The global caramel malt market is projected to grow from USD 1,110.0 million in 2025 to approximately USD 1,674.9 million by 2035, recording an absolute increase of USD 564.9 million over the forecast period. This translates into a total growth of 50.9%, with the market forecast to expand at a CAGR of 4.2% between 2025 and 2035. The market size is expected to grow by nearly 1.5X during the same period, supported by increasing global demand for specialty brewing ingredients, growing adoption of craft beer production methodologies, and rising flavor complexity requirements driving premium malt procurement across various brewing and food manufacturing applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,110.0 million |

| Market Forecast Value (2035) | USD 1,674.9 million |

| Forecast CAGR (2025-2035) | 4.2% |

| CRAFT BREWING EXPANSION | FLAVOR INNOVATION REQUIREMENTS | QUALITY & SPECIALTY STANDARDS |

|---|---|---|

| Global Craft Beer Movement Continuous expansion of craft brewing operations across established and emerging markets driving demand for specialty malt ingredients. Flavor Complexity Emphasis Growing emphasis on beer flavor diversity and sensory richness creating demand for varied caramel malt profiles. Premium Brewing Positioning Superior color contribution and flavor characteristics making caramel malt essential for differentiated beer products. | Sophisticated Recipe Development Modern craft brewing requires specialty ingredients delivering precise color control and enhanced flavor performance. Processing Versatility Demands Brewers investing in premium malt varieties offering consistent brewing characteristics while maintaining flavor complexity. Quality and Consistency Standards Certified maltsters with proven track records required for advanced specialty brewing applications. | Brewing Quality Standards Regulatory and industry requirements establishing performance benchmarks favoring high-quality specialty malt solutions. Flavor Profile Standards Quality standards requiring superior enzyme activity and resistance to processing variability in brewing operations. Recipe Compliance Requirements Diverse brewing requirements and style standards driving need for sophisticated specialty malt inputs. |

| Category | Segments Covered |

|---|---|

| By Colour | Light, Medium, Dark, Very Dark |

| By Source | Wheat, Rye, Others |

| By Drying Application | Kilned Caramel malt, Roasted |

| By End Use | Beer, Food, Dairy and Frozen Products, Bakery and Confectionery, Others |

| By Flavor | Candy Like, Caramel, Toffee, Raisiny, Slight Burnt Sugar |

| By Application | Microbreweries, Large Breweries, Regional Breweries, Brewpubs, Home Brewers |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Light | Leader in 2025 with 35% market share; likely to maintain leadership through 2035. Broadest use across pale ale brewing, lager production, and food coloring applications with mature supply chain and predictable brewing characteristics. Provides subtle sweetness and golden hues without overwhelming base malt character. Momentum: steady-to-strong. Watchouts: competition from darker varieties in craft beer innovation and flavor intensity preferences. |

| Medium | Strong performer with 25% share, offering balanced color contribution and moderate caramel flavor intensity. Preferred for amber ales, Vienna lagers, and products requiring noticeable but not dominant caramel character. Momentum: rising in craft beer segment driven by sessionable amber beer styles and balanced flavor profiles. Watchouts: squeezed between light and dark varieties as brewers polarize toward subtle or intense flavor expressions. |

| Dark | Growing segment with 22% share, providing rich amber-to-brown colors and pronounced caramel, toffee, and nutty flavors. Essential for brown ales, porters, and robust beer styles requiring substantial malt complexity. Momentum: strong growth through 2030 driven by stout and porter popularity and flavor-forward brewing trends. Watchouts: limited usage rates due to flavor intensity and potential for overwhelming delicate hop characteristics. |

| Very Dark | Specialized segment with 18% share, delivering deep brown colors and intense roasted, burnt sugar characteristics. Critical for imperial stouts, specialty dark beers, and products seeking maximum color and flavor impact. Momentum: selective growth in extreme beer styles and limited-edition specialty releases. Watchouts: narrow application range and potential for astringency requiring careful formulation management. |

| Segment | 2025 to 2035 Outlook |

|---|---|

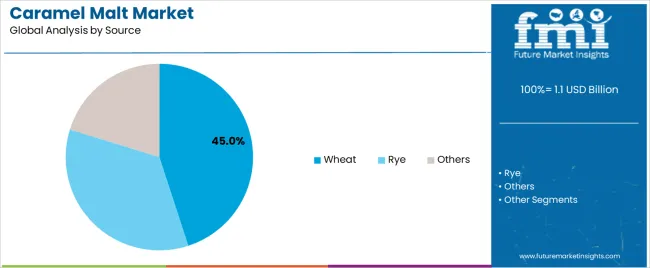

| Wheat | Dominant source with 45.0% share in 2025, valued for smooth mouthfeel contribution, enhanced head retention, and lighter color versus barley-based caramel malts. Particularly important in wheat beer styles and products emphasizing soft, bread-like malt character. Momentum: steady-to-strong growth driven by wheat beer popularity and gluten-reduced brewing experimentation. Watchouts: protein haze challenges and processing complexity requiring specialized brewing techniques. |

| Rye | Emerging source with 30.0% share, offering distinctive spicy, crisp flavor profile and unique fermentation characteristics. Growing adoption in specialty craft beers and innovative brewing experimentation. Momentum: rising through 2030 driven by flavor differentiation trends and experimental brewing culture. Watchouts: processing challenges including beta-glucan viscosity issues and limited agricultural supply infrastructure constraining volume growth. |

| Others | Niche sources with 25.0% share including barley, oat, and specialty grains. Barley remains traditional foundation for classic caramel malts while alternative grains enable product differentiation. Momentum: moderate growth as brewers experiment with ancient grains and unconventional malt sources. Watchouts: limited enzymatic power in some alternatives requiring careful recipe formulation and potential consumer confusion regarding non-traditional sources. |

| Segment | 2025 to 2035 Outlook |

|---|---|

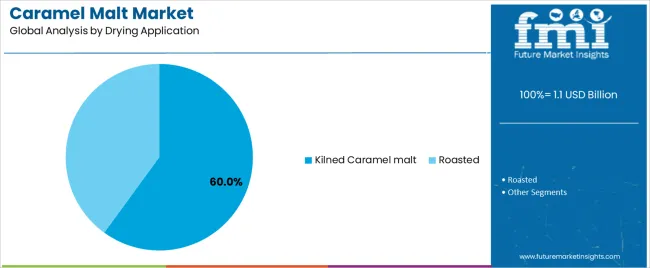

| Kilned Caramel malt | Dominant process with 60.0% share in 2025, utilizing controlled moisture and temperature management to develop caramel flavors while preserving enzymatic activity. Provides consistent, predictable brewing characteristics with broad application suitability. Superior control over color development and flavor intensity versus traditional methods. Momentum: steady growth driven by brewing consistency requirements and large-scale maltster production capabilities. Watchouts: energy intensity and capital equipment requirements limiting small-scale artisanal production. |

| Roasted | Specialized process with 40.0% share, employing higher temperatures to develop pronounced roasted, toasted, and burnt sugar characteristics. Creates more intense flavors and darker colors versus kilned processes. Critical for specific beer styles requiring roasted malt complexity. Momentum: moderate-to-strong growth driven by dark beer popularity and flavor intensity preferences in craft brewing. Watchouts: reduced enzymatic activity requiring supplementation with base malts and narrow flavor profile limiting broad application versus kilned varieties. |

| Segment | 2025 to 2035 Outlook |

|---|---|

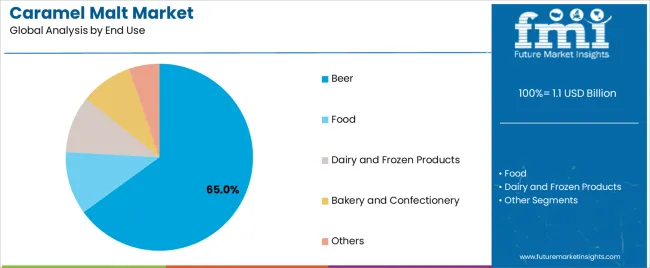

| Beer | At 65%, dominant end-use segment in 2025 with established brewing applications across ale, lager, and specialty beer production. Core market for caramel malt with consistent demand from craft and commercial brewing operations. Momentum: steady-to-strong growth driven by craft beer expansion in emerging markets and specialty beer innovation in developed regions. Watchouts: market maturation in some developed brewing markets and potential shift toward adjunct-heavy light beer formulations in price-sensitive segments. |

| Food | Growing segment with 12% share encompassing natural food coloring, flavor enhancement, and specialty ingredient applications across processed foods. Provides clean-label alternative to artificial colorants with added flavor complexity. Momentum: rising through 2030 driven by clean label trends and natural ingredient preferences. Watchouts: competition from other natural colorants and cost premiums limiting adoption in commodity food categories. |

| Dairy and Frozen Products | Niche segment with 9% share including ice cream flavoring, malted milk products, and specialty dairy applications. Valued for unique flavor contribution and natural coloring properties. Momentum: moderate growth via premium dairy innovation and nostalgic flavor positioning. Watchouts: limited penetration beyond specialty products and seasonal volume fluctuations in frozen dessert applications. |

| Bakery and Confectionery | Established segment with 9% share covering bread coloring, biscuit flavoring, and confectionery applications. Provides authentic malt character and natural browning enhancement. Momentum: steady performance with selective growth in artisanal bakery and premium confectionery positioning. Watchouts: competition from malt extract and other coloring/flavoring alternatives offering different functional properties. |

| Others | Diverse applications with 5% share including nutritional supplements, beverage bases, and industrial fermentation. Small volume but enables market diversification. Momentum: selective growth in functional food applications and malt-based nutritional products. Limited volume potential constrains market significance. |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Candy Like | Leading flavor profile with 40.0% share, characterized by sweet, confectionery-reminiscent notes with minimal roasted character. Dominant in light and medium caramel malts used across diverse beer styles. Broad consumer appeal and versatile brewing applications. Momentum: steady-to-strong driven by approachable craft beer styles and mainstream market expansion. Watchouts: potential perception as less sophisticated versus complex roasted profiles in premium craft segments. |

| Caramel | Classic profile with 22.0% share, offering traditional butterscotch and burnt sugar characteristics that define the caramel malt category. Essential for authentic amber and brown beer styles. Strong brand equity in traditional brewing applications. Momentum: steady growth supported by classic beer style persistence and nostalgic flavor preferences. Watchouts: commoditization risk and differentiation challenges versus specialty flavor innovations. |

| Toffee | Premium segment with 15.5% share, delivering rich, buttery, complex sweetness with layered depth. Highly valued in specialty and strong beer styles requiring sophisticated malt character. Commands flavor complexity premiums. Momentum: rising in craft beer segments emphasizing malt-forward profiles and layered sensory experiences. Watchouts: higher production complexity and narrow optimal usage ranges requiring careful brewing management. |

| Raisiny | Distinctive profile with 12.5% share, characterized by dried fruit, grape, and subtle wine-like notes. Critical for specific beer styles and unique product differentiation. Creates memorable flavor signatures. Momentum: selective growth in barrel-aged beers and specialty releases emphasizing fruit-forward malt character. Watchouts: polarizing flavor profile with limited mass-market appeal and challenges in achieving consistency across production batches. |

| Slight Burnt Sugar | Specialized profile with 10.0% share, offering subtle roasted notes with residual sweetness. Bridges gap between pure caramel and heavily roasted flavors. Valuable for nuanced recipe formulation. Momentum: moderate growth as brewers seek balanced complexity without overwhelming roast character. Watchouts: subtle flavor expression easily overshadowed by other recipe components and difficulty communicating differentiation to consumers. |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Microbreweries | Leading segment with 40.0% share in 2025, characterized by small-scale production, recipe experimentation, and specialty malt utilization. Drive innovation in caramel malt applications and premium variety adoption. Core customers for specialty maltsters with diverse flavor profiles. Momentum: strong growth through 2032 driven by craft beer expansion in emerging markets and continued innovation in developed regions. Watchouts: market saturation in mature craft beer markets and consolidation pressures affecting independent operators. |

| Large Breweries | Established segment with 22.0% share, focused on consistent, high-volume production with standardized recipes. Utilize caramel malt primarily in amber lagers and specialty line extensions. Volume-oriented procurement with price sensitivity. Momentum: steady but limited growth as large brewers maintain core brand focus while selectively expanding specialty offerings. Watchouts: continued light beer emphasis and cost reduction priorities limiting premium malt adoption. |

| Regional Breweries | Mid-scale segment with 15.5% share, balancing production efficiency with local market responsiveness and specialty product development. Important bridge between craft innovation and commercial scale. Momentum: moderate growth driven by regional brand strength and local flavor preferences. Watchouts: competitive pressure from both national brands and local craft breweries squeezing market positioning. |

| Brewpubs | On-premise segment with 12.5% share, offering fresh beer with immediate consumption and experimentation opportunities. Limited production volumes but high visibility and trend-setting influence. Momentum: selective growth concentrated in urban markets with strong dining cultures. Watchouts: real estate costs and operational complexity limiting expansion beyond prime locations. |

| Home Brewers | Enthusiast segment with 10.0% share, characterized by small-batch purchases, recipe experimentation, and education-driven engagement. Brand ambassadors and trend indicators despite limited volumes. Momentum: stable-to-moderate growth as hobbyist community matures and demographic shifts affect participation rates. Watchouts: competition from ready-to-drink craft beer options and time constraints affecting hobby engagement. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Craft Beer Expansion Continuing expansion of craft brewing operations across established and emerging markets driving demand for specialty malt solutions. Flavor Innovation Recognition Increasing recognition of specialty malt importance in beer differentiation and sensory complexity development. Premium Beer Positioning Growing demand for ingredients that support both flavor authenticity and brewing consistency in specialty beer production. | Raw Material Cost Volatility Grain price fluctuations and maltster margin pressure affecting production costs and supply chain predictability. Climate Impact on Supply Weather variability and agricultural challenges influencing barley and wheat quality and availability for specialty malting. Market Concentration Risks Consolidation among maltsters reducing supplier diversity and potentially limiting specialty variety availability. Competition from Alternatives Brewing adjuncts and flavor additives offering different approaches to color and flavor development. | Single-Origin Malt Traceability Integration of farm-to-glass transparency, terroir expression, and provenance storytelling enabling premium positioning opportunities. Sustainable Malting Practices Enhanced energy efficiency, water conservation, and regenerative agriculture partnerships compared to traditional malting operations. Experimental Grain Varieties Development of heritage grains, ancient varieties, and novel hybrids providing unique flavor profiles and brewing characteristics. Custom Malt Specifications Integration of brewer-specific roasting profiles and collaborative product development for differentiated specialty malts. |

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| United States | 4.0% |

| United Kingdom | 3.6% |

| Japan | 3.2% |

Revenue from caramel malt in China is projected to exhibit strong growth with a CAGR of 5.7% from 2025 to 2035, driven by expanding craft beer market infrastructure and comprehensive brewing innovation. This creates substantial opportunities for specialty malt suppliers across microbrewery operations, regional brewing facilities, and imported beer distribution sectors. The country's rapidly growing middle class and expanding beer culture sophistication are creating significant demand for both imported and domestically-produced specialty caramel malts. Major brewing companies and craft beer entrepreneurs are establishing comprehensive local brewing facilities to support large-scale craft beer operations and meet growing demand for flavor-diverse beer solutions.

Revenue from caramel malt in India is expanding with a CAGR of 5.3% from 2025 to 2035, supported by extensive craft beer regulatory liberalization and comprehensive microbrewery expansion, creating sustained demand for reliable specialty malts across diverse brewing categories and emerging craft beer segments. The country's young demographic profile and expanding urban middle class are driving demand for malt solutions that provide consistent brewing performance while supporting flavor innovation requirements. Malt suppliers and brewing entrepreneurs are investing in local distribution facilities to support growing microbrewery operations and specialty beer demand.

Demand for caramel malt in Germany is projected to grow with a CAGR of 4.8% from 2025 to 2035, supported by the country's leadership in brewing excellence and centuries-old malting technologies requiring sophisticated specialty malt systems for traditional and innovative beer production. German maltsters are producing world-class caramel malt varieties that support advanced flavor development, brewing efficiency, and comprehensive quality protocols. The market is characterized by focus on Reinheitsgebot compliance, ingredient purity, and adherence to stringent brewing quality and tradition standards.

Revenue from caramel malt in the United States is growing with a CAGR of 4.0% from 2025 to 2035, driven by mature craft beer market evolution and increasing specialty beer innovation, creating sustained opportunities for malt suppliers serving both established craft breweries and emerging nano-brewery operations. The country's extensive craft brewing infrastructure and expanding beer style experimentation are creating demand for caramel malt varieties that support diverse recipe requirements while maintaining brewing performance standards. Maltsters and specialty ingredient distributors are developing supply strategies to support craft brewery density and regional flavor preferences.

Demand for caramel malt in United Kingdom is projected to reach USD 59.8 million by 2035, expanding at a CAGR of 3.6%, driven by traditional cask ale preservation and craft beer market capabilities supporting amber ale production and comprehensive British brewing tradition applications. The country's established brewing heritage and growing craft beer appreciation are creating demand for high-quality caramel malt varieties that support authentic British beer styles and historical recipe recreation. Maltsters and brewing suppliers are maintaining comprehensive development capabilities to support traditional and innovative brewing requirements.

Demand for caramel malt in Japan is projected to reach USD 52.7 million by 2035, expanding at a CAGR of 3.2%, driven by craft beer regulatory evolution and sophisticated brewing quality capabilities supporting premium beer development and comprehensive flavor innovation applications. The country's meticulous quality standards and growing craft beer acceptance are creating demand for ultra-consistent caramel malt varieties that support exacting brewing specifications and flavor precision. Maltsters and brewing suppliers are maintaining rigorous development capabilities to support demanding Japanese brewing requirements.

<

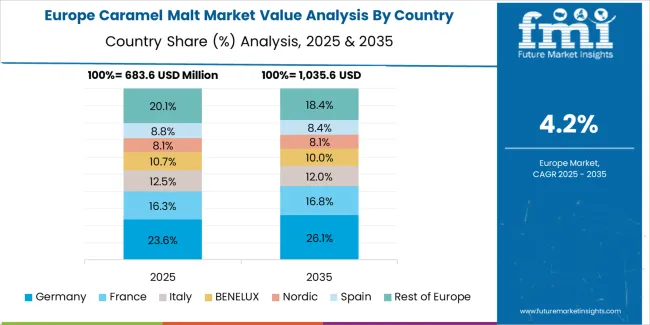

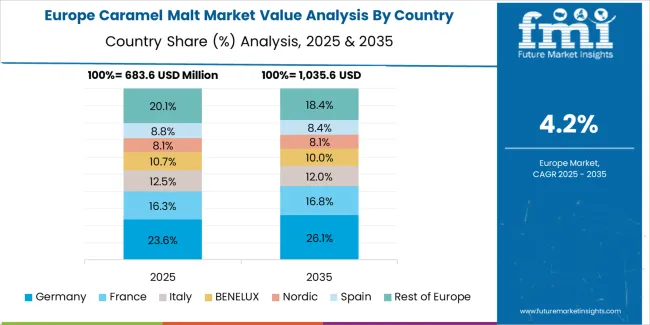

The caramel malt market in Europe is projected to grow from USD 53.5 million in 2025 to USD 80.9 million by 2035, registering a CAGR of 4.2% over the forecast period. Germany is expected to maintain its leadership position with a 32.8% market share in 2025, supported by its unparalleled brewing tradition and world-class malting infrastructure across Bavaria, Franconia, and Bamberg regions producing specialty malts for traditional and craft brewing applications.

United Kingdom follows with a 24.2% share in 2025, projected to reach 24.6% by 2035, driven by craft ale revival and traditional British brewing style renaissance. Belgium holds a 18.7% share in 2025, expected to reach 19.1% by 2035 due to specialty Trappist and abbey beer production requiring diverse caramel malt profiles. Czech Republic commands a 12.4% share, while Austria accounts for 11.9% in 2025. The Rest of Europe region is anticipated to maintain steady momentum, attributed to increasing craft brewing adoption in Nordic countries and emerging Eastern European microbrewery facilities implementing specialty malt programs.

European caramel malt operations are increasingly defined by the contrast between traditional brewing heartlands and emerging craft beer markets. German and Belgian maltsters dominate specialty caramel malt production, leveraging centuries of malting expertise and proprietary kilning techniques that command premium pricing in global brewing markets. German facilities maintain leadership in precision color control and flavor consistency, with major breweries and craft operations driving exacting specifications that smaller maltsters must meet to access premium brewing contracts.

British malting operations focus on traditional varieties supporting cask ale revival and modern craft interpretations of historical styles. Floor malting preservation and heritage barley varieties create differentiation opportunities in premium craft beer segments emphasizing authenticity and provenance. Production scale limitations and cost structures challenge competitiveness against continental European volume maltsters.

Eastern European malting operations in Czech Republic, Poland, and Slovakia leverage traditional Pilsner malting expertise while expanding into specialty caramel production. These facilities capture growing local craft beer demand while serving as cost-competitive suppliers for Western European brewers seeking quality alternatives to premium German and British malts.

The regulatory environment shapes competitive dynamics. Reinheitsgebot compliance requirements in Germany establish quality benchmarks while limiting ingredient flexibility. EU agricultural policies affect barley pricing and availability, influencing maltster economics and specialty variety production decisions. Sustainability regulations drive investments in energy-efficient kilning and water conservation technologies, creating cost pressures favoring larger, modernized facilities.

Consolidation accelerates as global malting groups acquire regional specialists to secure specialty malt capabilities and expand geographic coverage. Craft brewing's emphasis on local sourcing and artisanal production maintains opportunities for small-scale floor malting operations and heritage variety specialists serving premium market segments.

Japanese caramel malt operations reflect the country's precision brewing standards and growing craft beer sophistication. Major brewing companies including Asahi, Kirin, and Sapporo maintain established relationships with international maltsters for specialty caramel varieties, while emerging craft breweries increasingly experiment with diverse malt profiles to differentiate products in competitive urban markets.

The Japanese market demonstrates unique brewing preferences emphasizing clean, balanced flavor profiles with subtle malt contributions. This creates demand for lighter caramel malts providing color and mild sweetness without overwhelming delicate hop and yeast characteristics prevalent in Japanese beer styles. Imported German and British caramel malts dominate premium craft segments while domestic maltsters focus on base malt production.

Regulatory frameworks through Japan's liquor tax system historically favored large breweries but recent reforms reducing minimum production requirements have enabled craft brewery proliferation. This liberalization drives specialty malt demand as new brewers experiment with recipe formulation and style diversity, though volumes remain modest compared to traditional lager-focused production.

Supply chain dynamics emphasize long-term supplier relationships and quality consistency. Japanese brewers value reliable technical support and brewing consultation from maltsters, creating advantages for established international suppliers with local technical teams and Japanese-language resources. Price sensitivity remains secondary to quality assurance and supply reliability.

The market faces growth constraints from Japan's declining population and mature beer consumption patterns. Premiumization trends and craft beer's appeal to younger consumers support specialty malt demand growth. Continued craft brewery openings in Tokyo, Osaka, and regional cities drive incremental specialty malt requirements despite overall beer market stagnation.

South Korean caramel malt operations reflect the country's evolving craft beer market following regulatory liberalization enabling microbrewery and brewpub proliferation. Major conglomerates including Hite Jinro and Oriental Brewery dominate mainstream beer production with limited specialty malt usage, while hundreds of craft breweries established post-2014 regulatory reform drive specialty malt demand growth.

The Korean market demonstrates particular strength in experimental brewing embracing diverse international beer styles. Craft brewers actively incorporate caramel malts to produce American-style amber ales, British-inspired bitters, and Belgian-influenced specialty beers targeting sophisticated urban consumers seeking alternatives to mainstream lagers. This style diversity creates demand for varied caramel malt color and flavor profiles.

Regulatory frameworks continue evolving to support craft beer market development. Distribution restrictions historically limiting craft beer retail access are gradually relaxing, enabling market expansion beyond brewery taprooms. This improved market access supports production growth and corresponding specialty malt procurement increases.

Supply chain infrastructure remains developing compared to mature brewing markets. Most specialty caramel malts are imported from European or North American suppliers through distributors serving craft brewing communities. Some Korean brewers pursue direct import relationships for volume procurement, though smaller operations rely on domestic distributors offering smaller packaging and mixed malt shipments.

The market faces challenges from intense competition among craft breweries in saturated urban markets and consumer price sensitivity limiting premium beer adoption. Continued craft beer culture development and international brewing collaboration support specialty malt demand growth. Korean brewers' willingness to experiment with diverse ingredients and styles creates opportunities for maltsters offering distinctive caramel varieties and technical brewing support.

Profit pools are consolidating around established regional maltsters integrating agricultural relationships, proprietary kilning technologies, and direct brewery partnerships with proven quality consistency and technical brewing support. Value is migrating from commodity base malt production to specialty caramel varieties where flavor distinctiveness, color precision, and application expertise command premium pricing. Several archetypes set the pace: heritage European maltsters defending share through centuries of expertise and brand equity in traditional brewing markets; global malting groups offering integrated supply chains and technical resources; craft-focused specialty maltsters providing distinctive varieties and collaborative product development; and regional floor malting operations emphasizing terroir expression and heritage grain varieties.

Switching costs recipe reformulation requirements, flavor profile adjustments, brewing trials stabilize brewer relationships for incumbents, while craft beer innovation and local sourcing preferences reopen opportunities for regional specialists and heritage variety producers. Consolidation continues among mid-scale maltsters while craft brewing growth supports artisanal malting revival. Do now: secure long-term grain sourcing partnerships with quality barley and wheat farmers and establish technical brewing support capabilities; hard-wire proprietary kilning profiles and flavor consistency protocols; option: develop collaborative custom malt programs with flagship craft breweries and pursue organic/heritage grain certifications.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Heritage European maltsters | Centuries of expertise, brand equity, quality reputation | Long-term brewery partnerships, technical consultation, traditional variety preservation |

| Global malting groups | Scale efficiency, integrated supply chains, R&D resources | Multi-region sourcing, logistics optimization, standardized quality systems |

| Craft-focused specialty maltsters | Innovation agility, collaborative development, distinctive profiles | Custom malt development, small-batch flexibility, craft brewery relationships |

| Regional floor malting operations | Terroir expression, artisanal positioning, local grain partnerships | Heritage varieties, farm-to-glass traceability, premium craft positioning |

| Technical service providers & distributors | Brewing consultation, logistics coordination, portfolio curation | Brewing education, recipe development support, mixed product shipments |

| Items | Values |

|---|---|

| Quantitative Units | USD 1,110.0 million |

| Colour | Light, Medium, Dark, Very Dark |

| Source | Wheat, Rye, Others |

| Drying Application | Kilned Caramel malt, Roasted |

| End Use | Beer, Food, Dairy and Frozen Products, Bakery and Confectionery, Others |

| Flavor | Candy Like, Caramel, Toffee, Raisiny, Slight Burnt Sugar |

| Application | Microbreweries, Large Breweries, Regional Breweries, Brewpubs, Home Brewers |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, United Kingdom, China, India, Japan, and other 40+ countries |

| Key Companies Profiled | Bairds Malt Limited, Weyermann, Castle Malting, Thomas Fawcett Malting, Great Western Malting, Briess Malt & Ingredients Co., Simpsons Malt, Crisp Malting Group, Malteurop Group, Rahr Corporation |

| Additional Attributes | Dollar sales by colour/source/drying application/end use/flavor/application, regional demand (NA, EU, APAC), competitive landscape, craft vs. commercial brewery adoption, sustainable malting integration, and specialty variety innovations driving flavor differentiation, brewing consistency, and craft beer development |

The global caramel malt market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the caramel malt market is projected to reach USD 1,674.9 billion by 2035.

The caramel malt market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in caramel malt market are light, medium, dark and very dark.

In terms of source, wheat segment to command 45.0% share in the caramel malt market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Caramel Malt in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Caramel Malt in USA Size and Share Forecast Outlook 2025 to 2035

Malt Sprouts Market Size and Share Forecast Outlook 2025 to 2035

Malted Rye Flour Market Size and Share Forecast Outlook 2025 to 2035

Malted barley flour Market Size and Share Forecast Outlook 2025 to 2035

Malt Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malted Milk Market Size and Share Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Caramel Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Malt Market Trends and Forecast 2025 to 2035

Analysis and Growth Projections for Maltodextrin Business

Maltitol Market Analysis by form, end use industry and by region – Growth, trends and forecast from 2025 to 2035

Caramelized Sugars Market Trends Growth & Forecast 2025 to 2035

Caramel Food Colors Market Growth - Applications & Demand 2025 to 2035

Malted Milk Powder Market Trends - Growth & Industry Forecast 2025 to 2035

Caramel Market

Malted Wheat Flour Market

Isomalt Market Analysis - Size, Share, and Forecast 2025 to 2035

Isomalt Industry in Japan – Growth & Industry Trends 2025 to 2035

Isomalt Industry Analysis in Western Europe – Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA