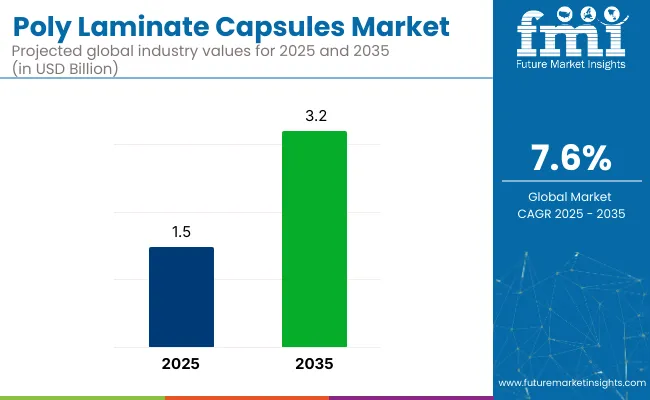

The global poly Laminate capsules market is projected to grow from USD 1.5 billion in 2025 to approximately USD 3.2 billion by 2035, registering a CAGR of 7.6% during the forecast period.

This growth is primarily attributed to the increasing demand for premium packaging solutions in the wine, spirits, and broader beverage industries. Poly Laminate capsules, composed of multiple layers of materials such as aluminum, paper, and plastic, offer superior barrier properties, enhancing the shelf life of products while maintaining their integrity.

These capsules provide an elegant and sophisticated look while ensuring product integrity, making them a preferred choice for wine and spirits brands. The market's expansion is further driven by the growing emphasis on sustainable and recyclable materials, as well as advancements in capsule manufacturing technologies that improve performance and environmental compliance.

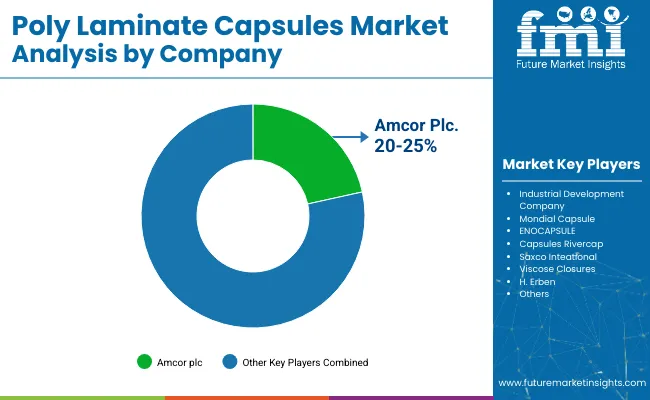

Amcor Plc, a global leader in packaging solutions, offers the APEAL capsule a two-piece premium Poly Laminate capsule designed for spirits brands. APEAL provides a tin-like appearance and adapts to various glass profiles, ensuring a strong visual impact and a perfect fit on diverse bottleneck finishes. The capsule incorporates anti-counterfeiting features such as Spycap, S+ (anti-removal system), micro-embossing, and printed holograms, enhancing product security and brand integrity.

Recent innovations in the Poly Laminate capsules market have centered around enhancing sustainability, functionality, and adaptability to diverse applications. Manufacturers are increasingly adopting biodegradable and recyclable materials, such as bio-based polyethylene, to produce eco-friendly capsules that align with stringent environmental regulations and cater to the growing consumer demand for sustainable packaging solutions.

Advancements in capsule manufacturing technologies have led to the development of capsules with improved moisture resistance, UV protection, and tamper-evident features, ensuring better performance in various environmental conditions. Additionally, the integration of anti-counterfeit technologies, including micro-embossing and printed holograms, is enabling better product authentication and brand protection, aligning with the growing trend of smart packaging and logistics.

The Poly Laminate capsules market is expected to witness significant growth in emerging economies, particularly in the Asia-Pacific region, driven by rapid industrialization, urbanization, and infrastructural development. Countries like China, India, and Australia are experiencing a surge in demand for premium packaging solutions in the wine and spirits industry.

The expansion of the e-commerce industry and the increasing need for efficient logistics and protective packaging solutions further propel the market's growth in these regions. Manufacturers are anticipated to focus on developing cost-effective, sustainable, and customizable poly Laminate capsule solutions to cater to diverse industry needs and comply with evolving regulatory standards.

Strategic collaborations, technological advancements, and investments in local production facilities are likely to play a crucial role in capturing market share and driving growth in these regions.

The market has been segmented based on type, application, end user, size and shape, coating type, and region. By type, synthetic and natural Poly Laminate capsules are adopted to address performance and sustainability priorities across pharmaceutical and nutraceutical applications. Application segmentation includes pharmaceuticals, food and beverage, nutraceuticals, and cosmetics & personal care, highlighting the multifunctional utility of capsules in health, wellness, and aesthetic markets.

End users include healthcare providers, pharmacies, online retailers, and supermarkets/hypermarkets reflecting diversified distribution touchpoints across institutional and consumer channels. Size and shape segments encompass small, medium, and large capsules, along with round and oblong formats, catering to dosage precision, ease of consumption, and packaging compatibility.

Coating types gummy coated, enteric coated, gelatin coated, and vegetable coated support bioavailability, stability, and consumer preference in oral delivery systems. Regional segmentation spans North America, Europe, Latin America, Asia Pacific, and the Middle East and Africa to capture formulation innovations, regulatory frameworks, and consumer health trends across developed and emerging economies.

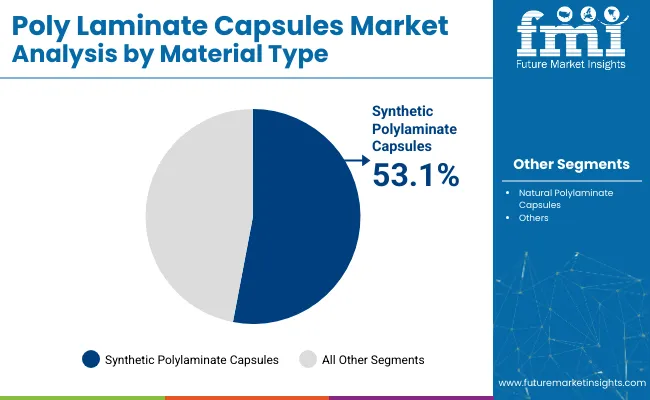

The synthetic Poly Laminate capsules segment is projected to dominate the type category with a 53.1% share in the Poly Laminate capsules market by 2025, driven by its superior durability, flexible design options, and multi-layered barrier efficiency. These capsules are constructed using layers of aluminum, polyester, and polyethylene, providing excellent sealing capabilities, tamper resistance, and shelf appeal critical in regulated and brand-sensitive sectors like pharmaceuticals and personal care.

Synthetic capsules allow for precise embossing, debossing, and hot stamping, making them highly customizable for product authentication and premium branding. Their superior resistance to oxygen, UV light, and moisture ensures long-lasting protection of sensitive contents such as liquid formulations, tinctures, and alcohol-based products.

Synthetic Poly Laminate capsules offer operational advantages including easier application on automated capping and sealing lines, reducing downtime and increasing throughput. The ability to produce thinner, yet stronger, multi-layer capsules also contributes to material savings and sustainability objectives in high-volume packaging operations.

With the growing demand for safety-sealed, visually distinct, and high-performance closures across multiple industries, synthetic capsules are set to remain the preferred choice, particularly in premium and regulated product segments globally.

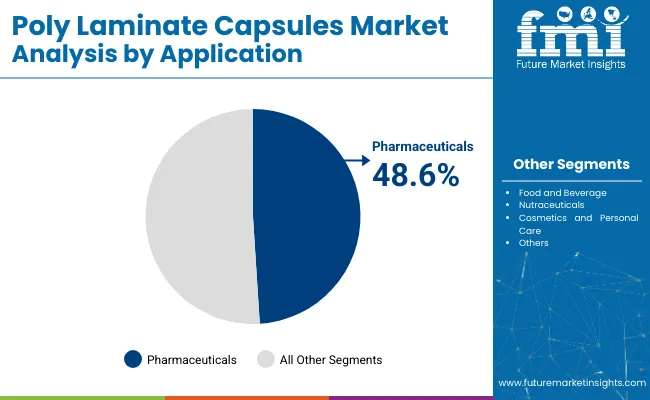

The pharmaceuticals segment is expected to lead the application category with a 48.6% share in 2025, fueled by the growing need for tamper-evident, protective, and regulatory-compliant packaging solutions across prescription drugs, nutraceuticals, and OTC medications. Poly Laminate capsules provide a strong secondary seal over bottle necks and closures, which is vital for safeguarding drug integrity during distribution and storage.

Capsules are commonly used in packaging liquid formulations, syrups, and dietary supplements, where maintaining shelf life, ensuring sterility, and enabling consumer confidence are paramount. These capsules meet key regulatory requirements from agencies like the FDA and EMA by offering features such as visual tamper indicators, batch traceability, and safe material compositions.

Capsule closures enhance product presentation and are compatible with both glass and PET containers, enabling pharmaceutical companies to maintain a premium look while complying with child-resistant and anti-counterfeit packaging protocols. The global rise in preventive healthcare, chronic disease management, and self-medication practices has also boosted demand for easily reclosable and hygienic capsule formats.

As the pharmaceutical industry scales up production and packaging of complex drug delivery formats, Poly Laminate capsules will continue to play a pivotal role in ensuring safety, compliance, and consumer trust across global markets.

Sustainability and Environmental Concerns

The high environmental cost of multi-layer materials used in their production is one of the biggest issues faced in the Poly Laminate capsules market. Conventional Poly Laminate capsules are made of an aluminum and polyethylene composite, which makes recycling difficult.

As legislation tightens and consumers increasingly demand greener packaging, firms are coming under greater pressure to create sustainable options. The cost of obtaining and producing sustainable materials is also an obstacle to small and medium-sized manufacturers using more sustainable choices.

Advancements in Sustainable and Customizable Packaging

Greater focus on sustainability is expected to be a key opportunity for the Poly Laminate capsules market. Manufacturers are investing heavily in introducing new, recyclable, and biodegradable materials aligned with global sustainability trends. Furthermore, production of bio-based and compostable Poly Laminate capsules will soon be ramped up further, giving brands an environmentally friendly packaging option without compromising on aesthetics or functionality.

Also seen are advances in digital printing, embossing and hot-stamping technologies that are allowing the customization of more, which is allowing brands to develop unique capsule shapes that will enhance shelf appeal and consumer interaction. Due to trends of premiumization that will continue contributing to demand for quality packaging, the transition to green and tailor-made packages will be responsible for driving long-term growth for the market.

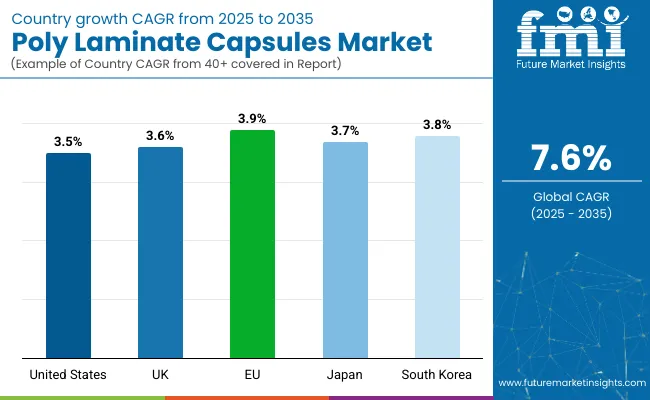

Poly Laminate capsules market in the USA is steadily increasing with rising demand for the premium wine and spirits. The market is only getting bigger with more and more wineries/distilleries opting for protective yet design friendly options in the capsule realm. The pressure of consumer demand for eco-friendly packages that are also recyclable is driving innovation as well, in the design of green capsules. Furthermore, the presence of leading beverage packaging companies and the investment into customization and branding further aids in market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.5% |

The growth of the UK wine and spirits industry, particularly for premium and high-end package wines and spirits, is nurturing the demand for Poly Laminate capsules in this region. The growth is propelled by increased consumer demand for high-quality tamper-evident caps. In addition, sustainability regulations and demand for recyclable packaging materials are encouraging the adoption of biodegradable Poly Laminate capsules. It is driving the market with wineries and spirit labels investing more in capsule customizing for labeling.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.6% |

Countries such as France, Italy, and Spain drive the use of Poly Laminate capsules in the EU as a backdrop of strong wine and spirits manufacturing within the market. Increasing demand due to emphasis on high-end packaging of premium wines and spirits. Even the tough laws in the EU surrounding sustainable packaging are driving the development of less-polluting substitutes for capsules. Increasing identity-based marketing and product distillation by the European wineries are further fueling the market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.9% |

The growth of the Japan Poly Laminate capsules market is medium, owing to gradual increase in consumption of premium alcoholic beverages, including newer and imported wines and premium spirits in the country. Thus, the need for high-quality and cosmetic packaging solutions is growing. In addition, Japan's high degree of packaging innovation and precision manufacturing is driving the development of complex capsule designs with superior material properties.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.7% |

The growing popularity of premium liquors and wines among South Koreans is driving demand of poly Laminate capsules. The market expansion is complemented with the growth of the food and beverage industry in the country coupled with the increasing expenditure by consumers on premium alcohol. Additionally, the shift toward sustainable and recyclable packing materials aligns with government policies that endorse green alternatives, which further drives the use of advanced capsule technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

The Poly Laminate Capsules market is experiencing steady growth, driven by the increasing demand for premium packaging solutions in the wine, spirits, and gourmet food industries. These capsules, made from a combination of aluminum and polyethylene or PVC, enhance product aesthetics, provide tamper-evident sealing, and offer branding opportunities. Growing consumer preference for visually appealing and secure packaging solutions, coupled with advancements in manufacturing technology, is propelling market expansion. Leading companies are focused on product innovation, customization, and sustainability initiatives to maintain a competitive edge.

The overall market size for poly Laminate capsules market was USD 1.5 billion in 2025.

The poly Laminate capsules market is expected to reach USD 3.2 billion in 2035.

The increasing demand for premium packaging in the wine, spirits, and beverage industries fuels Poly Laminate capsules Market during the forecast period.

The top 5 countries which drives the development of Poly Laminate capsules Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of material used, polyethylene to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymer Mixing Unit Market Size and Share Forecast Outlook 2025 to 2035

Polyester Shrink Film Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Polyurethane Coating Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Woven Bag and Sack Market Size and Share Forecast Outlook 2025 to 2035

Polyaspartic Acid Salt Market Size and Share Forecast Outlook 2025 to 2035

Polyphenylene Market Forecast Outlook 2025 to 2035

Polyimide Film and Tape Market Forecast Outlook 2025 to 2035

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polycarbonate Junction Box Market Forecast and Outlook 2025 to 2035

Polyvinyl Chloride (PVC) Packaging Film Market Forecast and Outlook 2025 to 2035

Polydimethylsiloxane Market Forecast and Outlook 2025 to 2035

Polypropylene Yarn Market Size and Share Forecast Outlook 2025 to 2035

Polysaccharide Films Market Size and Share Forecast Outlook 2025 to 2035

Polysilicon Market Size and Share Forecast Outlook 2025 to 2035

Polytetrahydrofuran (Poly THF) Market Size and Share Forecast Outlook 2025 to 2035

Polysulfide Market Size and Share Forecast Outlook 2025 to 2035

Polyolefin Pipe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA