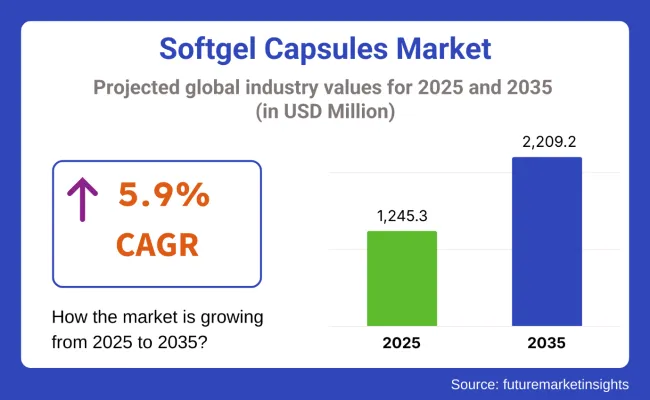

The global Softgel Capsule Market is estimated to be valued at USD 1,245.3 million in 2025 and is projected to reach USD 2,209.2 million by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

This upward trajectory is fundamentally driven by accelerating pharmaceutical and nutraceutical industry expansion along with a significant demand for gelatin-based capsules. Critical factors influencing the growth of this market include rising consumer preference for oral drug delivery systems, enhanced bioavailability characteristics of softgel formulations and increasing chronic disease prevalence. The market also benefits from technological innovations in encapsulation processes and growing demand for personalized medicine.

Market leaders Capsugel (Lonza Group), Catalent Inc., CAPTEK Softgel International, Aenova Group, and Procaps Group are driving substantial growth through strategic technological innovations and capacity expansions. These manufacturers are capitalizing on increasing nutraceutical demand and preventive healthcare trends, with plant-based softgel capsules gaining significant momentum through HPMC and pullulan innovations that enhance clean-label appeal.

Others factors include pharmaceutical companies' increasing adoption of softgel formulations for poorly soluble drugs, expanding manufacturing capabilities in emerging markets, and strategic partnerships with nutraceutical companies. In 2024, Roquette announced the Launch of New LYCAGEL® Flex Softgel Capsule Shell System.

“At Roquette, our guiding purpose is to solve the toughest challenges in drug delivery,” commented Steve Amoussou-Guenou, Technical Developer Manager Europe at Roquette. Key players are investing heavily in advanced encapsulation technologies, automated production systems, and quality assurance protocols to meet stringent regulatory requirements across global markets

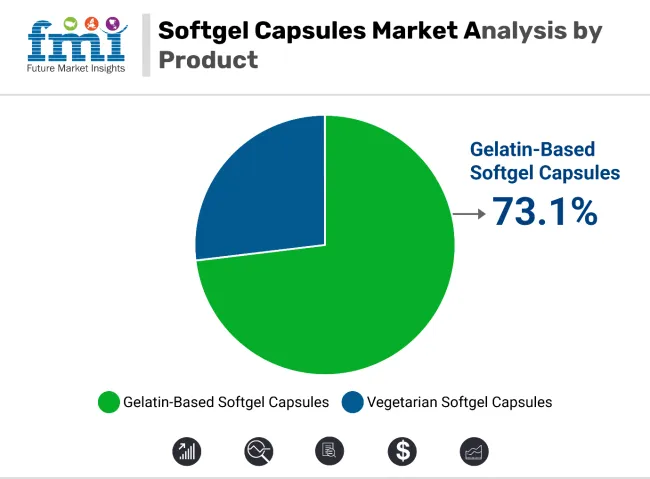

In 2025, gelatin-based softgel capsules are projected to capture 73.1% of the total revenue share in the softgel capsule market. This dominance is driven by the well-established benefits of gelatin as a versatile, biocompatible material that provides excellent stability and ease of manufacturing. Gelatin capsules are widely preferred in the pharmaceutical and nutraceutical industries due to their ability to encapsulate a variety of active ingredients, including oils, powders, and liquids, with high bioavailability.

Additionally, gelatin-based softgel capsules are cost-effective to produce and widely accepted by regulatory bodies, further bolstering their market share. The segment’s growth is also attributed to increasing consumer demand for dietary supplements, particularly those related to health, wellness, and aging, where gelatin-based capsules are a preferred format due to their ability to deliver a wide range of active ingredients in a single dosage form.

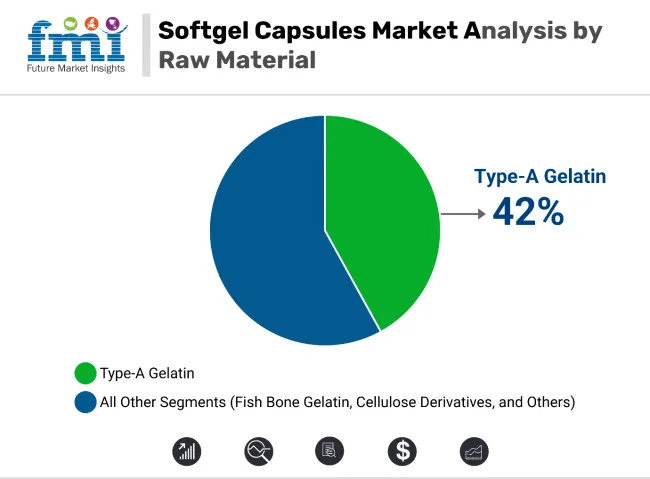

In 2025, Type A gelatin is expected to hold 42.0% of the revenue share in the raw material segment of the softgel capsule market. This leading position is due to Type A gelatin’s superior gelation properties, which provide excellent film formation, elasticity, and strength in softgel capsule production. Derived from pork skin, Type A gelatin is highly favored for its ability to dissolve efficiently and release active ingredients rapidly in the gastrointestinal tract, making it ideal for pharmaceutical and nutraceutical applications.

Its versatility in encapsulating both hydrophilic and lipophilic ingredients has further contributed to its widespread adoption in the production of softgel capsules. Additionally, Type A gelatin has been widely recognized for its cost-effectiveness, availability, and regulatory acceptance, making it the preferred raw material for manufacturers. As the demand for softgel capsules in the global pharmaceutical and dietary supplement industries continues to rise, Type A gelatin is expected to remain the dominant raw material in the market.

Challenge: High Production Costs and Material Sensitivities

In contrast, softgels need the use of specialized encapsulation machinery, stringent temperature and humidity controls, and a high degree of precision with gelatin or plant-based polymers. These challenging conditions result in higher operational costs, hence contract manufacturing and in-house production become on the capital-intensive side.

Moreover, softgels are sensitive to moisture, oxygen, and heat, which can cause product instability especially in design nutraceuticals or pharmaceuticals containing volatile oils, live probiotics, or lipid-soluble compounds. The growing number of vegetarian diets worldwide, for example, poses an additional challenge to the softgel form, as gelatin is unsuitable for certain consumer bases (e.g. vegetarians, vegans, and certain religious populations).

Opportunity: Growth in Nutraceuticals, Personalized Dosing, and Plant-Based Alternatives

Despite these limitations, the global softgel capsules market is expected to witness significant growth due to the rising demand for nutraceuticals, omega-3 dietary supplements, herbal extracts, and disease-specific formulations. It provides many benefits, such as convenient swallowing, fast bioavailability, and higher stability of oil-based compounds. Softgels are preferred by consumers for vitamins, anti-inflammatory blends, joint support and cognitive health, driving demand for end-users of all ages.

Vegetarian softgel shells contain tapioca starch, carrageenan or modified cellulose, which has given rise to plant-based supplement brands. In medicine, they are increasingly being used in controlled-release systems, pediatric formulations, and hormonal therapies due to their customizable dosage and taste-masking capabilities.

The USA softgel capsules industry is rising consistently due to growing need for dietary supplements along with aging population and growing preference for easy-to-swallow dosage forms. Softgels are commonly used for vitamins, fish oils and prescription drugs, with very high consumer acceptance in OTC and pharmaceutical markets.

Innovation in ways to use gelatin alternatives, controlled-release technologies and bioavailability enhancement are also pepping up. Increased growth in the direct-to-consumer nutraceutical sector in addition to solid retail distribution are also factors in the expanding market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.0% |

The UK softgel capsules market has been witnessing steady growth over the years, fueled by rising health consciousness among consumers, new opportunities in plant-based supplement trends, and advancements in functional nutrition. Softgels are the preferred form of omega-3, turmeric, and vitamin D supplementation, especially for joint health, immunity, and beauty applications.

To fulfil a gradually increasing customer base of vegetarians and halal consumers, brands are providing vegan and gelatine-free softgel choices. It is also a recommendation-driven market and e-commerce driven channel, with significant growth of personalized wellness products.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.5% |

The European Union softgel capsules market is poised for market expansion, driven by increased demand for high-absorption nutritional supplements, management of chronic diseases, and better regulation of nutritional products. It is due to this factor that Germany, Italy and the Netherlands is dominating in the production as well as consumption of nutraceutical and pharma-grade softgels.

As demand for clean-label, allergen-free and non-GMO supplements grows, softgel innovations, like plant-based and starch-based gel technologies, are also being developed by EU manufacturers. Because of higher bioavailability, pharmaceutical companies are utilizing softgels for hormone therapy, cardiovascular drugs, and central nervous system (CNS) treatments.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.8% |

Japan is experiencing moderate growth in its softgel capsules market, with the demand being led by its aging population, which prefers easy dosing formats and precise dosing, alongside a focus on wellness and health. Softgels are a popular delivery method in dosage forms that support eye health, energy, and cognitive function, and they are keenly focused on quality and efficacy.

At the same time, local pharmaceutical companies follow developments in customized softgel formulations for niche indications, and nutraceutical companies take advantage of their ability to combine coenzyme Q10 and lutein with collagen in softgel formats. Regulation promotes innovation and protects consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

Growth of the South Korean softgel capsules market is thriving thanks to the wellness trends along with cosmetic-nutritional crossovers and tech-driven supplement delivery. Softgels for skin-care, weight management, and anti-fatigue formulations are gaining popularity among consumers, who are heavily swayed by beauty and wellness influencers.

And domestically, brands are launching sugar-free, fast-dissolving, and plant-based softgel capsules aimed at young, urban consumers. Healthcare segment growth is also being compounded by booming pharmaceutical demand for precision-dose softgels in oncology and chronic care.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

The global softgel capsules products market enables consumers to attain a broad spectrum of physical and psychological wellness for longer and is one of the most promising and dynamic segments of the pharma industry. Softgels are popular not just for vitamins and supplements but omega-3s and prescription drugs as well, while providing protection to lipid-based and sensitive formulations.

Major players have their eyes set on gelatin and plant-based alternatives, high-throughput encapsulation, clean-label ingredients, and tailored release profiles. The market consists of CDMOs, pharma companies and dietary supplement manufacturers in therapeutic, preventive and wellness sectors worldwide.

Key Developments:

The overall market size for the softgel capsules market was USD 1,245.3 million in 2025.

The softgel capsules market is expected to reach USD 2,209.2 million in 2035.

The increasing demand for easy-to-swallow drug delivery forms, rising adoption in nutraceuticals and pharmaceuticals, and growing use of gelatin-based softgels, especially type-B gelatin, fuel the softgel capsules market during the forecast period.

The top 5 countries driving the development of the softgel capsules market are the USA, UK, European Union, Japan, and South Korea.

Gelatin-based softgels and type-B gelatin lead market growth to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enteric Softgel Capsules Market Analysis – Growth & Forecast 2025 to 2035

Softgel Encapsulation Machine Market Growth - Trends & Forecast 2025 to 2035

Coffee Capsules Market Analysis - Growth & Forecast 2025 to 2035

Coffee Capsules and Pods Market

Washing Capsules Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Capsules Market Growth - Demand & Forecast 2025 to 2035

Demand for Softgel Encapsulation Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Softgel Encapsulation Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Tablets And Capsules Packaging Companies

Tablets and Capsules Packaging Market Growth, Trends, Forecast 2025-2035

Hard Gelatin Capsules Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Poly Laminate Capsules Market Insights - Growth & Forecast 2025 to 2035

Polymeric Microcapsules Market Size and Share Forecast Outlook 2025 to 2035

Demand for Empty Capsules in EU Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Pods and Capsules Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA