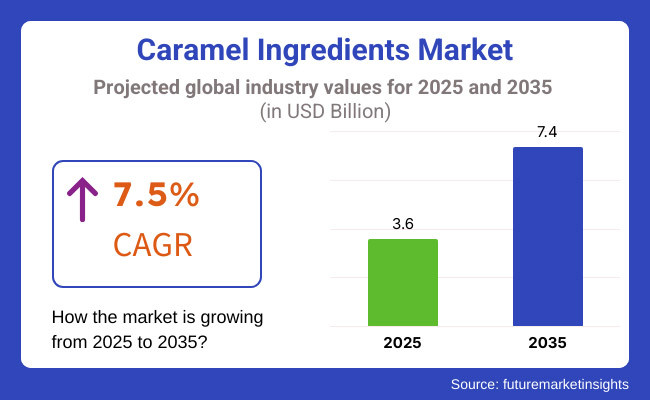

The global caramel ingredients market is currently valued at around USD 3.6 billion and is anticipated to progress at a CAGR of 7.5% to reach USD 7.4 billion by 2035.

This strong growth trajectory underscores the increasing integration of caramel-based components across diverse applications, notably in the bakery, confectionery, beverages, and snack sectors. Stakeholders across the value chain have demonstrated a marked shift toward caramel ingredients not only for their traditional flavor and color functionalities but also as versatile clean-label options that appeal to premium product consumers.

While traditional usage remains prominent, innovative product development strategies have emphasized naturally derived caramel colors and flavorings that align with evolving regulatory norms and health-conscious consumption patterns.

It is strongly believed by industry specialists and formulators that demand will continue to be steered by the visual and sensory enhancements caramel provides-particularly within high-growth bakery and ready-to-drink beverage segments. Caramel colors, for instance, are being reformulated to exclude ammonium compounds or sulfites, a development seen as essential for brands looking to meet natural or organic claims.

Additionally, the expansion of premium foodservice chains and on-the-go snacking habits has intensified the requirement for customized and shelf-stable caramel ingredients, whether in powdered, liquid, or granular form.

Another significant consideration fueling growth is the premiumization trend within the food and beverage sector. Consumers seeking artisanal and indulgent experiences are gravitating toward products that incorporate gourmet caramel profiles-such as salted caramel, burnt caramel, or vegan-friendly caramel syrups-thus opening innovation pipelines for specialty ingredients providers.

Notably, companies such as Kerry Group and Puratos have been proactive in advancing clean-label and functional caramel innovations, targeting bakery fillings and dessert applications. Meanwhile, multinationals like Cargill and Sensient are scaling production capabilities to ensure consistency and regulatory compliance in global supply chains.

Caramel ingredients market is not merely expanding in scale but also evolving in sophistication, where formulation expertise, sensory enhancement, and compliance with health-driven labeling will shape long-term strategic advantage. Continued investment in R&D and application-specific innovations is expected to dictate competitive positioning through 2035.

The coloring segment accounts for 38% of the caramel ingredients market in 2025, supported by a robust CAGR of 7.5% through 2035.

This segment has retained strategic importance due to its dual role in visual appeal and clean-label reformulation. As consumers increasingly associate natural-looking tones with product authenticity, manufacturers have prioritized caramel colors that can impart rich hues without reliance on synthetic or chemical additives.

Bakery and beverage sectors-especially ready-to-drink coffee, malted beverages, and artisanal baked goods-are actively reformulating to integrate ammonium-free and sulfite-free caramel colorings, in line with evolving EU and North American regulatory frameworks.

Brand owners view caramel coloring as a storytelling tool, enabling them to convey warmth, indulgence, and craft quality. This is especially evident in plant-based and functional indulgence formats, where the visual signal must match consumer expectations of taste and health. Continued pressure to align with vegan and organic labels is expected to catalyze further innovation in fermentation-derived or enzymatically treated caramel colors.

Over the next decade, the segment’s growth trajectory will depend less on volume expansion and more on purity claims, stability across matrices, and compatibility with fortified or reduced-sugar systems. As a result, coloring will serve not only as a passive additive but as an active enabler of premiumization and market differentiation.

The flavoring segment is projected to grow at a CAGR of 7.8% from 2025 to 2035, driven by its rising use in gourmet, clean-label, and hybrid food formats.

Caramel-based flavorings have evolved from legacy sweetness enhancers into nuanced tools for delivering depth, complexity, and indulgence across multiple food and beverage formats. This shift has been particularly evident in premium dairy desserts, RTD coffee beverages, snack coatings, and health-positioned confections where caramel flavoring serves both sensory and emotional functions.

With consumer palates becoming more sophisticated and preferences tilting toward recognizable yet elevated taste profiles, the demand for high-fidelity flavor replication-such as burnt caramel, fleur de sel caramel, or brown butter caramel-has seen a noticeable uptick.

Moreover, the integration of natural and organic flavoring systems has become a critical point of differentiation. Formulators are increasingly opting for label-friendly alternatives that exclude synthetic solvents or carriers, while maintaining flavor intensity and stability.

This has created a competitive landscape where providers of functional caramel flavorings-capable of withstanding pH variation and heat processing-are positioned at a strategic advantage.

Through 2035, the flavoring segment will remain a cornerstone of product storytelling and innovation, especially as brands blend nostalgic indulgence with modern health and sustainability narratives to secure consumer loyalty.

Challenges

Health Problem Associated with Consume of Sugar

The market for caramel ingredients is confronted by humongous challenges with elevated health problems coming with consume of sugar. As there has been growing and ongoing concern among individuals about the ill effects of high sugar intake, i.e., diabetes and obesity, individuals are becoming more aware of what they consume.

That is why there has been growing demand for healthy foods, thus spurring companies to innovate such caramel products with lower content of sugar. Flavor and texture control with reduced sugar is a technical challenge of the food industry, which has to find ways of preserving the rich, indulgent taste of caramel without sacrificing consumer health trends. The trend is reshaping the marketplace dynamics.

Opportunities

Growing Demand for Natural and Clean-Label Ingredients

Caramel ingredients are rich with opportunities in the face of the dilemma, particularly with growing demand for natural and clean-label ingredients. There has been a trend among the consumers of the food that does not contain artificial ingredients, additives, and genetically modified foods.

The companies have seen the trend and looked and created caramel ingredients from natural sources as part of the clean-label movement. This food easily makes its way to health-conscious consumers who love having simple and clear labeling of their food. As there is an increase in clean-label, natural caramels trend, caramels ingredients market will also increase, offering companies an opportunity to gain profit from such evolving consumer trends.

The USA caramel ingredients market has been driven by the nation's biggest food processing company and end-consumers' need for sweetness. Caramel-flavored drinks like the Caramel Macchiato in large food stores like Starbucks have also made it popular and, therefore, demand has been established.

Clean-labeling would be the trend most likely to force manufacturers to produce caramel ingredients that have zero artificial ingredients in the future since consumers will use natural ingredients and they are calling for transparency.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

In the United Kingdom, old-fashioned sweets such as sticky toffee pudding have remained favorites for caramel ingredients. The craft market has also created demand for high-end caramel sauces and spreads. Future growth will come from leveraging caramel flavor on gourmet snack foods such as popcorn and crisps in a bid to keep up with changing taste buds among British consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.6% |

The rich and varied food culture of the EU has been underpinning the use of caramel ingredients in other pastries and confectioneries. Promotion of natural additive policy has enhanced innovation using low-processed caramels by companies. Growth in the plant foods sector presents possibilities for plant-based sweet uses and milk replacers uses of caramel, according to the EU agenda of being sustainable.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.2% |

The Japanese sweets market has adopted the caramel tastes, and this is evident in the manufacturing of such sweet foods as the Caramel Almond Pretz by Glico. The combination of Japanese heritage sweets and caramel has led to specialty sweets with a mass consumer appeal. The innovation of high-end confectioneries and gift culture, which is estimated, is also bound to increase demand for high-quality caramels from ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.5% |

The highly developed snack food market of South Korea has introduced caramel-flavored flavorings in snacks such as Haitai's Caramel Corn Chips. Demand is created by K-Pop and K-Drama, as well, because the foods are promoted with the media as trends through caramel-flavor content. Demand is likely to be greater with the experimentation of caramel on traditional snacks as well as Western-style snacks for domestic as well as international markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

Cargill Incorporated (15-20%)

Cargill dominates the caramel ingredients space with its versatile portfolio of caramel colors, flavors, and fillings. It is dedicated to sustainable production and sourcing practices since consumers increasingly ask for green products.

Kerry Group (12-16%)

Kerry Group offers innovative solutions for caramel, especially for application in bakery and confectionery. Its clean-label product platform responds to increasing consumer demand for transparency and natural ingredients.

Sensient Technologies Corporation (10-14%)

Sensient has natural caramel colors and flavors capabilities and supplies the beverage and dairy markets. Its focus on natural ingredient procurement is consistent with the clean-label product movement of the industry.

Puratos Group (8-12%)

Puratos produces caramel toppings and fillings for industrial and artisan bakery items. Its focus on quality and innovation assists bakers in meeting changing consumer trends.

Sethness Caramel Color (5-9%)

Sethness is a top manufacturer of premium caramel colors for different food and beverage applications. Their emphasis guarantees stability and consistency in formulation.

Other Key Players (40-50% Combined)

Regional and private players contribute to the caramel ingredients market with niche products and innovations. These are:

The global caramel ingredients market size was estimated at USD 3.6 billion in 2025.

The caramel ingredients market is projected to reach approximately USD 7.4 billion by 2035, indicating continued growth.

The demand for caramel ingredients is expected to be driven by the booming convenience food industry, rising disposable incomes, urbanization, and the versatility of caramel in various food and beverage applications such as bakery items, confectioneries, and beverages.

The top 5 regions contributing to the development of the caramel ingredients market are: o North America o Europe o Asia-Pacific o Latin America o Middle East & Africa

The liquid form segment is expected to command a significant share over the assessment period, owing to its extensive usage in the beverage industry for both alcoholic and non-alcoholic drinks.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Way of Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Way of Form, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Way of Form, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Way of Form, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Way of Form, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Way of Form, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Western Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Way of Form, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by Way of Form, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Way of Form, 2018 to 2033

Table 40: Eastern Europe Market Volume (MT) Forecast by Way of Form, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (MT) Forecast by Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Way of Form, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (MT) Forecast by Way of Form, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 52: East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Way of Form, 2018 to 2033

Table 56: East Asia Market Volume (MT) Forecast by Way of Form, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (MT) Forecast by Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Way of Form, 2018 to 2033

Table 64: Middle East and Africa Market Volume (MT) Forecast by Way of Form, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Way of Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Way of Form, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Way of Form, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Way of Form, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Way of Form, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Way of Form, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Way of Form, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Way of Form, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Way of Form, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Way of Form, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Way of Form, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Way of Form, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Way of Form, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Way of Form, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Way of Form, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Way of Form, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Way of Form, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Way of Form, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Way of Form, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Western Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Way of Form, 2018 to 2033

Figure 90: Western Europe Market Volume (MT) Analysis by Way of Form, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Way of Form, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Way of Form, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Way of Form, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Way of Form, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Way of Form, 2018 to 2033

Figure 114: Eastern Europe Market Volume (MT) Analysis by Way of Form, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Way of Form, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Way of Form, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Way of Form, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Way of Form, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Way of Form, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (MT) Analysis by Way of Form, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Way of Form, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Way of Form, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Way of Form, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Way of Form, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 154: East Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Way of Form, 2018 to 2033

Figure 162: East Asia Market Volume (MT) Analysis by Way of Form, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Way of Form, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Way of Form, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Way of Form, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Way of Form, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Way of Form, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (MT) Analysis by Way of Form, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Way of Form, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Way of Form, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Way of Form, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Caramelized Sugars Market Trends Growth & Forecast 2025 to 2035

Caramel Food Colors Market Growth - Applications & Demand 2025 to 2035

Caramel Market

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Biotin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Baking Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Savory Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Examining Savory Ingredients Market Share & Industry Leaders

Energy Ingredients Market Analysis by Product Type and Application Through 2035

Perfume Ingredients Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA