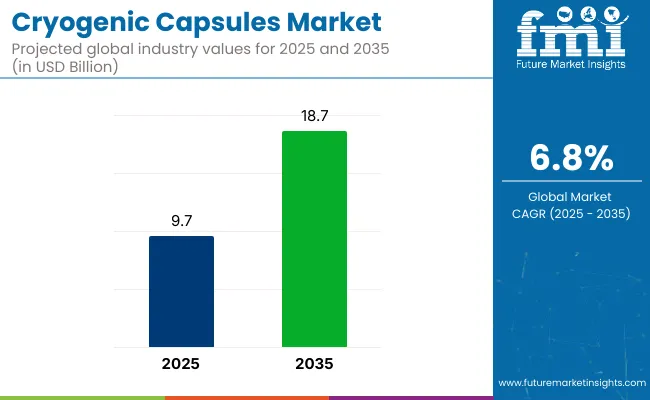

The cryogenic capsules market is projected to grow from USD 9.7 billion in 2025 to USD 18.7 billion by 2035, registering a CAGR of 6.8% during the forecast period. Sales in 2024 reached USD 9.0 billion, reflecting steady growth driven by increasing demand for efficient and secure storage solutions in various industries.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 9.7 billion |

| Industry Value (2035F) | USD 18.7 billion |

| CAGR (2025 to 2035) | 6.8% |

This growth is attributed to advancements in cryopreservation technologies, wider application in biomedical research, and growing demand for long-term preservation of biological assets. The market's expansion is further supported by innovations in capsule designs and materials, enhancing their durability and appeal to various end-users.

In June 2025, Cryogenmash intends to expand its presence in China and introduce innovative gas equipment to the market. "More than 2000 expander units manufactured by Cryogenmash are already operating in 25 countries of the world - both as part of cryogenic units and as stand-alone equipment, and all of them have proven themselves from the best side.

We hope that the new products in the line of Cryogenmash turboexpanders will also be able to gain the trust of customers in the international market," said Evgeny Matveev, General Director of Cryogenmash JSC. He noted that today Cryogenmash presents a new type of product that is in demand on the world market - highly efficient turboexpander units created using its own technologies and manufactured at Russian production.

Environmental considerations are playing an increasingly important role in the cryogenic capsules market, prompting manufacturers to prioritize the use of recyclable and eco-friendly materials. Recent innovations feature the creation of lightweight yet robust capsules, the incorporation of smart technologies like temperature monitoring sensors, and ergonomic designs that improve user comfort.

These advancements align with global sustainability goals and regulatory requirements, making cryogenic capsules an attractive option for environmentally conscious consumers. Additionally, the development of modular and customizable storage solutions has enhanced efficiency and convenience for users, further driving market growth.

The cryogenic capsules market is set to experience substantial expansion, fueled by rising needs for reliable and efficient storage solutions across the healthcare, biotechnology, and aerospace sectors. Companies investing in innovative, eco-friendly technologies are expected to gain a competitive edge.

The market's expansion is further supported by the growing focus on regenerative medicine, personalized therapies, and space exploration. With continuous advancements in materials and manufacturing processes, the cryogenic capsules market is set to offer lucrative opportunities for stakeholders over the forecast period.

The market is segmented by material, end-use industry, and region. By material, the market includes polypropylene, polyethylene, stainless steel, aluminum, borosilicate glass, and fluoropolymers such as PTFE-coated materials.

In terms of end-use industry, the market is categorized into hospitals & clinics, biobanks & cryo banks, research laboratories, pharmaceutical & biotech companies, academic institutes, and IVF & fertility centers. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

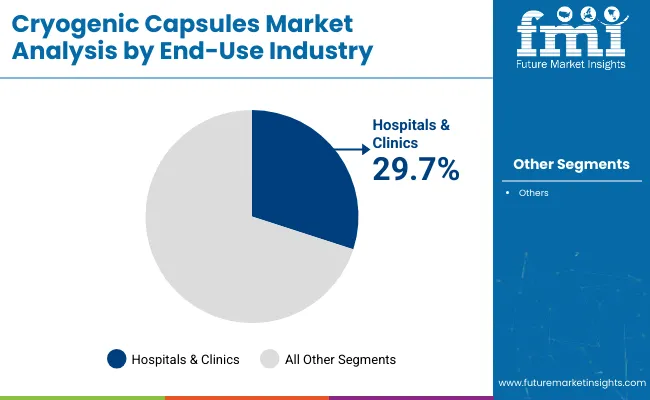

The hospitals and clinics sector has been projected to hold 29.7% of the global cryogenic capsules market by 2025, driven by the rising demand for cryogenic storage solutions in patient care, such as the preservation of biological samples, blood, and tissue for medical procedures.

Hospitals increasingly rely on cryogenic capsules for the safe transportation and long-term storage of critical biological specimens used in diagnostics, organ transplants, and fertility treatments. The convenience of cryogenic capsules in providing secure, temperature-stable environments has made them the preferred choice for sensitive medical applications. These solutions have been integrated into tissue banks, organ preservation programs, and fertility clinics, where maintaining sample viability is critical for successful outcomes.

Growing emphasis on personalized medicine and regenerative therapies has further increased the demand for cryogenic storage in hospitals, particularly for stem cell research and gene therapy applications. Technological advancements in capsule materials and sealing mechanisms have also contributed to increased reliability and ease of use in healthcare facilities.

Hospitals and clinics have responded to regulatory pressures for stringent quality controls by incorporating more sophisticated cryogenic capsule technologies, aligning with accreditation requirements in the medical and healthcare industries.

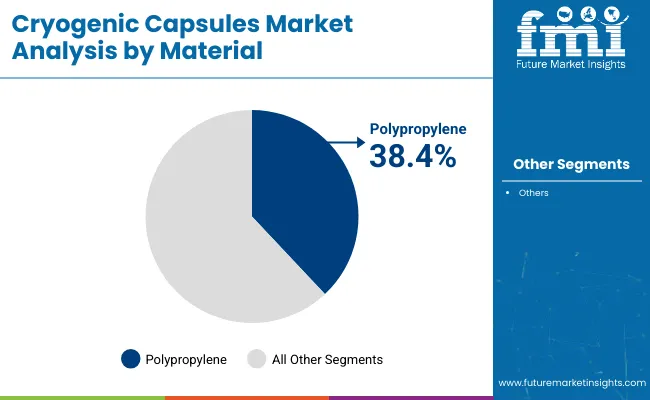

Polypropylene (PP) cryogenic capsules have been estimated to account for 38.4% of the global cryogenic capsules market by 2025, driven by their high chemical resistance, low moisture absorption, and ability to withstand extreme temperatures. PP's ability to maintain structural integrity in low-temperature environments has made it a popular choice for cryogenic storage applications in both medical and scientific sectors.

Polypropylene capsules are widely used for the storage and transportation of biological samples, stem cells, and vaccines, benefiting from their high strength-to-weight ratio and ease of molding into various formats, such as vials and ampoules. These features enable cost-efficient production, especially in high-volume settings.

The pharmaceutical, biotechnology, and healthcare sectors have increasingly adopted PP capsules due to their versatility, non-reactivity with stored samples, and ability to maintain sample stability for extended periods. They have also been preferred for their compatibility with standard cryogenic storage systems, which has contributed to their widespread use across hospitals, research laboratories, and biobanks.

Environmental considerations have driven the adoption of recyclable polypropylene formulations, further enhancing sustainability in the cryogenic storage sector. Investment in high-throughput cryopreservation facilities has also spurred demand for polypropylene capsules, as their affordability and durability meet the needs of both clinical and research-based cryogenic applications.

Structural Integrity at Ultra-Low Temperatures

Structural integrity at cryogenic temperatures is the primary challenge in the manufacture of cryogenic capsules. Thermal shock induces material expansion and contraction and creates microfractures in capsules. It is harmful to the safety of stored biological material, especially in long-duration space missions and deep-freeze medicine applications. Nano-reinforced composite materials are being researched by manufacturers that not only reinforce them but also reduce the thermal stress effect.

Smart Cryogenic Capsule Design

The greatest market opportunity of the industry is building cryogenic capsules intelligent with real-time tracking. Space-based or pharmaceutical cold chain cryogenic storage is the ideal use of the capsules because heavy demand exists for accuracy tracking on these.

Capsules of the future are constructed from IoT sensors that monitor real-time internal pressure, temperature, and integrity of samples. Such companies as BioPreserve Innovations and CryoTech Solutions are paving the way for the introduction of AI-regulated cryogenic management systems for storage condition improvement and temperature fluctuation evasion.

The United States has also experienced continuous growth in the field of cryogenic capsules since industries have opened within the pharmaceutical industry as well as the biotechnology industry. Growing interest in the business of personalized medicine and regenerative therapy has developed a new demand in the field of cryogenic storage. Hydrogen fuel and LNG and LNG pressure have also compelled the energy sector to be fashionable in the direction of demand for cryogenic storage with high-end.

The USA biopharmaceutical industry, which has approximately USD 625 billion, depends on cryogenic capsules to store medicine and biological samples. Hydrogen infrastructure investments following the nation's embrace of renewable resources have boosted the industry of cryogenic capsules in capacity. NASA Artemis mission aims to reinstate human beings onto the Moon, too, again prompting more cryogenic fuel space storage technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

A strong healthcare economy and research culture have driven UK demand for the cryogenic capsule market. Demand for regenerative medicine and biobanking generated a need to possess cutting-edge cryogenic storage technology. The UK's carbon footprint reduction drive also spurred LNG and hydrogen energy plans, which demand effective cryogenic storage.

UK's biobanking industry, with more than 20 million biological samples in storage, needs reliable cryogenic capsules. The government's aspiration to be net-zero carbon by 2050 has triggered unprecedented investment in hydrogen power, propelling the market further. UK Space Agency's plans for pioneering commercial spaceflight also generate demand for cryogenic fuel storage.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

Stringent environmental laws and high sustainability demands drive the European Union cryogenic capsule market. Healthcare sector growth and efforts towards alternative energy have boosted demand for innovative cryogenic storage. France and Germany are at the forefront of market growth as pioneers of biotechnology advancements and LNG network expansion.

The Horizon Europe program of EU funding puts €95.5 billion into research and innovation to advance cryogenic storage to the vanguard of science. The EU's climate strategy, with a 55% cut in greenhouse gases by 2030, has been propelling hydrogen energy initiatives, and they are the strongest driver of higher levels of hydrogen demand for cryogenic storage. Mars and the European Space Agency's far-side mission also demands established cryogenic fuel storage.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.5% |

The Japanese market for cryogenic capsules has expanded with increased medical research and more focus on clean energy. Japanese investment in hydrogen as an energy source without pollution has resulted in greater demand for advanced cryogenic storage technology. Japanese space exploration is also the cause for the expansion of the market.

The strategy of Japan in developing Basic Hydrogen is to construct a hydrogen society, and, therefore, the massive investment will be on the production and storage of hydrogen-like cryogenic capsules. The lunar missions by the Japanese Aerospace Exploration Agency (JAXA) necessitate upper-class technology in cryogenic fuel storage. Otherwise, the age problem of the Japanese population results in the generation of regenerative medicine, thereby demanding the use of cryogenic storage for biological samples.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.6% |

The cryogenic capsule market is a competitive arena dominated by massive global industry players and regional manufacturers fulfilling their share in technological advancement and industrial growth. Some massive players have dominating market shares with emphasis on long-term cryopreservation, bio-storage technology, and uses in space travel.

They are concentrated on material stability, high-end insulation technology, and compliance with regulations to emerge as market leaders. The sector consists of start-ups and incumbents, both of which are shaping the future of the industry through investments in research and product development.

The overall market size for the cryogenic capsules market was USD 9.7 billion in 2025.

The cryogenic capsules market is expected to reach USD 18.7 billion in 2035.

The increasing adoption of cryopreservation techniques in medical research, organ transplantation, and long-term biological sample storage fuels the Cryogenic Capsules Market during the forecast period.

The top 5 countries which drive the development of the Cryogenic Capsules Market are the USA, Germany, China, Japan, and South Korea.

On the basis of application, medical research and biobanking are expected to command a significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cryogenic Label Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Temperature Controller Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Freezers Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Tanks Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vials and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Pump Market Size & Trends 2025 to 2035

Cryogenic Valves Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Cryogenic Insulation Films Companies

Market Share Distribution Among Cryogenic Label Providers

Cryogenic Insulation Films Market Report – Demand, Trends & Industry Forecast 2025-2035

Analyzing Cryogenic Ampoules Market Share & Industry Leaders

Cryogenic Vial Market from 2024 to 2034

Cryogenic Technology Market

Cryogenic vial rack Market

Non-Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA