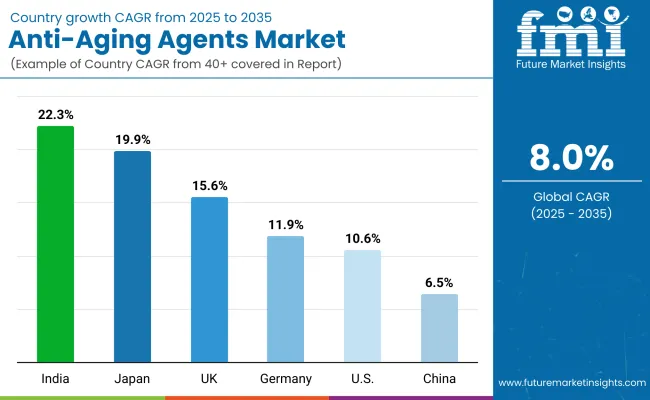

The Anti-Aging Agents Market was valued at USD 5,903.8 million in 2025 and is projected to reach USD 12,802.4 million by 2035. This expansion reflects an increase of USD 6,898.6 million, more than doubling the market size within the period. The overall growth represents a compound annual growth rate of 8.0%, supported by strong adoption of advanced raw materials, novel encapsulation technologies, and biotechnology-derived actives across formulation pipelines.

Anti-Aging Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Aging Agents Market Estimated Value in (2025E) | USD 5,903.8 million |

| Anti-Aging Agents Market Forecast Value in (2035F) | USD 12,802.4 million |

| Forecast CAGR (2025 to 2035) | 8.00% |

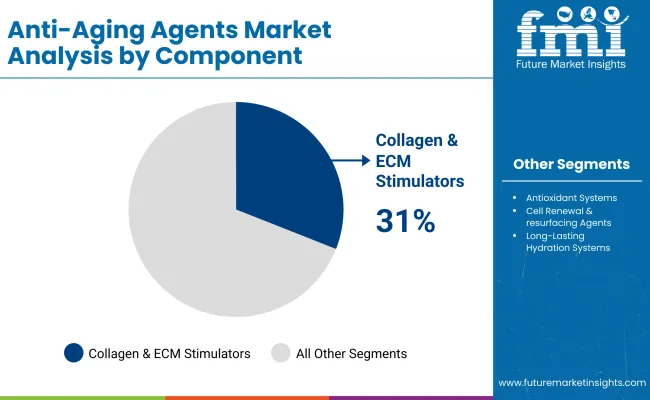

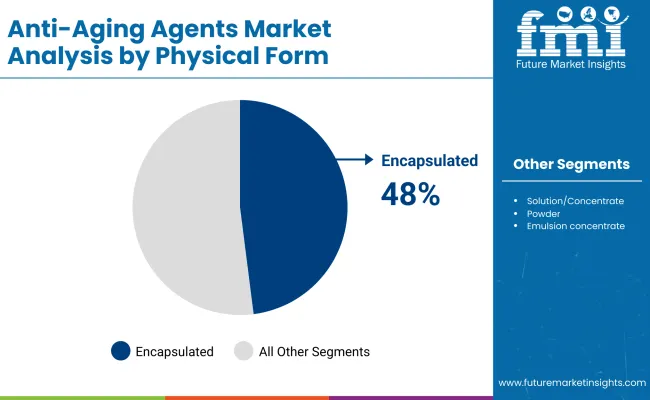

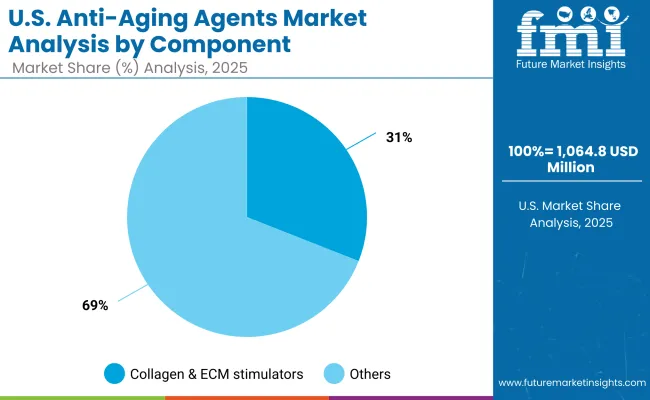

Between 2025 and 2030, the market is expected to rise from USD 5,903.8 million to USD 8,693.8 million, adding USD 2,790.0 million, which accounts for nearly 40% of the total decade gain. This phase is anticipated to be driven by steady uptake of collagen and ECM stimulators, which are forecast to capture 31.0% share in 2025. Encapsulated delivery systems are also expected to dominate with 48.0% share in 2025, as controlled-release technologies enhance performance reliability and consumer-facing claims.

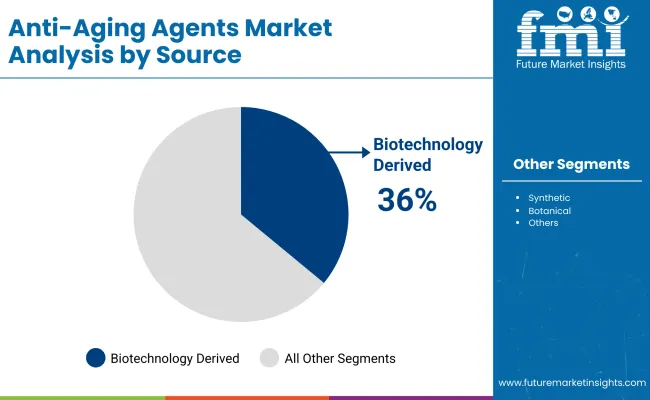

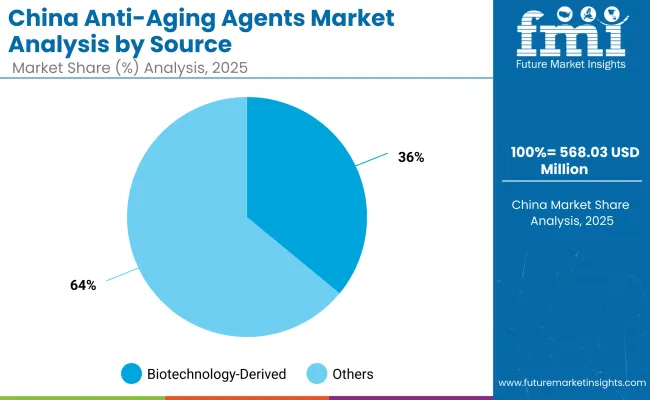

From 2030 to 2035, the market is predicted to accelerate from USD 8,693.8 million to USD 12,802.4 million, adding USD 4,108.6 million, equivalent to more than 60% of decade growth. During this period, biotechnology-derived ingredients are expected to consolidate their position, with a 36.0% share in 2025 and further scaling anticipated as sustainable sourcing and cost-efficient bioprocessing gain traction.

Regional momentum in India, China, and Japan is projected to reinforce supply chain resilience and expand application portfolios, ensuring long-term structural growth of the market.

From 2020 to 2024, the anti-aging agents sector expanded steadily as demand for clinically validated active ingredients intensified across skincare formulations. During this period, biotechnology-derived sources began to gain traction, though conventional synthetic and botanical routes retained the majority share. The competitive space was shaped by ingredient suppliers that focused on dossier strength, traceability, and safety substantiation.

By 2025, market value is projected at USD 5,903.8 million, and further growth to USD 12,802.4 million by 2035 is anticipated. The revenue mix is expected to evolve as encapsulation and advanced delivery technologies capture wider adoption, while biotechnology-derived ingredients are forecast to gain share due to sustainability and scalability. Leading suppliers are likely to reposition portfolios with stronger emphasis on co-development platforms, regulatory-ready actives, and sustainable production models.

Competitive advantage is expected to shift from traditional raw material supply toward integrated ingredient ecosystems, supported by clinical validation, digital traceability, and consistent supply reliability. Emerging players emphasizing biotechnology and encapsulation are projected to gain market relevance, while established multinationals are expected to defend positions through broader pipelines and innovation partnerships.

Growth in the Anti-Aging Agents Market is being supported by heightened demand for clinically validated raw materials that deliver measurable skin benefits. Expansion is being fueled by strong interest in collagen and ECM stimulators, as these ingredients provide structural reinforcement that aligns with long-term skin health claims.

Encapsulation technologies are being adopted widely, as controlled-release mechanisms ensure stability and enhance formulation efficiency. Biotechnology-derived actives are being prioritized, with sustainable production processes and reproducibility standards accelerating acceptance across global supply chains. Rising consumer awareness of preventative skincare is translating into greater demand from formulators, who are under pressure to deliver high-efficacy products with credible safety dossiers.

Regional expansion in Asia, particularly in India, China, and Japan, is driving procurement activity, while established markets in North America and Europe are reinforcing adoption through regulatory readiness and premium brand positioning. Future momentum is expected to be anchored by innovation in delivery systems and biotechnology platforms.

The Anti-Aging Agents Market has been segmented on the basis of mode of action, source, and delivery system. Each category reflects distinct demand drivers, regulatory considerations, and formulation opportunities that are expected to influence procurement strategies over the next decade. Collagen and ECM stimulators are projected to play a vital role in structural skin health, while biotechnology-derived ingredients are anticipated to reshape sourcing practices through sustainable production methods.

Encapsulation technologies are forecast to dominate delivery systems, owing to their ability to enhance stability and extend release profiles. Together, these segments provide a comprehensive view of how ingredient innovation and formulation science are expected to guide the long-term trajectory of the market.

| Mode of Action | Market Value Share, 2025 |

|---|---|

| Collagen & ECM stimulators | 31% |

| Others | 69.0% |

Collagen & ECM stimulators are expected to hold 31.0% share in 2025 (USD 588.9 million), while others will account for 69.0% share (USD 4,073.6 million).The mode of action segment is projected to be driven strongly by collagen and ECM stimulators, as their ability to restore structural support and improve skin resilience is being increasingly emphasized by formulators seeking high-efficacy actives. Strong preference is anticipated for these stimulators due to their established clinical validation and wide compatibility with advanced delivery systems.

Other mechanisms are likely to remain vital in supporting diverse formulation pipelines, ensuring that innovation is spread across antioxidant systems and other specialized actives. Demand is forecast to be reinforced by the need for multifunctional ingredients offering consistent, long-term performance.

| Source | Market Value Share, 2025 |

|---|---|

| Biotechnology-derived | 36% |

| Others | 64.0% |

Biotechnology-derived actives are projected to capture 36.0% share in 2025 (USD 566.7 million), while others are estimated at 64.0% share (USD 3,778.4 million).The source segment is expected to be reshaped by biotechnology-derived actives, with their sustainable production and reproducibility being prioritized by procurement teams as regulatory and environmental considerations intensify.

Demand is projected to rise further as fermentation and bioprocessing routes provide higher quality control and stronger scalability. Other sources are expected to continue supporting market breadth, particularly in regions where conventional sourcing remains cost-competitive.

However, the momentum of biotechnology-derived inputs is anticipated to accelerate as leading suppliers enhance portfolios with robust clinical dossiers, regulatory readiness, and transparent supply chains to meet rising formulator expectations.

| Delivery System | Market Value Share, 2025 |

|---|---|

| Encapsulated | 48% |

| Others | 52.0% |

Encapsulated delivery systems are forecast to secure 48.0% share in 2025 (USD 533.3 million), while others will represent 52.0% share (USD 3,069.9 million).Encapsulated systems are projected to dominate due to their ability to protect sensitive actives, improve stability, and deliver controlled release for enhanced efficacy. Procurement interest is expected to favor suppliers offering high payload efficiency, solvent compatibility, and reproducibility across large-scale production.

Other delivery formats will continue to provide alternatives where cost optimization and faster deployment are prioritized. Nevertheless, encapsulated formats are forecast to remain central in driving premium formulations, as their contribution to claim substantiation and consumer trust continues to expand. Long-term growth is anticipated to be anchored in encapsulation innovations that enhance delivery precision and sensory performance.

Complexity in regulatory compliance and escalating R&D investments are shaping the Anti-Aging Agents Market, even as opportunities are being unlocked through biotechnology-driven ingredients, advanced encapsulation, and sustainability-oriented sourcing strategies that are redefining value creation across B2B formulation ecosystems.

Biotechnology-Enabled Scalability in Ingredient Supply

Scalability through biotechnology platforms is being positioned as a transformative driver of the Anti-Aging Agents Market. Fermentation and bio-engineering processes are expected to replace volatile traditional sourcing channels by ensuring reproducibility, purity, and sustainable yield optimization.

By reducing dependency on agricultural inputs, biotechnology-derived actives are anticipated to stabilize supply chains, mitigate climatic risks, and enhance quality assurance. Procurement teams are increasingly guided by supplier capacity to provide validated documentation, global regulatory readiness, and eco-footprint transparency.

This convergence of sustainability with industrial efficiency is expected to create long-term procurement value, while simultaneously fostering competitive differentiation for suppliers with robust IP portfolios and strategic production alliances.

Regulatory Fragmentation Across Global Markets

Regulatory fragmentation is being observed as a significant restraint, limiting the pace of new ingredient adoption. Divergent standards across North America, Europe, and Asia are requiring suppliers to invest heavily in region-specific dossiers, safety trials, and compliance frameworks. Delays in approval cycles are likely to increase costs and extend commercialization timelines, creating friction for smaller players lacking regulatory infrastructure.

At the same time, heightened scrutiny on microplastics, preservatives, and environmental safety is intensifying documentation requirements, challenging scalability of innovative delivery systems. Without harmonized global frameworks, the operational burden on suppliers is expected to persist, discouraging rapid innovation transfer and slowing adoption of advanced actives.

| Country | CAGR |

|---|---|

| China | 6.5% |

| USA | 10.6% |

| India | 22.3% |

| UK | 15.6% |

| Germany | 11.9% |

| Japan | 19.9% |

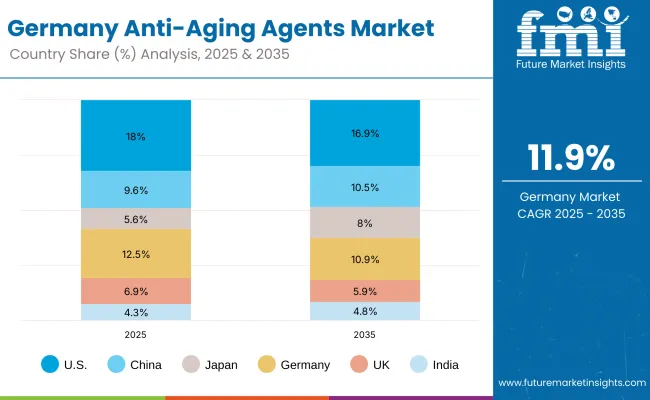

The Anti-Aging Agents Market is expected to display notable variation in growth across countries, reflecting differences in consumer behavior, regulatory maturity, and formulation innovation. India is projected to lead with a CAGR of 22.3% during 2025 to 2035, supported by rising penetration of dermocosmetic products and rapid adoption of biotechnology-derived actives in masstige and premium formulations.

Japan, forecast at 19.9% CAGR, is anticipated to maintain its position as a hub of precision-driven skincare, where consumer expectations for safety, efficacy, and multifunctionality are setting new benchmarks for product development.

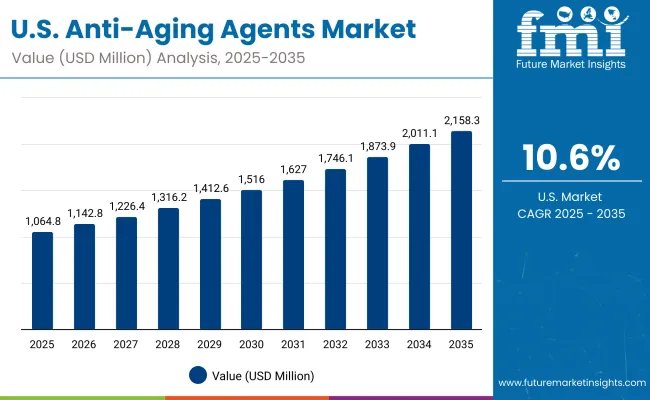

The United Kingdom, expected to grow at 15.6% CAGR, is likely to benefit from strong adoption of encapsulated delivery technologies and regulatory frameworks supporting advanced ingredients. The USA, forecast at 10.6% CAGR, is anticipated to sustain growth through high demand for clinically validated actives, particularly in collagen and ECM stimulation categories.

Germany, projected at 11.9% CAGR, is expected to strengthen Europe’s footprint through its leadership in research-backed formulations and sustainability-led procurement. Europe overall, with a CAGR of 9.3%, is likely to remain a steady contributor, while China, forecast at 6.5% CAGR, is anticipated to rely on biotechnology-driven growth despite relatively slower expansion. Collectively, these dynamics underscore region-specific trajectories shaping the long-term global market outlook.

| Year | USA Anti-Aging Agents Market (USD Million) |

|---|---|

| 2025 | 1,064.85 |

| 2026 | 1,142.80 |

| 2027 | 1,226.46 |

| 2028 | 1,316.25 |

| 2029 | 1,412.61 |

| 2030 | 1,516.02 |

| 2031 | 1,627.00 |

| 2032 | 1,746.10 |

| 2033 | 1,873.93 |

| 2034 | 2,011.11 |

| 2035 | 2,158.34 |

The Anti-Acne Agents Market in the United States is forecast to expand at a CAGR of 7.0% between 2025 and 2035. Growth is expected to be propelled by the rising integration of acne-focused actives into mainstream dermocosmetics, greater reliance on encapsulated delivery systems, and the convergence of professional and consumer skincare categories. Steady regulatory oversight is anticipated to elevate product validation standards, encouraging suppliers to provide clinically supported dossiers. Competitive positioning is likely to favor players with innovation pipelines that balance efficacy, safety, and sustainability.

The UK Anti-Aging Agents Market is projected to expand at a CAGR of 15.6% through 2035, reflecting strong demand for premium formulations supported by regulatory frameworks that prioritize consumer safety and transparency. Growth is expected to be reinforced by adoption of encapsulated delivery systems and biotechnology-derived actives, both of which are aligning with brand innovation strategies.

A rising preference for multifunctional ingredients is anticipated to strengthen procurement for suppliers with robust clinical substantiation. With sustainability positioned as a competitive differentiator, ingredient sourcing transparency is likely to gain prominence.

The India Anti-Aging Agents Market is forecast to grow at a CAGR of 22.3%, making it the fastest-growing market globally. This acceleration is expected to be driven by rapid expansion of dermocosmetics in urban and digital-first retail channels. Demand is anticipated to be guided by rising adoption of biotechnology-derived ingredients, as affordability and scalability continue to improve.

Encapsulation technologies are projected to penetrate masstige and premium categories, delivering higher efficacy and longer-lasting effects. Local manufacturing and cost-efficient sourcing are expected to strengthen market competitiveness, enabling broader access across diverse consumer bases.

The China Anti-Aging Agents Market is projected to expand at a CAGR of 6.5%, indicating a more moderate pace compared to other Asia-Pacific peers. Growth is anticipated to be supported by strong uptake of biotechnology-derived ingredients, reflecting consumer preference for clinically validated, safety-backed actives.

Regulatory alignment with international standards is expected to enhance adoption of advanced delivery technologies. Procurement strategies are likely to emphasize innovation in encapsulation, enabling higher stability and extended release for local and multinational brands operating in the region. Despite slower overall growth, innovation-led product pipelines are forecast to ensure sustainable momentum.

| Country | 2025 |

|---|---|

| USA | 18.0% |

| China | 9.6% |

| Japan | 5.6% |

| Germany | 12.5% |

| UK | 6.9% |

| India | 4.3% |

| Country | 2035 |

|---|---|

| USA | 16.9% |

| China | 10.5% |

| Japan | 8.0% |

| Germany | 10.9% |

| UK | 5.9% |

| India | 4.8% |

The Germany Anti-Aging Agents Market is expected to register a CAGR of 11.9% through 2035, underpinned by strong emphasis on research-backed formulations and adherence to strict regulatory compliance. Growth is forecast to be reinforced by demand for biotechnology-derived ingredients, which are aligned with sustainability and traceability priorities across the European Union.

Encapsulation technologies are projected to drive innovation pipelines, delivering enhanced stability and consumer assurance. With consumer demand shifting toward multifunctional formulations, suppliers offering clinically substantiated, eco-friendly actives are likely to gain competitive advantage. Germany’s leadership in dermocosmetics is expected to position it as a core hub for European expansion.

| USA by Mode of Action | Market Value Share, 2025 |

|---|---|

| Collagen & ECM stimulators | 31% |

| Others | 69.0% |

The Anti-Aging Agents Market in the USA is projected at USD 1,064.85 million in 2025. Collagen and ECM stimulators contribute 31% of market share, while other mechanisms account for 69%, showing a balanced but diversified portfolio of active ingredient strategies. The strong positioning of collagen and ECM stimulators is being shaped by their ability to reinforce structural skin health and by the preference of formulators for well-substantiated, high-efficacy actives.

Other categories, encompassing antioxidant systems and elasticity enhancers, are anticipated to remain critical, ensuring breadth of functionality across consumer-facing formulations. This dual structure highlights that procurement is being guided by both core performance ingredients and broader multifunctional platforms that respond to evolving consumer demands. Regulatory scrutiny in the USA is expected to reinforce reliance on clinically validated ingredients, while innovation pipelines are forecast to strengthen encapsulated formats for superior delivery.

| China by Source | Market Value Share, 2025 |

|---|---|

| Biotechnology-derived | 36% |

| Others | 64.0% |

The Anti-Aging Agents Market in China is projected at USD 568.03 million in 2025. Biotechnology-derived sources are anticipated to represent 36% of the market, while other sources will account for 64%, underscoring the coexistence of advanced bio-based inputs with conventional ingredient platforms. The adoption of biotechnology-derived actives is being accelerated by demand for sustainability, safety, and reproducibility, with formulators increasingly guided by globally aligned regulatory requirements.

Conventional sources are expected to remain dominant due to cost advantages and established consumer familiarity, yet their share is forecast to gradually normalize as bioengineered alternatives scale. Strategic importance is likely to shift toward suppliers able to deliver consistent biotech-based production at industrial scale, supported by evidence-driven dossiers and transparent sourcing practices. The balance of traditional and biotech inputs illustrates the evolving procurement strategies shaping China’s market outlook.

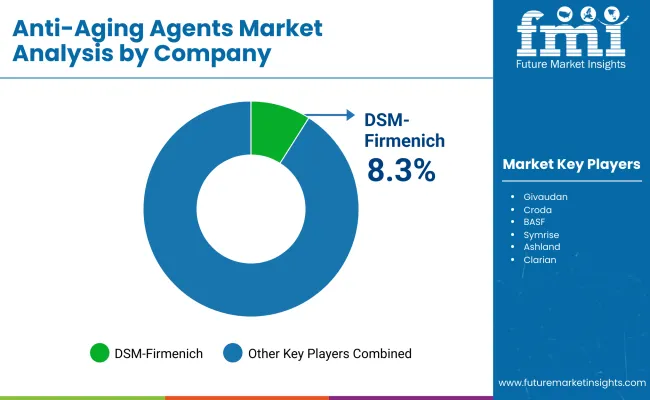

| Company | Global Value Share 2025 |

|---|---|

| DSM-Firmenich | 8.3% |

| Others | 91.7% |

The Anti-Aging Agents Market is moderately consolidated, with global leaders and specialized suppliers competing to strengthen their positions across B2B ingredient portfolios. DSM-Firmenich is recognized as the most influential player, holding an estimated 8.3% of the global market value in 2025, while the remaining 91.7% is distributed among other suppliers. DSM-Firmenich’s leadership is supported by a diversified portfolio of clinically validated actives, biotechnology-driven production capabilities, and long-term partnerships with leading dermocosmetic brands.

Mid-sized companies such as Givaudan, Croda, BASF, Symrise, Ashland, and Clariant are positioned as important challengers, with strong capabilities in specialty actives, encapsulation technologies, and formulation support. Their strategies are expected to emphasize innovation pipelines focused on multifunctionality, sustainability, and regional customization. These suppliers are projected to gain traction by aligning portfolios with regulatory requirements and by scaling sustainable sourcing initiatives.

Niche-focused providers, including Evonik, Seppic, and Lubrizol, are anticipated to compete on customization, technical service, and ingredient differentiation. Their ability to deliver specialized carriers, emollients, and bioactive blends is expected to secure relevance in targeted applications.

Competitive differentiation is forecast to move beyond traditional ingredient supply toward ecosystem-based approaches, where evidence-backed claims, traceability, and co-development partnerships will define long-term advantage.

Key Developments in Anti-Aging Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD 5,903.8 million (2025) - USD 12,802.4 million (2035) |

| Component | Collagen & ECM stimulators, Antioxidant systems, Cell renewal & resurfacing agents, Firming & elasticity enhancers, Long-lasting hydration systems |

| Source | Biotechnology-derived, Synthetic, Botanical, Marine-derived, Others |

| Delivery System | Encapsulated, Free-form, Sustained-release matrix, Anhydrous/powder-to-liquid, Others |

| Physical Form | Encapsulated, Solution/concentrate, Powder, Emulsion concentrate |

| Application | Serums, Creams & lotions, Eye/neck treatments, Masks & patches, Skincare, Sun care, Color cosmetics |

| End-use Industry | Dermocosmetics, Personal care brands, Pharmaceutical skincare, Professional dermatology, Consumer health & wellness |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, China, India, United Kingdom, Germany, Japan, France, Brazil, South Africa |

| Key Companies Profiled | DSM-Firmenich, Givaudan, Croda, BASF, Symrise, Ashland, Clariant, Evonik, Seppic, Lubrizol |

| Additional Attributes | Market expansion driven by biotechnology-derived ingredients, encapsulation technologies, and clinically validated actives; procurement emphasis on regulatory readiness, sustainability, and traceability; country-level growth led by India (22.3% CAGR) and Japan (19.9% CAGR); competitive advantage shifting to suppliers offering innovation pipelines, co-development support, and integrated sustainability metrics |

The global Anti-Aging Agents Market is estimated to be valued at USD 5,903.8 million in 2025, supported by rising demand for clinically validated actives and expanding use of encapsulated delivery systems.

The market size for the Anti-Aging Agents Market is projected to reach USD 12,802.4 million by 2035, reflecting more than a twofold increase over the decade.

The Anti-Aging Agents Market is expected to grow at a CAGR of 8.0% between 2025 and 2035, reflecting strong long-term adoption of biotechnology-derived and encapsulated actives.

The key product types in the Anti-Aging Agents Market include collagen and ECM stimulators, antioxidant systems, cell renewal and resurfacing agents, firming and elasticity enhancers, and long-lasting hydration systems.

In terms of delivery system, the encapsulated segment is expected to command 48.0% share in 2025, supported by superior stability, enhanced bioavailability, and claim substantiation in premium formulations.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA