The polyphenylene market is experiencing robust growth, driven by increasing demand for high-performance engineering plastics in automotive, electronics, and industrial applications. Polyphenylene polymers offer superior thermal stability, chemical resistance, and mechanical strength, making them suitable for components exposed to harsh operating conditions.

Market expansion is supported by advancements in polymer compounding, enabling tailored performance characteristics for diverse end-use requirements. The growing emphasis on lightweight materials for fuel efficiency and emission reduction in the automotive sector has further bolstered demand.

Additionally, rising adoption in electrical and electronic components enhances insulation performance and design flexibility. With ongoing R&D efforts focused on recyclability and cost optimization, the polyphenylene market is positioned for long-term growth in advanced manufacturing sectors..

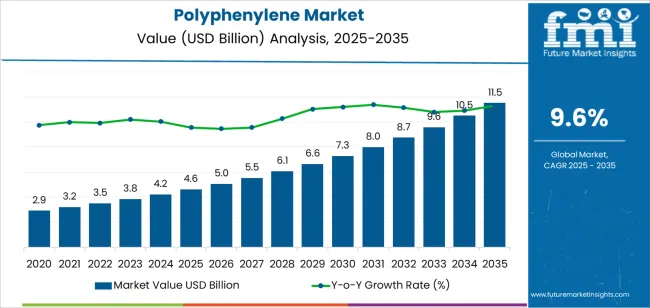

| Metric | Value |

|---|---|

| Polyphenylene Market Estimated Value in (2025 E) | USD 4.6 billion |

| Polyphenylene Market Forecast Value in (2035 F) | USD 11.5 billion |

| Forecast CAGR (2025 to 2035) | 9.6% |

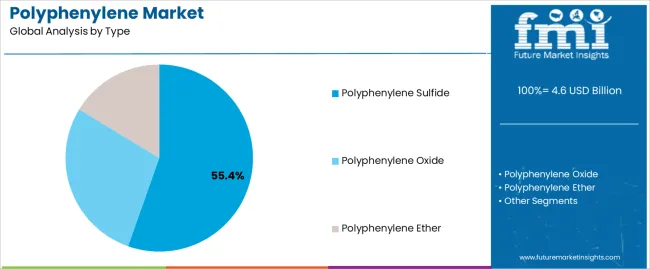

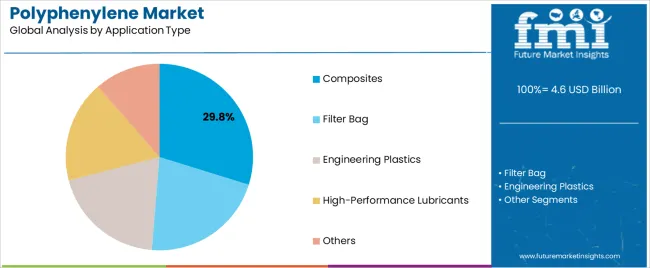

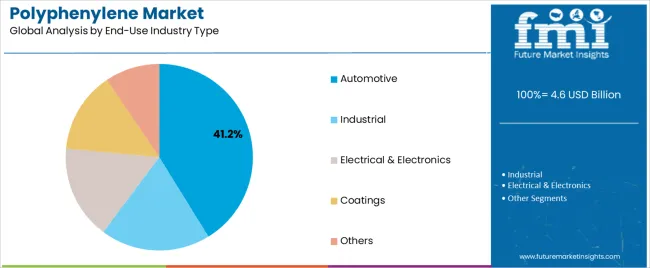

The market is segmented by Type, Application Type, and End-Use Industry Type and region. By Type, the market is divided into Polyphenylene Sulfide, Polyphenylene Oxide, and Polyphenylene Ether. In terms of Application Type, the market is classified into Composites, Filter Bag, Engineering Plastics, High-Performance Lubricants, and Others. Based on End-Use Industry Type, the market is segmented into Automotive, Industrial, Electrical & Electronics, Coatings, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

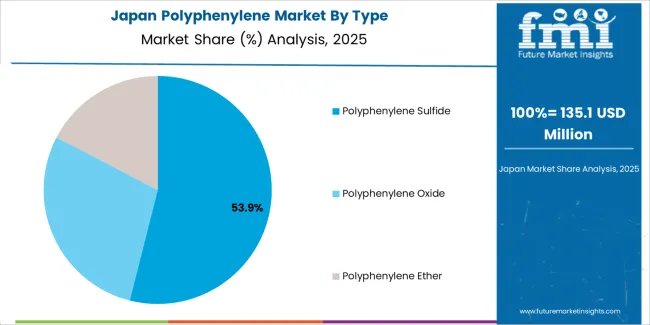

The polyphenylene sulfide segment dominates the type category, representing approximately 55.40% share. This leadership is attributed to its exceptional heat resistance, dimensional stability, and chemical durability, which make it ideal for use in high-temperature environments.

Its broad application range across electrical connectors, automotive parts, and industrial machinery components has reinforced market adoption. The segment benefits from consistent production scalability and compatibility with reinforcement additives that improve structural strength.

Growing substitution of metals and thermosets with polyphenylene sulfide in performance-critical applications has further strengthened its position. With expanding industrial automation and electric vehicle manufacturing, the segment is projected to sustain its dominant share throughout the forecast period..

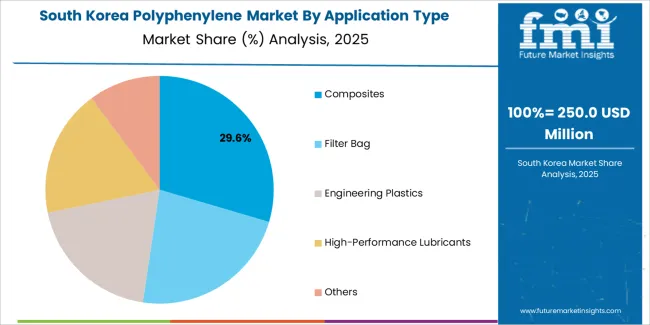

The composites segment leads the application type category with approximately 29.80% share, driven by increasing utilization of reinforced polymer composites for high-strength, lightweight structures. Polyphenylene-based composites deliver enhanced stiffness and durability, making them suitable for demanding environments such as aerospace, automotive, and electronic housings.

Continuous improvements in processing technologies, including injection molding and extrusion, have facilitated large-scale adoption. The segment also benefits from the shift toward lightweight materials in transportation industries to improve energy efficiency.

With ongoing innovation in fiber-reinforced thermoplastics and the rising need for structural performance optimization, the composites segment is expected to maintain its leadership in the coming years..

The automotive segment dominates the end-use industry category with approximately 41.20% share, supported by the increasing adoption of polyphenylene materials in under-the-hood components, electrical systems, and structural parts. The segment’s growth is reinforced by regulatory pressures for emission reduction and vehicle weight optimization.

Polyphenylene polymers are replacing metal and traditional plastics due to their superior mechanical integrity and thermal resistance. The electric vehicle industry has further boosted demand through the need for high-performance materials capable of withstanding elevated temperatures and electrical loads.

With continued advancements in material engineering and sustained growth in global vehicle production, the automotive segment is projected to remain the primary revenue contributor to the polyphenylene market..

This section thoroughly analyzes the industry during the previous five years, emphasizing the anticipated trends in the polyphenylene market. With a previously recorded historical compound annual growth rate of 10.4%, the market is gradually becoming more constrictive. The demand for polyphylene is expected to develop at a 9.6% CAGR through 2035.

Shortages of raw materials, supply chain disruptions, and unstable price dynamics that affect distribution and manufacturing are obstacles facing the global polyphenylene industry.

| Historical CAGR | 10.4% |

|---|---|

| Forecast CAGR | 9.6% |

The demand for polyphenylene is anticipated to face a slight decline. These possible reasons include:

Market participants must be astute and adaptive during the predicted duration, as these challenging characteristics set the market up for future progress.

High Utilization in 3D Printing Skyrockets Global Polyphenylene Demand

The 3D printing industry, which is often referred to as additive manufacturing, has been investigating new materials to expand its potential. Polyphenylenes are a specific material that has been attracting interest. These materials are being evaluated for their potential utility in 3D printing, owing to their unique properties and characteristics.

The market expansion in the 3D printing industry can be largely attributed to the ability of polyphenylenes to offer customized solutions and produce intricate pieces. With their high thermal stability, excellent chemical resistance, and impressive mechanical properties, polyphenylenes have emerged as a promising option for 3D printing applications.

The ongoing research and development efforts in the 3D printing material industry are expected to advance the use of polyphenylenes in additive manufacturing, leading to new possibilities and opportunities in the 3D printing sector.

Rise in Miniaturization Expands the Demand for Polyphenylene

The need for materials that can provide better performance in lightweight, compact designs is rising as technology develops and electronic gadgets get compact. Polyphenylene materials have emerged as a popular choice for such applications due to their exceptional strength-to-weight ratio and thermal stability.

Polyphenylene has remarkable mechanical properties, making it ideal for small devices and components, such as smartphones, laptops, and wearable devices. In addition, polyphenylene materials have excellent chemical resistance and electrical insulation properties, further enhancing their suitability in various industries, including electronics, automotive, aerospace, and medical devices.

The market for polyphenylene materials is anticipated to grow over the forthcoming decade because of the need for premium materials that can handle the demands of miniaturization and compact design.

Expansion of Automobile, Electronics, and Aerostructure Sectors Boosts Product Demand

Polyphenylene materials are increasingly favored in automotive applications due to their outstanding mechanical, chemical, and thermal resistance, meeting industry demands for lightweight materials amidst emission and fuel economy regulations. Moreover, their electrical insulating properties and high-temperature tolerance make them vital in the electronics and electrical sectors, driven by the expanding consumer electronics market and the rise of electric cars and renewable energy sources.

Polyphenylenes' lightweight and robust nature makes them ideal for aerospace applications, meeting demanding performance standards as the aircraft sector expands globally, leading to an upsurge in their use for aerostructures. Polyphenylene's versatility and performance characteristics position it as a key material across diverse industries.

A comprehensive analysis of certain polyphenylene market segments is provided in this section. The polyphenylene sulfide and composite segments are the two primary areas of study. This section aims to give a deeper understanding of these segments and their significance within the broader framework of the polyphenylene industry through a thorough analysis.

| Attributes | Details |

|---|---|

| Top Type | Polyphenylene Sulfide |

| CAGR from 2025 to 2035 | 9.5% |

From 2025 to 2035, polyphenylene sulfide accounted for the leading share of the polyphenylene industry, expanding at a 9.5% CAGR. Compared to the previous CAGR of the PPS, which was 10.2% from 2020 to 2025, this represents a reduction. The following drivers can explain the evolution of the polyphenylene sulfide component segment:

| Attributes | Details |

|---|---|

| Top Application Type | Composites |

| CAGR from 2025 to 2035 | 9.4% |

Forecasts indicate that the polyphenylene composites category is going to lead the market, growing at a noteworthy 9.4% CAGR from 2025 to 2035. These factors contribute to the rise of polyphenylene composites for polyphenylenes:

The United States, China, Japan, South Korea, and the United Kingdom are some of the most predominant nations on the global stage, and this section anticipates looking at their polyphenylene sectors. Examine the several aspects influencing these nations' need for, acceptance of, and interactions with polyphenylenes by a thorough investigation.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| United States | 9.9% |

| Japan | 10.8% |

| United Kingdom | 10.7% |

| South Korea | 11.2% |

| China | 10.5% |

The polyphenylene industry in the United States is expected to witness steady expansion, with a CAGR of 25.0% until 2035. With moderate growth, the industry is projected to reach a valuation of USD 11.5 billion by 2035. The following factors are driving the demand for Polyphenylenes, which is likely to play a crucial role in the growth of the industry:

The demand for polyphenylene in the United Kingdom is expected to surge with an estimated CAGR of 10.7% until 2035. The industry has already shown significant potential, with a CAGR of 14.4% between 2020 and 2025. The market is projected to be valued at USD 417.9 million by 2035, indicating a vast potential for growth and investment in the polyphenylene sector. Here are a few of the key trends:

China's polyphenylene industry is witnessing a significant surge in demand at a predicted CAGR of 10.5%. Experts anticipate reaching a valuation of USD 1.7 billion by the year 2035. Among the main trends are:

The demand for polyphenylenes in Japan is soaring dramatically, increasing at a CAGR of 10.8% through 2035. The market in Japan is anticipated to be valued at around USD 1.1 billion by 2035. Among the main motivators are:

The sales for polyphenylenes in South Korea are predicted to rise significantly with a potential CAGR of 11.2% by 2035. This growth is anticipated to translate into a valuation of USD 11.2 million. Here are a few of the key trends:

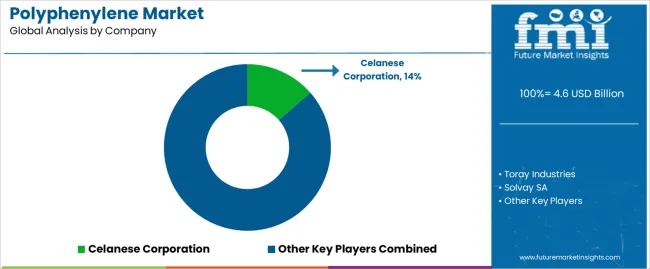

Manufacturers of polyphenylene are expected to be crucial in determining the direction of the polyphenylene industry over the next decade through various activities. Businesses that make expenditures on research and development are going to boost innovation and create new polyphenylene grades with improved qualities and applications.

Organizations prioritizing sustainability are expected to lead in creating eco-friendly polyphenylene materials by employing recycled resources and green production techniques. By increasing their presence in developing countries, businesses are expected to drive up demand for polyphenylene and meet changing industry and consumer demands. Corporations using cutting-edge technology like compounding methods and additive manufacturing are setting up new applications for polyphenylene.

Market players intend to promote cooperation and hasten polyphenylene use in various industries by establishing strategic alliances with vendors, clients, and academic institutions. Generally, firms prioritizing sustainability, innovation, and market growth are anticipated to greatly impact the polyphenylene industry's development over the forthcoming decade.

Recent Developments in the Polyphenylene Industry

The global polyphenylene market is estimated to be valued at USD 4.6 billion in 2025.

The market size for the polyphenylene market is projected to reach USD 11.5 billion by 2035.

The polyphenylene market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in polyphenylene market are polyphenylene sulfide, polyphenylene oxide and polyphenylene ether.

In terms of application type, composites segment to command 29.8% share in the polyphenylene market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyphenylene Sulfide Market Size and Share Forecast Outlook 2025 to 2035

Polyphenylene Ether (PPE) Alloy Market Size and Share Forecast Outlook 2025 to 2035

Polyphenylene Sulfide Resins Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA