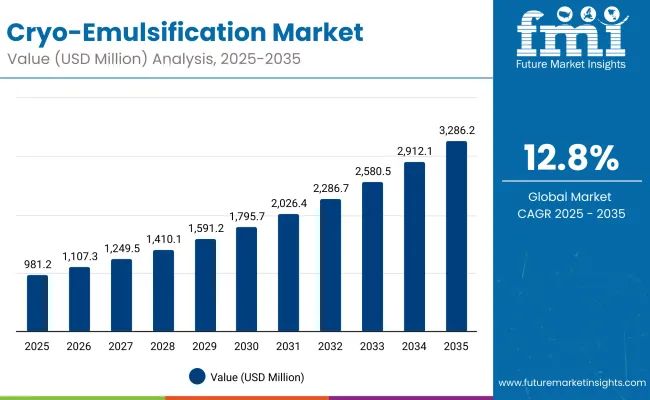

The Cryo-Emulsification Market is expected to record a valuation of USD 981.2 million in 2025 and USD 3,286.2 million in 2035, with an increase of USD 2,305.0 million, which equals a growth of 235% over the decade. The overall expansion represents a CAGR of 12.8% and a more than 3.3X increase in market size.

| Metric | Value |

|---|---|

| Cryo-Emulsification Market Estimated Value in (2025E) | USD 981.2 million |

| Cryo-Emulsification Market Forecast Value in (2035F) | USD 3,286.2 million |

| Forecast CAGR (2025 to 2035) | 12.8% |

During the first five-year period from 2025 to 2030, the market increases from USD 981.2 million to USD 1,795.7 million, adding USD 814.5 million, which accounts for 35.3% of the total decade growth. This phase records steady adoption of cryo-emulsification in skin tightening, anti-aging, and cooling-effect treatments, supported by the growing popularity of serums and creams. Clinical-grade positioning gains importance as dermatologist-tested and professional-use cryo formulations expand across specialty beauty stores, pharmacies, and spas.

The second half from 2030 to 2035 contributes USD 1,490.5 million, equal to 64.7% of total growth, as the market jumps from USD 1,795.7 million to USD 3,286.2 million. This acceleration is powered by premiumization trends, expansion of e-commerce distribution, and strong uptake in Asia-Pacific markets such as China and India. Claims around enhanced absorption, vegan formulations, and sustainable sourcing also gain traction, pushing competitive differentiation. By 2035, the category is anchored by a balanced mix of mass-market adoption and premium clinical-grade products, driving sustained revenue expansion.

From 2020 to 2024, the Cryo-Emulsification Market gained traction as cryo-based skincare moved from niche professional treatments into mainstream retail channels. Growth was fueled by early adoption in specialty beauty stores and spas, where cryo-serums and creams were marketed as premium anti-aging and skin-tightening solutions. Competitive differentiation during this period relied heavily on clinical validation, dermatologist-tested claims, and luxury positioning, with Lancôme and CryoSkin spearheading product visibility.

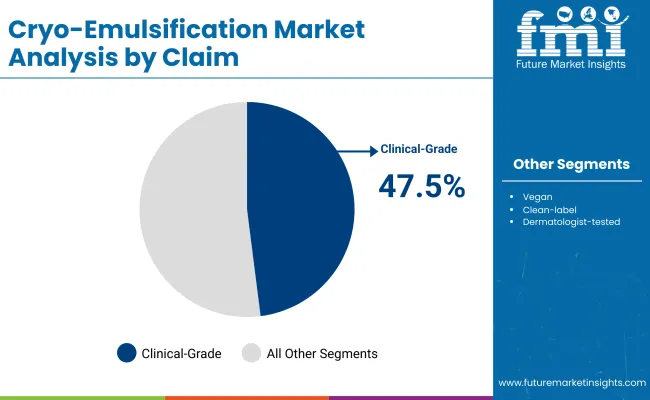

Demand for cryo-emulsification products is projected to expand to USD 981.2 million in 2025, with revenues shifting toward clinical-grade and professional-use formats, which already represent 47.5% of sales. Traditional luxury skincare leaders now face competition from digital-first and niche clean-label brands, which emphasize sustainability, vegan formulations, and enhanced absorption properties. Competitive advantage is moving away from brand prestige alone to include eco-conscious sourcing, omnichannel distribution, and clinical credibility, signaling a dynamic decade ahead for this market.

The growth of the Cryo-Emulsification Market is being driven by rising consumer preference for advanced, science-backed skincare solutions that offer visible improvements in skin tightening, anti-aging, and overall skin vitality. Cryo-emulsification enhances the penetration of active ingredients while delivering a refreshing cooling effect, which resonates strongly with consumers seeking both performance and sensorial benefits.

At the same time, the market is benefiting from the premiumization of skincare, as consumers increasingly favor dermatologist-tested and clinical-grade products. This has created opportunities for established luxury brands as well as niche innovators to position cryo-emulsified products as part of professional-grade beauty routines. Furthermore, broader wellness trends emphasizing clean-label, vegan, and sustainable formulations are aligning well with cryo-emulsification, enabling brands to market these products as both effective and ethically responsible.

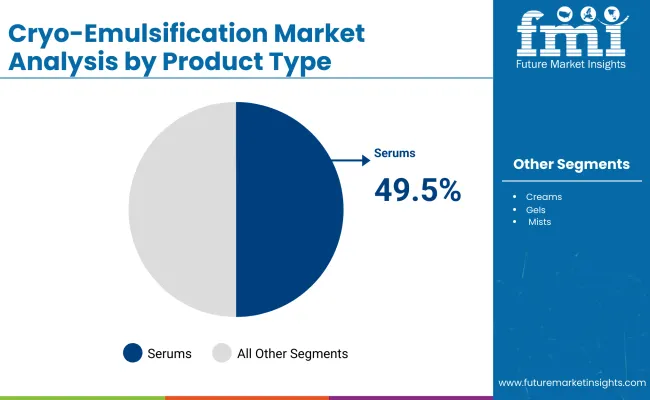

The market is segmented by function, product type, channel, claim, and region. Functions include skin tightening, anti-aging, cooling effect, and brightening, reflecting the diverse skin benefits delivered by cryo-emulsification. Product types cover serums, creams, gels, and mists, with serums gaining strong adoption due to their targeted application and compatibility with cryo-active formulations. By channel, the market is distributed through specialty beauty stores, pharmacies, e-commerce platforms, and spas/professional clinics, highlighting a mix of retail and professional touchpoints.

In terms of claims, segmentation spans dermatologist-tested, clinical-grade, vegan, and clean-label categories, which are increasingly shaping consumer purchasing decisions. Regionally, the scope includes North America, Europe, Asia-Pacific, and emerging markets across the Middle East and Africa. Within these regions, key countries such as the USA, China, India, Germany, UK, and Japan represent major centers of demand, each influenced by unique consumer trends, retail ecosystems, and brand presence.

| Product Type | Value Share% 2025 |

|---|---|

| Serums | 49.5% |

| Others | 50.5% |

The serums segment is projected to contribute 49.5% of the Cryo-Emulsification Market revenue in 2025, maintaining its lead as the dominant product category. Serums are favored for their concentrated formulations, faster absorption, and compatibility with cryo-emulsified actives, making them the preferred choice for skin tightening, anti-aging, and enhanced absorption claims. Their premium positioning allows brands to market them as high-performance products, often supported by dermatologist endorsements and clinical validation.

The others category, which accounts for 50.5% of revenues in 2025, includes creams, gels, and mists. These formats cater to a broader consumer base seeking daily-use skincare and sensorial experiences, especially in hydration and cooling-effect applications. Gels and creams, in particular, are gaining popularity in spa and professional clinic settings where cryo-emulsification is introduced as part of specialized treatments. Together, these formats ensure that while serums anchor the premium segment, the wider product portfolio sustains mass-market accessibility and overall category expansion.

| Claim | Value Share% 2025 |

|---|---|

| Clinical-grade | 47.5% |

| Others | 52.5% |

The clinical-grade segment is expected to contribute 47.5% of the Cryo-Emulsification Market revenue in 2025, positioning it as one of the most influential claim categories. Clinical-grade products resonate with consumers seeking science-backed efficacy and dermatologist-approved solutions, especially in anti-aging and skin tightening applications. This credibility makes them highly attractive in professional settings such as spas and skin clinics, where trust and visible results are key to product adoption.

The others category, which accounts for 52.5% of revenues, includes a broader mix of claims such as vegan, clean-label, and dermatologist-tested. These claims appeal to younger, eco-conscious, and lifestyle-driven consumers who value ingredient transparency and sustainability as much as product performance. Together, both segments highlight a dual dynamic: while clinical-grade claims strengthen the market’s professional credibility, lifestyle-oriented claims drive volume in retail and e-commerce, ensuring that cryo-emulsification continues to expand across both premium and mass-market segments.

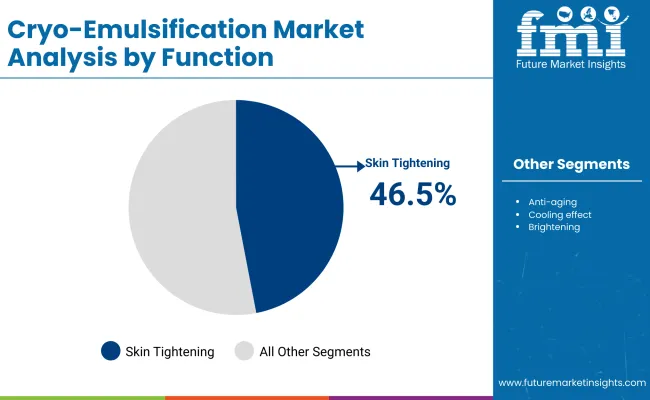

| Function | Value Share% 2025 |

|---|---|

| Skin tightening | 46.5% |

| Others | 53.5% |

The skin tightening function is projected to contribute 46.5% of the Cryo-Emulsification Market revenue in 2025, making it the leading functional category. This segment benefits from strong consumer interest in non-invasive solutions that deliver visible lifting and firming results, especially within anti-aging skincare regimens. Cryo-emulsification enhances the penetration of active ingredients while delivering a cooling sensation, which further supports its appeal in tightening and contouring applications.

The others category, which accounts for 53.5% of revenues, includes anti-aging, cooling effect, and brightening functions. Anti-aging is central to long-term consumer demand, while cooling-effect products are increasingly used for sensorial appeal in wellness and spa treatments. Brightening formulations are also gaining popularity, particularly in Asia-Pacific markets, where even skin tone and radiance are high-priority beauty outcomes. Together, these functions create a balanced portfolio, ensuring that while skin tightening anchors demand, adjacent applications broaden the appeal of cryo-emulsification across multiple consumer segments.

Rising Demand for Non-Invasive Skincare Solutions

Consumers are increasingly seeking alternatives to invasive cosmetic procedures, boosting demand for cryo-emulsification products that deliver visible results in tightening, cooling, and anti-aging without downtime. This shift is supported by growing awareness of dermo-cosmetic technologies and professional endorsements, allowing cryo-emulsification to move from clinical environments into everyday skincare routines. The appeal lies in its ability to provide both immediate sensorial benefits and long-term functional improvements, making it an attractive solution for aging and appearance-conscious consumers worldwide.

Premiumization and Clinical-Grade Positioning

Luxury and clinical-grade skincare brands are actively incorporating cryo-emulsification into serums, creams, and gels, elevating its credibility among affluent consumers. Dermatologist-tested and scientifically validated claims are driving trust, particularly in markets where product safety and efficacy are paramount. This premium positioning allows brands to command higher margins while expanding distribution in spas, clinics, and specialty beauty stores. Combined with clean-label and sustainable messaging, premiumization ensures cryo-emulsification appeals across both professional and retail channels, reinforcing its reputation as an advanced skincare innovation.

Limited Consumer Awareness Beyond Premium Markets

Despite its strong positioning, cryo-emulsification remains relatively unknown to mainstream consumers outside luxury and professional skincare circles. High prices and limited availability in pharmacies and mass retail hinder wider adoption. This creates a gap between consumer curiosity and actual purchase intent, slowing down volume penetration in price-sensitive regions. Unless brands expand education campaigns and develop affordable entry-level product lines, cryo-emulsification risks remaining confined to niche urban markets rather than reaching broad, mainstream skincare audiences globally.

Integration of Cryo-Skincare with Wellness and Lifestyle Routines

Cryo-emulsification is evolving beyond clinical anti-aging to align with broader wellness trends. Brands are positioning products as holistic solutions combining cooling relief, stress reduction, and improved skin health. Partnerships with spas, fitness centers, and wellness retreats highlight its versatility, creating crossover appeal between beauty and lifestyle industries. As consumers prioritize self-care, multifunctional skincare formats that merge beauty benefits with wellness experiences are gaining momentum, reinforcing cryo-emulsification as both a performance-driven and lifestyle-enhancing solution in the evolving beauty landscape.

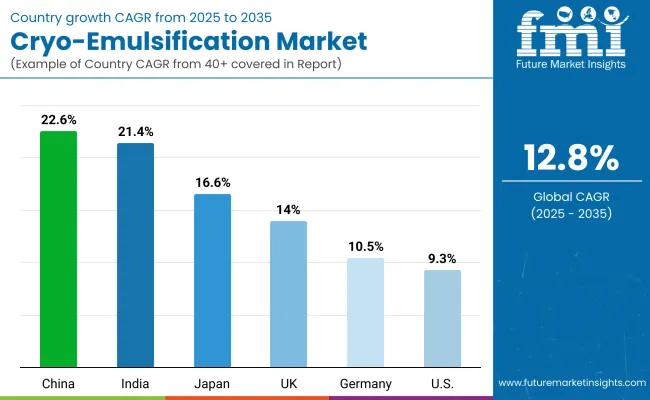

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 22.6% |

| USA | 9.3% |

| India | 21.4% |

| UK | 14.0% |

| Germany | 10.5% |

| Japan | 16.6% |

The global Cryo-Emulsification Market shows a clear disparity in adoption speeds, shaped by consumer preferences, retail dynamics, and brand penetration. Asia-Pacific emerges as the fastest-growing region, led by China (22.6%) and India (21.4%), where rapid digitalization of beauty retail, younger demographics, and strong affinity for innovative skincare drive expansion. In China, e-commerce platforms and influencer-led marketing are central to adoption, while in India, the fusion of cryo-emulsification with Ayurvedic and herbal positioning has made it more relatable to local consumers. Japan (16.6%) is another key growth market, where demand is rooted in the pursuit of functional anti-aging and skin-tightening products. The country’s mature consumer base values clinical-grade skincare, making cryo-emulsified serums and creams highly attractive in premium channels.

In Europe, growth is steady, with the UK (14.0%) and Germany (10.5%) playing central roles. Consumers in these markets place a premium on sustainability, ingredient transparency, and dermatologist-tested claims, aligning well with cryo-emulsification’s clinical and clean-label positioning. Specialty beauty stores and pharmacy-led distribution remain particularly strong. North America, led by the USA (9.3%), reflects moderate growth, with adoption anchored by luxury skincare brands and clinical-grade formulations. While the USA remains a large market in absolute terms, its slower growth compared to Asia-Pacific reflects market maturity and higher consumer saturation in premium skincare categories. However, digital-native brands leveraging clean-label and vegan cryo products are creating new opportunities within niche segments.

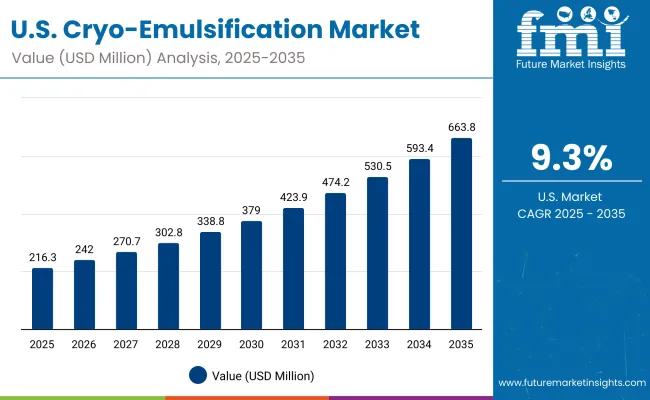

| Year | USA Cryo-Emulsification Market (USD Million) |

|---|---|

| 2025 | 216.38 |

| 2026 | 242.05 |

| 2027 | 270.76 |

| 2028 | 302.88 |

| 2029 | 338.81 |

| 2030 | 379.01 |

| 2031 | 423.97 |

| 2032 | 474.27 |

| 2033 | 530.53 |

| 2034 | 593.47 |

| 2035 | 663.88 |

The Cryo-Emulsification Market in the United States is projected to expand steadily through 2035, driven by rising consumer preference for clinical-grade and dermatologist-tested skincare. Growth is anchored in the premium skincare space, where cryo-serums and creams are marketed as advanced anti-aging and skin-tightening solutions. The USA market also benefits from strong adoption in spas, professional clinics, and specialty beauty retailers, where cryo-emulsification is positioned as a high-performance treatment.

At the same time, e-commerce platforms and subscription-based services are expanding access to cryo-products, especially among millennials and Gen Z, who prioritize vegan, clean-label, and sustainable skincare attributes. Competitive intensity is shaped by luxury global players such as Lancôme and La Prairie, alongside niche USA brands that emphasize eco-conscious sourcing and functional efficacy.

The Cryo-Emulsification Market in the United Kingdom is expected to grow steadily through 2035, supported by increasing consumer demand for premium, science-backed skincare solutions. Growth is particularly strong in anti-aging and skin tightening categories, where cryo-emulsified serums and creams are positioned as high-performance treatments with clinical-grade validation. UK consumers are highly receptive to products that combine efficacy with clean-label and sustainable sourcing attributes, making bamboo-derived and vegan cryo-formulations appealing across both luxury and mid-market brands.

Distribution is shaped by a balance between specialty beauty retailers, pharmacies, and spas, with e-commerce accelerating reach, especially among younger demographics. Brands leverage digital marketing and subscription services to capture loyalty, while professional clinics continue to position cryo-products as part of advanced treatment routines. Regulatory emphasis on ingredient transparency and sustainability standards is further reinforcing brand strategies that highlight eco-conscious sourcing.

India is witnessing rapid growth in the Cryo-Emulsification Market, driven by rising awareness of advanced skincare solutions and a strong cultural preference for natural and herbal-based beauty products. Cryo-emulsification is being integrated into skin tightening, anti-aging, and brightening ranges, making it relevant across both premium and mass-market consumer groups. The appeal is particularly strong among urban consumers seeking dermatologist-tested and clinical-grade products, while younger demographics are increasingly drawn to clean-label and vegan cryo-formulations.

Growth is no longer limited to metropolitan areas. Tier-2 and tier-3 cities are emerging as demand hubs, supported by e-commerce platforms and affordable product launches by regional and domestic brands. Local players are positioning cryo-emulsification within Ayurvedic-inspired product lines, blending modern cosmetic science with traditional wellness narratives. At the same time, international brands are expanding retail partnerships to capture aspirational buyers who associate cryo-skincare with premium global trends.

The Cryo-Emulsification Market in China is expected to record the fastest growth among leading economies, reflecting strong consumer demand for advanced skincare and the rapid expansion of digital retail ecosystems. E-commerce dominates distribution, supported by platforms such as Tmall, JD.com, and Douyin, where cryo-serums, creams, and gels are promoted through livestreaming, influencer partnerships, and subscription models. This digital-first retail infrastructure enables both global luxury players and local innovators to scale quickly.

Chinese consumers are particularly receptive to clinical-grade and performance-driven skincare, making cryo-emulsification highly attractive in anti-aging, tightening, and enhanced absorption formulations. At the same time, affordable offerings by domestic brands are broadening accessibility, ensuring penetration across both urban and regional markets. Sustainability and vegan claims are also resonating strongly with younger demographics, creating opportunities for brands to differentiate through clean-label positioning.

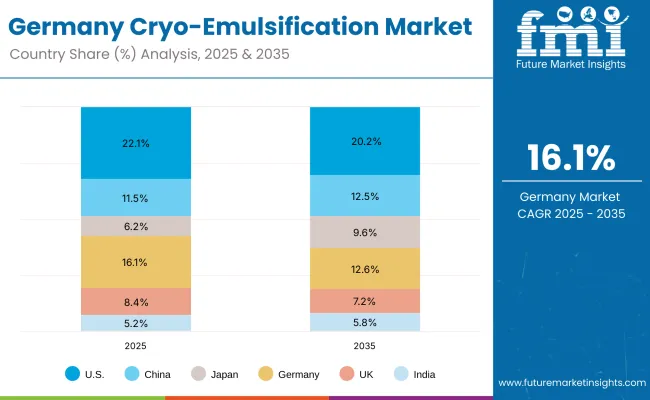

| Countries | 2025 Share (%) |

|---|---|

| USA | 22.1% |

| China | 11.5% |

| Japan | 6.2% |

| Germany | 16.1% |

| UK | 8.4% |

| India | 5.2% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.2% |

| China | 12.5% |

| Japan | 9.6% |

| Germany | 12.6% |

| UK | 7.2% |

| India | 5.8% |

Germany represented 16.1% of the global Cryo-Emulsification Market in 2025, with its share projected to decline slightly to 12.6% by 2035 as faster growth is captured in Asia-Pacific. Despite this relative moderation, Germany remains a critical European hub, shaped by strong consumer trust in dermatologist-tested and clinical-grade formulations. The country’s stringent EU-driven standards for cosmetic safety and ingredient transparency reinforce demand for cryo-emulsified skincare positioned around efficacy, safety, and sustainability.

German consumers show a clear preference for skin tightening and anti-aging functions, particularly in creams and serums marketed as high-performance, science-backed solutions. Specialty beauty retailers and pharmacies dominate distribution, with e-commerce gaining traction among younger consumers seeking convenience and niche brands. International luxury brands such as Lancôme and La Prairie continue to expand their portfolios, while local players emphasize eco-label certifications and sustainable packaging as key differentiators.

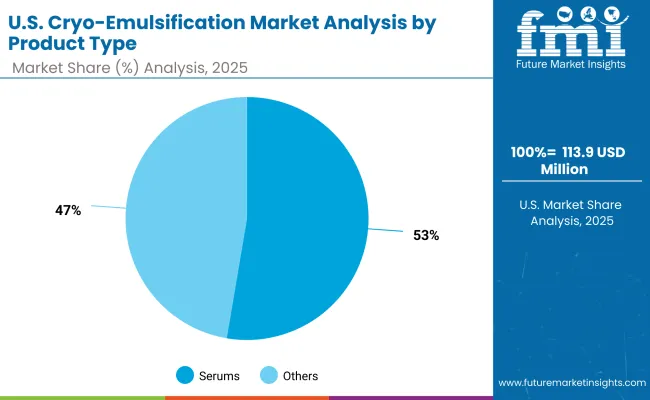

| USA by Product Type | Value Share% 2025 |

|---|---|

| Serums | 52.7% |

| Others | 47.3% |

The Cryo-Emulsification Market in the United States is expected to expand steadily, supported by strong consumer adoption of serums, which account for 52.7% of revenues in 2025. Serums are favored for their high concentration, fast absorption, and targeted delivery of cryo-actives, especially in anti-aging and skin-tightening applications. This aligns with USA consumer demand for visible results and premium formulations, where clinical-grade and dermatologist-tested claims play a decisive role in purchase decisions.

The others category (47.3%), including creams, gels, and mists, continues to hold relevance in daily-use skincare routines, with particular traction in hydration and cooling-effect segments. Distribution is shaped by a mix of specialty beauty retailers, pharmacies, and growing e-commerce, where subscription-based services and influencer-led promotions accelerate penetration. As sustainability gains importance, USA consumers are also showing increased interest in vegan and clean-label cryo-products, creating opportunities for both luxury and emerging digital-native brands.

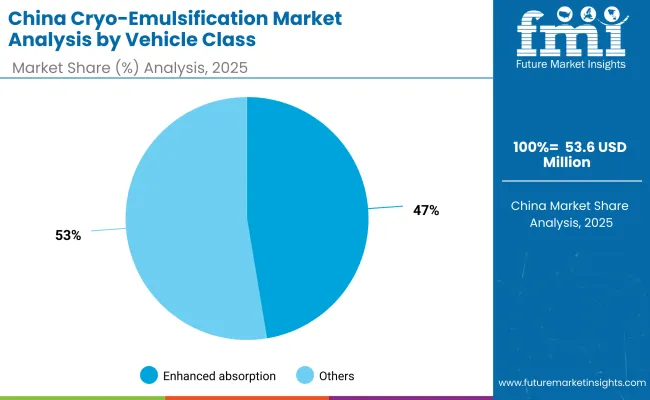

| China by Function | Value Share% 2025 |

|---|---|

| Enhanced absorption | 47.4% |

| Others | 52.6% |

In 2025, enhanced absorption accounts for 47.4% of Cryo-Emulsification Market revenues in China, positioning it as one of the most significant functional opportunities. Chinese consumers place high value on fast-acting and high-efficacy skincare, making enhanced absorption claims a strong differentiator. Serums and gels featuring cryo-emulsified actives are particularly well-received, as they combine immediate sensorial benefits with visible improvements in hydration, skin tightening, and anti-aging.

China also presents substantial opportunities for brands to scale through digital-first retail ecosystems. Platforms like Tmall, JD.com, and Douyin amplify reach through livestreaming, influencer campaigns, and subscription models, helping both global luxury brands and domestic innovators penetrate quickly. Younger demographics are driving adoption of vegan and clean-label cryo-formulations, while premium buyers increasingly prioritize clinical-grade credibility. Together, these dynamics make China the most attractive growth hub for cryo-emulsification globally, with opportunities spanning both mass-market expansion and high-end premium positioning.

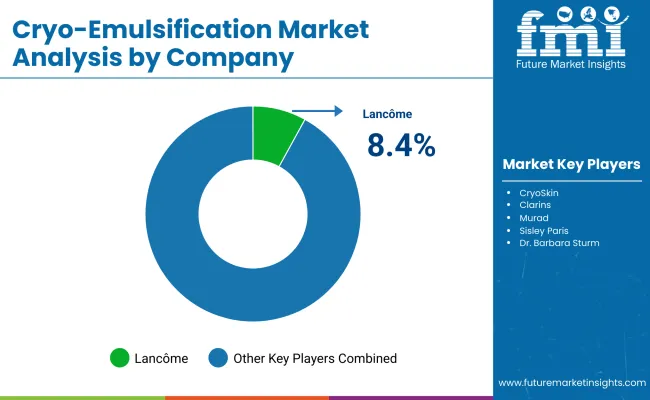

| Company | Global Value Share 2025 |

|---|---|

| Lancôme | 8.4% |

| Others | 91.6% |

The Cryo-Emulsification Market is moderately fragmented, with global luxury leaders, established skincare houses, and niche innovators competing for market share. In 2025, Lancôme accounts for 8.4% of global revenues, while the remaining 91.6% is distributed across premium and clinical-grade players such as Clarins, Murad, Sisley Paris, Dr. Barbara Sturm, 111Skin, BiologiqueRecherche, La Prairie, Elemis, and CryoSkin.

Global leaders like Lancôme and La Prairie leverage their strong distribution through specialty beauty stores, pharmacies, and high-end e-commerce platforms. Their strategies emphasize premium cryo-serums and creams supported by clinical validation, anti-aging claims, and sustainability-led narratives. Mid-sized innovators such as Murad, Clarins, and 111 Skin compete by offering targeted solutions, often integrating cryo-emulsification into dermatologist-tested and clean-label product lines. Their agility in product launches and collaborations with professional clinics help them capture share in both retail and spa-based channels.

Niche-focused brands including CryoSkin and BiologiqueRecherche specialize in positioning cryo-emulsified products within professional-grade treatments and spa ecosystems, where credibility and visible results are paramount. Their strength lies in personalization, eco-conscious sourcing, and regional adaptability rather than global scale.

Competitive differentiation is shifting from brand prestige alone to credibility, sustainability, and digital engagement. Companies that combine clinical-grade positioning with strong online visibility and eco-conscious innovation are best placed to consolidate growth in the coming decade.

Key Developments in Cryo-Emulsification Market

| Item | Value |

|---|---|

| Quantitative Units | USD 981.2 Million |

| Function | Skin tightening, Anti-aging, Cooling effect, Brightening |

| Product Type | Serums, Creams, Gels, Mists |

| Channel | Specialty beauty stores, Pharmacies, E-commerce, Spas/professional clinics |

| Claim | Dermatologist-tested, Clinical-grade, Vegan, Clean-label |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CryoSkin, Lancôme, Clarins, Murad, Sisley Paris, Dr. Barbara Sturm, 111Skin, Biologique Recherche, La Prairie, Elemis |

| Additional Attributes | Dollar sales by product type and claim category, adoption trends in skin tightening, anti-aging, cooling, and brightening formulations, rising demand for clinical-grade and dermatologist-tested skincare, sector-specific growth in e-commerce, specialty beauty stores, pharmacies, and spas/professional clinics, segmentation by natural, vegan, and clean-label claims, integration with wellness and holistic beauty trends, regional growth patterns shaped by Asia-Pacific expansion and European sustainability standards, and innovations in cryo -serums, cryo -gels, and advanced emulsification techniques for enhanced absorption and long-lasting efficacy. |

The global Cryo-Emulsification Market is estimated to be valued at USD 981.2 million in 2025.

The market size for the Cryo-Emulsification Market is projected to reach USD 3,286.2 million by 2035.

The Cryo-Emulsification Market is expected to grow at a 12.8% CAGR between 2025 and 2035.

The key product types in the Cryo-Emulsification Market are serums, creams, gels, and mists. Among these, serums lead the market with 49.5% share in 2025, owing to their concentrated formulations, faster absorption, and strong alignment with cryo-active delivery.

In terms of functional segmentation, skin tightening products are expected to contribute significantly in 2025, holding 46.5% of market share. Their popularity is driven by strong demand for non-invasive, high-performance solutions that deliver visible firming and anti-aging results.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA