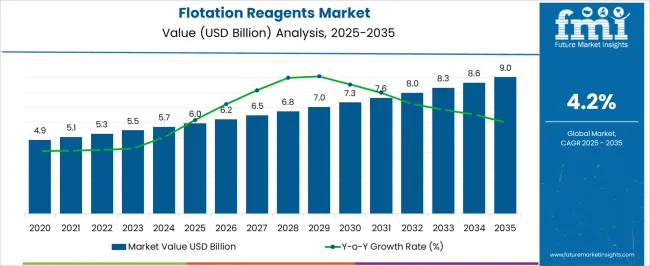

The Flotation Reagents Market is estimated to be valued at USD 6.0 billion in 2025 and is projected to reach USD 9.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period. The growth contribution index highlights the relative contribution of various periods within the forecast. From 2025 to 2029, the market is expected to increase from USD 4.9 billion to USD 6.0 billion, driven by a gradual growth rate fueled by continued demand for flotation reagents in industries such as mining, particularly for metal recovery and ore beneficiation.

This phase reflects steady growth as mining activities and the demand for efficient separation technologies continue to rise globally. Between 2029 and 2031, the market sees moderate growth from USD 6.2 billion to USD 6.8 billion, driven by technological advancements in flotation reagent formulations and increasing investments in sustainable mining practices.

During this period, more industries adopt eco-friendly reagents due to rising environmental regulations, contributing to a slight acceleration in growth. From 2031 to 2035, the market continues its upward trend, reaching USD 9.0 billion by 2035. This growth is fueled by the increasing adoption of flotation reagents in various industries beyond mining, such as in wastewater treatment, and the growing demand for sustainable and cost-effective processing solutions.

| Metric | Value |

|---|---|

| Flotation Reagents Market Estimated Value in (2025 E) | USD 6.0 billion |

| Flotation Reagents Market Forecast Value in (2035 F) | USD 9.0 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The flotation reagents market is gaining strong momentum due to the rising demand for efficient ore beneficiation techniques and the growing complexity of mineral deposits being processed worldwide. With declining ore grades and an increased focus on resource recovery, the use of specialized reagents has become critical in enhancing flotation performance and yield. Flotation reagents, including collectors, frothers, modifiers, and activators, are experiencing increasing utilization in both sulfide and non-sulfide ore processing, enabling improved separation selectivity and higher recovery rates.

Investments in mining automation and digital process optimization are further supporting the integration of customized chemical solutions tailored to specific mineralogies. Additionally, the tightening of environmental regulations is prompting a shift toward eco-friendly, biodegradable reagents, particularly in regions like Europe and North America.

Emerging economies continue to expand mining operations to meet global demand for base metals, precious metals, and rare earth elements, thereby creating long-term opportunities for reagent manufacturers. The market outlook remains positive, supported by innovation in flotation technologies and growing collaboration between chemical formulators and mining operators.

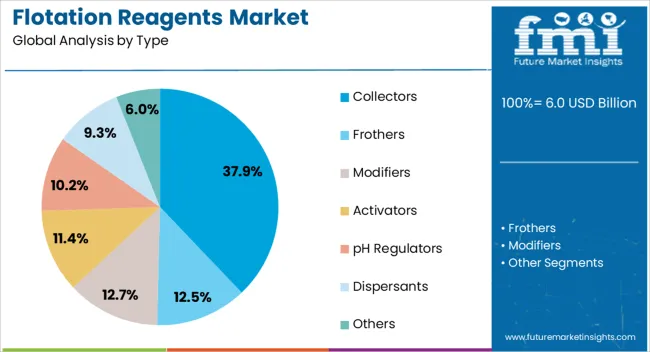

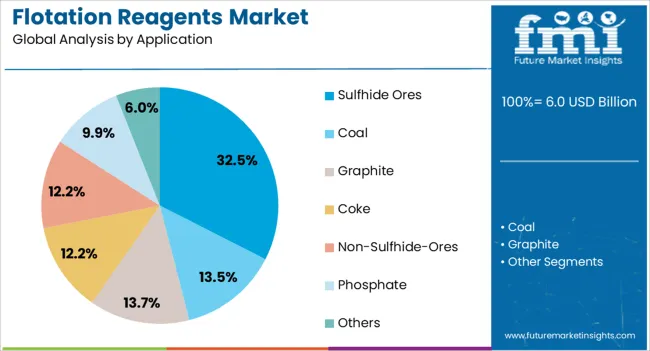

The flotation reagents market is segmented by type, application, end-use, and geographic regions. By type, the flotation reagents market is divided into Collectors, Frothers, Modifiers, Activators, pH Regulators, Dispersants, and Others. In terms of application, the flotation reagents market is classified into Sulfide Ores, Coal, Graphite, Coke, Non-Sulfide Ores, Phosphate, and Others.

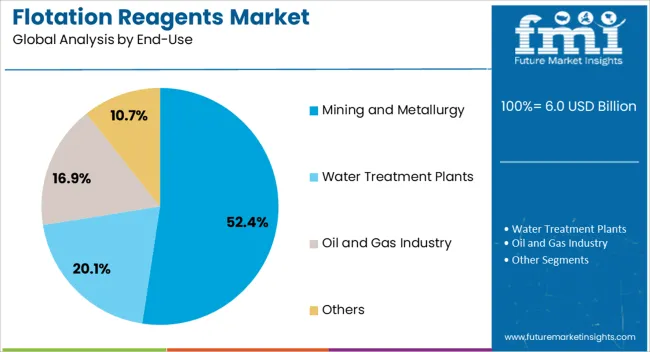

Based on end-use, the flotation reagents market is segmented into Mining and Metallurgy, Water Treatment Plants, Oil and Gas Industry, and Others. Regionally, the flotation reagents industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Collectors are projected to hold 37.9% of the flotation reagents market revenue share in 2025, establishing them as the leading type of reagent in flotation processes. The dominance of this segment is driven by its essential role in increasing the hydrophobicity of target minerals, enabling selective attachment to air bubbles during flotation. Their widespread use across various ore types, particularly sulfide ores, has positioned them as the most critical chemical group in flotation circuits.

Ongoing advancements in collector chemistry have enabled improved specificity and efficiency, reducing the need for multiple reagent types. The segment has also seen significant demand due to its compatibility with modern flotation cells and its performance in low-grade and complex ore beneficiation.

Customization of collector formulations to adapt to varying pH levels, mineral compositions, and environmental conditions has strengthened their application in both brownfield and greenfield mining projects. The ability of collectors to enhance metallurgical performance, optimize recovery rates, and support sustainable mining practices continues to drive their market leadership.

The sulfide ores application segment is expected to account for 32.5% of the flotation reagents market revenue in 2025, making it the dominant area of application. This prominence is attributed to the extensive global demand for metals such as copper, lead, zinc, and nickel, which are primarily extracted through the flotation of sulfide ores.

Reagent performance plays a crucial role in enhancing mineral selectivity and flotation kinetics for sulfide ores, which often present challenges due to their varying mineral compositions and the presence of gangue materials. Advances in flotation reagent formulations have enabled more precise targeting of sulfide minerals while minimizing environmental impact and reagent consumption.

The segment’s growth is also being supported by rising investments in base metal mining and the ongoing expansion of copper production to meet the energy transition needs for electric vehicles and renewable power infrastructure. As processing plants seek to maximize recovery from increasingly complex ores, the demand for high-efficiency reagents specifically tailored for sulfide flotation continues to accelerate.

The mining and metallurgy end-use segment is projected to capture 52.4% of the flotation reagents market share by 2025, reflecting its position as the largest consumer of these chemical solutions. The segment’s growth has been driven by the increasing global demand for base and precious metals across the construction, electronics, automotive, and energy sectors. Mining operations are increasingly relying on reagent-driven optimization to achieve higher recovery yields from lower-grade ores, which has elevated the importance of flotation chemistry in processing workflows.

The shift toward automation and digital control systems has also supported the use of sophisticated reagent dosing and monitoring systems, enabling consistent metallurgical performance. In the metallurgy domain, the use of flotation reagents in concentrate treatment and refining processes has further extended their utility beyond ore separation.

The ongoing exploration of critical minerals and the development of strategic reserves in regions like the Asia Pacific, Africa, and Latin America are expected to reinforce the segment’s dominance. Environmental and economic pressures are driving mining firms to adopt more efficient, selective, and sustainable reagent solutions, reinforcing the central role of this segment in the overall market.

The flotation reagents market is witnessing steady growth, driven by their critical role in mineral processing, especially in the mining industry. Flotation reagents are used to enhance the separation of valuable minerals from ores during the flotation process. With the increasing demand for minerals and metals, especially in emerging economies, the demand for effective flotation reagents is rising. The market is further supported by innovations in reagent formulations that improve efficiency, reduce environmental impact, and lower operational costs. As mining operations expand and require more advanced techniques for mineral extraction, the demand for flotation reagents continues to increase globally.

The flotation reagents market is primarily driven by the growing demand for mineral resources and the expansion of mining operations. The global need for minerals and metals in sectors such as construction, automotive, and electronics continues to rise, pushing mining companies to increase production. Flotation reagents play a crucial role in separating valuable minerals from raw ore, making them indispensable in modern mining processes. As mining operations become more complex and the demand for high-quality minerals increases, the adoption of advanced flotation reagents is growing. Additionally, the need to improve the efficiency and profitability of mining operations is driving the demand for better-performing flotation reagents.

Despite the growing demand, the flotation reagents market faces challenges related to the high cost of reagents and environmental concerns. The production and use of flotation reagents can be expensive, particularly those that require specialized chemical formulations to meet the specific needs of certain ores. The potential environmental impact of certain reagents, particularly in terms of water contamination and toxicity, has raised concerns among regulators and environmental groups. Mining companies are increasingly required to meet stricter environmental regulations, which may lead to additional costs for manufacturers and producers of flotation reagents. Addressing these challenges requires the development of more cost-effective and environmentally friendly reagents that still offer high performance.

The flotation reagents market presents significant opportunities with advancements in reagent formulations and the exploration of new applications. Researchers are focused on developing more efficient reagents that can improve the flotation process, reducing the need for excess chemicals while maintaining high recovery rates. These advancements offer the potential to reduce operational costs for mining companies. There is growing interest in the use of flotation reagents in other industries, such as wastewater treatment and recycling, where they can be used to separate valuable materials from waste streams. These innovations and broader applications provide promising growth opportunities for flotation reagent manufacturers.

A key trend in the flotation reagents market is the growing use of bio-based and environmentally friendly reagents. As mining operations face increasing pressure to reduce their environmental impact, the demand for flotation reagents derived from renewable resources or those with less toxic effects is on the rise. Bio-based reagents, including those made from plant or animal-based materials, offer a safer alternative to traditional chemical-based reagents. As regulatory requirements become more stringent, the push for safer and more sustainable reagents that minimize the environmental footprint of the flotation process is expected to drive further innovations in the market. This trend is expected to lead to the development of more environmentally friendly solutions that meet both performance and regulatory standards.

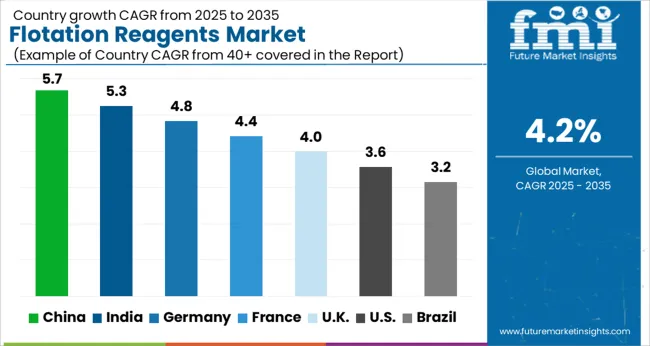

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

| USA | 3.6% |

| Brazil | 3.2% |

The global flotation reagents market is projected to grow at a CAGR of 4.2% from 2025 to 2035, driven by the rising demand for advanced reagents in the mining industry. China leads with 5.7% growth, supported by strong demand from mining and mineral processing sectors. India follows at 5.3%, driven by increasing industrial activity and expansion of the mining sector. France, the UK, and the USA experience steady growth, driven by the need for efficient extraction technologies and government support for mining operations and sustainable practices. The analysis spans over 40+ countries, with the leading markets shown below.

The flotation reagents market in China is projected to expand at a CAGR of 5.7% through 2035. The growing mining and mineral processing industries are key drivers behind the development of this market. China’s strong demand for flotation reagents, such as collectors, frothers, and modifiers, is fueled by its significant production of various minerals, including copper, gold, and coal.

Additionally, the country’s rapid industrialization and increasing focus on efficient resource extraction technologies are further enhancing the demand for flotation reagents. The government’s support for the mining sector and investments in advanced mineral processing technologies also contribute to the market’s growth.

The flotation reagents market in India is expected to grow at a CAGR of 5.3% through 2035. The demand for flotation reagents in the country is primarily driven by the expansion of the mining sector, especially in the extraction of metals such as coal, copper, and iron ore. India’s increasing industrialization and focus on improving the efficiency of mineral processing operations further fuel the market. Government initiatives to boost domestic mining operations and the rise of sustainable extraction technologies contribute to the growing adoption of flotation reagents, supporting the market’s steady development.

France’s flotation reagents market is projected to grow at a CAGR of 4.4% through 2035. The demand for flotation reagents is driven by the country’s mining industry, which focuses on the extraction of metals such as gold, copper, and rare earth minerals. The growth of the mining sector, coupled with increasing demand for advanced extraction techniques, supports the market’s expansion. Additionally, the country’s regulatory emphasis on resource efficiency and environmental sustainability in mining operations encourages the adoption of flotation reagents, driving further market development.

The flotation reagents market in the United Kingdom is projected to grow at a CAGR of 4.0% through 2035. The market’s growth is driven by the increasing demand for flotation reagents in mining applications, particularly in the extraction of base metals and precious metals. The UK’s growing mining industry, coupled with its focus on improving the efficiency of mineral processing techniques, further supports the adoption of flotation reagents. Additionally, the country’s push towards more sustainable and efficient mining practices, supported by government regulations, contributes to the steady growth of the market.

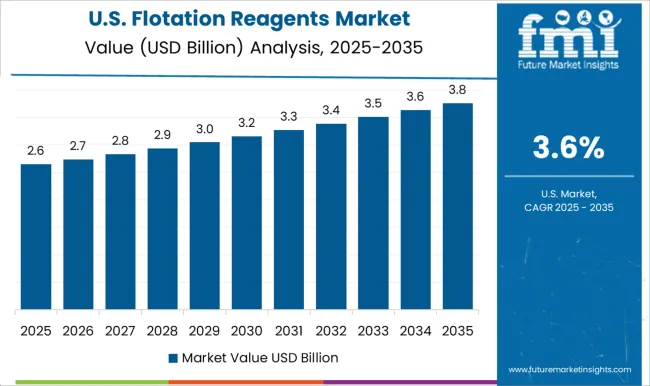

The USA flotation reagents market is projected to grow at a CAGR of 3.6% through 2035. The country’s strong mining industry, particularly in the extraction of minerals such as copper, gold, and coal, drives the demand for flotation reagents. As the USA continues to focus on improving the efficiency of its mining operations, the need for advanced flotation reagents grows. Additionally, government initiatives to support mining activities, along with increasing investments in mineral processing technologies, contribute to the steady expansion of the flotation reagents market.

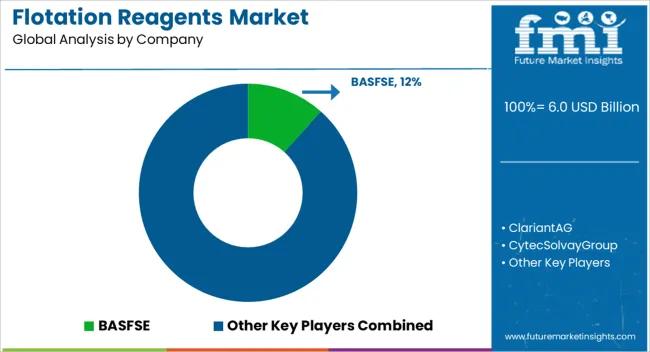

The flotation reagents market is driven by leading players offering high-performance chemical solutions for the mining and mineral processing industries. BASF SE is a prominent player, providing a comprehensive range of flotation reagents designed to enhance mineral extraction processes, with a focus on improving efficiency and reducing environmental impact. Clariant AG specializes in the production of flotation reagents, offering tailored solutions for various minerals, with a focus on enhancing separation processes and promoting sustainability in mining operations. Cytec Solvay Group, a part of the Solvay Group, is a major player, providing innovative flotation reagents used in the extraction of precious metals, ores, and other minerals. Kemira Oyj offers flotation reagents primarily used in mineral processing, with a focus on optimizing performance and efficiency in flotation systems. AkzoNobel NV is recognized for producing high-quality flotation reagents, providing advanced solutions for the mining industry, with a focus on maximizing yield while minimizing environmental impact.

SNF Group offers a comprehensive range of flotation reagents, with a focus on enhancing mineral recovery rates while providing cost-effective solutions for mining operations. Orica Limited is a key player in the market, offering flotation reagents that enhance the efficiency of mineral separation and processing, with a strong focus on customer satisfaction and technical support. Huntsman Corporation manufactures flotation reagents, recognized for their ability to enhance the flotation of various minerals, with a focus on high performance and environmental sustainability. Chevron Phillips Chemical Company offers a variety of flotation reagents that improve mineral processing in industrial mining applications, providing effective solutions for various minerals. Evonik Industries AG provides specialty chemicals, including flotation reagents, designed to enhance mineral extraction processes while minimizing environmental impact. CP Kelco manufactures a variety of flotation reagents used in mining, with a focus on enhancing operational efficiency and product quality. Nalco Water (Ecolab Inc.) is a global leader in providing flotation reagents, offering solutions that increase mineral recovery and ensure sustainable water usage. Senmin International specializes in producing flotation reagents for the mining industry, focusing on high-quality products that enhance efficiency and productivity in flotation processes. AECI Ltd. provides effective flotation reagents for the mining industry, offering solutions that maximize mineral extraction while focusing on minimizing environmental impact. Otsuka Chemical Co., Ltd. offers flotation reagents for various minerals, focusing on high performance, cost efficiency, and

| Item | Value |

|---|---|

| Quantitative Units | USD 6.0 Billion |

| Type | Collectors, Frothers, Modifiers, Activators, pH Regulators, Dispersants, and Others |

| Application | Sulfhide Ores, Coal, Graphite, Coke, Non-Sulfhide-Ores, Phosphate, and Others |

| End-Use | Mining and Metallurgy, Water Treatment Plants, Oil and Gas Industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Clariant AG, Solvay S.A. (formerly Cytec), Kemira Oyj, AkzoNobel N.V. (verify: many flotation chemicals now under Nouryon), SNF Group, Orica Limited, Huntsman Corporation, Chevron Phillips Chemical Company, Evonik Industries AG, CP Kelco, Nalco Water (EcolabInc.), Senmin (Pty) Ltd, AECI Ltd., and OtsukaChemicalCo.Ltd. |

| Additional Attributes | Dollar sales by product type (collectors, frothers, modifiers, flocculants) and end-use segments (mining, metal extraction, mineral processing). Demand dynamics are driven by the increasing need for efficient and sustainable flotation solutions in the mining industry, rising demand for precious and base metals, and advancements in flotation chemistry. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with innovations in flotation reagent formulations, regulatory pressure for environmentally friendly solutions, and increasing mining activity contributing to market expansion. |

The global flotation reagents market is estimated to be valued at USD 6.0 billion in 2025.

The market size for the flotation reagents market is projected to reach USD 9.0 billion by 2035.

The flotation reagents market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in flotation reagents market are collectors, frothers, modifiers, activators, ph regulators, dispersants and others.

In terms of application, sulfhide ores segment to command 32.5% share in the flotation reagents market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mining Flotation Chemicals Market Size, Growth, and Forecast 2025 to 2035

Grignard Reagents Market Demand & Trends 2022 to 2032

Myoglobin Reagents Market

Sequencing Reagents Market

Fructosamine Reagents Market

Lipase Testing Reagents Market Size and Share Forecast Outlook 2025 to 2035

Electrophoresis Reagents Market Size and Share Forecast Outlook 2025 to 2035

Urinary Protein Reagents Market

Magnesium Testing Reagents Market

Hematology Analyzer And Reagents Market

Total Iron-Binding Capacity Reagents Market

Molecular Biology Enzymes, Kits & Reagents Market Trends and Forecast 2025 to 2035

Eco-friendly Precious Metal Beneficiation Reagents Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA