Attractiveness by Type, 2023 to 2033

Figure 178: South Asia and Pacific Attractiveness by Application Gas, 2023 to 2033

Figure 179: South Asia and Pacific Attractiveness by End Use Industry, 2023 to 2033

Figure 180: South Asia and Pacific Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Value (US$ Million) by Pump Functionality, 2023 to 2033

Figure 182: East Asia Value (US$ Million) by Type, 2023 to 2033

Figure 183: East Asia Value (US$ Million) by Application Gas, 2023 to 2033

Figure 184: East Asia Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 185: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Value (US$ Million) Analysis by Pump Functionality, 2018 to 2033

Figure 191: East Asia Volume (Units) Analysis by Pump Functionality, 2018 to 2033

Figure 192: East Asia Value Share (%) and BPS Analysis by Pump Functionality, 2023 to 2033

Figure 193: East Asia Y-o-Y Growth (%) Projections by Pump Functionality, 2023 to 2033

Figure 194: East Asia Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 195: East Asia Volume (Units) Analysis by Type, 2018 to 2033

Figure 196: East Asia Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 197: East Asia Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 198: East Asia Value (US$ Million) Analysis by Application Gas, 2018 to 2033

Figure 199: East Asia Volume (Units) Analysis by Application Gas, 2018 to 2033

Figure 200: East Asia Value Share (%) and BPS Analysis by Application Gas, 2023 to 2033

Figure 201: East Asia Y-o-Y Growth (%) Projections by Application Gas, 2023 to 2033

Figure 202: East Asia Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 203: East Asia Volume (Units) Analysis by End Use Industry, 2018 to 2033

Figure 204: East Asia Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 205: East Asia Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 206: East Asia Attractiveness by Pump Functionality, 2023 to 2033

Figure 207: East Asia Attractiveness by Type, 2023 to 2033

Figure 208: East Asia Attractiveness by Application Gas, 2023 to 2033

Figure 209: East Asia Attractiveness by End Use Industry, 2023 to 2033

Figure 210: East Asia Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Value (US$ Million) by Pump Functionality, 2023 to 2033

Figure 212: Middle East and Africa Value (US$ Million) by Type, 2023 to 2033

Figure 213: Middle East and Africa Value (US$ Million) by Application Gas, 2023 to 2033

Figure 214: Middle East and Africa Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 215: Middle East and Africa Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Value (US$ Million) Analysis by Pump Functionality, 2018 to 2033

Figure 221: Middle East and Africa Volume (Units) Analysis by Pump Functionality, 2018 to 2033

Figure 222: Middle East and Africa Value Share (%) and BPS Analysis by Pump Functionality, 2023 to 2033

Figure 223: Middle East and Africa Y-o-Y Growth (%) Projections by Pump Functionality, 2023 to 2033

Figure 224: Middle East and Africa Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 225: Middle East and Africa Volume (Units) Analysis by Type, 2018 to 2033

Figure 226: Middle East and Africa Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 227: Middle East and Africa Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 228: Middle East and Africa Value (US$ Million) Analysis by Application Gas, 2018 to 2033

Figure 229: Middle East and Africa Volume (Units) Analysis by Application Gas, 2018 to 2033

Figure 230: Middle East and Africa Value Share (%) and BPS Analysis by Application Gas, 2023 to 2033

Figure 231: Middle East and Africa Y-o-Y Growth (%) Projections by Application Gas, 2023 to 2033

Figure 232: Middle East and Africa Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 233: Middle East and Africa Volume (Units) Analysis by End Use Industry, 2018 to 2033

Figure 234: Middle East and Africa Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 235: Middle East and Africa Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 236: Middle East and Africa Attractiveness by Pump Functionality, 2023 to 2033

Figure 237: Middle East and Africa Attractiveness by Type, 2023 to 2033

Figure 238: Middle East and Africa Attractiveness by Application Gas, 2023 to 2033

Figure 239: Middle East and Africa Attractiveness by End Use Industry, 2023 to 2033

Figure 240: Middle East and Africa Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cryogenic Helium Cycling System Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vial Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Label Market Size and Share Forecast Outlook 2025 to 2035

Pump Jack Market Forecast Outlook 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Freezers Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Tanks Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Capsules Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA