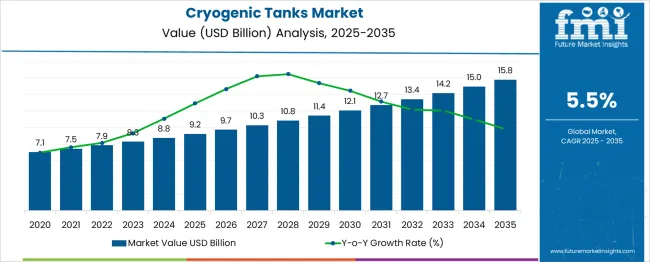

The Cryogenic Tanks Market is estimated to be valued at USD 9.2 billion in 2025 and is projected to reach USD 15.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 9.2 billion to USD 12.1 billion, driven by increasing demand for the transportation and storage of liquefied gases like LNG, hydrogen, and oxygen. Year-on-year analysis shows steady growth, with values reaching USD 9.7 billion in 2026 and USD 10.3 billion in 2027, supported by expanding industrial applications and infrastructure development in the energy and healthcare sectors. By 2028, the market is forecasted to reach USD 10.8 billion, advancing to USD 11.4 billion in 2029 and USD 12.1 billion by 2030.

Growth will be further supported by the adoption of cleaner fuels and the rise in hydrogen as an alternative energy source. Innovations in tank design and insulation materials to improve storage efficiency and reduce environmental impact are expected to contribute significantly to the market's expansion. These dynamics position cryogenic tanks as a critical component in the storage and transport of liquefied gases in an increasingly sustainable and energy-conscious global economy.

| Metric | Value |

|---|---|

| Cryogenic Tanks Market Estimated Value in (2025 E) | USD 9.2 billion |

| Cryogenic Tanks Market Forecast Value in (2035 F) | USD 15.8 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The cryogenic tanks market is witnessing steady growth, supported by increasing demand for industrial gases across energy, healthcare, and manufacturing sectors. The market is being shaped by rising investments in LNG infrastructure, expansion of healthcare facilities requiring medical-grade gases, and technological advancements in material and insulation solutions.

Adoption has been further influenced by heightened emphasis on operational safety, efficiency in storage and transportation, and compliance with stringent environmental standards. Future opportunities are expected to emerge from the development of green hydrogen projects, increasing LNG trade, and innovations in lightweight, high-strength materials.

Enhanced durability, reduced operational costs, and improved thermal performance are paving the way for broader deployment of cryogenic tanks across diverse industries.

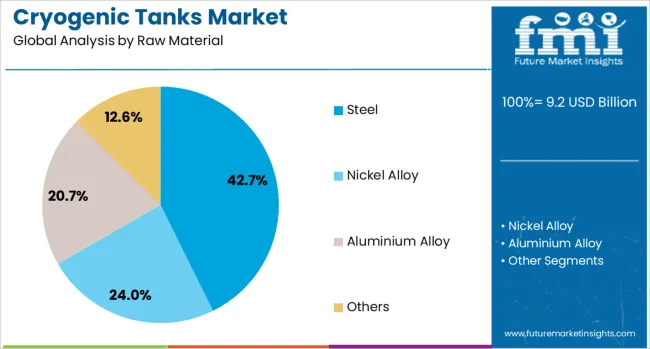

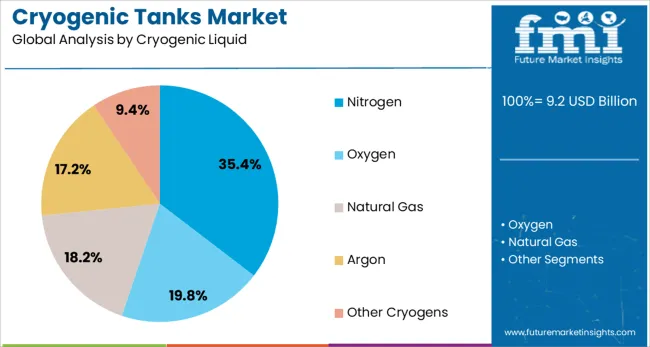

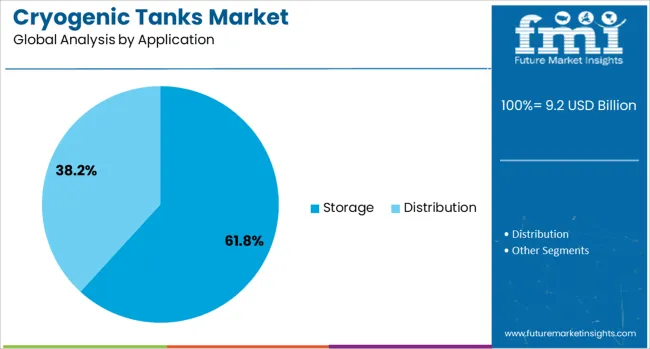

The cryogenic tanks market is segmented by raw material, cryogenic liquid, application, end-user, and geographic regions. The raw materials of the cryogenic tanks market are divided into Steel, Nickel Alloy, Aluminium Alloy, and Others. In terms of cryogenic liquid, the cryogenic tanks market is classified into Nitrogen, Oxygen, Natural Gas, Argon, and Other Cryogens. The cryogenic tanks market is segmented into Storage and Distribution. The end-user of the cryogenic tanks market is segmented into Oil & Gas Industry, Power, Food & Beverage, Chemicals, Rubber & Plastics, Metallurgy, Healthcare, Shipping, Agriculture, Forestry & Fishing, and Other Industries. Regionally, the cryogenic tanks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by raw material, steel is anticipated to hold 42.7% of the total market revenue in 2025, maintaining its position as the leading material choice. This dominance is attributed to steel’s superior strength, durability, and resistance to extreme cryogenic temperatures, which ensure structural integrity and long service life of tanks.

Its ability to withstand mechanical stresses and prevent leakage of cryogenic liquids has reinforced its preference in critical applications. Additionally, advancements in steel grades and fabrication techniques have improved thermal insulation compatibility and reduced overall maintenance needs.

Widespread availability and cost-effectiveness of steel, combined with established manufacturing processes and standards, have further consolidated its leadership in this segment.

In terms of cryogenic liquid, nitrogen is projected to capture 35.4% of the market revenue in 2025, positioning it as the top-performing segment. This leadership has been driven by nitrogen’s extensive utilization across diverse industries such as food processing, electronics manufacturing, and healthcare, where it is valued for its inert properties and cooling capabilities.

The growing demand for packaged food, semiconductor components, and biological sample preservation has significantly increased consumption of liquid nitrogen, thereby boosting demand for specialized storage and transportation tanks.

Its relative abundance and lower cost compared to other cryogenic liquids have further supported its prominent market share, reinforcing its critical role in industrial and medical supply chains.

When segmented by application, storage is forecast to account for 61.8% of the market revenue in 2025, securing its position as the leading application segment. This prominence has been underpinned by the need for reliable, long-term containment of cryogenic liquids in facilities such as LNG terminals, hospitals, and industrial plants.

The emphasis on safety, efficiency, and regulatory compliance has necessitated investments in high-capacity storage tanks equipped with advanced insulation systems. Growth in LNG production and consumption, coupled with rising healthcare infrastructure requiring medical gases, has further elevated the importance of storage solutions.

The ability to minimize product loss and maintain liquid integrity over extended periods has strengthened the dominance of this segment in the market.

The cryogenic tanks market is experiencing steady growth, driven by increasing demand in industries like energy, chemicals, and liquefied natural gas (LNG). In 2024 and 2025, growth drivers include the expansion of the LNG infrastructure and increasing use of cryogenic tanks for industrial gas storage. Opportunities lie in the growing adoption of renewable energy and hydrogen storage. Emerging trends focus on innovations in tank design for higher efficiency. The high cost of cryogenic tanks and regulatory challenges are expected to limit market growth.

The primary growth driver in the cryogenic tanks market is the rising demand for LNG and industrial gas storage. In 2024, the global demand for LNG surged, particularly in regions such as Asia-Pacific and Europe, as countries moved toward cleaner energy sources. This resulted in a significant increase in the need for storage solutions, including cryogenic tanks, to facilitate transportation and distribution. As the LNG market continues to expand, the cryogenic tanks market is expected to grow proportionally.

Opportunities in the cryogenic tanks market lie in the growing adoption of renewable energy and hydrogen storage. In 2025, governments and private companies focused on advancing hydrogen fuel infrastructure, driving the need for cryogenic tanks to store liquid hydrogen. As the renewable energy sector expands, the demand for efficient and safe storage of gases like hydrogen and biogas increases. Cryogenic tanks, with their ability to store liquefied gases at low temperatures, play a pivotal role in this growing market.

Emerging trends in the cryogenic tanks market include innovations in tank design and efficiency. In 2024, manufacturers began introducing advanced insulation materials and lightweight designs to improve the energy efficiency of cryogenic tanks, making them more cost-effective. These innovations allow for the storage of gases at lower temperatures with less energy consumption. As the demand for more efficient and reliable storage solutions grows, these advancements in cryogenic tank technology will drive the market forward.

The major restraints in the cryogenic tanks market are the high initial costs and regulatory challenges. In 2024 and 2025, the high cost of producing and maintaining cryogenic tanks limited their adoption, especially in emerging markets where budgets for infrastructure development are constrained. Additionally, regulatory challenges related to the safe storage and transport of cryogenic gases posed obstacles for market players. Stricter safety regulations and compliance requirements can increase operational costs, hindering market growth.

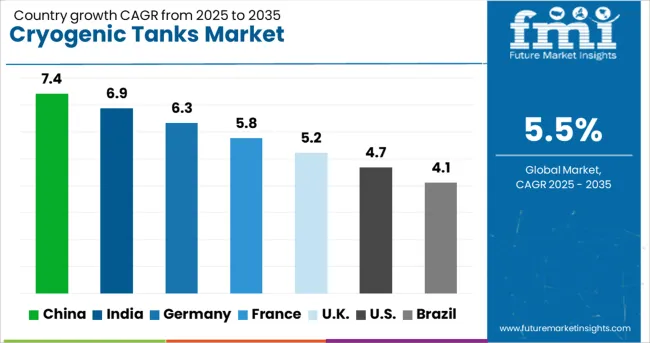

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global cryogenic tanks market is set to grow at a 5.5% CAGR from 2025 to 2035. China leads the market with a projected growth rate of 7.4%, followed by India at 6.9%, and Germany at 6.3%. The United Kingdom records a growth rate of 5.2%, and the United States shows a slower growth at 4.7%. The divergence in growth rates is primarily due to varying levels of industrial development and energy infrastructure. China and India are experiencing rapid industrial expansion, leading to higher demand for cryogenic technologies, especially in the energy and manufacturing sectors. Conversely, mature markets like the United States and the United Kingdom exhibit slower growth due to established infrastructures and existing widespread adoption of cryogenic tanks. The report covers 40+ countries with detailed analysis, highlighting the top markets in this sector.

The cryogenic tanks market in China is projected to grow rapidly, with a CAGR of 7.4%. The adoption of 3D scanning technologies is accelerating across sectors like manufacturing, healthcare, and construction. Government initiatives promoting digitalization, along with China’s push for Industry 4.0, are key growth drivers. The manufacturing sector, in particular, is rapidly evolving, increasing the demand for high-precision 3D scanning solutions. The shift towards smart manufacturing and automation is further enhancing the integration of 3D scanning technologies, which will continue to play an important role in improving product design and manufacturing processes. As digital transformation progresses, China is set to remain a major player in the 3D scanning market.

The cryogenic tanks market in India is forecasted to grow at a CAGR of 6.9%. The growth is primarily driven by increasing investments in energy infrastructure, particularly LNG and industrial gases. With rapid industrialization and expansion in sectors such as chemicals, food processing, and pharmaceuticals, the demand for cryogenic tanks is rising. Furthermore, India’s push for energy diversification and the government’s focus on natural gas as a cleaner alternative to traditional fuels are key factors driving demand. Increased imports of LNG and advancements in tank manufacturing technology will further contribute to market expansion in India.

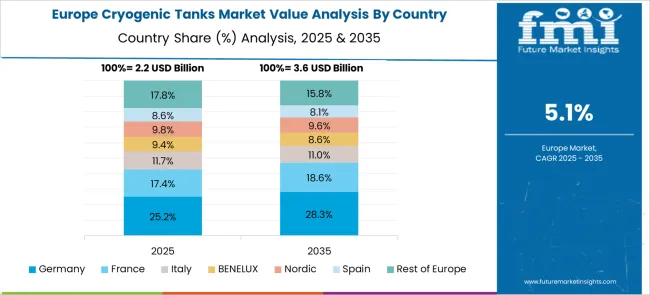

The cryogenic tanks market in Germany is projected to grow at a CAGR of 6.3%. As one of Europe’s largest industrial markets, Germany is heavily focused on energy transition and storage solutions, especially for LNG and industrial gases. The country’s leadership in industrial automation and precision engineering further boosts the adoption of cryogenic tanks. With significant investments in sustainable energy projects and the growing demand for clean fuel, the market for cryogenic tanks is expected to expand in sectors such as energy, chemicals, and manufacturing. Additionally, the shift towards LNG as a cleaner fuel option further drives demand in Germany.

The cryogenic tanks market in the United Kingdom is projected to grow at a CAGR of 5.2%. The market is driven by increasing demand for LNG and industrial gases in various sectors, including energy, chemicals, and manufacturing. The UK’s commitment to reducing carbon emissions and transitioning to clean energy sources supports the growing adoption of LNG. Additionally, investments in infrastructure for gas storage and distribution, coupled with technological advancements in cryogenic tank manufacturing, are expected to drive demand. While the market is more mature, ongoing innovation and government policies continue to push for increased adoption of cryogenic technologies.

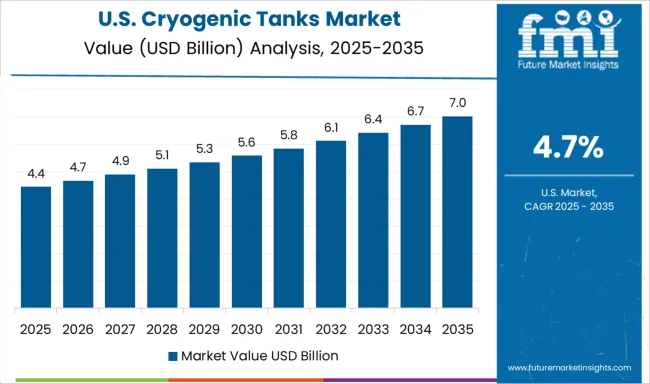

The cryogenic tanks market in the United States is expected to grow at a CAGR of 4.7%. The country’s industrial gas sector, particularly in energy storage and transportation, is the main driver of demand for cryogenic tanks. While the market is mature, technological advancements and infrastructure investments continue to support steady growth. The growing adoption of LNG as an alternative to traditional fuels, along with increasing applications in chemicals and pharmaceuticals, drives the demand for cryogenic tanks. Government policies to support the energy transition and reduce carbon emissions will further support long-term market growth.

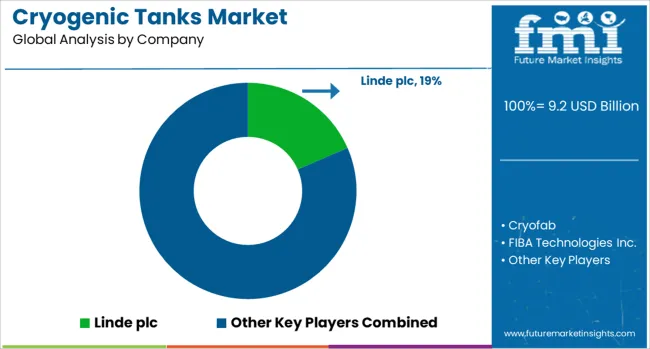

The cryogenic tanks market is dominated by Linde plc, which leads with its extensive range of high-performance cryogenic storage tanks and distribution systems used in industries such as healthcare, chemicals, and energy. Linde’s dominance is supported by its global presence, advanced tank design technologies, and commitment to providing safe, efficient solutions for liquefied gases like oxygen, nitrogen, and argon. Key players such as Air Liquide, Air Products and Chemicals, Inc., Cryofab, and FIBA Technologies Inc. maintain significant market shares by offering durable cryogenic tanks with advanced insulation, pressure control, and temperature regulation capabilities for both industrial and medical applications.

These companies focus on meeting stringent safety standards while ensuring the efficient storage and transportation of cryogenic gases. Emerging players like Cryogas Equipment Private Limited, Chart Industries, Taylor-Wharton, INOX India Limited, and SURETANK are expanding their market presence by providing cost-effective, customized cryogenic tank solutions for niche applications, such as liquefied natural gas (LNG) storage and aerospace. Their strategies include enhancing tank capacity, improving insulation performance, and expanding into emerging markets. Market growth is driven by increasing demand for clean energy solutions, expanding industrial use of cryogenic gases, and advancements in the storage and transport of LNG. Innovations in cryogenic tank manufacturing, including lightweight materials and improved safety features, are expected to further shape competitive dynamics in the global cryogenic tanks market.

Advancements in materials for cryogenic tanks and improvements in refrigeration and liquefaction technologies are boosting the efficiency and safety of cryogenic storage. Additionally, a growing trend towards miniaturizing cryogenic systems is making them more suitable for portable applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.2 Billion |

| Raw Material | Steel, Nickel Alloy, Aluminium Alloy, and Others |

| Cryogenic Liquid | Nitrogen, Oxygen, Natural Gas, Argon, and Other Cryogens |

| Application | Storage and Distribution |

| End-User | Oil & Gas Industry, Power, Food & Beverage, Chemicals, Rubber & Plastics, Metallurgy, Healthcare, Shipping, Agriculture, Forestry & Fishing, and Other Industries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Linde plc, Cryofab, FIBA Technologies Inc., Air Liquide, Air Products and Chemicals, Inc, Air Water Inc., Cryogas Equipment Private Limited, Chart Industries, Taylor‑Wharton, INOX India Limited, SURETANK, and Auguste Cryogenics |

| Additional Attributes | Dollar sales by tank type and application, demand dynamics across LNG, industrial gases, and transportation sectors, regional trends in cryogenic tank adoption, innovation in insulation materials and storage technologies, impact of regulatory standards on safety and environmental concerns, and emerging use cases in renewable energy and space exploration. |

The global cryogenic tanks market is estimated to be valued at USD 9.2 billion in 2025.

The market size for the cryogenic tanks market is projected to reach USD 15.8 billion by 2035.

The cryogenic tanks market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in cryogenic tanks market are steel, nickel alloy, aluminium alloy and others.

In terms of cryogenic liquid, nitrogen segment to command 35.4% share in the cryogenic tanks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cryogenic Helium Cycling System Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vial Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Label Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Freezers Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Capsules Market Growth - Demand & Forecast 2025 to 2035

Cryogenic Vials and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Pump Market Size & Trends 2025 to 2035

Cryogenic Valves Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Cryogenic Insulation Films Companies

Market Share Distribution Among Cryogenic Label Providers

Cryogenic Insulation Films Market Report – Demand, Trends & Industry Forecast 2025-2035

Analyzing Cryogenic Ampoules Market Share & Industry Leaders

Cryogenic Technology Market

Cryogenic vial rack Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA