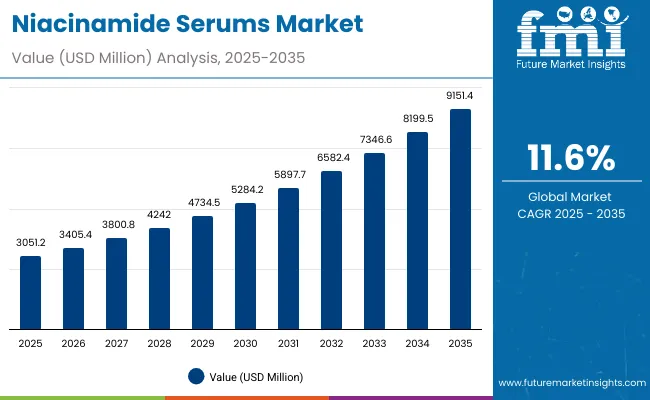

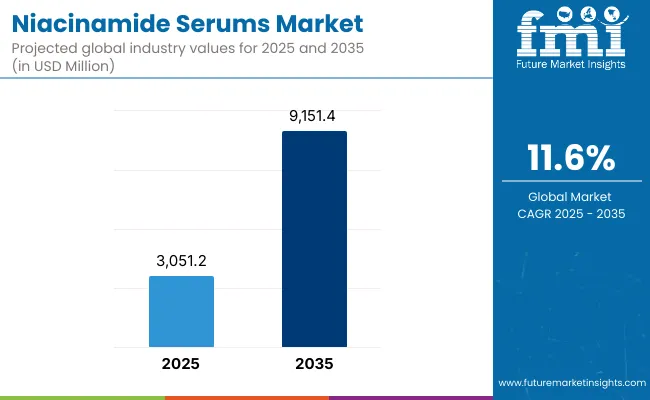

The Niacinamide Serums Market is projected to reach a valuation of USD 3,051.20 Million in 2025 and expand significantly to USD 9,151.40 Million by 2035. This growth marks an increase of more than USD 6,100 Million over the period, representing nearly a 200% expansion. The market is anticipated to record a CAGR of 11.60% during 2025-2035, reflecting rising adoption of active-driven skincare and consistent integration into daily beauty routines.

Niacinamide Serums Market Key Takeaways

| Metric | Value |

|---|---|

| Niacinamide Serums Market Estimated Value in (2025E) | USD 3,051.20 Million |

| Niacinamide Serums Market Forecast Value in (2035F) | USD 9,151.40 Million |

| Forecast CAGR (2025 to 2035) | 11.60% |

From 2025 to 2030, the market is expected to move upward from USD 3,051.20 Million to USD 5,284.20 Million, delivering USD 2,233.00 Million in additional value, which equals around 36% of the total decade growth. This period is likely to be defined by the mainstreaming of dermatologist-backed education, sustained uptake of mid-strength formulations, and increased credibility of niacinamide in addressing oil control and barrier health.

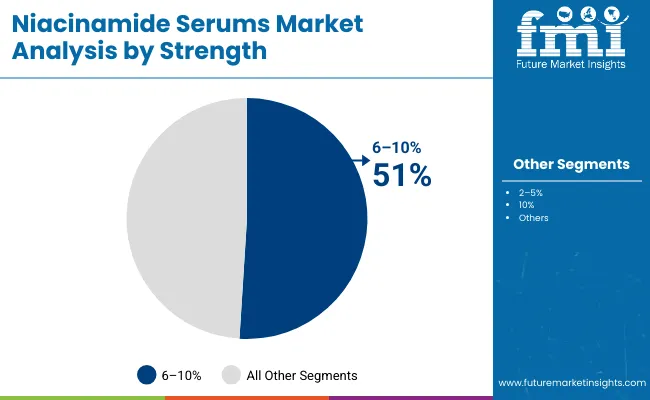

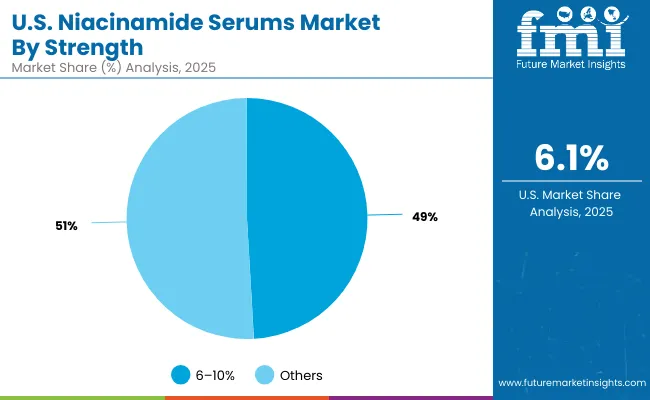

The 6-10% concentration segment, valued at USD 1,556.11 Million with a 51.00% share in 2025, is expected to lead adoption as performance-driven efficacy continues to influence purchase decisions.

The second half, spanning 2030 to 2035, is set to drive accelerated growth, adding nearly USD 3,867.20 Million, which equates to 64% of total decade gains. Market value is expected to climb from USD 5,284.20 Million to USD 9,151.40 Million during this phase, as cross-category bundling, e-commerce subscriptions, and strong Asian market penetration enhance uptake.

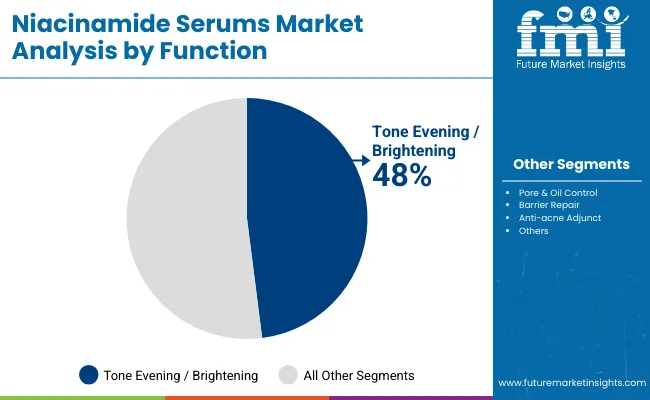

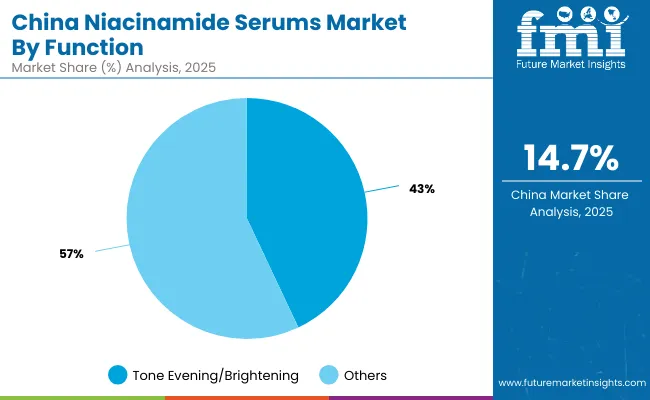

Functional leadership is projected to remain with tone-evening and brightening, valued at USD 1,464.58 Million with 48.00% share in 2025, while online channels are expected to strengthen their dominance through superior content and replenishment models.

From 2020 to 2024, steady momentum was observed as awareness around active ingredients and dermatologist-driven formulations expanded the category base. During this phase, credibility and efficacy were emphasized, with brands leveraging clinical storytelling and social commerce to reinforce trust.

By 2025, demand is projected to accelerate to USD 3,051.20 Million, and a structural shift is expected through the forecast horizon. Growth is projected to be driven by mid-strength serums, particularly 6-10% concentrations, which are forecast to dominate usage due to perceived efficacy and balanced tolerance.

By 2035, the market is anticipated to surpass USD 9,151.40 Million, with the revenue mix increasingly shaped by digital-first distribution models, subscription-led replenishment, and cross-category bundling. Competitive advantage is expected to move beyond basic formulation innovation toward ecosystem strength, dermatologist partnerships, and oMillioni-channel strategies.

Established leaders are expected to adapt by scaling refillable formats, strengthening clinical validation, and tailoring products to sensitive-skin users. Digital-native entrants are anticipated to disrupt by integrating AI-driven personalization, social commerce campaigns, and community-based engagement, accelerating adoption across younger demographics.

Growth in the Niacinamide Serums Market is being fueled by rising consumer awareness of science-backed skincare and dermatologist-endorsed formulations. Increasing preference for active ingredients with proven multifunctional benefits has positioned niacinamide as a trusted choice for concerns such as tone evening, oil control, and barrier support.

Mid-strength formulations in the 6-10% range are being favored for their balance of efficacy and tolerance, leading adoption across global markets. Expansion of e-commerce platforms has enabled broader reach, supported by digital education, influencer advocacy, and subscription-led replenishment models.

Demand is also being amplified by younger demographics seeking preventive solutions and sensitive-skin users drawn to fragrance-free, vegan, and dermatologist-tested claims. Regional growth is being accelerated by strong uptake in Asia, particularly China and India, where double-digit CAGRs are projected. Future gains are expected to be reinforced by innovations in texture, microbiome-friendly formulations, and clean-label positioning, sustaining long-term category momentum.

The Niacinamide Serums Market is segmented across strength, function, and format, each reflecting distinct consumer priorities and usage patterns. Strength-based segmentation highlights concentration levels that shape efficacy perception and tolerance among different skin types. Function-based categories are determined by key benefits such as tone-evening and barrier support, driving adoption across consumer demographics.

Format segmentation further illustrates evolving preferences, with texture and absorption properties guiding purchase decisions across e-commerce and pharmacy-led channels. Together, these segments provide a comprehensive view of how the market is structured and where future opportunities are expected to unfold.

Deeper insights into leading sub-segments indicate that efficacy-driven concentrations, brightening outcomes, and water-based textures are expected to retain dominance while adapting to regional preferences and evolving clean-label demands.

| Segment | Market Value Share, 2025 |

|---|---|

| 6-10% | 51% |

| Others | 49.0% |

The 6-10% strength segment is expected to dominate with a 51% value share in 2025, equivalent to USD 1,556.11 Million. This concentration is favored for its strong balance of efficacy and skin tolerance, making it widely accepted across diverse consumer bases. Growing dermatologist recommendations and clinical backing are expected to reinforce its adoption, particularly among performance-driven users.

Entry-level concentrations are expected to attract sensitive-skin consumers, but mid-strength products are projected to sustain leadership by delivering visible results within short usage cycles. Over time, broader education on active tolerance is expected to further consolidate the dominance of this category.

| Segment | Market Value Share, 2025 |

|---|---|

| Tone evening/brightening | 48% |

| Others | 52.0% |

Tone-evening and brightening functions are anticipated to lead with a 48% share in 2025, representing USD 1,464.58 Million in value. This function appeals strongly to consumers seeking uniformity and clarity in skin tone, making it the most recognized benefit of niacinamide serums. Regional demand is expected to be especially high in Asia, where hyperpigmentation and uneven tone concerns drive adoption.

Continuous integration of niacinamide into daily routines alongside sunscreens and moisturizers is projected to expand usage frequency. Growth will also be supported by rising consumer confidence in active-led solutions backed by visible outcomes and scientific validation. As routines become more targeted, tone-evening claims are expected to remain central to brand messaging and category expansion.

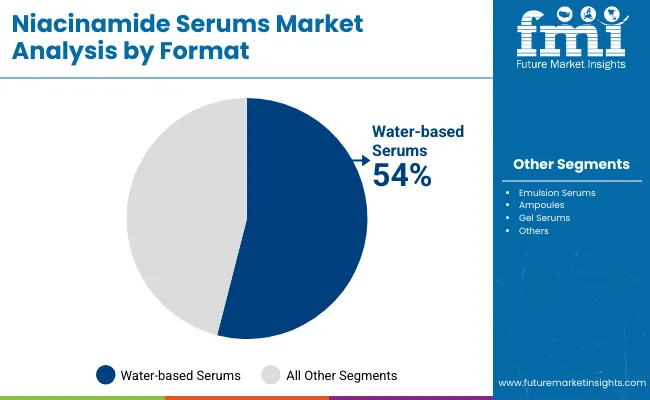

| Segment | Market Value Share, 2025 |

|---|---|

| Water-based serums | 54% |

| Others | 46.0% |

Water-based serums are expected to command the largest share, with 54% in 2025, valued at USD 1,647.65 Million. Their lightweight texture and ease of layering within multi-step routines make them highly preferred by both new and experienced users. Faster absorption and compatibility with diverse skin types have positioned this format as the most versatile choice.

Digital-led awareness campaigns and influencer advocacy are expected to accelerate penetration across e-commerce channels. Broader appeal is also being reinforced by the ability of water-based serums to combine seamlessly with complementary actives, enhancing their perceived effectiveness. As consumers prioritize efficacy, convenience, and layering flexibility, water-based serums are projected to remain the leading choice throughout the forecast horizon.

The Niacinamide Serums Market is being shaped by a mix of supportive and limiting dynamics, as increasing reliance on clinically validated actives is contrasted by formulation challenges, regulatory scrutiny, and shifting consumer expectations for authenticity and sustainability.

Clinical-backed Efficacy Elevating Consumer Trust

Market momentum is being accelerated by the growing weight placed on clinical validation, peer-reviewed trials, and dermatologist endorsement. Consumers are increasingly influenced by verifiable outcomes rather than generic marketing claims, which has elevated niacinamide to a status of scientific credibility in skincare.

As long-term efficacy data continue to be released and peer channels such as dermatology forums reinforce confidence, adoption rates are expected to rise further. This dynamic is positioning niacinamide not only as a treatment ingredient but also as a preventive solution, embedding it into broader daily routines.

Digital Commerce Ecosystems Redefining Growth Pathways

The structural expansion of digital commerce ecosystems is reshaping distribution and consumer interaction models. Algorithms are tailoring product discovery, while subscription-led replenishment is embedding serums into habitual purchase cycles. Social commerce is introducing dermatologist-led live sessions and consumer testimonials, turning product education into interactive experiences.

This shift is expected to compress decision-making timelines and accelerate repeat purchase rates, while simultaneously creating opportunities for smaller entrants to bypass traditional retail hierarchies. The trend indicates that digital-first ecosystems will be as critical as formulation innovations in defining competitive success.

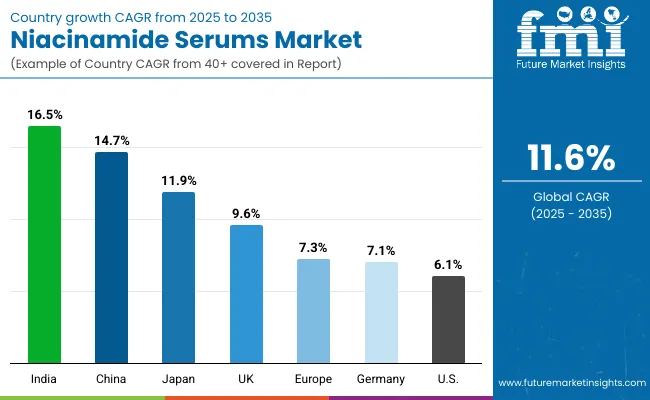

| Country | CAGR |

|---|---|

| China | 14.7% |

| USA | 6.1% |

| India | 16.5% |

| UK | 9.6% |

| Germany | 7.1% |

| Japan | 11.9% |

The global Niacinamide Serums Market demonstrates significant variation in adoption patterns across countries, shaped by consumer preferences, dermatological practices, and digital distribution maturity. Distinct growth dynamics are anticipated, with emerging economies leading expansion through younger demographics and digital-first strategies, while developed regions are expected to maintain steady momentum through premiumization and established retail ecosystems.

India is projected to record the fastest growth with a CAGR of 16.5% from 2025 to 2035. Expansion in this market is expected to be propelled by rising middle-class spending power, strong uptake of masstige offerings, and increasing preference for multifunctional skincare solutions. Localized digital platforms and marketplace-led penetration are anticipated to reinforce this momentum. China, with a CAGR of 14.7%, is expected to benefit from the heightened demand for brightening and tone-evening solutions, with cross-category bundling and KOL-driven digital engagement accelerating acceptance.

Japan is forecast to advance at 11.9% CAGR, supported by sensitive-skin framing and trusted pharmacy distribution models. The UK and Germany, at 9.6% and 7.1% respectively, are expected to maintain robust adoption as clean-label, fragrance-free, and dermatologist-tested claims align with consumer priorities. The USA is projected to expand at a moderate 6.1% CAGR, reflecting market maturity, though growth is expected to be sustained through subscription-driven e-commerce and refillable packaging innovations. Collectively, these key countries illustrate a dual-track growth outlook, where Asia drives acceleration while Western markets consolidate value through premium credibility and channel diversification.

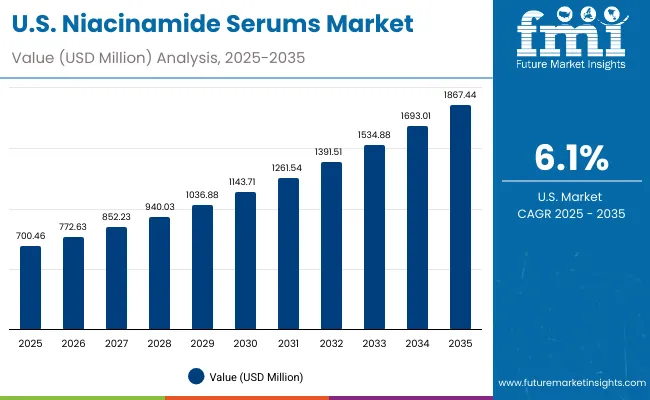

| Year | USA Niacinamide Serums Market (USD Million) |

|---|---|

| 2025 | 700.46 |

| 2026 | 772.63 |

| 2027 | 852.23 |

| 2028 | 940.03 |

| 2029 | 1036.88 |

| 2030 | 1143.71 |

| 2031 | 1261.54 |

| 2032 | 1391.51 |

| 2033 | 1534.88 |

| 2034 | 1693.01 |

| 2035 | 1867.44 |

The Niacinamide Serums Market in the United States is projected to grow at a CAGR of 11.6% from 2025 to 2035, expanding steadily on the back of rising demand for clinically validated skincare solutions. Growth will be reinforced by expanding consumer trust in dermatologist-endorsed formulations, alongside the scaling of e-commerce subscription models that embed serums into recurring skincare regimens.

The first half of the forecast window (2025 to 2030) is expected to witness a steady climb, reaching USD 1,143.71 million by 2030, with growth shaped by stronger adoption of mid-strength formulations and wider pharmacy availability. The second phase (2030 to 2035) is anticipated to accelerate further, adding over USD 700 million in incremental value. Market penetration is expected to deepen among teen and young adult users, supported by targeted influencer-driven campaigns and clean-label claims.

The Niacinamide Serums Market in the UK is projected to grow at a CAGR of 9.6% between 2025 and 2035, reflecting strong momentum within premium skincare categories. Expansion is expected to be supported by rising adoption of fragrance-free, dermatologist-tested, and clean-label formulations that align with evolving consumer values.

Pharmacy-led distribution channels are anticipated to maintain trust-driven dominance, while e-commerce penetration is set to accelerate due to digital-first campaigns. Mid-strength serums are expected to attract repeat purchases as efficacy and tolerance balance become consumer priorities.

The Niacinamide Serums Market in India is forecast to expand at a CAGR of 16.5% from 2025 to 2035, making it the fastest-growing country in this category. Growth is expected to be anchored by rising middle-class spending power, strong masstige adoption, and digital-first purchasing behavior. Marketplace platforms are projected to drive wider accessibility, while younger demographics are expected to accelerate trial adoption. Increasing demand for multifunctional skincare is anticipated to reinforce niacinamide as a preferred active ingredient.

The Niacinamide Serums Market in China is anticipated to grow at a CAGR of 14.7% over the forecast horizon, supported by robust demand for brightening and tone-evening formulations. Social commerce ecosystems are projected to shape category expansion, with key opinion leaders (KOLs) and live-streaming platforms driving awareness and conversion. Premium positioning is expected to benefit from rising disposable income and preference for clinical claims, while localized innovation will further tailor demand.

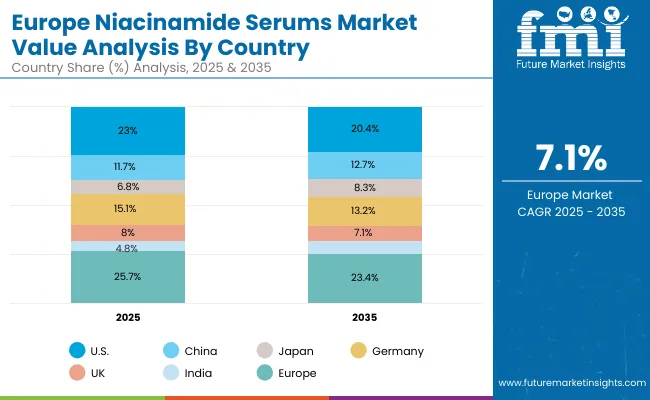

| Country | 2025 |

|---|---|

| USA | 23.0% |

| China | 11.7% |

| Japan | 6.8% |

| Germany | 15.1% |

| UK | 8.0% |

| India | 4.8% |

| Country | 2035 |

|---|---|

| USA | 20.4% |

| China | 12.7% |

| Japan | 8.3% |

| Germany | 13.2% |

| UK | 7.1% |

| India | 5.8% |

The Niacinamide Serums Market in Germany is projected to expand at a CAGR of 7.1% from 2025 to 2035, reflecting steady adoption supported by consumer trust in pharmacy-driven retail. Growth is expected to be reinforced by dermatologist-tested and sensitive-skin claims, aligning with the country’s preference for safety-led skincare. Digital adoption is anticipated to expand gradually, complementing traditional retail distribution. Mid-strength formulations are expected to remain prominent due to balanced efficacy and tolerability.

| Segment | Market Value Share, 2025 |

|---|---|

| 6-10% | 49% |

| Others | 50.8% |

The Niacinamide Serums Market in the United States is projected at USD 700.46 million in 2025. The “Others” category contributes 50.8% share, valued at USD 355.83 million, while the 6-10% concentration segment holds 49% share, worth USD 344.63 million. This marginal lead for lower and diversified concentrations reflects the broader consumer preference for accessible formulations, particularly among sensitive-skin users and early adopters. The strong presence of mid-strength serums highlights the importance of efficacy-led positioning, supported by dermatologist endorsements and visible results within short usage cycles.

Shifts in consumer awareness are expected to reinforce future demand for mid-strength serums, especially as education around active tolerance becomes widespread. At the same time, lower strengths are anticipated to act as an entry point for new consumers, driving market inclusivity. Competitive strategies are likely to focus on bundling niacinamide with complementary actives such as hyaluronic acid and ceramides to strengthen consumer trust and routine integration.

| Segment | Market Value Share, 2025 |

|---|---|

| Tone evening/brightening | 43% |

| Others | 57.0% |

The Niacinamide Serums Market in China is projected at USD 358.01 million in 2025. Within this, tone-evening and brightening functions are expected to account for 43% share, valued at USD 153.95 million, while other multifunctional uses hold the majority at 57% share, worth USD 204.07 million. This indicates that while brightening remains a key consumer driver, the category’s depth is being expanded by secondary benefits such as barrier repair, oil regulation, and acne support.

The prominence of brightening reflects cultural emphasis on even skin tone and radiance, which has long influenced beauty purchasing behavior. However, broader skincare goals are gaining attention, supported by increased consumer education and cross-category bundling strategies. Digital platforms and KOL-driven marketing are expected to strengthen functional diversification, creating room for expanded claims. As formulation sophistication increases, multifunctional serums are anticipated to outpace category averages, while tone-evening retains a stable leadership position in perception.

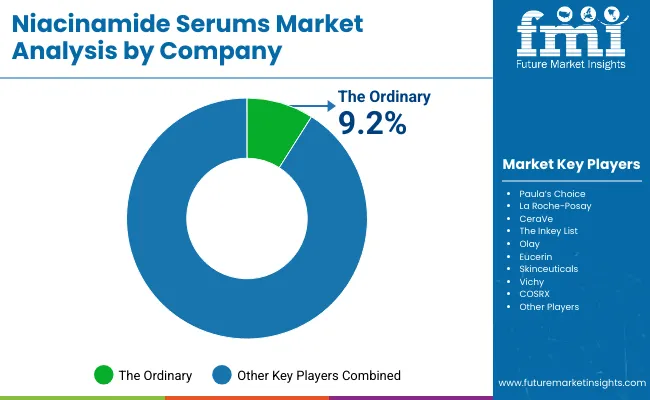

| Company | Global Value Share 2025 |

|---|---|

| The Ordinary | 9.2% |

| Others | 90.8% |

The Niacinamide Serums Market is moderately fragmented, with established leaders, mid-sized skincare innovators, and niche-focused brands competing across varied consumer segments. Leading global brand The Ordinary is recognized as the dominant player, holding a 9.2% global market share in 2025, reflecting its strong positioning in affordable, science-backed formulations.

This leadership is reinforced by the brand’s minimalist approach, transparent ingredient disclosures, and broad digital reach, which have collectively created high consumer trust. Based on trajectory, The Ordinary’s share in 2024 is estimated at slightly above 9%, confirming its role as the top competitor in the global category.

Beyond The Ordinary, the market is shared by diversified brands such as Paula’s Choice, La Roche-Posay, CeraVe, Olay, The Inkey List, Eucerin, Skinceuticals, Vichy, and COSRX. These companies are not only correct representatives of this market but are also expected to shape the competitive dynamic with their differentiated claims, strong retail networks, and dermatologist endorsements. Mid-sized players are focusing on sensitive-skin narratives, texture innovation, and refillable packaging formats to strengthen consumer loyalty.

Competitive differentiation is shifting toward ecosystems built around clinical proof, subscription-led e-commerce, and cross-category bundling. Digital-first storytelling, interactive education through dermatologists, and clean-label transparency are expected to define leadership in the decade ahead. While fragmentation will persist, value capture will increasingly favor players that combine credibility with scalability, reinforcing the importance of dermatologist validation and oMillioni-channel presence.

Key Developments in Niacinamide Serums Market

| Item | Value |

|---|---|

| Market Value (2025E) | USD 3,051.20 Million |

| Market Forecast Value (2035F) | USD 9,151.40 Million |

| Forecast CAGR (2025 to 2035) | 11.60% |

| Dominant Strength (2025) | 6-10% share |

| Dominant Function (2025) | Tone evening/brightening |

| Dominant Format (2025) | Water-based serums |

| USA Market (2025 → 2035) | USD 700.46 Million → USD 1,867.44 Million |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | USA; China; India; Japan; UK; Germany |

| Channels | E-commerce; Pharmacies/Drugstores; Specialty Beauty Retail; Mass Retail |

| End Users | Unisex; Teen/Young Adult; Sensitive-skin Users; Men’s Grooming |

| Key Companies Profiled | The Ordinary; Paula’s Choice; La Roche-Posay; CeraVe; The Inkey List; Olay; Eucerin; Skinceuticals; Vichy; COSRX |

| Additional Attributes | Evidence-backed claims; subscription e-commerce; sensitive-skin positioning; refillable/clean-label formats; dermatologist endorsements; regional localization |

The global Niacinamide Serums Market is estimated to be valued at USD 3,051.20 Million in 2025.

The market size for the Niacinamide Serums Market is projected to reach USD 9,151.40 Million by 2035.

The Niacinamide Serums Market is expected to grow at an 11.60% CAGR between 2025 and 2035.

The key product types in the Niacinamide Serums Market are water-based serums, emulsion serums, ampoules, and gel serums.

In terms of strength, the 6-10% concentration segment is expected to command a 51.00% share in the Niacinamide Serums Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Niacinamide Formulations Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Niacin and Niacinamide Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Cryo Serums Market Size and Share Forecast Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Aging Serums Market Analysis by Type, Application and Region from 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Caffeine-Infused Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Almond Oil-Based Serums Market Size and Share Forecast Outlook 2025 to 2035

Firming Creams and Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Aging Creams & Serums Market Size and Share Forecast Outlook 2025 to 2035

AI-Formulated Custom Serums Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alpha Hydroxy Acid (AHA) Serums Market Size and Share Forecast Outlook 2025 to 2035

Peptide-Infused Anti-Aging Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA