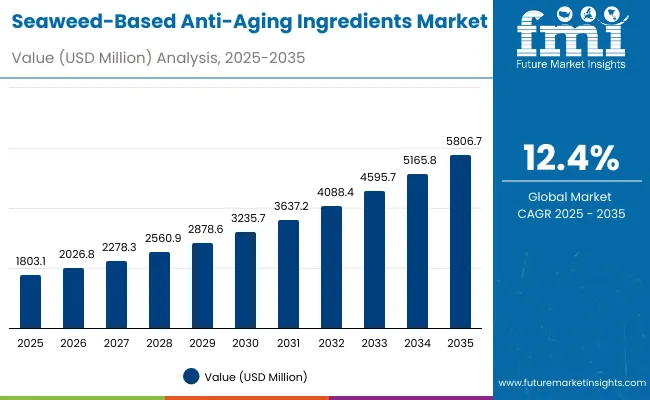

A valuation of USD 1,803.1 million has been projected for the seaweed-based anti-aging ingredients market in 2025, which is expected to rise to USD 5,806.7 million by 2035. This growth reflects an absolute increase of USD 4,003.6 million, equating to a market expansion of over 193% during the period. The overall trend translates into a CAGR of 12.4%, signifying robust, sustained momentum across global regions and applications.

Seaweed-Based Anti-Aging Ingredients Market Key Takeaways

| Metric | Value |

|---|---|

| Seaweed-Based Anti-Aging Ingredients Market Estimated Value in (2025E) | USD 1,803.1 million |

| Seaweed-Based Anti-Aging Ingredients Market Forecast Value in (2035F) | USD 5,806.7 million |

| Forecast CAGR (2025 to 2035) | 12.40% |

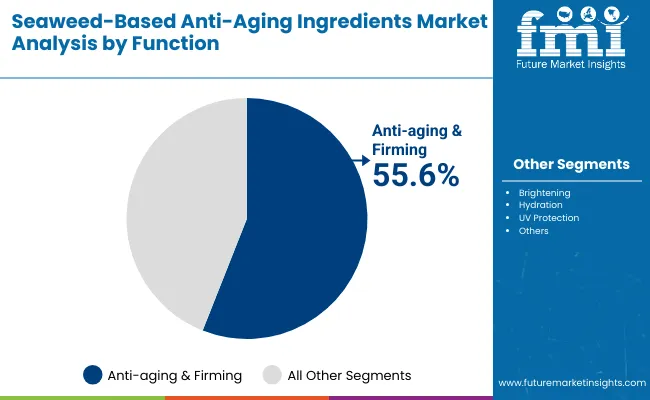

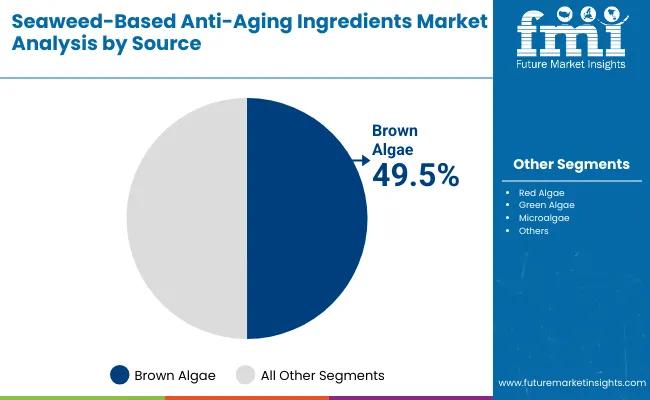

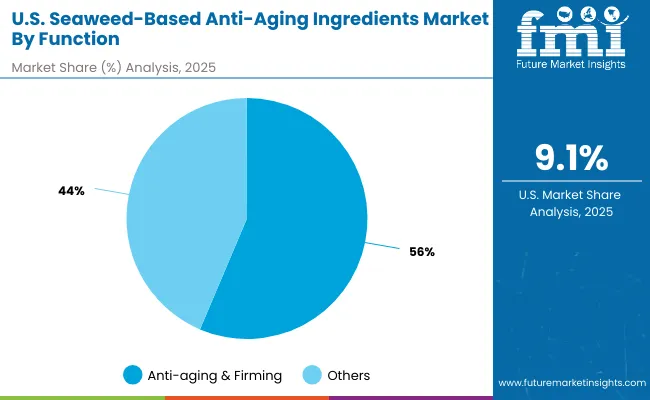

From 2025 to 2030, market value is estimated to climb from USD 1,803.1 million to USD 3,235.7 million, generating USD 1,432.6 million in additional revenue. This contribution accounts for 35.8% of the total decade growth. The period is anticipated to be characterized by steady adoption of marine-derived actives, supported by growing consumer inclination toward natural and sustainable skincare solutions. Anti-aging & firming functions, projected to hold 55.6% share in 2025, are expected to drive strong demand due to proven efficacy in skin tightening and wrinkle reduction. Brown algae-based ingredients, forecast at 49.5% share in 2025, are anticipated to lead the source category given their antioxidant-rich profile.

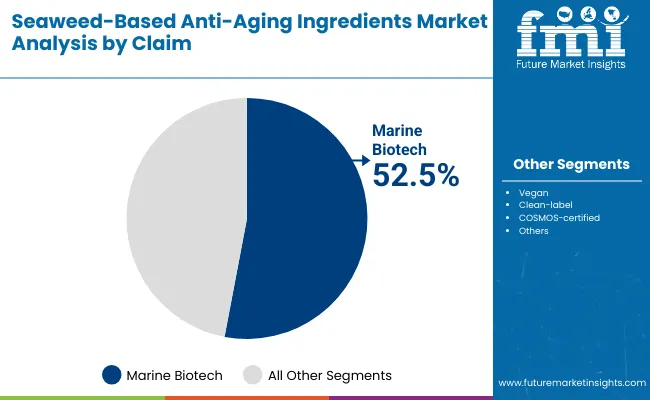

Between 2030 and 2035, growth is forecast to accelerate, with market size increasing from USD 3,235.7 million to USD 5,806.7 million, contributing USD 2,571.0 million, which equals 64.2% of total expansion. This phase is expected to be fueled by advanced biotechnology-based extraction methods and wider consumer acceptance of marine biotech claims, which are projected at 52.5% share in 2025. Expanding applications across premium skincare portfolios and heightened demand in high-growth economies such as China and India are anticipated to reinforce this trajectory.

From 2020 to 2024, momentum for marine-derived actives had been steadily established as consumer demand for clean-label and natural skincare accelerated. The adoption of seaweed-based ingredients was driven primarily by their recognized efficacy in firming, hydration, and wrinkle reduction. During this period, competition was highly fragmented, with biotechnology-focused suppliers and marine extraction specialists holding a dominant influence.

By 2025, demand is projected to advance to USD 1,803.1 million, marking a turning point as brown algae and marine biotech claims emerge as decisive differentiators. Over the decade to 2035, the market is forecast to reach USD 5,806.7 million, with significant growth concentrated in Asia-Pacific, where China and India are projected to post the fastest CAGRs at 20.1% and 22.7% respectively. The competitive landscape is expected to evolve as sustainability credentials, biotechnology-driven innovation, and clinical validation become the pillars of market leadership. Industry players are anticipated to pursue advanced extraction technologies, partnerships in biotech, and premium positioning to secure competitive advantage.

Growth in the seaweed-based anti-aging ingredients market is being fueled by rising consumer preference for natural, sustainable, and marine-derived skincare solutions. Increasing recognition of the efficacy of seaweed extracts in improving skin firmness, reducing wrinkles, and enhancing hydration has been widely acknowledged, driving adoption across premium beauty portfolios. Clean-label trends and regulatory encouragement for safe, traceable ingredients are reinforcing this momentum. Biotechnology-driven extraction methods are being advanced to enhance purity and performance, positioning marine biotech claims as a core driver of long-term demand. Expanding middle-class populations in Asia-Pacific, particularly in China and India, are contributing significantly through heightened awareness of natural beauty products and higher disposable incomes. In mature markets such as North America and Europe, demand is being strengthened by innovation in cosmeceuticals and clinical validations of seaweed actives. With sustainability and transparency becoming essential purchase criteria, the market is expected to witness accelerated growth over the next decade.

The seaweed-based anti-aging ingredients market has been segmented across multiple parameters to highlight the core growth drivers. By function, the market is divided into anti-aging & firming and others, reflecting the diverse benefits offered by marine-derived actives. By claim, the focus is placed on marine biotech and others, showcasing the rising prominence of biotechnology-led extraction processes and their impact on product positioning. By source, the market is categorized into brown algae and others, underlining the specific types of algae that are being leveraged for skincare applications.

Each of these segments is expected to demonstrate distinctive growth momentum. Anti-aging & firming functions are anticipated to dominate due to clinically validated efficacy, while marine biotech claims are projected to gain traction as sustainability and innovation become decisive factors. Brown algae are forecast to hold the leading share in the source category, supported by their rich antioxidant properties and proven effectiveness in skin protection.

| Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging & firming | 55.6% |

| Others | 44.4% |

The function segment is expected to be led by anti-aging & firming, projected at 55.6% share in 2025 with USD 1,000.3 million in revenue. Strong consumer trust in marine-derived actives for wrinkle reduction, skin elasticity, and firmness has reinforced this dominance. Demand has been shaped by a growing shift toward natural alternatives to synthetic ingredients, with seaweed extracts positioned as clinically backed solutions. Others, holding 44.4% share valued at USD 801.38 million, are forecast to remain important contributors as hydration and brightening gain relevance in multi-functional skincare. Continuous innovation in bioactive formulations and cosmeceutical adoption is anticipated to strengthen the overall outlook, with anti-aging & firming retaining its leadership role throughout the forecast horizon.

| Segment | Market Value Share, 2025 |

|---|---|

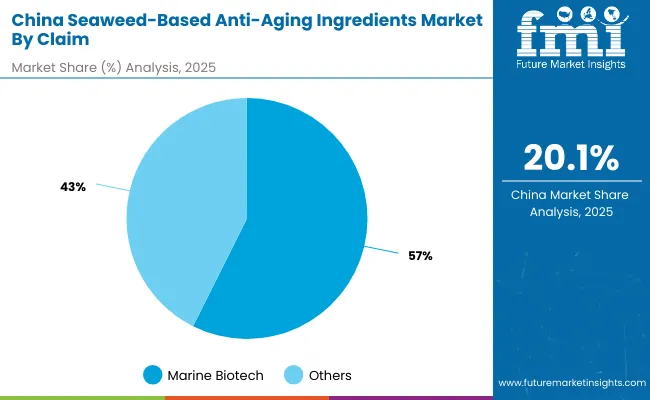

| Marine biotech | 52.5% |

| Others | 47.5% |

Marine biotech claims are projected to hold 52.5% share in 2025, equal to USD 945.5 million, establishing them as the leading claim category. The segment’s strength has been derived from rising awareness of advanced extraction techniques that enhance ingredient purity and efficacy. Biotechnology-driven processes are being increasingly favored by both formulators and consumers, as they align with clean-label standards and sustainability expectations. Other claims, representing 47.5% share and USD 856.02 million, are forecast to retain steady demand due to widespread application in traditional skincare lines. The growing consumer emphasis on science-backed natural products is anticipated to further elevate marine biotech positioning, solidifying its dominance in the market over the coming decade.

| Segment | Market Value Share, 2025 |

|---|---|

| Brown algae | 49.5% |

| Others | 50.5% |

Brown algae are expected to capture 49.5% share of the market in 2025, valued at USD 890.9 million, reinforcing their role as the most prominent source. Their high antioxidant concentration and proven anti-inflammatory properties have driven consistent preference among formulators and consumers. The ability of brown algae to protect skin from oxidative stress has positioned them as a natural alternative to synthetic anti-aging ingredients. Others, holding 50.5% share at USD 910.66 million, are anticipated to remain highly relevant as red algae, green algae, and microalgae find growing applications in skincare formulations. Continuous expansion of clinical research supporting algae-based efficacy is expected to further strengthen brown algae’s leadership within the source segment.

Complex supply chain dependencies and stringent regulatory benchmarks are shaping the dynamics of the seaweed-based anti-aging ingredients market, even as innovations in biotechnology and sustainability commitments strengthen adoption across skincare industries seeking clinically validated and eco-conscious formulations.

Advancement in Marine Biotechnology

The growth trajectory of the seaweed-based anti-aging ingredients market is being reinforced by breakthroughs in marine biotechnology that allow extraction of bioactives with higher purity and potency. Precision fermentation and enzymatic processing techniques are being employed to unlock compounds previously difficult to isolate at scale. This development is enhancing ingredient efficacy while lowering contamination risks, ensuring compliance with evolving safety regulations. Over the next decade, such advances are expected to redefine product formulations, positioning seaweed-derived actives as premium solutions within both cosmeceutical and dermocosmetic categories. The convergence of biotechnology and marine sciences is therefore anticipated to be a decisive catalyst for long-term growth.

Integration of Sustainability Metrics into Consumer Value Propositions

The market is being transformed by a shift in purchasing behavior where sustainability has been elevated from a supporting attribute to a primary value determinant. Brands are being increasingly evaluated on their ability to demonstrate transparent sourcing, carbon-conscious extraction processes, and traceable supply chains. Seaweed-based ingredients are being positioned favorably as naturally regenerative resources, yet credibility is now being measured through verifiable certifications and lifecycle assessments. This trend is driving companies to adopt circular economy frameworks and invest in ocean stewardship initiatives to reinforce brand trust. The embedding of sustainability metrics into marketing narratives is expected to become a critical differentiator, shaping competitive landscapes over the forecast horizon.

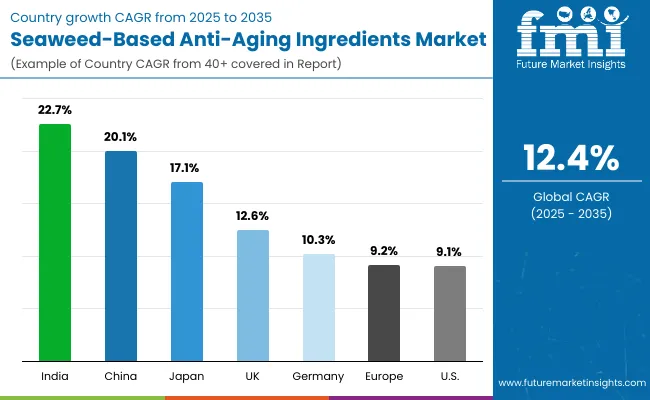

| Countries | CAGR |

|---|---|

| China | 20.1% |

| USA | 9.1% |

| India | 22.7% |

| UK | 12.6% |

| Germany | 10.3% |

| Japan | 17.1% |

The global seaweed-based anti-aging ingredients market has been projected to expand unevenly across key countries, with growth dynamics strongly influenced by biotechnology innovation, sustainability mandates, and consumer preferences for natural skincare. Asia-Pacific is anticipated to emerge as the fastest-growing region, with India recording the highest CAGR of 22.7% during 2025-2035. Rapidly expanding middle-class populations, coupled with increasing awareness of marine-derived actives, are expected to support this trajectory. China, with a CAGR of 20.1%, is positioned as another powerhouse, where strong domestic supply capabilities and demand for premium beauty products are projected to reinforce market leadership.

Japan, with an estimated CAGR of 17.1%, is forecast to leverage advanced R&D and consumer inclination toward science-backed formulations, enhancing its competitive strength in the regional landscape. In Europe, the UK (12.6%) and Germany (10.3%) are expected to show steady progress, driven by stringent compliance standards and strong clean-label adoption across personal care portfolios. The USA, with a more moderate CAGR of 9.1%, reflects a mature yet evolving market, where innovation in cosmeceuticals and biotechnology collaborations are expected to underpin future growth. Collectively, these countries are anticipated to drive sustained momentum, shaping the decade-long outlook for seaweed-based anti-aging ingredients.

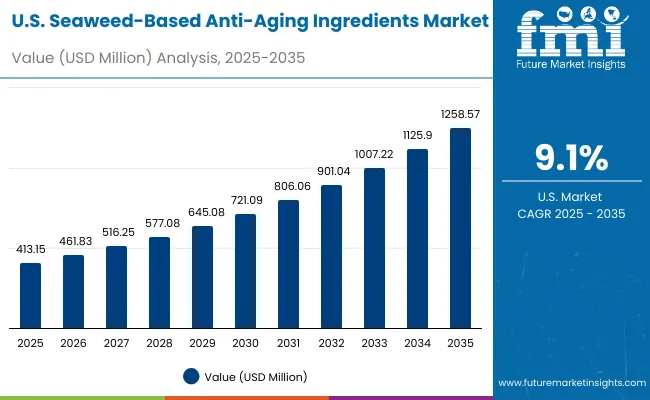

| Year | USA Seaweed-Based Anti-Aging Ingredients Market (USD Million) |

|---|---|

| 2025 | 413.15 |

| 2026 | 461.83 |

| 2027 | 516.25 |

| 2028 | 577.08 |

| 2029 | 645.08 |

| 2030 | 721.09 |

| 2031 | 806.06 |

| 2032 | 901.04 |

| 2033 | 1,007.22 |

| 2034 | 1,125.90 |

| 2035 | 1,258.57 |

The Seaweed-Based Anti-Aging Ingredients Market in the United States is projected to grow at a CAGR of 12.0%, led by expanding demand for marine-derived actives in premium skincare and cosmeceutical applications. A consistent year-on-year increase has been observed in anti-aging & firming formulations, supported by consumer trust in clinically validated seaweed extracts. The healthcare-aligned beauty segment, particularly dermocosmetics, has been integrating these ingredients into advanced product lines for targeted skin treatments. Adoption is also expanding in clean-label beauty portfolios, where seaweed-based claims resonate strongly with eco-conscious consumers. Regulatory momentum toward safe, traceable ingredients and the rise of biotechnology-enhanced extraction methods are creating opportunities for premium positioning and long-term brand differentiation in the USA

The Seaweed-Based Anti-Aging Ingredients Market in the United Kingdom is projected to grow at a CAGR of 12.6% during 2025-2035, supported by rising consumer preference for natural skincare with clinically validated efficacy. The UK beauty industry has been increasingly shaped by clean-label adoption, where seaweed extracts are positioned as sustainable alternatives to synthetic actives. Demand is expected to be reinforced by premium skincare brands investing in marine-derived solutions that address anti-aging and hydration. Regulatory scrutiny over ingredient transparency is also anticipated to drive wider uptake of certified seaweed-based actives.

The Seaweed-Based Anti-Aging Ingredients Market in India is expected to expand at a CAGR of 22.7% from 2025 to 2035, making it the fastest-growing country globally. This rapid growth is being fueled by a rising middle-class population, increased disposable incomes, and heightened awareness of marine-derived skincare benefits. Domestic supply strengths, coupled with the adoption of biotechnology-enabled extraction methods, are expected to position India as a hub for both consumption and production. Local brands are forecast to integrate seaweed-based actives into affordable beauty lines while premium categories expand in urban centers.

The Seaweed-Based Anti-Aging Ingredients Market in China is forecast to register a CAGR of 20.1% between 2025 and 2035, placing it among the leading growth markets. Expanding demand for premium and cosmeceutical formulations is expected to reinforce adoption. With advanced R&D and strong government backing for biotechnology, China is anticipated to dominate global supply and innovation in marine actives. Rising consumer awareness of sustainability and clinical validation has created opportunities for brands that integrate seaweed-based actives into high-performance skincare.

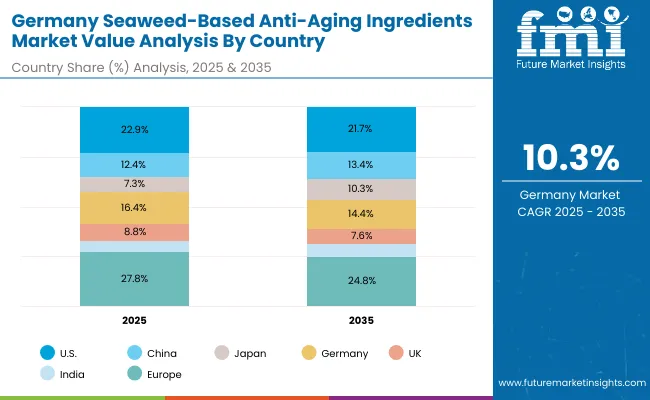

| Countries | 2025 |

|---|---|

| USA | 22.9% |

| China | 12.4% |

| Japan | 7.3% |

| Germany | 16.4% |

| UK | 8.8% |

| India | 5.5% |

| Countries | 2035 |

|---|---|

| USA | 21.7% |

| China | 13.4% |

| Japan | 10.3% |

| Germany | 14.4% |

| UK | 7.6% |

| India | 6.2% |

The Seaweed-Based Anti-Aging Ingredients Market in Germany is expected to grow at a CAGR of 10.3% during 2025 to 2035, driven by strong alignment with Europe’s clean-label and sustainability regulations. German consumers have been prioritizing natural, eco-certified skincare products, where seaweed-derived actives are well positioned. Innovation in dermo cosmetics and clinical testing standards is anticipated to elevate demand, particularly in pharmacy-led distribution channels. Partnerships between biotech firms and beauty companies are also forecast to support greater penetration of marine-based actives in the market.

| Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging & firming | 56.4% |

| Others | 43.6% |

The Seaweed-Based Anti-Aging Ingredients Market in the United States is projected at USD 413.15 million in 2025. Anti-aging & firming contributes 56.4% (USD 232.8 million), while others hold 43.6% (USD 180.32 million), highlighting the dominance of efficacy-driven skincare functions. This leadership reflects strong consumer confidence in seaweed-based actives for wrinkle reduction, elasticity improvement, and long-term skin rejuvenation. Demand has been shaped by a shift toward clinically validated, marine-derived solutions that outperform synthetic ingredients in premium and cosmeceutical applications.

Other functions, while slightly smaller in share, are expected to remain vital as hydration, brightening, and protection benefits gain traction in multifunctional skincare portfolios. The convergence of cosmeceuticals and clean-label products is anticipated to reinforce adoption across both mainstream and luxury segments. As biotechnology innovations expand ingredient potency, these functional categories are expected to diversify further, strengthening the overall USA market.

| Segment | Market Value Share, 2025 |

|---|---|

| Marine biotech | 57.4% |

| Others | 42.6% |

The Seaweed-Based Anti-Aging Ingredients Market in China is projected at USD 223.04 million in 2025. Marine biotech claims contribute 57.4% (USD 128 million), while others hold 42.6% (USD 94.96 million), underscoring the strong preference for biotechnology-driven innovation in skincare. This leadership reflects China’s rapid adoption of advanced extraction methods that enhance ingredient purity, efficacy, and sustainability.

Marine biotech formulations are expected to gain further traction as consumers prioritize science-backed natural ingredients that deliver visible results. Government support for biotechnology research and rising investments in cosmeceuticals are anticipated to amplify this dominance, positioning China as a hub for marine-based skincare innovation.

Other claims, while holding a smaller share, are projected to retain importance as multifunctional products targeting hydration, brightening, and overall skin health expand their appeal. The interplay of biotech-driven efficiency and consumer demand for clean-label solutions is expected to define market dynamics over the decade.

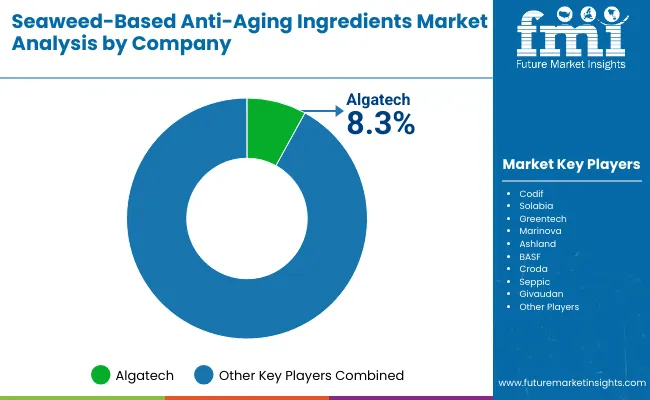

| Company | Global Value Share 2025 |

|---|---|

| Algatech | 8.3% |

| Others | 91.7% |

The market is moderately fragmented, with global leaders, mid-sized innovators, and niche specialists competing across marine-derived actives. Leading suppliers such as Algatech, BASF, Croda, Givaudan, and Ashland have been positioned strongly through portfolio breadth in seaweed extracts and biotechnology-enabled actives. Their strategies are being oriented toward clinically validated efficacy, traceable sourcing, and end-to-end partnerships with premium and dermocosmetic brands. Emphasis has been placed on marine-biotech processes that raise purity and potency while aligning with sustainability certifications.

Mid-sized players including Solabia, Greentech, Seppic, Marinova, and Codif are advancing differentiated extracts and standardized phycocompounds. Agility in R&D collaborations, faster custom development cycles, and targeted claims (firming, antioxidant defense, barrier support) are being used to win briefs from clean-label and pharmacy-led brands.

Specialists focused on high-grade brown-algae and microalgae fractions are competing on provenance, cold-chain processing, and verified bioactivity. Competitive differentiation is shifting from commodity extracts toward integrated ecosystems: validated in-vitro/in-vivo dossiers, lifecycle-assessment reporting, and co-development programs that accelerate time-to-launch. Over the forecast horizon, market share is expected to consolidate around suppliers that combine marine-biotech scale-up, documented clinical outcomes, and credible sustainability disclosures.

Key Developments in Seaweed-Based Anti-Aging Ingredients Market

| Item | Value |

|---|---|

| Quantitative Units | Global market size USD 1,803.1 million (2025); forecast USD 5,806.7 million (2035); CAGR 12.4% (2025-2035) |

| Component / Inputs | Seaweed extracts and marine bioactives (e.g., fucoidan, alginate, phlorotannins), carrier systems, preservatives compliant with clean-label norms |

| Primary Segments | Function: Anti-aging & firming, Others, Claim: Marine biotech, Others, Source: Brown algae, Others |

| Applications | Serums, creams/lotions, masks, capsules/powders across premium skincare and dermocosmetics |

| Channels | E-commerce, pharmacies, natural beauty stores, specialty beauty retail |

| End-use Industry | Beauty & personal care manufacturers, cosmeceuticals, dermocosmetic/pharmacy brands, contract manufacturers (CMOs), indie clean-beauty brands |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, China, India, United Kingdom, Germany, Japan |

| Key Companies Profiled | Algatech, Codif, Solabia, Greentech, Marinova, Ashland, BASF, Croda, Seppic, Givaudan |

| Competitive Snapshot | Moderately fragmented; leader Algatech ~8.3% global value share (2025); long tail of regional specialists; increasing partnerships for biotech extraction and clinical validation |

| Regulatory & Standards | COSMOS-certified, clean-label and traceability requirements; sustainability and lifecycle-assessment reporting emphasized |

| Growth Drivers (Summary) | Consumer shift to natural & sustainable actives; biotech extraction improving purity/efficacy; premiumization in dermocosmetics |

| Risks/Constraints | Raw-material variability, harvest seasonality, certification costs, scale-up challenges for consistent bioactivity |

| Additional Attributes | Dollar sales by Function (e.g., Anti-aging & firming USD 232.8 million in USA 2025); sales by Claim in China (Marine biotech USD 128 million, 2025); brown algae leadership (49.5% share; USD 890.9 million, 2025); emphasis on clinical dossiers, traceable sourcing, and sustainability metrics; rapid growth in India (CAGR 22.7%), China (20.1%), Japan (17.1%); partnerships for marine-biotech scale-up and co-development with premium brands. |

The global Seaweed-Based Anti-Aging Ingredients Market is estimated to be valued at USD 1,803.1 million in 2025.

The market size for the Seaweed-Based Anti-Aging Ingredients Market is projected to reach USD 5,806.7 million by 2035.

The Seaweed-Based Anti-Aging Ingredients Market is expected to grow at a CAGR of 12.4% between 2025 and 2035.

The key product types in the Seaweed-Based Anti-Aging Ingredients Market include serums, creams/lotions, masks, and capsules/powders.

In terms of function, the anti-aging & firming segment is expected to command 55.6% share in the Seaweed-Based Anti-Aging Ingredients Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Biotin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Baking Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Savory Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Examining Savory Ingredients Market Share & Industry Leaders

Energy Ingredients Market Analysis by Product Type and Application Through 2035

Perfume Ingredients Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Caramel Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA