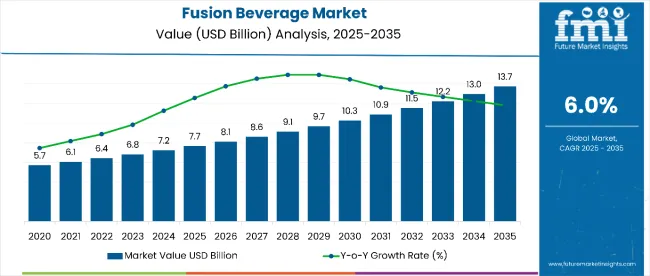

Throughout the years 2025 to 2035 the Fusion Beverage Market will expand to reach a value of USD 7.67 billion. It demonstrates predicted compound annual growth at a rate of 6.0% resulting in an ultimate value of USD 13.73 billion by 2035.

The fusion beverage market shows an increasing trend in growth because consumers desire modern healthy drink alternatives. The creation of fusion beverages combines classic ingredients with original components to develop unique taste patterns which also provide functional advantages.

Fused coffee and tea products along with carbonated drinks and alcoholic drinks and fruit juices and energy and sports drinks represent the multiple beverage categories. These beverages address health-focused consumers who desire beverage products which combine great taste with nutritional content to help them maintain their fitness routines.

Fusion beverages gain popularity through their delightful consumption experience which suits contemporary consumer taste changes. Multiple factors drive the increase in the market for fusion drinks. Among them is the increase in consumer interest in organic and natural products coupled with low levels of sugar content.

Consumers have been constantly on the lookout for beverages that suit their wellbeing needs, thereby propelling the demand for fusion drinks that include functional ingredients like vitamins, minerals, and antioxidants.

The trend of premiumization and craft among beverages has contributed immensely to further fueling market growth, with people paying an exorbitant price to consume goods that are exclusive and high-grade. Social media and influencer marketing have both been central to making fusion beverages popular, with a focus on their popularity with the masses.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025 E) | USD 7.67 billion |

| Projected Global Industry Value (2035 F) | USD 13.73 billion |

| Value-based CAGR (2025 to 2035) | 6.0% |

The industry for blended beverages will also continue on its rising pathProduct breakthroughs and more environmentally-friendly packaging are repeatedly making these offerings more attractive, driving them in the direction of the greener consumers.

North America currently dominates the market due to heightened consumer consciousness along with a dominant presence of marketplace champions. But the Asia-Pacific region will be growing at the fastest rate, fueled by rising urbanization, rising middle classes, and higher disposable incomes. Market leaders PepsiCo, The Coca-Cola Company, Nestlé, Danone, and Keurig Dr Pepper are still innovating to respond to evolving consumer needs and leverage emerging trends.

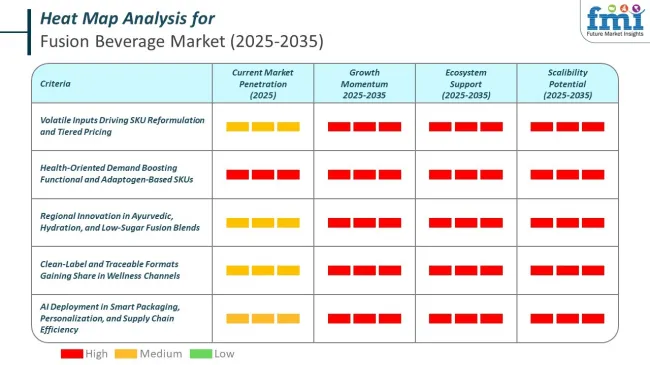

Fusion beverage SKUs are produced across regional facilities with automation integrated into batch coding, filler selection, and packaging control. Indian and ASEAN plants manage dairy and herbal combinations, while North American units operate composite filling lines. In Europe, small-run facilities use smart systems for label verification and packaging sequencing.

Most fusion beverages fall under multiple Codex standards depending on their ingredients, which serve as reference points for national rules and trade compliance.

Incorporation of vitamins, minerals, and antioxidants for added health benefits.

Incorporating vitamins, minerals, and antioxidants into fusion drinks is a dominant trend today fueled by consumers becoming more health-and-wellness-focused. These functional ingredients are introduced to further add value to the nutrition offered in a beverage such that in addition to being quenchers of thirst, these become healthier beverages too.

Vitamins C, E, and A, as well as B-complex vitamins, are added to supply a variety of body functions ranging from energy metabolism to immune function. Minerals such as calcium, magnesium, and potassium are added to support bone health, muscle function, and electrolyte balance. Green tea, berries, and other herbs in the form of antioxidants are added to inhibit oxidative stress and chronic diseases.

Consumers have greater knowledge about the function such nutrients have on proper health and are seeking products that offer something more than basic hydration. The use of beverages that have fusion formulas with vitamins, minerals, and antioxidants fit this bill through their provision of a quick form of consuming essential nutrients.

This comes particularly in handy for busy lives when one might not get the time to consume nutrient-dense food and would be interested in convenient methods of achieving wellness while on the move. Additionally, the availability of these functional ingredients also fits with the trend of being more organic and natural since more and more consumers are attracted to the use of natural sources of vitamins and minerals over man-made chemicals.

The popularity of the movement has led to more innovation in the market for blended drinks as companies attempt to come up with new means of increasing the nutritional value of their products. For instance, cold-press juices, infused drinks, and herbal teas are being supplemented with vitamins and minerals in a bid to produce healthy and tasty drinks.

Their brand aims to promote their functional ingredients and appeal to healthy consumers who are willing to pay more for drinks that maintain their health. The trend is not yet fully underway, so the market for fusion drinks can expect to expand and diversify while focusing on providing consumers great-tasting and healthy beverages.

Introduction of unique and exotic flavor combinations to attract adventurous consumers.

The addition of new and provocative flavor profiles within fusion drinks is one of the key methods for engaging exploratory customers who will try new taste experiences. In an oversaturated marketplace with standard flavors, having something different can establish a brand and generate word-of-mouth among consumers.

Fruit exoticals such as yuzu, dragon fruit, hibiscus, matcha, and lychee are being included in fusion drinks to deliver signature and unique tastes. They also come with colours and textures pleasing to the eye and pleasant on the senses, bringing an integrated sensory factor into the beverage.

Successful customers are always on the lookout for new and novel products that will deliver something new from the ordinary. With its development of unorthodox and foreign taste profiles, a business can ride this wave of novelty demand and attract a loyal fan base.

Social media has further accelerated this phenomenon, with visually appealing and Instagrammable beverages that can easily go viral, creating consumer interest and demand. Food bloggers and influencers tend to feature these unusual drinks, further increasing their popularity and exposure.

Besides, exotic flavor usage also stems from increased awareness of wellness and health. Some of the unique ingredients like turmeric, ginger, and moringa are healthy and increasingly being incorporated in fusion drinks. Blending fresh flavors and functionality will attract healthy consumers who are looking for something tasty but, at the same time, good for their health.

Growth of premium and artisanal fusion beverages that offer high-quality and unique experiences.

The development of craft and premium fusion drinks is led by growing consumers' needs for better and special drinking experience. These products are differentiated from mass-market beverages due to their craftsmanship, use of high-quality ingredients, and unique flavors. Craft and premium fusion drinks may use exotic fruits, rare botanicals, and other specialty elements, which the elite consumers want. The "craft" trend in the food and beverage market has also been a factor, with consumers looking for products that embody authenticity, innovation, and human touch.

Craft fusion drinks are usually made in smaller quantities, and more attention and quality control is given. This is appealing to consumers who value sustainability, transparency, and ethics. Most premium fusion drink companies emphasize the use of organic, non-GMO, and sustainably-sourced ingredients, which is attractive to environment- and health-conscious consumers. Furthermore, packaging for most such drinks tends to represent their quality, being characterized by sophisticated designs and green packaging that are complementary to the entire flavor experience.

The "Instagrammable" factor and the impact of social media have also promoted the consumption of premium and craft blend drinks. Visually appealing drinks with bright hues and creative presentation go viral on the internet, and people are willing to share their experiences and create word-of-mouth marketing. The trend is most common among younger generations, who consider experiences as important and would pay a premium for something new in products.

Increasing popularity of fusion alcoholic beverages, such as cocktails and mocktails.

The growing need for fusion alcohol drinks, including cocktails and mocktails, lies in a chain of factors. The key motivation is the growing consumer movement towards fresh and new drinking experience. Fusion drinks combine traditional bases of liquor with oriental ingredients, tastes, and ways of serving to develop thrilling and spectacular drinks. For instance, cocktails can incorporate tropical fruits, herbs, spices, and even new ingredients such as edible flowers or smoked infusions, providing a multi-sensory experience that will entice experimental drinkers.

But then there is the craft cocktail movement, with creativity, quality, and handmade production central to it. The mixologists and bartenders are continually experimenting with new ingredients and methods just to keep pushing the envelope and making something new and different out of a cocktail. This has spawned renewed interest in classic cocktails reimagined with a twist as well as new cocktails invented altogether. Mocktails or virgin cocktails have also come into existence, serving the ones who want to enjoy the same sophisticated and delicious experience but alcohol-free. This is in line with the increasing demand for healthier and more inclusive beverages.

Social media has been instrumental in the success of fusion alcoholic drinks. Attractive and shareable drinks become seen, and customers are willing to post online about them. Internet exposure generates buzz and demand for specialty cocktail and mocktail drinks. Celebrity endorsements and popular culture stardom also fueled the trend, with celebrities and events exposing the public to new-generation fusion drinks.

During the period 2020 to 2024, the sales grew at a CAGR of5.7%and it is predicted to continue to grow at a CAGR of6.0% during the forecast period of 2025 to 2035. The fusion drink market has grown enormously in the last decade, from being a niche market to a mass market.

At first, fusion drinks were distributed in specialty stores and health food shops, aiming at health-conscious customers looking for innovative drink products. But as there was a growing demand for healthy and diversified beverages, the market expanded.

The main drivers were consumers' demand for natural and organic ingredients, minimal sugar content, and the addition of functional ingredients like vitamins, minerals, and antioxidants. Influencer marketing and social media promoted the popularity of fusion drinks by highlighting their exclusive flavor and health advantages to the wider population.

Pioneering beverage companies recognized the scope of this market and the imperative to begin studying and crafting their products, leading to the subsequent innovation of a wildly diverse variety of fusion beverages designed for the evolving preferences of the consumer.

Forward, the market for fusion drinks will continue on the growth trajectory, with a future compound annual growth rate (CAGR) of 5.7% from 2025 to 2035. This is because there are several drivers that will have natural and organic ingredients, low sugar content, and plant-based alternatives remain at the forefront of trends.

Functional ingredient technologies, like adaptogens, probiotics, and superfoods, will remain driving the popularity of fusion beverages. Technology development in manufacturing technology and eco-friendly packaging also will be propelling the market.

Although North America is presently the leader in the market owing to massive consumer awareness and strong presence of market leaders, the Asia-Pacific market is expected to witness the most dynamite growth.

Drivers like more urbanization, an expanding middle class, and rising disposable incomes will propel demand in the region. As the market keeps maturing, customers will be able to treat themselves to an ever-expanding number of innovative and diverse fusion drink products that meet their evolving tastes and lifestyles.

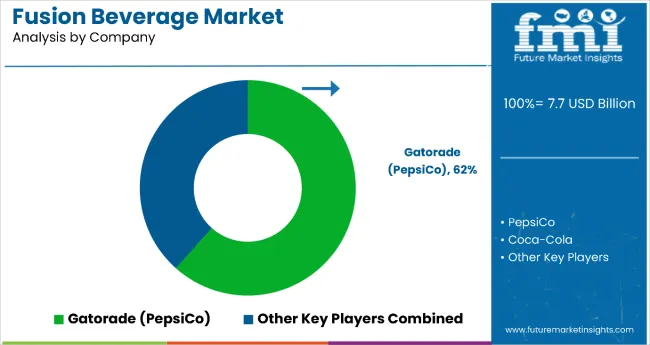

Tier1: Tier 1 players are the world leaders in the merger beverage industry with massive market share and large coverage. They are PepsiCo, The Coca-Cola Company, and Gatorade. They are accountable for a market leadership by virtue of their vast resources, powerful brand name, and capacity to innovate and diversify business.

They constantly invest in R&D to produce new and innovative fusion drinks, using their vast distribution channels to access a wide base of consumers. Their effective marketing campaigns and partnerships with other brands also improve their market leadership positions.

Tier 2: Tier 2 players in the fusion beverage industry are players with expanding presence and diversifying product portfolios at a high velocity. Lucozade, Pocari, and Powerade fall into this category. These players have identified the opportunity in the fusion beverage industry and are actively engaged in evolving their product portfolios.

They are engaged in creating innovative and innovative types of beverages for health-conscious consumers. Although they are not as widely spread as Tier 1 companies, their emphasis on quality and innovation makes them strong players in the market.

Tier 3: Tier 3 businesses are niche, small businesses in the fusion drinks industry that target specific regions or niches. Tier 3 businesses are defined by ZICO Beverages and 100 Plus. Tier 3 businesses focus on quality, sustainability, and differentiation to drive customers to them from large brands.

They specialize in distributing specialty fusion drinks to consumers that target specific desires and needs. Although they lack the vast resources and international presence of Tier 1 and Tier 2 players, niche specialization enables them to build a loyal client base and form a niche in the marketplace

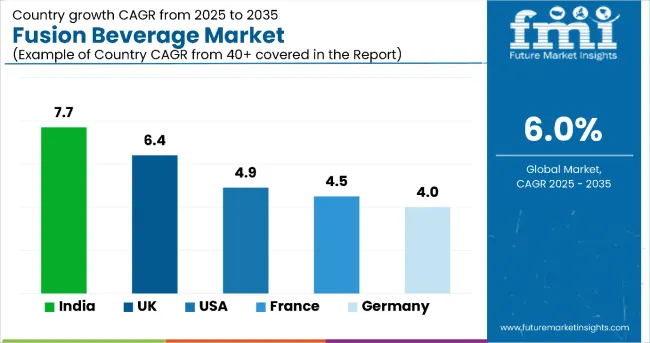

The following table shows the estimated growth rates of the significant three geographies sales. USA and Germany are set to exhibit high consumption, recording CAGRs ofxxx and xxxrespectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 4.9% |

| Germany | 4.0% |

| India | 7.7% |

The increasing need for natural and organic ingredients in the fusion drinks market is fueled by a mix of health awareness, sustainability, and the clean label. Today, consumers are more aware of the possible health impacts of synthetic additives, pesticides, and GMOs present in most traditional beverages. Thus, they turn to organic and natural fusion drinks that they believe are safer and healthier.

The role of the environment is also important, as consumers turn to organic products that ensure sustainable farming and reduce ecological impact. The growth of the clean label movement, which is simplicity and transparency-driven, has also contributed to this trend, with consumers choosing beverages that contain short, easily identifiable lists of ingredients.

Social media and influencer marketing have also been responsible for the mainstreaming of natural and organic blend beverages, promoting their advantages and encouraging healthier and sustainable options. Overall, there is a greater demand for organic and natural ingredients that is reshaping the market for fusion drinks, and healthier, sustainable, and transparent products are in demand.

Germany's strong environmental awareness and sustainability focus have played a crucial role in revolutionizing the fusion drinks industry. Consumers in Germany are highly environmentally aware of the ecological impact of their shopping and prefer products that reflect their sustainability and ecological values.

This has spurred demand for fusion drinks that use natural, organic, and sustainably grown ingredients. Fusion drink brands are responding by emphasizing sustainable methods, such as biodegradable packaging, reduced carbon footprints, and the encouragement of sustainable farming. In addition to this, government policy and action encouraging environmental sustainability and protection also contribute to fueling this trend.

The result is an engaged marketplace for fusion drinks for environmentally conscious consumers offering high-quality, innovative products that not only support health but also environmental well-being. This focus on sustainability not only sets apart brands in the market but also generates trust and brand loyalty for German consumers who buy green.

The cultural influence of ancient Indian herbal medicine and health practices is central to the growth of the fusion drink market. There is a strong cultural value among Indian consumers in Ayurveda and traditional herbal medicine, which is founded on the consumption of natural products for health and wellness.

The cultural heritage has fueled the growth of fusion drinks with herbs, spices, and botanicals that have proven medicinal content. Turmeric, ginger, tulsi (holy basil), and ashwagandha are some of the other herbs most frequently used in fusion drinks to provide health advantages such as immunity building, anti-inflammatory action, and general wellness.

As greater awareness of such ancient traditions combined with the recent well-being trend, fusion drinks based on well-being philosophies of a holistic nature have grown in popularity. Fusion beverage brands are riding this trend by developing new products that combine traditional herbal ingredients with modern flavors, attracting consumers who want both old and new. This combination of ancient wisdom and modern convenience is very trendy among Indian consumers, fueling growth and innovation in the industry.

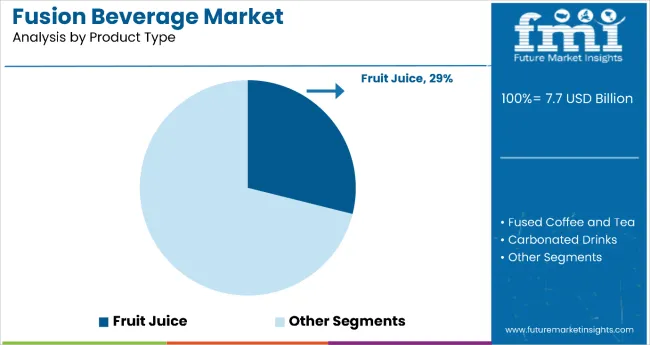

Fruit juice holds the dominant position with 28.9% of the market share in the product type category within the fusion beverage market. This leadership is driven by growing consumer preference for natural fruit blends combined with added vitamins, minerals, and functional extracts that offer both nutritional benefits and innovative flavor profiles. Fruit juice-based fusion beverages appeal to health-conscious consumers seeking refreshing and nutritious options that leverage the inherent health benefits and natural flavor profiles of various fruits.

The segment's dominance is reinforced by fruit juices' versatility in blending various fruit combinations with additional functional ingredients like botanicals, adaptogens, and superfoods that enhance their market appeal. These beverages align with consumer trends favoring natural and less processed products, driving sustained preference for juice-based fusion drinks. As consumers continue to prioritize wellness-oriented beverages that deliver both taste satisfaction and health benefits, the fruit juice segment is positioned to maintain its market leadership through continued innovation in functional ingredient integration and premium natural flavor combinations.

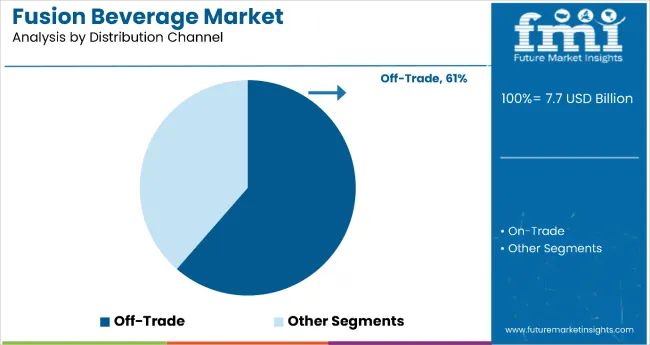

Off-trade dominates the fusion beverage market with 61.4% of the market share in the distribution channel category, reflecting the convenience and accessibility that retail outlets provide to consumers. This leadership is attributed to the widespread availability of fusion beverages across supermarkets, hypermarkets, convenience stores, and online platforms that enable consumers to enjoy these products at home. The off-trade channel benefits from convenience shopping, bulk buying options, and competitive pricing that make fusion beverages more accessible to a broader consumer base.

The segment's dominance is reinforced by the accelerated growth of e-commerce and online food retailing that has expanded consumer access to diverse fusion beverage varieties. Off-trade outlets offer consumers the ability to compare products, read labels, and make informed purchasing decisions while providing attractive pricing, promotional offers, and discounts. The COVID-19 pandemic further accelerated the shift toward off-trade channels as social distancing measures and lockdowns drove consumers to seek alternatives to on-premise consumption, solidifying off-trade's position as the critical distribution channel for fusion beverages.

The market for fusion drinks is highly competitive, with the likes of ZICO Beverages, PepsiCo, Lucozade, and Coca-Cola dominating the market. The competitors have been careful to keep up with the growing demand for healthy and distinct drinks and are busy diversifying their portfolios to gain more market share.

ZICO Beverages specializes in coconut water-based fusion drinks, banking on the health benefits and natural popularity of coconut water. PepsiCo and Coca-Cola, as world soft drink giants, are spending significantly on research and development in coming out with new fusion beverages that will meet the changing palates of different consumers, from functional and botanical categories.

Lucozade, having been known for its energy drinks, also ventures into fusion drinks by combining energy-providing ingredients with distinctive flavors. This rivalry among such big players is driving innovation and enhancing the ease of fusion beverages, which makes the market vibrant and more appealing to health-orientated buyers globally. While the firms are expanding and trying to keep pace with changing customers' habits, the fusion beverages market will grow to be very large in scope and diverse in composition.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 7.67 Billion |

| Projected Market Size (2035) | USD 13.73 Billion |

| CAGR (2025 to 2035) | 6.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2019 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameter | Revenue in USD Billion |

| By Product Type | Fused coffee and tea, Carbonated Drinks, Fusion alcoholic Beverage, Fruit Juice, Energy and Sports Drinks, Others |

| By Distribution Channel | Off-Trade, Grocers, Hypermarkets, Discounters, Online stores, Highly specialized retailers, Alcohol, Off-license stores, Confectionery, Supermarkets & Petrol stations, On-Trade, Bars, Pubs and cafeterias, Restaurants, Hotels and resorts, Temporary retail points, Mass events, Clubs & discos |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Brazil, Germany, Poland, Lithuania, Russia, Kazakhstan, China, India, South Africa |

| Key Players | ZICO Beverages, Pepsico, Lucozade, Coca-Cola, Pocari, Gatorade, 100 Plus, Power Ade |

| Additional Attributes | Rising demand for natural and organic ingredients, increasing functional beverage trends, sustainable packaging initiatives |

| Customization and Pricing | Available upon request |

As per Product type, the target industry has been categorized into Fused coffee and tea, Carbonated Drinks, Fusion alcoholic Beverage, Fruit Juice, Energy and Sports Drinks, Others

As per Distribution Channel, the target industry has been categorized into Off-Trade(Grocers, Hypermarkets, Discounters, Online stores, Highly specialized retailers, Alcohol, confectionery, and Off-license stores, Supermarkets, Petrol stations), On-Trade( Bars, Pubs, and cafeterias, Restaurants, Hotels and resorts, Temporary retail points, mass events, Clubs, discos)

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The industry is projected to grow at a CAGR of 6.0% during the forecast period.

By 2035, the market is estimated to reach USD 13.73 billion in sales value.

The North American region is expected to dominate global consumption.

Leading manufacturers include ZICO Beverages, PepsiCo, Lucozade, and Coca-Cola.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 6: Global Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: North America Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 12: North America Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: Latin America Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 18: Latin America Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: Western Europe Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Western Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 30: Eastern Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: East Asia Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 42: East Asia Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 42: East Asia Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Unit Pack) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 9: Global Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 13: Global Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 16: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 17: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 27: North America Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 31: North America Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 34: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 35: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 45: Latin America Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 49: Latin America Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Western Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 117: East Asia Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 121: East Asia Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fusion Beverages in Japan Market Analysis – Size, Share & Growth 2025-2035

Korea Fusion Beverage Market Analysis by Beverage Type, Ingredient Profile, Distribution Channels, and Country Through 2035

Demand for Fusion Beverages in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Fusion Beverage Market Analysis by Product Type, Distribution Channel, and Country through 2035

Beverage Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Fusion Bag Market Analysis Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA