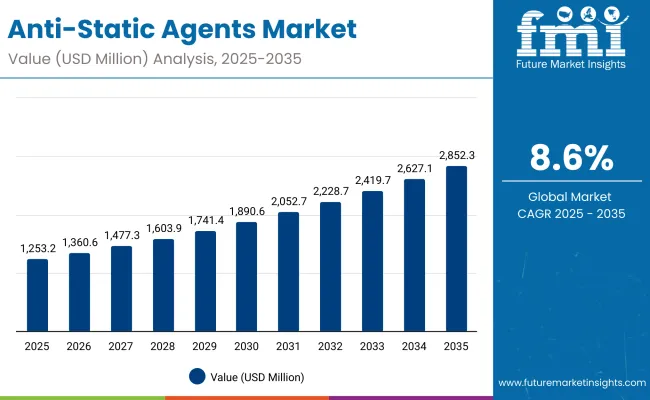

A valuation of USD 1,253.2 million has been projected for the Anti-Static Agents Market in 2025, with expectations that the figure will reach USD 2,852.3 million by 2035. This increase of nearly USD 1,599 million represents an overall expansion of 127% across the decade, equivalent to a CAGR of 8.6%. Growth has been underpinned by steady integration of advanced conditioning systems and performance-driven raw materials in cosmetic and personal care formulations.

Anti-Static Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Static Agents Market Estimated Value in (2025E) | USD 1,253.2 million |

| Anti-Static Agents Market Forecast Value in (2035F) | USD 2,852.3 million |

| Forecast CAGR (2025 to 2035) | 8.6% |

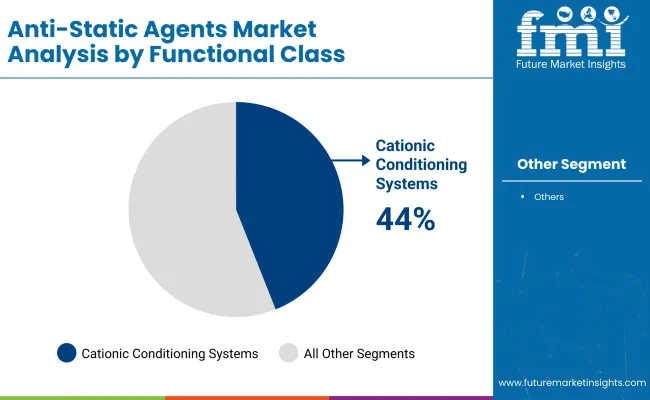

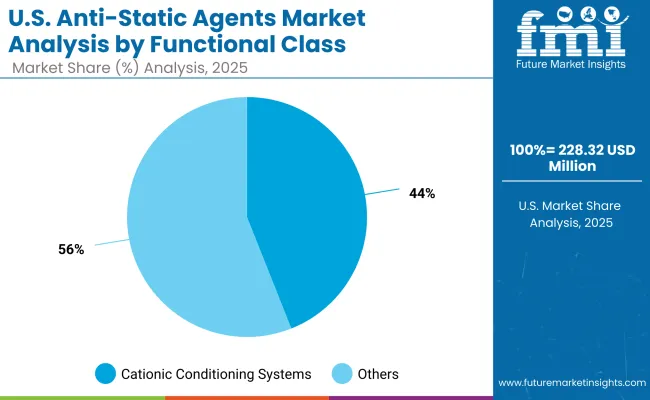

During the first half of the forecast period, from 2025 to 2030, the market is expected to rise from USD 1,253.2 million to USD 1,890.6 million, reflecting an addition of USD 637.4 million. This accounts for 40% of total growth over the decade, reflecting strong demand from hair conditioning and styling formulations. Cationic conditioning systems, with a 44.0% share in 2025, are expected to remain the dominant functional class, supported by widespread use in B2B ingredient supply chains.

The second phase, from 2030 to 2035, is projected to add USD 961.7 million, which represents 60% of overall growth. The market is anticipated to advance from USD 1,890.6 million in 2030 to USD 2,852.3 million in 2035, reflecting faster acceleration.

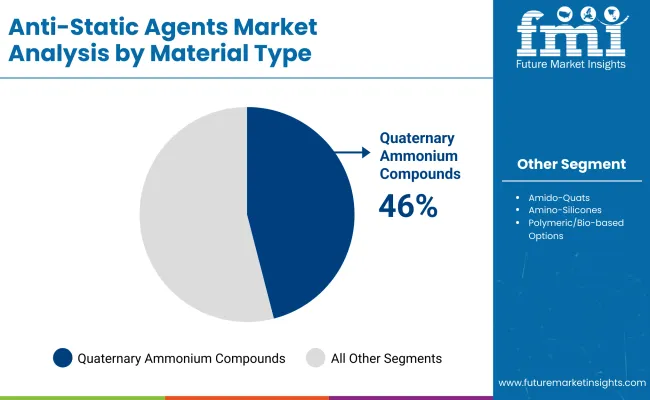

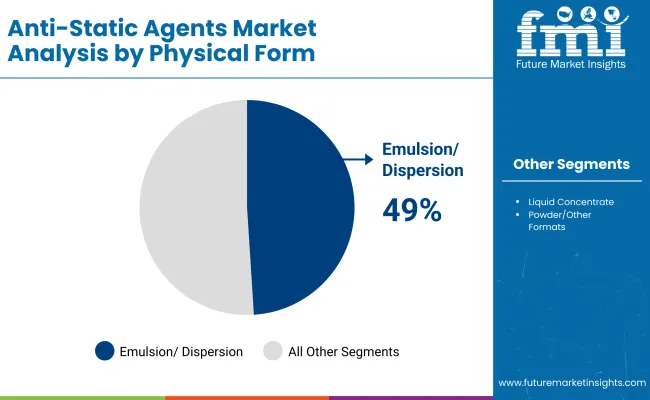

Quaternary ammonium compounds are expected to lead material types with a 46.0% share in 2025, while emulsions and dispersions are forecasted to dominate the physical form segment with 54.0%. Increasing alignment with sustainability goals and demand for multi-functional raw materials are expected to fuel broader adoption during this phase.

From 2020 to 2024, the Anti-Static Agents Market expanded steadily, supported by consistent demand for raw materials in personal care formulations. During this period, suppliers of cationic and quaternary ammonium compounds shaped the market landscape, accounting for the majority of ingredient adoption. Competitive positioning was defined by formulation compatibility, performance efficiency, and supply reliability, with leading players strengthening distribution networks to secure B2B demand.

By 2025, demand is expected to reach USD 1,253.2 million, and the market outlook suggests significant acceleration through 2035. The revenue mix is anticipated to shift toward bio-based and multifunctional raw materials as sustainability pressures intensify.

Traditional leaders are projected to expand their focus beyond standard conditioning systems, investing in innovation pipelines that align with regulatory compliance and evolving customer specifications. Emerging entrants are expected to emphasize sustainable chemistry, regional production, and tailored formulation support, gradually gaining share. The competitive advantage is projected to evolve from scale and cost leadership toward innovation capacity, sustainable ingredient portfolios, and long-term collaboration with downstream formulators.

The Anti-Static Agents Market has been segmented across functional class, material type, and physical form to provide detailed insights into growth drivers and demand patterns. Each segment has been evaluated to highlight its relative contribution to market value and its future growth potential.

By functional class, emphasis has been placed on the rising dominance of cationic conditioning systems. In terms of material type, quaternary ammonium compounds have been positioned as the most widely adopted ingredient category. By physical form, emulsions and dispersions have been identified as a critical contributor to demand, reflecting their versatility and compatibility with diverse formulation needs.

The Anti-Static Agents Market has been segmented to highlight the structural dynamics driving demand across formulations. Segmentation has been carried out by functional class, material type, and physical form, each reflecting critical factors influencing ingredient adoption. By functional class, categories include cationic conditioning systems and other anti-static solutions that address diverse formulation requirements.

Material type segmentation covers quaternary ammonium compounds alongside esterquats, amido-quats, amino-silicones, and other innovative chemistries designed for compatibility and sustainability. Physical form classification includes emulsions and dispersions, liquid concentrates, and other delivery formats, emphasizing versatility in application.

This segmentation provides a comprehensive view of how performance, safety, and sustainability considerations are shaping the market, offering insights into both established ingredient categories and emerging innovation pipelines.

| Functional Class | Market Value Share, 2025 |

|---|---|

| Cationic conditioning systems | 44% |

| Others | 56.0% |

Cationic conditioning systems are projected to contribute 44.0% of the Anti-Static Agents Market in 2025, representing USD 588.9 million. Their dominance has been attributed to superior efficacy in reducing electrostatic buildup and ensuring compatibility with a broad range of formulation bases.

Growth of this segment is expected to be reinforced by increasing demand in hair care and personal care applications, where enhanced conditioning and stability are prioritized. Others, capturing 56.0% and valued at USD 701.79 million, are forecasted to provide competitive alternatives. Broader adoption of diversified anti-static systems is anticipated, particularly as suppliers innovate to address sustainability, cost efficiency, and performance differentiation across multiple cosmetic and personal care categories.

| Material Type | Market Value Share, 2025 |

|---|---|

| Quaternary ammonium compounds | 46% |

| Others | 54.0% |

Quaternary ammonium compounds are anticipated to account for 46.0% of the market in 2025, valued at USD 369 million. Their sustained adoption has been driven by established performance benefits, reliable conditioning effects, and proven compatibility with a wide range of raw material formulations. Demand is projected to be further supported by the critical role these compounds play in high-performance hair conditioning products and styling applications.

Other material types, valued at USD 676.73 million and accounting for 54.0%, are expected to attract increasing interest, particularly esterquats, amido-quats, and amino-silicones. The shift toward sustainable chemistry and multifunctional ingredient performance is anticipated to strengthen growth opportunities in this category throughout the forecast period. Insights into the Physical Form Segment with Emulsion/Dispersion Maintaining Market Strength

| Physical Form | Market Value Share, 2025 |

|---|---|

| Emulsion/dispersion | 49% |

| Others | 51.0% |

Emulsions and dispersions are expected to secure 49.0% of the global Anti-Static Agents Market in 2025, valued at USD 533.3 million. Their preference has been attributed to ease of incorporation into formulations, stability, and effectiveness in delivering anti-static functionality across multiple personal care applications. Increasing reliance on this form is forecasted to be driven by high compatibility with conditioners, creams, and styling products.

Other forms, which capture 51.0% of share with value of USD 639.13 million, are anticipated to provide additional flexibility in formulations. Their growth outlook is linked to expanding use in niche cosmetic categories where alternative formats are preferred. Innovation in form diversification is expected to expand the competitive edge of suppliers over the next decade.

Complex formulation requirements and regulatory compliance continue to challenge anti-static agent adoption, even as demand intensifies across cosmetics, personal care, and industrial applications, where functional performance and sustainable chemistry are becoming decisive factors shaping the long-term market trajectory.

Integration of Multifunctional Ingredients

Growth in the Anti-Static Agents Market has been propelled by the integration of multifunctional ingredients within formulation pipelines. Anti-static agents are increasingly being engineered to deliver conditioning, detangling, and sensory benefits simultaneously, thereby reducing the need for multiple additives in a single product. This multifunctionality has been projected to appeal strongly to formulators seeking efficiency, cost optimization, and streamlined compliance with safety standards.

The transition toward concentrated and multi-benefit formulations is expected to place advanced anti-static systems at the core of next-generation product development. Suppliers with capabilities to align multifunctional properties with performance reliability are anticipated to secure a long-term competitive advantage.

Supply Chain Vulnerability of Specialty Chemicals

The scalability of anti-static agent production has been restrained by supply chain vulnerabilities in specialty chemicals. Dependence on limited raw material sources and stringent quality requirements has increased exposure to volatility in availability and pricing. This constraint has been compounded by regional production imbalances, where Asia-Pacific dominates manufacturing while Europe and North America maintain higher regulatory oversight.

Such dynamics have been projected to delay innovation cycles and restrict smaller suppliers from meeting global compliance benchmarks. Unless diversified sourcing and local production capacities are expanded, supply bottlenecks are expected to exert continued pressure on ingredient pricing and limit wider adoption.

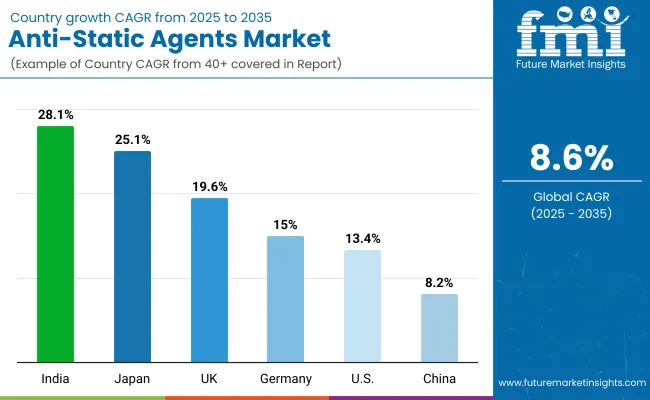

| Country | CAGR |

|---|---|

| China | 8.2% |

| USA | 13.4% |

| India | 28.1% |

| UK | 19.6% |

| Germany | 15.0% |

| Japan | 25.1% |

The global Anti-Static Agents Market has been observed to exhibit marked differences in growth across key countries, shaped by formulation practices, industrial expansion, and evolving regulatory frameworks. Asia-Pacific has been projected to advance as the fastest-growing region, with China expanding at 8.2% CAGR and India accelerating at 28.1%.

Growth in China has been reinforced by large-scale production of personal care and cosmetic formulations, alongside regulatory support for safer and performance-driven raw materials. India’s trajectory has been influenced by rapid industrialization and expanding consumer markets, with ingredient suppliers positioning themselves to meet both local demand and export-oriented manufacturing.

Japan is anticipated to deliver 25.1% CAGR, supported by premiumization trends and heightened demand for multifunctional conditioning agents in advanced formulations. Europe maintains a resilient profile, led by Germany at 15.0% CAGR and the UK at 19.6%, underpinned by stringent compliance with sustainability and quality standards in personal care products.

North America demonstrates steady expansion, with the USA expected to achieve 13.4% CAGR, reflecting mature demand structures yet continued innovation in sustainable chemistry. Across all key countries, suppliers have been expected to compete through portfolio diversification, regulatory alignment, and innovation pipelines designed to strengthen partnerships with global formulators.

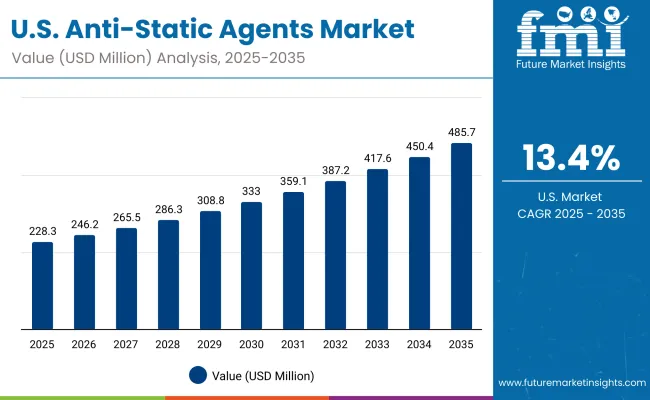

| Year | USA Anti-Static Agents Market (USD Million) |

|---|---|

| 2025 | 228.32 |

| 2026 | 246.22 |

| 2027 | 265.53 |

| 2028 | 286.35 |

| 2029 | 308.80 |

| 2030 | 333.02 |

| 2031 | 359.13 |

| 2032 | 387.29 |

| 2033 | 417.66 |

| 2034 | 450.41 |

| 2035 | 485.72 |

The Anti-Static Agents Market in the United States is projected to expand at a CAGR of 13.4%, supported by consistent integration of conditioning agents and specialty raw materials in hair care, styling, and cosmetic formulations. Premium positioning of personal care products has been expected to drive adoption of advanced emulsions and dispersions, while regulatory compliance has reinforced reliance on quaternary ammonium compounds and cationic systems.

Greater emphasis on sustainability and multifunctional chemistry has been anticipated to open new opportunities for ingredient suppliers. Strategic innovation pipelines and stronger collaboration between raw material producers and downstream formulators have been viewed as central to maintaining competitiveness in this evolving market.

The Anti-Static Agents Market in the United Kingdom is projected to grow at a CAGR of 19.6% between 2025 and 2035. Expansion has been supported by strong regulatory alignment with sustainability goals and the increasing role of premium personal care products in driving ingredient adoption.

Formulators have been placing emphasis on multifunctional and bio-based agents, strengthening the position of cationic conditioning systems and advanced dispersions. Supplier innovation pipelines have been expected to align closely with compliance benchmarks, creating long-term opportunities in both domestic and regional markets.

The Anti-Static Agents Market in India is anticipated to expand at a CAGR of 28.1% through the forecast period. Rapid growth has been influenced by industrial expansion, rising consumer markets, and the country’s emergence as a global manufacturing hub for personal care products. Suppliers have been increasingly targeting India with efficient, compliant raw materials to capture the surge in hair conditioning and styling applications.

Local production capacity has been projected to improve competitiveness, reducing import reliance and supporting exports. Multifunctional chemistry and cost-efficient ingredient innovation have been expected to play a central role in driving adoption across B2B supply chains.

The Anti-Static Agents Market in China is forecasted to grow at a CAGR of 8.2% between 2025 and 2035. Market progress has been reinforced by large-scale manufacturing ecosystems that serve both domestic and export-oriented personal care markets. Regulatory frameworks encouraging safer and high-performance formulations have been expected to guide suppliers toward compliant and advanced raw materials.

Quaternary ammonium compounds have been projected to maintain strong adoption, while emulsions and dispersions are anticipated to capture growing demand in premium formulations. Innovation pipelines designed around sustainable chemistry are expected to become increasingly significant.

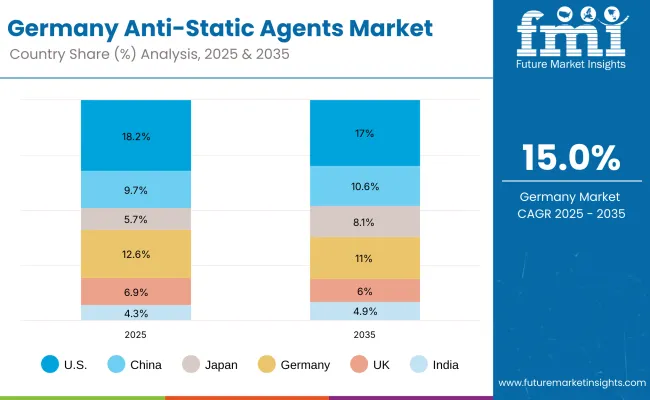

| Countries | 2025 |

|---|---|

| USA | 18.2% |

| China | 9.7% |

| Japan | 5.7% |

| Germany | 12.6% |

| UK | 6.9% |

| India | 4.3% |

| Countries | 2035 |

|---|---|

| USA | 17.0% |

| China | 10.6% |

| Japan | 8.1% |

| Germany | 11.0% |

| UK | 6.0% |

| India | 4.9% |

The Anti-Static Agents Market in Germany is expected to advance at a CAGR of 15.0% during 2025 to 2035. Growth has been supported by Germany’s leadership in sustainable formulation standards, stringent quality compliance, and the presence of advanced cosmetic manufacturing hubs.

Ingredient adoption has been shaped by demand for multifunctional and bio-based anti-static agents that align with clean-label positioning and eco-friendly chemistry. Supplier-formulator collaborations have been projected to strengthen supply chain resilience and accelerate integration of advanced conditioning systems. The market outlook has been reinforced by continued prioritization of sustainability commitments in both domestic and multinational production pipelines.

| USA by Functional Class | Market Value Share, 2025 |

|---|---|

| Cationic conditioning systems | 44% |

| Others | 56.0% |

The Anti-Static Agents Market in the United States is projected at USD 228.32 million in 2025. Cationic conditioning systems contribute 44%, while other functional classes hold 56%, which reflects a broader reliance on diversified formulations beyond core conditioning systems. The slight dominance of other functional agents has been attributed to growing experimentation with multifunctional and sustainable raw materials, particularly within high-performance hair care and styling applications.

This category has been expected to capture attention as formulators seek greater flexibility in balancing cost efficiency with advanced performance. Cationic conditioning systems, however, remain a central segment due to their proven electrostatic control and compatibility across formulations. As consumer expectations shift toward cleaner, multifunctional products, both categories are anticipated to grow, with innovation pipelines increasingly targeting bio-based and eco-aligned alternatives.

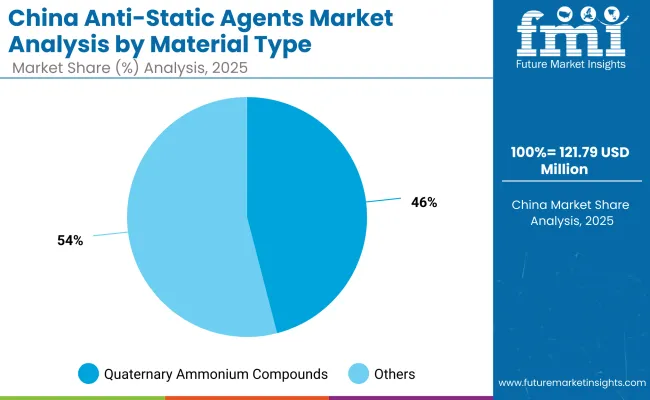

| China by Material Type | Market Value Share, 2025 |

|---|---|

| Quaternary ammonium compounds | 46% |

| Others | 54.0% |

The Anti-Static Agents Market in China is projected at USD 121.79 million in 2025. Quaternary ammonium compounds contribute 46%, while other material types hold a larger 54%, showing a broader distribution of demand across multiple alternatives. The higher share of other materials has been associated with the increased adoption of esterquats, amido-quats, and amino-silicones, which are favored for sustainability and multifunctional properties. Quaternary ammonium compounds, however, remain a core category due to their proven conditioning efficacy and compatibility with large-scale formulations.

China’s strong manufacturing base has been expected to drive steady consumption of both categories, with innovation pipelines emphasizing cleaner chemistry, cost-efficient alternatives, and performance optimization. The balance between established quaternary compounds and emerging sustainable ingredients has been anticipated to shape the competitive outlook through the decade.

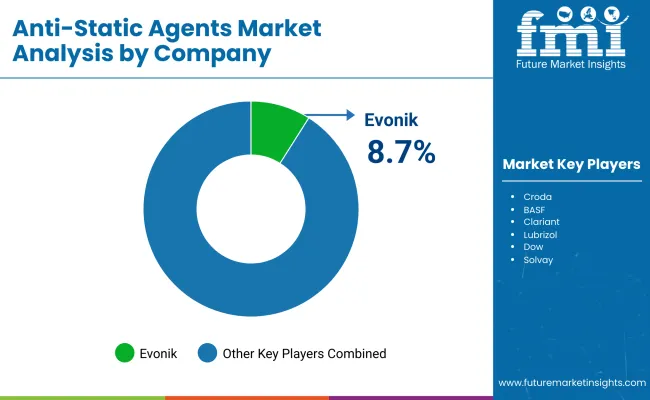

| Company | Global Value Share 2025 |

|---|---|

| Evonik | 8.7% |

| Others | 91.3% |

The Anti-Static Agents Market is moderately fragmented, with global leaders, established chemical producers, and niche raw material specialists competing across diverse formulation segments. Global ingredient suppliers such as Evonik, Croda, and BASF hold strong positions, supported by extensive product portfolios and long-term partnerships with personal care formulators.

Evonik is the dominant player, holding an estimated 8.7% share of the global market in 2024, making it the largest contributor among suppliers. Its strategies have been increasingly focused on bio-based anti-static agents, sustainable formulation chemistry, and alignment with global regulatory requirements.

Other established leaders including Clariant, Lubrizol, Dow, and Solvay are contributing significant shares through multifunctional conditioning systems and innovative dispersions designed to enhance formulation efficiency. Their presence has been reinforced by distribution networks that provide scale advantages in both mature and emerging markets.

Niche-focused companies such as Ashland, Kao Chemicals, and Inolex are delivering specialized performance solutions, particularly in premium hair care and styling applications where customization and flexibility are highly valued. These companies have been projected to strengthen their positions by investing in targeted formulation support and expanding sustainable ingredient offerings.

Competitive differentiation has been shifting from pure volume and price to innovation capacity, sustainability credentials, and collaborative development with downstream formulators, signaling a structural evolution in the global anti-static agents industry.

Key Developments in Anti-Static Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,253.2 Million (2025E); USD 2,852.3 Million (2035F); CAGR 2025 to 2035: 8.6% |

| Component (Functional Class) | Cationic conditioning systems; Others |

| Material Type | Quaternary ammonium compounds; Others (esterquats, amido-quats, amino-silicones, polymeric/bio-based options) |

| Physical Form | Emulsion/dispersion; Liquid concentrate; Powder/other formats |

| Application | Rinse-off conditioners; Leave-in conditioners & creams; Styling sprays & serums; Color cosmetics powders |

| End-use Industry | Hair conditioning; Hair styling; Color cosmetics |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; Canada; Germany; France; United Kingdom; China; Japan; India; Brazil; South Africa |

| Key Companies Profiled | Evonik; Croda; BASF; Clariant; Lubrizol; Dow; Solvay; Ashland; Kao Chemicals; Inolex |

| Additional Attributes | Value shares 2025: Cationic conditioning systems 44% (USD 588.9 Million); Quaternary ammonium compounds 46% (USD 369 Million); Emulsion/dispersion 49% (USD 533.3 Million). USA size path: USD 228.32 Million (2025) to USD 485.72 Million (2035). B2B drivers include sustainability alignment, multifunctional ingredient design, regulatory compliance, and supplier-formulator collaboration. |

The global Anti-Static Agents Market is estimated to be valued at USD 1,253.2 million in 2025.

The market size for the Anti-Static Agents Market is projected to reach USD 2,852.3 million by 2035.

The Anti-Static Agents Market is expected to grow at a CAGR of 8.6% between 2025 and 2035.

The key product types in the Anti-Static Agents Market are cationic conditioning systems, quaternary ammonium compounds, emulsions and dispersions, and other multifunctional raw materials.

In terms of functional class, cationic conditioning systems are projected to command a 44% share in the Anti-Static Agents Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA